Fiscal stimulus is costly

For years I’ve been warning that reckless fiscal policy (under Trump and Biden) would lead to future tax increases. And for years I’ve been attacked as an old fogey who doesn’t understand that we are in a new era of zero interest rates, a new era of free credit forever.

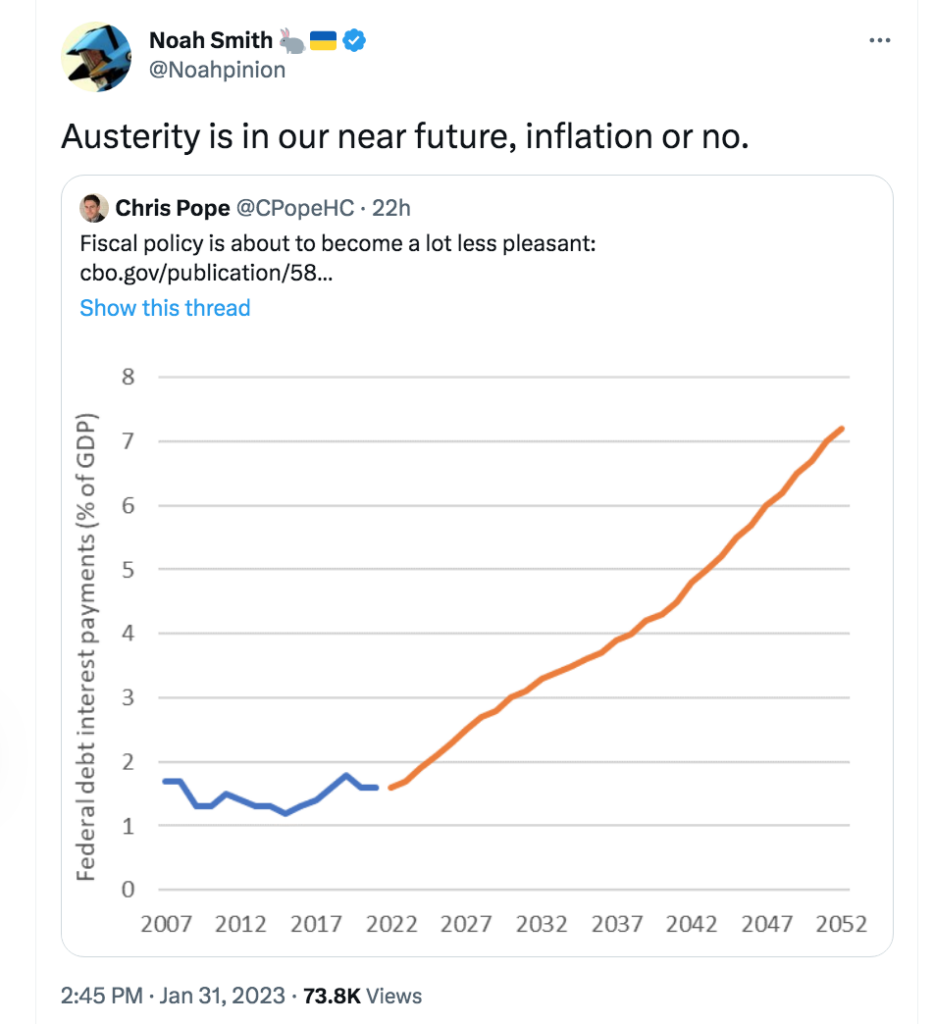

Here’s Noah Smith:

Monetary policy is about aggregate demand. Fiscal policy is about efficiency. The profession made a huge mistake in conflating the two policies.

PS. There are a few signs the economy might actually be speeding up:

Vacancies at US employers unexpectedly increased at the end of 2022, illustrating a solid appetite for labor that the Federal Reserve sees as one of the last hurdles to bring down inflation.

The number of available positions climbed to a five-month high of just over 11 million in December from 10.4 million a month earlier, the Labor Department’s Job Openings and Labor Turnover Survey, or JOLTS, showed Wednesday. The increase was the largest since July 2021 and mostly reflected a jump in vacancies in accommodation and food services.

(While I’m doing my annoying “I told you so” routine, I might as well add that I ridiculed those who claimed two falling quarters of GDP meant we were in recession during early 2022. I don’t recall any previous recessions with record job openings.)

Tyler Cowen has a post discussing the possibility of the economy reheating, and has this to say:

Another possible pathway for these scenarios involves interest rates. During a normal disinflation, the Federal Reserve raises rates and keeps them high for a long period of time while the economy adjusts slowly — often passing through recession. But inflation has fallen more rapidly than expected, and so the market may expect the Fed to lower interest rates sooner than planned. And an expected cut in interest rates can encourage expansionary pressures just as much as an actual cut in interest rates.

It is a funny world in which slow inflation can cause faster inflation. It’s the logic of expectations that makes it possible, albeit far from certain.

Of course this would not be a case where low inflation is directly causing high inflation. Rather, if this happened it would be a case of the Fed looking at inflation when it should be looking at NGDP growth, and wrongly concluding that monetary restraint is no longer needed. Persistently excessive inflation is always and everywhere a monetary policy failure.

Tags:

2. February 2023 at 03:55

Interestingly, taxes have been relatively steady for decades as a percent of GDP. So has spending, but of course the latter was always higher. The last few years beginning with the Covid illusion (I.e., that “closing down” the economy would prevent deaths) we have had 2 big spike up years in spending and 2 spike down years—all mostly caused by Covid illusion.

But who thinks you are crazy for being anti-spending? I am sure many are, but it could not be a more classical view. But we always spend more and it is inefficient and it is stupid. I don’t know how we stop. We have omnibus bills which can hide or at least put dark shade on details.

Arnold Kling once said that as long as we are the biggest pigmy in the jungle we can survive.

I can’t imagine how we will ever change. We created a Medicare and SS monster —-which could not be more insane. Assuming we owe the people our promises I estimate it would take a minimum of 50 years to break that ——-which does mean paying back thru taxes—-and less spending. Never will happen.

We have to many “idealists” (Climate Change, socialist thinking) who fight reason. —-what will keep us going is productivity growth—-which is very hard to measure —-but I believe it exists.

2. February 2023 at 08:36

Didn’t we have a tax regime in the middle of the 1900’s that allowed us to both pay our bills AND grow the economy? I’m not going to pretend we shouldn’t be more scrupulous and strategic with our spending, but isn’t there quite a bit of room for improving our current tax system to counter debt threats? Not to mention how the changes to the tax system over the last 30-40 years have contributed to growing economic inequality…

2. February 2023 at 10:49

Economics is an exact science. The answers are already there. The economy is predictable.

The FED created the collateral shortage, QE forever. The O/N RRP facility was a mistake. Now, draining the O/N RRP increases both cash and reserves in the commercial banking system. That would prolong a higher award rate and prolong stagflation.

Interest is the price of credit. The price of money is the reciprocal of the price level.

Contrary to JP, banks aren’t intermediaries. JP eliminated reserve requirements and destroyed deposit classifications. As I said: The only tool, credit control device, at the disposal of the monetary authority in a free capitalistic system through which the volume of money can be properly controlled is legal reserves. The FED will obviously, sometime in the future, lose control of the money stock.

May 8, 2020. 10:38 AMLink

Revisit Richard Werner:

https://www.youtube.com/watch?v=EC0G7pY4wRE

2. February 2023 at 14:33

re: “Monetary policy is about aggregate demand. Fiscal policy is about efficiency. The profession made a huge mistake in conflating the two policies.”

If the FED’s monetary transmission rate is interest rates, then the FED will end up monetizing fiscal deficits.

See:

https://scottgrannis.blogspot.com/2023/01/m2-news-continues-to-impress.html

“is powerful evidence that the surge in M2 growth was fueled by a massive increase in the federal deficit”

3. February 2023 at 00:44

“Fiscal stimulus is costly”?

“ . . . whereby the coefficient for ∆g is expected to be close to –1. In other words, given the amount of credit creation produced by the banking system and the central bank, an autonomous increase in government expenditure g must result in an equal reduction in private demand. If the government issues bonds to fund fiscal expenditure, private sector investors (such as life insurance companies) that purchase the bonds must withdraw purchasing power elsewhere from the economy. The same applies (more visibly) to tax-financed government spending. With unchanged credit creation, every yen in additional government spending reduces private sector activity by one yen. . . .

Equation (22) indicates that the change in government expenditure ∆g is countered by a change in private sector expenditure of equal size and opposite sign, as long as credit creation remains unaltered. In this framework, just as proposed in classical economics and by the early quantity theory literature, fiscal policy cannot affect nominal GDP growth, if it is not linked to the monetary side of the economy: an increase in credit creation is necessary (and sufficient) for nominal growth.

Notice that this conclusion is not dependent on the classical assumption of full employment. Instead of the employment constraint that was deployed by classical or monetarist economists, we observe that the economy can be held back by a lack of credit creation (see above). Fiscal policy can crowd out private demand even when there is less than full employment. Furthermore, our finding is in line with Fisher’s and Friedman’s argument that such crowding out does not occur via higher interest rates (which do not appear in our model). It is quantity crowding out due to a lack of money used for transactions (credit creation). Thus record fiscal stimulation in the Japan of the 1990s failed to trigger a significant or lasting recovery, while interest rates continued to decline. ”

http://eprints.soton.ac.uk/339271/1/Werner_IRFA_QTC_2012.pdf

3. February 2023 at 05:34

This is the first time you’ve called for fiscal restraint that I’m aware of.

You say “I told you so.”

But where have you said this previously? All you do is talk about your love for communist BLM, woke policies like open borders, a one-world-nato, and packing the courts. I would also kindly remind you that it was me, not you, that was talking about fiscal restraint. You are the one who said “I predict inflation will be temporary”, while your critics pointed to long term inflation due to overspending.

In other words, you were wrong. We were right. But I’m glad you are finally starting to come around.

You were also wrong about Russia, Bolton, Biden’s laptop which you called “fake”, Trump’s impending dictatorship, vaccines and masking. Yes, another study was published in Lancet two days ago that shows masks provide “no efficacy” which is what we told you and the other radicals, for about three years.

3. February 2023 at 08:52

Tyler, Yes, but that tax regime can’t pay the bills of our current spending regime (especially going forward).

Ricardo, “This is the first time you’ve called for fiscal restraint that I’m aware of.”

LOL, you are an idiot.

3. February 2023 at 09:51

I wish I knew the answer to how we get out of this fiscal mess. I’ve had several conversations recently with intelligent, otherwise caring people, who think there is nothing wrong with burdening each of our grandkids with $100K of our debts to pay off.

4. February 2023 at 10:49

“I wish I knew the answer to how we get out of this fiscal mess.”

People forget that Social Security already went broke once, in 1983. (Being old enough to be able to remember ancient history has its advantages). That example gives us the answer.

The SS Reform Act of 1983 “saved” SS by in equal parts cutting benefits and increasing revenue, via: reducing future benefits of the then young, increasing the current payroll tax, and applying a disguised means test by making benefits >$25k single $35k joint subject to tax. This tax is computed under the normal progressive income tax rules so it looks to the voting public like regular income tax, but instead of going into general revenue is returned to the SSA to result in a net reduction of SS benefits. (Make the rich pay more income tax? Yes! Means test SS benefits? NEVER!) Also the $25k/$35k amounts aren’t inflation adjusted, so the means test’s impact has been increasing annually ever since.

(All this is why people born after 1953 will get increasingly less from SS than they paid in thru taxes, while those born before then got back a whole lot more.)

This is the proven template for resolving the future entitlement program funding crisis: Split the cost among future benefit slashes for the young, means testing (which won’t be so easy to hide), and a current tax increase. Politically, nothing else is possible. As shown in the bitter fighting in 1983.

Twenty years ago, in the sci.econ newsgroup (where future econ bloggers lived before there were blogs) I predicted this would happen in the late 2020s-early 2030s using the same iron logic as in that chart above — just count up the ever rising cash flow costs of paying promised benefits. This reality was hardly a secret to anybody. It’s been obvious to all, all along. As has been the fact that the problem has been getting steadily worse.

Alas, some things never change. Back circa 1940 Congress re-worked FDR’s original funded SS program, “actuarily sound and out of the Treasury forever” into a paygo plan so it could slash the SS tax and ramp up benefits. FDR’s head of SS, Arthur Altmeyer objected that this would drive SS broke in 35 years, and FDR vetoed the changes. It was his only veto that Congress ever over-rode.

Altmeyer was right. He later reported that the Congressional leaders told him, “That will be somebody else’s problem”. And so it goes…

5. February 2023 at 10:20

Jim, FDR wanted the system to be PAYGO. He designed it that way so that it could not be abolished in the future.

6. February 2023 at 08:35

Thanks Jim. That sounds sensible. What I don’t see is any political will to take on something like that again and on the grander scale needed this time. Debt doesn’t even come up as a topic in our elections anymore.

8. February 2023 at 09:05

Jim, FDR wanted the system to be PAYGO. He designed it that way so that it could not be abolished in the future.

Professor, he funded it with payroll taxes so it could not be abolished in the future. He also *insisted* that the taxes be invested in T-bonds in a manner to create an actuarily sound system that would last perpetually. Famously, when he actually read the original version of the 1935 Act sent to Congress and discovered that it relied on contributions from general revenue starting in the 1960s (!!) he had a tantrum and withdrew it from Congress for re-writing.

.

The 1935 Act had a 6% payroll tax rate, worker benefits were based on the T-bond rate paid on their contributions (with a progressive adjustment based on income), full benefits weren’t to be paid until the 1950s.

In 1939 Congress amended SS to cut the payroll tax from 6% to 2%, accelerated benefits, added new “family” benefits, and …

“shifted the emphasis of the Old-Age Insurance program from protection of the individual worker to protection of the family. More emphasis was placed on the goal of providing socially adequate benefit payments, and less emphasis was placed on the principle of individual equity (amount of benefits linked to the amount of taxes paid).” — SSA.gov.

Slashing the tax rate to 2% created the paygo system we all know. I didn’t make up the facts that Altmeyer repeated objected to the changes because they obviously would result in what they did, FDR vetoed the changes, and it was his only veto ever to be over-ridden. You can read all about it at SSA.gov