Dwight D. Obama

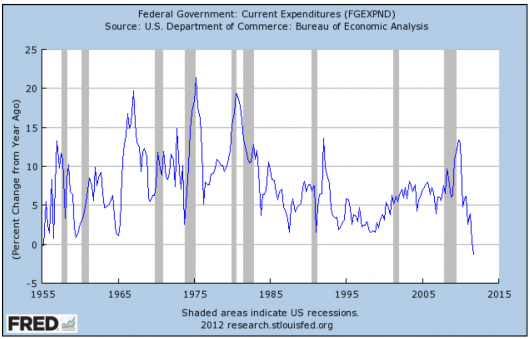

The inflation rate over the past 3 1/2 years has been the lowest since the mid-1950s, when Dwight D. Eisenhower was president. But lots of people say they don’t believe that. I certainly agree that inflation numbers are somewhat arbitrary, but the slightly more objective NGDP growth over the past 3 1/2 years is the slowest since Herbert Hoover was President. And now Michael Darda has sent me a graph showing Federal spending falling for the first time since the year I was born, even in nominal terms.

I’m guessing Paul Krugman won’t be pleased.

PS. The contrast between Clinton and the 2 Bushes is striking.

Tags:

12. April 2012 at 13:11

Here is the breakdown in real Federal spending on a YoY basis in Q4.

Consumption: -2%, Gross investment -10.8%

Defense: -3.6%, Non-defense: -2.5%

Defense consumption: -1.8%, defense investment: -14.2%

Non-defense consumption: -2.4%, non-defense investment -3.1%

In other words, most of the components are declining about -2%, but defense investment spending is a big drag. Since it is likely associated with the slowdown in spending in Iraq with the troop pull-out, it is unclear how strong this effect will be going forward. Nevertheless, -2% Federal consumption spending is rare.

12. April 2012 at 13:18

Government spending needs to fall to get G/GDP back in line, but point taken. Amazing that nominal spending would *fall* rather than simple grow more slowly for a bit. I guess we should be pulling for Obama + Republican senators….

12. April 2012 at 13:19

Where’s Morgan? :p

Of course, this follows a period of rapid growth and, unfortunately, I doubt it will last very long.

But yes, Obama is pragmatic (no racism intended) and has done a decent job except on monetary policy.

12. April 2012 at 13:30

I certainly agree that inflation numbers are somewhat arbitrary, but the slightly more objective NGDP growth over the past 3 1/2 years is the slowest since Herbert Hoover was President.

If you admit that inflation, i.e. price, numbers are somewhat arbitrary, then wouldn’t NGDP be as equivalently arbitrary, since NGDP simply tracks volume and the estimated prices paid?

Nominal GDP YoY growth is now at around 4%.

And yet the BS, I mean BLS, is reporting deflation in producer prices!

And now Michael Darda has sent me a graph showing Federal spending falling for the first time since the year I was born, even in nominal terms.

For those who panic over this, I have to ask, is federal spending not allowed to fall back to where it was a year ago, or fall back to where it was slightly more than a year ago…ever?

I guess it makes sense why government, once it grows, has a very difficult time shrinking. It’s a worship of the status quo.

12. April 2012 at 13:32

QE3 is back on the menu boys!

12. April 2012 at 13:47

Isn’t NGDP only good at indicating demand side inflation, but not supply side inflation?

12. April 2012 at 13:53

We’ve been at war so long that we forget its financial cost. Wars are supposed to be temporary. When we’re done fighting, the corresponding expenditures are supposed to fall. If they’re not falling dramatically, then we have a problem.

12. April 2012 at 14:32

‘…a graph showing Federal spending falling for the first time since the year I was born, even in nominal terms.’

Not according to the graph you posted. It’s got several down periods in it.

12. April 2012 at 15:10

Clinton was between two bushes—there must be a joke there, but anatomically it just does not work out.

Amazing chart.

The lowest inflation since a half-century, a deep, deep recession, yet we have a hide-and-seek, peek-a-boo Fed that cannot clearly and transparently tell us what it plans to do. Regime uncertainty. Dithering.

How about resolve that the Fed will print money until it sees the walls blistering at the plant?

12. April 2012 at 15:53

Patrick, the graph shows the rate of change and it only goes under 0 once.

12. April 2012 at 18:01

Do these numbers include SS? note you can see EXACTLY how Clinton traded away spending on his voters, to buy 4 more years.

That’s the reason I think Scott’s going to lose our bet.

Anyhoo, thank god for the American meta-culture. Thank god for the Tea Party.

Deficits matter… for Democrats. They must denied new pay-offs for their voters until they become depressed and the elites in the Blue States realize the game is so stack against them, they finally DEMAND to keep their taxes at home.

Over long 50+ year cycles, parties do learn.

Once the structural biases of our law towards distributed and free market power, convince the community organizer crowd it is better to live in their own utopias in IL, CA, NY, MA, OR and WA, we can see real federal spending cuts.

In mid 2010, I argued the GOP should trade Congressional Dems a safe election seat to buy enough no votes on Obamacare. It was that important.

Even now SCOTUS tossing it is worth any upside it gives Obama.

We can only hope that in June we are breathing a sigh of relief.

12. April 2012 at 19:23

Healthcare isn’t a market, and it’s filled with perverse incentives. If we repeal ObamaCare we’ll very likely be trading something bad for something worse.

The real problem is that we’re in an in between period – between the era when all medicine could do was prescribe antibiotics, cut pieces out of people and theorize without any useful data, and the era when medicine will be like electronics – incredibly complicated for manufacturers, but simple and inexpensive for customers. There are so many revolutionary medical developments in the pipeline that, I hear of a new one every week. This week it’s targeted gold nanostars. Last week it was using infrared in place of xrays, before that Alzheimers. We’re actually beginning to understand how the brain works well enough to make effective use of the knowledge.

Alzheimers, autism, cancer, myocardial infarction, obesity and type II diabetes, rheumatoid arthritis…

These are all huge drags on the economy. Even with more use of the healthcare system, prevention and cure instead of chronic treatment and much cheaper medical testing should dominate. Estimates of medical costs in 2035 are utterly worthless, like predictions of 2010 technology in 1960. A calculator that sold for 3000 1965 dollars now costs $1.98 in 2012 dollars, is faster and has more functions. A cell phone is much more powerful than an IBM 360/40. A cell phone is a portable general purpose computer. The effect of this in less developed countries will be huge. With appropriate apps and peripherals a near future (1 to 2 years) cell phone will be able to do anything a PC can do and more.

It’s a race among demographics, technology and environmental limits. We don’t know enough to predict the outcome.

12. April 2012 at 20:38

Scott tells me he didn’t block my comments despite what I consider an over the top response by myself recently.

Well let me tell you, disagree with the MMTs and you face a price. I’ve been blocked and reblocked at several places after debating with them. And I’ve faced other internet/computing issues. I don’t know where they get their computing power from but take it from me, don’t go there. I’d rather debate the Austrians. Who knew?

12. April 2012 at 20:57

Scott,

I’m not following the graph. It appears to deal with changes in federal expenditures.

I recently made the following point in response to Luigi Zingales’ appeal for a single mandate:

Would the abandonment of the dual mandate mean an even tighter monetary policy than we have now?

Certainly during 2004-2008 core PCE was rising at more than 2% a year but at no time did it rise by more than 2.3% on an annual basis. Moreover if 2% is the Fed’s implicit inflation goal then it should be noted that the average rate of increase in core PCE over the ten years through 2007 was 1.9%.

And 43 months after July 2008 core PCE stands a staggering 1.77% below where it would be had core PCE risen at a 2.0% annual rate.

So monetary policy was modestly tight in the decade through 2007 and has been etremely tight over the past 43 months even by a “price stability” measure.

So what’s to argue about?

“Loosen” up already.

12. April 2012 at 21:06

Mark, there’s a saying by “Jim Treacher” that has stood up for years amongst conservatives:

They just want us to shut up, and we just want them to keep talking.

Back when Breitbart was first talking to Arianna about starting Huffpost, he was really cheerleading it to her, and his entire motivation was to get all the liberals and celebrities together in one place so they would feel emboldened. I mean from Day 1, the idea was, they are half-wits and betas hiding behind largely unearned money, the more they feel empowered the quicker they will fall.

It was twice as subversive as Drudge as far as memetics go.

The unassailable point is the weaker your logic, the more fragile you feel, this gives your brain three choices: 1) justify turning off outside voices 2) become more and more irrational in its reasoning to justify your beliefs 3) change who you are

Peter, that was such a crazy jumble I can barely get up the energy to unwind it;

1. rich guys investing in and buying brand new high end stuff that may or may not work is where invention comes from

2. giving poor people older medical treatments is inevitable

Accept both those as true, and the poor will have the most advanced old medicine in the future

12. April 2012 at 22:44

FAIL. Scott, please select “compounded annual rate of change” in FRED. 1980-2008 are basically homogenous. The big outliers are the Obama years where the government expanded at rates not seen since the heady inflation days of the late 70s.

The current dip is also not unusual.

12. April 2012 at 23:05

Economically, Scott should be happy that government spending has finally fallen, however insignificant that fall may be. Less public spending means more resources are available to the private sector which generates real wealth and doesn’t suffer from the perverse incentives of bureaucracy. Aside from deregulation, dramatically slashing public spending, especially on things that create disincentives to work, would be one of the best steps to creating a healthy long term economy. Setting a 5% NGDP target would be a great way to make huge spending cuts less painful in the short run. In the long run, a steady NGDP target wouldn’t do much to produce a healthy economy with current levels of regulation, government spending, cronyism, and bailouts. So these issues need to be addressed as well.

13. April 2012 at 00:29

Peter,

If the government treated health care the same as any other economic good like computers for instance, you would see a continual increase in the quality of medical care and a decrease in the real or nominal cost of a given procedure. This is what you see in almost all of the less heavily regulated industries under capitalism.

On the other hand, the government could inject itself into any market, no matter how frivolous, and destroy it by offering to pay for services. The incentive of a bureaucrat is always to spend more money in order to justify a bigger budget and there are no consequences for poor service.

The argument by Kenneth Arrow typically used to justify intervention in health care is weak at best. The same type of knowledge gap between purchaser and producer exists for almost all products in the economy.

13. April 2012 at 04:28

Congress proposes spending. It’s almost as if there was a radical shift in control of Congress just over a year ago…

13. April 2012 at 04:45

Mark,

In recent months I’ve become cautious about visiting sites on several sides that seem to have been subjected to attacks leaving them (in some cases) all but unusable. Who knows what’s behind all that, I hope your computer starts working better.

13. April 2012 at 06:56

“The same type of knowledge gap between purchaser and producer exists for almost all products in the economy.”

If I buy a car, I can look at road tests and reviews or take a test drive. At the very worst I’ll get a lemon and lose money on it.

I can’t do any of that sort of research for a doctor or hospital, and the worst is I might wind up dead.

So there’s a large risk aversion gap. Also health care isn’t a classical market. Instead, there’s monopoly, Monopsony, lock in, lack of competition – everything you don’t want to see in a market.

The real market, such as it is, is between large insurance companies and health care providers, who are consolidating to match the bargaining power of the insurance companies. This market is riddled with barriers to entry, monopolies, collusion (insurance companies have an antitrust exemption) and inefficiency.

Patients have almost no power in this. For instance, where I live, there is a dominant provider, which exacts rents, because the insurance companies can’t exclude it from coverage. It is the most favored nation and a dollar more.

This is article by Atul Gawande is worth a read:

http://www.newyorker.com/reporting/2009/06/01/090601fa_fact_gawande

Nobody has been able to find a way to transition to a true market where the customers are the patients. There are too many powerful interests that believe they stand to lose by one.

Obamacare or Ryancare, either way you’ll get a system largely designed by lobbyists from the drug companies, insurance companies and healthcare providers. The rhetoric and appearance may be different, but the same players will end up with about the same amount of profit.

ObamaCare isn’t a market, and RyanCare wouldn’t be, either.

13. April 2012 at 07:15

John Hall, Thanks for that data.

Justin and Cameron, Yes, it’s partly making up for the previous rapid growth.

MF, You said;

“If you admit that inflation, i.e. price, numbers are somewhat arbitrary, then wouldn’t NGDP be as equivalently arbitrary, since NGDP simply tracks volume and the estimated prices paid?”

No, it’s much easier to estimate the revenue earned by Dell Computer than the change in the price (or volume) of Dell Computer. Indeed economists cannot agree even in principle how to measure inflation in the computer industry. What is “a computer?” Or computer inflation?

Brito, Yes.

Ryan, Yup, and we obviously had a problem after other wars like the first Gulf War and Vietnam. But also see John Hall’s comment.

Patrick, See Paul’s comment.

Ben, Yes, there should be a joke there somewhere.

Morgan, I presume it includes SS.

Mark, Sorry to hear the MMTers cut you off, you had some excellent observations at Nick Rowe’s. I’d think they’d appreciate that sort of comment.

And it’s not just core that’s been averaging well below 2%, so has headline inflation.

Jon, Why would I care about that figure?

John, I agree.

Chris, Good point.

13. April 2012 at 07:32

ssumner:

it’s much easier to estimate the revenue earned by Dell Computer than the change in the price (or volume) of Dell Computer. Indeed economists cannot agree even in principle how to measure inflation in the computer industry. What is “a computer?” Or computer inflation?

I agree that this would be easier, and if that is the end of things then it makes sense.

But then I have to ask: Since NGDP targeting is based on “NGDP = RGDP + inflation”, then wouldn’t the fact that RGDP requires an estimating of prices, make NGDP based on estimating prices after all?

13. April 2012 at 07:38

Peter,

Healthcare isn’t a classical market at all. It is industry that the government has distorted more than any other. The barriers to entry in healthcare are predominantly a product of regulation. We know beforehand that large companies can handle the burden of regulation while smaller ones cannot. Furthermore, regulation greatly raises the cost of entry. Combine this with the fact that 50% of all laws in the federal register are related to health care and you have an obvious example of an industry that you couldn’t call free market by any stretch of the imagination.

The information argument is still weak and getting weaker everyday. You can do research about medical conditions online and more and more you can read reviews of hospitals and doctors. Just like any other product, the only limit to your knowledge is the time you are willing and/or able to put in learning about it.

I agree the transition to a market system would be painful. But ultimately only 3 things have to happen.

1. Insurance is bought by individuals (requiring a change in the tax code)

2. Like any other form of insurance, medical insurance covers catastrophic events. People pay out of pocket for normal procedures. This reintroduces competition into the health care market.

3. The government ceases to directly pay for medical services. This sounds difficult but with the lower costs and better care from step 2, it is possible and would act to significantly reduce the cost of procedures much further.

A nice additional step would be the abolition of government sponsored medical licensing. Not every doctor has to be great to perform routine procedures and there are many procedures nurses or physician’s assistants could handle that they’re currently not allowed to. Plus people should be allowed to try experimental drugs if they so desire.

Do you really believe that if we did these things medical care wouldn’t be much more affordable and effective, Of course inequality in care would exist but so what. Almost everyone who works can afford a car but not everyone can buy a Bentley.

About the article, yeah healthcare is currently expensive as hell and bankrupting the government. Anything the government pays for becomes expensive as hell. Remember the case of the Pentagon paying $500 for a toilet seat or the recent story about the GSA spending $300,000+ to relocate an employee?

http://politicalticker.blogs.cnn.com/2012/04/12/employee-says-gsa-spent-millions-on-relocation/

The reason anything the government buys becomes expensive is that a bureaucracy has no incentive to control costs. If it comes in under budget, its funds get cut. If it is wasteful and over budget it needs more money.

13. April 2012 at 08:54

same series in dollars:

http://research.stlouisfed.org/fredgraph.png?g=6rk

13. April 2012 at 18:24

MF, No, NGDP doesn’t require either P or Y. But to get either P or Y you must get both. In other words NGDP is just money spent. Both P and Y require judgments about quality changes, etc.

jck, Thanks, but if not in log form it’s a bit misleading, as it makes it look like growth accelerates.

13. April 2012 at 18:54

Because you wrote:

“And now Michael Darda has sent me a graph showing Federal spending falling for the first time since the year I was born, even in nominal terms.”

And that’s wrong. Comparing one-year-ago numbers does not tell you whether Federal spending is falling in nominal terms for the entire budget year, which it is not. It is telling you that in this particular year, the distribution of spending between quarters is different.

That might be unusual but inflation is fairly low now compared to before. So for instance if you look at the ratio percentage change of FGEXPND to CPI rates, you’ll see that the ratio is “normal”–smaller than some earlier time periods. Second if you compute the decline in real-spending y-y quarter as you’ve done, there were bigger declines in the 1970s.

13. April 2012 at 19:26

ssumner:

MF, No, NGDP doesn’t require either P or Y. But to get either P or Y you must get both. In other words NGDP is just money spent. Both P and Y require judgments about quality changes, etc.

RGDP. Don’t you need P and Y to get that?

14. April 2012 at 12:49

Jon, You said;

“That might be unusual but inflation is fairly low now compared to before.”

That was the entire point of my post, to show more evidence that inflation is low. I don’t care at all about real government spending, which I admit behaves very differently.

MF, You need NGDP and P to get RGDP. Indeed RGDP=(NGDP/P)

18. April 2012 at 05:42

ssumner:

MF, You need NGDP and P to get RGDP. Indeed RGDP=(NGDP/P)

This is hilarious circular logic.

NGDP = RGDP + inflation, so

NGDP = (NGDP/P) + inflation, so

NGDP(1 – 1/P) = inflation, so

NGDP = inflation/(1 – 1/P)

If RGDP depends on P, and NGDP depends on RGDP, then NGDP depends on P.

Or,

If NGDP depends on RGDP, and RGDP depends on P, then NGDP depends on P.

If RGDP = NGDP/P, then NGDP = RGDP * P

Either way you slice it, NGDP targeting requires P estimations.