Don’t be a China bear, or bull

China is a glass half full country, and will be for the foreseeable future. Here I’ll point out what’s wrong with the China bulls and bears. Let’s start with the bears.

Last year lots of China bears predicted recession, after the stock market crashed and the yuan fell in a disorderly fashion in forex markets. The recession did not happen. In recent years, lots of people have pointed to “ghost cities” in China. According to this article, the ghost cities are filling up quite nicely:

Lingang was built for one reason: to support the new Yangshan deep sea port and corresponding FTZ, which link into the new city’s southern edge, as well as the nearby Lingang Industrial Zone. 800,000 people were projected to be living there by 2020, and the phrase “mini Hong Kong” was often uttered to describe what it was meant to become.

Construction on the $5.6 billion, 133 square kilometer satellite city began in 2003, but ten years later the place was a virtual ghost town. While I was told at that time that the emerging city had 50,000 residents, its wide open, empty streets and completely vacant housing blocks indicated that this may have been a wishful overestimate. While every property that went on the market there sold quickly, home buyers were hesitant to move in — who is going to move into a city before it’s ready to be inhabited?On one of my early visits to Lingang in 2013 I met with a team of researchers from Colliers who were scouting out a location for an impending hotel for a client. They weren’t put off by the excessive amount of empty buildings.

“It has potential,” Marco Zhou, the leader of the team, said as we looked out over an expanse of vacant construction lots and a yet-to-be-used high-tech park.

“Who do you think will come to this hotel?” I queried skeptically. “There really isn’t much going on here.”

“Don’t worry, man, all that will change,” Zhou replied with a laugh. “It is just a matter of time. They will all be filled . . . The only question here is when.”

This sentiment was echoed by the fact that a couple of days before two nearby plots of land sold for record prices, going for 445.45% and 427.4% premiums respectively.

Sounds like a typical ghost city, right? Here’s a return visit, two years later:

Since the last time I was in Lingang, Shanghai’s Free Trade Zones had been officially commissioned and its administrative offices moved in, the deep sea port continued expanding, the high-tech park began welcoming businesses, some of the office complexes had opened, the 100,000 student university town continued developing, and a new metro line linking in the new city to the core of Shanghai went into operation.

While not yet running at 100% capacity, considerable progress had been made. There was a steady stream of cars on the main road where there wasn’t any sign of traffic before, workers were walking in an out of previously unused office towers, a slew of new restaurants had opened, and many once-uninhabited residential complexes had filled up. The new city that had once been the domain of exiled students and migrant construction workers was now home to actual residents, white collar workers, researchers and shoppers.

“It’s full of life,” the news anchor complained. “It just looks like normal.” . . .

China seldom builds colossal new cities without a broader, larger-scale development plan. The ghost city narrative of cities built for nobody doesn’t stand up if you look at how many of the country’s booming new metropolitan areas were once mocked as being ghost towns.

New city building is obviously a long-term endeavor — long-term meaning 15 or 20 years, not five or six. Nearly all of China’s major “ghost cities” have by now filled up or are on pace to meet their population goals, giving the phrase “too big to fail” real-life relevance:

Shanghai’s Pudong financial center can no longer be considered a “statist monument for a dead pharaoh on the level of the pyramids;” Zhengdong New District is now the million person plus financial capital of Henan province rather than being “uninhabited for miles and miles and miles;” and even the “Great Ghost Mall of China” has come back from the dead.

The reason why China never gives up on its ghost cities is that they tend to eventually work.

And now for the bulls. This article claims that China (and India) is booming because of lots of state investment:

Why Are China and India Growing So Fast? State Investment

. . . In 2015 China’s per capita GDP growth was 6.4 percent and India’s 6.3 percent based on World Bank data.

These are easily the fastest growth rates for any major economies. They also propel the most rapid rates of growth of household and total consumption. In particular, both China and India are growing far more rapidly than the Western economies — in 2015 the EU’s per capita was only 1.7 percent, the U.S. 1.6 percent, and Japan’s 0.6 percent. Data for 2016 to date show the same pattern of rapid growth in China and India and slow growth in the U.S., EU and Japan.

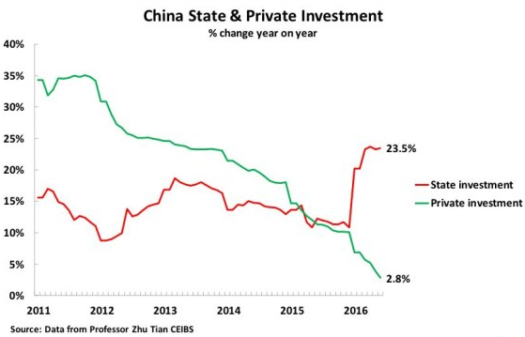

Professor Zhu Tian from China Europe International Business School points out, referring to National Statistics Bureau data, that from January to June 2016, state-owned fixed-asset investment had grown by 23.5 percent over the same period last year, but private fixed asset investment growth had decelerated to 2.8 percent.

Put aside the fact that China and India grow faster than Western economies because of catch-up growth. This graph shows almost exactly the opposite of what the author claims. Until 2015, private investment was growing faster than state investment. And during this period, China grew rapidly. As the gap narrowed, and then reversed, China’s growth slowed. The author’s argument is basically that China is still growing pretty fast in 2016, and its state is investing a lot in 2016. That’s it.

Put aside the fact that China and India grow faster than Western economies because of catch-up growth. This graph shows almost exactly the opposite of what the author claims. Until 2015, private investment was growing faster than state investment. And during this period, China grew rapidly. As the gap narrowed, and then reversed, China’s growth slowed. The author’s argument is basically that China is still growing pretty fast in 2016, and its state is investing a lot in 2016. That’s it.

In fact, this graph is almost exactly what you’d expect if state led investment did not boost growth, but instead simply crowded out private investment. The truth is that China’s grow surge began in 1979, when they started to allow private enterprise, and the state sector is a net drag on growth.

Now in fairness, China’s state does build infrastructure more efficiently than most other countries. In fact, the author’s attempt to lump together China and India make no sense, as India’s government is notoriously inept at building infrastructure. So why is India growing faster than China? Because it’s poorer, so the “catch-up growth” factor is more powerful. When China was as poor as India currently is, it was growing at double-digit rates.

The author claims that these Asian miracles provide justification for more state investment in the US. If our government was willing to build infrastructure cheaply, as Singapore and Dubai do, then I’d be all for more state investment in infrastructure (although even in that case I’d prefer private investment, like the recent passenger rail project being built in Florida, or Hong Kong’s private subway system.) But the US is not willing to build infrastructure cheaply, and hence any new projects are likely to be California high-speed rail-style boondoggles.

PS. No time for comments today, as I’ll be traveling. I really enjoyed yesterday’s Mercatus/Cato conference on monetary rules. John Taylor gave the keynote address, and I had a chance to meet interesting people like Miles Kimball and Peter Ireland.

Tags:

8. September 2016 at 07:57

Scott,

Thanks. Yes, more people should read Wade Shepard. He actually goes to these places. And he keeps going back. That’s the key. Most people who write about these places have no idea what they’re really like for they haven’t been there. And even those who actually go, they tend to go only once, take one look, and assume things won’t change. Really looking forward to his upcoming book on the New Silk Road.

And yes, many people like to mention China and India together, something I’ve never understood. And John Ross. Sigh. What did you expect.

8. September 2016 at 08:24

Great article. China will be in better shape, economically, if it does not sign the new Basel accords. It didn’t sign Base 2 and there was no mark to market destruction and liquidation of its economy, while there was in the west.

I argue that China will be ok if it does not sign Basel 3: http://www.talkmarkets.com/content/global-markets/china-could-be-the-next-basel-victim-or-not?post=92667&uid=4798

8. September 2016 at 09:07

In 1980 the population of Shenzhen (the Silicon Valley of China) was 30,000. Today, it’s over 10 million. Do you think it might have taken a little public investment for that to occur? Sumner alludes to this (“catch-up growth”) but doesn’t indicate the scale. China’s economy has slowed because the world economy has slowed, but China continues to invest in infrastructure so when the world economy recovers, China will be prepared. And lest we forget, China’s savings rate is about 50% (as compared to our 5%). Here’s a simple solution to secular stagnation: China adopts social welfare programs comparable to those in the west, turning all those savers into spenders (on something besides public infrastructure).

8. September 2016 at 09:52

A classic economist’s post, spoken like a true two-handed economist. Nothing to nitpick…

8. September 2016 at 17:34

Nice post.

China’s outlook may be clouded by politics more than economics.

President Xi appears to be (despite urbane demeanor) an Asian leader more akin to Putin, Jung, Duterte than, say, Modi or Abe.

In addition, the People’s Bank or China may be Westernizing, with poor results.

8. September 2016 at 20:33

Rayward, You said:

“China adopts social welfare programs comparable to those in the west, turning all those savers into spenders”

That’s wishful thinking. Based on what we see in Europe, I’d say it will turn a nation of workers into non-workers. And China is not suffering from “secular stagnation.”

Ben, Can no longer tell when you are joking . . .

9. September 2016 at 00:17

You know the cheap building of infrastructure that you cite in Singapore and Dubai is because both cities have hired hundreds of thousands of workers from Bangladesh and India, respectively. Paying them very little and housing them in substandard conditions.

I don’t know if the US has the stomach for this, considering the fuss being made about immigrants.

9. September 2016 at 08:17

Well I thought I was serious.

The PBoC is well below its IT, like Western central banks.

On President Xi people are saying there is less civil and political rights than in a couple generations. Capital is pouring into Hong Kong.

Tight money and political repression could hamstring China.

9. September 2016 at 09:13

Flamey, Yes, I know this, and in other posts I’ve advocated this policy for the US. It’s far more humane than our current policy of building infrastructure

9. September 2016 at 10:45

Actually, it was wishful thinking for China to adopt social welfare programs to solve our secular stagnation problem, not China’s. Shifting $9 trillion in annual GDP from countries with a low savings rate (5%) to a country, China, with a high savings rate (50%) might have contributed to our secular stagnation, although I appreciate that theory suggests it makes no difference. Also, the social welfare program for China I had in mind is social security; people in China save so much because they don’t have social security.

9. September 2016 at 12:22

Good post Scott. There are a bunch of these ghost town stories from places, even Vice, and almost no one goes and follows up a few years later to see if this is really a bridge to nowhere or if it is real.

I have to wonder if building lots of modern housing is part of the Chinese success. I mean look at America’s building boom in the 50s. Both private companies and government agencies were determined to build more housing and there was real growth and prosperity. Today there is so little growth and such housing restrictions both local and not.

10. September 2016 at 01:41

Maybe I’m a bit slow here, but how has investment as percentage of GDP gone up in China while GDP growth has gone down? Shouldn’t that go the opposite way?

http://data.worldbank.org/indicator/NE.GDI.TOTL.ZS?locations=CN

I’m having a hard time seeing how these investments have payoffs with future GDP. Investment/GDP has remained high and furthermore, FDI is 50% higher today versus 2006. The increase in FDI is striking compared to the low growth of private investment, meaning more private investment is coming from foreigners.

My mind is really stuck on this point: C is what ultimately pays OFF I and pays FOR G. For state investment, it’s hard to say what the correction “valuation” of such investment is, but state investment can certainly be overinvested. If there is not much return to infrastructure in terms of future GDP, or really future C, then the infrastructure has a higher cost in terms of future GDP.

I know the issues with predicting bubbles. You say a market will go down long enough and eventually pure chance will make you right. But there can also be honest LONG-TERM valuation of assets, for tech stocks in the 90’s or real estate in the 00’s.

To put it more bluntly, Madoff could not have run a Ponzi scheme for as long as he did if he was honestly audited. That was a mini-bubble that lasted for over a decade. There is also obfuscation at the micro-level in Chinese investments. Such obfuscation could prolong mispricing compared to tech stocks and mortgage-backed securities under US law and audits.

12. September 2016 at 14:31

Rayward, I’d guess that China’s been a net plus for US growth.

Benny, Yes, both housing and infrastructure are easier to build over their, as they don’t have to worry (as much) about Nimbyism. Indeed even India has that problem, from what I’ve read.

Matthew, I’d guess the productivity of recent investments is not as high as in the 1990s and early 2000s, but you also need to distinguish between private firms and SOEs. It’s the latter where productivity is the biggest problem.