Disposable income is not holding back the economy

In the Keynesian model, fiscal stimulus boosts demand during a recession by making up for the decline in disposable income during a period of falling GDP. For example, disposable income fell between March 2008 and March 2009, even in nominal terms. That was one motivation for the Obama stimulus package.

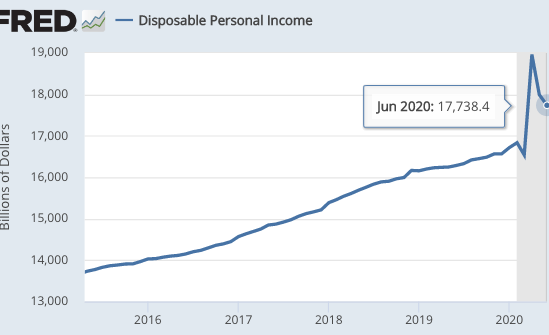

This time things are very different. Not only is disposable income not falling, it’s rising at perhaps the fastest pace in history, mostly due to fiscal stimulus.

And yet the recent fall in GDP is even worse than in 2008-09. Clearly the economy is not being held back by a lack of disposable income. So what is holding it back? My theory is that the Covid-19 epidemic is making people reluctant to spend money on services where there is human interaction.

The conventional wisdom is exactly the opposite. I see article after article claiming that the problem is a lack of sufficient fiscal stimulus. Here’s Bloomberg:

Chances for a deal in Congress on a new, comprehensive stimulus package before September diminish with each passing day, leaving the U.S. economy limping and many businesses and millions of consumers coming up short.

So what’s the argument against my claim? I see several, none persuasive:

1. Other things equal, fiscal stimulus would help, even though Covid-19 is also a problem. That may be true to a small extent, but it’s hard to see how it could have a decisive effect. Again, we’ve seen the biggest increase in disposable income in history, coinciding with plunging consumer spending. Doesn’t that suggest that lack of disposable income is not the relevant constraint right now? How is even more disposable income going to make a decisive difference if people are afraid to spend?

2. Disposable income fell between April and June. Yes, but it’s levels that matter, and even in June disposable income was far higher than 6 months earlier. And yet spending is far lower.

3. Inequality. Maybe all the extra disposable income is going to the rich. That seems unlikely. The rich don’t qualify for the $1200 payment or the enhanced unemployment compensation. Yes, the rich have seen their stocks go back to February levels, but that’s not counted as “disposable income”. Both the $1200 checks and the extra $600 unemployment compensation tend to be a higher percentage of the income of the poor. I suspect that if you had a graph of the disposable income of the bottom 50%, or the bottom 25%, it would show the same sort of spike after March that this Fred graph shows, maybe even bigger. If I’m wrong, please present data showing that fact.

I’m genuinely mystified by claims that lack of fiscal stimulus is a big problem right now. I actually do think monetary policy should be a bit more expansionary—enough to prevent disinflation—but I’m under no illusion that this would miraculously cure the recession. We need to address Covid-19 before we can return to a healthy economy.

Tags:

17. August 2020 at 10:15

I read this and think, “this is so basic, why does it even need saying?”

But I’m glad you’re saying it. It does need to be said. And it’s weird that it’s an uncommon view.

I’d also add that the fall in GDP, at this point, is not because the high unemployment payments are making workers stay home.

We need to contain covid first!

17. August 2020 at 10:25

bill said: ‘I read this and think, “this is so basic, why does it even need saying?”’

I thought that about Scott’s econlog post regarding consumption and GDP, but then I read the confused comments. He even had to do a follow up on it.

17. August 2020 at 11:36

What about the looming rent/ eviction crisis that folks on the left and the media are pointing to? Haven’t we seen that the economy / GDP / stock market are only weakly linked to the actual suffering and livelihoods of tens of millions of people in America? Should we do something about that even if “stimulus” doesn’t help the “economy”?

17. August 2020 at 11:46

“We need to address Covid-19 before we can return to a healthy economy.”—Scott Sumner

In that case, we are going to have a long, long wait.

And even then. Thailand has almost no cases of Covid-19 and yet the economy is doing even worse than that of the US. Japan has far far fewer cases of C19, per capita, than the US, than the us, but their economy has tanked too.

Great Britain and France have death rates from C19 not all that different from the US. Aside from from some island nations and mainland China (into which immigration is tightly controlled) no nation has succeeded against C19.

It appears fiscal stimulus has worked in China to maintain GDP. They went back to the well for heavy spending on infrastructure.

In democeacies, the lockdowns have been an economic disaster, yet have not yielded a victory against C19.

US policy makers and macroeconomists need to come up with a better plan.

17. August 2020 at 11:53

Scott,

I don’t hear many proponents of stimulus making a disposable income argument. Mostly, I hear arguments about avoiding evictions, foreclosures, and bankruptcies. They might mention disposable income but it is hardly the meat of their argument. Who are the economists making disposable income arguments.

As for inequality, people like me are having a minor windfall by working from home. I’ve reduced my spending by close to $1k per month, just by not driving to work, eating breakfast and lunch at home, dry-cleaning, buying work clothes.

17. August 2020 at 12:03

Paul, Two points. There is an argument for targeted programs that help those in need. Unemployment compensation is one such program, as are loans to small businesses.

But much of what was done is completely unrelated to need.

bb, Lots of people are saying we need to help those in need, as you say, but lots are saying we need to boost AD. And disposable income is the Keynesian transmission mechanism. But can fiscal stimulus boost AD right now?

17. August 2020 at 14:37

You should take advantage of this rare opportunity for a monetarist tell Keynesians that their preferred policy amounts to pushing on a string.

17. August 2020 at 14:41

Thanks Scott – so if I’m understanding you correctly, you would support something targeted, e.g. a massive helicopter drop of money for the unemployed or folks who have lost substantial income, potential debt forgiveness / foreclosure and eviction freezes for people behind on payments? What do you think are the best policies to help the people in need and how much do you think those policies would cost?

As someone not super deep on macro policies (and on the left side of the spectrum) all the NGDP targeting policies you typically advocate seem to me like policies that keep asset prices up and mostly benefit wealthier folks and (sigh) trickle down to help the rest. I’m willing to buy that these policies make sense from a utilitarian/technocratic standpoint (again, I’m no expert), but it feels like doing only that with nothing to directly help millions of people that are actually suffering seems like precisely the kind of policy that led to Trump (as in, what we did to bail out bankers and not homeowners in 2008).

17. August 2020 at 15:23

Sumner is bankrupt of ideas. Note how pathetic his post is, compared to Sumner’s 2008 vintage era, where his NGDPLT could work miracles. Now Sumner writes: “I actually do think monetary policy should be a bit more expansionary—enough to prevent disinflation—but I’m under no illusion that this would miraculously cure the recession.”

And Sumner refuses to give the US Fed credit for reversing the March stock market, which turned on a dime when the Fed announce their QE plan. Go figure…how the once mighty have fallen. They don’t even believe their own b.s. anymore.

Ben Cole has it right, again, pointing out that perceptions are a bigger factor to GDP than reality. Sumner focuses on “supply side” economics, the ‘reality’, claiming a vaccine is what’s needed, which, while true, doesn’t explain the fall in Japan and Thailand as Ben points out, nor the miraculous V-shaped rise of the US stock market this year. Only AD by way of perceptions does that.

17. August 2020 at 15:50

To those claiming Thailand and Japan disprove the case that the coronavirus is depressing the US economy because neither country has many domestic cases of COVID-19: take a look at how coronavirus is crushing those countries’ trade and tourism numbers and causing knock on effects for private investment.

17. August 2020 at 16:05

Hello Dr. Ray Lopez:

Speaking of epidemics, this is from the Bulletin of Atomic Scientists:

“There have been three publications, in 2015,30 2016 and 2017, describing the WIV (Wuhan) gain of function research. The WIV, having learned both basic and traceless infectious-clone technology from joint research with a laboratory at the University of North Carolina (UNC) in 2015, initiated construction of novel chimeric coronaviruses without UNC immediately thereafter. WIV’s first publication on the use of basic infectious-clone technology to construct novel chimeric coronaviruses at WIV appeared in 2016.31 WIV’s first publication on the use of traceless, signature-free infectious-clone technology also appeared in 2016.32

As this article was being edited, two excellent publications appeared that provide greater technical detail on WIV’s gain of function research, and readers should certainly examine these with care.33 The two papers strongly support the argument that the SARS-CoV-2 outbreak was the results of an escape from one of the two Chinese virology laboratories in Wuhan.”

By the way, the above article starts off with a long anti-Trump diatribe.

https://thebulletin.org/2020/06/did-the-sars-cov-2-virus-arise-from-a-bat-coronavirus-research-program-in-a-chinese-laboratory-very-possibly/#

Dr. Lopez and his early commentary about chimeras…well, was correst.

A consensus among experts is that the Wuhan virus was artificial and escaped from a Wuhan lab. Thus the appelation “Wuhan virus” is fair, and not a slander.

Worth pondering is why there are disinformation articles on the web that posit the Wuhan virus could not have been made artificially.

17. August 2020 at 16:15

SALT LAKE CITY — The virus that causes COVID-19 has been found in mink in two Utah farms — the first confirmed cases of the virus in the species in the U.S., state and federal officials said Monday.

The virus was found in five animals after tests were conducted at Washington State University on recently diseased minks in Utah. Dr. Dean Taylor, the state veterinarian for the Utah Department of Agriculture and Food, said both farms experienced a “substantial increase” in the death rates of their mink populations. The deaths prompted officials to test for SARS-CoV-2, which is the virus that results in COVID-19 for humans.

—30—

This virus is a Frankenstein. Minks? Tigers? Cats and dogs?

17. August 2020 at 20:08

Scott, this isn’t rich or poor, job or no job. If you can figure out who to target with what money more power to you. I say you don’t waste that time and just get it out. For part of that reason, see below.

Paul,

To me, the evictions/foreclosure/back rent/mortgage issue is the (with emphasis on “the”) looming disaster. We can only kick that can so far down the road. I can’t even fathom how it is going to be dealt with (other than generous fiscal support). What I do know is whatever solution they eventually come up with, it is not going to be an easy one. I’d like to see them start talking about ideas ASAP instead of wasting time on means testing the immediate disaster relief.

17. August 2020 at 23:35

“I actually do think monetary policy should be a bit more expansionary— . . . ”

‘This’:

“A reasonable view is that reliance on banking systems to finance budget deficits will keep money growth positive, at annual rates at least in the mid- single digits %, over the next year or two. The

evidence is universal and compelling, that agents’ money-holding preferences are stable in the long run. Whereas in spring and summer 2020 ratios of money to GDP (i.e., the inverse of the velocity of circulation) have climbed dramatically, in coming quarters they will drop sharply, closer to long-run averages. The rates of increase of nominal GDP and the price level will soar, probably after or in association with asset price inflation.”

https://mv-pt.org/wp-content/uploads/2020/07/Monthly-e-mail-2007-Global-money-round-up.pdf

is not ‘expansionary’?

18. August 2020 at 02:28

I suspect that some of the comments are motivated by falling commercial real estate prices, and the wish that the Fed can do for real estate prices what the Fed did for stock prices; and if the Fed can’t, maybe Congress can (through fiscal policy). Of course, there is a big difference between stocks and commercial real estate: liquidity. Sumner is correct: the underlying problem with the economy (prices) is the pandemic, and until the pandemic is defeated, the economy will suffer, and suffer enormous damage. In the meantime, we can expect more QAnon explanations for the public health crisis. To paraphrase Friedman, we are all conspiracists now.

18. August 2020 at 04:23

My sense is that most of what is labelled stimulus spending is really disaster relief spending – help for individuals, businesses and state/local governments that are in economic distress because, in your words “people [are] reluctant to spend money on services where there is human interaction.”

As has long been the case, the key is to fix the public health crisis and to keep those hurt going until the public health crisis is fixed.

18. August 2020 at 08:10

Paul, I strongly disagree. NGDP targeting is not aimed at boosting assets prices, and it helps the poor more than the rich. Look at the 1930s—stocks crashed but the poor suffered the most. That’s what I’m trying to prevent.

I favor unemployment compensation for those who lose their jobs. I’m not a fan of government programs aimed at debt forgiveness.

rwperu, I’m all for keeping AD growing at the appropriate level. The question is HOW? I prefer to use the least costly and most effective tools, and that’s not fiscal stimulus.

As for targeted aid, I’d say unemployment comp is far more targeted than $1200 for everyone. And if you insist on cash grants, why not $2400 for half as many people (i.e the lower middle class?) Isn’t that more progressive?

18. August 2020 at 13:00

This has always been my view. The lockdown is not causing the economic slump. The virus is causing the slump.

Of course, people want someone to blame, so the loudest people want to proclaim that the problem is the lockdown, and can’t possibly be the virus (which would be impervious to blame and require, you know, actually investing in helping people instead of just waving a magic wand).

I, for one, didn’t wait for anyone to tell me to stay home. I just went home, and stayed there, keep getting my work done. Then, as everything shut down around me, I just accepted my refunds on all my tickets, stopped eating out, and it’s been good for my bank account. But since these decisions were made independent of the lockdown, well, getting rid of the lockdown won’t start me spending again. I’ll keep up what I’m doing until I’m satisfied that the virus is past and we have protections in place.

Those who would counter that I have to get used to a new normal, that the virus is here to stay, all I can reply is, they can get used to a new normal too and live just fine without me spending money on their businesses.

18. August 2020 at 16:38

IVV, Yes, and I’d add that Sweden’s slump is as bad as Denmark and Finland.

18. August 2020 at 17:25

Scott,

Your plan is plenty progressive and would help a lot of people that need it, but it would also miss a lot of people that need it. Think of it like this;

Working vs Not Working

Upper 50% Income vs Lower 50% Income

That makes four quadrants. People in all four are hurting and could benefit from a boost (ie might increase spending). In my own life, of the 11 people I’m closest to I know someone in each quadrant who is fine and someone in each quadrant who would spend more if they had more.

It is not difficult for me to visualize small business guy who hasn’t shuttered but has lost 30% of revenue and more than that in profit/income (among this group is basically every individually owned restaurant). They may be upper 50% income, but they are still taking a beating.

In fact so far in this bizarre recession/depression the quadrant that has performed the best is low income, not working! That obviously stops with the expiration of enhanced UI.

IVV,

Exactamundo!

18. August 2020 at 17:37

One more thing. You don’t try and conserve water when your house is on fire. Coronavirus is the fire. It is not out.

19. August 2020 at 07:29

@Scott,

– ” Lots of people are saying we need to help those in need, as you say, but lots are saying we need to boost AD. And disposable income is the Keynesian transmission mechanism. But can fiscal stimulus boost AD right now?”

No. I do not believe that fiscal stimulus will boost AD in a meaningful/worthwhile way. I would prefer not to call it stimulus. I agree with you on UI. What are your thoughts on support for state and local government?

19. August 2020 at 10:01

rwperu, You said:

“Working vs Not Working

Upper 50% Income vs Lower 50% Income

That makes four quadrants. People in all four are hurting and could benefit from a boost (ie might increase spending).”

I can’t imagine how someone in the top 50% who still has a job is “hurting”, unless your definition of hurting is so broad as to insult the real poor of the world, for whom a $60,000/year job is not a tragedy that one sheds tears over.

And fiscal stimulus isn’t “water”—it’s not effective.

bb, State and local governments should pay their own way. We already have far too much moral hazard. The federal government should not be a money tree.

19. August 2020 at 21:26

Scott,

I want to let this go, but you are so far detached from reality I just can’t.

What about the family that saw it’s income fall by 75%? They are currently blowing through their savings, will eventually (if it hasn’t happened already) walk away from car payments, and in a worst case scenario will have to stop paying rent. I don’t care if they still have $100k in income, this family is hurting. BTW, that $100k is because that company got PPP (ie fiscal stimulus).

What about Small Business Guy who has part of his revenue tied to credit card swipes at restaurants and bars (down 30%) and another part tied to selling equipment to new restaurants (down 95%)? Do you think he can pay all of his bills? His income is down nearly 50%, so no. No he can’t.

I have another friend who took a 40% pay cut. The only reason he’s ok is because he got forbearance on not one, but two mortgages!

Another friend agreed to take a 10% pay cut before he was furloughed. He would have been fine at a 10% drop given the cut back in spending.

As for fiscal not helping, what a load of crap. There are enough papers that looked into it and determined the demand impact of the enhanced UI outweighed the work disincentive. Walmart speculates it’s revenue rose and fell with the stimulus. Last and most important, you know for a fact that there are some people who would spend more if they had more money. We highly suspect there would be no monetary offset. EG the only logical conclusion is more fiscal spending would lead to more spending throughout the economy.

Every system works…until it doesn’t. If you’ve been searching for a scenario where NGDPLT wouldn’t work, here it is. A global pandemic. You are blinded by your ideology. To get out of that rut, ask yourself;

Is tight money the reason people aren’t going to bars? No! It’s because they’re closed.

Is tight money the reason restaurants are only half full? No! It’s because that’s what the state/county/city mandates.

Is tight money the reason the people aren’t filling up stadiums/conventions/shows/airlines/hotels? No. It’s because those things aren’t allowed or aren’t safe.

Do this for every sector and sub sector and you’ll see there is a huge swath of the economy that monetary policy just can’t help. That leaves you two choices. No help or fiscal help.

20. August 2020 at 08:36

rwperu, Everyone who goes into business for himself knows it’s risky. I’m on record favoring expanding unemployment comp. to cover the self employed. A year ago that would have made me a super progressive. Now if I don’t favor guaranteeing that the self-employed can keep earning as much as they’ve always earned, I am some sort of reactionary?

What do you think the incomes of farmers look like? Their incomes go up an down dramatically from year to year. My dad was a realtor, and the same applied to him. The self employed need to learn to put aside money for years when their income will be lower than normal. Again, provide unemployment comp to keep them well fed, but don’t pretend we can guarantee their normal annual incomes.

You said:

“There are enough papers that looked into it and determined the demand impact of the enhanced UI outweighed the work disincentive.”

Even progressives like DeLong and Krugman didn’t believe this back in 2007. Then they suddenly changed their views after 2008. Remember what Krugman predicted would happen in 2014 when the enhanced unemployment ended? Remember what actually happened (a big speed up in jobs growth)? Remember who got it right? (Hint: Me.)

These “demand studies” typically ignore monetary offset, and hence are almost worthless.

You said:

“If you’ve been searching for a scenario where NGDPLT wouldn’t work, here it is.”

I agree, and have said so many times. We’d still have a severe recession with NGDPLT, but also we’d still have a severe recession with massive fiscal stimulus—and we do!

The final part of your comment completely contradicts the earlier part. First you claim fiscal stimulus would work right now, then claim that monetary stimulus won’t work because of the virus. Which is it? Both claims can’t be right.

20. August 2020 at 19:31

It is a mistake to look at fiscal policy as affecting aggregate demand; it is to Fed’s job to keep aggregate demand (NGDP) on track. Fiscal policy is microeconomic policy, to adjust taxes and expenditures to maximize real income over time.

20. August 2020 at 20:46

Scott, What Paul Krugman said back then is just as irrelevant as what you said back then. This is not that. You were right in 2014. You know why you were right. You know the reason you were right is not applicable today.

There is no contradiction. You are talking about economic stimulus, I am talking about disaster relief. You are talking about NGDP, I am talking about people. You are asking what to do to improve the employment situation, I am asking what to do when we know we are in for a long period of high unemployment caused by Coronavirus. It is here where I must make the obligatory statement that the best, most efficient spending is that which is directed at suppression of the virus. We know that’s not coming and we know why.

About six week ago I challenged some people (including Krugman) to write an article on why the recession hasn’t even started yet. Nobody took me up. It’s not that there hasn’t been a big loss in jobs or productivity, because obviously there has been. My take was that because of the fiscal spending, most people who lost their job didn’t lose income. Many of the people who did lose income were able to cut spending enough to offset those losses by not having anything to spend on and forbearance. Even the people getting crushed aren’t losing their homes (yet) because of eviction/foreclosure moratoriums. The pain that normally comes with massive job losses just hasn’t been felt…yet.

As a college professor, do you think it’s realistic for colleges to ask students to not socialize while back on campus? Me neither. If the Coronavirus strategy is relying on kids not socializing there is no Coronavirus strategy. Likewise if your economic policy is counting on small business owners having two years of expenses saved, you don’t have an economic policy. For policy to be effective, it must model reality.

21. August 2020 at 09:59

rwperu, You said:

“You know the reason you were right is not applicable today.”

What are you talking about. Of course it’s applicable today.

You said:

“Likewise if your economic policy is counting on small business owners having two years of expenses saved, you don’t have an economic policy. For policy to be effective, it must model reality.”

As I said, I support unemployment comp, and even extending the program to the self employed. But if we give $20,000 to an unemployed gardener then I don’t favor giving $200,000/year to a suffering small business owner, just because that was his previous annual income. Sorry, but business owners must accept that incomes will fluctuate with the business cycle. (BTW, I very much doubt this will last two years. The economy has already recovered quite a portion of the losses, in just a couple of months.)

You may think it’s unfair that business people must suffer, but that’s the world we live in. Government can’t fix that reality.

22. August 2020 at 18:22

Scott, what are the arguments for having government unemployment insurance in the first place?

From what I can tell, insurance like this is excludable and rivalrous, so not a public good.