Bubbles are such a useful concept!

Yes, I’m being sarcastic. I’m long past the point where I regard “bubbles” as an intellectual idea that should be taken seriously.

A few months back, I did a post mocking all of the (failed) previous predictions about Bitcoin being a bubble. Yet because the price at that time was well down from the peak, there continued to be lots of claims like the following:

We can safely say the ICO bubble is over now.

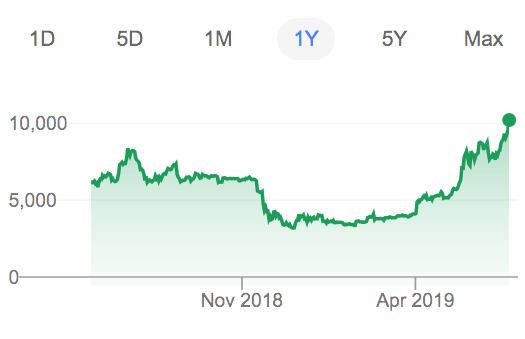

That was in March, when Bitcoin was at $4000. Today it’s up over $10,800.

If these are bubbles, then please give me more, and more, and more of them. I’ll laugh all the way to the bank.

HT: MSGKings

Tags:

22. June 2019 at 13:48

Very fair points.

22. June 2019 at 13:48

Bubbles are only definitively identified after the fact, which makes them useless for many of things people want to use them for.

Markets can be unstable, but that does not mean that they are inefficient.

24. June 2019 at 08:17

I’ve got into heated debates on this very subject. I am forced to tell people:

“look, if it’s a ‘bubble’ an asset which will predictably fall in price, then open a Binance account and short Bitcoin ok? If you’re not willing to do this, your opinion is worthless”. This is a great way to filter out intellectually weak acquaintances/needlessly burn bridges. It’s so facile to insist an asset will fall in price, just because it’s had a huge run, returns are proportional to volatility.

Massive run-ups in asset classes which haven’t existed before, or equities of totally new industries are exactly what you’d expect under the EMH view. You have this *thing* that’s new (Amazon.com, pets.com, Bitcoin, whatever), no one really knows how it will interface with the economy in the long run, but there are plausible stories you can tell where it’s huge, revolutionary. It’s rational jump on the moving train, because some people might know something you don’t, and volatility is compensated by expected return. This can result in brief periods if ‘irrational’ valuation, but that’s just the cost of discounting the future value under uncertainty. Was it irrational to buy bitcoin at $1500 just because it was flying like a rocket? No, you made money. Not obvious it was irrational to buy it at $17,000, it could easily have climbed further, no way to know. If you want a shot at being someone who owns a few million-dollar bitcoins, you have to risk being someone who took a loss.

Americans keep $14 trillion in M2 money. Why can’t the people of planet earth keep $10 trillion in BTC? An asset with trivial transaction fees (on the lightening network), backing from Jack Dorsey of Square and many others, and an inability of dysfunctional governments to steal it from banks or inflate it away? It’s totally plausible BTC becomes the ‘focal point’ crypto currency which commodities are traded in and large transactions in poor countries are done in. Trillion-dollar market caps get you a unit price in the six figures. You want some of this sweet action.

28. June 2019 at 02:46

Hi Dr. Sumner,

I’ve read your blog for years now and recently began your most recent book. Having seen several posts like this from you, I’ve always wondered what your take on portfolio construction is. Perhaps that is too personal and off-topic for an econ blog, but do you essentially view investing in something like Sharpe’s global market portfolio as the most logical? It becomes a little difficult for retail investors only due to investment options available at reasonable expenses, but I assume that is the long-term goal for individual investors that don’t worry over bubbles. Is that correct?

Thanks for all your wonderful posts and any answer.