Bartenders would hate me

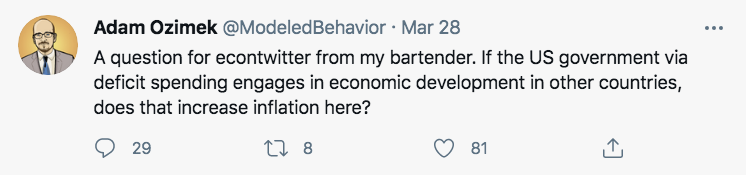

Tyler Cowen directed me to this Adam Ozimek tweet:

When fiscal stimulus is spent in the US then we can expect inflation to average 2% during the 2020s. If fiscal stimulus is spent overseas then we can expect inflation to average 2% during the 2020s.

But interest rates in the US might be a tiny bit lower if the money is spent overseas.

PS. My fellow economists might also find me to be highly annoying.

Tags:

30. March 2021 at 08:40

*if the Fed does what they say they will do*

30. March 2021 at 09:36

Inflation is based on the rate-of-change in monetary flows, volume times transaction’s velocity, relative to the ROC in real output. So, inflation may oscillate by the change in both variables.

30. March 2021 at 09:44

@Spencer Hall: Yes, inflation depends on nominal GDP vs. real production, and yes, we all know that NGDP = MV = PQ.

But the money supply M is controlled by the central bank, which is running a negative feedback control loop on inflation, with a target of 2% average annual inflation.

So, in the end, it doesn’t matter at all what happens to V or P or Q. Inflation will be whatever the Fed wants it to be, regardless of any other influences from the rest of the economy.

30. March 2021 at 10:31

Somewhat related to this post, I saw this thread from David Andolfatto a little while ago you might be interested in (could make for a good blog post). Here’s David: “To Friedman, the price-level is linked to supply of liquidity (central bank liabilities) and not to supply of outside wealth (treasury securities). If we’re more in the latter world (and I think we are), then the quoted passage below is wrong. The nominal interest rate on USTs at all maturities can be set by the Fed if it wants (it chooses not to peg longer yields). Easier monetary policy clearly means lower interest rates. This is what gives fiscal authority maximum fiscal space. Low inflation is a sign of tight fiscal policy, not tight monetary policy.” Here is the link to the full thread below

https://twitter.com/dandolfa/status/1369311863884947465?s=20

30. March 2021 at 11:28

John, Yes, but whether the Fed is lying or not does not hinge on where fiscal stimulus is spent.

30. March 2021 at 11:32

Tristan, The empirical evidence overwhelmingly suggests that Friedman is right for the US, and Sargent and Wallace are wrong.

30. March 2021 at 12:57

Scott, what’s your thinking behind the interest rate difference?

30. March 2021 at 15:00

Travis, Maybe a bit less investment demand in the US if the money flows overseas? I actually don’t have strong views on the topic.

30. March 2021 at 15:34

If loanable funds in the U.S. were less because the U.S. government was doing extraordinary investment spending abroad (or consumption spending, for that matter), that might make interest rates in the U.S. *higher*, since U.S. entities would have a harder time borrowing. But maybe others (private investors or foreign governments) would act so as to counter-balance U.S. government activity, leaving no effect on interest rates.

30. March 2021 at 16:02

@ssumner @Tristan Sinha: I was curious about the Sargent and Wallace paper, so I started reading it. Their mistake was obvious on the first page, in the introduction, and they even admit it:

“the monetary authority independently sets monetary

policy by, for example, announcing growth rates for base

money for the current period and all future periods … The fiscal authority then faces the constraints imposed by the demand for bonds … Under this

coordination scheme, the monetary authority can permanently

control inflation in a monetarist economy, because

it is completely free to choose any path for base money.”

vs:

“On the other hand, imagine that fiscal policy dominates

monetary policy. The fiscal authority independently sets

its budgets, announcing all current and future deficits and

surpluses and thus determining the amount of revenue

that must be raised through bond sales and seignorage.

Under this second coordination scheme, the monetary

authority faces the constraints imposed by the demand for

government bonds, for it must try to finance with

seignorage any discrepancy between the revenue demanded

by the fiscal authority and the amount of bonds

that can be sold to the public.”

Well, that’s hardly surprising. We already know that, with one tool (the money supply), a central bank can choose any single nominal target. If you choose to target the price of gold, then you can’t also choose the price of oil. You only get to choose one.

If you constrain the monetary authority to be required to support any fiscal budget deficit, then of course you can’t also control inflation.

But what kind of idiot would do that? That’s why we have independent central banks, with a clear mandate for inflation control, and not a mandate for supporting the fiscal budget.

They spend the entire paper exploring a scenario that is not important and essentially never happens (perhaps aside from corrupt governments and hyperinflation).

31. March 2021 at 06:27

Scott, would you consider commenting on the debacle in Turkey in a future post. Is it a monetary management problem or just general mismanagement by a clumsy authoritarian? How would you fix things?

The only excitement we have in U.S. economics right now is Larry Summer shouting about inflation risks from rooftops.

31. March 2021 at 08:24

This is a great response. Monetary offset wins the day.

31. March 2021 at 09:29

From extensive personal experience- bartenders might hate you but they will tolerate you if you do not act like they are your servants and can manage to get along with the other patrons while not getting overly intoxicated. Actually, if you can manage those three things, they are probably going to like you- especially if you tip well.

And you are only moderately annoying and only on occasion at that.

🙂

31. March 2021 at 09:30

Don, Good point.

David, I did a post on Turkey a couple weeks ago.

31. March 2021 at 12:28

A better question is to ask why we are spending millions to pay for development costs. And the answer to that is simple: we live in a corrupt world, and the only way to ensure that countries follow us and not China, is to pay them a kickback in the form of “financial aid”. But that is a system that is bound to fail. At some point, the American tax payer will no longer be able to afford buying up alliances and partnerships. We are seeing the culture decay, as Rome’s culture decayed. And soon we will see the economic and financial collapse that Rome all suffered after people realize that 30 trillion in debt, and living way beyond their means (including policing the world), will soon coming crashing down – maybe not for the ungrateful leftist Che and Fidel loving baby boomer generation that totally and completely destroyed America (Thanks Hillary), but certainly for the kids being born today.

31. March 2021 at 14:58

Scott, thanks–just made the trek over to Econlib for your comments on Turkey. It will only get worse for them.

And, I should be going to Econlib more frequently.

31. March 2021 at 18:48

If the spending is deficit financed, won’t it lead to some combination of higher taxes, less government spending, and higher inflation in the future? I am guessing that if the Fed does keep inflation at 2%, and that higher taxes led to lower economic activity, the Fed would have to increase the money supply as the velocity of money falls due to the lower levels of economic activity?

1. April 2021 at 10:51

David, Remember, this is my bad blog.

Lizard, Yes.

2. April 2021 at 21:07

Lizard, contrary to Scott’s simple confirmation, I think it depends:

The Fed might not have to increase the money supply to keep inflation at 2% in Thai scenario, if real GDP gets damaged enough by all that government meddling.

8. April 2021 at 14:22

As I said on the 1/23, gasoline to follow:

2021-01-18 2.285

2021-01-25 2.298

2021-02-01 2.316

2021-02-08 2.372

2021-02-15 2.409

2021-02-22 2.549

2021-03-01 2.625

2021-03-08 2.684

2021-03-15 2.766

2021-03-22 2.780

2021-03-29 2.771

2021-04-05 2.777

The FED eliminated guide lines for the money stock in 1987. Thus Greenspan gave us Black Monday.

8. April 2021 at 14:41

re: “the velocity of money falls”

Vi, is endogenously derived and therefore contrived (N-gDp divided by M) whereas Vt, is an “independent” exogenous force acting on prices.

As Dr. Philip George posits: “Changes in velocity have nothing to do with the speed at which money moves from hand to hand but are entirely the result of movements between demand deposits and other kinds of deposits.”

See: G.6 Debits and Deposit Turnover at Commercial Banks

http://bit.ly/2pjr81u

fraser.stlouisfed.org/…

The decline in income velocity, MZM velocity, since 1981 parallels the decline in the transactions velocity.

The decline in velocity was directly caused by the impoundment of monetary savings in the payment’s system, i.e.; caused by turning the thrifts into banks; the FDIC raising deposit insurance levels and the complete deregulation of interest rates for the member banks.

But we knew this already. In 1931 a commission was established on Member Bank Reserve Requirements. The commission completed their recommendations after a 7 year inquiry on Feb. 5, 1938. The study was entitled “Member Bank Reserve Requirements — Analysis of Committee Proposal” Its 2nd proposal: “Requirements against debits to deposits”

http://bit.ly/1A9bYH1

After a 45 year hiatus, this research paper was “declassified” on March 23, 1983. By the time this paper was “declassified”, Nobel Laureate Dr. Milton Friedman had declared RRs to be a “tax” [sic].

And then as of March 15, 2020, the Board reduced reserve requirement ratios to zero percent effective March 26, 2020. This action eliminated reserve requirements for all depository institutions.

The only tool, credit control device, at the disposal of the monetary authority in a free capitalistic system through which the volume of money can be properly controlled is legal reserves. The FED will obviously, some time in the future, lose control of the money stock.

8. April 2021 at 14:43

Velocity is set to accelerate. Why? Because the FED has reduced the remuneration rate on IBDDs to those almost below money market funding interest rates thereby releasing savings. Otherwise we’d have deflation.

Keynesian economists have achieved their objective – that there’s no difference between money and liquid assets. The 1966 Savings and Loan Association credit crunch is prima facie evidence (whence the term credit crunch originated), where the thrifts shrank in size, but the banks remained unaffected (because saver-holders can’t remove their funds from the payment’s system – unless they hoard currency…).

Whereas the 1966 Interest Rate Adjustment Act created a .50% interest rate differential in favor of the Savings and Loan Associations (the thrifts, the nonbanks), the Emergency Economic Stabilization Act of 2008 provided a preferential interest rate differential in favor of the commercial banks, which induced nonbank disintermediation (where the size of the nonbanks shrank by $6.2 trillion dollars, while the banks were unaffected, increasing by $3.6 trillion dollars).

Funny, because the banks don’t loan out existing deposits, or savings.

9. April 2021 at 05:45

U.S. PPI up 1% in March, up 4.2% year-over-year.

According to money flows, volume times transactions’ velocity, inflation should peak after May’s release.

Just read:

Getting it Wrong: How Faulty Monetary Statistics Undermine the Fed, the Financial System, and the Economy (The MIT Press) Paperback – December 16, 2011. by William A. Barnett

9. April 2021 at 06:40

Parse date; real-output; inflation

02/1/2020 ,,,,, 0.05 ,,,,, 0.03

03/1/2020 ,,,,, 0.20 ,,,,, 0.21

04/1/2020 ,,,,, 0.33 ,,,,, 0.40

05/1/2020 ,,,,, 0.40 ,,,,, 0.45

06/1/2020 ,,,,, 0.44 ,,,,, 0.50

07/1/2020 ,,,,, 0.44 ,,,,, 0.53

08/1/2020 ,,,,, 0.45 ,,,,, 0.56

09/1/2020 ,,,,, 0.45 ,,,,, 0.61

10/1/2020 ,,,,, 0.53 ,,,,, 0.68

11/1/2020 ,,,,, 0.77 ,,,,, 0.79

12/1/2020 ,,,,, 0.84 ,,,,, 1.26

01/1/2021 ,,,,, 0.64 ,,,,, 1.31

02/1/2021 ,,,,, 0.66 ,,,,, 1.41

03/1/2021 ,,,,, 0.70 ,,,,, 1.51

04/1/2021 ,,,,, 0.66 ,,,,, 1.54

05/1/2021 ,,,,, 0.66 ,,,,, 1.47

06/1/2021 ,,,,, 0.58 ,,,,, 1.44

07/1/2021 ,,,,, 0.55 ,,,,, 1.47

08/1/2021 ,,,,, 0.37 ,,,,, 1.45

09/1/2021 ,,,,, 0.12 ,,,,, 1.4

10/1/2021 ,,,,, 0.12 ,,,,, 1.4

11/1/2021 ,,,,, 0.07 ,,,,, 1.28

So we know that inflation will prove transitory as it declines rapidly after Nov. 2021