Are the tax cuts affecting growth?

Probably, but it’s too soon to say. Here is some (annualized) data on RGDP and NGDP growth:

2009:Q4 to 2016:Q4: NGDP growth averaged 3.8%, RGDP growth averaged 2.1%

2016:Q4 to 2018:Q1: NGDP growth averaged 4.5%, RGDP growth averaged 2.4%

2018:Q1 to 2018:Q2: NGDP growth was 7.4%, RGDP growth was 4.1%

Conclusions:

1. Monetary policy has recently become more expansionary, especially in 2018:Q2. This would be expected to modestly boost RGDP growth, and it did. But NGDP growth has no effect on long-term trend RGDP growth.

2. There is a small amount of evidence that RGDP growth picked up after 2016, but it’s really only in the last three months where we seem to see significant effects from Trump policies—especially the corporate tax cut. (I’m not interested in the demand side effects of other tax cuts, which are offset by monetary policy over any significant period of time.) But it’s still not completely clear if this growth surge is any different from 2014-15.

In my view, about 1/2 of the 0.3% initial boost to growth was due to deregulation, and the rest was due to easier monetary policy.

This year I expect a bigger growth surge due to the tax cut. I predict an extra 1% of RGDP growth, and I also predict this growth burst will fall off sharply in subsequent years, so that the long run effect will be RGDP about 2% higher than otherwise, at most. But 2% more RGDP is a lot–well worth doing. (Here I’m referring to actual RGDP, the tax bill might slightly distort the figures by changing the way corporations report the location of economic activity. We’ll know that occurred if Ireland’s GDP takes a hit.)

I have not factored in a major (and persistent) international trade war, as I still consider that outcome to be unlikely.

BTW, the 7.4% NGDP growth in Q2 is not likely to be sustained, according to the Hypermind prediction market (which shows 4.6%). Ditto for real GDP growth. I recall that RGDP growth averaged over 5% during the second and third quarters of 2014, but that was not sustained.

PS. Earlier GDP figures were revised downwards, so the NGDP growth under the previous year’s Hypermind market was actually 4.6%, not 4.8%. Of course the payoffs depend solely on the initial announcement.

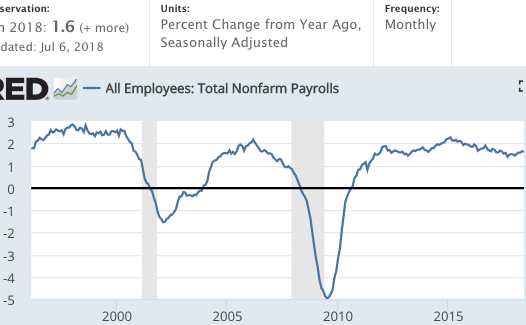

PPS. The employment situation is of course much less impressive. Job growth has not increased under Trump, despite the fantastic claims of some in the media:

Trump’s policies have produced the best of all economic worlds — surging growth and employment, with little inflation and a rising dollar.

That’s simply not true:

Tags:

27. July 2018 at 10:16

Why isn’t the corporate tax cut offset by monetary policy?

27. July 2018 at 10:48

Scott Sumner on jobs, June 2, 2017:

“So we must be producing lots of jobs, right? No, payroll employment rose by just 138,000 in May, well below the pace of the previous 7 years. Yes, one month is not significant, but job growth over the past three months has averaged only 121,000. Companies cannot find workers.

In 2018, we’ll look back on these job gains as boom numbers, as things are going to get even worse.”

27. July 2018 at 14:30

Scott,

Question – Why do you think the impact of the corporate tax cuts will not be permanent. If they shift some percentage of GDP from consumption to investment, won’t that result in ongoing higher growth throughout the period when the tax cuts are in effect?

28. July 2018 at 07:51

Raver, Supply side effect.

Brian, Yes, that prediction was wrong, as the Trump job creation pace is only slightly worse than under Obama, not way worse.

dtoh, I claimed it would be permanent, a permanent 2% rise in RGDP. You’d find very few other economists who are as optimistic as I am.

In any growth model I’m aware of a permanent rise in investment does not permanently increase the growth rate, due to diminishing returns. But the level may permanently increase.

28. July 2018 at 08:25

Scott, I can’t find your seasonally adjusted year-on-year rate graph, but here is the overall total job graph, and it looks a bit different:

https://fred.stlouisfed.org/series/PAYEMS

Why?

28. July 2018 at 10:56

If you could set down Trump for just one minute, it may be a source of curiosity how a first rate economist could blow a 12-month job projection by 2 million. Big miss.

Or not. It’s your life.

28. July 2018 at 12:56

Scott,

How significant do you think the law of diminishing returns are?

IMHO and looking at the industries and human activities with which I am familiar, we are a long, long, long way from any diminution of returns. So much so to the point that you need to question the whole theory.

29. July 2018 at 08:19

David, That’s levels and I’m showing rates of change, but the results are the same–no big change after 2016.

Brian, You said:

“If you could set down Trump for just one minute, it may be a source of curiosity how a first rate economist could blow a 12-month job projection by 2 million. Big miss.”

Yeah that would be a big miss—glad I didn’t do it. Getting your facts right is the first step to enlightenment. You have yet to take that step.

dtoh, It’s hugely important and it’s everywhere in our economy, even if people don’t see it. Without diminishing returns a single acre of land could feed the entire world. Do you think that’s likely to occur in the near future?

29. July 2018 at 18:15

Scott,

Long discussion, and I have to head into a meeting…

but

1) Yes. If you build a tall enough farm factory on top of the one acre.

2) I think the argument is a kind of Malthusian/Club of Rome hybrid fallacy based on the theory of limited resources. I bet that for most of what the economy produces we can increase production by at least an order of magnitude while increasing efficiency at the same time.

30. July 2018 at 02:57

Indeed you were a bit vague. You merely observed that we would look back on the 2017 numbers of 121K per month as “boom numbers”, whereas the reality has been more like 200K per month. Upon further review, you nailed it!

30. July 2018 at 11:42

Is Hypermind’s NGDP futures volume enough to make it meaningful in teh sense that it represents a large portion of the broader market participants? What about alternative , large volume, measures that go along with NGDP ?

30. July 2018 at 14:55

dtoh, I disagree, it’s technologically infeasible to feed 7 billion that way.

As for Malthus, it’s really completely unrelated to that fallacy. I’d say 99.99% of economists believe in diminishing returns, and only a small fraction believe Malthus was correct.

Jose, Is there a better market forecast out there? If so, use it and play Hypermind.

30. July 2018 at 17:47

Wrong. Using hydroponics, GMO, high intensity lighting, no meat production, etc. you can probably feed 1000 people per acre. (World average is 2. China is about 20.) That would require 7 million acres. Assuming 3.5 feet per floor (including lighting) and assuming a 7000 foot building. That will get 2000 floors, which in turn would require a floor plate of 3500 acres (roughly 2.3 miles per side).

Now assume 2ft x 2ft carbon nanotube (for high compressive strength) support beams placed every 120 feet seated on a large underground foundation to elevate the building to minimize actual ground use. That’s 10,000 support beams each with a cross section of 4 square feet for a total of 40,000 square feet of actual land (surface area) used.

That’s 0.92 acres. Trivial!

31. July 2018 at 09:01

As technological frontiers are very rich at this time, I hope positive hysteresis will be happen to the economy.

31. July 2018 at 16:51

Scott,

Does 7.4% NGDP growth start to get you in the zone of real concern that an Austrian boom-bust cycle may be getting inflated again?

1. August 2018 at 10:39

dtoh, So a giant platform? I’m skeptical of whether even that could be done at a feasible cost. In any case, diminishing returns say if you fix one input like land, the cost of production rises as you increase output by adding other factors. That’s still true in your example.

John, Absolutely, if it persists. My lack of concern reflects the expected slowdown seen in the Hypermind market. But of course that market may be wrong, and we need to closely watch this issue.

1. August 2018 at 17:08

Scott, so a few thoughts on this.

1) I wouldn’t say a 2.3 x 2.3 mile platform is giant especially in the context of feeding the entire world’s population. I think it would be more appropriately described as petite….and miraculous when we think about it.

2) I see your argument has gone from technological feasibility to economic feasibility, to which I would agree. If it were economically feasible (i.e. would yield a market rate of economic return,) it would already have been done.

3) I don’t think the theory of diminishing returns was based on holding one factor constant. Rather it was based on the decreasing productivity of each factor. To paraphrase Malthus, I think he was talking about the relative fertility of hardscrabble land on the side of a mountain versus lush lowland pastures.

4) From the point of view of the efficacy of tax cuts in permanently increasing growth rates, I believe you need to look at total factor productivity. From that point of view, I don’t see any serious limitations. Land does present some limitations based primarily on infrastructure (availability of economical transportation and electricity.) Capital productivity has no practical limits and in today’s world, capital productivity increases as you increase capital.

5) Lastly, I do think labor availability (productivity) could limit growth, but there are several factors mitigating against it: a) capital substitution, b) increasing capital productivity (mentioned above,) c) low LFPR, and d) the ability to increase labor productivity by investing in human capital (which the tax cuts actually facilitate.

3. August 2018 at 17:57

dtoh, Economists generally hold one factor constant when they talk about diminishing returns.

Malthus would have argued that even if all land were identical, adding more and more labor and capital would eventually result in diminishing returns from that land. The problem with Malthus is not that he was wrong about diminishing returns, it’s that he was wrong about technological progress.

You probable won’t be persuaded by this, but note that other developed countries sharply cut their corporate tax rate long before us, and did not have a growth spurt. Yes, those other countries have other bad policies that we lack in some cases, such as higher overall taxes. Nonetheless, the specific effect of lower corporate tax rates doesn’t seem very notable, unless I missed something. (I do think it’s positive, just not all that large.)