An NGDP targeting boomlet?

With all of the recent supply shocks, it’s increasingly obvious that inflation is the wrong target. Today I came across two articles advocating NGDP targeting. Ramesh Ponnuru has a piece in Bloomberg and Norbert Michel has a piece in Forbes.

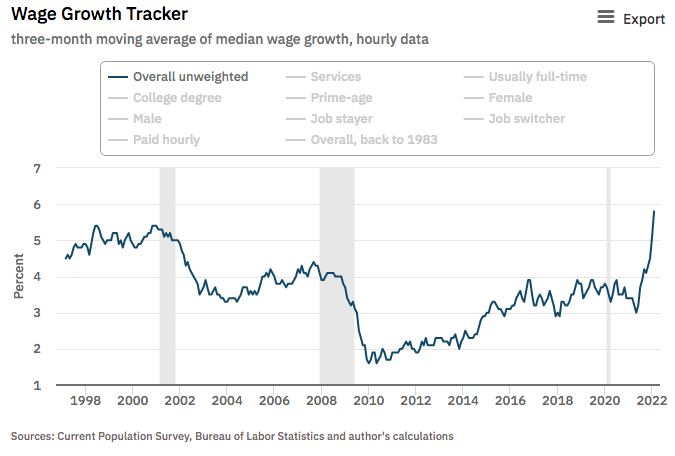

In a recent article, Larry Summers links to this frightening graph showing soaring nominal wage growth:

He’s right, the Fed’s recent mistakes make a recession more likely.

There’s been a lot of discussion of inverted yield curves. Yield curve inversion implies a market forecast of lower future nominal interest rates. It can occur from expectations of slower real growth, slower inflation, as well as a number of other factors. The simplest model is to assume that yield curve inversion predicts slower NGDP growth.

On some occasions, such as 1966, 1981, and today, you would like to see substantially slower NGDP growth, even at the risk of recession. In other cases, a sharp slowdown in NGDP is undesirable, and a sign that monetary policy is too contractionary.

NGDP growth was over 11% over the past year, and will continue at well above trend for at least a few more quarters. I’d like to see NGDP growth fall below 4% in 2023, but not sharply below 4%. That’s much harder to do when the Fed has no credibility, Unfortunately, their recent abandonment of FAIT has cost them a lot of credibility.

It’s like the farmer said to the lost motorist, “First of all, I wouldn’t start from here.”

Tags:

18. March 2022 at 12:21

I’m disappointed that the Fed only hiked a quarter. I would have hiked 50bps and committed to hikes until 5 year TIPS breakevens fell below 2.25%, if I had a 2% inflation target.

Ideally I’d target an NGDP growth rate of population + 1%.

18. March 2022 at 19:09

Looking at that graph brings back all kinds of painful economic memories from 2010-2014. The fed could have fixed that in an instant.

18. March 2022 at 20:34

I’m doubling down on my position that we’re headed for a repeat of the 1990’s. I’m basing that on the expectation that the Fed could a braking maneuver that levels us off with NGDP growth higher than what Scott likes, but relatively stable for a decade.

Of course, the Fed can’t do anything about immigration reform, war, plagues, zoning codes, and the general insanity of Trumpism.

19. March 2022 at 06:02

Will there be a 2023 NDGP prediction challenge on Hypermind?

19. March 2022 at 10:43

Sort of related, but I listen to a lot of finance stuff, podcasts, etc … during work, and they have this weird perception of, oh wages are rising, that’s good right?, oh no inflation, that’s bad. They were complaining endlessly about the fed hiking at all.

And I just keep waiting for them to distill all this complicated and long mumbo-jumbo into something quite simple: real GDP growth is good. Excess nominal GDP growth is bad. Everything comes down to that. All the increase in asset prices over the past year or decrease this year is irrelevant unless you ask what it is a function of. Did productivity meaningfully change? In some ways it did and some ways it didn’t.

I have a friend who works for the fed and I asked him about 6 months ago whether the fed was going to raise interest rates, and he responded that its likely a supply issue that will sort itself out. As someone with much less formal economic training, but whose job is in supply chains, I responded that I don’t don’t think its that, its excess aggregate demand. I suppose I’ll take the win?

19. March 2022 at 12:54

–“I have a friend who works for the fed and I asked him about 6 months ago whether the fed was going to raise interest rates, and he responded that its likely a supply issue that will sort itself out. As someone with much less formal economic training, but whose job is in supply chains, I responded that I don’t don’t think its that, its excess aggregate demand. I suppose I’ll take the win?”–

Correct, if supply disruptions occur, overall prices shouldn’t rise that much unless accommodated by monetary and fiscal policy.

For a fixed amount of money, if the price of one object goes up due to a decrease in supply, demand for other products should fall due to budget constraints, leading to price cuts for those products. Yes, some overall price increase is likely, due to sticky prices and sloped demand/supply curves, but at some point you need actual buying power to bid up the price of all goods, and then in turn wages.

Consider Japan, prices there are up 0.9% YoY vs. 7.9% in the United States. Is Japan magically free from global supply constraints? Even Canada has only 5.1% YoY inflation. Switzerland only has 2.2% YoY inflation.

5-year TIPS spreads have been close to or above 3% since last October, unless it is a 5-year problem, supply chain pressures shouldn’t impact market expectations of the price level 5 years from now.

https://www.stat.go.jp/english/data/cpi/1581-z.html

https://www150.statcan.gc.ca/n1/daily-quotidien/220216/dq220216a-eng.htm

https://www.bfs.admin.ch/bfs/en/home/statistics/prices/consumer-price-index.gnpdetail.2022-0285.html

19. March 2022 at 13:07

Tacticus, I don’t know. Last year’s market was poorly designed.