About that eurozone “liquidity trap”

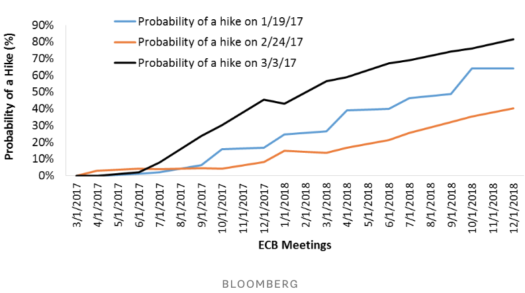

Just a year ago, Keynesians were telling us that the eurozone was stuck in a “liquidity trap” and that the ECB was “out of ammo”. Instead, Europe needed fiscal stimulus. Now markets are predicting that the ECB will raise rates within the next 12 months:

Obviously if the eurozone actually were stuck in a “liquidity trap” then it would be absolutely insane to raise interest rates this year.

Obviously if the eurozone actually were stuck in a “liquidity trap” then it would be absolutely insane to raise interest rates this year.

For years I’ve been arguing that the sluggish NGDP growth we see in many developed countries is due to contractionary monetary policies. Central banks are perfectly capable of delivering faster NGDP growth, they simply don’t want to.

Prediction: Even as the ECB raises rates, we’ll still hear from the usual suspects that “fiscal austerity” is the problem, even though the US has done just as much austerity over the past 5 years, if not more.

Suggestion: Those who don’t think the supply side of the economy is important should take a look at Germany and Greece, both operating under the exact same monetary policy.

Tags:

7. March 2017 at 20:20

Well said.

7. March 2017 at 21:30

Raise rates? But I recall someone saying that this is done by way of increased inflation. You know, all that Milton Friedman stuff:

“Low interest rates are generally a sign that money has been tight, as in Japan; high interest rates, that money has been easy.”

Well, raised rates occurring in the future in the EU means money would be easy up to that point.

8. March 2017 at 02:30

Contemplating precisely how much Greece could increase economic activity by supply-side reforms is enough to make one start muttering darkly into one’s beer.

Or, to summarise your very well said post: Very Serious People can have some remarkably silly debates.

8. March 2017 at 03:56

Verily, the Greeks should work harder, and devise and implement a fair tax system.

But they should also quit the ECB and print drachmas to the moon.

Milton Friedman predicted such a large monetary union (the ECB) would be too tight in some places, and perhaps too loose in others. I think he was right.

Whatever, the Greeks and the ECB have hit a dead-end.

Write off Greek loans, and set them free. Let them borrow in drachmas.

8. March 2017 at 04:28

This got me thinking about income differences in the US. It would be bizarre if a Keynesian kept harping that Mississippi or West Virginia just needed to run bigger deficits. I’d note too that cultural or historical or other reasons probably have more to do with these differences than do supply side differences. At least supply improvements will help. So called fiscal solutions will most likely make things worse.

8. March 2017 at 07:18

> Suggestion: Those who don’t think the supply side of the economy is important should take a look at Germany and Greece, both operating under the exact same monetary policy.

Those who don’t think the demand side of the economy is important should take a look at Germany and Greece, both operating under the same monetary policy with very different fiscal policies.

Really, you’ve over-reached with this one. The ECB sets aggregate demand for the entire Eurozone, but it’s up to the individual Euro nations to divide that aggregate demand amongst their economies.

Since Greece is required to repay its debts, that debt repayment detracts from the nation’s aggregate demand as money that would be used for domestic consumption is instead sent to the creditor nations and institutions. With a lump-sum transfer of wealth (which as we all know does not affect the margins), Greece’s economy would be at least moderately healthier.

The supply-side factors are in addition to this. Greece certainly needs to reform its tax infrastructure and unfunded pensions, but from a political point of view we know that supply-side reforms are far easier to make against the backdrop of a healthy or growing economy.

@bill:

It would be strange for Keynesians to argue that West Virgina should run larger deficits, but I do not think it strange for a Keynesian to argue that maybe the state should not be so focused on running a surplus to be sequestered out of state.

Conservative intuition is correct here from both a Keynesian and supply-side standpoint: distributing surplus in the form of tax cuts is both a Keynesian stimulus (if monetary policy is exogenous) and a supply-side boost.

8. March 2017 at 07:23

John Cochrane on TIPS spread targeting:

http://johnhcochrane.blogspot.lt/2017/03/target-spread.html

8. March 2017 at 08:18

Sigh, it’s like playing the game of Whack a Mole with Sumner. The reason NGDP is increasing, interest rates are increasing, money supply is increasing is due to an increase in animal spirits, in real GDP. Real GDP is the independent variable, and not NGDP. Increasing NGDP will not increase RGDP. Whack-A-Mole, sigh.

8. March 2017 at 09:01

How is a market prediction that the ECB will raise rates, even though that would be absolutely insane, inconsistent with Keynes?

Possibilities include that the ECB is absolutely insane and that market predictions are inaccurate.

8. March 2017 at 09:10

OT – Internet screen scrape below. Two ways to read this: (1) the correct way: money is neutral, Fed follows the market, and recessions happen, or, (2) the Ben Cole/ SS way: Fed is the bad guy, killing a good party by taking away the punch bowl. Note of course Bond King Mr. Gundlach below is ‘taking his book’ (maybe wants higher rates for to his trades). – RL

With inflation targets pretty much met, unemployment at multiyear lows and the support of improving economic data, DoubleLine Capital’s “Bond King” Jeffrey Gundlach said the Federal Reserve has no excuse not to start hiking rates in March, but that may also unleash an “old school” central bank that keeps on raising rates.

“Something has changed in influence of the Fed over the market, and vice versa,” Gundlach said in a webcast late Tuesday.

While he said he doesn’t see a recession on the horizon, Gundlach said he’s looking out for red flags now that the market appears to have changed its tone with regard to the Fed.

“The Fed had been following the market, as we’ve talked about in the past how many times the Fed would have to capitulate because they would say they were going to raise rates and the market would basically laugh in their face in disbelief,” Gundlach said.

“They may start to go ‘old school’ and start to see more sequential Fed rate hikes, and if we’re going to go ‘old school,’ what has happened historically — and this is pre-credit crisis — the Fed gets into a sequential hiking mode and they keep doing it until something breaks. And the definition of ‘something breaks’ is the onset of recession, which is usually preceded by a flat or inverted yield curve. Clearly the yield curve has been flattening since July, [and] post-election, but it’s nowhere near inverted.” Dow Jones Newswires 03-08-17 0530ET

PS–Germany and Greece are two different countries (Sumners’ last line)

8. March 2017 at 12:57

The Greek situation is well past the point of cruel absurdity. In 2010 I was confident they’d be out of the EMU by 2012. In 2012 I figured 2013. Instead they’ve endured the biggest, longest economic contraction of any more or less developed nation in modern history (possible exceptions are Ukraine, pre-Putin Russia, Rhodesia/Zimbabwe). I’m frankly shocked at what the Greeks are willing to endure. Hopefully Le Pen makes France French again and finishes off the Euro so the Greeks can be removed from this hopeless situation.

8. March 2017 at 14:25

Germany and Greece, both operating under the exact same monetary policy.

Isn’t that the main problem?

8. March 2017 at 14:47

The supply side of Greece sucks since always. And under Merkel’s reign (the last 12 years btw) the supply side of Germany got worse and worse and worse (if anything).

So the only thing that really changed between Greece and Germany (and so many other European countries btw) is in fact the currency regime. Or not?

European countries like Greece, Italy, France are used to devaluing their currency when the going gets tough. Pressing them into a currency regime with Germany is like throwing a baby into the ocean and expecting it to swim.

Swim baby, swim!

8. March 2017 at 14:48

Ray your arithmetic is off. If RGDP increases, then all else equal, prices fall, because “the same dollars are chasing more goods.

If all else is not equal, if RGDP rises and NGDP rises by more, then prices will rise. If RGDP rises and NGDP rises but not as much, then prices fall.

Increased RGDP does not force spending upwards. Money and goods are separate and can move in opposite directions. You cannot assume that increased RGDP will necessarily be accompanied by rising NGDP. Only if prices rise, which is caused by the Fed and not increased RGDP, then NGDP can rise when RGDP rises.

Basic math

8. March 2017 at 16:19

@Major-Freedom: yes, I know that, but in the modern fiat money era usually increased RGDP means increased inflation. That’s the problem however: the correlation between increased RGDP and inflation gets people like Sumner excited, and they get the causation backwards (aka a variant of the “Philips Curve”) and think that inflation causes RGDP growth.

8. March 2017 at 16:19

House and Tesar over at University of Michigan disagree

“Counterfactuals suggest that

eliminating austerity would have substantially

reduced output losses in Europe. Austerity shocks

were sufficiently contractionary that debt-to-GDP

ratios in some European countries increased as

a consequence of endogenous reductions in GDP and

tax revenue”

http://www.nber.org/papers/w23147.pdf

8. March 2017 at 16:22

I guess they’re the “usual suspects”?

9. March 2017 at 02:29

“The supply side of Greece sucks since always.”

Really?

Between 1999 and 2008 Greece had the greatest increase in ‘Gross domestic product per capita, current prices {U.S. dollars}’

9. March 2017 at 02:32

“Central banks are perfectly capable of delivering faster NGDP growth, they simply don’t want to.”

Quite right.

“ANFA has been used to limit the capacity of NCBs to create liquidity in accordance with monetary policy objectives.”

http://www.ecb.europa.eu/press/pr/date/2016/html/pr160205.en.html

9. March 2017 at 02:43

“The E.C.B. Could have prevented these bubbles. Just has it could have ended the ensuing banking and economic crises. But it refused to do so until major political concessions had been made, such as the transfer of fiscal and budgetary powers . . . ” 84”19′ in

https://www.youtube.com/watch?v=p5Ac7ap_MAY

9. March 2017 at 10:03

Between 1999 and 2008 Greece had the greatest increase in ‘Gross domestic product per capita’

The greatest of what? This rise began around 1992 by the way. I don’t know the exact reasons for this rise but I assume it was mostly the Euro, deficit spending – in short: demand side policies and not such much supply side policies. They focused on AD (which is not completely wrong) but unfortunately (mostly) without the necessary supply side reforms. This might be the reason why it didn’t last.

Anyhow: The real question is how can Greece (and all the other countries) get back on their feed again. I see only three possible ways:

1) Major supply side reforms.

–> I don’t see how this is happening ever.

2) Major transfer payments.

–> This might be the reality already but how is this wise and sustainable and good in the long run. I just don’t see it. This is just destroying the EU even more.

3) Separate demand side policies again.

–> The only realistic way I can see right now.

9. March 2017 at 11:11

Off topic for this post, but since it has been predicted here that Trump and the Republicans will fail to materially change Obamacare, see Karl Rove’s column in the WSJ today;

https://www.wsj.com/articles/the-beginning-of-obamacares-end-1489016361

In which he explains the political maneuvering within the confines of the senate rules–the 60 vote hurdle. Essentially, the Republicans intend to use ‘reconciliation’ to repeal what they can do legislatively, but that the heavy lifting will be done by HHS Sec’y Tom Price.

Obamacare gives the HHS the power to write 1400 or so regulations regarding health insurance. Now that that Sec’y is not named Sebelius watch those regulations! Price intends to introduce market competition, as well as regulatory relief, into health insurance through that process.

Further, the Republicans will later introduce new legislation preventing ‘junk’ malpractice lawsuits, allow consumers to buy insurance across state lines and permit smaller businesses to band together to get the same treatment large employers do now.

9. March 2017 at 14:02

Patrick says…”Obamacare gives the HHS the power to write 1400 or so regulations regarding health insurance. ”

So It will need to be far more Trumpcare than Ryancare to get rid of Obamacare…

Trump is already trying to distance himself from the GOP plan…he’s upset that people are calling it Trumpcare… For a man who loves to see his name on everything…that’s saying something…

I wonder who’s gonna break it to him that his administration needs to make most of the real changes and…take all the heat?

Trump needs to know….Someone at Breitbart News needs to do a report on this… God knows Trump believes them…

http://www.politico.com/story/2017/03/trump-branding-obamacare-repeal-235831

9. March 2017 at 15:23

Peter Thiel’s latest: ???????

http://marginalrevolution.com/marginalrevolution/2017/03/latest-peter-thiel.html

“What’s very striking is that on some level I think fracking represents a bigger economic form of progress for our society as a whole than the innovation in Silicon Valley.”

……….

“I am not sure this is a good thing, but it is a fact that maybe politics is becoming more important and more intense, the range of outcomes is becoming greater.”

???????

9. March 2017 at 16:09

Ray, well that’s true enough.

Although you will hear the belief that inflation causes real growth in a different way, normally something like “steady inflation just stops the economy from shrinking due to “bad” monetary policy”

Same thing said in a slightly different way to make it appear less insane.

10. March 2017 at 06:07

“I don’t know the exact reasons for this rise but I assume it was mostly the Euro, deficit spending – in short: demand side policies and not such much supply side policies.”

L.O.L.

So demand created its own supply?

10. March 2017 at 06:40

You are the one to laugh about because you really seem to think that by quoting a GDP increase per capita you somehow “proved” that this was caused by supply side policies.

I still say it was mainly caused by demand side policies and I gave actual arguments for that. You can argue otherwise of course by using real arguments but so far you didn’t use any arguments.

Judging from all your comments during the last months you have no clue what you are talking about anyhow. So the lack of any arguments from your side is not really surprising. It’s just like you roll since forever.

10. March 2017 at 07:06

Re Greece and B. Cole’s point: it’s generally acknowledged that Greece spent beyond her means in the 00’s, living on foreign credit. They also had a lower growth period during the 1980s when a Socialist, Papandreou Sr., took over and not only printed inflation (which is not that big a deal IMO) but also empowered workers with all sorts of pro-labor laws that resulted in productivity going down (workers constantly going on strike for more pay, more benefits, and they would only work half a day, still largely true today).

10. March 2017 at 07:39

OT -we all agree–even I, who thinks money is neutral–that a HYPERinflation is very bad. So how to prevent hyperinflation? Simply guarantee a portion of fiat money is backed by a real asset, like gold. It doesn’t even have to be 100% backed. Source: “If the government fractionally backs the currency by guaranteeing a minimal real redemption value for money, the problem of speculative hyperinflation disappears.” – Speculative Hyperinflations in Maximizing Models: Can We Rule Them Out? Author(s): Maurice Obstfeld and Kenneth Rogoff, Journal of Political Economy, Vol. 91, No. 4 (Aug., 1983).

George Selgin approves of this message.

10. March 2017 at 08:17

L.O.L.

10. March 2017 at 08:21

“I still say it was mainly caused by demand side policies and I gave actual arguments for that. ”

R.O.T.F.L.

10. March 2017 at 12:32

Majromax, You said:

“The ECB sets aggregate demand for the entire Eurozone, but it’s up to the individual Euro nations to divide that aggregate demand amongst their economies.”

Regional AD is determined by supply-side factors.

Foosion, Keynesians have been saying that the ECB wanted more AD, they just lacked ammo.

Christian, Greece has multiple “main” problems.

Patrick, Do you consider the new GOP bill to “repeal Obamacare”?