A “powerful argument” for market monetarism?

Unfortunately market monetarism is still a fringe movement, even less popular than other heterodox theories like ABCT. So I have to constantly act like that nerdy guy who barges into a party he wasn’t invited to. Noah Smith recently quoted John Cochrane on the problems with traditional Keynesianism and traditional monetarism:

The conventional way of reading this graph is that inflation is unstable, and so needs the Fed to actively adjust rates…When inflation declines a bit, the Fed drives the funds rate down to push inflation back up…When inflation rises a bit, the Fed similarly quickly raises the funds rate.

That view represents the conventional doctrine, that an interest rate peg is unstable, and will lead quickly to either hyperinflation (Milton Friedman’s famous 1968 analysis) or to a deflationary “spiral” or “vortex.”…

But in 2008, interest rates hit zero…The conventional view predicted that the broom will topple. Traditional Keynesians warned that a deflationary “spiral” or “vortex” would break out. Traditional monetarists looked at QE, and warned hyperinflation would break out…

The amazing thing about the last 7 years in the US and Europe — and 20 in Japan — is that nothing happened! After the recession ended, inflation continued its gently downward trend.

This is monetary economics Michelson-Morley moment. We set off what were supposed to be atomic bombs — reserves rose from $50 billion to $3,000 billion, the crucial stabilizer of interest rate movements was stuck, and nothing happened.

Then Noah Smith adds the following comment:

This is a powerful argument, and I think that those who sneer at Neo-Fisherism don’t take it seriously enough.

That said, there are some serious caveats.

And before Noah explains his views, this is where I barge in, like a student eagerly waving his hand up to be called on.

Let’s slow down and figure out what John Cochrane is glossing over. He was right that an interest rate peg was supposed to lead to hyperinflation or a deflationary vortex. But Friedman did not believe that this applied at the zero bound. Rather he thought that when nominal rates were positive an interest rate peg makes the quantity of money endogenous, and that’s where the problems come in. (Indeed Friedman once argued for zero nominal interest rates on “optimal quantity of money” grounds.) Now in fairness to John, he’s right that traditional monetarists overestimated the impact of base increases at the zero bound, or more precisely didn’t adequately account for the distinction between temporary and permanent injections (which Krugman modeled in the now-famous 1998 paper.) So it’s fair to criticize the traditional monetarists, even if they didn’t expect price level indeterminacy at the zero bound.

And it’s also fair to criticize the Keynesians for their flawed Phillips Curve approach, which predicted more deflation than we actually got (even more so in countries like Britain.)

But unless I’m mistaken the market monetarists got this exactly right. Let’s take it in steps:

1. We accept the distinction between temporary and permanent currency injections. So like Krugman we said there’d be no high inflation. He relied more on Phillips Curve thinking and IS-LM, we relied more on TIPS spreads (the market part of market monetarism.)

2. But unlike many Keynesians, we thought QE could be effective at the zero bound. This would also prevent deflation from occurring. Which it did. Further support for the model occurred after the BOJ adopted a more expansionary policy, and deflation ended. And of course markets (stock and forex) in the US, Europe and Japan clearly believe monetary policy matters at the zero bound. In my view that means a University of Chicago guy like John Cochrane should be required by law to believe the same thing.

Noah Smith then criticizes the neo-Fisherites:

Our basic supply-and-demand intuition says that demand curves slope down and supply curves slope up. Dump a lot of a commodity on the market, and its price will fall. Start buying up a commodity, and its price will rise.

Neo-Fisherianism goes against this intuition. Suppose the Fed lowers interest rates. Abstracting from banks, reserves, etc., it does this by printing money and using that money to buy bonds from people in the private sector. That increase in demand for bonds makes the price of bonds go up, and since interest rates are inversely related to bond prices, it makes interest rates go down.

Now, you can write down a model in which this doesn’t happen – for example, a model in which Fed money-printing-and-bond-buying stimulates the economy so much that interest rates end up rising instead of falling. But in practice, it looks like the Fed has total control over interest rates (at least, the Federal Funds Rate; let’s put aside the question of heterogeneous interest rates).

So when the Fed lowers interest rates, it prints money in order to do so. But in a Neo-Fisherian world, that makes inflation fall – in other words, it makes money more valuable. That’s worth repeating: In a Neo-Fisherian world, dumping a ton of new money on the market makes money a more valuable commodity.

That is weird! That totally goes against our Econ 101 intuition! How does dumping money on the market make money more valuable??

I think this is exactly backwards, but nonetheless Noah ends up in the right place. How he ends up being correct despite flawed reasoning is an exercise worth spending some time on.

Let’s start with the supply and demand model, which Noah cites in support of his advocacy of what’s usually called the “liquidity effect.” The supply and demand model assumes perfect competition and price flexibility. But in that sort of world money is superneutral, even in the short run. Do you see the problem? Neo-Fisherism is basically a model that claims money is superneutral, even in the short run. In this model a lower rate on money growth immediately causes lower inflation. And since prices are flexible in a S&D model there is no liquidity effect. Thus monetary policy doesn’t impact real rates, and hence slower money growth leads to both lower inflation and lower nominal interest rates.

In contrast, Noah assumes the lower interest rates are caused by “printing money.” But what makes him think that? Because it’s true? OK, it probably is true in some cases, but it’s not true if NeoFisherism is true. So it’s a weird assumption to use when criticizing NeoFisherism.

There are all sorts of problems with trying to apply S&D in the way that Smith tries to. If you want to apply the S&D model to bonds, you need to account for the fact that money is itself the medium of account. So changes in the supply of money change its value, and hence change the supply and demand for bonds. That’s the story of the 1960s and 1970s. Printing lots of money made bond yields rise. (It’s also the problem with “Cantillon effect” claims that the Fed buying bonds helps bondholders.) Long-term T-bond holders were devastated by the Great Inflation. So no, there is no S&D presumption that more money should lead to lower nominal interest rates, even if the new money is used to buy bonds (as it was in the 1960s and 1970s).

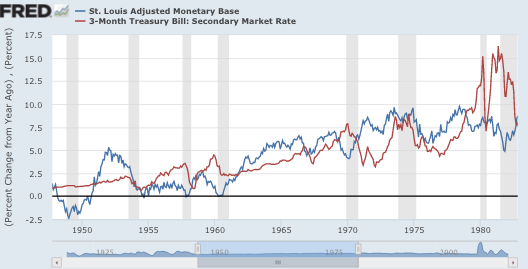

Take a look at money growth (the base) and short-term nominal interest rates from 1948 to 1982.

Unfortunately it’s a big mess, because monetary policy is partly endogenous. But if you look closely you can see some support for Neo-Fisherism, but also why people like Noah and I are a bit skeptical.

The long run trend looks Neo-Fisherian. But it was a struggle to even find that much correlation. Other periods of American history are far messier. For instance, there was virtually no expected inflation under the gold standard. And recently base growth has soared at the zero bound. So the Great Inflation is the period where it seems to work best. The Fed gradually printed money at a faster and faster rate. Inflation rose higher and higher, and so did nominal interest rates.

But if you look closely you’ll also see the opposite. Right before the 1960, 1970, 1980 and 1982 recessions, nominal rates spiked upwards and yet money growth seemed to slow. In those cases a tight money policy raised nominal rates, and this lowered inflation, perhaps with a slight lag due to sticky prices.

In fairness to the Neo-Fisherites, if I’d shown you the correlation between inflation and nominal rates it would have been even stronger. For instance, higher inflation leads to higher velocity. So when money growth rose during the Great Inflation, so did velocity. This meant that inflation rose by even more than money growth, and the high inflation helps explain why nominal interest rates were so much higher than money growth during 1979-81—velocity was rising as there was a flight from the dollar.

Lower interest rates won’t cause low inflation, but a tight money policy that leads to low inflation will also lead to low nominal interest rates much more quickly than most Keynesians assume. In other words the income and Fisher effects begin to dominate the liquidity effect more quickly than you might assume, and one can construct plausible thought experiments where Neo-Fisherism is even true in the short run. But in the world we currently live in, a September rate increase by the Fed will lead to lower inflation than not raising rates in September.

Cochrane and Williamson don’t have to convince me, they have to convince Wall Street. One nanosecond after Wall Street is convinced, I’m on board.

I also have recent posts on the interest sensitivity of the economy, and rational expectations, over at Econlog.

HT: Gordon

Tags:

3. September 2015 at 05:34

“Neo-Fisherism is basically a model that claims money is superneutral, even in the short run.”

Scott, how did you let that slip in? Cochrane clearly considers sticky price versions of his model. And Williamson talks about segmented markets that can also cause short run liquidity effects.

That said, I think the whole NF makes sense *only* if one understands what is assumed about how the fiscal authority is supposed to accommodate itself to monetary policy.

3. September 2015 at 05:48

Pace Holden Caulfield;

‘You can’t ever find a place that’s nice and peaceful, because there isn’t any. You may think there is, but once you get there, when you’re not looking, somebody’ll sneak up and write “interest rates are the price of money” right under your nose. I think, even, if I ever die, and they stick me in a cemetery, and I have a tombstone and all, it’ll say “Patrick R. Sullivan” on it, and then what year I was born and what year I died, and then right under that it’ll say “interest rates are the price of money.” I’m positive, in fact.’

3. September 2015 at 05:56

Steven Williamson´s glide from “New Monatarist” to “New Fisherite”:

https://thefaintofheart.wordpress.com/2015/09/01/steve-williamson-should-change-the-name-of-his-blog-from-new-monetarist-to-new-fisherite/

3. September 2015 at 06:08

Nice post. There is an old joke out there, “If you torture the data long enough, it will confess.”

That does not seem to be the problem with Market mMonetarism. It seems to hold up. It is not extremely esoteric. It relies on rational behavior and efficient market theory.

How do Cochrane and the Neo Fisherites explain the success of Paul Volcker in 1980-81?

Print a few more trillion dollars. I prefer prosperity to ZIRP low growth.

btw Q2 unit labor costs down.

3. September 2015 at 06:14

@Cole

Jesus, we get it already: you really really really want lots and lots and lots of inflation. Don’t you have anything better to do in life than announce this ten times a day?

3. September 2015 at 06:19

@Scott,

So to keep repeating.

1. Fed OMP causes a) increased demand for bonds > higher prices (lower yields), and b) higher NGDP expectations causing a shift in the supply curve for bonds > lower prices (higher yields). You have to look at both.

2. MB is not important. MB less reserves is what is important. Exchanging assets between financial institutions has no effect on the economy. If the NY Fed exchanges Treasuries for deposits with Chase it has no more impact on the economy than the NY Fed doing the same trade with the St. Louis Fed.

I don’t understand why these are such elusive concepts. They are both fundamental and obvious.

3. September 2015 at 06:56

Regarding QE at the zero bound:

“In my view that means a University of Chicago guy like John Cochrane should be required by law to believe the same thing.”

He’s concerned about the equilibrium which is (amply) represented by credit, not the one that markets seek to maintain in spite of the difficulties of doing so. And the equilibrium which seeks credit dominance is where all the facts supposedly change!

3. September 2015 at 07:05

David, OK, but in any case it assumes superneutrality with respect to the effect of monetary policy on interest rates. Monetary policy does not change real interest rates, rather nominal rates move one for one with inflation.

My point is that you can get the same result with a flexible prices S&D model of the economy. So you don’t want to use “supply and demand” to argue for a liquidity effect.

Holden, I know how you feel.

Marcus, I wondered about that too.

3. September 2015 at 07:29

Dtoh,

Number 3 is a good point with one nuance i would add. Exchanging money for short term treasuries may not have an effect. At some point they may just be close to perfect substitutes. However, exchanging money for longer term securities or non-treasury assets (sometimes called qualitative easing if the risk profile of the balance sheet is expanding as opposed to just the size) certainly has an effect.

Regarding the importance of MB less reserves. I tend to agree with this. Velocity (NGDP/M0-Reserves) exhibits a more stable trajectory than the traditional definition when looking at the post 2009 episode. Since then M0 has been dominated by reserves so it’s no wonder you’d get this divergence. When looking at the price level, M0, and currency you get the same behavior.

Currency velocity and short rates:

https://research.stlouisfed.org/fred2/graph/?g=1KMk

M0 velocity vs Currency velocity:

https://research.stlouisfed.org/fred2/graph/?g=1KMx

M0, Currency, CPI

https://research.stlouisfed.org/fred2/graph/?g=1KMT

3. September 2015 at 07:32

Great post, finally understood the basic idea behind Neo Fisherian models. Money is superneutral in the short run and all there is are “long and variable leads”, rates influence expectations that in turn influence velocity and there you go …

3. September 2015 at 09:06

The problem is that the fiat/endogenous money era is relatively new and most of today’s economists are still relying on theories and opinions written down ages ago.

The idea of the Phillips curve is nonsense; the idea that reserves get out into the real economy is nonsense; the idea that the Fed ‘prints money’ is nonsense; there are some many nonsensical ideas that still get serious consideration.

3. September 2015 at 09:43

Scott, Just to give credit where credit is due. Jack Hirshleifer in his textbook Interest, Investment and Capital anticipated Krugman’s distinction between permanent and temporary injections of money by almost 30 years. Here’s the relevant passage from Hirshleifer.

The simple two-period model of choice between dated consumptive goods and dated real liquidities has been shown to be sufficiently comprehensive as to display both the quantity theorists’ and the Keynesian theorists’ predicted results consequent upon “changes in the money supply.” The seeming contradiction is resolved by noting that one result or the other follows, or possibly some mixture of the two, depending upon the precise meaning of the phrase “changes in the quantity of money.” More exactly, the result follows from the assumption made about changes in the time-distributed endowments of money and consumption goods. pp. 150-51

3. September 2015 at 09:57

dtoh,

“MB is not important. MB less reserves is what is important.”

The US monetary base Granger causes the US output and price level, and it leads to statistically significant positive responses in each in the age of ZIRP.

https://thefaintofheart.wordpress.com/2015/07/02/a-simple-baseline-var-for-studying-the-us-monetary-base-and-the-channels-of-monetary-transmission-in-the-age-of-zirp-part-3/

Currency in circulation does neither of those things in the age of ZIRP.

3. September 2015 at 11:19

You do indeed, Simon S – many thanks for that. I suspected there might be one or two more but couldn’t see any and never would have: I knew of the film but had no idea of its origin. It doesn’t appear in any of the lists I’ve perused today!

3. September 2015 at 13:28

David Glasner, right you are, Jack Hirshleifer did indeed anticipate the distinction between permanent and temporary changes in the stock of money, both in the price theory classes which I took at UCLA in the late 1960’s and in his text, the correct name of which is Investment, Interest and Capital.

Glad you provided Jack with deserved credit.

3. September 2015 at 16:43

Cochrane’s fundamental error is conflating a temporal stability with a counterfactual stability.

If the economy otherwise would have went through a very, very pronounced correction phase, due to the accumulated malinvestments caused by the Fed, but instead was propped up for a time by accelerated Fed intervention, such that from a temporal viewpoint historical aggregate trends continued on more or less stable, then it would be an error in economic reasoning to believe that “nothing happened” (assuming Cochrane is defining that phrase not the literal sense but in the general colloquial sense).

3. September 2015 at 17:05

Jose, Although David Andolfatto informed me that they do have sticky price Neo-Fisherian models, which seems kind of weird. In any case, they don’t seem to believe that monetary policy affects real interest rates.

Charlie, You said:

“the idea that reserves get out into the real economy is nonsense”

You do realize that when I go to the bank and withdraw $100 in cash, then $100 in reserves have gone out into the economy, don’t you? Oh, I guess you really don’t. And yes, the Fed doesn’t PRINT MONEY, the Bureau of engraving prints money. The Fed puts it into circulation. And your point is . . .

Thanks David, I used that book in grad school, still have it.

I did a paper with a distinction between temporary and permanent monetary injections back in 1993. I think Krugman’s claim to fame is applying it to the liquidity trap–for which he does deserve credit.

3. September 2015 at 18:14

Sumner concedes that: “Neo-Fisherism is basically a model that claims money is superneutral, even in the short run.” – and he concedes that it might have merit. Sumner being deprogrammed? No, cognitive dissonance will prevent Sumner from seeing the obvious. He’s a propagandist for NGDPLT. But see how upsetting Sumner’s concession was to his apt pupils, like David A. It’s like Ptolemy conceding that perhaps the earth is not the center of the universe.

3. September 2015 at 18:40

@Mark,

Thanks for the link. I read all your stuff. I’m not a stats expert so it was a bit of slog. Anyway, I had some questions. They are not at all intended to be argumentative. You understand the transmission mechanism better than anyone on this blog, so I’d be appreciative of your help in understanding this.

1. Is it correct to summarize your posts as — there is a statistical correlation between changes in the base (SBASENS) and subsequent changes in output and prices.

2. What happens if you do the analysis on SBASENS less WRBWFRBL or something similar.

3. Assuming reserves are important, in another post you say with respect to the excess bank reserves channel “I am skeptical that an increase in bank reserves would have much of a marginal effect on the amount of bank credit.” If so, what is the transmission mechanism. I have suggested before, that I think there may be an expectations channel with respect to reserves if the market believes an increase in ER will subsequently lead to higher MB-ER. Thoughts?

4. Also a question on Granger causation. Would it be accurate to say that the rooster crowing outside my window at 5:45am every morning Granger causes the sunrise at 6am. Or am I over simplifying. (Not trying to be cute. Just want to make sure I understand the statistical concepts.)

3. September 2015 at 18:54

@dtoh – “4. Also a question on Granger causation. Would it be accurate to say that the rooster crowing outside my window at 5:45am every morning Granger causes the sunrise at 6am.” – yes, yes it is accurate.

And don’t be fooled by Sadowski’s studied politeness. He can and will bare his teeth when and if he feels you are threatening his position, as can Sumner.

3. September 2015 at 19:07

@dtoh,

As a practical statistical matter, we usually use a shorthand definition of Granger casuality that says x Granger causes y if and only if your best forecast of y using only lags of y can be improved by adding lags of x. So the rooster doesn’t Granger cause the sunrise because a model with just lags of sunrise times predicts future sunrises very well without knowing anything about the rooster. For example, if y(t) is the time of sunrise today, it’s going to be very hard to beat the prediction that y(t) = y(t-365).

Actually, this isn’t a very good example because there is nothing random about y(t) at all, it is actually a deterministic function of time and can be perfectly predicted years in advance, and the actual technical definition of Granger causality is that x(t) Granger causes y(t) iff the best prediction of y(t) you can make given all information available at time (t-1) is better than the best prediction you can make given all information available except lagged values of x(t). Since the time of sunrise can be perfectly predicted whether you know about roosters crowing or not, the crowing does not Granger cause the sunrise.

3. September 2015 at 19:09

And of course, as usual, Ray gets it wrong.

3. September 2015 at 19:28

@jeff– your attempt to confuse dtoh is ignoble but wrong (as I suspect is usual with you; can you do anything except try to parrot what the professor just said? You can’t do that very well either).

First, it’s y(t) = y(t-24 hrs), not 365 days. Second, more importantly, if the rooster crows before the sun comes up, each and every time, then indeed the rooster will ‘trump’ the autocorrelation that you mention, namely, the sun rising on its own, since the rooster is ‘later in time’ to the sun rising from 24 hours before (that is 15 minutes rather than 24 hours, first in time wins in Granger causation).

There’s no shame Jeff in acknowledging you know nothing about what you speak, in fact, Socrates said that’s the first step towards wisdom (“I know something, that I know nothing”). Granger himself (via Wikipedia): “Granger also stressed that some studies using “Granger causality” testing in areas outside economics reached “ridiculous” conclusions. “Of course, many ridiculous papers appeared”, he said in his Nobel Lecture, December 8, 2003.”

3. September 2015 at 20:29

Ray,

I’m pretty sure that y(t-365 days) [except leap year!]) or (t-8,760 hours) is going to be a better predictor of sunrise time than p*Y(t-24) hrs given the curvature of the earth, change of seasons etc.; and Y(t-365) is available well before the rooster sounds off just before time (t).

3. September 2015 at 20:31

@Ray,

I don’t really pay any attention to politeness. I’m more interested in useful information.

3. September 2015 at 21:05

@gofx – perhaps, but you will concede then that “Granger Causation” has multiple solutions. Which is more probable? Sun autocorrelation or rooster crowing? T=365 days, plus fudge factor for leap years, or T=24 hours? Picking sun autocorrelation as an answer is nothing more than saying: “Stuff happens, we don’t know why” while the second is more of a cause-and-effect, even though it’s a wrong correlation. In short, Granger Causation” is nothing more than (often bad) data mining of the kind Sadowski engages in and tried to make respectable.

Shorter answer: economics is non-linear, and ‘Granger causation’ is about as useful as finding patterns in random data. These patterns exist, but have no predictive power.

3. September 2015 at 21:31

@Jeff,

So let me give you another example. In Ho Chi Minh City during the rainy season, it frequently rains in the afternoon. 10 to 15 minutes before it starts raining, the number of motorcyclists wearing rain ponchos increases significantly. If the number of motorcyclists wearing rain ponchos is the best predictor of rain, does that mean that wearing rain ponchos Granger causes it to rain?

Again, not trying to argumentative. Just trying to understand what we mean by Granger causality.

Also as an aside, the time of the sunrise is not deterministic. It also depends on the orbital permutations of the planets.

4. September 2015 at 03:20

Donald Trump on Shinzo Abe and currency devaluation:

“They’re killing us! Japan is killing us!

And by the way, they have a great leader now, Abe. And Abe is cutting the hell out of their currency — cutting, cutting, cutting. And they’re back. Japan is back.

Look what happened today. Today, front page of The Wall Street Journal, China devalues its currency big league. You know why? Because they have no fear of us. They’re killing us. When they do that, they are killing us.

Now they’re going to take more jobs. They’re going to take — I mean, it’s ridiculous!”

http://www.foxnews.com/transcript/2015/08/12/trump-on-iran-will-know-am-not-playing-games

4. September 2015 at 03:38

WSJ op-ed on the quote above:

http://www.wsj.com/articles/trumps-defective-economics-1439764789

Tim Worstall on the quote above:

http://www.forbes.com/sites/timworstall/2015/08/17/donald-trump-really-doesnt-understand-the-economics-of-currency-markets

4. September 2015 at 05:05

“David, OK, but in any case it assumes superneutrality with respect to the effect of monetary policy on interest rates. Monetary policy does not change real interest rates, rather nominal rates move one for one with inflation.”

Scott, that is not correct. In the short-run, the increase in the nominal rate is associated with a slow increase in the inflation rate. That is, the real interest rate falls. (At least, this is how it works in the segmented-markets version of Williamson’s model.)

4. September 2015 at 05:14

David, OK, I was wrong on that point–no superneutrality. But what action does the Fed take (in Williamson’s model) to make interest rates go higher? Does it take an expansionary or a contractionary policy step?

Either is possible, as I’ve shown in previous posts. It seems to me that it would have to be expansionary, otherwise why would inflation rise? But if the Fed raises rates in September it will reduce inflation expectations. How does Williamson explain that fact?

4. September 2015 at 05:24

@dtoh,

If you use the technical definition that refers to all available information, then the ponchos don’t Granger-cause the rain. There is something in the available information that the motorcyclists are aware of that is causing them to don their ponchos, and it is that information that is Granger-causing the rain. It could be, for example, that they motorcyclists notice the sky getting dark and that usually happens before it rains.

But if your information set includes only rain or not rain, versus rain or not rain plus ponchos or no ponchos, the latter will do a better job of forecasting rain, and you would conclude that ponchos Granger-cause rain. It is a statistical definition, not a metaphysical one.

Ray, I probably shouldn’t respond to you at all, but in this case I’ll just tell you that I knew Clive Granger very well. He was my adviser when I got my PhD at UCSD, and I’ve coauthored a couple of published papers with him.

Your contention that ” ‘Granger causation’ is about as useful as finding patterns in random data. These patterns exist, but have no predictive power” is wrong. As I’ve explained already, and as you would know if you simply looked it up yourself, the very definition of Granger causality has to do with predictive power. If x doesn’t help you predict y, then x does not Granger cause y. So patterns exist, but have no predictive power, then there is no Granger causation. Once again, you are demonstrating your inability to comprehend plain English.

4. September 2015 at 06:23

Noah Smith: “China May Never Get Rich”

http://www.bloombergview.com/articles/2015-09-04/china-may-never-get-rich

4. September 2015 at 07:12

@Jeff

Thanks. Sort of what I figured. Just a couple of final follow up questions. Under the technical definition of Granger causality, how do we define available information? Specifically.

If the weather service has access to all the data (cloud formation, wind speed, humidity, temperature, etc), and the number of ponchos still does a better job than the weather service’s supercomputer of predicting rain, then do the Poncho wearers Granger cause the rain. In other words, we have the information, but for unknown reasons we can’t process as effectively as the poncho wearers.

We have the information, but for known reasons we can’t use it predicatively. (E.g. we can’t accurately predict sunrise because we can’t (or think we can’t) solve n-body problems and therefore we can’t know the exact effect of orbital permutations on the earth’s angle to the sun.) Do the roosters assuming they are better predictors Granger cause the sunrise.

Dogs are known to bark before an earthquake. We suspect there is some information out there, but we don’t what information it is. Do the dogs Granger cause the earthquake?

In general, are we simply saying that the best predictive model at any point in time determines Granger causality?

Thanks for your patience on this.

4. September 2015 at 08:05

@dtoh,

The technical definition doesn’t specify what “all available information” is beyond just that. How could it?

In practice, Granger causality is always said to exist or not exist with respect to two information sets that are identical except that one of them leaves out x. Usually, the larger set is just lagged values of x and y, and the smaller set is just lagged values of y. If you tell an econometrician that x Granger causes y without specifying anything about the relevant information sets, he will either assume that’s what you’re talking about, or, if he’s careful, he’ll ask you for more specifics about what information sets you are using.

In your example of the poncho wearers who process the info better than the weather service does, I would say that yes, the poncho wearers are Granger-causing the weather, as observing them is giving me information I wouldn’t otherwise have had. Sometimes data has to be interpreted by someone who understands it to yield good predictions.

As I said, Granger causality is not the same concept as ‘real’ true causality. It’s just a statistical definition. But in many cases, it’s all we’ve got.

It is often the case that when people argue about whether or not a causes b they actually have differing definitions of causality in mind. What Granger was trying to do is come up with a definition of causality that could actually be tested for statistically.

Granger causality is very much in the spirit of Milton Friedman’s logical positivism. Friedman said the test of a theory is whether or not it helps you make correct predictions. If the variables in a theoretical model don’t Granger cause the movements in some variable that the theory is trying to explain, then clearly that theory is not going to pass Friedman’s test.

4. September 2015 at 08:12

dtoh

“1. Is it correct to summarize your posts as “” there is a statistical correlation between changes in the base (SBASENS) and subsequent changes in output and prices.”

Yes, I think that is a fair summary.

dtoh:

“2. What happens if you do the analysis on SBASENS less WRBWFRBL or something similar.”

I repeated the analysis with US currency in circulation and I found that it does not Granger cause US industrial production or PCEPI in the age of ZIRP.

SBASENS less RBWFRBL is almost but not exactly the same as currency in circulation. I’m genuinely curious, is there a reason why you think that particular measure might be preferred to currency in circulation?

dtoh:

“3. Assuming reserves are important, in another post you say with respect to the excess bank reserves channel “I am skeptical that an increase in bank reserves would have much of a marginal effect on the amount of bank credit.” If so, what is the transmission mechanism. I have suggested before, that I think there may be an expectations channel with respect to reserves if the market believes an increase in ER will subsequently lead to higher MB-ER. Thoughts?”

That quote is from my concluding post in that series. In the same paragraph I also refer to the “balance sheet channel” and the “household liquidity effects channel” as influences on bank credit.

In my post on the Bank Lending Channel I discuss these channels in greater detail. What I neglected to mention is that I found that stock prices Granger cause bank credit, which is supportive of the idea that it is through these channels that the monetary base is causing bank credit to increase.

Now, I also found that excess reserves Granger causes bank credit. So it is possible that increased excess reserves are leading to increased bank credit. It’s just that I personally find the balance sheet channel and the household liquidity effects channel to be more plausible causes of increased bank credit during the age of ZIRP. This is because I find it difficult to believe, with excess reserves being so great, that increases in reserves are what is directly causing banks to increase lending.

Also, I want to underscore that I find no evidence that increased bank credit is leading to changes in the output or price level in the age of ZIRP.

dtoh:

“4. Also a question on Granger causation…”

In my opinion Jeff has already answered your question more comprehensively than I would have. My hat is off to both of you for what I hope will be an educational conversation for third parties.

Also, thank you for taking the time to read some of my other posts in the series. There was a time this summer when I wondered if what I was doing was falling on deaf ears.

4. September 2015 at 08:39

@jeff,

Thanks!

4. September 2015 at 09:19

@Mark,

Thanks for the reply. I’ll spend some time re-reading your other posts tomorrow.

4. September 2015 at 11:22

@Jeff – so you are an expert on Granger causation? On the internet anybody can be an expert. But let’s assume so, and thanks for your reply. Then in your statement: “Your contention that “ ‘Granger causation’ is about as useful as finding patterns in random data. These patterns exist, but have no predictive power” is wrong.” – while correct, is not 100% right either. Granger causation is like a subset of Bayesian analysis (a series of if/then statements). As you know, the strength of Bayesian analysis depends on your data set, and by definition is backward looking. Hence, suppose your data set contains a pattern that can be predicted from one variable in the set. Then the one variable “Granger Causes” the pattern. But if the pattern is random, by definition, going forward, you cannot predict the pattern using the one variable (or any other variable). That is all I’m saying. Since this is not a forum conductive to back-and-forth, I will not be adding to this thread on this topic. Thanks however to responding to dtoh though, it was informative and despite your numerous qualifications it’s clear that Granger causation is extremely weak, hence popular in economics which tries to tease out signals where hardly none may exist (recall from a prior thread of mine the Granger-caused analysis by Bernanke et al (2003) that found monetary policy shocks accounted for only 3.2% of the output change, i.e., nearly trivial).

4. September 2015 at 14:35

Ray, I have no idea what you just said. But if you found anything I wrote at all educational, I’m glad of it. And you’re welcome.