A picture tells 1000 words

Update: Well that was an embarrassing error on my part. It’s actually a post by David Beckworth, which was “borrowed” by the Malaysian blogger.

Nick Rowe directed me to an excellent graph from Economic Mind (produced by an anonymous Malaysian blogger):

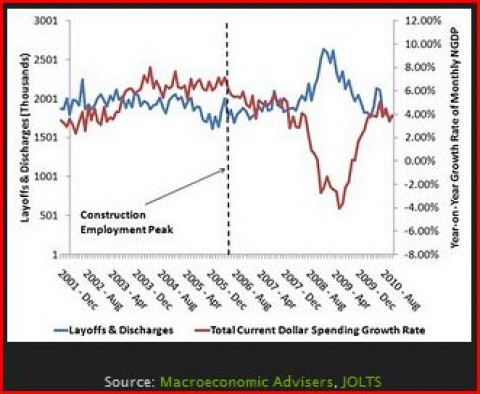

Scott Sumner’s case, however, gets even stronger if we look beyond mid-2008 and compare it to the growth rate of nominal spending. The figure below shows layoff and discharges again, but now it is graphed against the growth rate of monthly nominal GDP. Now we see there is a surge in layoffs and discharges but it coincides with the collapse in the nominal GDP growth rate.

The data seems very clear to me. It indicates there was a housing bust that was putting a damper on economic activity, but by itself was not large enough to create the Great Recession of 2007-2009. Rather, that required the failure of Fed officials to stabilize nominal spending in 2008.

I love the graph. But as this old post shows, the case against recalculation is even stronger. During the period after the housing market peaked, non-residential real estate construction and employment continued to rise. Hence the drop in residential construction employment was much sharper than the drop in overall construction employment. Non-residential construction employment plunged after mid-2008, when the economy tanked.

Take a look at the graph and ask yourself what the layoffs numbers would have looked like if the Fed had kept NGDP growing at 5% per year.

PS. I’ll put the following in a postscript, because I know many readers are sick of hearing about the Wren-Lewis/Krugman mistake. But for those who still think I don’t understand accounting identities, I regret to inform you that there seems to be an epidemic of confusion among some of our most brilliant bloggers, especially those named of “Smith.” Here’s a new post from Karl Smith:

I took Scott’s point to be that one must invoke the old Keynesian model in order for Wren-Lewis to have been correct. Its not simply that once one acknowledges consumption smoothing that even a child can see Cochrane was wrong.

Even worse, if you do invoke that model (where I is unaffected), then the balanced budget multiplier is one and there is no consumption smoothing. And smoothing was the factor that allegedly proved John Cochrane wrong.

And here’s several observations that Noah Smith left in my comment section yesterday.

In the classic Keynesian model of a “balanced budget multiplier,” government taxes people X and spends X on building a bridge. People’s income goes down X from the taxes and goes up X from being paid to build the bridge. Hence, there is no change in their after-tax income, so their investment and consumption behavior are unchanged. Meanwhile, output rises by X because now we have a bridge that we didn’t have before (or, alternatively, because now people’s pre-tax incomes are higher by X). Thus, the balanced-budget multiplier in this model is 1. Taxing and spending X increased output by exactly X.

So, basically, Wren-Lewis’ example does not correspond to the classic Keynesian model; he understates his case by forgetting about the extra income that people will receive from being paid to build the bridge, and arrives at a balanced-budget multiplier of 0.8 instead of 1.

In fact, I believe that Scott made exactly this point in his first “S=I” post, where he said that if income doesn’t fall, then no consumption smoothing actually occurred, or something like that.

The more general point is, I can’t think of any Keynesian type of model where the multiplier is inversely related to the elasticity of intertemporal substitution. Multipliers in old Keynesian models would be bigger if people consumed a fixed percent of their income instead of smoothing it. In the main New Keynesian models I don’t think it matters…

Noah Smith is of course the highly respected Keynesian blogger that Paul Krugman linked to as an expert on the issue of misinterpreting identities. Who says I always disagree with Paul Krugman?

Tags:

24. January 2012 at 07:52

And can that anonymous blogger do something to fix the comment thingy on his blog so that people can leave comments? I wrote a comment, tried to scroll down to see the capcha thingy and “submit” button, but it wouldn’t let me! (Or maybe it was just me screwing up somehow?)

24. January 2012 at 07:57

“…there seems to be an epidemic of confusion among some of our most brilliant bloggers….”

What else is new?

24. January 2012 at 08:02

Funny, that Malaysian blog post looks very familiar… http://macromarketmusings.blogspot.com/2011/01/further-evidence-against-recaluation.html

24. January 2012 at 08:06

BTW, some readers may have missed the excellent post which Simon Wren-Lewis did about consumption-smoothing and the multiplier. Worth a look, but note the health-warning at the top:

http://mainlymacro.blogspot.com/2012/01/consumption-smoothing-and-balanced.html

24. January 2012 at 08:09

Note that the Malaysia-related posts on the blog seem to have been copied from other blogs too, e.g.,

http://economics-mind.blogspot.com/2012/01/rm8-billion-for-257-armoured-personnel.html

is transparently copied from

http://tonypua.blogspot.com/2010/04/rm8-billion-for-257-armoured-personnel.html

and the latter is apparently a member of the Malaysian Parliament so it’s probably the real thing.

Basically it’s possible the whole Economics Mind blog is site scraped material.

24. January 2012 at 08:12

And for what it is worth, I did a follow up post along those same lines recently with some new graphs: http://macromarketmusings.blogspot.com/2011/12/what-really-caused-crisis.html

24. January 2012 at 08:19

Oh S**t. It looks like a direct copy of David’s post! Thought it looked good!

24. January 2012 at 08:24

The only good thing is: it means I and Scott can recognise and acknowledge quality even if it seems to come from some totally anonymous blogger in a faraway land rather than someone like David Beckworth who I already know is good!

Not so sure what it says about our memories though.

24. January 2012 at 08:50

“Was the Great Recession of 2007-2009 the result of a large reallocation of workers out of the housing sector after it busted or was it the consequence of a collapse in nominal spending that could have been prevented by policy?”

What a completely incoherent dichotomy. A recession is /defined/ by a collapse in nominal spending. You can’t claim that a decline in nominal spending is an alternative theory of recession to the housing bust because a decline in nominal spending is not a theory, it’s a definition of recession, so it doesn’t have anything to do with the question regarding what /caused/ the recession. Saying the recession was caused by a decline in nominal spending is a tautology at best, if not grammatically incorrect.

It’s like saying “is global warming caused by fossil fuel use, or by an increase in the global temperature?”

24. January 2012 at 08:53

Who and how is this any argument against a Hayek causal account of the boom and bust?

I don’t get it.

This is taking confirmation bias to new heights, as far as I can tell.

Want to explain this better?

24. January 2012 at 08:56

The housing collapse is part of the causal process creating a collapse in “nominal spending”, etc.

24. January 2012 at 09:04

I would love to see Greg Ransom lay out Ransom’s interpretation of Hayek’s “causal account of the boom and bust”.

Or he’ll hide behind a wall of “you don’t truly understand Hayek like I do” again.

But that aside, isn’t “recalculation” Arnold Kling’s specific account of the crisis, not Hayek’s?

24. January 2012 at 09:41

Me, well-respected Keynesian? Thanks, but not sure I deserve either title… 😉

For my views on stimulus, see this post:

http://noahpinionblog.blogspot.com/2012/01/cochrane-just-dont-call-it-stimulus.html

24. January 2012 at 10:13

Greg Ransom is right.

Why did NGDP fall in the first place? Why would it have been necessary for the fed to change their policy? You didn’t explain that.

24. January 2012 at 10:29

Scott, no need to be embarrassed. It took me a minute to realize that the figure looked familiar for a reason. I will chalk this one up to imitation is the highest form of flattery.

24. January 2012 at 10:39

I thought it was odd, since I’d never heard of this Malaysian economics blog (if there are two blogospheres I’d say I’m remotely familiar with, they are the economics and Malaysian ones, so it’s extremely odd I’d never heard of this one). A quick look suggests to me that this blog is just scraping content to plagiarise, so it might be advisable to take the link down to avoid boosting its visibility on the web.

There is one excellent Malaysian economics blog I know of: http://econsmalaysia.blogspot.com/

24. January 2012 at 10:41

In October last year he endorsed market monetarism, citing Beckworth (seems like Malaysians like Beckworth more than Sumner?): http://econsmalaysia.blogspot.com/2011/10/david-beckworth-on-market-monetarism.html

In a later post, he called market monetarism “the only big idea” to come out of the Great Recession. I’d link to it, but I don’t want to trip the spam filter.

24. January 2012 at 11:18

Thanks David, Nice post, I corrected mine.

Brito, You said;

“What a completely incoherent dichotomy. A recession is /defined/ by a collapse in nominal spending.”

Oh really? I guess Zimbabwe is doing great then.

Greg, You said;

“Who and how is this any argument against a Hayek causal account of the boom and bust?’

Hayek’s argument is that unstable NGDP causes recessions, so no, it’s not an argument against Hayek.

Noah, You said;

“Me, well-respected Keynesian? Thanks, but not sure I deserve either title…’

How about “more respected than me and more Keynesian than me.”

Wonder, NGDP fell because the Fed changed it’s policy, I didn’t want them to.

johnleemk, OK, I’ll take the link down.

24. January 2012 at 11:26

This post I updated today shows the “weakness” of the “recalculation story” also.

http://thefaintofheart.wordpress.com/2012/01/24/crisis-and-the-non-recovery-the-common-element-2-or-too-much-stability-may-be-hazardous-to-the-economy%C2%B4s-health/

24. January 2012 at 11:33

Noah Smith. Good post. Those views of Cochrane actually don’t surprise me. When you look closely at all his writing he’s actually a very reasonable guy. But that’s not a criticism of you, it’s aimed more at him, as I think some of his earlier posts were too broad-brushed, and created the impression he didn’t think stimulus could ever work under any circumstances. Or at least paragraphs within those earlier pieces created that impression–sometimes they were qualified later on. I think he needs to be more nuanced in his arguments.

24. January 2012 at 11:37

The housing collapse is part of the causal process creating a collapse in “nominal spending”, etc.

Yes — but a part that is neither necessary nor sufficient.

24. January 2012 at 11:47

ssumner:

“Wonder, NGDP fell because the Fed changed it’s policy, I didn’t want them to.”

Why would NGDP fall without the Fed’s continued inflation? Animal spirits?

“But as this old post shows, the case against recalculation is even stronger. During the period after the housing market peaked, non-residential real estate construction and employment continued to rise. Hence the drop in residential construction employment was much sharper than the drop in overall construction employment. Non-residential construction employment plunged after mid-2008, when the economy tanked.”

Didn’t Bob Murphy expose the flaws in this story, way back when?

“Take a look at the graph and ask yourself what the layoffs numbers would have looked like if the Fed had kept NGDP growing at 5% per year.”

You are making a tacit assumption about how we should all be reading the graph, and that we should accept the claim that aggregate spending generates demand, employment, and productivity.

The main assumption you are making is that aggregate spending growth rates have immediate impacts on employment. For someone who doesn’t accept the recalculation story, that sure sounds like agreeing with it! Employers and employees immediately recalculate prices based on monetary changes!

What if we instead looked at the chart using a different theory, which is that aggregate spending growth rate changes have DELAYED effects on unemployment? After all, monetary and fiscal policy have delayed effects on unemployment, so why not aggregate spending growth changes as well?

Suppose that we look at the chart starting mid-2008, and then consider the thesis that changes in the growth rate of aggregate spending have a delayed effect on employment, say by one year.

The graph would be consistent with a completely different, indeed opposite interpretation, to the NGDP growth rate story, wouldn’t it? It would show that unemployment fell as aggregate nominal spending growth rates came back down, which then encouraged recalculation to actual consumer preferences (and not Federal Reserve System generated spendings sprees) and hence recovery.

Aren’t you just presuming the NGDP model is true when interpreting that chart?

24. January 2012 at 12:13

1. Nuanced debate is fine and dandy, but red meat moves the needle.

2. I too would like to see Ransom’s boom and bust description.

3. Note, this does wonders for my theory that David Beckworth is a Malaysian blogger.

24. January 2012 at 12:21

“Brito, You said;

“What a completely incoherent dichotomy. A recession is /defined/ by a collapse in nominal spending.”

Oh really? I guess Zimbabwe is doing great then.”

Errr well alright the exact definition is a decline in real GDP, but the nature of this specific recession was a decline in nominal spending, or a collapse in AD. Collapses in AD on that scale don’t just happen for no reason, so it’s still not informative to say the recession was caused by a collapse in nominal spending. Perhaps it is not quite a tautology however.

24. January 2012 at 12:40

Brito,

It’s not “not informative”. It’s “not very informative”, in that a collapse in AD might take place for a very wide variety of reasons i.e. it doesn’t finish off the specification of the cause to our fullest satisfaction.

A fall in real GDP can take place for a large variety of reasons. It is interesting to distinguish a fall in nominal spending from a supply-side shock caused by a massive reallaoction of resources (for example). In the former case, the Fed can do something about it. In the latter case, it cannot (in the long-run).

24. January 2012 at 13:16

“Brito,

It’s not “not informative”. It’s “not very informative”, in that a collapse in AD might take place for a very wide variety of reasons i.e. it doesn’t finish off the specification of the cause to our fullest satisfaction.

A fall in real GDP can take place for a large variety of reasons. It is interesting to distinguish a fall in nominal spending from a supply-side shock caused by a massive reallaoction of resources (for example). In the former case, the Fed can do something about it. In the latter case, it cannot (in the long-run).”

Ah, so is this article basically trying to argue that the recession was demand side rather than supply side caused as suggested by the recalculating story? That is more coherent, but I think saying it was “caused by a drop in nominal spending” is a really bad way to phrase that.

24. January 2012 at 13:53

Serious question – At what point does nominal GDP targeting blur the distinction between monetary and fiscal policy? At what point, after the overnight rate has been lowered to 0%, after QE has exhausted all of the outstanding Treasuries and the central bank has to begin purchasing “other stuff”, do these purchases essentially amount to fiscal policy being conducted by the central bank rather than the treasury? On a related note, if the central bank is going to purchase “other stuff”, might it not be better if they made direct investments in new capital (roads, bridges, etc.) rather than buying existing financial claims (MBS, equities, etc.)?

24. January 2012 at 14:52

RueTheDay:

“At what point, after the overnight rate has been lowered to 0%, after QE has exhausted all of the outstanding Treasuries and the central bank has to begin purchasing “other stuff”, do these purchases essentially amount to fiscal policy being conducted by the central bank rather than the treasury?”

To pseudo-monetarists, never, because the Fed is not a “true” government institution, which is strange, considering how it was made by Congress, chartered by Congress, its board chairman is elected by Congress, and its monopoly is enforced by the Executive.

It’s strange isn’t it? We’re supposed to believe that the Treasury buying GM equity is “bad”, but the Fed buying GM equity to target NGDP is “good.”

I think it’s just a desperate call to the power brokers to listen and one day offer employment to a new generation of wannabe technocrats. Ask Sumner if he’d accept a job as governor of one of the Fed’s main branches to put into effect his NGDP 5 year plan, and you’ll see someone giddier than a toddler at an amusement park.

24. January 2012 at 15:04

The model might be ignoring the income flowing back to the private sector to pay people to build a bridge, but the conclusion that the multiplier equals one is ignoring the cut that government bureaucrats will take when transferring the revenue (X) from taxpayers to construction workers (X-cut). Therefore, the multiplier must be less than one, because the bureaucracy has not produced any capital asset.

24. January 2012 at 15:10

Brito,

“Ah, so is this article basically trying to argue that the recession was demand side rather than supply side caused as suggested by the recalculating story? That is more coherent, but I think saying it was “caused by a drop in nominal spending” is a really bad way to phrase that.”

Perhaps, since people use ‘aggregate demand’ in really weird ways sometimes. Personally, I find the idea that output collapsed because people’s spending collapsed quite intuitive.

24. January 2012 at 15:17

Sorry, Jon.

If the government bureaucrats take a cut, that is still income. Even if they take the entire amount, and the bridge gets built by slaves, then Y still rises.

Of course, the effect of moving to a slave economy might induce other real effects… does the whip-cracking increase productivity, or reduce it?

Still, what you say doesn’t immediately imply that the multiplier is less than 1.0.

24. January 2012 at 16:02

Scott

I’m surprised you cosigned Noah’s post with the accusation of bad faith that it ended on. Cochrane says that now, like always we should do careful cost benefit analysis, and Noah basically calls him a hypocrite for not screaming for a giant basket of spending that almost has to have at least some wasteful/sub-optimal spending. There is no contradiction. Even if he did agree with all the spending Smith advocates he undoubtedly thinks there is a lot of wasteful spending elsewhere in the federal budget.

If Cochrane were asked specifically about fiscal stimulus and started rattling off projects he personally felt passed cost benefit even though he didn’t they would have a stimulative effect, that would be a hell of a lot more dishonest than saying that he doesn’t believe we need fiscal stimulus.

25. January 2012 at 06:08

Marcus, thanks for that link.

Jim Glass, That’s exactly right.

Major freedom, You said;

“Didn’t Bob Murphy expose the flaws in this story, way back when?”

He tried to, but failed. He was looking at the wrong data, total construction employment not residential construction employment.

“For someone who doesn’t accept the recalculation story, that sure sounds like agreeing with it! Employers and employees immediately recalculate prices based on monetary changes!”

No, that is not the recalculation story.

The evidence shows that AD changes affect employment quite rapidly.

Morgan, A very light skinned Malaysian.

Brito, You said;

“Errr well alright the exact definition is a decline in real GDP, but the nature of this specific recession was a decline in nominal spending, or a collapse in AD.”

Replace “nature” with “cause” and you’d be exactly right. The Fed drives NGDP growth.

RueTheday, Fiscal policy makes our debt bigger, monetary policy makes it smaller, so I don’t see any point where that would happen.

If the Fed eliminates IOR, then there is probably no point at which they exhaust Treasuries and GSE securities (which are basically Treasuries in all but name), we’d have hyperinflation before that occurred.

Major freedom, You said;

“To pseudo-monetarists, never, because the Fed is not a “true” government institution,”

Actually, us monetarists consider it a government institution. It’s the Austrians who sometimes view it as a private institution.

You said;

“It’s strange isn’t it? We’re supposed to believe that the Treasury buying GM equity is “bad”, but the Fed buying GM equity to target NGDP is “good.””

I certainly don’t want you to believe that. You might want to find out just a tiny bit about market monetarism before you criticize it. I know it’s fun to throw wild charges that just pop into your mind. But you only hurt your cause by repeatedly telling me I believe things that are in fact the opposite of what I believe. The more time I spend responding to these false charges the less time I have to do new posts.

Jon, Yes, but I still say the more likely reason is that private output will fall.

e, I was focusing on the meat of the post, about how their views on fiscal stimulus are similar. I probably should have pointed that out, as I don’t want to imply it was bad faith on Cochrane’s part. I don’t recall Smith’s exact wording–but I meant I agreed with the main part of his argument, not necessarily his view of Cochrane’s motives. I agree with you that any actual real world stimulus is likely to include lots of waste. For instance, I think transportation projects should probably be financed by states, at least for the most part. Federal financing leads to wasteful projects being done.

I get so many comments every day that there are times when I don’t fully address all their relevant points.

25. January 2012 at 06:29

“Replace “nature” with “cause” and you’d be exactly right. The Fed drives NGDP growth.”

But it’s not a ’cause’ that anyone could possibly care about because every single person on the planet even vaguely familiar with current affairs knows this already, and it’s hard to even call it a cause because nominal spending is heavily co-integrated with real GDP. Nominal spending doesn’t just drop like that by record levels without any reason whatsoever, you HAVE to provide a reason for these things. And it’s not mutually exclusive with the housing bust story – I’m not saying it’s true but if the economy was based on housing construction and then suddenly houses lost their value with everyone involved in that business becoming unemployed then you would definitely expect a huge drop in nominal spending.

25. January 2012 at 07:13

“Nominal spending doesn’t just drop like that by record levels without any reason whatsoever, you HAVE to provide a reason for these things.”

It drops because the Fed lets it drop. Boom.

Everyone understands by now that Greenspan’s quick response in the late ’80s prevented a serious demand crisis — the markets effed up, causing demand for money to rise, and since there isn’t free banking, the onus was on the government authority responsible for the money supply to adjust it accordingly.

The housing crisis should not have caused as severe falls in nominal spending and real income as it did, because similar crises at other times or at the same time in other locations did not necessarily result in such a huge crisis affecting the entire economy. It’s purely because there isn’t a free market to adjust money supply in response to money demand, and because the Fed abdicated its role to supplant that market, that we saw this huge drop in nominal spending.

25. January 2012 at 08:44

ssumner:

“Actually, us monetarists consider it a government institution. It’s the Austrians who sometimes view it as a private institution.”

Actually, it’s the monetarists who often say that the government should not be in the business of managing the economy’s aggregates, but then turn around and say that the Fed should be managing the economy’s aggregates, which logically implies that monetarists believe the Fed is not a real government institution!

How can you be for small government but big government bank? It’s like saying you’re for small heads but large bodies.

No Austrians view the Fed as a private institution. You show me an actual Austrian who believes the Fed is a private institution and I will eat my hat. I have only ever spoken to or read Austrians who treat it as a non-market, hence non-private, hence government institution. ALL Austrians say End the Fed. ZERO Austrians say end private enterprise. Therefore, no Austrian holds the Fed to be a private institution.

“It’s strange isn’t it? We’re supposed to believe that the Treasury buying GM equity is “bad”, but the Fed buying GM equity to target NGDP is “good.””

“I certainly don’t want you to believe that.”

Oh? Then what is it? We’re supposed to believe that the Fed buying up GM equity to target NGDP is bad? OK, well, if buying up GM equity is bad, then by the same logic, buying up options and other derivatives on GM equity would be bad as well, correct? Similarly, continuing with the logic, it should also be bad if the Fed bought up equity, options, and other derivatives of all other private enterprises too. Continuing on, it should also be bad if the Fed bought debt of private enterprises. In fact, the only “good” thing that the Fed can buy, that would keep your worldview internally consistent, would be if the Fed just bought government debt. But in order to target a 5% NGDP growth on the basis of buying government debt alone, it must be the case that the size of government borrowing, and hence the size of government spending, and hence the size of government itself, must grow by 5% per year in absolute terms.

After just 25 years, a government that grew at 5% per year would be almost 4 times the size. Small government? Where? I don’t see one.

“You might want to find out just a tiny bit about market monetarism before you criticize it.”

You know, I don’t think you fully understand what I know. It’s OK, you don’t know me, but you keep saying I should read before I speak, as if I haven’t already. I am just going by what you guys are writing. I have been reading what you guys have been writing for years, and it absolutely reeks. I just wish you would be fully and totally upfront, instead of saying things only half way that necessitates people like me to be douchebags about it.

“I know it’s fun to throw wild charges that just pop into your mind.”

They’re not “pops.” They’re a product of years of studying what you guys are writing. I would appreciate a little less condescension and a little more direct confrontation of ideas.

If you want “pops”, just look at the assertion you made that Austrians believe the Fed is a private institution. That is a knee jerk pop. If you read what they are saying, you would have known that yes, most of them know the private origins of the Federal Reserve Act, the private bankers who wrote the legislation, the private lobbyists, and what have you, but no Austrian holds the Federal Reserve to be a private institution.

“But you only hurt your cause by repeatedly telling me I believe things that are in fact the opposite of what I believe. The more time I spend responding to these false charges the less time I have to do new posts.”

I think they are not only not opposite to what you believe, but they are embarrassing truths of what you believe. That’s probably why you’re not actually saying what you believe upfront and in plain English. Instead of correcting me and telling me what I said that was wrong, you refer me to literature that I know does not even exist. I am going by what you are actually writing in the literature. I am not just spamming message boards. I have read enough to have a very informed opinion, and I find your advocacies very destructive and antithetical to human welfare, and contrary to sound economic principles. To me that calls for speaking out against it. You don’t have to respond if you don’t want to. I won’t feel bad.

What I do know from your writings and from other pseudo-monetarist writings is this:

You advocate that the Fed should start engaging in a program of buying up whatever securities and assets are necessary to target a 5% NGDP growth. If they buy up securities and assets but NGDP growth is only 1%, then they are supposed to expand their securities and asset purchases, to include anything really, since in no place have any NGDP theorists made an explicit list of what is legitimate to buy and what is not legitimate to buy. You of course leave it purposefully vague, because your advocacy would collapse if only you made it explicit. The Fed buying up securities and assets includes “Fed buys GM equity = good” by definition.

You also advocated many times for small government. That includes “Treasury buys GM equity = bad” by definition.

I just wish that sometimes you give your critics a little more credit, other than the awkward forced pleasantries such as “Krugman is brilliant, but…”.

Make a blog post detailing exactly what you advocate that the Fed be permitted to buy, and what they are not permitted to buy, to target 5% NGDP, and for what exact reasons, and how it can be reconciled with small government, and provide a sound, theoretical explanation for why “aggregate demand” or “NGDP” allegedly provides the foundation for employment, investment, production, and output, that hasn’t already been refuted countless times before by recalculation theorists. None of this exists anywhere, and yet these are burning questions that no pseudo-monetarist is answering. It’s like we’re all supposed to believe in the wizardy of you guys if only you took control of the money printing machine. “Don’t worry about the details folks, we promise not to base our decisions on our own subjective preferences of economic value, we promise not to abuse the power by being so clueless and lost about the economy that we hastily and without thinking engage in favoritism when choosing which special assets to buy at above market prices. Oh, and the reason past Fed controllers screwed up is because they weren’t brilliant angels like we are. Yes, you’ve heard this story a million times before, but this time, we promise, this time we have the end game solution, no more busts after this. Pinky swear.”

25. January 2012 at 09:16

johnleemk:

“It drops because the Fed lets it drop. Boom.”

Yeah, “boom” goes that mythical belief.

The Fed cannot force people to spend money. The decision to spend money is on the part of individual cash holders, not the Fed. To say “the Fed LET it drop” is like saying the government “let” the Cardinals win the World Series.

Contrary to popular myth, the Fed desperately tried to expand money and spending in the early 1930s, but the banks and the economy was so shaky that the banks and deposit holders refused to spend and lend more money. The Fed couldn’t stop this without printing so much money that the currency collapses.

“Everyone understands by now that Greenspan’s quick response in the late ’80s prevented a serious demand crisis “” the markets effed up, causing demand for money to rise, and since there isn’t free banking, the onus was on the government authority responsible for the money supply to adjust it accordingly.”

The markets didn’t “eff up”, the Fed did. After Volcker stopped 1970s inflation by tightening up the rate of money expansion that interest rates rose to double digits, the economy went through a very steep correction, but then just like all Fed chairmen do, he gave in to the temptation, and started loosening money once again, thus blowing up an economic bubble. To forestall out of control consumer price inflation, the Fed again tightened up, which resulted in the failure of LTCM, and the stock crash of 1987. After Greenspan bailed out LTCM, that sent a signal to the rest of Wall Street that no bank or financial institution was too big to fail, and so again there was credit expansion, another false boom, and another bust, etc, etc, etc.

To say “the market effed up” here is like saying there is a free market to begin with.

“The housing crisis should not have caused as severe falls in nominal spending and real income as it did”

Have you ever considered the possibility that the housing crisis was caused by the same primary cause that resulted in the “severe fall in nominal spending”? Why should the housing collapse have caused nominal spending to collapse? It’s not necessary that it did, in order for the “Fed did it” story to be true, and the “market did it” story to be false.

“because similar crises at other times or at the same time in other locations did not necessarily result in such a huge crisis affecting the entire economy.”

They weren’t similar crises. The crisis that intensified in 2008 was not just another recession. It was another stage in the ongoing collapse of fiat money. The next bubble to burst will be sovereign debt. The international central bankers are just waiting for the world chess pieces to be in place first, and through the Fed they’ll raise rates back up, bankrupt nation states, and through the chaos establish a world central bank with a world nation state to protect it. They recently signalled to be keeping rates at near zero for another year, this time into 2014. My guess is that the war mongering with Iran is taking more time than they would have liked. The internet is to blame for that, which is why they are now throwing the hammer down on internet freedom, before they can continue.

“It’s purely because there isn’t a free market to adjust money supply in response to money demand, and because the Fed abdicated its role to supplant that market, that we saw this huge drop in nominal spending.”

The Fed abdicated its role?

http://research.stlouisfed.org/fred2/graph/?s%5B1%5D%5Bid%5D=BASE

Are you kidding me? The Fed threw a bazooka at the economy. Just because the economy was so screwed up that (just like in the early 1930s), people chose not to spend and the banks chose not to lend as much as would be required to maintain AD, it doesn’t mean the Fed “abdicated.”

I could give a banker $1 trillion in newly printed money, but if the economy is so screwed up that he expects a guaranteed loss no matter what he invests in, then he won’t lend. Just because he has a lot more money, it doesn’t mean he is willing to burn any of it.

The troglodyte Keynesians are at least vaguely aware of this, which is why that want to introduce an artificial SPENDER of money to act alongside the artificial PRINTER of money. They believe that the effect of a healthy economy, namely a gradually growing aggregate demand, is somehow a cause for a healthy economy. So that skip the intermediate step of “helping the economy”, and they go right to the “this is what a healthy economy looks like in terms of outcome, so let’s force that outcome and pretend that an effect can be a cause for itself.”

And people wonder why Keynesians so very often simply assume their model is true. It’s because there is no other way to think about a model that conflates causes with effects, switches them around, such that they can only say that if the effect, which is treated as a cause, is not had, then there is not enough Keynesianism, as the cause, which is really just an effect.

GDP didn’t rise? Then it’s because there wasn’t enough Keynesianism!

GDP did rise? Then it’s because there was enough Keynesianism!

It is like a dog chasing its own wagging tail, believing that if it can eat its own tail, his body can grow a new one that will then wag its body.

25. January 2012 at 10:38

Major_Freedom, the internet Austrianism story is not particularly compelling for reasons which have been outlined many times before. In the specific instance here, your post makes a number of factual mistakes and common fallacies which have been debunked on this blog and many others:

1. You confuse money and credit;

2. You seem to believe that the supply and demand for money have nothing to do with whether money is spent;

3. You assume that bubbles are caused by expansions of the money supply (this is really begging the question);

4. You seem to have gotten the 1980s and 1990s mixed up (LTCM failed in the late ’90s, not ’80s).

25. January 2012 at 11:26

“It drops because the Fed lets it drop. Boom.”

Not informative, the Fed is one of THOUSANDS of factors that can affect firms and consumers’ spending behaviour. The FED is treated in pretty much every economic model as a reaction function, as in it reacts to exogenous shocks to spending by changing policy in order to restore spending back to its trend. This CAN and does explain why a shock might have a persistent effect on output, which is the important stuff that market monetarists contribute IMO. However this is only part of the story, since a shock is by definition unanticipated, it does NOT explain what caused the shock in the first place, which is an interesting story in itself. For instance, if you hear about three people in a room, Bob, Joe and John, and John shoots Joe. You may ask: “why did John shoot Joe?”. I might respond “because Bob let John shoot Joe”. This may well be perfectly true, Bob

is big and powerful and could have easily disarmed Joe if he wasn’t so frightened. But this story is not comprehensive, it completely ignores something that might be of extreme interest to you: the motivation behind John’s shooting.

“Everyone understands by now that Greenspan’s quick response in the late ’80s prevented a serious demand crisis “” the markets effed up, causing demand for money to rise, and since there isn’t free banking, the onus was on the government authority responsible for the money supply to adjust it accordingly.”

See this is better, because it provides an explanation for the drop in demand, even if vague: “the markets effed up”.

“The housing crisis should not have caused as severe falls in nominal spending and real income as it did, because similar crises at other times or at the same time in other locations did not necessarily result in such a huge crisis affecting the entire economy. It’s purely because there isn’t a free market to adjust money supply in response to money demand, and because the Fed abdicated its role to supplant that market, that we saw this huge drop in nominal spending.”

So again, we have an explanation here, it WAS the housing bust after all that caused the initial shock. The fed story does not explain the shock, only its persistence, which is a different question.

25. January 2012 at 11:34

“So again, we have an explanation here, it WAS the housing bust after all that caused the initial shock. The fed story does not explain the shock, only its persistence, which is a different question.”

Um, this is what was said in the post by Glasner which Sumner quotes approvingly:

The failure of the Fed to respond to greater money demand caused the Great Recession. Shortfalls in aggregate demand are not innately a problem provided there is the necessary liquidity to facilitate adjustment in the economy.

25. January 2012 at 11:35

Oops, by Glasner I meant Beckworth.

25. January 2012 at 11:35

D R, you are wrong. When bureaucrats take their cut, there’s less funds available to build the bridge. The argument that the multiplier is one is that net income is unchanged *and* society gains a capital asset worth the value of the tax revenue (X). But you won’t, you’ll get a capital asset worth (X – cut).

So the percentage of tax revenue diverted to bureaucracy directly reduces the multiplier by the same factor.

And of course, this all presumes that the masterminds in the government can choose projects that are as productive in producing value for society as the free market would. Real world evidence does not support that proposition.

25. January 2012 at 11:37

D R:

And as far as your slave scenario goes, that’s also wrong, since forcing people to build the bridge would mean society is forgoing their income that they would produce as free workers.

25. January 2012 at 11:59

Jon,

I think I see what you are saying.

If the government wishes to spend $100 million on a bridge, but must raise $100 billion to “pay” me $99.9 billion more, then G and Y rise by $100 billion each. The balanced budget multiplier is 1.0.

If the government wishes to spend $100 million on a bridge, but must raise $100 billion and “gives” $99.9 billion to me, then G and Y rise by $100 million each. The balanced budget *spending* multiplier is 1.0, but the balanced budget *transfer* multiplier is 0. [And because there is 999 times more transfer than spending, the overall effectiveness is quite low.]

25. January 2012 at 12:13

johnleemk: I know that the blog post goes into greater detail, my main gripe was with the question at the beginning which I thought was badly worded not the post as a whole. The problem is I see the rhetoric presented in the question ALL over the place, I really don’t think it is good PR for the MM movement.

25. January 2012 at 13:08

johnleemk:

“Major_Freedom, the internet Austrianism story is not particularly compelling for reasons which have been outlined many times before.”

Aww, you actually think those “reasons” have not already been shown as flawed or misrepresentations of Austrianism. It’s telling how you have to say “internet Austrianism”, as if that casts a cloud of doubt on it, when Austrian economics is just the most popular economics school on the internet. Strange that when the world can speak freely and not be subjugated by ivory tower intellectuals scared of losing their jobs, such an environment of open communication and debate has led to Austrian school being dominant on the web. Do you really think that is a coincidence?

“In the specific instance here, your post makes a number of factual mistakes and common fallacies which have been debunked on this blog and many others:”

“1. You confuse money and credit;”

No, I didn’t confuse them, Sumner did. All credit is money, but not all money is credit. Sumner believes credit is not money, when credit most certainly is money, because it is universally accepted. Not the bonds of course, but the money on the credit side.

“2. You seem to believe that the supply and demand for money have nothing to do with whether money is spent;”

Please don’t base your claims on “seems”. I do not hold that the supply and demand for money “have nothing to do with whether money is spent.” The supply of money is determined by the Federal Reserve System, since they act to create money. The demand for money is by definition the comparison of money held to money spent.

I don’t see how anything I said would lead anyone to believe I hold the supply and demand for money as independent from money spending.

Money spending is in fact determined primarily by the quantity (supply) of money.

“3. You assume that bubbles are caused by expansions of the money supply (this is really begging the question);”

It’s not an assumption, it’s based on very compelling theory based on economic principles. It is not begging the question, because I am not using a conclusion as one of it’s own premises. The bubbles themselves are neither defined nor characterized by expansions in the money supply. Bubbles are typically defined along the lines of “trade in high volumes at prices that are considerably at variance with intrinsic values.”

Nothing about expansions of the money supply. That I argue “trade in high volumes at prices that are considerably at variance with intrinsic values” is caused by undue expansions of the money supply is not begging the question.

“4. You seem to have gotten the 1980s and 1990s mixed up (LTCM failed in the late ’90s, not ’80s).”

I reversed the order, it is stated poorly, but I didn’t intend to write that LTCM blew up in the 1980s.

None of these 4 points are examples of “factual mistakes” or “fallacies” of mine. In fact, they only show you to be mistaken and a believer of fallacies.

It’s too bad you found yourself compelled to saying what you did.

25. January 2012 at 13:25

johnleemk:

“The failure of the Fed to respond to greater money demand caused the Great Recession. Shortfalls in aggregate demand are not innately a problem provided there is the necessary liquidity to facilitate adjustment in the economy.”

Wrong on multiple levels.

When there is a “shortfall in aggregate demand”, what that means is that people are trying to increase the purchasing power of their cash balances, since the economy is sick and in need of correction.

There is no such thing as a “proper”, technocratically determined “optimum” level of aggregate spending. Aggregate spending is the outcomes of individuals allocating their earnings to cash, consumption, and investment.

If in the absence of busybody central planners, what an increased demand for cash will accomplish is exactly what the people want. For when people hold more cash, that means demand falls, and when demand falls, that puts downward pressure on prices. Letting prices fall is therefore a good thing. It enables those who are trying to increase their purchasing power to actually accomplish getting a higher purchasing power.

Calling for the government to print and spending money to reverse this, is just asking to short circuit the coordination process based on the changed pricing structure that is characterized as a revolution in economic knowledge, preferences, and actions.

If consumers reduce their consumer spending and hold more cash, then that means they want to reduce their current consumption, and increase their future consumption. In the absence of violent intervention, then what that will do is generate a changed relative profit structure between consumer goods and capital goods. The relative rate of profits in consumer good will fall, and the relative rate of profit in capital goods will rise. Even with the presence of the fall in consumption, the fact that capital goods earn a higher relative return, is incentive for investors to allocate less resources and labor to current consumption, and more towards future consumption.

If prices are free to fall, then whatever remaining demand that exists for labor and capital, can buy up every single laborer and idle resource. Of course it will take time, but the key is to get the economy as quickly as possible into the new configuration that accommodates the new consumer preferences.

Yes, aggregate demand will fall. That is a good thing, because it means purchasing power will rise, and that is what people want when they hold more cash.

Yes, unemployment may develop in the consumer goods industry, if the decline in consumer demand is high enough and wages can’t fall any further because laborers are presented with higher wage offers in the industrial sectors.

Yes, the government is going to be yammered at relentlessly to print and spend money, by very powerful and politically connected people. But economically speaking, the solution is to let people hold more cash and don’t strip that away from them by printing and spending money hoping to raise prices and thus decrease people’s purchasing power.

Finally, the Fed didn’t respond with enough inflation? Really? Is that because NGDP fell, and so the Fed failed by definition? What if NGDP growth was too fast to begin with? Have you ever considered that possibility? Or is NGDP growth always a good thing as long as it’s less than 5%? Why not 5.01%? Why not 5.02%? Or 5.4%? These numbers are all arbitrary. Saying “5% has been historically stablizing” is just more evidence that one is not thinking like an economist, but a historicist astrologer.

25. January 2012 at 15:58

Scott

That makes sense, and frankly although I appreciate the effort you make to respond to comments I’m not sure that effort passes cost benefit analysis either.

I remember reading Cochrane’s Feb 2009 essay and your reaction to it and thinking that you two were really close and would hopefully engage and find an agreement, or at least I would have interesting stuff to think about. It is frustrating to think that that was almost 3 years ago.

25. January 2012 at 20:51

Major Freedom,

What happens when people “want to hold cash,” but can’t get it? Do you know?

Similarly, what happens when trillions of dollars of cash substitutes that had been floating around in the financial system become vaperware almost over night? Do you know? Do you know the purpose of the Federal Reserve Act?

I’m not really sure that you have thought through all over your assertions because you don’t really address it – more or less assume that cash is a given with little impact on nominal debt.

26. January 2012 at 09:01

Brito, It was tight money that caused NGDP to fall. Just like in the early 1930s

Major Freedom, You said;

“Actually, it’s the monetarists who often say that the government should not be in the business of managing the economy’s aggregates, but then turn around and say that the Fed should be managing the economy’s aggregates, which logically implies that monetarists believe the Fed is not a real government institution!”

I have no idea what this means. Nor do I follow the logic in your other arguments. What does the size of government have to do with monetary policy?

e, It’s only recently that Cochrane got back into this debate (with his blog); maybe we can make progress going forward.

27. January 2012 at 07:41

Bonnie:

“What happens when people “want to hold cash,” but can’t get it? Do you know?”

Everyone (well almost everyone) always wants more money in a non-hyperinflation economy.

If an individual wants more money, then he must offer more value relative to his peers. If he succeeds, he was more productive. If he fails, if he can’t get more money, then he must settle for less money. That happens all time with wage earners, goods sellers, equity investors, and all other income earners who want to make more, but others don’t value their production by as much to justify a higher income.

If everyone tried to increase their cash balances, then what that means for the most part is that business firms are trying to become more liquid. If all business firms try to accumulate cash at the same time, then asset prices will fall. Firms will offer a lower demand for assets, and firms will attempt to sell their assets to attain cash. Asset prices will keep falling until business firms stop trying to increase their cash balances. When businesses are liquid enough, they will operate with a higher cash balances, and prices will be lower. This is actually a desirable outcome.

“Similarly, what happens when trillions of dollars of cash substitutes that had been floating around in the financial system become vaperware almost over night? Do you know?”

“Do you know the purpose of the Federal Reserve Act?”

Yes, the purpose of the Act was not to “help the economy”, or “stabilize prices”, or “facilitate a healthy and growing economy.” The purpose was to help the bankers and politicians at the expense of everyone else. The Morgans and Rockefellers wanted a banking cartel and they needed a central bank to facilitate a general inflation among the separate banks. They had friends in Washington, and in 1913, while most of Congress was away on vacation, the Act was passed. President Woodrow Wilson later expressed regret for unwittingly ruining his country.

“I’m not really sure that you have thought through all over your assertions because you don’t really address it – more or less assume that cash is a given with little impact on nominal debt.”

What is it with people on this blog being so condescending? Is this how you people justify your beliefs? By pretending that those who disagree are not educated, haven’t read enough literature, haven’t “thought enough about it”, etc?

To respond to your point, yes I do assume that cash is a given. Cash exists. I adhere to the quantity theory of money. You speak of nominal debt? In our banking system, a substantial quantity of new money is created out of thin air as new debt, and once that money is spent, it bids up (certain) prices, and changes (relative) profits. The money is backed not by anything tangible, but by a promise to pay. this credit MONEY then provides the fuel to bringing out false booms that later bust once the central bank fails to keep inflating at levels that the boom requires to keep going. They fear consumer price inflation getting out of control, so they inflate less than they otherwise would have, that eliminates the fuel, and all the projects that depended on accelerating easy money, are exposed as unprofitable.

27. January 2012 at 08:41

ssumner:

“Major Freedom, You said;”

“Actually, it’s the monetarists who often say that the government should not be in the business of managing the economy’s aggregates, but then turn around and say that the Fed should be managing the economy’s aggregates, which logically implies that monetarists believe the Fed is not a real government institution!”

“I have no idea what this means.”

It means that contrary to your claim that Austrians sometimes consider the Fed as a private institution, it is precisely monetarists who almost always consider the Fed a private institution.

How can monetarists be for small government and want the Treasury to be minimized, only to then turn around and what the government central bank to be maximized, unless they considered the central bank as a market institution? How many times have we heard monetarists say they want “market based” solutions that conveniently include the Fed?

It’s why the rhetoric of Chicago school economists is primarily laissez faire, primarily government hands off, but then they turn around and advocate for government central banking. Well, when you have people supporting the free market, but refuse to abolish government control over money production, and insist that we have a central bank, then logic dictates that monetarists in practise aren’t considering the Fed as a government institution, but a “banker’s institution”, a “market-based” institution that doesn’t include “government = Congress.”

Those who want small government cannot possibly want communist money production, i.e. a government monopoly in the production of money. It makes no sense. It would be like wanting fewer murders, but then asking that murderers control their own money printing machines, and then acting all surprised at why there are more murders. Ah, if only the murderers were targeting nominal gross domestic murders, instead of targeting unemployment in the murder industry, then everything would be better. What’s that? No, I’m not for murder, I just recognize the truth that we have murderers, and in an ideal world I’d want to abolish murder, but the world we live in has murderers, so targeting nominal gross domestic murders at a rate of 5% per year is the next best option.

Monetarists who use rhetoric about small government and laissez faire in computers, shoes, food, trucks, cars, clothes, etc, etc, for explainable reasons, suddenly turn into Mr. Hyde when it comes to money production, and say “This is what the government should monopolize”. They aren’t being consistent.

“Nor do I follow the logic in your other arguments.”

Too bad.

“What does the size of government have to do with monetary policy?”

??????

You really can’t see the connection between the government having an “independent” monopolized money printing machine, and the size and scope of its own activity?

If I had the ability to tax people, and I had a legal money printing machine at my place of business, (or I was living beside a neighbor who had a money printing machine, and he promises to buy my debt to keep my borrowing costs low), then you wouldn’t be able to connect these facts to the growing size and scope of my activity?

Government activity grows when it controls the money. This is perhaps the most obvious and plain truth in all of political economy. It’s why governments the world over have a huge incentive to taking over money production if they are not in control of it. It’s because not controlling it represents a constraint to them. A constraint to what? Well, a constraint to their activity.

I cannot believe I have to explain the connection between the size and scope of someone’s activity, and their controlling their own money printing machine.

Central bankers only have an interest in the real economy growing in size because a larger real economy enables them to create more money out of nothing in order to lend and charge interest. With a growing economy, that would have otherwise lowered prices, they can inflate more without raising prices too much and without causing a revolt among the populace. The “smart” ones act as parasites by only easily and gradually inflating. They can inflate more only when it won’t raise “the price level” by too much.

That is the main reason why central bankers like the “free market” Chicago school monetarist economists so much, why they bankroll their wages, grants, subsidies, and research, and, if you’ll excuse me if you’ll pardon me, it’s also why some of the more powerful and more morally unscrupulous among them have a large incentive in welcoming, and generating, economic collapses. When the economy collapses, they can print money like gangbusters which they could not do before. They can bankroll wars that they desire but couldn’t before because it would raise prices too fast. This is why wars the world over often take place after economic collapses. The interests of war mongering politicians and central bankers align in depressions. It’s happened before, and it’s happening how. Notice how almost every member of Congress (who are bought and paid for by the large banks that control the Fed) don’t want to cut the military budget? With the economy in a supposed “liquidity trap”, all the useful pawns calling themselves monetarists and Keynesians will crawl out from the rocks they have been living under to unwittingly brainwash the hapless public to accept more and more government inflation and spending. This is why the central bankers gave their fake Nobel to Krugman. His actual job, unbeknownst to him, is to brainwash his readers into accepting more government inflation and spending, by appealing their popular prejudices like “corporations bad”, “government spending money to boost employment good”.

Did you know that the Fed gave billions of dollars to the Libyan central bank leading up to the Libyan revolution? They did so in order to finance a local rebellion to oust Gadaffi, who was threatening to sell his oil in something other than dollars. The Fed of course wanted him out.

The same thing happened to Saddam Hussein. He too threatened to sell his oil in something other than US dollars, and so they bankrolled his ousting as well. The Fed audit revealed that the NY Fed secretly sent tens of billions of dollars to Iraq between 2003 and 2008. What do you think they were doing? Targeting inflation? Reducing unemployment? No, the Fed was bankrolling the Iraq war to oust a major oil supplier who was threatening to sell his oil in something other than dollars.

Do you really believe that there is no connection between size and activity of government, and government money printing machines? Please tell me you’re just joking around. Or maybe you are just so fixated on equations, inflation targeting, NGDP, and other non-human technocratic issues that you don’t see the human picture?

28. January 2012 at 07:36

Major Freedom, Your logical error is in assuming that small government equals zero government.

28. January 2012 at 09:22

“Major Freedom, Your logical error is in assuming that small government equals zero government.”

Where did I make that assertion explicit or implicit?

I think you are making the mistake of believing that small Congress, but gigantic Fed, is small government. What if Congress works for the Fed, and made decisions based on what the technocrats at the Fed recommended? Would that still be small government to you? What if I told you that most of Congress already works for the Fed?

For someone who knows central planning doesn’t work, if I see two people, one saying the Congress should own more and take more control, and the other saying the Fed should own more and take more control, then I know they are both equally wrong and both wanting big government, not small government.

I know the difference between minarchism and anarchy, but I don’t see how you can reconcile “small government” with “big central bank.”

29. January 2012 at 12:39

Major Freeman, You said;

“How can monetarists be for small government and want the Treasury to be minimized, only to then turn around and what the government central bank to be maximized, unless they considered the central bank as a market institution? How many times have we heard monetarists say they want “market based” solutions that conveniently include the Fed?”

That implies you believe small government can’t have central banks. It can. We did in 1925.

29. January 2012 at 13:07

ssumner:

“That implies you believe small government can’t have central banks.”

Small government can’t have a large central bank. Central banks are a part of government. The more you want the central bank to do, the bigger you want government to that extent.

“It can. We did in 1925.”

And look what happened. Small government with a central bank turned into big government with a big central bank.

Why shouldn’t the central bank control the entire economy, using the executive merely as their enforcement wing? Wait a minute…

31. January 2012 at 14:02

Major, So you agree with me then? We had both in 1925?