Further thoughts on Thursday

I’ve seen a lot of interpretation of Thursday’s money supply announcement. But it’s important not to overreach, just because we might find a particular theory attractive:

1. The theory needs to be consistent with what we know about past reactions to Fed announcements.

2. The theory needs to be consistent with the timing of the reaction.

3. The theory needs to be consistent with the other market responses.

For instance, some argue that the market responded as if the Fed knew more than they do. But that’s not the reaction we typically observe. Why would that be the case this time, but not other times? On the other hand I see why this theory is attractive, as the secondary (negative) reaction after 2:50 pm. does look like a response to bearish news about the economy—stocks, bond yields and the dollar all fell. But I’m still reluctant to accept that interpretation unless someone can find a plausible explanation as to why the market would believe the Fed knew more this time, but not other times. And also explain what new information about the Fed’s view of the economy came out after 2:50.

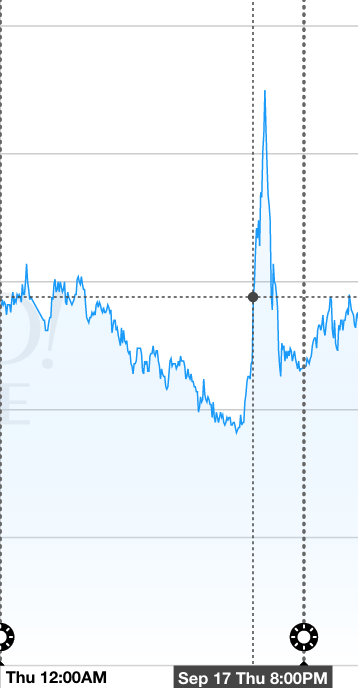

Here’s a graph showing the stock market reaction to the 2pm announcement:

I highlighted 2:35, which is about when the Yellen press conference began. Both the sharp (almost 1%) increase and the even bigger subsequent decline occurred during the press conference. But I have trouble seeing what Yellen said that would have made markets more bullish around 2:40 made more bearish after 2:50. Still, just because I don’t see it, doesn’t mean the market didn’t see something meaningful. Despite my skepticism, I still think Yellen’s comments were the most plausible cause of the market swings.

If you look at the forex markets, you see an interesting pattern. The commodity currencies like the Australian and Canadian dollars rose sharply on the announcement, and then even further when the US stock market rose sharply during the early part of Yellen’s talk. Then both currencies immediately plunged almost all the way back down just a few minutes later, in tandem with the fall in US stocks. Risk on, then off? Here’s the Aussie dollar:

In contrast, currencies like the euro and yen rose sharply and stayed higher for the rest of the day. (Although the euro did fall the next day, but it’s hard to see how that relates to the Fed.)

You might wonder why I don’t just accept:

1. It was already priced in.

But if that were true, why did other markets respond so strongly?

2. The stock market didn’t much care either way.

That’s more plausible. But stocks usually respond strongly to unexpected monetary policy announcements.

3. Yes, the stock market usually cares, but with unemployment at 5.1% the market thought the risks were balanced in this case.

That’s an even better argument (and essentially what Tyler Cowen suggests). But I still have this nagging feeling that stocks would have fallen on a .25% rate increase, partly because in the lead up to the announcement stocks often seemed to swing significantly on news about whether the Fed was going to raise rates—things like statements by key Fed officials.

Here’s an analogy. A few months back US stocks were very volatile during the Greek crisis. Suppose that on Monday the Greek government announced it had printed up currency in secret and was leaving the euro. And suppose the US stock market did not react. Wouldn’t you be surprised, even if you thought there was no valid reason for stocks to respond? Even if you thought the stock market had been foolish to respond to the Greek crisis in July, wouldn’t you expect another response if they actually left the euro?

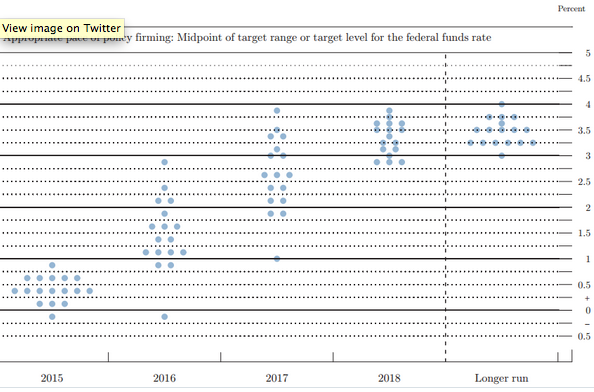

And finally, don’t forget that the other markets did provide useful information. For instance, we know that the TIPS spreads remained quite low, which I believe supports Kocherlakota’s claim that we need a rate cut. People laugh at how far behind Kocherlakota is on the dot graph, like the little boy that can’t keep up with his Boy Scout troop:

Only 1% interest rates in 2017? Yes, that’s probably too low, but it wouldn’t surprise me all that much if Kocherlakota had the last laugh. His 1% forecast is certainly far more plausible than the official who predicts 4% in 2017. Consider that Japan and probably even the eurozone are still going to be at zero in 2017. How plausible is it that the US has 4% rates when the rest of the developed world is at zero? Especially given that we are growing at just over 2% in a period of rapidly falling unemployment, and the unemployment rate will stop falling by 2017, and hence RGDP growth will slow sharply from the current pathetic levels. We might even have another recession, recall that America has never had an expansion that lasted 10 years.

PS. Frederic Mishkin really hit the nail on the head. I wish he were still on the FOMC.

Tags:

19. September 2015 at 09:51

Sumner grasping straws to attempt to show money is non-neutral. Heck, the stock market, forex, etc react to all kinds of stuff, many of it false “the stock market has predicted 9 out of the last five recessions” as the joke has it. But econometrics informs us (Bernanke et al. FAVAR paper) that Fed policy shocks are nearly trivial to 95% confidence (3.2% effect). Base not case, meaning, look at the big picture (the decades long study that Bernanke Granger-cause fit), the baseline, not one Yellen announcement, a particular isolated case.

19. September 2015 at 10:16

Since Scott would not address the question I asked the “Fed”.

The Futures Market as Forecasting Tool: An Imperfect Crystal Ball

https://www.stlouisfed.org/publications/regional-economist/january-2002/the-futures-market-as-forecasting-tool-an-imperfect-crystal-ball

19. September 2015 at 10:50

Ray, No, I’m not trying to show money is non-neutral, and indeed Thursday’s announcement doesn’t provide a shred of evidence that money is non-neutral. It’s sad when you don’t even know what I’m trying to show.

Dan, Markets are imperfect forecasters? That can’t be right; everyone knows that markets forecast perfectly. Markets have never once made a mistake when forecasting any future economic outcome. You shouldn’t believe everything you read—especially from the St. Louis Fed.

19. September 2015 at 11:22

There could have been a lot of long positions hoping to profit from dumb money buying the news and then nothing happened really so speculators sold off.

Basically like when speculators short ahead of news and cover after negative news.

Or something else.

19. September 2015 at 11:39

Scott, FM said:

“The key is clarity,” he told CNBC’s ” Squawk on the Street .” “If you’re going to do something, say what you’re going to do and actually mean it.”

But if you are clueless, how can you know what you´re going to do, let alone meant it?

I believe that´s what the markets confirmed: The Fed is clueless and, therefore, rudderless!

19. September 2015 at 13:12

Another way to think about it is that some asset managers were probably waiting for clarity from fed before doing what they were going to do anyway. So, you get a couple weeks of pent up risk off sentiment traded in a day

19. September 2015 at 14:31

@Ben, the “risk-on/off” language always bothered me. If managers are going risk-off, then they are happily doing so at lower prices than previous days. So if they were going to do it anyway, then why arbitrarily affix to a calendar trigger? It sounds silly if you switch the language to “liquidity-on/off” on date XX/XX/XXXX. Even if they are stuck on a calendar trigger, there must be some underlying model, or you would think that liquidity providers would happily arbitrage them.

19. September 2015 at 14:37

I’m actually more scared of a severe recession than Sumner and the general market. If there is one lesson, from the last recession, that every economic viewer can agree upon, it’s that the Fed will not defend a nominal level. No commitment to nominal levels + implicit belief in NAIRU + consistently overestimated natural level of unemployment + belief in ZLB = China (and everyone else) had better not screw up.

19. September 2015 at 16:27

Scott, apologies for an off topic comment but this slate article is priceless:

http://www.slate.com/blogs/moneybox/2015/09/17/uber_surge_pricing_study_shows_that_it_helps_supply_meet_demand.html

It’s zeitgeist captures well the re-radicalization of the left since the mid-90s…

19. September 2015 at 16:38

“But I have trouble seeing what Yellen said that would have made markets more bullish around 2:40 made more bearish after 2:50.”

Interesting comment from someone who supposedly adheres to EMH.

The price trend from 2:35pm to 2:50pm is itself information that becomes incorporated into future prices.

Nobody can predict the future.

19. September 2015 at 16:43

Ray continues to sputter, desperately trying to convince himself and others of money neutrality.

“But econometrics informs us (Bernanke et al. FAVAR paper) that Fed policy shocks are nearly trivial to 95% confidence (3.2% effect).”

That 3.2% is the LOW end of Bernanke’s estimate, and is itself sufficient for money non-neutrality.

The UPPER end of his estimate was 13.2%.

That means on average the effect in any random period would be on the order of 8.2%, which is even stronger evidence of non-neutrality.

That is not “trivial”.

19. September 2015 at 19:29

Sumner: “Ray, No, I’m not trying to show money is non-neutral, and indeed Thursday’s announcement doesn’t provide a shred of evidence that money is non-neutral”

That is true; Thursday’s announcement response is consistent with money neutrality, my point. If money was not neutral, then there would have been much more volatility, since any misalignment with Fed policy by the market has real implications. The fact that the market largely said “so what?” is further evidence of market neutrality.

19. September 2015 at 19:59

@MF – “That 3.2% is the LOW end of Bernanke’s estimate, and is itself sufficient for money non-neutrality.” – as I told you low end and high end have the same probability of occurring in a confidence interval. Six of one, half a dozen of the other. And most rational people will ignore a 3.2% effect in favor of a 96.8% effect, or a 13.2% effect in favor of a 86.8% effect. Rational people, of the kind not found in this blog readership. And I sometimes wonder what I’m doing here…

19. September 2015 at 20:27

Ray,

Perhaps I should dumb this down for you.

3.2% IS SUFFICIENT FOR MONEY NON NEUTRALITY.

Is that clear enough?

Money non neutrality does not require a larger than 3.2% number. Money non neutrality only requires a non zero number.

It is irrelevant what your opinions are on what “most people” choose to ignore (“ignore” by the way is your chosen word here, which means you are giving credence to the reality of non neutrality. You are not so muddleheaded as Sumner in believing that ignoring something is equivalent to, or causes, that something to not exist I hope).

It is also irrelevant what people actually ignore.

If money has an effect, which Bernanke’s paper you cited does show has an effect, then you choosing to ignore it does not mean it suddenly no longer exists. It still exists.

Most rational people will not admit there is 3.2% and then right away pretend that 3.2% does not exist. They will admit that if the 3.2% exists, then ignoring it won’t make it go away.

Do you have any clue what neutrality means? It means money has NO effect whatsoever on real output. That is why the theory is called neutrality of money theory, not “kind of sort of” money neutrality.

You’re not being rational. You’re being incredibly irrational because you still don’t get it that you don’t need to accept money neutrality or make people believe money is neutral in order to refute anything Sumner says or refute the arguments about the destruction that the Fed causes.

19. September 2015 at 20:33

And finally, Ray, the fact that you keep harping on Summer’s NGDP theory shows you practically don’t believe in money neutrality.

For if you really believed money was neutral, then you would have no problems with his theory. For it would not have any effect anyway. It could be practised or it could be not practised, and it shouldn’t matter to you because it will have no effect on anything anyway.

You are both theoretically and practically refuted. Just admit it and move on.

20. September 2015 at 05:01

Ray, You said in response to me:

“Sumner: “Ray, No, I’m not trying to show money is non-neutral, and indeed Thursday’s announcement doesn’t provide a shred of evidence that money is non-neutral”

That is true;”

If true then why are you not apologizing for saying exactly the opposite in your previous comment. Why don’t you apologize for saying that I was trying to prove money is non-neutral in this post? I can’t figure you out.

20. September 2015 at 05:03

Thanks Jon.

20. September 2015 at 05:45

@A– A lot of managers track benchmarks. There’s herding going on in the AM business.

20. September 2015 at 05:45

I’m still convinced that Ray Lopez is a foil created by ssumner to make these chats more interesting.

20. September 2015 at 05:58

@MF – “Perhaps I should dumb this down for you. 3.2% IS SUFFICIENT FOR MONEY NON NEUTRALITY. Is that clear enough?” — clear enough, but wrong. Consider the US economy grows 3%/yr, and is a 17T $ economy. Then a Fed policy shock is, at the 3.2% number given by Bernanke’s FAVAR paper, equal to: $17000 B * 0.03 * 0.032 = (drum roll please) = $16.3B at the low end of the confidence interval, and $67B at the high end. This is peanuts. The Fed Food Stamp program was $80B in 2012, and if it goes away nobody would think the end was nigh.

@Sumner – I may have misread you, I apologize. But it’s not clear what you are arguing; perhaps some variant of the Efficient Market Hypothesis.

20. September 2015 at 08:58

What happened at 2:50 was that Yellen said they could raise rates in October.

October and November were supposed to be out of bounds for rate hikes.

From MarketWatch:

“Markets seem to want certainty from the Fed about interest rates, but the Fed won’t be bullied into giving certain guidance about when it will raise rates. Financial conditions will be the most important factor in the timing of the first rate hike.

“I can’t give you a recipe,” Yellen says.

The first rate hike could come in October, Yellen says. If the Fed does hike in October, it would call a press conference afterward. Currently, there is no press conference scheduled for the Oct. 28 meeting.”

20. September 2015 at 09:33

Off topic, unfortunately, but more things to worry about (for market monetarists, that is) !

It seems like the neo-Fisherian movement has made it to the Swedish Riskbank (link to the paper below). I did not carefully go through their model, but the line of reasoning just totally seems backwards. It’s the entire “if we set a higher nominal interest rate, then inflation will adjust upwards” story again I feel. Of course, it should be rather the other way around: if we aim for and achieve higher inflation, then nominal interest rates will increase accordingly to compensate bond holders for additional inflation risk, etc. They totally ignore Wicksell, which is especially sad given that it comes from Sweden.

Anyways, here is a taste (p.17):

http://www.riksbank.se/en/Press-and-published/Notices/2015/Interest-and-inflation-rates-through-the-lens-of-the-theory-of-Irving-Fisher/

“According to the long run Fisher relation there is only one level of the policy rate that is consistent with a specific inflation target, given the long run real interest rate. If the policy rate deviates from this level during a longer period, there is a risk that agents in the economy may interpret this as a change in the inflation target. The agents may therefore have interpreted the long-lived cut in the policy rate as an intention to lower the inflation target from two to zero per cent in this scenario. In other words, if the central bank has an inflation target of two per cent and the long run real interest rate is two per cent, the policy rate must on average be four per cent if the inflation target is to be attained. If the policy rate instead averages two per cent, the inflation rate, as we have seen in Figure (6), will on average be two percentage points lower, i.e. zero per cent.”

Does anyone have any thoughts on it? Maybe somebody could forward it to Nick Rowe. He’ll probably go on a rant 😀

20. September 2015 at 10:02

Ray, perhaps I should dumb this down even lower. Amazingly.

You said:

“Consider the US economy grows 3%/yyr”

No no that is impossible Ray. If the percent is 3%, which is less than 3.2%, then by your own purposeful ignorance and head in the sand insanity, that is not what you can call “growth”. That must be effectively zero change.

In other words, the annual 3% since the year 1900 was not growth at all, but ” effectively zero.” In other words, the standard of living pple have today is “effectively” no different today than it was before airplanes, refrigerators and automobiles were invented.

YOU ARE WRONG.

20. September 2015 at 10:19

@MF – OMG, I just realized what your mistake is (on this issue, not your many other issues): you think Bernake’s 3.2% is related to the growth of an economy? No, rather, the 3.2% is as follows (from a quick reading of the paper, granted, I’ve not gone through it with a fine tooth comb–that’s Sumner’s job, and he’s failed at that): given a clear Fed policy shock, like the famous 1994 Great Bond Massacre (I remember we lost a lot of interest with that, at “Riggs National Bank” which was a CIA sponsored spooks bank in DC, lol), what percent of the real economy is affected? It’s as low as 3.2% to 95% confidence, meaning, of the rate of change of various parameters (there’s a list in the paper), such as industrial production and the like, in aggregate the rate of change due to the Fed is 3.2%. Concrete example: if the economy grew by 3% after a Fed surprise, then the 3% can be decomposed as follows: 3% = 2.904% (due to non-Fed factors, this is 96.8% * 3.2%) + 0.096% (due to the Fed policy shock). So the Fed’s monetary stance accounts for 0.096%/yr, not 3%. Got it now?

The paper uses Granger causation to prove this (subject to the usual caveats) and looks at the rate of change in variables before and after such Fed policy shocks, and tries to find the best correlation to explain these rates of change. The Fed moves accounted for just 3.2% of the change, it was Granger-cause found.

I’ll stop since I’m not really trying to convince you, just anybody else more rational reading this…

20. September 2015 at 10:20

John Cochrane had an excellent post on Friday. Two excerpts:

Well, let’s think about that. If a central bank were holding down rates, what would it do? Answer, it would lend a lot of money at low rates. Money would be flowing out the discount window (that’s where the Fed lends to banks), to banks, and through banks to the rest of the economy, flooding the place with low-rate loans. …

That is, of course, the exact opposite of what’s happening now. Banks are lending the Fed about $3 trillion worth of reserves,…

20. September 2015 at 10:21

3% = 2.904% (due to non-Fed factors, this is 96.8% * 3%) + 0.096% (3.2%*3%) corrected…

20. September 2015 at 10:24

Ray – I assume you are referring to this paper (it contains that quote)

http://www.federalreserve.gov/pubs/feds/2004/200403/200403pap.pdf

I’m going to be charitable and assume you didn’t actually read the paper, because your interpretation is wrong. The 3.2% and 13.2% is not a range of one variable – they are different values for different variables. 3.2% is the number for non-durable consumption, 13.2% is for capacity utilization. Unemployment is in the middle at 12.6%. Take a look at Table 1 on page 43.

Also, note that the paper says “In doing so, we treat the federal funds rate as a factor and interpret it as the monetary policy instrument.” That is, it assumes no other ways of implementing monetary policy, such as QE or interest on excess reserves, or NGDPLT.

20. September 2015 at 17:22

@Negation of Ideology – thanks, but I read the paper perhaps better than you think. Below is the key excerpt (p. 24). It’s true there’s not one variable in play (I oversimplified to make my point, using language from p. 24), but as you now know, Fed influence is very small. Even the Fed Funds rate on the monetary base is practically uncorrelated (R2 = 0.10, almost nothing). Correlation to M2 is even less, as Friedman found out to his chagrin late in his career.

As for your qualifications about Fed did not do NGDPLT, well obviously as a Granger-caused historical survey, Bernanke et al cannot measure something that’s never been done before. But in this respect you remind me of a communist who claims that all communist countries to date have not really practiced ‘true communism’ therefore they cannot be taken as representative of communism. It’s actually a fair theoretical point, but it’s essentially metaphysics. You can always claim that about anything (and Sumner often ‘parses’ data this way, to qualify it).

BTW, thanks for being brave enough to engage on this topic. You Know Who would never do so. Sumner’s lame response is that papers always have errors in them and you often cannot replicate them–pretty lame, considering Bernanke is using historical data that’s unchanging. Unless Bernanke made a Rogoff type typographical error with the math, which seems unlikely given his stature and the team he was working with, no doubt top grad students, anybody can replicate his findings.

RL

* Measuring the Effects of Monetary Policy: A Factor-Augmented Vector Autoregressive (FAVAR) Approach * Ben S. Bernanke et al (2003) “Apart from the interest rates and the exchange rate, the contribution of the policy shock is between 3.2% and 13.2%. This suggests a relatively small but still non-trivial effect of the monetary policy shock. In particular, the policy shock explains 13.2%, 12.9% and 12.6% of capacity utilization, new orders and unemployment respectively, and 7.6% of industrial production”

20. September 2015 at 17:29

@myself – one more thing, and I’ve said this before: if NGDPLT is radically different than the Fed monetary frameworks (frameworks, plural, keep in mind Bernanke’s FAVAR paper is for Fed actions from January 1959 through August 2001 which encompasses a wide range of Fed actions) practiced by the Fed to date, the burden of persuasion is on Sumner to come up with a model–other than a word picture that assumes the answer–that shows the economy would respond differently than the economy has to date to Fed action, i.e., nearly no-correlation to Fed actions as per Bernanke’s 2003 FAVAR paper. But Sumner refuses to do this. Perhaps he senses what the answer might be? Unless the economy is on an unstable ‘knife edge’ and responds radically to greater increases in money creation–and there’s no evidence it does–then Sumner is blowing smoke and using mirrors.

21. September 2015 at 03:25

I think a lot of traders were betting “No Increase” going into the Fed meeting, but it turned out there weren’t many people surprised by the decision, so the traders didn’t have anyone to sell to.

I know that’s not an EMH perspective, but markets are hard because you have to handicap not only economic developments, but also the size of the bets that are already placed on those developments.

The other thing that contributed to weakness going into Friday is a realization that the drumbeat of “When will they tighten” will continue into both the October and December meetings…and the policy objective remains unclear…so nothing really changed. Add to that the elections in Greece, and options expirations, China. Nothing changed.

21. September 2015 at 05:05

Catherine, Maybe, but if they ask her if a October rate increase is possible she absolutely has to say yes. Recall that she’s speaking for the entire committee. She can’t arbitrarily preclude the possibility of a rate increase before they’ve met and looked at the data. Indeed she can’t even preclude a rate increase later in September–the Fed has acted between meetings in emergencies.

If the markets thought she could rule out October they are not well informed about how the Fed operates.

Julius, Thanks. It depends how you interpret what they say. If they are just talking about correlations, that’s fine. But if they are drawing causal links then I have a problem.

Bill, Yes, IOR is contractionary.

Ray, Bernanke says the Fed caused the Great Depression. Was the Great Depression “significant?”

21. September 2015 at 06:03

I couldn’t agree more with Mishkin. The issue with Thursday is the uncertainty that the Fed created. The market has no clue what the Fed is going to do because there are far too many inconsistencies. Ultimately, I don’t know what they’re targeting or why. It’s ludicrous.

I also agree with Steve that there are distortions in marketplace right now based on positioning and also a high beta among hedge fund strategies with large positions and little dealer balance sheet. I question the efficiency of markets on a minute-by-minute basis and think that you really need to look over a period of a week or so (at least multiple days) for the market to reflect news. It’s kind of like driving on a freeway. You can’t just make a U-Turn. You may even have to keep driving or speed up to switch lanes to get off faster.