Money matters

I’ve been thinking about how to teach monetary economics from the beginning. Perhaps before people start learning, they need to unlearn things they believe, that just ain’t so. We market monetarists believe that monetary shocks (or “disequilibrium” if you prefer) is the primary cause of business cycles, indeed almost the only cause of big swings in unemployment.

Most people don’t believe this; indeed it’s not even clear that most economists believe this. Instead the average person thinks recessions are caused by big real shocks, or financial shocks, of one sort or another. Asset bubbles bursting, 9/11, stock market crashes, devastating natural disasters, etc.

It’s surprisingly easy to dispose of these real theories. We know that 9/11 didn’t cause the 2001 recession, because the recovery started just 2 months later. The biggest stock market crash in my life was 1987, which was almost identical to 1929, including the subsequent stock price rebound. The biggest natural disaster to hit a rich country in my lifetime was the 2011 Japanese earthquake/tsunami/nuclear meltdown, which killed tens of thousands of people, devastated a sizable area of Japan, and caused their entire nuclear industry (25% of total electrical output) to shutdown for more than a year (causing brownouts.)

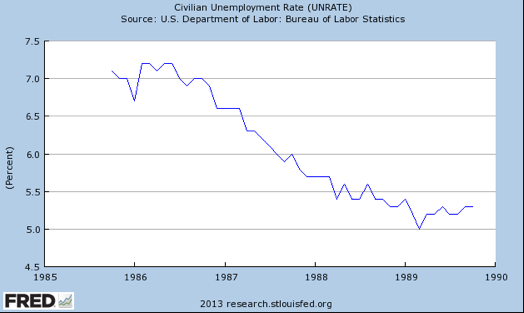

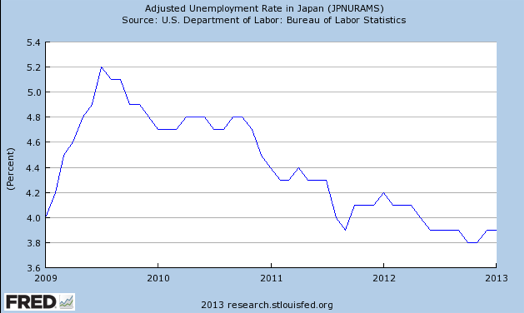

The next two graphs show the US unemployment rate from 2 years before the October 1987 crash to 2 years after, and the Japan’s unemployment since January 2009 (the tsunami was March 2011):

What do you see? Nothing!!! I’m tempted to say “real shocks don’t matter.” But that would be incredibly insensitive for 9/11, or the tsunami that killed nearly 30,000 Japanese people. One could argue that nothing mattered more to these two countries, in 2001 and 2011. The stock crash wasn’t as traumatic, but certainly impacted people’s lives and outlook.

But these real shocks don’t matter (very much) for business cycles. The tsunami did cause a temporary dip in industrial output, but nothing severe enough to constitute a recession. However when you turn your attention to the labor market you can really see how little real shocks matter. Real shocks do not cause big jumps in unemployment. Period, end of story. Even I’m surprised by this fact, but it is evidently true. Recessions are caused by unstable NGDP, which is in turn caused by unstable monetary policy (by definition, as stable NGDP growth is my definition of a stable monetary policy–and Ben Bernanke’s too.) But it’s not a tautology that the recessions themselves are caused by monetary policy, indeed it’s surprisingly difficult to explain why NGDP instability causes unemployment to fluctuate so much. Especially when the NGDP shocks are caused by rather obvious changes in monetary policy, rather than “errors of omission.”

Another example is January 2006 to April 2008, when housing construction in the US collapsed, falling by 50%. What happened to unemployment? It rose from 4.7% to 4.9%. The worst clearly non-monetary shock in my lifetime was the nationwide steel strike of 1959, which caused unemployment to rise by 0.8%. But the smallest recession in my lifetime was 1980, where unemployment rose by 2.2%. The steel strike ended quickly and unemployment fell back down to where it was before the strike. (The two 1970s oil shocks are debatable.)

We’ve seen that most people, and even some economists, grossly overestimate the importance of real shocks in the business cycle. On the other hand most people, and some economists, grossly underestimate the importance of monetary shocks. Now that we’ve disabused everyone of the notion that non-monetary shocks cause recessions, it’s time to move on the to real cause (pun intended) of business cycles—monetary policy. In a future post.

Tags:

16. March 2013 at 06:33

Scott,

Here’s my question/challenge: Please point out a recession/monetary shock which occurred for no apparent endogenous reason whatsoever, unambiguously. Put another way, are you aware of any recession driven by a monetary contraction (or monetary demand spike) which was not immediately preceded by a real shock?

For example, you make a convincing case that the Great Recession and collapse of employment since 2008 was “caused” by a collapse of NGDP due to a velocity unmet by the Fed (and likely aggravated by IOR policy). But that collapsed didn’t just happen. People didn’t suddenly start hoarding cash. The change was either a result of Fed change (exogenous) and/or a money demand change in reaction to deteriorating bank balance sheets.

The same seems to be true for Japan, the dot-com crash, the Great Depression, the 1907 panic, etc, etc.

Is there ANY case where a sudden mass hoarding event took place as the proximate cause of a recession? If not, perhaps the best way to frame the monetary “cause” of recession is as a “monetary aftershock” or, in Hayekian terms, a “secondary deflationary shock”.

David Ricardo said “men err in their productions, there is no deficiency of demand”. This isn’t precisely true in the sense that, as you’re noting, monetary shocks matter a great deal. But it IS (it might be) true in so far as understanding the full causal chain. Men don’t just hoard. They err in their productions, and mounting losses can lead to fear-based hoarding which, if unmet by the monetary system, will induce excessive unemployment.

16. March 2013 at 06:34

Real shocks are economic iconography for people. Most will never let go of their belief that those shocks cause downturns because of their need of symbolism. Quite unfortunate. Maybe I’m too pessimistic?

16. March 2013 at 06:35

I always found the “real shocks” theories really unintuitive. Until, I found your explanation of the Great Recession as falling NGDP, nothing else made any sense.

I still sometimes ask people: “can you explain to me why houses being overbuilt in Phoenix, Arizona, is supposed to have caused the restaurant across the street to close down?”

If people have thought about it at all, it’s normally, pre-fiat-money Keyenesianism and they will explain to you that NGDP fell. Except that they will not use the term NGDP, but some roundabout way of getting there. That never made sense to me either.

16. March 2013 at 06:43

John Papola: Your question is partially “can you point out a case of a recession where people were not able to interpret an unrelated bad event near the start of the crisis as ’cause’?” It has nothing to do with economics.

There is a part which is economics and the answer is ‘real shocks can have nominal effects, but only the nominal effects cause recessions’ [if you define a recession not as 2-quarters negative real growth, but as exploding resource waste, ie. massive unemployment].

In 1929, the Fed used monetary contraction to burst the “bubble”. And, by Lord, they succeeded beyond their wildest dreams.

16. March 2013 at 07:36

@Scott,

Excellent post. I reposted here: http://econlog.econlib.org/archives/2013/03/scott_sumner_on_5.html

16. March 2013 at 07:37

Luis,

Do you truly believe that questioning the causes of monetary shocks “has nothing to do with economics”? That’s all I’m doing. Is it hard, even impossible, to tease out causality in macroeconomic analysis? Yes. Does that mean it’s not economics to seek falsification of certain hypotheses? Hardly.

So I have a hypothesis: most if not all nominal shocks have some real proximate cause. One cause is central bank bungling. Another is larger-scale structural re-adjustment after an inflationary boom, which once could also place at the feet of central bank bungling.

I’m trying to falsify my own hypothesis.

Why? Because the other school of thought, largely from the Keynesian camp, is that we have booms and busts because of unexplainable mass psychological shifts (“Animal Spirits”). This criticism, that nominal shocks are “endogenous”, underpins a broader criticism of markets as unstable spinning tops in need of demand management to maintain a steady circular flow.

I understand that “real shocks can have nominal effects”. But my question remains. Are there any nominal shocks for which there was no potential, proximate real (or central bank) cause? If 1929 was the result of central bank bungling, that fits into my thesis and counters the anti-market thesis.

This question matters. We should care about how our understanding impacts the case for markets. I’m inclined to believe that “macroeconomics” is dominated overwhelmingly by philosophical concerns over the role of government by economists. Market skeptics concoct the macro models that serve their bias. Market advocates do the same. Can we break this logjam? Is that even possible?

16. March 2013 at 07:42

@John Papola,

Are there any nominal shocks for which there was no potential, proximate real (or central bank) cause?

A central bank bungling IS a nominal shock.

16. March 2013 at 07:57

John: I meant that people will often be able to interpret events in a hazy fashion to fit their theories and this may become the official narratives. In the same way that many people have told me they’ve been cured of several illnesses by homeopathy. This is about failures of human cognition, not medicine.

16. March 2013 at 07:57

John: I meant that people will often be able to interpret events in a hazy fashion to fit their theories and this may become the official narrative if enough people think it so. In the same way that many people have told me they’ve been cured of several illnesses by homeopathy. This is about failures of human cognition, not medicine.

16. March 2013 at 08:09

‘We know that 9/11 didn’t cause the 2001 recession, because the recovery started just 2 months later.’

Especially since the 2001 recession started in March (if not the 4th quarter 2000).

16. March 2013 at 08:11

‘Are there any nominal shocks for which there was no potential, proximate real (or central bank) cause?’

I’m guessing the most popular answer would be ‘oil price shocks’.

16. March 2013 at 08:27

@John Papola: I’m having a hard time understanding what you’re after. You say “This question matters,” but you haven’t really explained why you think it matters.

Real shocks happen all the time. They may, or may not, cause a change in the mass psychology of hording. If such a change happens, the central bank may, or may not, accommodate the changing demand for money.

Sumner is saying: real shocks that don’t affect NGDP (either because they don’t change hording psychology, or else because the CB accommodates them), don’t have (significant) macroeconomic effects. Meanwhile, nominal shocks (either due to a psychology change that the CB ignores by omission, or else directly caused by an explicit CB action), do have large effects on, e.g. unemployment.

This means that tracking NGDP “screens off” this historical contingency that “ultimately caused” the NGDP change.

Why does it matter what the original cause was? We know that the real shocks have no (macro) power unless they go through the nominal mechanism of NGDP, and we know that the CB has (most likely) absolute control over NGDP.

So what is the value in trying to track back through history to try to find long causal sequences?

16. March 2013 at 08:30

Scott,

If you want to teach “monetary economics from the beginning,” shouldn’t we start WAY back at the beginning and ask why the government needs to control the money supply in the first place? Why assume the necessity of a central bank?

Laissez-faire banking (or “Free Banking”) systems of privately issued banknotes redeemable for outside money (historically specie, but not necessarily so) provided elastic, stable currencies in Scotland (1716-1845), Canada (1817-1935), and about 60 other historical cases

( http://menghusblog.files.wordpress.com/2012/02/the-experience-of-free-banking.pdf ).

George Selgin and Larry White have provided extensive theoretical explanations of why Free Banking works, and the historical record backs them up. The US experienced frequent financial panics in the late 19th century (due to ill-conceived govt regulations), while Canada’s Free Banking system had none. Canada also had ZERO bank failures during the Great Depression, while the US under the Fed suffered some 9,000 failures.

Privately produced money has succeeded again and again historically, yet there’s no mention of this in any macroeconomics or monetary textbook. Why not?

16. March 2013 at 08:37

Scott, you are really onto something (for four years now). But what’s still missing is a non circular measure of “tight money” (not: why falling NGDP? Because tight money. How do we know money was tight? Falling NGDP. I know, “Other measures exist but are lousy.” etc.). This is the missing link that would convince the unconvinced.

16. March 2013 at 08:59

@mbk: “tight” and “loose” money are defined by counterfactuals. NGDP is “just” an indicator.

You need to start with some theory, which is roughly that the economy has some natural rate of economic growth (population + productivity), and a natural rate of unemployment. E.g. the Great Moderation 1985-2005.

From that basis, if money is “tight”, then you find that unemployment becomes elevated, and output is below potential. You find that if you take steps to loosen money, that output rises, and unemployment falls (but inflation remains stable).

Conversely, if money is “loose”, then inflation is high. Under this condition, if you take steps to tighten money, output and unemployment remain stable, but inflation falls. While if you take steps to loosen money, inflation rises.

That’s the “definition”. What we’re looking for, are “indicators” that allow us to determine whether money is currently tight or loose, without needing to do the experiments of tightening or loosening from the current state, and observing the resulting changes in macro variables.

Naturally, you need to start all this with a framework that the money supply has some effect on unemployment, output, and inflation. “Nominal shocks have real effects.” If you don’t accept that yet, then “tight” and “loose” aren’t meaningful concepts.

16. March 2013 at 09:54

Maybe another angle is: velocity changes are caused by expectation changes. While expectations changes are associated with “real shocks,” the “cause” of the exp changes is the combo of real shock plus lack of expectation management (effective monetary policy).

16. March 2013 at 10:01

Don Geddis:

I don’t agree with your assumptions behind your arguments concerning monetary policy, so nothing of what you said is applicable or valid.

Oh sorry, that’s something you would say. I wish I had the motivation to seriously address your ideas. Darn.

16. March 2013 at 10:02

Dr. Sumner:

A good argument can be made that “real shocks” and “monetary shocks”, alone, are insufficient causal explanations for why business cycles occur.

If we just considered “monetary shocks”, then there would be a lack of explanation for why central banks repeatedly find themselves in a position where they have to suddenly act more than usual to prevent falling AD. In other words, a lack of an explanation for why cash preferences throughout the market suddenly rise at the same time, that would seem to necessitate more central bank activity in order to offset the fall in AD that otherwise would take place, given that the Fed isn’t destroying money.

If we just considered “real shocks”, then there would be a lack of explanation for why investors repeatedly find themselves in a position where there is a shortage of sufficient real resources that would make the prices of capital low enough to enable profits to be earned on existing investments. In other words, there would be a lack of explanation for why investments throughout the market suddenly become in need of real capital that does not exist, given that investors aren’t destroying real capital.

It is imperative that both real and nominal factors are included in explaining the cause of business cycles. Why? Because each factor is the missing explanation of other factor. The nominal shocks are the missing explanation for why real shocks occur, and the real shocks are the missing explanation for why nominal shocks occur.

The reason monopoly money issuers repeatedly find themselves having to act more than usual is because there is something wrong with the real side. The reason investors repeatedly find themselves having to cut costs more than usual is because there is something wrong with the monopoly money issuers.

Only if one a priori asserts that money issuers are the ultimate standard under which everyone else must adapt, does one conclude that real shocks “have nothing to do with recessions”. Similarly, only if one a priori asserts that real goods issuers are the ultimate standard under which everyone else must adapt, does one conclude that nominal shocks “have nothing to do with recessions.”

There is NO reconciliation possible between respect for property rights and disrespect of property rights. That is, no reconciliation possible between peace and violence. That is, no reconciliation between the market and the state. If real goods are monopolized by the state, while money is privately issued, then there will be problems between the two. If money is monopolized by the state, while real goods are privately issued, then there will be problems between the two.

Market forces work at regulating the expansions of private industries because of the profit and loss brought about by the market process itself. If an industry is monopolized and immune from profit and loss, then the communication signals between that industry and all other industries become jammed. It doesn’t matter what specific industry is monopolized when it comes to signal jamming. Protection and security services, which are typically viewed as provinces of the state, are not immune from this. Money is also not immune from this.

Without those profit and loss signals, there is no possible way for the issuer of said good or service to know if it is expanding too much or too little, relative to the plans of those market participants who utilize said good or service. Everyone uses resources out of the same total resource pool. Each individual can only know if its expansion of resource usage is justified, if it is acting within the confines of market profit and loss.

So we can see why nominal shocks and real shocks are related phenomena, and why explanations of recessions must include both. There is no such thing as a non-market monetary “rule” that can avoid problems between money and real goods. There is no such thing as a non-market production “rule” that can avoid problems between money and real goods.

——————-

A true “teaching of monetary economics from the beginning” cannot take the monetary system for granted, nor the belief that recessions are 100% nominal, nor the conclusion that if NGDPLT is carried out then we’ll never have any problems between money and real goods ever again.

A helpful technique for ensuring that one’s deductions and reasoning avoid logical and economic pitfalls is to imagine the life of a single isolated individual on an island, imagine what they might do, and how economics can be used to understand what we can and cannot know about his life. Then, once there is a good understanding of this, THEN add another individual, and imagine how their lives might be, and to use economics to figure out what we can and cannot know about their lives. Then add a third person. Then a fourth.

16. March 2013 at 10:03

Scott, This gives a nice ‘visual’ on the spending (NGDP) employment relation:

http://thefaintofheart.wordpress.com/2011/05/06/jobs-where-are-you/

16. March 2013 at 10:04

[…] Scott Sumner, “Money Matters;” David Henderson, “Scott Sumner on Real Causes of Business […]

16. March 2013 at 11:11

John, In my view most recessions are triggered by monetary shocks, with no important real shocks. But then real things are always happening to the economy, so I suppose one could always point to something. What was the real shock in 1982? How about 1958? 1960? BTW, the 2008 recession was triggered by a sharp slowdown in the growth of the monetary base, not money hoarding. The intensification of the recession in late 2008 was due to money hoarding.

The recessions of 1920-21, 1929-30, 1937, 1948-49, were all triggered by a fall in the monetary base.

I partly agree with Hayek. If the economy is overheated, then a fall in output can occur with no monetary shock as all. Output would fall to the natural rate. Then if a monetary shock kicked in, output might fall below the natural rate. That’s the secondary deflation.

If you are asking whether some sort of real factor usually causes the Fed to make mistakes, then I agree. Thus if you are targeting interest rates then a bursting asset bubble might cause money to tighten.

Thanks David.

Patrick, Yes, both the 1970s oil shocks are possibilities–both were entangled with monetary shocks.

John S, Those are interesting issues, but I’m focusing on the impact of money on the economy, not the debate over different institutional set-ups. One must first understand the principles of money before those can be evaluated. You may already understand, but I’m trying to create a primer for beginners.

mbk, I’m not going to rely on circular reasoning in my course, I’m simply going to explain the mechanics of how money affects the economy. Nothing will hinge on whether it is called “tight” or “loose.”

My obsession with tight money in this blog is pushback against people who use the concepts in a confusing way, and muddle the monetary debate. They say money was tight in the 1930s but easy in the last five years, even though in both cases interest rates fell and the base rose. I’m pushing back against that sort of confusion.

Geoff, There are costs and benefits to any simplification in models–one always needs to keep in mind what’s being lost, or covered up.

Thanks Marcus.

16. March 2013 at 11:13

Marcus, I’d add that trend NGDP in the 1980s was closer to 7%, so the 1991 recession might have been a bit farther below trend. But I basically agree with that.

16. March 2013 at 11:20

The thing is, though, that real shocks cause monetary ones. The collapse in the housing bubble didn’t initially, Scott’s right about that. But once home prices fell further, pushing many homeowners into negative equity, then the bubble induced money hoarding.

16. March 2013 at 11:36

Yes while reading it I was thinking of the 70s oil shocks-then I saw you mentioned them. However, they could be used to make the case for a “real” or “supply side” recession.

16. March 2013 at 11:37

What are “monetary shocks?”

Why are the called “shocks”

16. March 2013 at 12:04

I’ll admit I’m not even entirely sure what I think about this, the more I try to, but somehow the idea that all elevated unemployment is nominal seems hard to believe-and again, if someone wants to insist it’s not true they can always refer back to the 70s shocks.

16. March 2013 at 12:06

I’ll admit I’m not even entirely sure what I think about this, the more I try to, but somehow the idea that all elevated unemployment is nominal seems hard to believe-and again, if someone wants to insist it’s not true they can always refer back to the 70s shocks.

16. March 2013 at 12:06

I’ll admit I’m not even entirely sure what I think about this, the more I try to, but somehow the idea that all elevated unemployment is nominal seems hard to believe-and again, if someone wants to insist it’s not true they can always refer back to the 70s shocks.

16. March 2013 at 12:12

Sorry about the triple post-I only pressed enter twice-as the first one seemed not to have gotten through.

16. March 2013 at 12:22

[…] Update: Scott Sumner has a post: “Money Matters“: […]

16. March 2013 at 13:11

Problems in Cyprus. Germans have just enforced a haircut on apparently guaranteed €100k retail deposits. An appallingly dangerous precedent has just been set. It’s going to be hard to prevent bank runs in peripheral, even some core, Europe. Is this a monetary shock, Bill?

16. March 2013 at 13:58

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1840705

Abstract:

Shock is a term of art that pervades modern economics appearing in nearly a quarter of all journal articles in economics and in nearly half in macroeconomics. Surprisingly, its rise as an essential element in the vocabulary of economists can be dated only to the early 1970s. The paper traces the history of shocks in macroeconomics from Frisch and Slutzky in the 1920s and 1930s through real-business-cycle and DSGE models and to the use of shocks as generators of impulse-response functions, which are in turn used as data in matching estimators. The history is organized around the observability of shocks. As well as documenting a critical conceptual development in economics, the history of shocks provides a case study that illustrates, but also suggests the limitations of, the distinction drawn by the philosophers of science James Bogen and James Woodward between data and phenomena. The history of shocks shows that this distinction must be substantially relativized if it is to be at all plausible.

16. March 2013 at 14:27

@John S: I read the introduction in your free banking link. Very interesting stuff. Correct me if I’m wrong, but the free banking movement seems to only be solving the “problem” of the medium of exchange: provide convenient paper for people to carry around, instead of heavy metal. But for the medium of account, the historical cases all seem to rely on the gold standard (or something very much like it).

The critical section in the introduction seemed to be: “Inflations and deflations did occur, but they occurred in response to changes in market conditions for the anchor commodity (e.g. when there were gold discoveries) and these changes had similar effects on all economies on the same monetary standard regardless of whether they had free banking or not. Price-level changes depended primarily on the monetary standard, in other words, rather than on the regulatory regime under which the banking system operated … One might note too that the government-induced abandonment of convertibility was always followed by later monetary expansion and inflation.”

So it seems like the argument should be broken into two different parts: first, a comparison of free-banking gold standard, vs. a central bank gold standard; and second, a comparison of a CB gold standard, vs. a CB with fiat currency (and something like NGDPLT).

I expect the MM would respond that the problem with free banking then becomes clear: (1) low, stable inflation actually isn’t a significant harm to society; and (2) the gold standard (for the medium of account) is unnecessarily inflexible, and causes economic harm when the supply of money can’t adjust to meet a change in demand.

A CB running NGDPLT would result in a much more stable, growing, and successful economy, than either a CB on the gold standard, or free banking on the gold standard. That’s the problem with free banking: it (apparently) commits you to something like a gold standard, which is a poor choice for a monetary basis.

16. March 2013 at 14:51

@John S: BTW, I do understand that free banking does not necessarily require gold; free bank notes could be convertible to “…silver, copper, … seashells…”, etc. The problem again seems to be the medium of account. If you take out a mortgage for 30 years to buy a house, what is it exactly that you promise to pay back three decades from now? The problem with choosing a commodity, is that the supply/demand for the commodity doesn’t track with the supply/demand for money overall.

No doubt David Glasner explained the concerns much better than I am able to.

16. March 2013 at 15:29

You said last week to not conflate stock market volatiliy with a financial crisis.

largest stock market corrections in you lifetime — as measured by the S&P peak to trough:

1987 -25.6%

2001 -50.5%

2008 -57.3%

1973 -47.2%

1929 -86%

“We market monetarists believe that monetary shocks (or “disequilibrium” if you prefer) is the primary cause of business cycles.”

You have defined tight money as NDGP growth below trend. So by your definition all recessions are accompanied by tight money.

But this is rather unsatifying for the rest of us. How did money become tight? Did somebody do something, or does the money supply spontaneously expand and contract?

I have a big problem with the term equilibrium… equilibrium suggest that all forces are equally ballanced. The economy is never in equlibrium. Chaos happens. The only thing to do is control the damage.

16. March 2013 at 16:52

Recoveries from disasters are rapid as Jack Hirshleifer pointed out in the papers he wrote for Rand in the 1960s on post-nuclear war civil defence.

As long as the basic market system is not suppressed, recoveries are rapid. war communism caused far more economic damage than the mass bombing of Axis cities in WW 2.

Recoveries from disasters are rapid because they are a case of unbalance growth.

The war and disaster damage is random and once these missing inputs are restored, everything goes back to normal rapidly because the remaining capital is intact.

16. March 2013 at 17:07

Jseydl, No, bubbles don’t induce money hoarding; very low expected NGDP growth does.

Bill, That’s standard terminology for unexpected changes in monetary policy.

Doug, You said;

“You have defined tight money as NDGP growth below trend. So by your definition all recessions are accompanied by tight money.”

I must have heard this one 100 times, and it’s silly every time. No, recessions are not declines in NGDP.

Your stock data is inaccurate, and I have no idea what point you’d be trying to make if it had been accurate.

Jim, Good point.

Everyone, My newest post won’t accept comments–I have no idea why.

16. March 2013 at 17:19

thanks scott,

taxes,regulation and a failure to invest in higher education was good a enough to open up a 30% gap in income between the EU-6 and the USA. smaller fluctuations in tax, regulation and other costs should be able to cause recessions.

See also Fiscal Sentiment and the Weak Recovery from the Great Recession: A Quantitative Exploration by Finn E. Kydland and Carlos E. J. M. Zarazaga

– The U.S. economy isn’t recovering from the deep Great Recession of 2008-2009 with the anticipated strength. A widespread conjecture is that this weakness can be traced to perceptions of an imminent switch to a higher taxes regime.

– The main finding is that the fiscal sentiment hypothesis can account for a significant fraction of the decline in investment and labor input in the aftermath of the Great Recession, relative to their pre-recession trends.

– These results require a qualification: The perceived higher taxes must fall almost exclusively on capital income. This is not an unreasonable condition.

– People suspect that the tax structure that will be implemented to address large fiscal imbalances will be far from optimal

– As agents realize that their capital income will be taxed more heavily in the future, they reduce their holdings of the capital stock by not completely replenishing the part of it that depreciates every period and by changing the composition of output in favour of consumption.

Why should technology unfold at an even rate? who is the guiding hand to ensure such neatness?

Andofatto reminds that general purpose technologies are enough to ensure larger variations in technological progress, followed by slowdowns for learning about new techologies, and for intervening periods of less innovation.

16. March 2013 at 17:24

Money matters because, in a monetary exchange economy, almost all transactions are mediated by money. (Hence the demand for goods and services is the “supply” of money circulating in the economy.) So, everyone cares (at least to some extent) about their money income and the expected future swap values of (their) money. (In a monetary exchange economy, goods and services have prices, money has swap values; it keeps the terminology, and so thinking, clearer.) Something everyone in an economy cares about is going to matter a lot more than something only some folk care about.

If people have expectations that the money is going to significantly lose value, obviously they have an incentive to spend sooner rather than later. This will be an economy-wide tendency that will tend to drive up money incomes. If they think it is going to significantly gain value, clearly they have an incentive to spend later rather than sooner. This will be an economy-wide tendency that will tend to drive down money incomes.

If they expect it to retain value reasonably well, then it all turns on their future expectations about money income. If they have poor expectations, that creates an incentive to hold money. If those expectations are limited to a particular industry, then folk will tend to exit the industry and other industries will not have to bid quite so high for resources, stimulating them. If these expectations are general, then the tendency to hold money will tend to drive down money incomes. (Which comes back to something everyone cares about matters a lot more than something only some folk care about.)

The trouble with the “loose” and “tight” terminology is the two axes problem–do you mean that money will tend to lose/gain value, or do you mean that people have poor expectations of future income, or some combination of the two? Presumably “disastrously tight” means gain swap value plus poor income expectations. And sure, “ugly” deflation means that, but there is a certain amount of chicken-and-egg problem here since each will cause the other. So the two axes are not causally independent.

Worse, you can have serious supply issues for goods and services as well as money, so poor income expectations AND falling swap values. (We could call this case “Greece”: I have limited sympathy for a country which is still paying lots of people to get in the way of folk transacting and then complains about a shortage of transactions.) So we cannot even say they are simply causally interdependent.

Perhaps better terminology is needed?

16. March 2013 at 17:27

Opponents of RBC default to an invisible explanation of smooth productivity growth.

In Nozick’s terms, where is the filter and where is the equilibrating mechanism to ensure growth is a smooth 2% but for monetary policy errors?

The filter of the market process is profits and losses and the equilibrating mechanism is relative prices. Losses eliminate undesirable behaviours and prices tell people what to do.

16. March 2013 at 17:35

Also, using ‘swap value’ means that ‘price’ always refers to money price. (So the price of money is itself.)

16. March 2013 at 18:10

[…] See full story on themoneyillusion.com […]

16. March 2013 at 18:14

What was my point…

“The biggest stock market crash in my life was 1987, which was almost identical to 1929”

1987 was not the worst bear market of your life-time.

1987 looked nothing like 1929.

16. March 2013 at 18:31

Jim Rose, The RBC model can’t even come close to explaining US business cycles, whereas the monetary theory can. The slow recocvery from this recession is exactly what one would expect with only 4% NGDP growth, so I don’t understand that comment.

In general the economy often booms with bad big government policies (late 1960s) and in late 1982 we had the highest unemployment rate in my lifetime, after a year and a half of Reagan starting to unwind the crazy Carter policies. In constrast, the monetary explanation fits well with almost all US business cycles.

I do agree that supply-side (real) factors explain the GDP difference between the US and Europe, but not business cycles, which reflect changes in the unemployment rate. Many European countries have unemployment rates similar to the US, and still have 25% lower GDP per person (Britain, Netherlands, the Nordics, etc.) Cyclical unemployment is THE great monetary problem, and RBC theory can’t explain it, although it can explain changes in the natural rate or unemployment, or longer vacations, or higher rates of disability, or less capital per worker, or lots of other factors.

Lorenzo, I have some new posts coming up that address those issues.

Doug. Nope, the 1929 and 1987 crashes were almost identical. If you don’t think so, you’d better take another look at the data. I’ve studied both crashes intensively–the graphs overlay almost perfectly. No other crashes are as dramatic.

16. March 2013 at 19:53

@Scott Sumner,

Unfortunately, I do not understand the principles of money well, as I am just a student. However, I wonder if it’s really fair to characterize a comparison of Free Banking and Market Monetarism as simply a “debate over institutional set-ups.” Is it not at least conceivable that Free Banking could produce a superior, more stable outcome on economic grounds alone? And how do we know that a perpetual, unchanging 5% NGDP growth path is optimal? Perhaps periodic adjustment of NGDP growth, in response to market signals, is the best monetary policy.

Also, by studying the theory and practice of Free Banking, I think we could learn a lot about the principles of money. At one time, it seems that thinking about alternative banking arrangements and payment systems was a hot topic for prominent economists (Fama, Black). Even you wrote about money privatization at least once (I hope to read your paper, “Privatizing the Mint,” someday). But somehow I feel that this kind of theoretical curiosity has waned for no other reason except that it’s “impractical” (i.e. we’re stuck with the Fed, so let’s focus our energy on improving it). While understandable, this seems truly unfortunate.

Given it’s theoretical and historical richness, Free Banking really does seem to be an viewpoint that is underrepresented in the curriculum of monetary economics. That’s all I wanted to say.

16. March 2013 at 20:25

@Don Geddis,

First, thank you for your thoughtful response.

Re: medium of exchange, account–yes, as I understand it, the medium of account was a “dollar” (defined as a certain number of grains of gold), while the medium of exchange was inside money (primarily banknotes in the 19th century, but also checks and deposit transfers).

Re: mortgages–I’m not familiar with the specifics of the mortage market, but I’ve read that very long-term corporate bonds (up to 100 years) were commonly issued during the gold standard years in the US. Presumably, debt payments were also made with redeemable notes w/o any problems, so I don’t see why mortgages would be different.

“The problem with choosing a commodity, is that the supply/demand for the commodity doesn’t track with the supply/demand for money overall.”

This doesn’t seem to be a strong criticism, imo. Free banks can issue as much inside money as the public wants to hold; commodity convertibility only serves as a check against rampant overexpansion (i.e. overissuing banks will eventually see those excess notes come back through the clearing system and thus lose commodity reserves).

Looking at the historical experience of Canada, it seems that free banks were able tailor the money supply to the public’s demand for money to a high level of precision. Please take a look at Selgin’s description here from 15:10 to 19:30.

http://www.youtube.com/watch?v=JeIljifA8Ls

16. March 2013 at 21:18

@Don,

You’re right that Glasner is opposed to any form of gold standard (either with Free Banking or centrally managed). But re: the flexibility issue specifically, he did have this to say elsewhere:

“under a gold standard, if people want to hold more dollars, more dollars can be created. Yes more dollars can be created out of thin air under a gold standard! The whole point is that any dollars created have to be convertible on demand into gold. Well if people want to hold more dollars, they can be created, and held, just as desired… So an increase in the demand for money need not cause a recession under the gold standard.”

http://uneasymoney.com/2012/03/23/bernanke-has-trouble-explaining-whats-wrong-with-the-gold-standard/

In the Glasner post you cited, he really seems to overexaggerate the “scariness” of gold-based free banking and the difficulty of the transition process. As Larry White has shown, the transition isn’t that difficult to imagine:

“Does the US Treasury own enough gold to return to a gold-redeemable dollar at the current price of gold? Yes.. At a market price of $1600 per fine Troy oz., the US government’s 261.5m ounces of gold are worth $418.4b. Current required bank reserves are only $83b. Looked at another way, $418.4b is 19.9 percent of current M1, a more than healthy reserve ratio by historical standards.”

http://www.freebanking.org/2011/12/22/making-the-transition-to-a-new-gold-standard/

This plan addresses Glasner’s somewhat overblown fears** (“Would the US continue to hold gold reserves if it went out of the money creation business? I have no idea.”) The dollar would not “[disappear] as we know it,” it would merely be redefined as a certain amount of gold (which would in no way hinder the ability of free banks to issue notes redeemable for said amount).

Selgin has proposed another way to transition to a privatized monetary system. The plan is a bit too long to summarize here, but it’s on the last two pages of this paper (in the section, “A Practical Proposal for Reform”): http://www.cato.org/sites/cato.org/files/pubs/pdf/pa060.pdf

It’s worth mentioning that under either of these plans, there is flexibility for base money to evolve. So it need not be gold, or frozen Federal Reserve notes, forever (a point which you alluded to earlier).

**Glasner’s attitude toward Free Banking is puzzling, given that he wrote a book advocating it (“Free Banking and Monetary Reform,” which I have not yet read).

17. March 2013 at 00:31

“No, bubbles don’t induce money hoarding; very low expected NGDP growth does.”

And for the 90% of the population who doesn’t even know what NGDP stands for? They save when NGDP growth slows?

It’s more likely that people shift spending/saving habits based on wealth shocks.

17. March 2013 at 00:35

Can we dump the dramatically unhelpful theortically loaded cheat word “shock” already?

17. March 2013 at 02:01

[…] Source […]

17. March 2013 at 02:48

[…] — Britain’s Treasury chief says the government will compensate U.K. troops who lose money to Cyprus’s bailout tax. About 3,500 British military personnel are based in Cyprus, which […]

17. March 2013 at 04:50

Scott:

I agree that many economists use “monetary shocks” to mean unanticipated changes in monetary policy.

They mean that interest rates change an amount different from a Taylor rule (or whatever it is the researcher wants to use to describe anticipated monetary poicy,) then how do the other variables in the system, particularly real output and inflation, respond through time.

I think it is fair to say that this is not what you have in mind.

Don’t you instead mean something like a deviation of nominal GDP from a log linear trend?

Worse, don’t you really mean something like a deviation of expected nominal GDP away from a log linear trend?

This would have nothing to do with whether this deviation was caused by the central bank’s monetary policy rule or else was some deviation from its actual rule. (Filtered through expectations. Will the rule cause nominal GDP to deviate from trend or while the rule would leave nominal GDP on trend, the central bank has broken the rule and so nominal GDP will deviate from trend.)

There is a tremendously normative element because there is always the notion that the central bank’s policy rule should be to keep nominal GDP on a target growth path. So, these “monetary shocks” are shifts of nominal GDP away from what it should be.

Whether they are mistakes made by a central bank regarding the right rule, or a central bank that has a wrong rule, is of less importance.

Of course, we also have the problem that the growth rate of the existing growth path might be too high or too low, so that the trend inflation rate is undesirable. A planned disinflation, for example, would cause a recession.

I think “shocks” imply realizations of a random variable. It is a characteristic of a mathematical model that includes an error term.

There is also some notion that “shocks” are things that cause a system to deviate from equilibrium. The system is “at rest” and them some exogenous “shock” forces it to change.

Are deviations of nominal GDP from target usefully characterized as exogenous? While we might treat intentional changes in base money as exogenous, is it useful to treat the demand for base money as exogenous?

We estimate the “model” and the unexplained variance are the shocks. We tune the policy response function to minimize the variance in the target varianbles (real output or unemployment and inflation) due to those “shocks.”

It seems to me that the lingo of shocks is closely tied to the optimal control project. The central bank is the social engineer minimizing variance in the target variables.

17. March 2013 at 05:42

John S.:

Sumner is a bit of an outlier among Market Monetarists in his devotion to government issued hand-to-hand currency.

Many Market Monetarists have no problem with allowing banks to issue hand-to-hand currency and appreciate many of the advantages described by Selgin and White regarding such a system.

There are three elements of free banking — the micro elements, the macro elements, and the constitutional elements.

I think most Market Monetarists favor both the micro and constitutional elements of Free Banking. People (and banks) should be free to use whatever monetary arrangments they like (Constitutional.) If people in the U.S. want to use Euros, gold, or whatever, they should be free to do so.

Banks issuing dollar-denominated deposits (and banknotes) should operate pretty much subject solely to freedom of contract (micro.) That means no reserve requirements, no capital repuirements, no (or little) deposit insurance, and so on.

The issue is the “macro” element, Market Monetarists don’t believe that having a fixed dollar price of gold or else having the banking system tied to a fixed quantity of historical dollar denominated government currency is a good idea. Instead, the quantity of the medium of account should adjust to the demand for it in a way that spending on output grows at a slow, steady rate.

To the degree that a banking system with private issue of currency and no reserve requirements manages that–great. That is an advantage of privatizing hand-to-hand currency and getting rid of reserve requirements. But we are skeptical that the demand for base money would not change, perhaps substantially, and so it is better for it to be possible to change the quantity of base money too.

I don’t know that everyone has bought into this, but Sumner and I favor using index futures contracts to adjust the quantity of base money as needed. If private currency and no reserve requirements results in a more stable demand for base money, then it is likely that those trading the index futures contracts will have an easier time and be more sucessful in keeping the quantity of base money equal to the demand for it and so spending on output growing at a slow, steady rate.

17. March 2013 at 06:07

Rose:

Let’s consider some elementary macroeconomics.

If worries about future capital taxation resulted in less investment, then the result should be a shift in the allocation for resources towards current consumption and away from investment.

We would see an expansion of consumption and a contraction of investment. We do observe the contraction of investment–it is below the peak of 2006 (I think, if we include housing.) But consumption, both real and nominal, is well below the trend of the Great Moderation.

If there is an unfortunate expectation that investment income will be taxed alot, so that saving and investment is less desirable, then we should expect a consumption led recovery. We are seeing that, but both nominal and real consumption remain too low. They have not recovered to trend, much less expanded beyond that point to reflect the realocation of demand and resources.

In my view, higher expected taxes on labor should result in higher labor supply now (work and consume now before taxes go up.) Anyway, to the degree there is a current reduction in labor supply, we should have seen an increase in quits and an increase in the vacancy rate. From 2008 to 2009, quits collapsed and while they have risen a bit, they remain way below what they were in 2007.

Vacancies also fell, and remain depressed relative to what they were.

Just no evidence of people no wanting to work.

Anyway, I don’t believe that potential output always grows at a constant rate. I have my doubts regarding sudden decreases, but they are possible, I suppose.

But I don’t think that is what we have observed for the last 5 years.

In my view, there is just a disconnection with reality.

People think taxes on capital will be high, so they invest less, and so they work less now. Why work to earn income to save and invest when the after tax return on investment is so low?

OK. So, we have people quiting work right and left and if you asked them why, they would say that there is no point in working, since I just wanted to save the money, and there is no point in saving if the after tax return on saving is so low.

That is a real business cycle story.

A story where low after tax returns on investment leads people to save by holding money, and so spending on output falls, expecially spending on capital goods fall, and the people who were employed producing capital goods and now unemployed.

That is a monetary disequilibrium story.

Why didn’t the quantity of money rise enough, and market interest rates fall enough, to keeping saving and investment in balance with full employment of resources?

17. March 2013 at 06:21

Bill,

That’s a great breakdown of the different aspects of free banking, thanks. I knew you supported privatized currency, but I didn’t realize it was a common stance among MMs.

Re: macro effects of free banking–do you know of any literature featuring disagreements between MMs and Free Bankers on the optimal growth of base money?

17. March 2013 at 08:13

The only “crazy policy of Carter” that had anything to do with the 1981 unemployment rate was appointing Volcker.

17. March 2013 at 08:59

“Nope, the 1929 and 1987 crashes were almost identical. If you don’t think so, you’d better take another look at the data. I’ve studied both crashes intensively-the graphs overlay almost perfectly.”

Bull Crap!

1929

http://www.stock-market-crash.net/wp-content/uploads/2012/06/1929-crash.gif

1987

http://www.stock-market-crash.net/wp-content/uploads/2012/06/1987-crash.jpg

Completely different scale!

The 29 crash was multiple record declines between 10/1 and 10/31.

The 87 crash was 1 day down and half the way back over the next 2 weeks.

17. March 2013 at 14:35

ssumner:

IMO, education is about getting your audience from where they currently are to where you want them to be.

And so, this post contained the succinct core that you should lean on when advocating NGDPLT in public media:

“… most people … overestimate the importance of real shocks in the business cycle. On the other hand most people … underestimate the importance of monetary shocks.”

17. March 2013 at 15:26

Bill Wollsey:

“Why didn’t the quantity of money rise enough, and market interest rates fall enough, to keeping saving and investment in balance with full employment of resources?”

Money supplies and interest rates are not the variables of control when it comes to the phenomena of savings equaling or tending to equal investment.

If one argues that savings is or is not equal to investment, then they are begging the questions of:

A. What time period is relevant in making a decision as to whether or not savings equals investment; and

B. Presuming that savings are the same thing as cash hoarding.

There is no justifiable reason nor social obligation for some individual or group of people to deceive market participants through money supply and interest rate manipulation that would generate savings equaling investment.

Assuming you define savings as cash holding, it follows that savings can NEVER equal investment. Economic action is sequential. A person cannot earn money, hold the money, and invest the money, all at the same exact instant. But that is what would have to occur if it were possible for savings to equal investment. No, savings will ALWAYS be greater than investment, because one must hold money for a positive period of time, to be considered an owner, before they can invest the money.

So at any moment in time, savings defined as cash holding is the entire money supply, and investment is precisely zero.

The only meaningful equation of cash holding and investing cash, is if we are talking about a period of time. But then it immediately becomes arbitrary, because while one person may believe that the time horizon ought to be a month, while another might believe one year, and there would be no objective way to reconcile their disagreement. It would invariably come down to whose arbitrary time horizon should be enforced by state intervention (through central banking).

Savings is continually misunderstood and confused by the very people who should be least confused about it (economists and monetary economists).

In a free unhampered market, savings defined as using earnings for purposes other than consumption, is always exactly equal to investment. Savings defined as cash holding, is never equal to investment, nor should it be.

If there is a rise in cash holding, without an equivalent rise in investment, then it is a fallacy to the nth degree to believe that some sort of problem is occurring that requires anti-market activity to “correct.” This is the case even if prices don’t instantly adjust (since price discovery and formation isn’t instantaneous either).

“Employment” and “output” are not rational economic ends that we should seek. They are MEANS used to achieve desired ends. Employment for the sake of employment, and output for the sake of output, are economically backwards endeavors. Few if any economists are actually serious about these concepts being ends that we ought to seek. If they were serious, then they would advocate for inflation financed employment welfare programs for every unemployed person, to engage in make work projects.

There is this ping pong, back and forth, committed then not committed devotion, especially in MM circles, to maximize employment and output. When pressed, there is this “offense” taken that MMs are not saying employment and output are the ends sought. But when not pressed, they advocate for NGDP targeting because of what a lack of NGDP targeting does to employment and output!

At some point, all MMs will have to come to the realization that there is no reconciliation possible between the market and the state. There will always be a conflict of interest because of the fundamental difference between respect for private property and voluntary trade on the one side, and disrespect for property rights and theft on the other.

If you start with the assumptions that central banks have the obligation to prevent aggregate spending from ever declining for a population living on an arbitrarily sized territory of land, then you can’t presume to be unbiased, value free, and ready and able to address purely economic principles and questions, such as the relationship between interest rates, savings, money supply growth, and investment. You’d be using the wrong tools.

18. March 2013 at 02:23

[…] a conjecture without evidence. Actual experience, as people as diverse and diametric as Scott Sumner and J.W. Mason point out, suggests that “demand-side dynamics” may overwhelm the bounds […]

18. March 2013 at 06:30

John S. I do not support the current institutional set up of the Fed, I support having the market determine the money supply and interest rates. But as long as we have this set up, it’s very important to encourage the Fed to do as little damage as possible. I agree that Free Banking might do better. But no one has been able to come up with a persuasive argument that they could do better. Until that happens I’ll minimize the damage from central banking–it’s an important task.

I notice that some on the far right who insist one should never give a central bank advice, because they’d be tainted somehow by doing so, are the first to cry “hyperinflation” when they think central bank policy is wrong. Hypocrites.

JSeydl, 90% of the public doesn’t know what inflation, or RGDP, or bond prices, or lots of other things are, that doesn’t mean that economic factors don’t affect their behavior. They do know what their income is. If they each act in response to changes in their income, then collectively they are acting in response to changes in NGDP.

Bill, You said;

“Sumner is a bit of an outlier among Market Monetarists in his devotion to government issued hand-to-hand currency.”

In 1995 I published an article in the JMCB entitled “Privatizing the Mint” which supported the idea. Where I differ with others is that I’d like the government to continue earning seignorage by auctioning off the rights to each denomination.

Regarding “shocks,” I agree that there are definitional problems, so for the purposes of my blog you could view that as unexpected changes in NGDP, or NGDP expectations.

Doug, You are flat out wrong. In 1929 the stock market fell gradually for 6 weeks, by about 20%, then plunged 25% in two days, then gradually recovered over the next 6 months. In 1987 it fell about 20% over 6 weeks, then plunged 23% in one day, and then partly recovered over the next 6 months. If you overlay the graphs they are almost identical. I’ve seen it done many times.

Thanks Ricardo.

18. March 2013 at 07:35

Scott,

I agree 100% that NGDP targeting is better than inflation targeting. You are doing important work, and I applaud your tireless efforts to improve the current system.

I actually think promoting awareness of Free Banking would help the cause of NGDP targeting. Although it has no academic influence, the Ron Paul-inspired “End the Fed” movement is gaining considerable popularity (and it will gain even more with Rand Paul’s rise). But these people are mostly coming from a misguided Rothbardian, ultra-hard money, anti-frac reserve banking perspective.

As you know, the major Free Bankers (White, Selgin, and Horwitz) all endorse NGDP targeting to some extent b/c they feel that it would emulate Free Banking outcomes better than the current system. If explained in this way to the “End the Fed” crowd, they would likely be more receptive to NGDP targeting as well.

NGDP targeting needs all the positive PR it can get. How cool would it be to have Rand Paul espousing NGDP targeting in the next election cycle?

18. March 2013 at 08:46

Sorry for a very basic question but are you claiming that there wouldn’t be a business cycle or simply that the amplitude of business cycles would be reduced without monetary shocks?

As it stands, I don’t know how to evaluate your claim. I was thinking I would look for instances of monetary shocks that didn’t cause increases in the amplitude of the business cycle but I have no idea how to do that.

18. March 2013 at 10:13

[…] Taken from: TheMoneyIllusion » Money matters […]

19. March 2013 at 00:19

greg mankiw siad on a Fed conference that if post-war monetray policy was efficient, most of business cycle fluctuations must be due to real factors. the real issue, Mankiw said, was whether the Fed could cause a recession if it wanted too.

19. March 2013 at 06:59

[…] 1. Sumner on teaching macro and the importance of demand shocks. […]

19. March 2013 at 07:35

Geoff:

Saving is income less consumption. It is not the same thing as accumulation of money or currency. It includes all sorts of expenditures of money–just not purchases of consumer goods and services.

Investment is spending on capital goods–like machines buildings and equipment.

For saving to be equal to investment means that the amount spent on capital goods matches the amount of income not spent on consumer goods and services.

Your argument about consecutive economic activity has nothing to do with it.

You seem to be thinking of investment to be spending on stocks, bonds, or real estate.

Something like an individual first earns money and then later spends it on stocks or bonds. In other words, people choose to invest their saving. That has nothing to do with it.

When people accumulate money, they are saving. When they spend that money on stocks, bonds or real estate, they are still saving the money.

It would really help to learn some economics.

20. March 2013 at 02:12

[…] that’s a conjecture without evidence. Actual experience, as people as diverse and diametric as Scott Sumner and J.W. Mason point out, suggests that “demand-side dynamics” may overwhelm the bounds of a […]

20. March 2013 at 07:28

[…] but Scott Sumner has been doing a very nice job laying out his worldview in some recent posts (here, here, and […]

23. March 2013 at 09:11

Bill Woolsey:

“Saving is income less consumption. It is not the same thing as accumulation of money or currency. It includes all sorts of expenditures of money-just not purchases of consumer goods and services.”

Saving and consumption are activities that take place over time. Subtracting one from the other requires a definite time period to be made explicit.

Saving doesn’t just include the purchase of consumer goods? That’s odd, because savings is by definition exclusive of purchases of consumer goods.

“Investment is spending on capital goods-like machines buildings and equipment.”

Agreed.

“For saving to be equal to investment means that the amount spent on capital goods matches the amount of income not spent on consumer goods and services.”

They are never equal by that definition, because as soon as I earn an income, at that very moment, I am not spending money on capital goods. Then, some time later, when I do make the choice of what to buy, say capital goods, then it is the case that my capital goods purchase, at that very moment, is not equal to my income at that moment.

“Your argument about consecutive economic activity has nothing to do with it.”

It has everything to do with it. Economic activity is sequential. If earning money is not the same thing as investing in a capital good, and all choices are sequential, then by the nature of the case, any two different concepts in the sequence, can never be identical with each other when each choice/action is made.

“You seem to be thinking of investment to be spending on stocks, bonds, or real estate.”

Nope.

“Something like an individual first earns money and then later spends it on stocks or bonds. In other words, people choose to invest their saving. That has nothing to do with it.”

It doesn’t have to be bonds or stocks. Someone can earn money and then later on invest in a capital good using that money. This has EVERYTHING to do with the meaning of “savings equals investment”. If we look at a large enough time frame, say a trillion years, then savings will be so close to investment that for all intents and purposes, we can regard them as equal by definition, if the context is a trillion years.

But if the time period consider by Mr. Smith is a day, or an hour, or a week, then earning money can take place without any investment, and Mr. Smith will believe savings can be different from investment. Yet someone who is considering a much longer time period, say Mr. Jones, he wouldn’t make the conclusion that savings can differ from investment, because his considered time period hasn’t elapsed yet.

“When people accumulate money, they are saving. When they spend that money on stocks, bonds or real estate, they are still saving the money.”

I use a different definition. I don’t regard accumulating money as “saving”, because by that definition, every single person who earns money is a saver, because every earner of money holds money for at least some positive period of time, before exchanging it. Thus, by your definition, we would have to regard someone who never purchases stocks, bonds, capital goods, labor, nothing of these sorts, and who only buys consumer goods, these people would be considered “savers” using your definition, because if we look at their behavior, they are accumulating money for periods of time.

Since your definition would call for labeling profligate consumers who never invest “savers”, I choose not to define accumulating money as “saving.”

“It would really help to learn some economics.”

Hahahaha, well I guess we all deal with our insecurities and lack of total knowledge in our own way. Yours is to make sloppy statements, and then consider those who disagree with you for justifiable reasons, ignorant.

To each their own.

25. March 2013 at 03:30

[…] Money Matters, by Scott Sumner. The Money Illusion, March 16th, 2013. […]

3. April 2013 at 10:26

[…] Full post worth reading. […]

7. April 2013 at 08:46

[…] Money matters a lot. (and non-monetary shocks don’t matter as much as you’d […]

8. April 2013 at 01:58

[…] Money matters a lot. (and non-monetary shocks don’t matter as much as you’d […]

27. February 2016 at 14:09

[…] TheMoneyIllusion » Money matters – … 9/11, stock market crashes, … are you aware of any recession driven by a monetary contraction (or monetary demand … Money matters because, in a monetary … […]

22. February 2017 at 08:51

[…] a year (causing brownouts.)” http://www.themoneyillusion.com/?p=20114 “I’m tempted to say “real shocks don’t matter.” […]