An even greater moderation?

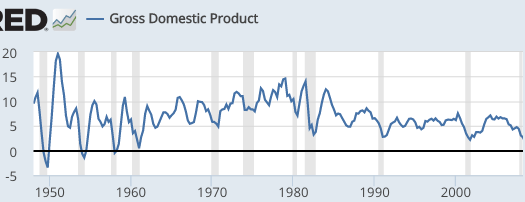

After 1985 there was a definite moderation in NGDP (and RGDP) instability:

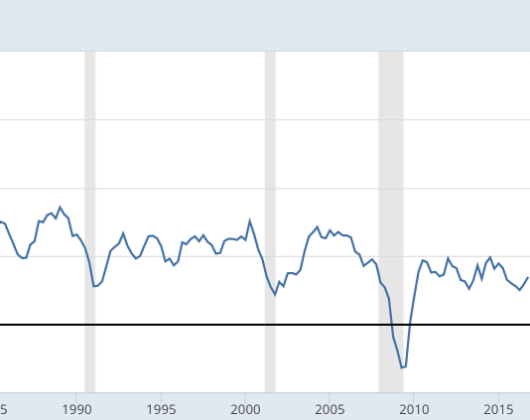

But this period of stability ended in 2008:

I am going to go out on a limb and predict that we are now entering a new Great Moderation, even more stable than the 1985-2007 period. Let’s start with what we know.

I am going to go out on a limb and predict that we are now entering a new Great Moderation, even more stable than the 1985-2007 period. Let’s start with what we know.

We are only a few months away from being eight years unto the expansion. This 8-year period will likely be the second most stable in all of American history, outdone only by the 10 years of stability from 1991 to early 2001. As you can see from the second graph (YoY data), the recent stability of NGDP growth is about the same as during the 1990s, albeit averaging somewhat below 5%, rather than somewhat above 5%.

So why do I think we are entering an even greater moderation? Seven reasons, none of which I expect people will find all that persuasive:

1. No excesses yet. I think it’s likely that this expansion will exceed the 10-year expansion of the 1990s. We only need two more years to do so, and I don’t see any signs of the sort of excess that often occurs before recessions. Not saying a recession cannot happen within two years (they tend to be unforecastable) just that it seems much less than a 50/50 proposition.

2. Supply-side reforms. I think it’s likely that there will be some sort of tax reforms, as well as deregulation, which will tend to slightly boost the supply-side of the economy. I don’t expect the sort of dramatic effects that true believers predict (a new long run RGDP trend of 3% to 3.5%) but I do see a small improvement as likely. Recessions are often preceded by adverse AS movements, which create inflation, leading to Fed tightening. In addition, an adverse supply shock tends to lower the Wicksellian equilibrium interest rate, which leads to unintentional Fed tightening when the Fed believes a given rate setting to be more expansionary than it actually is. (See 2008, for instance.) But since Trump took office, it seems like the Wicksellian equilibrium rate has risen slightly. This also gives the Fed more room to operate, relative to the zero bound.

3. Spotlight on the Fed. This one is hard to quantify, but I feel it’s important. I became radicalized in late 2008 because I saw that pundits were totally ignoring the drop in NGDP growth expectations, and basically giving the Fed a free pass. Kevin Erdmann directed me to an absurd WSJ editorial from right after Lehman failed, which captures the mood of that period:

These columns have been tough on the Federal Reserve in recent years, so it’s only fair to praise the central bank when it does the right thing. And that’s what it did yesterday by holding the federal funds rate stable at 2%, despite the turmoil in the financial markets and enormous Wall Street pressure to reduce rates further.

Face palm. Yes, and Boston firemen took a brave stand against smoking in bed, by refusing to douse a house fire sweeping through East Boston tenements. Hardly anyone was criticizing the Fed’s tight money policy in 2008. David Beckworth noticed that interest on reserves was a potential mistake, but even that program was mostly ignored.

Now the blogosphere and academic economists are paying far more attention to NGDP growth than in the past. I am watching it like a hawk, and unlike in late 2008 I have a big mouthpiece to scream through if I see the Fed making the same mistake again. I can’t even imagine the Fed letting growth expectations slip as they did after Lehman, without putting up a fight.

4. Learning from mistakes. I am not saying the Fed has adopted NGDP targeting—they haven’t. Rather I’m saying the Fed is increasingly aware that they cannot allow highly erratic moves in NGDP growth. The Fed learned from the mistakes of the Great Depression. They learned from the mistakes of the Great Inflation. They didn’t learn as much as I would like from the Great Recession, but surely they learned something.

5. QE works, and negative IOR hasn’t even been tried. Some might worry that although the Fed would wish to keep NGDP growth fairly stable, they lack the tools to offset “shocks” when we are near the zero bound. But the Fed did succeed in fully offsetting the fiscal tightening of 2013, even though we were at the zero bound. When the next shock hits we probably will not be at the zero bound, giving the Fed even more “ammo”.

6. Yellen is a cautious dove. Janet Yellen understands that the best way to prevent a recession is to prevent the sort of excessive rise in AD that often leads to a recession (as tight money is then used to bring inflation back down.) The Fed’s caution produced a substandard recovery, but it also means the expansion is likely to be longer than normal.

7. No financial crisis on the horizon. Although the Fed can offset shocks like the 2013 fiscal tightening, they still may not have learned how to do monetary policy in a major financial crisis. And forthcoming GOP banking deregulation probably makes another financial crisis more likely, unless the GOP deals with the underlying moral hazard problem (and I fear they won’t.) But this is partially offset by the fact that major financial crises are pretty rare, and the banks were burned so badly by 2008 that they are likely to be more cautious in even a deregulated environment. I do think we’ll eventually have another financial crisis unless we adopt the sort of system the Canadians have (and even theirs is not perfect), but these major crises are rare events. There is less than a 20% chance of one occurring in the next 2 decades.

Conclusion: By the year 2040 we will be more than 3 decades past the Great Recession. I may not live long enough to see if this prediction comes true, but I’m going on record predicting only one US recession between now and 2040. A thirty-year span with only one recession would be unprecedented, and even Greater Moderation. The Aussies have done it, why can’t we?

So cheer up MMs of the world, we are winning.

And if I am wrong and you lose lots of money in the stock market, which was invested based on my prediction? Then you are welcome to spit on my grave in 2040.

Update:

From Peter in the comment section:

Hi Dr. Sumner,

I was able to ask Loretta Mester, the Cleveland Fed President, what she thought of NGDPLT, and thought you might be interested in her response. Overall she was cautiously positive on the idea.

She started her answer by saying that she thought Inflation Targeting was probably good enough for stabilizing the economy, and that the inflation target has worked pretty well thus far. But, she said she saw the benefits of NGDPLT (and price level targeting) over IT, and mentioned that it would have been particularly effective in stabilizing the economy during the Great Recession. She was hesitant to endorse switching to NGDPLT in the very near future because they only just adopted the explicit 2% inflation target, and she worried that switching to another target so quickly would be too discretionary, and would damage the Feds credibility. As a result, she wanted to keep the inflation target for now, but felt that NGDPLT and PLT where promising directions to move in the future.

Hopefully Barnard puts the video from the talk up soon, so you can hear her answer for yourself. But, I think you can add her to the list of fed officials who are at least mildly supportive of NGDPLT.

http://bwog.com/2017/03/03/barnard-power-talk-with-loretta-mester-gets-economical-real-quick/

I actually think that’s a very reasonable answer. From the beginning, I’ve understood that a sudden switch to NGDPLT would create a bit of a credibility problem for the Fed, as it only recently adopted the 2% inflation target (formally.) I’m pleased that Fed people see how that policy might have done better during the Great Recession, which leads me to believe they might incorporate a bit on NGDP thinking in there response to the next crisis, if only informally.

Update#2: From commenter MFFA:

About that comment from Peter

I once asked the exact same question to professor Kashyap (who’s just been appointed to an advisory role to the BoE) from the University of Chicago Booth school of Business and got almost exactly the same answer. So let’s not be too hasty in our desire to move to NGDPLT, we need to move at the right pace