Marcus Nunes sent me a post by the always excellent Joe Gagnon. I’m not sure I fully agree with Gagnon’s view of the situation, but his post does a beautiful job of explaining the issues faced by the Fed in December 2008, and how they evaluated their various policy options:

The FOMC did not discuss the possibility of a negative interest rate on bank reserves, but it is widely agreed that a significantly negative interest is not feasible because banks would convert their reserve balances to paper currency. A lingering puzzle is why the Fed never lowered interest on reserves to zero in subsequent years, when financial strains had diminished and depositors and market participants had gotten used to the low rate environment, but standard macroeconomic models imply that the benefits of such a small decline would have been correspondingly small.

This paragraph shows that the Fed had two serious misconceptions. Vault cash is a part of bank reserves, and hence there is no reason that the negative IOR could not also be applied to vault cash. (There may be legal barriers, but laws can be changed.) In earlier posts I’ve recommended that banks be exempt from negative IOR on a “normal” level of bank reserves, perhaps required reserves plus X%. The key is to make excess reserve holding costly at the margin, so that new injections of base money go out into circulation as cash. Because cash is very costly to store, this would depress market interest below zero, if the policy failed. More likely it would succeed and dramatically boost AD, and therefore the mere threat of negative IOR would make the actual implementation of negative IOR unnecessary.

Update: Mark Sadowski clarifies the legal status of vault cash

The second misconception is the assumption that the benefits from a further small reduction in interest rates are minor. That comes from flawed Keynesian models of monetary economics, which ignore the role of money as a medium of account. If you set IOR at a rate slightly above the T-bill yield, then the demand for base money rises dramatically, which is highly deflationary. To be sure, a lower rate might decrease T-bill yields by a roughly similar amount, in which case the spread is preserved, but that assumption raises all sorts of further questions, such as what impact does lower interest rates have on the expected future path of monetary policy. There are numerous cases where over a trillion dollars in global stock market wealth has been created or destroyed within minutes by a decision over a 25 basis point change in the fed funds target. In other cases that sort of change has little impact. There is no basis for simply assuming that a small change in the fed funds target would be unimportant when the economy is poised on the knife edge of a depression.

There was some discussion, both within the meeting and in the background memos, about the possible benefits of committing to hold the policy rate low for so long that the economy would be likely to overshoot the long-run desired levels of employment and inflation temporarily. Some participants questioned the credibility of such a commitment, given the likelihood that the Fed would come to regret it later. More generally, FOMC participants seemed to have little appetite for tying their hands in such a dramatic fashion. Although they were all for getting back to their economic goals quickly, they had no desire to speed up the recovery at the expense of overshooting their goals.

Not willing “to speed up the recovery at the expense of overshooting?” Sorry Fed officials, but that is against the law. You have a dual mandate. A decision that you are unwilling to overshoot 2% inflation by even a tiny bit, even when unemployment is 10%, is tantamount to admitting that only inflation matters. A policy of never trying to overshoot 2% inflation is basically a single mandate policy, inflation targeting pure and simple. That which has no practical implications, has no policy mandate implications. If your policy is indistinguishable for a single mandate IT regime, then it is a single mandate IT regime.

There was widespread approval of the Fed’s generous provision of liquidity during the crisis, with some participants noting that measures of financial stress were beginning to ease a bit. Both the discussion and one of the background memos agreed that the liquidity facilities had a macroeconomically important effect to the extent that they were preventing cutbacks in consumption and investment that would otherwise have occurred. Some noted that these facilities were less effective at providing additional stimulus than they were at offsetting negative shocks because market participants could not be coerced into using these facilities.

God help us all if 80 years after the Great Depression Fed officials were still worried about pushing on strings and leading horses to water.

The FOMC discussion shows that there was little appetite for a dramatic push to increase inflation expectations, with some participants expressing doubt that the Fed could raise expectations substantially through statements about its intentions without any additional actions. But there was also an acknowledgment that the Fed had not been as clear as it could have been about what inflation rate it aimed to achieve. Speeches and other published materials seemed to show a comfort zone for inflation with a lower end around 1 to 1.5 percent and an upper end at 2 percent. One of the background memos assumed an inflation goal of 1.75 percent. Participants did not agree on a common inflation goal at this meeting.

The first sentence might be translated as: “There was little appetite for pushing inflation expectations up to a level where the policy was expected to succeed, and in any case in order to actually raise inflation expectations we might have to actually do something.” Not quite sure what “little appetite” has to do with optimal monetary policy. Perhaps it just means the FOMC members were not as hungry as the 15 million unemployed.

On the plus side, the actual adoption of a 2% inflation target in January 2012 might be viewed as a limited victory for Ben Bernanke, given that the implicit target was a bit lower. Keep in mind that a 2% PCE inflation rate implies a 2.4% CPI inflation rate. Very few people understand that the current 5 years TIPS spread of 2.16% means that markets expect the Fed to fall short of their PCE inflation target. And since unemployment is also elevated, there is an overwhelming case for easier money (if you accept the Fed’s announced policy goals–perhaps not if you favor a lower target.)

PS. Just to be clear, I’m not recommending negative IOR in the current situation, the Fed has far better options.

PPS. Note that the excerpts I quoted here aren’t necessarily Gagnon’s views. He occasionally recommended a more aggressive Fed stance. They are his view of what the Fed was thinking.

PPPS. My second link was to a recent Charles Evans speech which contained this gem:

Although all central banks face these strategy and communications issues, and they implement them somewhat differently, my view is that 90 percent of the communications challenge is met by expressing policy intentions clearly so that the public can understand the Federal Reserve’s goals and how the Fed is committed to achieving these goals in a timely fashion.A clear expression of policy intentions requires stating the Fed’s policy goals clearly and explicitly. These messages need to be repeated – over and over again. It is also necessary to clearly demonstrate our commitment to achieving these goals in a timely fashion with policy actions.

That’s what the Fed did not do in 2008-09.

Update: Mark Sadowski also has some comments on Gagnon’s post.

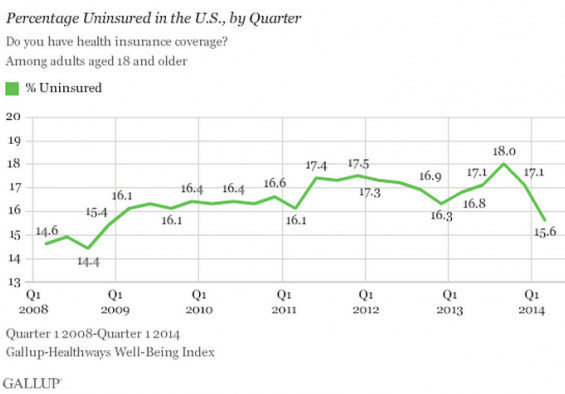

The share of the population that is uninsured has dropped sharply since last summer. On the other hand the share of Americans lacking health insurance has risen in the 5 and 1/4 years since Obama was elected, from 15.4% to 15.6%. On the other, other hand 3 or 4 million more Americans will have health insurance by 2014:3. On the other, other, other hand that’s less than 2 percent of adults. So the share lacking health insurance will still be almost as high as in the summer of 2008. Or am I missing something?

The share of the population that is uninsured has dropped sharply since last summer. On the other hand the share of Americans lacking health insurance has risen in the 5 and 1/4 years since Obama was elected, from 15.4% to 15.6%. On the other, other hand 3 or 4 million more Americans will have health insurance by 2014:3. On the other, other, other hand that’s less than 2 percent of adults. So the share lacking health insurance will still be almost as high as in the summer of 2008. Or am I missing something?