Yield curve bleg (plus LA real estate)

Back from a long vacation—it will take me a while to catch up on what I missed.

I notice that 5-year Treasuries are currently yielding 1.56% and 10-year yields are 2.04%. I was taught two theories of the yield curve:

1. Expectations hypothesis—> Long term yields are an average of expected future short term yields.

2. Term premium hypothesis—> Long term yields are an average of expected future S-T yields, plus a term premium.

The first hypothesis implies the 5-year, 5-year forward yield is expected to be 2.52%. The second predicts a somewhat lower expected yield. Are these two theories still the state of the art, or is it possible that investors expect higher than 2.52% yields in 2020?

If I am correct, then investors are predicting stunningly low 5-year yields in 2020. Why do I say 2.52% is stunningly low? Very young readers that are used to low rates might find that claim to be odd. But recall that the market cannot predict business cycles 5 years out in the future. Thus investor forecasts for yields at that date essentially represent estimates of what rates will look like once they have been “normalized.” (And by the way, I hate it when central bankers use that term; it does more harm than good. There is no such thing as “normal” in an ever-changing world.)

Theories:

1. Slightly lower expected inflation. Although the Fed’s been targeting inflation at about 2% since 1990; during 1990-2008 the market probably thought they’d err a bit on the high side, now they’re expected to err a bit on the low side.

2. Low real interest rates. The 5-year TIPS yield is 0.29% and the 10-year is 0.38%, implying a 5-year, 5-year forward real rate of 0.47%. That seems low to me—the Great Stagnation?

I’m looking for feedback from people who know more finance than I do (like David Beckworth.)

PS. Speaking of blegs, our family will probably end up in Southern California when we retire (although the way things are going I’ll never really “retire.”) We explored the entire area and sort of liked North Tustin in Orange County. But our favorite was Glendale in LA County. Anyone have any opinions on either place? Also Woodland Hills/Sherman Oaks. I’d like a house high enough up to have a view, but can’t afford west LA. I like LA itself, but am too old for the gritty urban lifestyle of more central locations. But I want to be close.

And I’ve always wanted a mansion from mansions for sale.

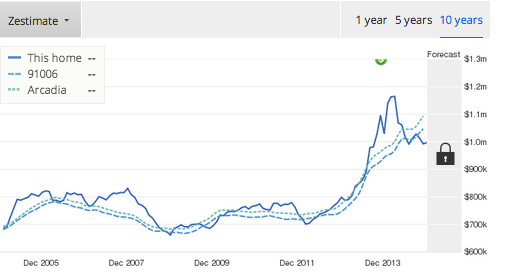

PPS. Did you know that Arcadia is considered the Chinese Beverly Hills? This suburb is far from the coast, in the hot, flat, smoggy San Gabriel valley. We ate lunch there. This ad shows a 2100 sq. foot ranch for $1,680,000. That’s the power of Chinese money. In 2005 and 2006 Bush was expected to enact immigration reform that would have led to many more Asian and Hispanic immigrants to southern California. You all know what happened when that reform failed. But the Chinese immigrants will come, it’s just a matter of time. In Arcadia house prices have already soared far above the 2006 “bubble” peaks:

Low rates as far as the eye can see and 1.4 billion Chinese who covet the SoCal lifestyle. Bubbles? You ain’t seen nuthin yet.

Low rates as far as the eye can see and 1.4 billion Chinese who covet the SoCal lifestyle. Bubbles? You ain’t seen nuthin yet.

Tags:

5. January 2015 at 16:56

Glendale is an interesting spot. It is heavily Armenian, Russian, and Persian.

Did you really explore the entire area? Did you make it as far south as San Clemente? There are so many unique neighborhoods in SoCal I just can’t believe it. I love North Tustin; it has more open space, larger lots, and lots of character. It’s easy to get to some of the better dining options in the area from there. The Talega/San Clemente area is similar, with Ocean and/or hillside views, but is further South: a bit worse for dining options, but beach access is phenomenal. You can find nice houses and great views up and down the entire 241 Toll Road Corridor.

I’ve lived in SoCal my entire life. If you have any more detailed questions, ask me.

5. January 2015 at 17:00

Do you think the yield curve will invert ahead of the next recession? At this point, it wouldn’t take much more than a 2% funds/ioer/tbill rate.

5. January 2015 at 17:02

The steepest of curve can also be constrained by the expected value of ‘riding the curve’ down. If the returns from riding the curve are too high, they will be arbitraged away (via compression of spread). If short term rates are low, that pressure puts some soft ‘cap’ on the long term rates which may not be refelctive of the forward-forward, albeit it is not a perfect mechanism.

5. January 2015 at 17:32

We are over in Woodland Hills. Nice affordable place for families.

The comment on Glendale from cthorm seems accurate.

Your comment on Arcadia also seems accurate!

I would be happy living in Woodland Hills, Sherman Oaks, Calabasas, Glendale, Pasadena, and Arcadia. Also La Crescenta, and Porter Ranch area for the views of the valley.

Also, great post – have been wondering about these yields!

5. January 2015 at 17:42

P.S. – I was thinking of the yields in terms of concrete steps. Knowing that the US economy was doing better, I thought that the rest of the world was buying up treasuries thus pushing down the yields. Otherwise, they should have gone up.

5. January 2015 at 18:00

Even Beverly Hills is becoming the Persian Jewish Beverly Hills.

On the yield curve, it may be that some portions of the maturity premium that have been dependably positive are now negligible or negative. So, the term premium hypothesis may not lead to a lower implied future interest rate, contra past experience and intuition.

Also, previous interest rate recovery periods have tended to see rates rising by 50 to 75 basis points per quarter. The current yield curve implies only about 25 bp per quarter. This is an oddity, in addition to the low level of the far forward rates. This could be due to some changed expectations, related to the Fed’s additional tactical tools or the current economy. But, it could be that expectations are not normally distributed. It could be that there is a decent portion of the market that expects us to never leave the ZLB or to only leave it momentarily. There could be a set that sees 2020 rates at 4%, and another set that sees them at ZLB. The effect is to proportionately pull down the entire yield curve, both the slope and the terminal level.

5. January 2015 at 18:21

I live in Arcadia and object to “This suburb is far from the coast, in the hot, flat, smoggy San Gabriel valley.”

Its 25 miles from the coast, not very smoggy and (as you probably saw if you visited last week) nestled in the far from flat foothills of the San Gabriel mountains.

5. January 2015 at 18:34

I think the yield curve will invert before the next recession, and that it will certainly do so by late 2017. Also, it is interesting that the trend of linearly falling nominal 10 year T-Bond rates began with Chair Greenspan. Who wants to bet on negative nominal 10 year T-Bond rates before 2030?

5. January 2015 at 18:36

Thanks Cthorm. We stopped at San Juan Capistrano, which is near San Clemente, but didn’t look around San Clemente. I worry that’s too far from LA, indeed even Tustin may be too far. I plan to see films in LA.

We went all the way south to San Diego, but didn’t explore the area in detail. Saw Irvine, Laguna Beach, Newport Beach, Tustin, Orange, Palos Verde, then up the beach towns, over the top to Topanga, Calabasas, Woodland Hills and then over to Sherman Oaks. Then Glendale, north side of LA, Pasadena, Arcadia.

My 15 year old daughter was detained on suspicion of terrorism in the LA port area. Fortunately she was released. Apparently they don’t like 15 year old girls taking pictures of oil refineries for their photography classes. How many industrial sites have been attacked by terrorists? Zero? And how many of those attacks were preceded by 15 year old girls taking photos? Double zero?

Tommy, Yields curves do seem to invert fairly often about 12 months before recessions, but that’s heavily influenced by the 1969-82 period. Not so good outside that period. I seem to recall inversions before the 3 more recent recessions, but too early to be a timely call. So I’d guess 50-50.

Michael, Not sure I fully understand that concept, but thanks for the info.

Jonathan, Thanks for the very useful info.

Kevin, Good points.

5. January 2015 at 18:51

“Apparently they don’t like 15 year old girls taking pictures of oil refineries for their photography classes.” Have you seen the site photographyisnotacrime.com? It publishes stories of people who have been arrested for taking photos or video in ways which are legal. You may want to let them know your story.

5. January 2015 at 18:52

@ssumner

The yield curve did not do a good job predicting recessions between 1933 and the early 1950s. After 1968, it always predicted recessions several months to nearly two years in advance.

http://research.stlouisfed.org/fred2/graph/?g=Wct

http://research.stlouisfed.org/fred2/graph/?g=DV6

Caveat: smoothed short-term rates are used for before the Great Depression due to short-term rates’ extreme volatility and general uselessness for predicting recessions until well after the fact during that period.

5. January 2015 at 19:07

Welcome back Kotter. Re SoCal, I lived there for years (Santa Monica), and, like anywhere else it’s a mosaic. Re Persia, heck even Westwood (UCLA) is “Persia-town”. In practice, your neighbors make a big difference no matter what background, if they are too close. Teenage kids are always a problem I find. Location x3. Surprised you have so much money to afford SoCal, good for you.

Re the blog post, another factor to consider is large organizations like insurance companies must buy long-term bonds by law or custom. So it distorts the ‘true’ market price. Almost no individuals buy bonds on their own, that should tell you something about the missing invisible hand in the bond market.

5. January 2015 at 19:10

@Gordon – don’t take photos while crossing the Rio Grande from the USA into Mexico, as I did. You will be arrested by the US Border Patrol (the laid back Mexicans don’t care), as I was not. Apparently there’s a law. Ditto UK’s Heathrow Airport (same result).

5. January 2015 at 19:25

Fascinating issue Scott- I’ll be interested to see what others say.

Because the yields you quote are ‘par yields’, I don’t think the math is as straightforward as what you use to get 2.52%.

I’m getting an “embedded” yield on the 5-year bond 5 years from now of about 2.7%. I don’t think this materially changes your argument.

I think it’s the new normal, largely a demographic phenomenon on a planet with populations aging and getting rich pretty quickly.

I also think “expectations plus term premium” is a good model here. And a reasonable estimate the 5-year term premium right now is the 5-year TIPS yield, which is 0.32%.

So, a 5-year bond 5 years from now around 2.4%? It’s not obvious to me that the over is a good bet here.

5. January 2015 at 21:12

I lived in Pasadena and Encino (adjacent to Sherman Oaks). I worked for some years in the Calabasas too. So I know all the areas you mention well. Many of similar housing prices but for different reasons. Consider what is valuable to you.

Pasadena/Arcadia/San Marino: these areas are heavily bought by Chinese nationals in recent years. Likely first pulled to the area by the very strong ethnic culture, with those three cities being more high end. Six of the ten largest Asian neighborhoods are together there. So good food. Traffic in Los Angeles is busy all the time, and often bad. Traffic from San Gabriel to anywhere west is awful.

You mention immigration. It is happening. Big factor is the EB-5 scam since 2011. You have to invest 1M in a business that creates 10 jobs. Except Los Angeles has unemployment over 150% of the national average and therefore is a targeted area. So the threshold is 500K. Furthermore, your investment can run through something called Regional Center. This is an investment vehicle. The pattern is that the regional center takes your 500K puts it into rental real-estate. Then the LLC runs an unrelated operating business which is capital light but labor intensive–think landscaping, maid services. This qualifies and you now get a green card.

People live in Sherman Oaks for access to the Westside. Okay 405 is horrible over the hill, but isn’t worse to drive half an hour first to reach the horrible jam over the hill? Indeed. Sherman oaks is about five degrees warmer than San Gabriel and ten degrees warmer than TO in the summer and five degrees colder in the winter. I still prefer it to the San Gabriel area, but then my wife works at UCLA. YMMV.

I prefer South Pas to Glendale, nice to live near the gold line, but then you want something up in the hills.

As you go West from Calabasas out toward Oxnard you get more moderate weather–basically coastal. Camarillo is nice. Geography–all those mountains make the different regions of Los Angeles very different. If you want los angeles, but want good weather without the prices of the west side/los angeles basin area, go west past Calabasas.

Feel free to email for more information.

5. January 2015 at 22:28

Rob, It seemed flat to me, but I’ll defer to your expertise since you live there.

Thanks Gordon.

E Harding, That’s true about the 1930s-50s.

Brian, You may be right, I did a simple averaging.

Thanks Anon, What is TO?

5. January 2015 at 22:38

Scott I actually live in Tustin. It’s a great place thats both close to the best beaches (Newport and Huntington) and not too far from LA.

And I definitely recommend North Orange County over the South which is mostly just boring track housing and really inconvenient to get around..

6. January 2015 at 01:17

Term premium is really a residual catch all term… It doesn’t really have much of a theoretical underpinning. It depends on temporal preferences for which we have little other observable data especially at longer tenors.

For a more technical point of view the calculation in a bit more complex as there is a convexity effect you need to take into account as the tenor goes further out. As a commenter above noted it’s not a massive difference but it roughly goes up following 0.5 * sigma^2 * t^2 where sigma is the annual yield volatility (which is about 90 basis points right now in 5y5y for example) This formula is an approximation, but I think it works up to 10yr or so… So not a huge effect but somewhat significant.

From a theoretical point of view, term premiums can be negative so that could be a possible explanation. We have definitely observed negative term premiums in some markets, most notably the very long end in UK (20yr+) where pension regulation created severe imbalances in the long end gilt market. It would either require some significant regulation changes or a big shift in preferences, but either are possible.

6. January 2015 at 01:49

Do we have stats on who the main buyers of 10y are at the moment?

6. January 2015 at 03:41

When treasuries have negative beta, term premium should be negative.

6. January 2015 at 04:24

Anon, If someone lives in Topanga can they take 27 to the coast, then the PCH to avoid the 405 over the hill? It took me 16 minutes to drive from the PCH to Topanga.

Thanks ChargerCarl.

Thanks Acarraro.

Britonomist, I don’t know.

Vaidas, OK, but the term premium has usually been positive throughout most of US history. Does that imply T-bonds have usually had a positive beta? And if so, is it likely that the beta would have recently changed for some reason?

6. January 2015 at 05:32

Scott,

Beta is time-changing.

Take a look at the chart on the page 3:

https://media.pimco.com/Documents/PIMCO_Quantitative_Research_Stock_Bond_Correlation_Oct2013.pdf

“is it likely that the beta would have recently changed for some reason?”

Yes – higher credibility of inflation targeting and higher risk of negative AD shocks has lowered the beta.

6. January 2015 at 06:03

@E Harding and Scott,

I’ve been doing some rethinking of the whole monetary policy/ business cycle thing.

What do you think of the following idea? We have the historical causality backwards. Tight monetary policy (increasing rates in the non-ZLB case, flattening or inverting the yield curve) helps contribute to recessions.

Krugman the other day made passing comment to historical examples of the Fed “taking the punch bowl away too soon.”

@Kevin Erdmann, good comment. Given that long-term rates are so low, it’s not surprising that the market is pricing a slow or tentative pace of Fed hikes. I mean, just in the past year, the curve has flattened a lot. It seems to that communication between the Fed and the markets is pretty good right now.

The continued decline in both inflation expectations(under 1.9% for 30 years now) and real yields on Treasuries suggests that things are a bit tighter than they should be. I’d go ahead and signal renewed purchases of $100 billion per month until 30-year breakevens are back to 2%, but that’s just me.

Part of the problem of course is the ECB. The whole developed world needs more monetary accommodation.

Does anyone see the Fed funds rate going above 2% in this environment?

6. January 2015 at 06:05

Of course, current treasury yields (entry yield versus past returns) will predict your nominal return (emphasis on return) on the bond if held to maturity. But IMO that will not necessarily predict the rate X years in the future. In January of 2000 the 10 year yielded around 6.5% and 10 years later yields were 2.51%. IMO it is often a function of current short rates, and buyers price the bond now based on current credit rates. A mutual fund or pension that must buy treasuries, must buy them now – at current rates. In 1981 did investors expect rates to be 13% 10 years in the future? They were wrong if they did.

Just to reiterate I am differentiating between what the return will be and what future rates will be. Also return is also a function of the divergence between the entry yield and the overall return because future bond earnings will be reinvested at different rates as time passes – assuming you keep recycling into those bonds.

This has been my experience working with bond managers investment committees.

Does this mean expectations play no role? No, it can at times where something obvious changes in the credit markets. But i think entry yield determines maybe 90%, and expectations say 10% over long periods.

I have only thought this through in terms of nominal yields, and not real yields.

6. January 2015 at 06:11

Also I ignored the fact that the Fed can set current bond rates regardless of what future rates might be. If the Fed wants the 10 year yield to be 2.5% they can make that happen.

6. January 2015 at 06:28

I wonder if there is an undue amount of faith in the Fed’s forward rate guidance. After all, while the guidance has changed in language it has been the same in practice — mid-2015. There is also a widespread belief that the Fed will move gradually. The stability of this view despite a fairly notable improvement in the labor market makes it reasonable to call into question the Fed’s “data-dependence.” If the Fed is truly dependent on data, there is considerably more uncertainty in the outlook for short-term interest rates than currently priced into markets. I would think the term premium on Treasuries at the long end should be somewhat higher than they are at the moment.

6. January 2015 at 06:48

http://krugman.blogs.nytimes.com/2015/01/05/thinking-about-international-bond-yields/?module=BlogPost-ReadMore&version=Blog%20Main&action=Click&contentCollection=Opinion&pgtype=Blogs®ion=Body#more-37945

Am I missing something here, or does Krugman not understand Fisher? At the very least he’s making it far more complicated than it really is for his readers.

6. January 2015 at 07:01

As I mentioned above, the quoted yield on a coupon-paying bond is a ‘par yield’- an internal rate of return over the life of the bond, an amalgam of rates over that period.

The beautiful thing about Treasuries is they provide robust data on future ‘spot’ or ‘zero coupon’ yields out to 30 years via the STRIPs program:

http://online.wsj.com/mdc/public/page/2_3020-tstrips.html

‘Spot yields’ are more elemental than ‘par yields’, but they are basically isormorphs, although translating from par to spot yields is tricky, which is one reason STRIPs are so useful.

A more granular isomorph is the ‘forward yield’, which is basically the incremental yield between time x and time x + 1, and can easily be derived from the spot yield.

I’m not sure what people mean when they talk about declining term premia. Clearly, forward rates can decline as you move along the curve, but I’m hard-pressed to see how they can be negative, and it’s fair to expect this curve to be smooth, because, at any maturity, a zero coupon bond faces close substitutes, namely it’s adjacent neighbors.

If forward rates decline a lot, the ‘spot curve’ can invert a bit (it sorta does right now in 2043), but not so much that a zero coupon bond at time x pays me $100 but at time x+1 pays $99.

The ‘par curve’ (what you get from plotting these coupon-paying bond numbers: http://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield) is even less prone still to inverting.

So, declining term premia yes, but always an incremental reward for an incremental extension of the horizon.

Under the ‘expectations’ theory, each forward rate is our expectation of the 6-month Fed rate at some point in the future. The reality is that expectations get close to 100% weight at short horizons, rapidly declining to zero weight a few years out (Can anyone meaningfully estimate the 2022 Fed funds rate today?)

tl;dr

6. January 2015 at 07:07

Brian D – I like your last paragraph – well said.

6. January 2015 at 07:20

Vaidas, That makes sense. Inflation is well anchored, but on the other hand I’m not sure the risk of AD shocks have increased. It may have, but I don’t seem much evidence (for instance stocks are doing really well.)

Brain, Those remarks seems plausible to me.

Matt, Aren’t you confusing future rates with expected future rates? Forecasts are often wrong, but still useful.

Neil, Yes, but the Fed doesn’t provide interest rate guidance more than 5 years out, other than perhaps very vague forecasts. Fed policy only impacts expected rates that far ahead via the Fisher effect.

Brian, On your second comment, I see the market as forecasting the Wicksellian equilibrium rate 5 years out, as the most reasonable assumption is that rates will be set at a level likely to come close to the Fed’s 2% inflation target. Actually future policy in 2020 may be nutty, but the market would have no ability to forecast that today–even the direction of the nuttiness.

6. January 2015 at 07:31

Scott, I was basically saying expectations of future rates are often wrong, except for possibly the shorter term as Brian states above. At the same time, I am not saying expectations never play a role in determining yields or how a financier may construct the duration of a portfolio of bonds. But the current Fed funds rate will probably be the primary determinant, and the more times the Fed passes on raising it, then the market will probably expect it to stay low with each passing inaction.

6. January 2015 at 07:45

Scott, why is the dollar so strong? I know you have more important activities, but I would love to see a post if you have a chance. Thanks!

6. January 2015 at 09:00

Scott/Vaidas

The risk of AD shocks may not have gone up, judging by stocks. But the low NGDP growth and low inflation mean that if there were a shock the impact could be great if not well managed by the central bank, as so little room for error before NGDP goes negative and sticky wages does the rest. Just like in 2008/9. An unintended consequence of the “success” of IT.

6. January 2015 at 09:17

Scott,

You should check out Whittier if you haven’t already. Knew a lady who lived in a home in the foothills there, beautiful area.

6. January 2015 at 09:30

@Adam Platt:

It looks like he’s approaching the issue from the perspective of interest rate parity and exchange rates.

6. January 2015 at 09:32

And in some ways the short end of the US yield curve is already inverted, with some measures of 12m rates higher than expectations of 24m rates.

The bond market worries more about rising short rates due to the recovery curtailing the recovery.

The equity market often takes a more short term view and just looks at the recovery and the promise of the Fed to be patient.

6. January 2015 at 09:51

Matt, OK, but the fact that expectations are often wrong has no bearing on whether the yield spread measures expectations. That’s what I am interested in—does the yield spread tell us something about expectations of future short term rates? If it does, it is quite interesting that expectations of future rates are currently so low, even if actual future rates turn out to be very different.

I agree that longer rates are an average of expected future fed funds rate targets, plus a term premium, but the key issue is the third factor that determines both future fed funds rates and futures longer term rates. In my view that third factor is future NGDP growth–which seems likely to be quite low.

Don’t think of causality as going from fed funds rates to longer rates, but rather from the third factor to both.

Todd, I suppose because the US economy is growing much faster than Europe and Japan, but that’s just a guess.

James, Yes, that’s possible. But then why does the yield curve slope up between 12 and 24 months?

SG, Thanks for the tip. How about Anaheim Hills? We didn’t get that far.

6. January 2015 at 10:14

I live in Woodland Hills and I love it (I have only been here about 5 months). You are pretty close to LAX (23 miles) and very close to Malibu (I can ride my bike to the beach there in about half an hour). Also Woodland Hills and surrounding neighborhoods are still relatively affordable.

6. January 2015 at 11:23

I don’t know LA as well, but I know San Diego very well. I much prefer San Diego to LA. If you are not set on LA I suggest you look in LaJolla, Pacific Beach and Mission Bay if you want something near the water or you should look at Point Loma, Hillside or Old Town if you’d like a home with a view.

6. January 2015 at 12:05

The curve doesn’t want to invert … all is well with the economy. But the guidance is what it is. We will shortly be raising rates even though inflation is below target bc wage growth will be too high and unemployment too low.

No one quite believes that we will decide to recess for absolutely no reason, but stagnate? It seems like that is the explicit plan.

6. January 2015 at 12:20

Yield curve forwards are like old science fiction predictions about the future. It says a lot more about thoughts at the time of prediction than about the time they are predicting about. It appears that forward rates are generally derivatives of current spot rates rather than the other way around. It would be nice if the forward rates were the primary things that set values, with fixed income securities being priced off those market-derived forward rates (which is how basic financial math is taught), but it’s actually the other way around. So a 5yr 5yr forward rate is a derivative priced using non-arbitrage conditions with the 5 yr and 10 yr rates as given.

So how are 5 yr and 10 year rates determined? This leads to a version of the old “preferred habitat” theory, where there is a market for 5 years, a market for 7 years, a market for 10 years, etc, and supply and demand of each market determine the price of each, without necessarily implying anything special about the relationship between them (except that if there is a large enough intertemporal mispricing someone with enough patience should be able to arbitrage it away). Of course, there is some interaction between them (someone looking for a 4 year duration could get it with a 5 year bullet or with a 3yr/7yr barbell and deal with differences in convexity, etc. in some other way) so prices, and therefore the yield curve, can’t get too out of whack. But trying to predict a recession 8 years out is too much for even the most sophisticated financial market.

This seems to go against EMH but no more than the fact that option prices are not at all an expectation of where a particular stock will be in the future.

6. January 2015 at 12:26

“Rob, It seemed flat to me, but I’ll defer to your expertise since you live there”

Many parts of Arcadia are flat – but its only the foothills region that is known as “the Chinese Beverly Hills” and that is far from flat.

BTW: What restaurant did you eat at here ? I would have dropped by and bought you a beer if I had known you were in town.

6. January 2015 at 12:45

@James in London

Judging from VIX at 20, there is a decent amount of negative AD shock risk.

6. January 2015 at 13:29

Inflation expectations have been plummeting. Right now the 1yr core PCE priced by the TIPS market (you have to hack it a little since TIPS pay CPI) is priced at 10bps. The 4yr is priced at 70bps per year.

Longer dated, the 5y5y inflation rate is around 1.82% (by the Fed’s measure). The lowest this got to in 2008 was 1.97%

If this is your inflation outlook, 30yr UST at 2.50% don’t look that bad.

6. January 2015 at 13:46

Scott: For films, you may wish to locate within hailing distance of USC or UCLA for their film schools and related showings of films, or also near the Los Angeles County Museum of Art, which regularly shows films in a large theater. I would recommend renting for a few years, first possibly in Park LaBrea, which is within walking distance of LACMA.

On interest rates: how about old-fashioned supply and demand? Bain & Co. and other groups have pointed out enormous “superabundances” of capital. Of course, there are non-private sector actors creating pools of capital today, such as sovereign wealth funds, also many public pension programs must automatically increase assets. For the first time in history, the globe has large populations of people with enough income that they can save. This may be the new normal, too much capital for the investment arena. So, the new normal is lower interest rates.

6. January 2015 at 13:54

Thoughts.

Term premium is non-existent now. I say thats Portfolio effect plus money pouring in from everywhere else that hasn’t recovered.

Equity risks premium is where it gets interesting. At 2.5% long term rate the S and P multple of 16-18 range seems stupid cheap.

6. January 2015 at 14:28

I have a slightly higher value for the 5 year 5 year forward.

Nonetheless, it doesn’t change the point…

While the shape of the yield curve should, at least in theory, be the market’s expectation of the future interest rate environment, it is a horrible predictor of future rates.

There are a few inherent biases. Since bills and notes less than 1 year to maturity are considered “money markets” or cash equivalents, they get favorable regulatory and accounting treatment. The yield-curve is always too flat 0-1 year.

And as the Fed becomes increasingly difficult to predict beyond 1 year. So, the 5 year rate may have embedded into it the markets best guess for rates in years 2-5, but it is hardly a certainty.

Maybe the 5-year rate is just a reflection of the supply and demand for funds at that term compared the cost / compensation for nearby substitutes.

Now is 2.6 an unrealistic 5 year rate for 2020? Perhaps not. What are the chances that we can go another 5 years without a recession? In which case what is the past of future Fed funds? Fed hikes rates in 2015 and cuts them in 2017? Maybe, maybe not. Not entirely out of the question, though.

6. January 2015 at 15:05

iane, Thanks for that helpful info, but only in LA would 23 miles be called “close.” 🙂

Seriously, if the 405 is clogged can you get to the westside via the PCH, or is that also clogged?

Anthony, We did look at San Diego, and it’s nice. But I prefer LA–it has more to do.

Nick, That’s plausible.

Njnnja, Yes, I agree that recessions cannot be predicted 8 years out, which is why the rates surprised me.

Rob, Only my wife would remember the name, it was a big Chinese restaurant. Maybe we can have a beer when I move out there.

JD, Good point.

Ben, I agree on the new normal for rates, and lots of people suggest we rent first. But we don’t want to have to move twice.

Sean, It’s no surprise that stocks are so high, given the combination of low rates and record profits.

Doug, I agree, but I’m much more interested in what the market thinks rates will be in 5 years, than what they will actually be.

6. January 2015 at 15:19

Scott,

Any thoughts on Alan Landon?? Do u think he was a member of the Choom Gang << This was the nominee we waited how long for ??

6. January 2015 at 15:47

Brian,

Do you know of a free source for historical data on spot or forward rates?

It is interesting how forward rates seem to be relatively unbiased, in some ways, when the yield curve is normal. But, there is some set of forces that prevents the yield curve from inverting. Flat yield curves seem to be a decent predictor of recessions and falling rates, but when that happens, the inability of the yield curve to invert significantly seems to create a bias. It doesn’t seem like this is something that one could expect to reliably profit from, yet it seems to be the case. It’s an interesting issue.

There seem to be two speculative opportunities there. First, with some risk, there is the tendency when the yield curve inverts slightly for short term rates to subsequently decline. Second, with very little risk, the apparent “ZLB” on yield curve slope means that a position for a steepening curve should be expected to be profitable with little risk. (When the curve is flat, take a neutral position that gains with rising long term rates and falls with rising short term rates.)

6. January 2015 at 15:59

Traffic during your News Year visit is not representative. Topanga Canyon & PCH gets pretty dense during normal days. You can check traffic flow at this website. PCH & Topanga are both represented on that map.

There is only one fast way to get in and out of the Westside: timing.

I had a friend live in the hills of Glendale, the housing stock seemed very nice. You should visit in July, though, it can get hot. The suggestion above that you rent for a few years is very good. It’ll be easier to change your mind if it comes to that.

6. January 2015 at 19:18

Scott, TO is shorthand for Thousand Oaks a town west of Calabasas…

I haven’t used Topanga too much to reach the coast. I usually take Las Virgenes (Malibu Canyon) which reaches the PCH @ Pepperdine. But then I am not trying to reach the West Side–still this is 10 minutes faster than the 27 from my house. Topanga is slow because of the curves. There are easier alternatives to the 405–there are lots of little roads in the hills to bypass the traffic. There was this amusing pseudo-news story:

http://www.dailynews.com/general-news/20141214/waze-app-directing-la-drivers-to-once-hidden-streets-to-avoid-405-freeway-traffic

6. January 2015 at 22:32

1- There has been a lot of talk about the “relative value” in US Treasuries vs. European bonds; Krugman isn’t the only one.

2- Several well known bond managers have postulated that the yield curve will flatten at unimaginably low levels, e.g. 1.5-2.0%

3- One well known bond manager believes that the neutral real rate is negative.

4- Draghi is rumored to be failing to obtain consensus for QE in Europe.

5- There is a major macro shock underway in the oil market. A $3.0 trillion global market just became a $1.3 trillion global market. Most US economists are arguing this is good for the consumer, but they are missing a key point: people who are experiencing the $1.7 trillion in cuts tend to stop spending immediately, while people receiving $1.7 trillion in benefits tend to be skeptical at first (permanent income and all that). So the oil shock is likely a large global negative for now.

6- USD is skyrocketing, where she stops no one knows.

Personally, I think the Euro will soon bounce, as the Eurozone is running a very large (and growing) trade surplus (thanks to oil), and the ECB appears to be accepting of a 0% inflation outcome, vs about 1.5% in the US.

7. January 2015 at 01:32

The inverted short end of the US rate curve is hard to show as the money markets are complex. Sure US government paper shows an upward curve. But US$1yr Libor has been consistently rising all of 2014 hitting highs of 70bps in the last two weeks of December, before coming back to around 60bps today. It was above the level of US$2yr government paper for a few weeks but is now about the same. This crossover trend is presaging rate rises as banks prepare their books for coming Fed action.

7. January 2015 at 01:49

In unrelated news, the irony is particularly sweet

http://www.nytimes.com/2015/01/06/us/health-care-fixes-backed-by-harvards-experts-now-roil-its-faculty.html

7. January 2015 at 02:44

Scott,

“My 15 year old daughter was detained on suspicion of terrorism in the LA port area.”

Ah, sweet memories… LA, home of paranoia at every level. Someone once called the cops on me there (Playa del Rey to be precise) because I was taking pictures of the evening sky. From the public street, no less. And that was in the 90s before 9/11 and all that. You did see the movie “Short Cuts”, did you? It gets the basic feeling of LA right.

7. January 2015 at 09:56

Scott –

Wow, you did see a lot. I assume you want to see films at independent theaters in the Hollywood area, right? In typical traffic it will take you anywhere from 15-30 minutes coming from Glendale. Coming from Orange County it usually takes an hour…no more than an hour and 15 minutes coming from San Clemente (OC traffic is a non-issue). Metrolink is a pretty good way to go if you’re going somewhere in Downtown LA, but that’s all I ever use it for.

7. January 2015 at 10:39

@Kevin,

Sorry, other than the wsj site I shared upthread, I’m not aware of a source for STRIPs data (from which forward rates can be calculated). I’ve been collecting the data myself from the WSJ site more or less since early 2010.

TIPs data is of pretty recent vintage too…only back to 2003 for up to 10 years, 2004 for 20 years, and 2010 for 30 years.

7. January 2015 at 11:29

bklyn, I’ll do a post.

Thanks Bababooey, That website will be super useful.

Anon, Thanks, and I saw that story too. I need to avoid that road. They need a tunnel through that hill.

Steve, All good points, and isn’t that massive surplus a sign that the fear that trade deficits cost jobs is silly?

Thanks James.

Daniel, That was funny.

Mbka, I saw it, but Altman movies never stick in my mind.

cthorm, That’s the only negative of OC for me, it take so long to get to LA.

BTW, anyone know why gas prices are all over the map in the LA area? I saw everything from 2.39 to 3.29. Other states don’t have so much diversity.

7. January 2015 at 12:10

Low yields in the US may also be a response to an expected long-term appreciation of the US dollar (or over-extrapolation of the recent rise of the dollar into the future). What will become of the euro over the next five years? I don’t know, but there’s certainly a lot a cause for worry. Worry-wart me would rather park my capital into USD the EUR. Perhaps the People’s Bank of China feels the same way.

There is a risk that secular stagnation, or decline, in the US may result in the Treasury/Fed to inflate away its debt obligations. You would think that this would lead to an upward-sloping yield curve. But if the rest of the world is facing much worse inflation risk, US Treasuries are still the place to park financial wealth. If US future US inflation is at 6%, but the rest of the world is at 10%, the dollar should trend up at about 4%. The stronger dollar offsets capital losses of rising Treasury rates for foreign investors, making US Treasuries attractive to foreign investors.

The point I’m trying to convey is that the expectations hypothesis gets a lot harder to interpret in a open economy than a closed economy. There are more moving parts that we need to account for.

7. January 2015 at 12:45

Hi Scott,

Longtime resident of Glendale here (23 years I guess…born here!).

So there’s a few things you should know about Glendale.

1) Different parts of Glendale have a different Vibe.

If you live anywhere near downtown (IE-south or Central Glendale), expect a lot of energy/life – but also expect to encounter a lot of traffic/noise.

West Glendale (the part closer to Burbank and where I live) is a lot more calmer, yet it isn’t too “dead”.

North Glendale (the part closer to the Community College) is much more laid back/quiet.

And of course, the higher you get into the mountains, the less noise/traffic/etc you’ll encounter.

2) Know that Glendale is the 3rd biggest city (in terms of population, 6th in terms of area) in LA county – so this is definitely NOT a “small city”.

3) I like where Glendale is geographically situated. It’s between the two “Valleys” (on the west being the San Fernando Valley AKA “The Valley”, and on the east being the San Gabriel Valley.

And just south of Glendale is Silver Lake area and Downtown.

Hollywood is 15-20 mins away as well – depending on the traffic.

So in terms of quick access to the all the places in LA county – its tough to top Glendale.

Obviously the beach is a little further away – give/take 45 mins – but unless you’re a HUGE beach lover, you only go a few times a year anyway.

4) There is a big Armenian population here. I’m not saying this is a good or bad thing – every heavily concentrated ethnic group has its +s & -s…..but just know that if you plan on moving here.

5) In terms of climate, if you like the sun, Glendale is for you (as I’m typing this, it’s partially sunny 72F). It does tend to get a little hot during the summer, but NOTHING like the “Valley” where it could get to 115 easy (Glendale usually tops out at 100ish).

6) Glendale is a super safe city (in terms of crime) – so if you’re looking for that, this is the city for you. However, Glendale has one of the higher automobile accident rates in the country….so there’s that unfortunately.

Can’t really think of much else to say. If you have more specific questions – just reply here or email me jerryk09 at Gmail dot com. I’d be happy to answer.

7. January 2015 at 16:36

@Scott

First, PCH should never be relied on for a commute. If you want to beat 405 traffic, the right move is to figure out the best surface streets that run parallel to it. PCH is always getting closed for construction, accidents, etc.

Second, great observation. A lot of cities have their own gas taxes (Newport Beach has one that is just as high as the state gas tax), moreover each gas station tends to set their prices relative to their closest competitors. Gas prices tend to be more competitive when you’re close to the freeway; in more remote or ritzier areas, prices are significantly higher (the gas station is counting on low price elasticity of demand from their customers). The gas stations closest to gated communities are the worst.

A gas station ~2 miles from my house, and about 2 miles from a large gated community, was selling Diesel for $3.09 today. I filled up at another station that’s ~2 miles away and right next to the freeway for $2.53.

8. January 2015 at 07:55

Greg, You said:

“Low yields in the US may also be a response to an expected long-term appreciation of the US dollar”

Isn’t it just the opposite? Yields are higher in the US, as the dollar is expected to depreciate against the euro and yen.

Thanks Jerry, That info is very helpful, especially the temperature difference, which doesn’t show up in the averages on the internet. My wife would not like 115.

Cthorm, Thanks for the info. BTW, I would not have to commute in “rush hour,” although I know the freeways can be somewhat busy other times as well.

8. January 2015 at 13:08

Yeah, you are right, Scott. The 10-year Treasury yield is 70 to 90 basis points higher in the US than in Germany and Japan. Uncovered interest rate parity then asserts that the market expects the USD to depreciate relative to the EUR and JPY. But UIRP is rejected by empirical studies in short term horizons (a year or less), but somewhat supported for horizons of 5 to 10 years (Chinn and Meredith, 2004, “Monetary Policy and Long-Horizon Uncovered Interest Rate Parity,” IMF Staff Papers). For short horizons the regression coefficients on the interest rate differentials go the opposite direction: high interest rate countries tend to appreciating currencies, counter to UIRP predictions. This exchange rate behavior is what makes the carry trade an investment strategy with an attractive return-to-risk ratio””but, alas, with a risk of sharp reversal. But this makes absolute intuitive economic sense, because….um….well… er…. Squirrel!

Where were we? US 10-year Treasury yields are under 2%. It’s higher than in Germany and Japan (two countries with lousy growth prospects), but really low for a country with a decent growth prospect (http://www.imf.org/external/pubs/ft/survey/so/2014/NEW100714A.htm). I contend that US long-term yields would be higher if not for the dollar being viewed as a hedge/safe-haven currency.

Hey! Speaking of Menzie Chinn…Chinn has a related post at http://econbrowser.com/archives/2015/01/an-economic-warning. The post is about yields and yield spreads predicting recessions and economic growth. He wonders if the zero lower bound constraint will mess up the predictive abilities of the yield spreads. He writes, “If the expectations hypothesis of the term structure is not the only determinant of long term rates, and some version of the preferred habitat model obtains, then it could be that long term rates are depressed due to excess savings from abroad. That is a theme that we’ve been discussing for a long time, but now it’s exacerbated by the flight to safety.”

Yikes! What a rambling post! Sorry about that.

9. January 2015 at 10:21

Greg, You may be right about the dollar being a safe haven, but of course eurozone and Japanese yields are also low, so it seems to be a global issue. On the UIRP, I am most interested in the expected move in rates, not the actual move. The expected move gives you a read on whether the market expects a “Great Stagnation.”

9. January 2015 at 13:45

I think the low expected future rates view is correct — but I don’t think the 5-year rate is adding any information here as you can get almost the same information from the 10-year rate.

http://informationtransfereconomics.blogspot.com/2015/01/caught-between-3-month-and-10-year.html

12. January 2015 at 10:55

“Isn’t it just the opposite? Yields are higher in the US, as the dollar is expected to depreciate against the euro and yen.”

Bingo! Yet 99.99% of what I see, are economists/journalists who say that raising yields strengthens a currency.

As for forward price. Market participants have no great crystal ball. Market forward price is simply extrapolated as a series of spreads added to spot price. The market even tells you its own opinion of its lack of confidence by having a tradeable volatility. That is what most people miss, layering the standard deviations on forward price.

I prefer to look at forward price as being BASED on current spot price. Basically all the market is telling you is what it feels comfortable as a series of spreads as it builds out in time. And that is with the understanding that whoever makes the volatility assumption knows that the volatility assumption is incorrect as well.

Now what markets do, are build from familiarity. Forward prices tend to mean revert ‘smoothly’ to historical, this is why price moves are always more dramatic in the front end of the curve, and why curves invert. Of course holding spot rates near 0% for 6 years ‘significantly’ forces down the actual mean, and peoples expectations of the future mean, and therefore, in the instance you are discussing, long term yields.

One never knows… but I find it hard to believe the curve would invert at such a low level. I would think it would shift first before flipping. But what fun would a market be if it did what you thought it was supposed to.

14. January 2015 at 09:48

Here’s a Woodland Hills house that (1) was for sale twice in the past 10 years; and (2) represents one of your favorite ideas, that all of the good musical styles were “used up” in the 1960’s.

http://www.beefheart.com/woodland-hills-house/