The CPI and housing prices

Nine years ago I did a post discussing how the CPI was distorted by mis-measurement of housing prices:

Good News! There was no housing crash.

At least according to the US government.

The BLS claims that housing prices are up 2.1% in the last 12 months. Why does this matter? For all sorts or reasons, but first let’s try to figure out what really happened. According to the BLS, housing makes up nearly 40% of the core basket of goods and services.

Category weight inflation

Housing 39 % 2.1%

Other 61% 1.4%

Overall 100% 1.7%

Suppose that instead of rising 2.1%, housing costs have actually fallen 2.1% over the past 12 months? In that case the core rate would be zero. Which number seems more likely? For much of the past year house prices have been falling at more than 2% a month.

Bloomberg reports a new academic study that reached similar conclusions:

New research shows that the CPI is slow to reflect changes in prices—and, equally important, understates the degree to which prices move up and down. The problem stems from the way the government calculates the price of shelter, a category that makes up one-third of the index.

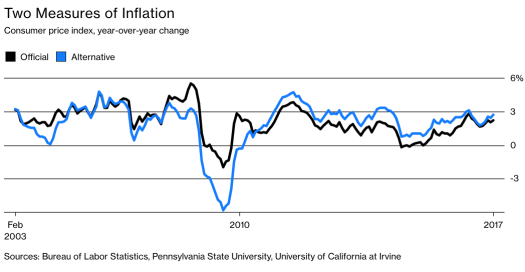

Three economists have developed an alternative measure that captures price moves as soon as they occur and shows the full range of changes. If it had existed in 2008-09, when the economy was in the deepest recession since the Great Depression, it would have shown far deeper deflation than the Bureau of Labor Statistics registered. The official CPI, they write in a new paper, was overstating inflation by 1.7 percentage points to 4.2 percentage points annually during the Great Recession. More recently, they write, the problem has been the opposite: Annual readings have understated inflation by 0.3 to 0.9 percentage points. Those are huge disparities given that forecasters make a big deal of fluctuations of just one or two tenths of a percentage point in the official rate.

Here’s a graph that shows how big a difference it makes:

That correction is actually a bit larger than even I would have expected. But even if their method is not perfect, I have little doubt that the basic point is correct; the CPI is less volatile than an alternative price index that reflects actual market prices in the economy.

The problem they point to is similar to the one I mentioned back in 2009. The BLS uses rent payments on existing contracts that do not reflect the market rent on apartments currently on the market. During a slump, it’s not unusual for a new tenant to get one or two months free rent:

The economists behind it are Brent Ambrose and Jiro Yoshida of Pennsylvania State University’s Smeal College of Business and Edward Coulson of the Merage School of Business at the University of California at Irvine. Their latest version is described in an April 20 academic paper titled “Housing Rents and Inflation Rates.” The key difference from the CPI is that their measure factors in only new rental leases, including those of new tenants and old ones who recently renewed. The BLS, in contrast, also includes rent paid by tenants whose leases weren’t up for renewal in the latest month, which means it’s slower to pick up on changes in market conditions.

Kudos to Ambrose, Yoshida and Coulson for putting a spotlight on a very important flaw in the CPI, which many professional economists use too uncritically.

Tags:

11. May 2018 at 12:26

I would distinguish between rent and owner’s equivalent rent.

The BLS uses both of these to compute shelter inflation. It makes sense to me that rent would be based on what people are actually paying. This includes all contracts. Maybe the series that has just newly turning over properties is relevant here for forecasting where future rents will go, but it’s not the rent cost itself.

However, I would agree that it makes more sense to use more recent information with the owner’s equivalent rent. If home prices fall -10%, then this should affect owner’s equivalent rent, even if normal rents are slower to change.

11. May 2018 at 16:55

John, It depends on the purpose of the CPI. If you want to measure actual prices, then rent paid on older contracts may not be relevant. If the Fed is using the CPI to understand inflation trends in the economy, then you presumably want to look at actual market data.

Take an extreme case; someone in 1985 making the final payment on a mortgage taken out in 1955. That final payment has no bearing on the 1985 price of housing, even though it’s is an actual payment made by a homeowner to a bank.

11. May 2018 at 17:27

Kevin Erdmann at The Idiosyncratic Whisk has been doing excellent work on inflation and housing for many a year.

Erdmann monthly publishes a CPI core minus housing figure which lately shows inflation near 1% rather than 2%.

BTW the US Federal Reserve says that new housing production on the West Coast has been hampered only by labor shortages.

http://ngdp-advisers.com/2018/05/10/reserve-bank-australia-understands-housing-fed-dangerously-clueless/

12. May 2018 at 13:31

But if they changed it, y/y CPI + RGDP would no longer equal NGDP.

Just imagine the countless textbooks and blog posts that would need to be rewritten!

12. May 2018 at 18:00

Speaking of housing and prices and labor….thought of the day:

The average house price in Seattle today is $820k. The town Boeing built. A middle-class stronghold through the 1980s.

Today, the Fed Beige Books say (repeatedly, in every Beige Book) there are “labor shortages” along the West Coast.

Gee, with a house at $820k, why would there be labor shortages in Seattle?

So, the solution, say orthodox-conventional macroeconomists is…more immigration!

So, they won’t be building more housing in Seattle, but we can import more people to the region, who happen to be desperate for work. Cheaper labor, in other words. Won’t immigration exacerbate housing shortages? Not a topic.

So the Seattle middle-class sees itself priced out of housing markets, and then underpriced out of labor markets.

The glories of globalism manifest themselves thusly.

But Seattle-ites are Neanderthal-Luddites-Nativists to not embrace the new world order.

Yes, I have described the situation without nuances.

Yes, the real solution is to end to property zoning, and not overt nationalism (although what may be “necessary minimum social fabric” to some is “nationalism” to others).

But I do not see hue and cry for an end to property zoning, not from the macroeconomics establishment. They are jibber-jabbering about labor shortages…just read the Fed Beige Books if you think I overstate matters….

https://www.seattletimes.com/business/real-estate/home-prices-have-risen-fastest-in-south-seattle-as-citywide-median-nears-820000/

https://www.federalreserve.gov/monetarypolicy/beigebook201804.htm

12. May 2018 at 18:35

Randomize, CPI plus RGDP never did equal NGDP.

13. May 2018 at 05:16

Interesting stuff. What does it means for the future if housing costs are rising faster than income or other inflation metrics?

13. May 2018 at 06:08

This looks like a very important contribution.

One of the big “puzzles” during the financial crisis was why inflation really didn’t fall too much despite the fact that we had one of the largest negative AD shocks in decades. This breakdown of the “divine coincidence”, a feature of many neo-keynesian models, was a big puzzle. Well, now it looks like inflation did actually fall by much more than we thought, it’s just that the measurement errors associated with the CPI are even larger than we assumed.

One more reason to abandon inflation targets altogether and to target NGDP.

13. May 2018 at 07:35

Benny, If we don’t build enough houses, it will impact living standards.

Julius. That’s right.

13. May 2018 at 07:53

Scott,

That’s true but how will that affect the common macro metrics like CPI, purchasing power, unemployment, etc?

13. May 2018 at 18:35

Scott I think you make a good distinction. When you measure actual contracts, you are measuring real prices. Using market transaction data is relevant for telling you where inflation will be in the future. So I agree that it is relevant for the monetary authority to understand both of those things. Nevertheless, the primary purpose of the CPI is to measure prices. So maybe I’m just caught up in the definitions of things. I see no issue with them releasing a separate series that calculates shelter inflation with market prices.

14. May 2018 at 08:09

Benny, I don’t see much impact on the CPI (monetary offset) or unemployment. Mostly it will reduce NGDP growth and real wages.

John. It depends how you define prices. The BLS does not consider monthly payments in a 60 month auto loan contract to be prices. So why consider monthly payments in a rental agreement to be prices?

14. May 2018 at 13:30

I should have said “growth” at the end of that sentence to clarify.