The actual problem

The global media seems endlessly fascinated by the question of whether monetary policy in the US is too easy or too tight, even as the Fed comes amazingly close to hitting its targets. I suppose this interest can be partly justified by the size and influence of the US, which David Beckworth calls a “monetary superpower”. Nonetheless, there should be more discussion of the fact that monetary policy in the Eurozone and Japan is way off course, and that these policy mistakes are a danger to the global economy.

Core inflation in the Eurozone is 1.0%, far below the ECB’s roughly 1.9% target:

And growth in the Eurozone is slowing as we go into 2019.

And growth in the Eurozone is slowing as we go into 2019.

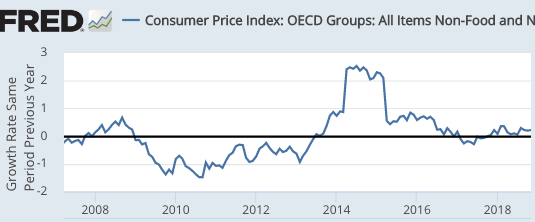

Core inflation in Japan is even further below the BOJ’s 2% target:

And growth in Japan is also slowing.

And growth in Japan is also slowing.

My suggestion is that both central banks consider switching to level targeting and adopt a “whatever it takes” approach to hit their targets. These changes might require legislation, and I’m not expert on the political barriers to getting this done, which I presume are formidable. Fortunately, these two changes might well be enough; I doubt they’d need to take any additional “concrete steps”.

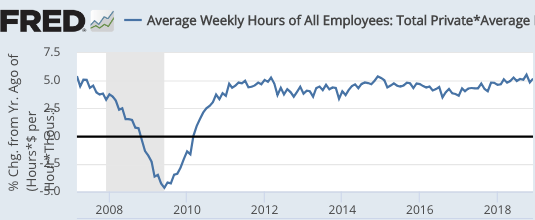

PS. Commenter LK Beland constructed a monthly series of wage income for the US, by multiplying average hourly earnings, average hours per week and payroll employment. In some respects, this data is superior to NGDP as an indicator of the appropriateness of monetary policy. Interestingly, the graph shows even greater stability than NGDP growth, mostly hovering around 4% to 5%:

This is what I’ve been advocating as a long run policy ever since I started blogging in early 2009. However I would have liked to have seen faster “catch-up” growth in the early years of the recovery. Even so, this is a good sign. If they can keep roughly 4% growth going forward then . . . . we win.

This is what I’ve been advocating as a long run policy ever since I started blogging in early 2009. However I would have liked to have seen faster “catch-up” growth in the early years of the recovery. Even so, this is a good sign. If they can keep roughly 4% growth going forward then . . . . we win.

Tags:

23. January 2019 at 14:02

What would LK’s indicator look like for Europe and Japan?

23. January 2019 at 14:06

It’s so damn hard though to convince people that monetary policy is tight when interest rates are near zero. I argued that ECB was behind the curve recently and quoted that even their own inflation projections don’t have inflation hitting 2% by 2021 and yet they ended QE and if anything have signaled they want to tighten policy (though let’s see at Thursday’s meeting).

I chuckled reading the PS because I did the exact same thing as LK Beland within the past six months or so. However, there’s something much easier you can do: use the wage and compensation data from the BEA’s report on personal income (it’s monthly and you can get it real or nominal, you can also get broader measures of personal income). I tried a whole bunch of variations on this theme, including cointegration of the variables LK Beland has and the wage and compensation data. I don’t remember what my favorite approach was, but I recall that one nice thing about LK Beland’s approach is that you can add some granularity to things based on the BLS data. For instance, the growth of women in the labor force or other changes in demographics.

23. January 2019 at 14:41

Very good post. Yes, Europe and Japan are again shooting themselves in the foot, poor dears.

23. January 2019 at 16:31

The Japan story is remarkable.

Japan’s CPI is now running under 1%.

The Bank of Japan has purchased about 45% of Japanese government bonds outstanding. Japan had run up the national debt to about 225% of GDP. These are heroic numbers, yet Japan remains mired in near-deflation.

I submit that Ben Bernanke was correct and that Japan should ponder money-financed fiscal programs.

Another idea that I have never heard discussed is that the Bank of Japan should start buying government bonds of other nations. Then Japan should start cutting domestic taxes offset by the income from the foreign bonds.

Unfortunately, to a central banker the phrase “whatever it takes” has a very limited meaning. perhaps subscribed to by the general conventional macroeconomic profession as well.

It may be that central banking cannot be left to central bankers. There are often extreme blind spots that develop among experts. You would need a sociopathologist to figure this out.

It is also probably true that the expression “independent public agency” is synonymous with “ossification.”

23. January 2019 at 16:31

Scott,

I know you know better than to refer to the Fed hitting an inflation target as meaning monetary policy is on track.

And with regard to the graph from LK Beland, I wish I could see pre-recession data. Much more importantly, it’s not forward-looking, like liquid asset markets. At best, it’s trying to drive looking out the side windows.

It seems to me that if you expect NGDP growth to be around 4%/year going forward, risk-free bond yields should be at least 4%, especially going out 30 years. Yields should at least approach that level, especially if we had perpetual bonds. I think it falls short, because policy is still too tight.

Hence, expect more workers to enter the workforce and/or unemployment to continue to decline as long as NGDP contiuues to grow at around 4% or higher.

23. January 2019 at 16:54

Michael Sandifer

There is pre recession data for non supervisory and production workers:

https://fred.stlouisfed.org/graph/?g=mKZj

23. January 2019 at 17:12

LK Beland,

Thank you. I apologize if I missed the data in my phone browser. I thought I clicked to view all the data, but I struggle with Fred on my phone.

Very interesting data, and nowhere near the brief, pre-recession peak.

23. January 2019 at 17:50

Japan is a worrisome case. Since their central bank has done such a bad job for such a long time, it looks to me like a huge amount of idle money has accumulated on the sidelines. People over there must be used to getting above market returns on government paper.

If they finally get their inflation up, all this supply of money might start moving at the same time and inflation could spike up uncontrollably.

I don’t know if there is a good solution to this, the longer they wait to correct course, the more uncontrollable things will be when they do. I suppose IOR could help if things get out of control.

23. January 2019 at 22:46

Michael, You said:

“I know you know better than to refer to the Fed hitting an inflation target as meaning monetary policy is on track.”

Yes, I do. Which is why I did not do so in this post.

23. January 2019 at 22:54

Scott, perhaps the US could export money to these other places that find it harder to produce currency. A form of division of labor under competitive advantage.

(But of course, US politics seems to have an allergic reaction to exporting money.)

24. January 2019 at 00:33

Scott,

I was referring to your opening sentence of the post, which can be interpreted as you thinking the global media puts weight on how close the Fed is to hitting its inflation target, but it strikes me as ambiguous.

I don’t understand why you mention whether the Fed’s currently hitting its target, when it can easily do so while actively tightening monetary policy, such as tightening after a real shock. In fact, I think it was doing that in December, before somewhat reversing course with its language early this month.

I think that with a bit more monetary stimulus that we could get little more productivity growth and even perhaps a bit more population growth such that we could have sustained real GDP growth in the 2.5-2.7% range, with an unemployment rate that would again be lower than most expect. By sustained, I mean perhaps 10 years or so, with perhaps a more gradual real GDP growth rate decline than many expected. This would include at least one technologically-based boom to productivity and a bit of a catch-up spurt.

24. January 2019 at 03:44

There is effectively no legislative obstacle to the ECB increasing its asset purchases with the objectives of pushing inflation higher.

24. January 2019 at 05:49

In the US, an interesting point is that since 2010, the wage-based indicator shows very robust monetary offset. You might see the 2013 fiscal slowdown and 2018 fiscal stimulus if you squint very hard, but it’s a minor effect at best.

And these fluctuations are a lot smaller than historical fluctuations.

https://fred.stlouisfed.org/graph/?g=mKZj

The Fed is providing a very stable nominal environment.

24. January 2019 at 05:58

And here’s a similar metric for Japan.

https://fred.stlouisfed.org/graph/?g=mLdm

It’s on a roll.

24. January 2019 at 09:25

Scott,

Four things.

1. Japan’s problems are primarily structural… too much regulation and too much taxation.

2. 2% inflation is the wrong target for Japan. We have discussed the trade-off between higher real growth and inflation when you raise the NGDP growth rate. At some rate of NGDP growth (or monetary growth if you want to think about it that way,) the curve becomes vertical, i.e. all NGDP growth is nominal with no real growth. In Japan’s case I think that happens around a 1.5% real growth rate.

3. The BoJ renders it’s own policy ineffective by sterilizing a lot of the monetary growth.

4. More importnatly, because expected investment returns are so low (maybe negative) in Japan, I think the actual transmission mechanism in Japan is through the purchase of foreign currency assets which weakens the yen resulting in export driven growth. Without this, I’d guess Japan would have a hard time achieving consistent real growth above 0.5%.

24. January 2019 at 09:41

Looking at the graph in the post, the increase in IOR done in Dec 2015 is aggravating. Then I saw the longer time series link (thanks LK) and can see that the Fed has really improved its performance compared to the past (which really tempers my view). I wish I knew FRED better. I’d like to look at LK’s chart using QoQ instead of YoY numbers to see better what the Fed might have been seeing at the end of 2015.

24. January 2019 at 11:35

That last graph is basically a front-door approach to calculating year over year NGDI – Investment Earnings, right? Thanks for sharing.

24. January 2019 at 11:45

Ever consider that the EU is not missing its Target at all? Who’s to say the EU cares at all about how the Eurozone is dojhn. Last I checked Germany is at about 2% inflation and sub 4% unemployment.

When you look at their REAL target, which is German inflation and unemployment, they’re doing great. The EU clearly doesn’t care much about non-German countries

24. January 2019 at 13:59

Why isn’t JPY / USD at 160?

I was asking this question in 1998, and I never got a satisfying answer then. Instead the BoJ decided to start defending the currency.

But this maneuver would solve their deflation problem, devalue their debts, improve the trade deficit, etc.

24. January 2019 at 16:24

Michael, The Fed is not targeting productivity growth; the dual mandate discusses high employment and stable prices, which the Fed interprets as 2% PCE inflation and unemployment around 4.3%.

LK, Thanks for those graphs.

dtoh, Do you mean the aggregate supply curve curve becomes vertical at 1.5% RGDP growth? If so, I agree.

But I do think that higher inflation would reduce the debt burden.

Randomize, I think you’d have to also subtract depreciation and indirect business taxes.

Doug. Probably because there is an evil nation out there that is an obnoxious bully that would punish Japan for doing what’s best for Japan, which would be 160 yen to the dollar.

24. January 2019 at 17:45

Scott,

Yes, the dual mandate is for maximizing employment and price stability and the Fed’s done an awful job at both. There’s no law that says the Fed has to use the vastly suboptimal inflation targeting regime.

Even worse than their regime is their forecasting. They’ve been consistently, embarrassingly wrong about the natural unemployment rate. There are constant revisions downward. That suggests the real possibility that their model is very wrong.

What I’m calling for presents nearly zero risk to the economy, but significant potential upside, especially for those who still seek employment. 5% NGDPLT is an idea you can endorse, so why grade the Fed on a curve?

24. January 2019 at 21:19

Scott,

I also want to make explicit a point that is implicit in my above comments. You say the Fed is not targeting productivity growth, but they are speculating on hidden variables such as the natural unemployment rate, the natural interest rate, and potential real GDP. Their speculation on these hidden variables has helped influence their forecasting, which in turns informs their policy decisions.

All of these hidden variables are related to estimating the output gap. So, productivity growth is obviously then also related, as it is critical to determining potential real GDP, which in turn, is related to the natural rate of unemployment.

My model differs from theirs and those of most people and has certainly been more correct than those that disagree with it over the past couple of years. Again, that doesn’t make my model correct, but it does mean those it outperforms those that are incorrect in some respects.

I simply see no reason the risk-free interest rates should be lower than NGDP growth forecasts. I think it’s a contradiction. Even in the case in which there is increased foreign capital inflows, I’d expect a boost to real GDP potential.

Certainly, there are good reasons to expect real potential GDP to decline over time in many advanced countries, but not as abruptly as it has and not with such abrupt drops beginning during the Great Recession in many cases. I don’t think it’s a coincidence.

Sure, productivity growth already began declining in 2004 in the US, and that does give me reason for pause, but monetary policy can be argued to have also been tight in 2004, and some of it could also be coincidence. It simply isn’t necessarily true that it’s part of a single trend, with mostly secular causes.

I think tighter money has been one factor in the natural interest rate falling in the US since 1982.

25. January 2019 at 05:41

The WSJ had an interesting front page story on Japan’s work force last week. The numbers that struck me was that while the “working age” population had dropped by 4 million people, the work force had also increased by 4million. I don’t recall the time frame. Since I believe debt ultimately has to be paid back some way and some how, I viewed this as such a way. For now at least, Japan is “paying itself back” by working more hours than they other wise would have had to without such a large debt. I don’t know how this relates to monetary policy, but there must be some connection.

25. January 2019 at 08:06

Professor,

What do you make of the Euro strength vs the USD a day after Draghi supposedly signaled a dovish ECB by keeping rates unchaged? Is it the market betting the ECB will never hit their inflation target?

25. January 2019 at 08:11

@ Michael Rulle:

Debt—which does have to be paid back—can be paid back by fresh borrowing, i.e., by incurring new debt.

25. January 2019 at 08:12

Or, as Ben Cole likes to remind us, it can be paid off by creating new money.

25. January 2019 at 09:39

Scott,

if you put this in such a general way, it sounds like a conspiracy theory, not much better than the Protocols of the Elders of Zion. A whole “nation”, really? And even better: A whole “evil nation”? Oh my gosh.

Specific examples may be better, so people don’t get it wrong. And maybe without the harsh moralistic tone.

For example like this:

In June 2015 Kuroda sent markets into a tailspin after dropping strong suggestions that the yen shouldn’t weaken much further against the dollar. Why did he say this? The only explanation is the G7 summit this week, attended by Japanese Prime Minister Abe. It can be assumed that Obama said to Abe that the Japanese devaluation of the Yen must end, otherwise the US would have to take “countermeasures”.

Sad but it really happened. And even before Trump.

25. January 2019 at 10:17

Scott,

Good post.

Realistically, what can they do? They cannot cut rates any further; deeply negative rates lead to less credit creation as they hurt the net worth of the banking system (they say so themselves). Flattening the curve via more QE seems pointless as well. Explicitly targeting a weaker EUR might help, but would antagonise the US.

What do you think they should do in the short term?

25. January 2019 at 11:56

Bonus questions:

1) How do we determine what’s “best” for Japan?

2) What exactly is this “Japan”? A volksgemeinschaft with one common interest, which can be determined and which is the same for anybody? (Hardly so).

3) There’s no conflict of interest between Japan and the US? A yen at 160 is what’s best for the US as well?

4) What are politicians called that want to do what’s “best” for America, again? (Same problems here anyway: What’s “best” and what’s “America”?)

Okay, I stop know. I assume you will (once again) say I’m ignorant and obnoxious.

25. January 2019 at 12:39

It seems to me like Japan’s monetary policy is actually quite expansionary, if we look at total wage growth ( https://fred.stlouisfed.org/graph/?g=mLdm ). The labor component of NGDP is growing at its fastest rate since the 90s. One could even argue that the BoJ is being too expansionary (it’s growing at 4%, instead of the 2% post-Abenomics average).

The main driver of this growth is massive job creation. Their employment ratios–especially the prime-age employment ratios–are quite high and still rising.

25. January 2019 at 16:02

>> Do you mean the aggregate supply curve curve becomes vertical at 1.5% RGDP growth? If so, I agree.

Yes.

>> But I do think that higher inflation would reduce the debt burden.

A little, but

1. I think it’s very hard for Japan to push up inflation. Wage and price stickiness are learned behaviors, and in Japan they’ve spent 30 years learning that wages and prices are upwardly (not downwardly) sticky. I think the AS supply supply curve in Japan goes from horizontal to vertical very quickly. I.e. you can either have no inflation or lots of inflation. It’s could be difficult to dial in an inflation number anywhere in between.

2. Even though the average maturity of Japanese government debt is fairly long (around 10 years I think.) Higher inflation would eventually push up interest rates and offset the benefit of inflation.

3. I’m pretty sure that higher inflation would increase the annual deficit…certainly in absolute terms and maybe as a percentage as well. That also offsets the benefit that inflation would have in reducing the real value of the accumulated existing debt.

In total, any increase in inflation (that’s within the realm of political possibility) would have a fairly minimal effect on total debt or debt servicing costs.

As noted, Japan’s problems are primarily systemic and not monetary. Discussion of monetary cures is IMHO a distraction which takes focus away from the real problems that need to be solved.

OT – a post on whether Japan’s debt burden matters might be interesting.

25. January 2019 at 18:05

Japan’s unemployment rate is at a 25-year low at 2.5%.

I have been doing a lot of conference calls with Japanese managements and they ALL say they are having trouble finding enough people to man their factories and stores.

The BoJ must be looking at that and saying, “Why do we want to goose the economy more when we don’t have enough people to exploit the growth opportunities that exist now?”

27. January 2019 at 21:56

Kgaard,

The problem in Japan is not so much employment as it is growth because regulation and high taxes have strangled new business and capital formation.

Take away workers’ tools and you can easily double the number of hours they have to work.

There are huge growth opportunities in Japan, but no one will pursue them because the expected after tax return on the investments is negative.

28. January 2019 at 15:03

Michael, S. You said:

“I think tighter money has been one factor in the natural interest rate falling in the US since 1982.”

In nominal terms yes, but probably not in real terms.

Rodrigo, I’m not sure.

Christian, Yup, we’ve been evil for many years.

Mr, Broegger, By far the best solution is to set a new target. If not, then do as much QE as it takes to hit the target.

If they buy the entire world without hitting their target, then at least they own the world!

LK, But their target is 2% inflation.

dtoh, If Zimbabwe can push up inflation, I’m sure Japan can as well. They may be slightly more incompetent than the Zimbabweans, but not that much more. Seriously, I think that higher inflation would reduce real interest rates on Japanese debt, as nominal rates would rise by less than inflation. Since 2013 I’ve been right, rates haven’t risen with inflation. And they can certainly create inflation is they wish to.

Kgaard, You said:

“Why do we want to goose the economy more when we don’t have enough people to exploit the growth opportunities that exist now?””

Nobody is calling on them to goose the economy; I’m suggesting they should hit their nominal targets. I don’t think 2% inflation would goose the economy for any sustained period.

28. January 2019 at 18:40

Scott,

Yes, I think rates are low currently due to the perceived reaction function of the Fed.

29. January 2019 at 05:39

Scott,

I received this in my mailbox yesterday. The guy reach the same conclusion as you: ECB must restart QE. However, he is looking at velocity and monetary base growth while you look at inflation.

“Money must continue to flow into the financial system

faster than the demand for it expands, otherwise asset

values will fall.

Each cent of U.S. GDP growth since the crisis has come at

the expense of 2.53 cents of additional debt. Whilst the

ratio of debt:GDP has remained the same, thanks to lower

interest rates, we are now getting to the point where the

lower interest rates are balanced against the increased

debt. Without further falls in interest rates, nominal GDP

growth is starting to slow.

European and Japanese interest rates are negative and

monetary velocity is less than one. Both factors suggest

that even the present very low level of nominal GDP

growth cannot be sustained, or debt serviced without base

monetary expansion. The ECB needs to resume QE.”

Since PY = MV, NGDP growth by definition must come from monetary base growth (dM) or increased velocity (dV) – but what is the best way to understand the predicament that the ECB is in? It’s been a while since I was in grad school (I’m from Denmark – we outsource monetary policy to ECB and monetary economics is a bit under-taught in econ programmes here unfortunately).

29. January 2019 at 08:22

“LK, But their target is 2% inflation.”

You are right.

I thought that the BoJ had a dual mandate (in which case their current monetary stance would be appropriate), but it has, in fact, a single mandate. The BoJ needs to be more accommodating.