Teaching money/macro in 90 minutes

A few weeks ago I gave a 90-minute talk to some high school and college students in a summer internship program at UC Irvine. Most (but not all) had taken basic intro to economics. I need to boil everything down to 90 minutes, including money, prices, business cycles, interest rates, the Great Recession, how the Fed screwed up in 2008, and why the Fed screwed up in 2008. Not sure if that’s possible, but here’s the outline I prepared:

1. The value of money (15 minutes)

2. Money and prices (20 minutes)

3. Money and business cycles (25 minutes)

4. Money and interest rates (15 minutes)

5. Q&A (15 minutes)

Intro

Inflation is currently running at about 2%. It’s averaged 2% since 1990. That’s not a coincidence, the Fed targets inflation at 2%. But it’s also not normal. Inflation was much higher in the 1980s, and still higher in the 1970s. In the 1800s, inflation averaged zero and there were years like 1921 and 1930-32 where it was more like negative 10%!

We need to figure out how the Fed has succeeded in targeting inflation at 2%, then why this was the wrong target, and finally how this mistake (as well as a couple freshman-level errors) led to the Great Recession.

1. Value of Money

Like any other product, the real value of money changes over time.

But . . . the nominal price of money stays constant, a dollar always costs $1

Value of money = 1/P (where P is price level (CPI, etc.))

Thus if price level doubles, value of a dollar falls in half.

Analogy:

Year Height Unit of measure Real height

1980 1 yard 1.0 1 yard

2018 6 feet 1/3 2 yards

Switching from yards to feet makes the average size of things look three times larger. This is “size inflation”. But this boy’s measured height increased 6-fold, which means he even grew (2 times) taller in real terms.

Year Income Price level Value of money Real Income

1980 $30,000 1.0 1.0 $30,000

2018 $180,000 3.0 1/3 $60,000

The dollar lost 2/3rds of its purchasing power between 1980 and 2018, as the average thing costs three times as much. This is “price inflation”. But some nominal values increase by more than three times, such as this person’s income, which means the income doubled in real terms, or in purchasing power.

Punch line: Don’t try to explain inflation by picking out items that increased in price especially fast, say rents or gas prices, rather think of inflation as a change in the value of money. Focus on what determines the value of money . . .

2. Money and the Price Level

. . . which, in a competitive market is supply and demand:

Demand for Money: How much cash people prefer to hold.

Who determines how much money you carry in your wallet? You? Are you sure? Is that true for everyone?

Who determines the average cash holding of everyone in the economy? The Fed.

How can we reconcile these two perceptions? They are both correct, in a sense.

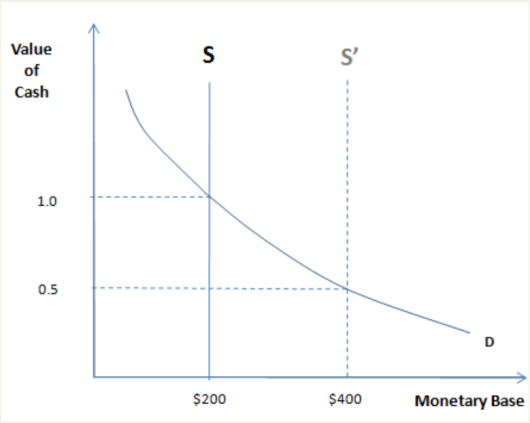

Helicopter drop example: Double money supply from $200 to $400/capita

==> Excess cash balances

==>attempts to get rid of cash => spending rises => AD rises => P rises

==>eventually prices double. Back in equilibrium.

Now it takes $400 to buy what $200 used to buy. You determine real cash holdings (the purchasing power in your wallet), while the Fed determines average nominal cash holdings (number of dollars).

Punch line: Fed can control the price level (value of money), by controlling the money supply.

What if money demand changes? No problem, adjust money supply to offset the change.

Fed has used this power to keep inflation close to 2% since 1991. Before they tried, inflation was all over the map. After they tried, they succeeded in keeping the average rate close to 2%. That success would have been impossible if Fed did not control price level.

But, inflation targeting is not optimal:

3. Money and business cycles

Suppose I do a study and find that on average, 40 people go to the movies when prices are $8, and 120 people attend on average when prices are $12. Is this consistent with the laws of supply and demand? Yes, completely consistent. But many students have trouble seeing this.

Explanation: When the demand for movies rises, theaters respond with higher prices. The two data points lie along a single upward-sloping supply curve.

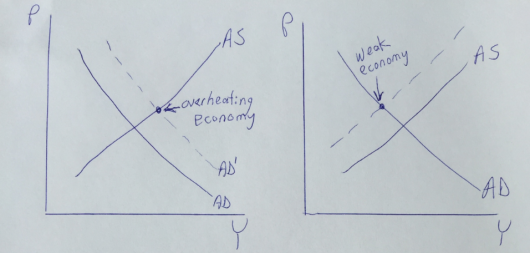

Implication: Never reason from a price change. A rise in prices doesn’t tell us what’s happening in a market. It could be more demand or less supply. The same is true of the overall price level. Higher inflation might indicate an overheating economy (too much AD), or a negative supply shock:

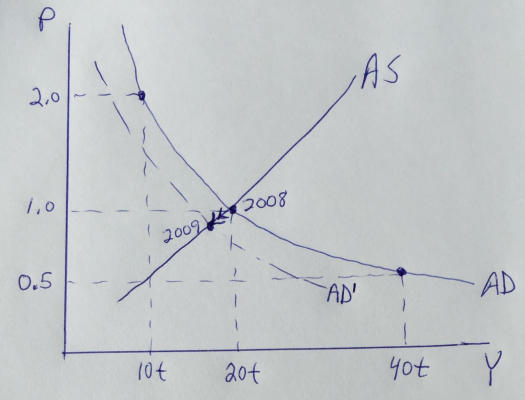

In mid-2008, the Fed saw inflation rise sharply and worried the economy was overheating. It was reasoning from a price change. In fact, prices rose rapidly because aggregate supply was declining. It should have focused on total spending, aka “aggregate demand”, for evidence of overheating:

M*V = P*Y = AD = NGDP

This represents total spending on goods and services. Unstable NGDP causes business cycles.

Example: mid-2008 to mid-2009, when NGDP fell 3%:

Here we assume that nominal GDP was $20 trillion in 2008, and then fell in 2009, causing a deep recession and high unemployment.

Musical chairs model: NGDP is the total revenue available to businesses to pay wages and salaries. Because wages are “sticky”, or slow to adjust, a fall in NGDP leads to fewer jobs, at least until wages can adjust. This is a recession.

It’s like the game of musical chairs. If you take away a couple chairs, then when the music stops several contestants will end up sitting on the floor.

The Fed needs to keep NGDP growing about 4%/year, by adjusting M to offset any changes in V (velocity of circulation).

Punch line: Don’t focus in inflation, NGDP growth is the key to the business cycle

Why did the Fed mess up in 2008? Two episodes of reasoning from a price change:

1. The 2008 supply shock inflation was wrongly viewed as an overheating economy.

2. Low interest rates were wrongly viewed as easy money.

4. Money and Interest Rates

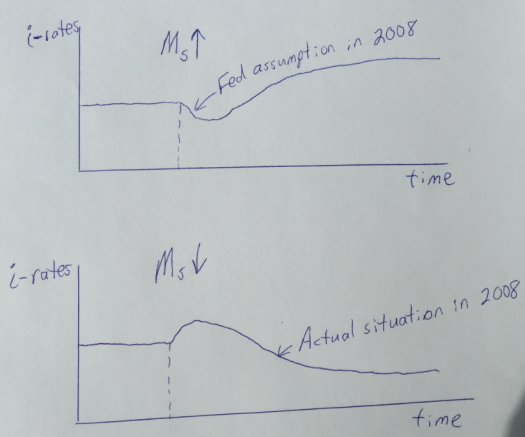

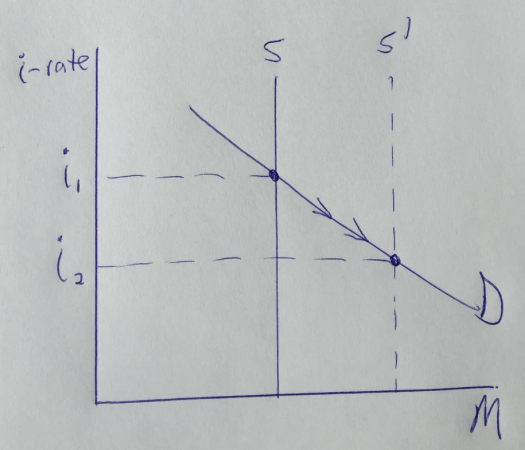

Below is the short and long run effects of an increase in the money supply, and then a decrease in the money supply. Notice that easy money causes rates to initially fall, then rise much higher. Vice versa for a tight money policy.

When the money supply increases, rates initially decline due to the liquidity effect. The opposite occurs when the money supply is reduced.

When the money supply increases, rates initially decline due to the liquidity effect. The opposite occurs when the money supply is reduced.

However, in the long run, interest rates go the opposite way due to the income and Fisher effects:

However, in the long run, interest rates go the opposite way due to the income and Fisher effects:

Income effect: Expansionary monetary policy leads to higher growth in the economy, more demand for credit, and higher interest rates.

Fisher effect: Expansionary monetary policy leads to higher inflation, which causes lenders to demand higher interest rates.

In 2008, the Fed thought lower rates represented the liquidity effect from an easy money policy.

Actually, during 2008 we were seeing the income and Fisher effects from a previous tight money policy.

Don’t assume that short run means “right now” and long run means “later”. What’s happening right now is usually the long run effect of monetary policies adopted earlier.

Punchline: Don’t assume low rates are easy money and vice versa. Focus on NGDP growth to determine stance of monetary policy. That’s what matters.

(I actually ended up covering about 90% of what I intended to cover, skipping the yardstick metaphor.)

Tags:

19. August 2018 at 11:11

“Punch line: Fed can control the price level (value of money), by controlling the money supply.”

How can the Fed control the money supply and at the same time perform its main function of keeping the payments system operational?

19. August 2018 at 16:43

Great post/lecture!

Only thing I would recommend you add would be a short explanation of the liquidity effect, since you’ve explained both the income and fisher effects.

20. August 2018 at 02:25

Jerry Brown,

Because the two goals are compatible, especially outside of very short periods of time.

20. August 2018 at 02:49

Scott,

Funny I was thinking about this same thing in a taxi this morning. I think you’re trying to do way too much.

1) I would start with monetary policy goals, i.e. the role of the Fed in trying to maintain steady growth by increasing/reducing the amount of money that goes into the economy.

2) From there I would go into why shocks (primarily changes in asset prices) in combination with wage/price stickiness makes this necessary.

3) Then talk about the tools/mechanics of monetary policy, i.e. buying and selling assets from the market.

4) From there I would get into the different policy targets the Fed uses and why NGDP is the right target. (And at this point you might want to touch on how too much money leads to inflation.)

Other than briefly when you’re talking about wage/price stickiness or why too much money causes inflation, I would stay away from the value of money and money and the price level. It’s obvious and trivial, which means that any discussion will descend into boring repetition and/or technicalities after about 30 seconds,

20. August 2018 at 03:31

W. Peden, I appreciate the answer but you had to know I was going to argue that those goals are not always compatible. But the entire argument is ridiculous when there are still many billions of dollars in excess reserves in the Fed accounts. I will just withdraw the question if I might.

20. August 2018 at 08:00

Sumner was the first to focus on NGDP growth and NGDP targeting as an alternative to inflation targeting, and it is finally gaining support (even from Larry Summers). What’s left unsaid is that inflation targeting doesn’t work anymore, not in an economy with wealth and income so concentrated. What investors look for today is asset appreciation (i.e., rising asset prices), and the Fed has been accommodating for the most part. Of course, “for the most part” is the operative phrase, as the Fed’s policy of rising asset prices to achieve prosperity runs head-long into asset bubbles (which is not included in “inflation”). In his 2008 Okun lecture Larry Summers referred to bubbles as “inflation lurking in the background”. And I suppose it was “lurking”. The problem with NGDP targeting is that setting a higher target runs the risk of promoting asset bubbles, as investors’ “irrational exuberance” feeds the bubble. My view is that reliance on rising asset prices for prosperity all but guarantees financial instability. Fixing that dilemma deserves a Nobel prize. The problem is that the fix is highly unpopular in certain circles.

20. August 2018 at 08:39

Jerry, Why would control of the price level interfere with the payments system?

Iskander, Good point.

dtoh, Lots of economists don’t even think the Fed can control the price level. One needs to start with the basics.

20. August 2018 at 09:42

Jerry Brown,

We can draw up very artificial scenarios in which the goals are incompatible.

Note that “control the supply of (base) money” does not mean “increase the supply of (base) money at a fixed rate”. I think that’s the thrust of Scott’s question above.

20. August 2018 at 10:35

How did reasoning-from-a-price-change cause the Fed to take the wrong action? Surely if money is more valuable than they wanted it to be then their correct response is to increase the money supply, and this is true independently of whether the price-change was caused by a change in supply or a change in demand?

20. August 2018 at 12:44

(memorial comment)

20. August 2018 at 14:54

W. Peden and Scott, I guess my point would have been that the Fed does not consider itself as targeting the money supply. It targets an interest rate, at least for the last 30 years. And under certain situations the Fed would find that it has to make reserves available to the banking system, even if they actually were trying to control the money supply. Now it could definitely charge a high price for those reserves- but they still would need to be made available. This is the endogenous money vs the exogenous money supply debate. I am in the endogenous camp.

20. August 2018 at 19:52

‘…a dollar always costs $1’

No, it always costs $1 worth of goods and services. It’s those that are the ‘price of money’. If a grocer has been selling loaves of bread for $1, but raises HIS price to $2 (and continues to find customers willing to pay that) then a dollar now costs 1/2 half a loaf.

20. August 2018 at 19:52

Should have been 1/2 a loaf, above.

20. August 2018 at 20:07

‘Demand for Money: How much cash people prefer to hold.’

Wouldn’t it be simpler to say that the demand for money is what people are willing to pay for it in goods and services?

If people were willing to pay for $10 with one hour of labor, but decide that they only want to pay a half hour of labor for $10 (or, an hour for $20), hasn’t the demand for money been cut in half?

21. August 2018 at 07:48

I like it.

A brief anecdote in Section 3 addressing why deflation is REALLY bad would be helpful. People tend to get caught up in a “free ride” mentality, imagining their money to gain value, when the reality of businesses going under as they’re forced to sell inventory at a loss is much darker.

21. August 2018 at 09:17

@Randomize

The problem is not deflation itself but sticky wages. People are focused on nominal values. That’s the problem.

Imagined? Their money is gaining value, isn’t it? At least until prices adapt.

It might be that you made a little “nominal error of reasoning” here as well.

21. August 2018 at 09:22

Scott,

your posts about macro are always great. I can’t wait for your book to come out. When does it come out again?

21. August 2018 at 21:53

Christian/Randomize

In deflation people hold off purchases in anticipation of falling prices, the vicious cycle effect.

22. August 2018 at 09:14

@James Alexander

I know that effect. I guess he knows the effect as well.

In fact, you even say the same thing that I say: The problem is nominal. I just say it directly, and my emphasis is on sticky prices and especially wages.

I do not particularly like your example, because it’s a bit of a faulty comparison, at least on the micro level. It might be in all the textbooks but that doesn’t make it more correct. The problem seems to me that the “producers” don’t adapt their prices fast enough, so they are the ones who make the actual mistake here. “Consumers” make a similar nominal mistake though by demanding the same wages as before.

23. August 2018 at 11:51

Christian List

I don’t really like the example either. It’s not as though consumers (in the aggregate) have a choice. Their buying power shrinks as fewer of them have jobs due to the producers cutting the wage bill by cutting employees rather than nominal wage rates. The real (nominal) vicious cycle effect.

23. August 2018 at 15:31

Oscar, They were looking at interest rates, and assuming it represented the stance of monetary policy.

Jerry, The fact that they target interest rates has no bearing on the “endogenous money debate”.

Patrick, In your example the value of money falls in half, not the demand for money.

Christian, I need to find a publisher.

23. August 2018 at 20:32

I would say it is a recognition of the endogenous nature of the money supply Professor.

7. May 2019 at 20:53

where do you explain what money actually is?