About those high gold prices

As far as I know there is really only one respectable argument that inflation expectations are approaching dangerous levels in the US. We know that 5 year TIPS spreads are low, and we know that the near to medium term consensus inflation forecast is low. We know actual inflation is low and falling. But then there are those gold prices.

I’ve never been convinced that the high gold prices were signaling US inflation fears. One problem is that gold prices are set in a global market, so it’s not clear why we should assume they are forecasting high inflation in the US, rather than the eurozone, Japan, India or China. India has generally been the world’s largest buyer of gold. Furthermore, most other metals prices have also been soaring, presumably due to rising demand in the developing world.

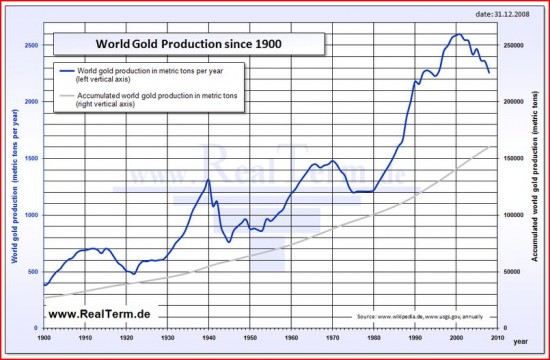

First let’s look at the supply side of the equation. We can’t directly observe supply curves, only equilibrium points. But nonetheless the recent price and quantity data suggests that supply may be falling. We know that gold prices have soared in terms of all major currencies, and yet gold output continues to decline rapidly:

Note that production peaked at 2600 tons, and fell to 2260 tons in the latest year available (2008.) I’ve read articles suggesting that most of the world has now been thoroughly explored, and it is felt that most of the major goldfields have already been discovered. Producers are having to concentrate on less high quality ores.

Set against that bleak supply picture, we have the following news from the FT about gold demand in China:

Gold imports into China have soared this year, turning the country, already the largest bullion miner, into a major overseas buyer for the first time in recent memory.

The surge, which comes as Chinese investors look for insurance against rising inflation and currency appreciation, puts Beijing on track to overtake India as the world’s largest consumer of gold and a significant force in global gold prices.

The size of the imports – more than 209 tonnes of gold during the first 10 months of the year, a fivefold increase from an estimate of 45 tonnes last year – was revealed on Thursday. In the past, China has kept the volume secret.“Investment is really driving demand for gold,” said Cai Minggang, at the Beijing Precious Metals Exchange. “People don’t have any better investment options. Look at the stock market, or the property market – you could make huge losses there.”

Beijing has encouraged retail consumption, with an announcement in August of measures to promote and regulate the local gold market, including expanding the number of banks allowed to import bullion.

Shen Xiangrong, chairman of the Shanghai Gold Exchange, who disclosed the import numbers, said uncertainties about the Chinese and global economies, and inflationary expectations, had “made gold, as a hedging tool, very popular”.

The rise in Chinese demand could further inflate gold prices. Bullion hit a nominal all-time high of $1,424.10 a troy ounce last month. But adjusted for inflation, prices are far from the 1980 peak of $2,300.

“The trend is undeniable – gold demand in China is rising rapidly,” said Walter de Wet, of Standard Bank in London.

. . .

Chinese total gold demand rose last year to nearly 450 tonnes, up from about 200 tonnes a decade ago, according to the World Gold Council, the lobby group of the mining industry. Analysts anticipate a further leap this year, putting the country within striking distance of India’s total gold demand of 612 tonnes in 2009.

Those Chinese consumption estimates are rather large when set against a world production total of 2260, and falling. I seem to recall someone pointing out that Asian gold demand couldn’t be the problem, because the totals were fairly stable. But that confuses shifts in demand with movements along a demand curve. When world output is falling, it is necessarily true that total quantity demand will also fall. If you confuse demand and quantity demanded, it will never look like higher demand is pushing up prices when output is declining. For instance, consider the following scenario:

1. The world supply of gold is shifting to the left, and is expected to continue doing so.

2. Chinese demand is rapidly shifting to the right, and is expected to continue shifting right as Chinese wealth rises dramatically.

3. Indian demand is shifting right, but much more slowly.

Here’s what I would expect. Global gold prices would be expected to rise strongly over the next few decades. If markets are efficient and nominal interest rates are very low, the expected future rise should also raise current gold prices. The intertemporalarbitrage necessary to make this happen would be provided by gold speculators who buy up lots of gold, driving current prices much higher. Because Indian demand is increasing only modestly, yet remains the world’s largest, the higher price causes India to slide up and to the left along their demand curve, to a higher price and a lower quantity demanded. People might wrongly assume that Indian demand had declined, whereas in fact Indian demand was still increasing (due to income growth) but the price was increasing so fast that quantity demanded declined.

The fact that Chinese quantity demanded increased rapidly despite a huge rise in gold prices suggests that the Chinese demand curve is moving to the right at a truly explosive rate. Indeed in this model it would be possible for future expected Chinese demand to explain 100% of the world’s recent gold price rise, even if the current quantity demanded were falling slightly. Speculators might be holding gold stocks in readiness for future expected Chinese demand. But of course Chinese consumption (Qd) is rising fast despite the high prices.

The real price of gold is still much lower than in 1980, a time when China was not a factor in the world gold market, and also a time when lots of new gold fields were yet to be discovered. I can easily understand how savvy hedge fund managers could see the China boom as being very bullish for gold:

The surge in gold imports to China bodes well for some of the world’s biggest hedge fund managers, including David Einhorn of Greenlight Capital and John Paulson of Paulson & Co, who have invested heavily in bullion, and top miners Barrick Gold of Canada, US-based Newmont Mining and AngloGold Ashanti of South Africa. [Also from the FT article.]

Again, I don’t doubt that there are individual investors fooled by news stories of massive monetary base increases and huge deficits, who think that high inflation is just around the corner. Not many average investors know that the same thing happened 15 years earlier in Japan, with no inflationary consequences. But I believe the best point estimate of the market’s consensus inflation forecast comes from the CPI futures market, as well as the TIPS spreads in the T-bond market.

One interesting question is why Chinese inflation is rising sharply. It’s clearly not due to any rise in US inflation; rather the most likely explanation is the Balassa-Samuelson effect. I’ve been predicting a huge appreciation in the real value of the yuan for quite some time, and so far I’ve been right. A recent article in The Economist pointed out the real yuan is up about 50% since 2005, with about half the increase being nominal appreciation and the rest representing higher inflation in China.

Update: Commenter David Pearson sent me the following information:

Demand and supply statistics

Gold Demand and Supply – Q2 2010

Outlook

The World Gold Council recently published the latest issue of Gold Demand Trends for Q2 2010, which suggests demand for gold for the rest of 2010 will be underpinned by the following market forces:

- India and China will continue to provide the main thrust of overall growth in demand for the remainder of 2010, particularly for gold jewellery.

- Retail investment will continue to be a substantial source of gold demand in Europe.

- Over the longer-term, demand for gold in China is expected to grow considerably. A report recently published by The People’s Bank of China and five other organisations to foster the development of the domestic gold market will add impetus to the growth in gold ownership among Chinese consumers.

- Electronics demand is likely to return to higher historic levels after the sector exhibited further signs of recovery, especially in the US and Japan.

Note that none of the major factors driving future gold demand is associated with inflation fears in the US. The report also indicated that investment demand has risen strongly in 2010, but this is consistent with my argument that higher future Chinese demand, coupled with slow growing supply, would lead speculators to buy gold in anticipation of future price increases.

Here is another way of thinking about the problem. Suppose that the Chinese yuan is expected to double in real terms over the next 25 years (which I think is quite likely.) Also suppose that gold prices in dollars are expected to rise at the risk free interest rate (on T-bonds.) In that case gold prices in yuan terms might be expected to show little change over the next 25 years—which would lead to a much higher quantity demand as China becomes much richer. That future expected Chinese demand (partly driven by the Balassa-Samuelson effect combined with Chinese exchange controls) could very easily be underpinning current investment demand in the US.

PS. The article above links to “Gold Demand Trends,” which shows a wealth of detailed information about the gold market. It seems gold ouput has risen a bit since the 2008 figures I got from Wikipedia. But that doesn’t mean the supply curve is increasing.