Not just errors of omission

Given that I am regarded as a monetarist, and that I blame the 2007-09 recession on tight money, you might think it strange that I’ve never really discussed what happened to the money supply at the beginning of the recession. I notice that some commenters simply assume that the problem was an increased demand for money, produced by the financial crisis. After all, you’d expect an increased demand for liquidity during a banking crisis. And some money supply indicators rose sharply during 2008-09.

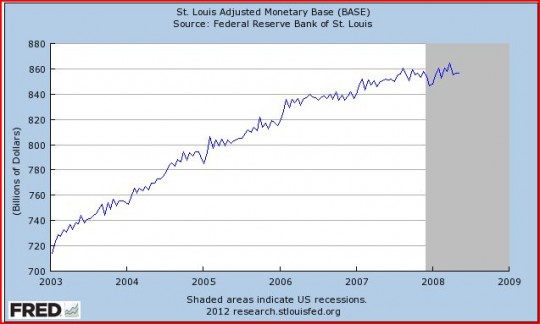

But this is not the case. It turns out that in an accounting sense the problem was a lack of supply of money during the early stages of the recession. During the period from 2003 to 2006 (when the housing bubble peaked), the monetary base rose at a fairly brisk and steady rate of about 5% a year. Then, beginning in early 2006, the growth rate slowed sharply. Indeed the base only rose by about 2.4% between early 2006 and May 2008 (1% per year), with the slowest growth occurring in late 2007 and early 2008, just as the recession was beginning:

So it wasn’t just errors of omission.

Why haven’t I emphasized this fact? Because I don’t think the base is a reliable indicator of the stance of monetary policy. It soared in late 2008, yet money actually got much tighter.

I don’t think the distinction between errors of omission and errors of commission is meaningful in the realm of monetary policy. Using my ship captain analogy, the captain’s equally at fault if he steers the ship on to a reef, or if he falls asleep and the wind blows the ship on to the reef.

But others do make that distinction, so I thought it might be useful to point out that by this criterion the Fed was to blame, and indeed committed errors of commission. The nominal recession was initially triggered by less growth in the supply of money, not more demand. Indeed it’s surprising that NGDP growth did not slow down even more rapidly during 2006-08.

After mid-2008 the surging demand for base money did become the main problem, and was caused by near-zero interest rates and IOR. That raises the question of whether there are any reliable money supply indicators.

William Barnett has a new book out which discusses the use of various divisia indices of money. These indices are analogous to the consumer price index, i.e. they don’t weight all types of money equally. I would encourage knowledgeable grad students to take a look at this link, and see what you think. The approach is certainly theoretically superior to simple sum indices, and one of the M4 indices shows a sharp drop in growth during late 2008 and early 2009. I don’t feel I know enough about the various indices to have an informed opinion, but it’s a topic I’d like to discuss in the comment section. When I get a better understanding of the pros and cons of this approach, I hope to do more posts. I’m especially interested in the intuition behind the sharp drop in M4 growth during late 2008.

PS. Michael Belongia and Josh Hendrickson, both at the University of Mississippi, are also heavily involved in the divisia index project.

Tags:

2. January 2012 at 09:24

It would be interesting to see the next six months from where the chart ends.

2. January 2012 at 09:52

Patrick, It soars much higher. I didn’t include it because if you do it so distorts the scale on the graph that the slowdown in 2006-08 is harder to see. But the base doubled in late 2008.

2. January 2012 at 10:01

Then Fed policy would have made sense. Reliable numbers for NGDP would only have come later.

2. January 2012 at 10:05

Scott,

I guess I am one of those commenters.

I disagree, as your argument proves too much. In 2006-2007 NGDP increased according to the long term trend, and what is more important, it was expected to grow along the long term trend. So there was no error of commission in terms of monetary base. Of course there was an error of commission in failing to properly react to the developments in the supply of broad money.

“ith the slowest growth occurring in late 2007 and early 2008, just as the recession was beginning:”

The slowest growth was both in late 2007 and in the second quarter of 2006.

2. January 2012 at 10:26

I did my senior project in college on the velocity of money calculated from divisia indices. I don’t recall it being a very good project….

2. January 2012 at 11:19

I would suggets reading this:

http://econ.tepper.cmu.edu/barnett/divisia_data_sources.pdf

2. January 2012 at 11:22

Your welcome, Scott (I posted the observation that the monetary base nearly flatlined from 2006-08 in your comments several weeks ago).

“Indeed it’s surprising that NGDP growth did not slow down even more rapidly during 2006-08.”

Doesn’t this highlight the importance of expectations around the Fed’s broader policy objective? No one really believed they would blow things up until 08Q3. Before then, velocity actually increased slightly to offset the slowing base.

2. January 2012 at 11:38

Patrick, Yes, in my view it was defensible until September 2008 (although in retrospect it was too tight even a bit earlier.)

123, I don’t agree. NGDP growth slowed signficantly in 2007, and then slowed much more in the first half of 2008. The numbers don’t exactly match the M-base growth rates, but who would expect them to? The point is that the base growth in late 2007 and early 2008 was even slower than NGDP growth (which was also slow.) So in an accounting sense the supply of money was the problem. Not only was money demand not increasing, it was falling as a share of GDP. Thus base velocity actually sped up a bit in late 2007 and early 2008, as the recession began. Money hoarding was most certainly not the problem, there was simply too little money in circulation. Had the Fed increased the base faster, then interest rates would have fallen faster, and NGDP growth would have been higher.

The reason the slow base growth in 2006 didn’t immediately cause a recession is because V sped up as interest rates rose in 2006.

John, Did you see any specific problems?

Thanks Bill.

Steve, Sorry I didn’t credit you. I’d known about the data for three years, but your comment probably reminded me of it. This post was triggered by comments by 123, and several others during recent months.

2. January 2012 at 11:44

I note that they include commercial paper, repurchase agreements and t-bills in their money supply definition. I may be wrong, but I thought that they came on the asset side of a bank balance sheet, not the liability side. So, for all commercial paper and t-bills, there is a corresponding narrower-money deposit.

Anyway, I don’t think much of the monetary base as a guide to NGDP at any point, since (a) the public can shed themselves free of excess notes & coin in a way they can’t (as a whole) shed themselves of broad money and (b) the banks’ reserves are important only insofar as a shortage of them means they have to borrow in order to meet their liabilities.

2. January 2012 at 11:44

* I might be wrong.

2. January 2012 at 12:15

To make your ship analogy a little more explicit, Scott, you might argue that there is no difference between an error of omission and an error of commission when it comes to the Fed: all errors are errors of emission. That is, the Fed errs exactly when the policy governing its emission of money is inconsistent with its dual mandate.

2. January 2012 at 12:58

Scott, You said:

“Not only was money demand not increasing, it was falling as a share of GDP. Thus base velocity actually sped up a bit in late 2007 and early 2008, as the recession began. Money hoarding was most certainly not the problem, there was simply too little money in circulation. ”

During the second half of 2007 disturbances in the supply of broad money have caused the demand for narrow money to increase. The Fed did not like this and used various tools to reduce the demand for narrow money – remember the reactivation of discount window in August 2007 and the start of TAF program in December 2007. The tools were so successful that the net result was the reduced demand for narrow money.

But all the important action was in the broad money at that time.

2. January 2012 at 13:04

Russ Roberts has posted his latest Econ Talk podcast. Scott Sumner is his guest.

http://www.econtalk.org/archives/2012/01/sumner_on_money.html

2. January 2012 at 15:51

Perhaps computing indicies that try to measure the “total stock” or “total volume of flow” of money is a wrong model at least for understanding “tight” versus loose.

Could a better scheme be to have some Test of Tightness, which is based on a basket of hypothetical borrowers attempting funding for some standard loans? (So this is the reverse of CPI – rather than measuring prices of some basket of goods, we’d measure the cost of the standard grocery visit of a set of exemplary consumers.)

The point being that total money supply is only indirectly interesting – what matters is how tight/loose access to money is.

2. January 2012 at 16:27

“I don’t think the distinction between errors of omission and errors of commission is meaningful in the realm of monetary policy.” Me, neither. “But others do make that distinction . . . .” Well, let’s not be too generous: others *confusedly suppose* that there is such a distinction. They must assume that is some default monetary policy, so that if the authority *does nothing*, *that* policy is the one it will (perhaps unthinkingly) be following. But the idea of “doing nothing” is much too fuzzy to determine any particular monetary policy as the *unique default*. Perhaps the clearest notion is that someone in a coma is “doing nothing,” so the default monetary policy is whatever would emerge if everyone involved in the monetary authority (surely including the President) fell into and remained in a coma. But that suggestion wouldn’t satisfy the would-be distinction-drawers.

Even the notion of a *change* in monetary policy is unclear. The authority can change (or hold constant) various things: the quantity of base money, the discount rate, public expectations about the near-term growth of NGCP, the weight being given internally to reducing unemployment vs. holding down inflation, etc. But “overall policy” is describable at too many different levels of abstraction for there to be any unique sequence that would clearly constitute *unchanging monetary policy*.

However, there *is* a distinction between *good* and *bad* monetary policy!

2. January 2012 at 18:06

It was just that my first econometrics course had focused more on cross-sectional regression than issues with time series. Anyway, I recall that if you just graph the velocity from both, they will look very similar. So it was a challenge to explain to the Professor why it mattered to use the divisia velocity.

2. January 2012 at 19:10

How did the huge drop in home values affect indices?

For example, the start of the housing crisis was marked by a record number of adjustable mortgages resetting. As you mentioned this contributed to a liquidity crisis.

In addition, cash out refinancing, fed by the housing bubble, had been financing lifestyles that more stable income streams could not support. The choices are either to reduce demand or to find new credit sources. Of course the market then suffered significant declines.

How well do traditional monetary indices really capture these market dynamics?

2. January 2012 at 20:26

tight money, no

it was the level of private debt:

1) Keen

2) Mian and Sufi

http://www.bloomberg.com/news/2011-11-17/how-household-debt-contributes-to-job-cuts-commentary-by-mian-and-sufi.html

3. January 2012 at 00:36

I had a couple questions about monetarism in general.

1) What’s the causal mechanism explaining why monetary policy stimulates? In the Austrian view, monetary policy produces a temporary stimulus because most businessmen fail to properly and totally account for increased capital and depreciation costs. Since businessmen buy at a certain price and, with inflation, can sell at a higher price, profits go up as businessmen unintentionally give their capital away as a gift to the consumer. Inflation works in the short run because of the errors it produces. This shows why it is both highly stimulative in the short term and unsustainable and damaging in the long run. I’m pretty sure that Friedman tells the same story about inflation. If that’s the case, why is stimulative monetary policy so popular as a recession fighter?

2. If sudden changes to M*V cause recessions, what causes changes to M*V? I don’t think resorting to these ill-defined aggregates is a sufficient explanation. Economic theory should be able to trace economic effects back to individual action.

3. January 2012 at 00:53

Jonathan Wilmot, James Sweeney, Matthias Klein, and Carl Lantz of Credit Suisse provide evidence for believing that the problem was a collapse in near monies or what they call “shadow money”.

See their paper “Long Shadows: Collateral Money, Asset Bubbles and Inflation”:

http://faculty.unlv.edu/msullivan/Sweeney%20-%20Money%20supply%20and%20inflation.pdf

3. January 2012 at 00:59

Jonathan Wilmot, James Sweeney, Matthias Klein, and Carl Lantz:

“Hayek’s point is that the economy can create its own media of exchange in order to economize on the use of inside and outside money when there is significant demand for some type of money for use in purchasing assets. Of course, when assets can themselves serve as collateral, allowing for leveraged purchases, then they take on money-like properties. And when financial assets serve as collateral for borrowing to purchase yet more financial assets (buying on margin) this form of shadow money can become particularly potent in driving asset price overshoots and bubbles.”

And when it collapses, these “shadow monies” and near money assets lose much of their liquidity and a significant portion of their value — i.e. they no longer offer themselves as substitutes for money, producing a decline in the effective stock of money.

But don’t rely on my explication of the phenomena, look at the evidence and arguments provided in the paper.

3. January 2012 at 01:02

Here’s Hayek on near money assets and money substitutes:

” “There can be no doubt that besides the regular types of the circulating medium, such as coin, notes and bank deposits, which are generally recognised to be money or currency, and the quantity of which is regulated by some central authority or can at least be imagined to be so regulated, there exist still other forms of media of exchange which occasionally or permanently do the service of money.

Now while for certain practical purposes we are accustomed to distinguish these forms of media of exchange from money proper as being mere substitutes for money, it is clear that, other things equal, any increase or decrease of these money substitutes will have exactly the same effects as an increase or decrease of the quantity of money proper, and should therefore, for the purposes of theoretical analysis, be counted as money.”

Also this:

“It is necessary to take account of certain forms of credit not connected with banks which help, as is commonly said, to economise money, or to do the work for which, if they did not exist, money in the narrower sense would be required. The criterion by which we may distinguish these circulating credits from other forms which do not act as substitutes for money is that they give to somebody the means of purchasing goods [or securities] without at the same time diminishing the money spending power of somebody else. …. The characteristic peculiarity of these forms of credit is that they spring up without being subject to any central control, but once they have come into existence their convertibility into other forms of money must be possible if a collapse of credit is to be avoided.”

Friedrich Hayek, Prices and Production 1931 – 1935.

3. January 2012 at 05:58

Scott wrote:

“During the period from 2003 to 2006 (when the housing bubble peaked)…”

Scott, you mean during the period in which people unfamiliar with the EMH say the ‘housing bubble’ peaked, right? There’s no such thing as bubbles, I thought.

3. January 2012 at 09:42

Unlike the Fed’s simple-sum monetary aggregates, based on accounting conventions, my Divisia monetary aggregates are based on microeconomic aggregation theory. The accounting distinction between assets and liabilities is irrelevant and is not the same for all economic agents demanding monetary services in the economy. What is relevant is market data not accounting data. The relevant theory on how to measure the economy’s aggregate flow of monetary services is in the appendixes of my new book, “Getting It Wrong.”

3. January 2012 at 12:40

W. Peden, I certainly agree that the base is a lousy way of forecasting NGDP.

But I don’t agree about getting rid of cash. It’s just as easy to get rid of T-bills as cash.

Neal, Good point.

123, A few comments:

Broad money is completely irrelevant for this post, I am discussing the base.

During normal times like mid-2007 to mid-2008 almost all the base is cash held by the public. So Fed policies aimed at reserves (like TAF) have almost no impact on base demand.

The banking system played virtually no role in monetary policy during 2007-08, all the action was (lack of) Fed OMPs and cash held by the public.

Thanks CA, I have a post up now.

Bryan, You are confusing money and credit. The best test is expected NGDP growth relative to the policy goal.

Philo, Well said.

John Hall, I don’t understand the question.

DanC, How does that relate to this post? I’m not trying to explain the recession (I do that elsewhere) I’m just examining the change in cash relative to prices, or NGDP.

You said;

“The choices are either to reduce demand”

This is a common mistake–you don’t reduce demand, you reduce consumption when you’ve borrowed too much.

JLD, That has no bearing on this post. I’m trying to explain the change in the base relative to prices or NGDP.

John, You question is all muddled. You need to first figure out whether you are trying to explain movements in NGDP or RGDP. The two have very different explanations. The monetarists and Austrians have pretty similar views on what determines NGDP—monetary policy. As for RGDP, the monetarists put a bit more weight on sticky wages and prices.

Greg, I am making a accounting argument, and you are replying with an unrelated argument about causation.

Bob, Whenever I say “bubble” imagine there are invisible quotation marks. I also say “inflation,” even though that also doesn’t exist.

Thanks William.

3. January 2012 at 20:58

Scott,

I completely disagree.

“The banking system played virtually no role in monetary policy during 2007-08, all the action was (lack of) Fed OMPs and cash held by the public.”

Market based measures of demand for non-cash reserves (such as Ted spread) indicate elevated demand for base money by the banking system since August 2007. Bernanke was a hero in 2007 as he managed to suppress the demand reserves.

3. January 2012 at 21:00

I meant to write “suppress the demand for reserves.”

3. January 2012 at 21:49

[…] Scott Sumner have brought up William Barnett’s new book “Getting it Wrong: How Faulty Monetary […]

3. January 2012 at 22:53

Um, no. And indeed this isn’t a response, it’s an admission you’d rather ignore the substance presented. Why don’t you just say it straight up, e.g.: “I don’t want to think about that.”

Scott wrote,

“Greg, I am making a accounting argument, and you are replying with an unrelated argument about causation.”

4. January 2012 at 05:35

I think you have to be fairly eclectic about explaining time series movements, especially in money supply statistics. Academic economists have a tendency to overlook practical details. My suggestion is that the 2003-2008 deceleration in dollar base money, which in those days largely comprised banknotes, two thirds of which circulate outside the USA, was related to the rise of the euro as a currency circulating outside the eurozone, not least because it offered a €500 note that is attractive for high value discreet transactions (recall in 2007 the appearance of euros in a JayZ music video and the report that Gisele Bundchen demanded to be paid in euros?).

4. January 2012 at 08:37

123, Roughly 90% to 95% of base demand was cash held by the public, so I don’t see how reserve demand could have had a major impact. Suppose the Fed had increased the base at the normal 5% instead of less than 1%. I say it’s quite likely that almost all of the extra base money would have gone into cash held by the public. I can’t be sure, but that’s the most likely counterfactual in my view. Inflation would have been even higher than 5%, which makes a liquidity trap somewhat unlikely.

Greg, Are you saying the real demand for base money increased in the period from mid-2007 to mid-2008? If so, where is the data to support that proposition? The data I got from the St. Louis Fred says real base demand decreased.

Rebeleconomist, Perhaps, but in that case I’m right, as I also argued that demand for dollars fell. You are simply, giving a different possible cause. But why the sharp break in 2006, the euro had been around for a while?

4. January 2012 at 12:32

It looks like seasonal noise to me – note that there is another similar “break” around the beginning of 2005. The series you show is seasonally adjusted, and base money typically peaks seasonally around Christmas, and troughs not long after. It looks to me like the series is being over-adjusted in the years you show, so that you get a wobble around the change of years.

The problem is that the Fed is either not devoting sufficient resources to monetary seasonal adjustment or that it does not give sufficient respect to its statisticians to allow them to use their judgement in such matters. I say that with feeling, because I once had a job seasonally adjusting and forecasting note circulation!

4. January 2012 at 12:46

By the way, you might be right that the demand for base money was falling, but if I am right, it was not American demand, so is hardly relevant to US economic developments. Note again that the majority of the dollar monetary base is (or was, before reserves exploded) believed to circulate outside the USA.

4. January 2012 at 13:07

[…] Barnett has a comment on his blog about the comments from Scott Sumner, Bill Woolsey and […]

4. January 2012 at 13:48

Glad to see there is interest on this eminent blog about what I’m doing at the Center for Financial Stability (CFS) in NY City. That said, I probably should mention that interpretation of Divisia money is more difficult than it may seem. In index number theory, there are quantities, prices, and weights. With Divisia, the growth rate weights are the expenditure shares, which depend upon all quantities and prices, not just one price. The prices and the weights are not the same thing. With the Divisia monetary aggregates, the prices are foregone interest (opportunity costs). Those prices are not the same as the weights, but often are misinterpreted as weights.

Consider, for example, the case of a Cobb-Douglas aggregator function. The expenditure shares are constants for Cobb-Douglas. Regardless of what happens to the prices, the shares will not change. Hence the Divisia weights will not change.

What about other aggregator functions, not Cobb-Douglas? Suppose the price of a good goes up. Will its share (and thereby its Divisia weight) go up? That’s unpredictable, since it depends upon whether the own price elasticity of demand of the good is greater than or less than 1.0.

The CFS Reports section, which is not yet online, will try to help with accurate interpretation. My new book also does that in Appendix E. Once you get the hang of it, it all becomes clear. It’s all about the microeconomic aggregation theory that we all know from the CPI, the National Accounts, etc.

4. January 2012 at 15:17

Rebeleconomist, Over three years it grows from about 715 to 835, then over the next 2.4 years it grows to 855. That’s a dramatic slowdown, not just a wobble. If I had growth rates it would be obvious. I guess I should have done the graph that way. The growth rate fell from 5% to under 1%.

I agree the seasonal adjustment looks a bit off.

You said;

“By the way, you might be right that the demand for base money was falling, but if I am right, it was not American demand, so is hardly relevant to US economic developments.”

This is flat out wrong, as a 10% rise in the demand for cash has exactly the same effect on prices and interest rates whether it occurs in the US or Russia. I did my dissertation on currency hoarding, by the way.

William, Thanks, that’s helpful. I read Bill Woolsey’s post and found it helpful in terms of the intuition. I now have a better understanding of why the divisia indices fell off significantly in 2009, whereas other Ms kept rising. But if I read you correctly then Bill made one mistake; he referred to the spread between market interest rates and interest rates on various moneys as the “weight,” whereas I think you are saying that it’s the price. Thus let’s say the market interest rate is 5%, while TDs pay 4%, DDs pay 2% and cash pays 0%. Then the TDs provide 1% worth of liquidity services at the margin, DDs provide 3% and cash provides 5%. These numbers are better characterized as “prices” than “weights”. Am I on the right track?

And in 2009 these spreads narrowed, so less liquidity services were being provided.

4. January 2012 at 16:30

You are on the right track. You are a Chicago guy, so you really know how to do this kind of reasoning. But remember the key words, “at the margin.” You were not entirely clear, when you said “less liquidity services were being provide,” without qualifying that by saying “at the margin” or alternatively mentioning quantity. Remember the famous diamonds versus water paradox. Total and average utility (subjective services) produced by water far exceed those produced by diamonds, but at the margin diamonds produce much more, so are priced higher. In fact along a concave (cardinal) utility function, lower marginal utility means higher average and total utility.

One other minor comment. Francois Divisia was a French economist (a long story). So Divisia should always be capitalized.

Incidentally, if you haven’t received a copy of my book yet, you will soon. I’ve asked MIT Press to send you a complimentary copy.

4. January 2012 at 16:57

Oops. There was an error in my last post. Decreasing marginal utility along a concave utility function is associated with increasing total utility, but not with increasing average utility.

Oh, well. You Chicago-school guys know that in your sleep.

4. January 2012 at 17:07

William, Don’t overestimate what I remember after 30 years!

If we use the water analogy, then the area under the demand curve is the total value being provided to consumers, which is expenditure plus consumer surplus. So applying price to quantity of money gives you something analogous to expenditure, but not total value of liquidity services. Yes, that’s why I added “at the margin,” I saw that I was about to make that mistake.

I had no idea Divisia was a name. It sounds kind of like division, so I thought it was a math or stat term.

4. January 2012 at 18:19

Perhaps I should say more. Everything you said was correct, until you got to the last sentence. Keep in mind that the shares sum to 1.0, and they are the Divisia growth rate weights. They always sum to 1.0. Lower prices cannot cause them to sum to less than 1.0. What changes in prices do is to change the relative weights on the growth rates of different components in computing the growth rate of the aggregate.

When you’ve read the book, all will be clear. You’ll see. You didn’t get a Chicago PhD for nothing!

4. January 2012 at 18:37

Along with W. Peden above I noticed that the M4 measure included commercial paper.

Yglesias links to a paper in his old blog about how corporate debts used to be more information insensitive and basically operated as treasuries in the past:

http://thinkprogress.org/yglesias/2011/04/13/200580/are-naked-credit-default-swaps-a-case-of-too-much-information/

Not to endorse the argument about CDS’s adding information to corporate debt in the PDF linked there — just wanted to link to an argument that shows that commercial paper could be like a “private monetary policy” with commercial paper playing the role of treasuries.

The 2006-2007 slowdown in BASE is accompanied by a huge increase in commercial paper (COMPOUT) — therefore there is a steady increase in M4 from 2004 to 2008. The drop in M4 could be almost entirely attributed to the drop in commercial paper.

http://research.stlouisfed.org/fred2/series/COMPOUT

The argument goes like this: steady increase of BASE by the Fed starts to be accompanied by a steady increase of COMPOUT, so the Fed tightens a little, but COMPOUT undergoes a crisis:

http://thinkprogress.org/yglesias/2010/10/25/198887/the-money-market-run/

And suddenly monetary policy that is too loose (too much BASE given COMPOUT) becomes too tight (not enought BASE). Recession ensues.

You mentioned a lag in the appearance of recessions and the Fed response here is on the order of months:

http://www.themoneyillusion.com/?p=12362

Typical commercial paper has maturities < 270 days; it would take a few months for the "private monetary policy" to register the full drop in its contribution to M4. It would then take some time for the Fed to make up the full loss in the rate of COMPOUT (corporations "tighten" when a recession hits) with BASE until the Fed knew how much it needed to compensate.

Note in the COMPOUT graph the trillion dollars or so on the corporate balance sheet has been made up by the Fed taking on a trillion dollars or so on its balance sheet. (This would indicate that the Fed needs to take on another trillion or so to get M4 where it needs to be.)

"Modern" recessions have slow recoveries because they are caused by the tension between a pro-cyclical COMPOUT monetary policy and counter-cyclical BASE (or whatever) monetary policy running in opposite directions — like a pendulum with friction. Earlier recessions were due more to fluctuations in BASE under control of the Fed.

As a more technical point: there is no reason to believe $1 of COMPOUT is equivalent to $1 in BASE, so the "true" index would be something like M4 where it has different parts contributing at different weights.

4. January 2012 at 18:53

William, Thanks, I see that my last sentence was wrong. Since the weights sum to one, the decline in 2009 is probably due to the shifting weights. Do you know whether in 2009 the weights shifted toward the highly liquid assets like cash, or toward the less liquid assets like TDs?

I do plan to read the book, but not until this summer as I’m putting things off until I can get my own book revised (plus this blog is very time-consuming.) That’s why I wanted an intuitive sense of how this works. Your comments are very helpful.

Jason, Thanks for all that info. There’s more there than I have time to digest tonight, maybe William will have a comment.

4. January 2012 at 20:57

[…] in his first paragraph. William Barnett provides lots more explanation in the comment section of this earlier post. He literally wrote the book on Divisia monetary […]

4. January 2012 at 22:34

Scott, I appreciate your correct understanding of the role of the growth-rate weights, and I have noted your good question. But I’d rather not answer your question. What I’m trying to do at the Center for Financial Stability is to provide the information needed to permit others to learn how to use and appreciate the data. The program I am directing at the CFS is withholding nothing. We are providing all of the components, complete information on sources, and a library providing easy access to the international research and international data. My book has the same objective.

Neither the CFS nor my book provide explicit policy advocacy. Other economists, such as Steve Hanke at Johns Hopkins, are beginning to use the new CFS data for policy commentary and advocacy, and indeed Steve has commented in Globe Asia on the decline in Divisia M4. I’d prefer to remain in the background, dealing with the research and hopefully motivating others to learn how to interpret and use the data.

I think you will find that the kind of question you’ve asked will be easier to answer, once the Reports section goes online and the data releases begin to appear. Those releases and reports will likely include a decomposition of the aggregates’ growth rates into their share-weighted component growth rates. That decomposition should speak for itself without my having to provide a word of interpretation.

I’ve heard today from my colleagues at the CFS that the Reports section will likely include its own blog. If so, I might get dragged, kicking and screaming, into answering questions about interpretation and possible implications for policy. But I’m going to try to avoid that, and hope that others will enter the blog and take that over for me, so I can continue to focus on the science.

5. January 2012 at 03:57

Scott,

But why did you pick 2006? Because there was a discontinuity in the series which you interpreted as the start of the recession. But if this discontinuity was eliminated by better seasonal adjustment, the slowdown might well appear to have been more gradual and not coincident with the start of the recession.

Perhaps I did not make my economic point very well. In the post you said “It turns out that in an accounting sense the problem was a lack of supply of money during the early stages of the recession”. I am arguing that the release of some of this long-standing overseas hoard of dollar bills, probably being used as a store of value beyond the reach of the local authorities, effectively increased the supply of base money in the US economy during critical period.

5. January 2012 at 23:59

Ehh, only M4 I know is the Army carbine.

MZM and publicly held debt (on a FRED chart) certainly have an interesting relationship.

http://tinyurl.com/7e4pecs

6. January 2012 at 11:33

Scott,

You said:

“Roughly 90% to 95% of base demand was cash held by the public, so I don’t see how reserve demand could have had a major impact.”

I don’t agree. Cash held by the public represents a source of stable and permanent demand for base money. During the periods of financial change, demand for non-cash money is unstable and it is mostly temporary. I don’s see how the presence of one source of demand for base money disproves the presence of another.

“Suppose the Fed had increased the base at the normal 5% instead of less than 1%. I say it’s quite likely that almost all of the extra base money would have gone into cash held by the public. I can’t be sure, but that’s the most likely counterfactual in my view. Inflation would have been even higher than 5%, which makes a liquidity trap somewhat unlikely.”

Important details are missing here, your counterfactual is underspecified. One-time 5% boost to the price level in 2007 would postpone the financial crisis and all the base would have gone into cash, but such cure is excessive, and as Minsky feared, in the long run it would create an inflationary spiral. On the other hand, temporary one-year 5% increase in base money would have been hoarded by the banks, and it might have been insufficient.

The challenge is with finding the right mix of temporary and permanent increases in base money that would keep the economy along the NGDP path in the face of frequent shocks to the demand for base money that are generated by the commercial banking system.

6. January 2012 at 19:13

“Indeed it’s surprising that NGDP growth did not slow down even more rapidly during 2006-08”

NgDp’s rate-of-change did fall rapidly during 2006-2008 (from a 12% rate-of-change to a -2% rate-of-change). NgDp was in sync with the TRUE monetary base (was highly correlated), during the 2006-09 period.

William Barnett’s divisia monetary aggregates haven’t worked for the last 28 years. Paul Spindt’s debit weighted money figures performed just as bad.

There is a Gospel, a Holy Grail. I read about it in the University Daily Kansan in 1973. You people are lost.

7. January 2012 at 16:23

Some posts do not merit a reply.

9. January 2012 at 10:36

William, OK.

Rebel Economist, The 2006 date has almost nothing to do with my argument. If you constructed a YOY growth rate series you’d immediately see I’m right. And recall that YOY growth rates have no seasonality problems.

123, It seems to me you are mixing up two unrelated phenomena–financial crises and the zero lower bound.

If we aren’t at the zero lower bound there won’t be much demand for ERs, even if you have financial turmoil. Banks would hold T-bills instead.

I didn’t mean to suggest that a 5% MB growth rate would have been the optimal policy, just that it would have prevented a recessions in 2008. It seems you agree. I certainly do not favor targeting the MB.

10. January 2012 at 14:34

Scott: “Banks would hold T-bills instead.”

Banks would want to hold both T-bills and base money, with most of the increased demand reflected in the quantity of T-bills held and their price, but the demand for base money would grow too. And there are three ways central banks can reverse the resulting monetary disequilibrium – monetary base could be increased, T-bills could be sold and replaced by less liquid assets, or the demand for base money could be suppressed by discount window operations and refinancing auctions. Bernanke used all of these options during various times.

11. January 2012 at 07:30

123, I agree, but doesn’t the discount window affect the supply of base money?

12. January 2012 at 09:33

Scott, in 2007 discount window operations were sterilized, so they did not affect the supply of base money. And in fact, it was the threat to increase the discount window operations that did most of the work.

So in my view the broad money demand shock that started in August 2007 was the source of the crisis. At first Bernanke did a good job containing it, but after some time it was out of control.

12. January 2012 at 13:11

123, It seems to me that base demand fell after August 2007, until mid-2008 when it started rising rapidly. The data show the real MB falling during that period, so it seems pretty clearcut. The Fed should have increased the supply of base money more quickly, to keep NGDP growing at 5%.

15. January 2012 at 04:55

Scott,

your analysis presumes that the only tool the Fed used in 2007 was changing the supply of base money, and all the actions Bernanke used to suppress the demand for base money are ignored.

15. January 2012 at 07:35

123, In those days most of the action in the base was in currency, not reserves, and the Fed wasn’t suppressing currency demand. It was slowing because of less supply.

16. January 2012 at 12:42

Scott, I don’t agree. Please read the August 10, 2007 FOMC announcement:

http://www.federalreserve.gov/newsevents/press/monetary/20070810a.htm

There is nothing about cash there. Only the reaction to the broad money demand shock.

Here are the 2007 September meeting minutes:

“Meeting participants also noted that financial market conditions, while seeming to have improved somewhat in the most recent days, were still fragile and that further adverse credit market developments could well increase the downside risks to the economy. Even after market volatility subsided and the recent strains eased, risk spreads probably would be wider and credit terms tighter than they had been a few months ago. Although these developments would likely be consistent with longer-term financial stability, they were likely to exert some restraint on aggregate demand.”

The discussion in the same meeting about the hoarding of dollars:

“Participants discussed the turbulence in foreign financial markets and noted that unusually high precautionary demand for dollar-denominated term funding in Europe had added to strains in U.S. interbank markets and contributed to a wide spread between libor and federal funds rates.”

Precautionary hoarding of dollars was so heavy that Trichet has printed almost 100 million euros in August 2007 to soften the blow. Still nothing about cash and drug dealers though.

17. January 2012 at 17:01

123, The Fed defines “dollars” as the broad aggregates. I define it as cash.

18. January 2012 at 14:05

Scott,

the definition is not that important. What is important is how the Fed’s reaction function takes the broad money into account. Since 2007 August, disturbances in broad money were very important for the reaction function.

19. January 2012 at 14:06

123, Do you think broad money contains useful information that doesn’t show up in TIPS spreads? And if so, why?

22. January 2012 at 04:20

Scott,

Bingo!

On the last day of August 2007, 5 year breakevens dipped below 1.9%, so the markets were concerned with the possibility that the contraction of the shadow banking system could disrupt AD. So the TIPS spreads confirm that the broad money was the source of the crisis. At first the Fed was quite successful in managing AD while the problems were developing in broad money, but in spring 2008 Bernanke thought he needed more tools (like IOR) to manage the crisis.

Late June 2008, TIPS spreads have reached the 2,6% level. Based on my analysis of likely future developments in the broad money, I thought that TIPS spreads were wrong at that time, and I thought that monetary tightening was not warranted. By the way, at the time some market indicators were showing that the problem is excessive AD, others were telling us that the problem is the lack of AD. So if there was a futures targeting regime at the time, the results would have greatly depended on market design – eligibility of market participants, collateral requirements etc.

In Autumn 2008, breakevens have crashed. But in the Eurozone the crash was milder. This shows the benefits of IOR, and it shows the benefits of countercyclical asset-side policies of the central banks.

22. January 2012 at 09:36

123, I disagree with several points.

1. You don’t know that broad money was the problem, perhaps the markets were concerned that the base would only grow about 1% between May 2007 and May 2008.

2. NGDP was slowing sharply in 2008, which shows why it’s a much better variable than inflation. It gave a warning that money was too tight, just like your indicator.

3. I believe the eurozone crash in NGDP was just as severe as in the US.

23. January 2012 at 11:40

Scott,

here are my comments:

1. Here is a Bloomberg headline from August 3, 2007: “U.S. Stocks Drop on Credit Woes; Bear Stearns Leads Banks Lower”. So you should say that the markets were concerned that the broad money problems will cause the Fed to underestimate the optimal size of the monetary base.

2. The problem in June 2008 was not in choosing the best backward-looking indicator (yes, the historical NGDP is better than historical headline CPI), the problem was in choosing which market price should be believed in if you wanted to predict the future NGDP. And here the TIPS spread was wrong, and some other prices were right.

3. For example, the benefits of Eurozone’s higher inflation expectations are visible in the EUR/USD exchange rate performance during the period when breakevens were very low.

29. January 2012 at 07:20

(… continuing my previous comment)

3. The better performance of the Eurozone labour markets in 2008-2009 might have been caused by more stable NGDP expectations, as signaled by more stable TIPS inflation expectations, even though ex-post NGDP looks similar. This puts the Bryan Caplan – John Quiggin labour market bet into a more important context.

7. June 2012 at 08:12

[…] base their estimates on mathematical models or correlations. On the intentions side, Scott Sumner compares the central bank to a captain of a ship – if the course is off, change the steering wheel […]