Negative IOR need not hurt bank profits, if done correctly

The ECB moved more aggressively than expected to cut IOR and increase QE. Today I will explore the effects, beginning with the banks. Recall how negative IOR was supposed to be so bad for bank profits. It seems those theories were wrong:

Banks have warned that negative interest rates are eroding their profitability. The rates cut into banks’ net interest margins as lenders have been reluctant to pass on the cost of negative rates to all but the biggest retail customers.

To offset some of the pain to banks, the ECB will provide cheap loans through targeted longer-term refinancing operations, each with a maturity of four years, starting in June 2016. These loans could potentially be provided at rates as low as minus 0.4 per cent, in effect paying banks to borrow money. Banks will also benefit from a refinancing rate of 0 per cent.

Shares in eurozone banks rallied sharply after the ECB announcement with Deutsche Bank up 6.5 per cent, Commerzbank up 4.9 per cent, Société Générale up 5.4 per cent and UniCredit up 8.2 per cent.

Over the years I’ve pointed out that there are things that central banks could do to offset the hit to bank profits. For instance, they could raise IOR on infra-marginal reserve holdings, while they lowered IOR at the margin. I did not propose the exact offset discussed above, but it seems that the general concept is workable. Negative IOR need not be a problem for banks, if done correctly.

European stocks rose sharply on the more aggressive than expected announcement and the euro fell in the forex markets. Oddly, however, for the 347th consecutive time the “beggar-thy-neighbor” theory was falsified by the market reaction. Not only did Europe’s actions not hurt the US, our stocks soared higher on the news:

Dow futures added more than 150 points after the ECB cut the deposit rate to negative 0.4 percent from minus 0.3 percent, charging banks more to keep their money with the central bank. The refinancing rate was also cut, down 5 basis points to 0.00 percent.

I warned people to be careful after the Japan announcement; the EMH is not a theory to be trifled with. As you recall, Japanese stocks soared and the yen fall sharply when negative IOR was announced in Japan. But then a few days later both markets went into reverse (probably for unrelated reasons). Many people assumed it was a delayed reaction to the negative IOR. That’s possible, but markets generally respond immediately to news. With the European moves today we see yet another confirmation of market monetarism:

1. Policy is not ineffective at the zero bound. So do more!!

2. Reducing the demand for the medium of account (negative IOR) is expansionary.

3. Increasing in the supply of the medium of account (QE) is expansionary. I.e. the supply and demand theory is true.

4. There is no beggar-thy-neighbor effect from monetary stimulus.

Market monetarists were the first to propose negative IOR. It’s our idea. When your ideas are correct, they help to explain how the world evolves over time. Things make sense. In contrast, people with a more “finance view” of monetary policy have been consistently caught flat-footed. Note that these people are represented on both the right and the left, and they have been consistently wrong in their views of monetary policy at the zero bound.

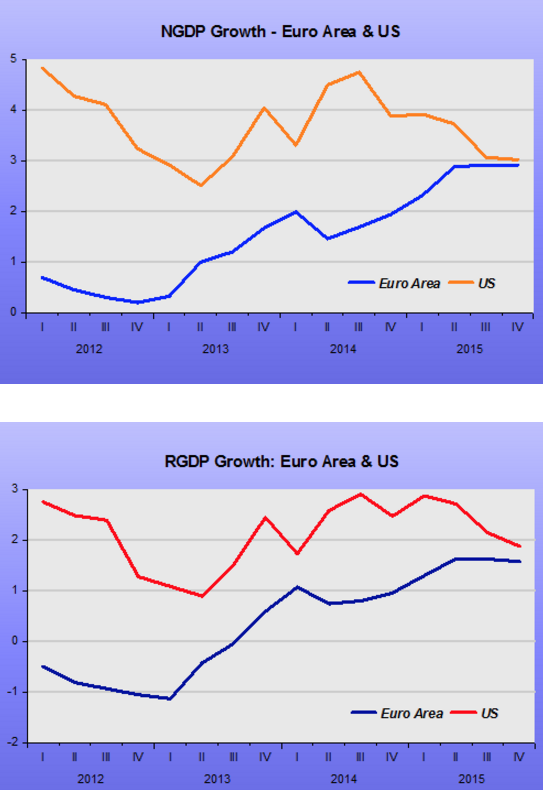

BTW, James Alexander has a post showing that eurozone growth has nearly caught up with the US:

Notice that at the beginning of 2012, NGDP growth in Europe had been running at less than 1% over the previous 12 months. That’s the horrific situation that Draghi inherited from Trichet. Draghi did move much too slowly at first, but at least things are beginning to look a bit better for the eurozone. Still, Draghi needs to do more, as the eurozone is likely to fall short of its 1.9% inflation target.

Even better, the ECB needs to change its target, and set a new one high enough so that the markets are not expecting near-zero interest rates for the rest of the 21st century:

Take overnight interest rate swaps. They imply European Central Bank policy rates won’t get back above 0.5 percent for around 13 years and aren’t even expected to be much above 1 percent for at least 60 years.

Update: The euro later reversed its fall. But note that US stocks soared even after the initial plunge in the euro. It’s interesting to think about why the euro reversed its losses–perhaps a view that the ECB action will make the Fed less likely to raise rates? Or because it was expected that the action would lead to stronger eurozone growth? What do you think?

Update#2: Commenters HL and GF pointed out that the euro rose in value after Draghi indicated (in a press conference) that the ECB would probably not push rates any lower.

Tags:

10. March 2016 at 07:02

About the EURUSD / Euro Stoxx reversal, well, I blame Draghi’s undisciplined press conference, during which he hinted that the GC does not expect to cut more. He had a fair bit of rambling about whether or not the Eurozone is in deflation, etc.

Why he suddenly lost the Jedi Force, I have no idea. But it was clearly the preso that killed the good vibe.

10. March 2016 at 07:17

The reversal in the euro was clearly a reaction to Constancio mentioning rate hikes 3-4 years out and Draghi saying rates won’t go lower. In a Sumnerian spirit , here are some of the headlines:

13:38:23 *DRAGHI SAYS ECB QE WILL RUN UNTIL AT LEAST END OF MARCH 2017 13:38:30 *DRAGHI SAYS ECB RAISES ISSUE SHARE LIMIT ON QE BONDS TO 50%

13:41:00 *DRAGHI SEES RATES AT PRESENT OR LOWER LEVELS FOR EXTENDED TIME

13:41:55 *DRAGHI SAYS MORE DETAILS ON STIMULUS TO BE PUBLISHED AT 3:30PM

13:47:50 **ECB STAFF SEE 2018 EUROZONE HICP AT 1.6%

13:54:04 *RATE ON ECB TLTROS LINKED TO AMOUNT OF LOANS BANKS GRANT

13:54:13 *DRAGHI: BANKS CAN GET BETTER TLTRO RATE TIED TO LENDING LEVELS

13:54:45 more technical details in the later press release

13:56:18 *DRAGHI SAYS RATES WILL STAY VERY LOW FOR A LONG PERIOD OF TIME

13:56:29 *DRAGHI SAYS ECB DOESN’T SEE ANY NEED TO REDUCE RATES FURTHER

13:58:06 *DRAGHI SAYS ECB CAN’T TAKE RATES SO LOW THEY HURT BANKS

13:58:14 *DRAGHI SAYS ECB DISCUSSED TIERED RATE SYSTEM

13:58:25 *DRAGHI: ECB DECIDED AGAINST TIERED SYSTEM TO SEND RATES SIGNAL

These are a bit delayed but EUR rises from the start of the meeting and surges 12:50-13:00

10. March 2016 at 07:36

“Eurozone growth has nearly caught up with the U.S.” is the optimistic way of describing that chart. Another way would be to say ‘U.S. growth rate has been declining towards the rate in the Eurozone.’ Guess I’m just feeling pessimistic today. You still advocate around a 4.5% NGDP target for the U.S. don’t you?

10. March 2016 at 07:38

Thanks HL and GF, I added an update.

Jerry, I’d be happy with a 4.5% NGDP growth target. Indeed I’d be happy with any growth target in that general vicinity (higher or lower) as long as it’s LEVEL TARGETING.

10. March 2016 at 08:04

For me, the highlight came near the end of the press conference… Draghi indicated -for the first time, I think- that the ECB could tolerate short term inflation above 2%, because their goal of 2% or close to 2% is only binding in the medium term. This – Draghi explained – could be done to make sure that the ECB policy is perceived as symmetrical, countering short term periods below 2% with short term periods above 2%. Which would be level targeting…

10. March 2016 at 08:21

libertaer

You are right in once sense. But it was in answer to the only decent question, and there was no follow up. And he LOOKED physically sick when he gave the answer and refused to elaborate in any meaningful way. He seems completely unwilling to use the expectations channel, but keeps retreating into instruments (TLRO, more QE, -ve rates, etc, etc).

I think he knows the power of inflation expectations but the Bundesbank has an electric tag on him that switches on when he goes near the inflation target.

Of course, the HICP inf tgt overstates actual inflation, it doesn’t use hardly anly hedonic adjustments. so it is like the CPI vs PCEPI in the US, but an even bigger gap. so <2% HICP is more like <1-% PCEPI. Hopeless, and the market knows it.

10. March 2016 at 10:05

I think you rely too heavily on event-studies (market moves). Did you know that something near 100% of the gains on the S&P 500 over the past 15 years have come in the 24 hours prior to the 2pm FOMC announcements (not including the actual announcement)? There are clearly enormous market distortions happening in the window of central bank announcements.

I think markets are wise in general, but to fixate on a small window documented to contain highly abnormal trading behavior seems wrong.

10. March 2016 at 10:15

“For instance, they could raise IOR on infra-marginal reserve holdings, while they lowered IOR at the margin.”

Scott, would a 0.25% cut in both infra-marginal and marginal IOR on reserves have a greater effect on NGDP than a 0.25% cut in marginal IOR while inframarginal reserve IOR stays constant (or increases)?

10. March 2016 at 10:33

EMH may be weakening. There are less computers and more machines. Personally I view the last 6 months as relatively boring macro with data pretty stable, but it hasn’t resulted in lower volatility. Equity futures seem to have far too many 10% moves in this environment. Iron Ore was up 30% I believe on Monday. Bonds had a 80 basis point move to start the year. Large standard deviation moves have become the norm. Flash moves happen far too often. It seems to me that discounting of events has weakened significantly over time.

10. March 2016 at 10:33

Less humans not computers.

10. March 2016 at 10:39

Libertaer, Maybe, but that seems far short of a level targeting commitment.

Effem, You said:

“I think you rely too heavily on event-studies (market moves).”

Market moves are not event studies, you need now information.

“Did you know that something near 100% of the gains on the S&P 500 over the past 15 years have come in the 24 hours prior to the 2pm FOMC announcements (not including the actual announcement)?”

That’s exactly what I mean, there’s no new information in that case, so it has no bearing on event studies. And I very much doubt that pattern will continue to persist in the future. If it did it would be easy for anyone to get rich.

The immediate reaction of markets to new information is the most useful, other changes could be due to 1001 factors.

JP, I’m not sure, I don’t see any reason for it to make a big difference, but maybe I’m missing something.

10. March 2016 at 10:40

Sean, If true, that’s great news. It will be much easier to get rich. But I’m skeptical of the claim that the EMH is weakening.

10. March 2016 at 10:52

Prof. Sumner

Why does EZ needs a higher inflation target if Draghi is being succesful in raising NGDP. if interest rates don’t matter, why do we need them away from zero?

10. March 2016 at 10:59

“Recall how negative IOR was supposed to be so bad for bank profits.”

“To offset some of the pain to banks, . . . “

10. March 2016 at 12:05

Not sure if it would be easier to “Get Rich”. Hedge funds are not performing well. In order to take advantage of deviations from fair value you have to be able to define risks and timing (especially leveraged). The Machines are capable of stopping out a lot of well thought out trades.

10. March 2016 at 12:17

Jose, There’s always room for improvement—but I’d prefer they switch to a NGDP target, rather than raise the inflation target.

Sean, Of course it would be easier to get rich. The fact that hedge funds have struggled suggests that the EMH is pretty much accurate.

10. March 2016 at 12:19

Sean,

Higher volatility most certainly does not mean a market is inneficient. If willing buyers and willing sellers are being satisfied then markets are doing what markets are meant to do. Markets are nothing more than equilibrium seeking mechanisms. No one knows what value ‘should’ be. NO ONE!!!! Oh, and computer algos make markets much more efficient than humans ever could. I could never compete speedwise against my own algos. Not even close.

10. March 2016 at 12:24

@Scott

“Market moves are not event studies, you need now information.”

My bad. I’m not an academic. Whatever you want to call it, relying on market-action from the window directly before/after central bank meetings seems problematic. It is well documented that this window has highly, highly abnormal trading behavior (and not just “noisy” but directionally-biased).

https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr512.pdf

10. March 2016 at 12:38

High volatility on what? We’ve witness very little change in FED speak over the last 4 months, little change in payrolls or most US data. Yet we have witnessed a 10 year yield change from roughly 2.4% to 1.4% (listing it probably a little wider than actual trade).

I have no problem higher volatility does not mean the market is inefficient. But I do have a problem calling current markets efficient as in trying to roughly pick fair prices. From what I can tell studying price trend and momentum are dominant right now and there is little interest in “value”.

10. March 2016 at 13:01

Sean,

Read what I wrote. There is no God that knows what fair value is. Looking for it is a waste of time. 96 million barrels can clear at 110 or 40. F**k if I know which one is correct. I’ll accept both.

Now some products do have fair value and arbs can be set up. If a market is trading 55 and a 50 put is worth 1 than a 50 call is fair value at 6. But what the price of something should be… Don’t waste your time. And the little inneficienciwes that do occur, you would never have the transaction cost structure to play against the big boys. So again don’t waste your time. As for trends and momentum, I do believe in that. I just know few people have the emotional structure required to play that game.

Scott is correct, EMH is a bitch to fight.

10. March 2016 at 13:22

I think you are agreeing with me. EMH implies that their is a fundamental price that something is worth and market players are in a process of trying to establish that price.

The best strategies this year have been momentum strategies by their nature they are not trying to arb prices. Similar ETF’s and the rise of passive investors have weakened the EMH. Algos are not EMH palyers. Many of their strategies are actually to force fundamental players into stop loss situations. EMH implies that the majority of market players are concerned with price and fundamentals. I see a market right now that is far more concerned with trend and momentum rather than price and fundamentals.

10. March 2016 at 13:25

In happy happy news the scumbag ex president of Brazil looks like he is on his way to prison. Wonderful!!!

10. March 2016 at 13:42

Fair enough Sean. I do believe the markets are beatable. I guess what I believe in really would be equilibrium market hypothesis and accept EMH because most people that try and beat the market blow themselves to pieces. Which funny enough is a contradiction to EMH in itself as if the market was really a coin toss, and your trades were small relative to capital, and you did enough trades, most people that trade should simply break even. I’d say 95% blow out in months of trying what I just described.

10. March 2016 at 15:05

I believe in a weak form of the EFM hypothesis. That because of scarcity of capital, liquidity constraints that opportunities do arise. I think the EFM hypothesis though has weakened over time. A large part of that is limits on proprietary trading, algos, etfs, and a few other reasons. I think medium time frame risks capital isn’t as abundant as it once was. Algos really cause a problem with flash moves. They limit the risks other capital can take to oppose non-fundamental price moves.

10. March 2016 at 16:59

“That’s the horrific situation that Draghi inherited from Trichet”

-Except Y-o-Y EZ NGDP growth was over 2% when Trichet left office. It then collapsed the moment Draghi came to power, and stayed below 2% for a solid two years.

“Draghi did move much too slowly at first”

-Sounds exactly the same as “During the crisis, Bernanke did move much too slowly at first”…

11. March 2016 at 05:35

Effem, I agree that market moves before the announcement are useless, but don’t see why that applies to moves afterwards. Event studies are not perfect, but they are the best indicator we have. You can’t beat something with nothing.

derivs, I’ll do a post soon on Brazil, perhaps at econlog.

Harding, Draghi took office in November 2011, but a new leader has zero chance to impact policy for at least a few weeks or months. He first must build support among his colleagues. And while long lags are misleading, there are at least short impact lags. So 2012:1 is a reasonable starting point, and by then the eurozone had fallen into a double dip recession.

But yes, Draghi moved too slow in 2012, just as Bernanke did in 2008. But Trichet was far worse, he caused the double dip recession.