Kocherlakota watch

Last year I made a mental note to do occasional updates of Kocherlakota’s 2015 predictions, when he strayed far, far off the reservation:

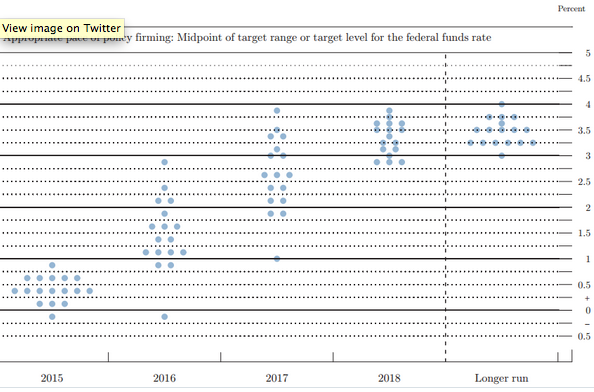

And finally, don’t forget that the other markets did provide useful information. For instance, we know that the TIPS spreads remained quite low, which I believe supports Kocherlakota’s claim that we need a rate cut. People laugh at how far behind Kocherlakota is on the dot graph, like the little boy that can’t keep up with his Boy Scout troop:

Only 1% interest rates in 2017? Yes, that’s probably too low, but it wouldn’t surprise me all that much if Kocherlakota had the last laugh. His 1% forecast is certainly far more plausible than the official who predicts 4% in 2017.

Here’s the FT today:

A disintegrating oil price, coupled with a round of disappointing data on the US economy on Friday, has pushed back expectations to September of when the Federal Reserve will add to last month’s historic rate rise.

Fed funds futures are on Friday morning pricing a roughly 50-50 chance of US policymakers lifting rates at least once more by the end of September. On Thursday, futures implied even odds of the Fed making its next move as early as June.

Another rate increase would push rates up to 0.625% in September, 2016. The Fed had been forecasting 4 rate increases in 2016, which most MMs thought was unlikely (because the market thought it was unlikely). Kocherlakota was even more bearish than the markets, but they have been moving in his direction so far this year. While it’s much too soon to predict 2017, Kocherlakota must be feeling pretty good about his farewell shot at the Fed establishment.

Oh, and the 10 year yield is back below 2%. Remember all those “experts” that said the Fed’s actions would push up mortgage rates? I guess they don’t read MM blogs.

PS. Kocherlakota reminds me of the little boy at the end of this music video. He realizes that just wishing you can fly, doesn’t make it so.

PPS. Just to be clear, while I predicted things would be worse than the Fed believed, I did not predict they’d be this bad. Some of the other MMs, however, did make this prediction.

PPPS. And how about my claim that raising the policy target rate has the effect of lowering the Wicksellian equilibrium rate, thus giving policymakers less “ammunition”?

Tags:

15. January 2016 at 07:51

I wonder what´s going on in Steve Williamson´s mind!

https://thefaintofheart.wordpress.com/2012/10/31/from-hero-to-nemesis-in-2-short-years/

15. January 2016 at 08:06

Yes, it seems like his views and predictions will be vindicated whereas most other members of the FOMC were far too optimistic again, just as every single year since 2008.

Kocherlakota also has some really nice remarks on inflation and TIPS spreads (see here: https://sites.google.com/site/kocherlakota009/home/policy/thoughts-on-policy/1-14-16).

His thinking is very market monetarist. He understands that even while the Fed funds rate was held at 0 throughout the entire year of 2015, monetary policy became increasingly more tight over the course of the year, as indicated by the fall in inflation expectations measured by TIPS spreads (the Wicksellian interest rate seems to have decreased somewhat).

15. January 2016 at 08:42

I stole this from Kevin Erdmann: the Fed can raise rates, the way a kangaroo can fly.

15. January 2016 at 09:03

@Julius Probst

“His thinking is very market monetarist.” Yes!

https://thefaintofheart.wordpress.com/2013/05/17/kocherlakota-embraces-a-market-monetarist-argument/

15. January 2016 at 09:09

We we’re back to more Fed stimulus and yet no one can explain why we are in this period of unprecedented “demand for money.”

And what if, just by chance, the BIS is correct and something about these Fed-aided credit cycles deteriorates productivity over time. Then isn’t every attempt at stabilizing the cycle (i.e., avoiding full recognition of misallocated capital) simply self-defeating. That might be the best explanation for overwhelming demand for money that i’ve heard.

15. January 2016 at 09:25

There’s a case that the best forecast is the following:

-50% Fed dots

+150% Market expectations

The reason is that the Fed is the arrogant cloistered institution that can’t, and it is the market’s job to discipline the Fed.

The Fed has taken exactly the opposite tact for the last decade, repeatedly claiming that it is the markets who need some old fashioned central bank spanking. The Fed is congenitally incapable of understanding it’s role in the economy.

15. January 2016 at 09:25

A statement and question not tightly related to this post, but have to say it.

One thing I learn from your book Midas Paradox and you detailed explanation of NYT headlines back in 1930s is this:

There are always some unexplained, sudden, large scale stock market decline precede a real financial crisis…..

I see something very similar in the stock market today (or I should say several time these two weeks)

Am I reading too much from your book? Or is this the real Great Depression 2.0? 🙂

Sorry for being off topic.

15. January 2016 at 10:00

Marcus, Looks like we now know who was right.

Julius, Thanks, that’s excellent.

Effem, The odds of the BIS being right look increasingly long.

Steve, Good point.

Cloud, No, I don’t think it’s the Great Depression #2. On the other hand if we do get another Great Depression, you can be sure that I won’t forecast it ahead of time.

15. January 2016 at 10:08

Well, I guess any fears about the rate hike should be allayed now that we are getting all this stimulus from low rates at the long end!

15. January 2016 at 10:12

Scott. Nice to have you back on side. The central problem for markets, and therefore for expectations (especially NGDP ones), is that the Fed is so lacking in credibility. Why did it raise the target rate? It is so unpredictable. What does it really want? It could so easily start paying attention to markets tomorrow, causing a rally, a rise in NGDP Expectations, at least a short term one, but the credibility gap may take longer to narrow.

15. January 2016 at 10:16

The graph isn’t a forecast of what the rate will be, but rather the “appropriate pace of policy firming”. I’m not defending all those upper dots, but it isn’t a prediction of where the car will go. Rather it’s a plan of where the drivers think the best place to take the car is.

Of course, those upper dots are at least consistent with their (incorrect) inflation forecasts!

15. January 2016 at 10:17

James – appears to me the Fed is incompetent when looking through many economic schools of thought, but especially so thru the MM lens that they caused the great recession, and have not done enough thru the lackluster recovery.

15. January 2016 at 10:28

Kevin, Good one.

James, You said:

“Nice to have you back on side.”

No it isn’t, I’m always with the market, and market crashes aren’t “nice.”

Jason, Yes, but it’s a prediction of appropriate policy by those who implement the policy. Let’s put it this way, if Kocherlakota is right, will those 3.5% to 4% dots for 2017, still feel that way in 2017?

15. January 2016 at 10:32

@marcus, Williamson yesterday didn’t seem that down on him:

http://newmonetarism.blogspot.com.br/2016/01/neo-fisherism-and-finite-horizons.html

He concludes:

“So, Narayana’s note didn’t give me cause to worry about infinite horizon monetary models, or about neo-Fisherism. His finite horizon framework has some problems, but in spite of those problems it actually has some Fisherian properties.”

15. January 2016 at 11:20

Fed raised rates because they could raise rates and maintain the current path of NGDP.

I would look past this stock market volatility slightly. Markets act irrationally from time to time. Though this is the closest thing to a real crisis we have seen in years.

I predict the fed ends up hiking something between market forecasts and fed forecasts.

If the FED wanted higher growth they shouldn’t have hiked rates.

15. January 2016 at 12:13

Jon Hilsenrath’s latest: “Fed Almost Certain to Keep Interest Rates Unchanged at Next Meeting”

http://www.wsj.com/articles/fed-almost-certain-to-keep-interest-rates-unchanged-at-next-meeting-1452882343

15. January 2016 at 13:04

Scott. I think we might have a transatlantic language divide. I was being ironic. Apologies for any confusion.

The issue is more if even you seemed to many to have given up on 5% stable nominal growth path what hope is there for the Fed maintaining stable nominal growth?

15. January 2016 at 13:22

“How interest rates matter, and how they don’t”

http://econlog.econlib.org/archives/2015/03/when_interest_r.html

“Does a measly quarter point matter?”

http://econlog.econlib.org/archives/2015/08/does_a_measly_1.html

15. January 2016 at 13:30

30-year TIPs spreads closed at a new post-crisis low today of 1.54%.

Watch those kangaroos fly!

15. January 2016 at 14:52

Is anyone tracking the history of the “dots”?

How much forecasting skill do the FOMC members actually have?

It would be really nice if the dots were named so that we could track the forecasting accuracy if each participant.

15. January 2016 at 16:16

Pardon me if I change topic, Scott, but I wonder if you’re following the political crisis in EU, and think it might escalate any time soon, with Renzi being the new Tsipras. Also, what do you think of an article like this? Would you agree with Zingales http://europaono.com/2016/01/14/zingales-fighting-german-cultural-economic-hegemony-europe-strada-per-evitare-euro-germania/

15. January 2016 at 17:29

James, Yes, I was also joking.

On the 5% growth, I’ve given up on it as a likely outcome. I still think it would be a fine policy goal—but so would 4%. The real problem is not the slowness of NGDP growth, it’s the instability. Markets are not falling because they think growth will fall short of 5%, they are falling because growth is likely to fall short of the 3.5% to 4.0% of recent years.

Brian, That’s scary.

Doug, Good question.

Bill, I agree with much of what he says, but I strongly oppose fiscal union. Better to go back to national currencies. Another option is monetary stimulus combined with fiscal austerity.

15. January 2016 at 17:47

Must-read:

“Are Long-Term Inflation Expectations Declining? Not So Fast, Says Atlanta Fed”

http://economistsview.typepad.com/economistsview/2016/01/are-long-term-inflation-expectations-declining-not-so-fast-says-atlanta-fed.html

15. January 2016 at 17:48

“Better to go back to national currencies.”

I can’t but agree with you, but remember Zingales is Italian, and Italian classic liberals will always prefer further European integration to an independent Italy with an independent Italian Central Bank.

15. January 2016 at 18:23

Given the Fed influences the Fed funds rate by changing the rate at which it increases member bank reserves, and given the rate at which it increases reserves does not affect the incomes of all industries and firms to the same extent, and given intra-industry and intra-firm incomes are interdependent, how can MMs believe that booms and busts are not primarily a function of the Fed funds rate relative to a market driven baseline?

16. January 2016 at 01:22

@MF, You must be new here.