IS/LM and AD

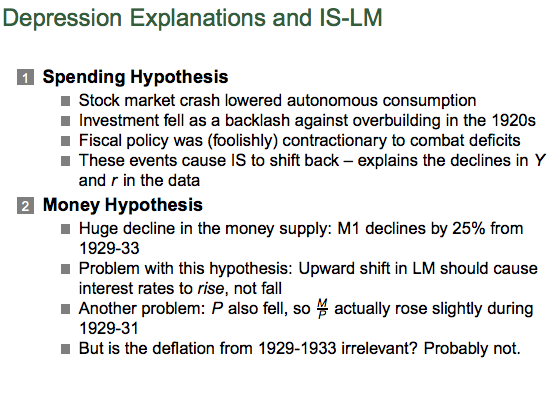

Commenter Joseph sent me an excellent set of PP slides by a professor at Harvard named Chris Foote. He has a very clear derivation of the AD curve from the IS-LM model. This slide caught my attention.

The “spending hypothesis” obviously cannot explain the Great Depression. In 1987 we saw an equally big stock market crash, and GDP kept booming. (And don’t bother trying to concoct excuses about how things were different in 1987—I’ve swatted them all down 100 times.)

An investment backlash? Does that mean people switch from investment goods to consumer goods? If so, why did consumption also fall?

Hoover actually favored public works projects, so fiscal policy explains nothing until at least 1932, when he raised taxes. Was there a Great Depression in 2013? I don’t think so. And yet we had “savage” austerity in 2013.

OK, so it was tight money. We’ve known that for 50 years, ever since Friedman and Schwartz. What interests me is the suggestion that the “money hypothesis” is contradicted by various stylized facts. Interest rates fell. The real quantity of money rose. In fact, these two stylized facts are exactly what you’d expect from tight money. The fact that they seem to contradict the tight money hypothesis does not reflect poorly on the tight money hypothesis, but rather the IS-LM model that says tight money leads to a smaller level of real cash balances and a higher level of interest rates.

To see the absurdity of IS-LM, just consider a monetary policy shock that no one could question—hyperinflation. Wheelbarrows full of billion mark currency notes. Can we all agree that that would be “easy money?” Good. We also know that hyperinflation leads to extremely high interest rates and extremely low real cash balances, just the opposite of the prediction of the IS-LM model. In contrast, Milton Friedman would tell you that really tight money leads to low interest rates and large real cash balances, exactly what we do see.

Note the very last comment on the slide, about the significance of deflation. The rest of the PP slides develop this idea further, and correctly show that while tight money might raise real interest rates, it could lower nominal rates through the Fisher effect. Thus it could shift the IS curve. That helps, but it seems to suggest that the IS-LM model can be rescued by switching the argument from nominal to real interest rates. Alas, that won’t work. The Fisher effect is only one of the ways that monetary shocks impact interest rates. Tight money also reduces expected future real GDP, and this also shifts the IS curve. So it isn’t just nominal interest rates that fall, real rates also fell during the 1930s, as expected future real GDP plunged. The IS-LM model is useless, and should be discarded. The fact that it is used to derive the AD curve probably explains why I can’t seem to understand how Keynesians use the concept of AD; they are basing it on ideas that make no sense to me.

Here’s a simpler model. AD is a hyperbola (a given level of NGDP). This model does not assume NGDP targeting, just as the current AD model does not assume money supply targeting. Changes in NGDP are caused by monetary policy. The P/Y split for changes in NGDP is determined by the slopes of the SRAS and LRAS curves. The LRAS curve is vertical. Interest rates? Yeah, they fluctuate a lot.

BTW, the PP slides end up with an excellent Greg Mankiw post from December 2008. Mankiw recommends the Fed commit to a price level 30% higher in 10 years time. Had they done so the recession would certainly have been much milder.

On the other hand if Mankiw had been head of the Fed in December 2008 they would have done almost exactly what they did under Bernanke, not what Mankiw recommended in 2008. Mankiw’s policy views are pretty similar to Bernanke’s views. Unfortunately there is also the formidable “FedBorg.” Had Mankiw been in charge, it would have been Bernanke who wrote the blog post suggesting the Fed should commit to a 30% higher price level in 10 years. We are all just puppets, filling out the roles determined for us by blind fate.

Off topic: Ramesh Ponnuru is right, I see lots of interest in NGDPLT among conservatives.

I have a post on AD over at Econlog, for those not burned out on the issue.

Just to show you that MMs don’t agree on everything, David Beckworth has a excellent post arguing against the Great Stagnation hypothesis. Marcus Nunes is also skeptical. In contrast, I accept the Great Stagnation hypothesis. Fortunately it doesn’t matter for our monetary policy views, as we all favor targeting NGDP and ignoring RGDP.

Tags:

18. July 2014 at 07:27

There were huge societal changes begun with WWI and ending with WWII: electricity, the automobile, the telephone, the airplane, self-determination, communism, the welfare state, etc. Many of these changes started gathering force in the roaring ’20s.

While monetary policy certainly played an important role, I would caution against a view the sees this period as essentially static in other respects. It was not, and was arguably the most dynamic years in human history (or perhaps since the Great Plagues). So, yes, by all means, let’s credit monetary policy. But let’s not forget other things were going on as well and these very likely played a huge role in the Great Depression and its aftermath.

This was also true in the decade to 2008. More people were lifted out of poverty than at any time in the past, including the interwar period. These changes were utterly monumental, save that they occurred in China, rather than the United States. We also need to keep this in mind when thinking about the Great Recession. It did not occur in the context of a static global economy, but rather at a time of unprecedented fundamental economic change.

18. July 2014 at 07:27

‘Fiscally policy was foolishly contractionary.’

Where does he get that? Hoover drastically enlarged spending. Federal spending went from about $3.1B in 1929 to $4.6B in 1933.

Even without adjusting for the deflation (which makes it larger in real terms) that’s a 50% increase.

18. July 2014 at 07:28

I believe that the investment assertion on the Spending Hypothesis is factually and conceptually incorrect (Investment fell as a backlash against overbuilding). A Recent NBER work on the 1920’s and through the Great Depression provides very interesting set of papers that address part of this topic (Housing and Mortgage Markets in Historical Perspective, edited by Fishback, White, Snowden), and the opposite appears to be the truth. Investment in building, reflected by housing and mortgage bond indices, peaked in 1925. Stock investment peaked in 1929 and did so as a partial response to the decline the aforementioned building and bond investments. A more accurate assertion would be that the stock investment decline occurred as a response to contractionary Federal Reserve policies, I believe.

18. July 2014 at 07:46

OT: here’s the series on risk, interest rates, and valuations that I mentioned a few weeks ago. I realize it’s a bit long, but I would love to know what you think.

http://idiosyncraticwhisk.blogspot.com/2014/06/risk-and-valuations-series.html

18. July 2014 at 07:51

I remember my undergrad macro class, where everyone had a project to model the data from 1929-1933 to see if we could make the data fit using IS-LM/AD-AS. The first thing I learned was that Hoover was far from the liquidationist fiscal hawk I had heard about all my life, and second was that you could only make the data fit if the IS curve sloped upward. When I showed this to my professor, he grinned and said “welcome to macroeconomics.”

18. July 2014 at 08:23

“An investment backlash? Does that mean people switch from investment goods to consumer goods? If so, why did consumption also fall?”

An investment backlash does not mean declines in investment is offset by increases in consumption, either in nominal or real terms.

Consumption depends on investment. The monetary transmission mechanism tends to effect different prices differently. Consider the last few years. Stock market prices, commodity prices, real estate prices, oil prices, tuition prices, healthcare prices, have all risen substantially, while consumer goods indexes representing final consumer goods in general, has not risen nearly as much.

Why hasn’t the Fed’s money printing raised all prices more or less the same percentage? It is because the structure of inflation has money entering primarily the banking system. It is not until quite some time after the “upper stages” prices have increased, does the additional spending make its way into consumer spending. There are absolutely without a doubt “long and variable lags.” If you deny this, you are totally wrong.

If changes in consumption are to take place, there has to be changes in investment. In real terms that is easy enough to grasp, but for some reason it becomes a confusion, for MMs and Keynesian types alike, when the changes are nominal.

A collapse in investment, either in real terms or in nominal terms, cannot physically be instantly matched by on offsetting increase to consumption. How in the world could it? If investment collapses, every income dependent on investment: wages, capital goods, land for productive use, all have the source ripped out from under their feet. It is absurd to believe that a collapse in investment will not affect consumption.

How to reconcile that with 1987 crash? Simple. The stock market collapse of 1987 did not last long enough for the real and money flows towards consumption to be significantly affected. Why is that? Because the Fed aggressively printed money to specifically goose the stock market. This was when the plunge protection team was put into effect by Reagan. The Fed through their cronies bought stocks on the exchanges. The collapse in market investment was replaced by government inflation financed investment.

This of course only delayed the problems, which is why there was an acute recession in the early 1990s. So over the 1987-1992 period, yes, it is true that a stock market crash was followed by a reduction in consumption from what it otherwise would have been.

Time is an important factor that is totally absent in the general equilibrium frameworks such as MM. In these frameworks, all spending is concurrent, all production is concurrent. The Keynesian “flow” diagram, etc. “Chicken or the egg” prattling.

MM cannot explain why it is that stock, bond, commodity, and real estate prices have risen so much more so than consumer goods prices.

18. July 2014 at 08:24

O/T: Krugman is explicitly taunting the “market monetarists” (by name this time): calling them “homeless”…

http://krugman.blogs.nytimes.com/2014/07/17/understanding-the-crank-epidemic/?_php=true&_type=blogs&module=BlogPost-Title&version=Blog%20Main&contentCollection=Opinion&action=Click&pgtype=Blogs®ion=Body&_r=0

That sounds kind of cruel doesn’t it? Throwing rocks at the homeless kids? 😀

(Yet I detect a note of sympathy there too, … perhaps?)

18. July 2014 at 08:30

Tom Brown:

Seems Krugman is still butthurt after that smackdown by Ferguson.

18. July 2014 at 08:38

Steven, Yes, the 1920s and 1930s saw huge technological innovations. The supply side was very strong, apart from the NIRA. That makes the monetary explanation of 1929-33 far MORE likely.

Patrick and John, Both very good points.

Kevin, I’ll take a look but you need to get feedback from others as well. It’s not my area of expertise.

I do like the argument about the tax advantage of interest making greater leverage likely at higher rates.

Jordan, More specifically, Keynesian macroeconomics.

18. July 2014 at 08:47

Tom Brown,

Yes krugman’s is at it again. Unfortunately he’s right. Libertarian conservatives have an inflation ” phantom menace problem.”

18. July 2014 at 08:48

Tom,

I tend to agree with PK’s general theme – that MM doesn’t have strong support within any given political party. But this is a good thing! It lends great credibility to the objectivity of MM ideas. Unfortunately, his tone also seems to suggest he feels MM is a conservative scheme to limit gov’t. Why does he single out Eric Cantor and lack of traction for MM in the GOP?

Whereas PK’s economics are, in my view, simply a means to a public/social policy end; therefore, I regard his views as inherently biased and to be observed with caution and skepticism.

18. July 2014 at 08:48

Scott,

David answered a commenter on his blog about digital deflation:

“Jed, on one hand digitization does lower the capital requirements for innovation. We see that in smart phone apps. On the other hand, the kind of sustained rise in economic growth envisioned by Brynjofsson and McAffee is one that will require huge capital investments. For example, it will take a lot of investment spending to get a smart highway grid and cars for diverless future. And more robot automation won’t be cheap. In my view, this latter effect will dominate.”

This is wrong. That’s why I keep asking you to try and explain where the money goes.

Everyone from the Armed Forces to B2B, everyone is moving to software running on throwaway devices. There is nothing better anymore than consumer grade tech. That in an of itself means something.

I won’t be surprised if driverless cars cost less to build than normal cars and no upgrades are required to the highway system.

Robots are the same deal. Ultimately, everything is going to cost $1 per pound.

So WHAT IF David’s hopeful fallback is dead wrong?

What if it is digital deflation all the way down?

18. July 2014 at 08:50

“We also know that hyperinflation leads to extremely high interest rates”

No, we don’t…real rates? or nominal rates? It is impossible to discuss rates relative to the stance of monetary policy unless you are looking an real rates. Real rates are generally negative while the hyper-inflationary trend is building.

18. July 2014 at 08:57

Scott, your “simpler model” is approximately the derivation of AD in the Cowen/Tabarrok macro principles text. Rather than use IS/LM, Cowen and Tabarrok use a more intuitive equation of exchange approach.

While it is just an introduction to AD in a principles text, I think it is a more useful conception of AD than more “advanced” derivations of AD.

18. July 2014 at 09:50

Isn’t Krugman endorsing Market Monetarism as legit economics here;

‘They’ve been trying to convert Republicans to market monetarism, but the right’s favorite intellectuals keep turning to cranks peddling conspiracy theories about inflation.’

If the cranks are agin’ it, shouldn’t he be for it.

18. July 2014 at 10:03

Jason & Patrick, I agree: he’s not calling MMs cranks. But he doesn’t sound like he’s offering them a home either.

18. July 2014 at 12:45

Thanks, Scott.

Later in the series, I apply the same conjecture to wages – that there is an inherent risk swap in labor contracts, similar to the trade between equity and debt holders. This connects higher wages and labor utilization to low equity risk premiums and high risk free interest rates….

18. July 2014 at 13:10

“An investment backlash? Does that mean people switch from investment goods to consumer goods? If so, why did consumption also fall?”

Define investment and investment good.

18. July 2014 at 15:28

Scott Sumner

“CMA, That makes no sense. By that logic a central bank that targeted the exchange rate would be “subsidizing” tourists who use the forex market when they take a trip. “Target” does not mean subsidize.”

If only banks can borrow at 0.25% FFR and everyone else borrows at 5-10% it is a type of gift or welfare system for banks. Just allow everyone to hold electronic deposits at fed then target a rate on lending that is broader if that is the chosen instrument.

“In addition, “reserves” are nothing more than a name for cash held in the banking system. Walmart also holds lots of cash. A better argument is that IOR subsidizes banks. I’ve opposed IOR.”

I know but not everyone can borrow cash at 0.25% so its inequitable and innefective.

18. July 2014 at 16:25

“We are all just puppets, filling out the roles determined for us by blind fate.”

Wait, are you into determinism? You? The guy who is on the front lines screaming for a new economic revolution? How could a David ever be resigned to fate while fighting a Goliath?

18. July 2014 at 18:09

Excellent blogging.

The “Fedborg”—perfect!

When will the righty-tighties get it—you cannot tighten your way to lower interest rates, not for long anyway.

Three times (at least) Milton Friedmam blamed economic contractions on tight money: Great Depression, 1958 USA and Japan 1990s.

Today you cannot find any right-wing economists to suggest 2008 was caused by tight money…simply not PC.

18. July 2014 at 18:35

“The “spending hypothesis” obviously cannot explain the Great Depression. In 1987 we saw an equally big stock market crash, and GDP kept booming. (And don’t bother trying to concoct excuses about how things were different in 1987″”I’ve swatted them all down 100 times.)”

Margin requirements?

19. July 2014 at 05:27

Dustin, That’s right. Krugman seems to think MM is a right wing idea, but it isn’t.

Doug, Hyperinflation raises nominal rates. That’s why the data is not inconsistent with the monetary view of the Depression.

Scott, Yes, that’s a good way to teach it.

Fed up, Investment goods are buildings and business machines and inventory.

CMA, When banks borrow at 0.25%, there is no subsidy involved at all. The money is being borrowed from other banks, who receive the exact same 0.25%. So are the banks lending money at 0.25% being negative subsidized?

It is important to use terms like “subsidy” precisely. They have very specific economic meanings. If you don’t do so you’ll end up with meaningless statements.

There is no law preventing banks from lending you money at 0.25%. The reason banks prefer to lend to other banks at that rate, and not you, is that it is more profitable to lend to other banks. They are a smaller credit risk. The Fed has nothing to do with that. It was true even before the Fed was created in 1913. They charge you more because you are a bigger credit risk.

Fed up. Margin requirements? I don’t think so.

19. July 2014 at 05:28

Re: Krugman. Has Krugman explained anywhere why it’s pointless for MMs to try to “convert” liberals? If not, does Krugman consider it so obvious that liberals will never accept MM that there’s no need to even explain why? The implication would be that Krugman thinks liberals are even more closed minded than conservatives: MMs might delude themselves into thinking that they can “convert” conservatives, but even naive MMs know that they have no hope of converting liberals.

If Krugman did feel the need to explain that liberals would never accept MM, he might point to 2013 as an example. The liberal “cranks” kept “peddling” theories about how fiscal austerity couldn’t be offset with monetary policy. There was a high-profile liberal that said that 2013 would be a good test of market monetarism until MM passed that liberal’s test. Then, he said that 2013 was not a good test after all. I’m trying to remember who that liberal was….

19. July 2014 at 07:51

‘They charge you more because you are a bigger credit risk.’

Also because the FFR loans are extremely short term; overnight.

19. July 2014 at 08:30

“Fed up. Margin requirements? I don’t think so.”

Oh, I think so.

http://www.fee.org/the_freeman/detail/monetary-policy-disasters-of-the-twentieth-century

“Kirby R. Cundiff is an associate professor of finance at Northeastern State University in Tulsa, Oklahoma, and an adjunct associate professor of finance at the University of Maryland University College.”

“In the 1920s the use of debt by both banks and individuals to invest in the stock market was common. Today Federal Reserve margin requirements limit debt for stock for purchases to 50 percent. But during the 1920s leverage rates of up to 90 percent debt were not uncommon. When the stock market started to contract, many individuals received margin calls. They had to deliver more money to their brokers or their shares would be sold. Since many individuals did not have the equity to cover their margin positions, their shares were sold, causing further market declines and further margin calls. The stock market crash of 1929 was the result.

In the 1920s banks were allowed to invest their assets in the stock market, so many banks went bankrupt as well. The Glass-Steagall Act of 1933, one of the many new Depression-era banking regulations, made equity positions for banks illegal. This act split banks into two types: commercial banks and investment banks. (This law was repealed in 1999.)”

I’m pretty sure a 90% leverage rate means a 10% margin requirement. Plus, the change about banks investing in the stock market.

http://www.colorado.edu/ibs/eb/alston/econ4524/lectures/great%20depression%201.pdf

“margin requirements 10%”

19. July 2014 at 09:16

BC, Good point. I did a blog post over at Econlog a few weeks back making a similar argument.

Patrick, That’s right.

Fed up, You said;

“Since many individuals did not have the equity to cover their margin positions, their shares were sold, causing further market declines and further margin calls. The stock market crash of 1929 was the result.”

I very much doubt that margin problems caused the crash, as there was an identical crash in 1987 without the margins problems, and even less fundamentals to explain it.

In any case, whatever caused these crashes the 1987 crash was just as large, and had zero macro effects. Thus it’s wrong to claim falling stock markets cause recessions. They don’t. Falling NGDP causes recessions, and that only happens with tight money, as we saw in 1987, when money was not tight and there was no recession.

19. July 2014 at 12:17

“Hyperinflation raises nominal rates. That’s why the data is not inconsistent with the monetary view of the Depression.”

yes… hyper inflation raises nominal rates. But real rates are negative. Hence the relationship between low real rates and easy money is intact.

19. July 2014 at 21:14

The BIS believes the stock market is in a bubble:

http://business.financialpost.com/2014/06/30/bank-for-international-settlements-warns-that-stocks-are-in-euphoric-territory-and-central-banks-need-to-start-raising-rates-now/

The Fed’s chair believes the stock market is in a bubble:

http://www.federalreserve.gov/monetarypolicy/files/20140715_mprfullreport.pdf

The head of the IMF believes the stock market is in a bubble:

http://mobile.reuters.com/article/idUSKBN0FN14Z20140718?irpc=932

——————–

There’s something happenin’ here…

http://www.youtube.com/watch?v=gp5JCrSXkJY

20. July 2014 at 11:33

I guess in your acceptance of secular stagnation, you have something that you and Cowen can agree with Krugman and other Kyenesians on.

In this I give Morgan Warstler credit for having an optimistic scenario at least. I get so bored with pessimists even if they’re right.

20. July 2014 at 11:34

Or is there a difference between Cowen’s Great Stagnation and the secular stagnation of Krugman, etc?

20. July 2014 at 12:09

Doug, You said;

“Hence the relationship between low real rates and easy money is intact.”

No it isn’t, as I said in the post. Real growth also impacts interest rates. And monetary policy influences expected real growth.

20. July 2014 at 12:49

Mike:

“I guess in your acceptance of secular stagnation, you have something that you and Cowen can agree with Krugman and other Kyenesians on.”

Not quite.

20. July 2014 at 12:58

ssumner:

“Real growth also impacts interest rates.”

No it doesn’t. If all companies innovate and start selling twice the goods at half the prices, while nominal revenues and full nominal costs remain unchanged, there is no reason for interest rates to change.

21. July 2014 at 08:28

Maybe it was spending and tight money – as I believe it was in 2008. And, when I say spending I don’t mean a simple reduction. Spending needs to be viewed in terms of other balances – private credit, trade balance, tax collections/rates etc…. Preceding the 1929 crash we ran surpluses for years, and those drained the economy of private savings. Probably would have been better to run a balanced budget or small deficits during that time. At the same time you had tighter money. It was the perfect storm. In 2008 we had increasing interest rates, large trade deficits, large private debt, low savings rate, and deficits that got too small to support the credit structure of the economy. So it was not spending in the 20s, but we should not have been running persistent surpluses.

21. July 2014 at 11:13

Matt, The budget surpluses in the 1920s played no role in NGDP falling in half from 1929-33.

Nick, I also noticed that the recent growth slowdown was correlated with Lebron James returning to Cleveland.

21. July 2014 at 14:21

Anyone else notice how as this Ukraine situation gets more heated the pace of our secular stagnation (/digital deflation) keeps increasing? Or maybe the lower interest rates are reflective of how much easier it’s made money…

22. July 2014 at 04:25

Scott, I have to disagree. Surpluses are a reserves drain and 9 or so years of that was not a positive draining significant private sector savings. Not the only factor, but along with other negatives it helped make the economy worse.

22. July 2014 at 08:49

Matt, How do surpluses “drain reserves?” Budget surpluses are a good thing.

22. July 2014 at 12:40

Scott,

“Budget surpluses are a good thing”.

a government surplus means a private sector deficit, unless there is an external surplus… correct? If so, which is better – a government surplus or a private sector surplus?

23. July 2014 at 05:47

Scott, if the government takes in more than it spends then it deducts reserves from the system. Best analogy I can think of is that taxpayers must “withdraw cash” to pay their taxes, and there is no offset to the surplus tax payment debits via government spending or any bond issuance. It would be the same if the Fed confiscated reserves and did not sell any bonds back into the banking system. Surpluses put upward pressure on rates, which the FED will need to offset if they want to keep rate at their target.

Surpluses can be good an bad depending on other circumstances such as balance of trade. IMO surpluses are often a symptom of an economy at full employment, but you cannot run a surplus forever – as these drain private sector income. Ans it is no surprise that every depression and recent recessions were preceded by this condition – all fiscal and monetary mistakes IMO.

23. July 2014 at 08:13

David Glasner’s take on this slide (and the slides that come after it!):

http://uneasymoney.com/2014/07/22/monetarism-and-the-great-depression/#comments

23. July 2014 at 11:59

Matt McOsker,

“if the government takes in more than it spends then it deducts reserves from the system”

I think you’re wrong to think of it as necessarily a reserve drain. When the government runs a budget surplus it usually ‘uses’ the surplus to pay down debt, meaning it spends those reserves to buy back bonds.

The reserves don’t just accumulate in the Treasury’s account at the Fed. Either they are paid to bond holders, thereby flowing straight back into the banking system, or they are paid to the Fed.

24. July 2014 at 05:20

[…] Friday, Scott Sumner posted a diatribe against the IS-LM triggered by aset of slides by Chris Foote of Harvard and the Boston Fed […]

24. July 2014 at 06:47

Philippe right the reserves do not accumulate – the money retires debt so it disappears. You have a debit from someone’s checking account, and a credit to the debt account. It is the same thing as the Fed parking it on their balance sheet in OMO – it is just in this case the bond disappears – it reduces private savings. Historically there was a lot of interaction between Fed and Treasury regarding surpluses and the monetray base.

For example:

“”November 1947 the TReasury agreed to use its surplus to retire treasury bills held by the reserve banks instead of paying out cash to retire debt held by the commercial banks or the public.”

– History of the Federal Reserve Vol 1 Meltzer

24. July 2014 at 07:38

Matt,

“the money retires debt so it disappears”

I don’t see how it disappears if the Treasury uses the money to retire debt held by commercial banks or the public. In this case the money taxed out of the economy by the surplus is just put back into the economy by retiring bonds.

You’re right that private savings reduce as a result – all else being equal – however the reduction is seen as a reduction in government bonds held by the public – not a reduction in reserves. There might be a reduction deposits however if the retired bonds were held by commercial banks.

24. July 2014 at 07:42

Philippe – forgot to add – it reduces treasuries on the Fed’s balance sheet versus the Treasury going into the secondary market to buy/redeem treasuries. The FED can counteract the reserve drain by conducting counter fiscal OMOs.

24. July 2014 at 08:02

ok.

24. July 2014 at 11:45

Philippe, That’s a strange definition of “deficit.” But if you insist, a private sector deficit is better.

Matt, I have no idea what you are talking about. The Fed controls reserves, not fiscal policy.