Is Japan in recession?

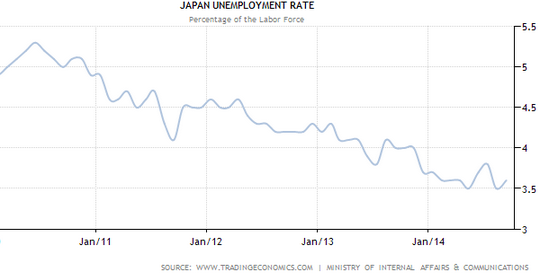

The media says yes. I say if Japan is in recession it’s time to redefine the term. Here is the Japanese unemployment rate over the past few years:

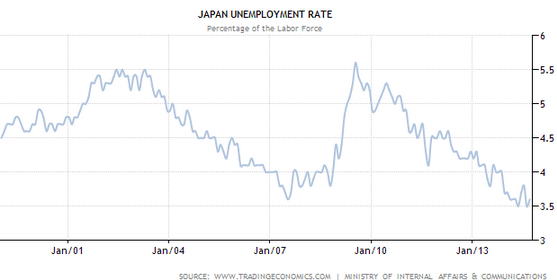

The unemployment rate in Japan is currently 3.6%, one of the lowest figures in decades. It’s true that the Japanese unemployment statistics are a bit peculiar, but so are all their other data. And when they are unquestionably in recession, as during 2008-09, the unemployment rate in Japan rises just as in any other country.

The unemployment rate in Japan is currently 3.6%, one of the lowest figures in decades. It’s true that the Japanese unemployment statistics are a bit peculiar, but so are all their other data. And when they are unquestionably in recession, as during 2008-09, the unemployment rate in Japan rises just as in any other country.

Welcome to the new world of business cycles. Japan is a country with low productivity growth and a working age population that is shrinking by 1.2% per year. The trend rate of RGDP growth is somewhere near zero, perhaps negative. Japan will have lots more “recessions” during the 21st century.

A few months back I very reluctantly supported the sales tax increase, as their debt situation is so scary. That was probably a mistake. For some strange reason I thought that a country engaged in monetary expansionary to try to boost growth, that was also raising sales taxes by 300 basis points, must have been raising the sales taxes for the purpose of reducing the budget deficit. Silly me:

The government approved a 5.5 trillion yen extra budget in December to help the economy weather April’s tax hike. Finance Minister Taro Aso has signaled readiness to boost stimulus and Abe said last week he would consider compiling an extra budget depending on the economy.

(OK, commenter dtoh, you win.) So let me get this straight. You raise the sales tax by 3 percentage points to reduce the budget deficit, and simultaneously raise spending by about 1% of GDP? And the goal of all that activity is what?

In any case, Japanese stocks are still doing well, which suggests that Abenomics is still on track. (But on track to where?) Adverse factors that have a multiyear impact on RGDP lead to higher unemployment. The global recession of 2008-09 is a good example. On the other hand temporary growth pauses don’t raise unemployment—the 2011 tsunami is an example. This looks like a temporary pause, like 2011, as unemployment is not rising. Even so, with zero or negative trend growth in Japan, expect many more negative quarters, many more “recessions.” And that public debt? I have no idea what they plan to do about it.

This line from the Lewis Carroll classic seems relevant, in a reverse sort of way:

“When you say ‘hill'” the Queen interrupted, “I could show you hills, in comparison with which you’d call that a valley.”

BTW, here’s a story that you would not have seen 6 years ago:

Kuroda last month led a divided BOJ board to step up asset purchases, with the aim of delivering 2 percent inflation. [Deutsche Bank’s chief economist for Japan] Matsuoka says there is more the central bank should do to rebuild the economy. He suggests “level targeting,” in which policy makers pledge to keep stimulative monetary policy until the inflation index or nominal GDP resemble what they looked like in the late 1990s.

HT: Stephen Kirchner

PS. This graph shows what the recessions of 2001 and 2008 looked like:

Tags:

16. November 2014 at 19:41

Since Japan is frequently mentioned regarding extreme levels of stimulus spending, it’s surprising that Japan’s governmental expenditures are very low both as a percentage of GDP and in per capita terms, compared to other developed countries.

16. November 2014 at 19:41

“In any case, Japanese stocks are still doing well, which suggests that Abenomics is still on track. (But on track to where?)”

I love it when you talk about the the genius day traders who determine stock prices. My answer would be “on track higher stock prices, but only for a while,” based not on any theory of mine, but on the evidence. Higher stock prices is pretty all we’ve seen so far both in Japan and in the USA, with little or no evidence that the “wealth effect” is stimulating aggregate demand. I gather that the wealth effect is not the basis of your position (I’m not sure where you stand on aggregate demand), but honestly, where’s the beef on the efficacy of expansionary monetary policy at this point? Again, I understand that you say, at least with regard to the USA, that money has been too tight, but isn’t that case harder to make with Japan since Mr. Abe took over? Again, where’s the wagyu beef?

16. November 2014 at 22:52

@Kevin Erdmann

Their fiscal stimulus spending tended to come in giant bursts, with much of it in the form of construction projects (mostly in rural and non-Tokyo areas) paid out to party supporters of the LDP. In fact, that’s how the LDP kept its power for most of Japan’s postwar period.

17. November 2014 at 00:33

The Japanese have managed to boost their inflation rate; however, in doing so, they’ve pushed the real rates on government bonds below zero (they’ve been negative for over one year). This must have a negative effect on domestic consumption, particularly given the percentage of that debt that is held domestically. Not only does it operate effectively as a tax, but psychologically a saving public is loath to dig into principal to fund consumption. And, for those who have jobs have wages risen fast enough to keep up? Has QE, combined with other factors, succeeded in producing stagflation in Japan?

As far as unemployment is concerned, it doesn’t surprise me that is has yet to show up in statistics. Normally, people are laid off during a recession, not before it or in the first sign of it, particularly when the recession, as here, was not predicted. The Japanese culture is also not amenable to quick responses in laying off its workforce. Therefore, I’m not persuaded by the first graph here showing Japanese unemployment “over the past few years”.

Stocks have done well recently in large part due to the announcement that the public pension fund would reallocate a significant percent of its investment portfolio from bonds to stocks.

I don’t see any way for them to get out of this, particularly since they don’t want to open their borders to a flood of immigrants.

17. November 2014 at 03:59

why do you think the public debt is scary? Are you worried that interest rates might suddenly rise to very high levels?

17. November 2014 at 05:23

Kevin, Yes, relatively low, but rising very fast as a share of GDP.

Maynard, Abenomics has done almost exactly what I predicted, so I’m not sure what you mean by “where’s the beef.” I said it would raise inflation but not to 2%, and I’ve been exactly right. I’ve said don’t expect fast RGDP growth because of the falling population and low unemployment rate, and have been right. I said nominal interest rates would stay low , and have been right. I’ve said the exchange rate would fall if they stuck with it, and have been right. I said the sales tax increase would reduce RGDP, and have been right. What more “beef” do you want?

Vivian, You said:

“As far as unemployment is concerned, it doesn’t surprise me that is has yet to show up in statistics.”

Look at the unemployment rate in previous recessions. Or come back here in 6 months and let’s see who’s right.

I doubt if the low real interest rates would reduce consumption, but even if they did they’d still increase AD.

Stocks have done well because the yen has fallen from 77 to 116 to the dollar!! The small amount of stocks bought by the government has little impact.

Philippe, I’m not worried about higher rates, at least in the near term. I’m worried about an unsustainable debt. I have no idea where rates will be in 50 years, or 100 years.

17. November 2014 at 05:25

BTW, No comments on the post itself? I thought my “no recession” claim would be controversial.

17. November 2014 at 05:45

okay, I will take the bait. The Japanese reported today a 0.4% quarterly GDP contraction. I think that is 2 quarters in a row of contraction. It may make sense to report Japanese GDP on a per capita basis. Still, they need a sustained aggressive program of monetizing national debt.

17. November 2014 at 05:54

Defining “recession” as “falling RGDP” is not a good definition, agreed. Your unemployment rate graph is fairly convincing. But just to be complete, I would like to see participation rates for (e.g.) 25 to 55 year olds. Just to check it’s not discouraged workers.

17. November 2014 at 06:01

Scott, why do you think it’s unsustainable then?

17. November 2014 at 06:37

Japan’s employment ratio 15-64 is going up, up, up (in regard to Nick Rowe’s comment):

http://research.stlouisfed.org/fred2/graph/fredgraph.png?g=RgF

17. November 2014 at 06:38

Good post, Scott.

Can a country really run a 6.5% budget deficit for 20 years with the assumption that it has no negative effects on growth? Do we really believe that?

Also, the stats you post suggest that Japan probably has some substantial hidden unemployment. Is it plausible that the unemployment rate in Japan increased only 1.5 percentage points during the 2008 financial crisis? Hard to believe. If so, then the current 3.6 percent might be materially misleading (as I think dtoh may have argued earlier).

17. November 2014 at 06:39

Kevin –

According to the IMF, Japan central government expenditure is 40% of GDP, not a low number at all.

17. November 2014 at 06:48

Scott,

A few random comments.

1. If you are doing monetary policy with the hope of causing wage inflation (as frequently stated by Japanese pols), you’re defeating the purpose. You need monetary policy because you have sticky wages. If you un-stick wages on the upside, it does nothing to reduce real wages and you don’t get a reduction in unemployment.

2. Like Nick I would like to see labor participation rates.

3. Monetary policy (or quantity) does not drive inflation directly. It causes inflation because it causes an expected imbalance in the short to medium term supply and demand for goods and labor. In other words,expected RGDP growth drives inflation. Not the other way around.

4. The only way to solve the deficit is with economic growth… specifically reductions in tax rates on capital.

5. I think there is a lot of funky stuff going on with the grey (i.e. cash) economy in Japan which makes it difficult to tell how accurate the RGDP and employment numbers are.

17. November 2014 at 06:50

As for commenting on the post itself: Who knows with Japan? Is there a business cycle need for a recession? Is inflation too high, employment too strong, assets over-valued? Doesn’t seem to be the case.

So if there’s to be a recession, it’s one of:

1. Demographics and a perpetuo-recession;

2. Some monetary thing, and more inflation could help

3. Endless drag from too much government debt and deficit spending

4. Bad domestic policies, principally those related to redeploying labor from lower to higher productivity activities.

But who knows with Japan?

17. November 2014 at 07:05

Ok so recession no longer means two straight quarters of negative GDP if the unemployment rate is low. Japan has had low unemployment throughout. If we do the ‘structural reforms’ the conservatives want won’t this make the unemployment rate look a lot less rosy?

17. November 2014 at 07:12

I don’t understand the focus on yen-based stock prices. By that measure Zimbabwe was doing well as their shares skyrocketed.

17. November 2014 at 07:14

dtoh

If you un-stick wages on the upside

I wasn’t aware such a thing existed.

it does nothing to reduce real wages

You’re assuming everybody gets a raise.

In other words,expected RGDP growth drives inflation.

I take it Zimbabwe expects A LOT of RGDP growth.

17. November 2014 at 07:31

By this new definition of recession Japan was never in recession in the first place.

17. November 2014 at 07:50

As every upward tick of the market proves Keynesianism is ‘dead’ what did today’s Nikkei prove-that it was resurrected?

17. November 2014 at 08:10

@Vivian:

If we believe that Japan’s rate of potential RGDP growth is somewhere in the neighbourhood of zero, then a negative real rate on savings makes perfect sense and is in fact necessary.

Nominally-denominated savings represent a claim to a share of the nation’s future output. If that output is not growing over time, then the value of those savings must also not grow in real terms, or else the savings represent an unsustainable Ponzi scheme.

17. November 2014 at 08:30

We need to re-define Growth so we can define recessions the right way. Many economic activities that benefit society do not get measured in conventional growth terms, while lots of useless activities do add to growth.

The biggest example would be that the positive economic impact of stay at home parents is not measured in traditional numbers.

I think you are on the right track looking at employment numbers. You could also look at quality of life measures like longevity, education, participation in civic or religious activities, etc.

17. November 2014 at 08:47

Japan’s labor force participation rate has climbed about a full percentage point this year to 59.9% and during that time the jobless rate has declined by 0.1ppt. So, Japan’s labor market has held together this year. Recent data on retail sales, IP, and machinery orders suggests growth into Q4. Not that we should be doing any high fives … but growth is likely stronger than today’s data implies.

17. November 2014 at 10:25

Looking at the economic numbers decrease and low unemployment rate:

With falling unemployment and economy, how much of the problem is simply just the demographic reality the last 25 years? The economy literally can’t increase demand as most of the population is past the peak earning and spending year?

Can they simply use the Singapore (Or Texas/Cali) solution to which the economy can improve with low wage immigrants?

17. November 2014 at 10:29

The “goal” is to increase the share of the economy that under some sort of centralized control as much as possible. I am shocked that supposedly smart people still don’t know this.

17. November 2014 at 12:28

Ben, Yes, they need more monetary stimulus.

Philippe, It might be sustainable and it might not be. It’s clear that under current policy the debt/GDP ratio will keep rising sharply. It’s possible that that rise is unsustainable, and that possibility is not acceptable. Suppose the ratio rose to 600% of GDP, and then interest rates started rising.

LK, Thanks for that info.

Steven, Yes, unemployment is certainly worse than the 3.6% figure suggests, but I still say that changes in the Japanese unemployment rate do track the business cycle, just not as dramatically. It’s the same in Germany, by the way, where unemployment only rose by a small amount despite a big drop in GDP.

dtoh, In my view NGDP drives both RGDP and inflation.

It’s unlikely that Japan’s debt problem can be solved with growth, unless they open the door to immigration.

Steven, But is it a recession?

Mike Sax, No, that’s not my claim. But at least you are consistent—consistently misinterpreting me. Maybe just once . . .

effem, Zimbabwe was doing well—at creating inflation and reducing the real value of their debts. Japan could learn something from Zimbabwe. 🙂

Charlie, We could even use RGDP, but then use deviation from the trend line. It must be at least 3% below, or something like that.

Neil, Thanks, People that don’t follow Japan have no idea how strange their data can be. Someone should do a post on the difference between CPI and GDP deflator inflation in Japan over the past few decades.

Collin, Good point, although I think it’s better to describe that as a problem with the AS curve, and the “quantity demanded.” The BOJ can boost AD, but it will be inflationary.

17. November 2014 at 15:35

Scott,

You said, “In my view NGDP drives both RGDP and inflation.”

I think that’s probably because we have slightly different views of the transmission mechanism.

You also said, “It’s unlikely that Japan’s debt problem can be solved with growth, unless they open the door to immigration.”

I think you’re saying that they can’t grow without immigration, to which a couple of points. A) There already is quite a lot of immigration. B) If you had growth, you wouldn’t have a stagnant population. The low birth rate is an effect not a cause of the economic problems.

Japan’s problem is structural and very obvious. High taxes and regulations are strangling new business formation. If Japan fixed these problems they could easily get 7% ongoing real growth.

17. November 2014 at 15:48

What I notice is that most people when they say someone has misinterpreted follow it up with a clarification of what their point actually was. You never do which makes me skeptical I’m misinterpreting.

17. November 2014 at 17:01

Mike Sax,

Prof. Sumner’s time spent on his comments section to total blog reader ratio is OFF THE CHARTS! NO ONE with his amount of influence is as generous with his time with commenters.

You also have a long history of demonstrating that your understanding is is limited so you should be thankful that Prof. Sumner ever interacts with you at all.

17. November 2014 at 17:48

Draghi says the ECB could do full QE””i.e., buy government bonds””if inflation stays too low

http://www.bloomberg.com/news/2014-11-17/draghi-lists-new-year-resolutions-to-aid-ecb-monetary-stimulus.html

17. November 2014 at 19:08

Assuming a constant velocity of money when considering changes in the money supply, we can all agree is unrealistic.

So is assuming a constant productivity of labor when considering changes in the labor supply.

17. November 2014 at 19:29

Sumner:

“dtoh, In my view NGDP drives both RGDP and inflation.”

NGDP does not drive RGDP, and RGDP does not drive NGDP. RGDP and NGDP are contemporaneous. They are aggregates representing the two sides of final goods exchanges.

——–

TravisV:

I rarely if ever agree with Mike Sax, but he has a point. The standard definition of recession is two consecutive quarters of declining GDP.

If Sumner wants to argue Japan is not in recession because of the unemployment rate being low and the stock market remaining elevated, then fine, he can redefine recession any way he wants. Definitions are not objective claims of reality. They are verbal conventions. But given Sumner’s admission of having a history of purposefully misleading others when he can get away with it, I won’t be surprised if this attempt to redefine recession is to mislead people into agreeing with him to suit some ulterior agenda.

17. November 2014 at 19:32

Decentralised Bitcoin prediction markets – of interest to Scott?

http://www.augur.net/

17. November 2014 at 20:02

“Japan’s problem is structural and very obvious. High taxes and regulations are strangling new business formation. If Japan fixed these problems they could easily get 7% ongoing real growth.”

Tax in Japan is not so high. Especially if you make less than JPY 18000000.

http://www.jetro.go.jp/en/invest/setting_up/laws/section3/page7.html

Corporate taxes are high, but not unbelievably so.

Setting up a business in Japan is also not so hard. Requires only a minimum ofdocuments + approximately 1 month of time for registration/review. No capital requirements.

http://www.jetro.go.jp/en/invest/setting_up/laws/section1/page3.html

Now actually succeeding as a business in Japan might be far harder than in other place, but succeeding as a startup business is generally hard anwywhere.

18. November 2014 at 06:12

dtoh, You said:

“A) There already is quite a lot of immigration. B) If you had growth, you wouldn’t have a stagnant population. The low birth rate is an effect not a cause of the economic problems.

Japan’s problem is structural and very obvious. High taxes and regulations are strangling new business formation. If Japan fixed these problems they could easily get 7% ongoing real growth.”

I strongly disagree with all of these points. I won’t believe there is a lot of immigration unless I see the data. Their working age population is falling at 1.2% per year. Any immigration they have obviously isn’t having much effect.

We know that the other East Asian developed countries (Singapore, HK, Korea, Taiwan) have as low or lower growth rates, and they are booming. So economic problems is not causing the low birth rates.

Supply side reforms might boost trend growth to 1%, but not 7%.

Mike, I said:

“And when they are unquestionably in recession, as during 2008-09, the unemployment rate in Japan rises just as in any other country.”

And only you could interpret the statement as follows:

“By this new definition of recession Japan was never in recession in the first place.”

Saturos, Interesting, that certainly bears watching.

18. November 2014 at 07:40

But what happened to NGDP growth? Has it been on a predictable upward trend or not? I’m surprised that Scott did not report on this. If it has been then he has something to explain. If it has not then he has something to criticize. The sort-of criticism of increased consumer tax with additional expenditure seems irrelevant if BOJ was doing its job. But we do not know.

18. November 2014 at 07:47

A revaluation of yen (as Turkey did with lira for other reasons before years) could be a way by increasing the value of yen for a short term period to stabilise Japan in a possibly “like” a recession period?

The current QE in terms of the yen/dollar today is appreciated differently compared 2 years before.80 tril yen are about $700 bil, when before 2 years where almost $ 1 tril.

18. November 2014 at 12:28

Go badgers! Seriously, it seems debt truly doesnt matter if you can print your own currency so why pretend like it does?

18. November 2014 at 14:13

Thomas, NGDP growth has also been very weak, and hence money is too tight.

Just don’t, Just don’t tell the Zimbabwean people that debt doesn’t matter when you can print your own money.

18. November 2014 at 15:52

Scott,

A couple of things.

– Large cities (i.e. Singapore) are a bit of a special case because of very high child rearing costs.

– Compare Korean fertility rates to the GDP growth rates. Sure there is a long term trend, but I think you’ll see there is a pretty close correlation with growth rates as well.

– Immigration data is tricky to interpret in Japan because of the number of very long term Korean and Chinese residents, but take a look at the number of student visas or walk into any convenience store, fast food restaurant or construction site in Tokyo.

– Like births, you can’t confuse cause and effect for growth and immigration. No jobs = no immigration. With even very modest growth rates, you would immediately see annual increases in foreign workers of 500k (1% of workforce).

– I stand by 7% growth. Not enough room in a comment to discuss this, but if you compare per capita GDP and productivity between U.S. and Japan and then compare education, skills and motivation of Japanese workers to U.S workers, you would probably say 15% not 7%. (Just to be clear – I’m talking about elimination of all taxes on capital not just small tweaks to tax rates.)

19. November 2014 at 05:40

dtoh, Japan did not allow much immigration when it was booming in the 1980s, so I doubt growth will affect that very much. What are the numbers for net immigration each year (which may be very different from gross immigration?)

If the large city effect in the problem in Singapore, that suggests Japan is hopeless, as it is dominated by large cities like Tokyo, Osaka, Nagoya, etc.

Korea is still growing faster than Japan, and faster than Japan is likely to grow with supply-side reforms, and has an even lower birth rate. So I just don’t buy the claim that faster economic growth will significantly raise the birth rate. It would require many more women to work, which makes it even harder to raise children.

Supply side reforms might produce one or two years of above normal growth, but not 7% per year.

19. November 2014 at 15:24

East Asian low birth rates are due to the educational system. It simply costs too much in time and money to have many kids. Cram schools from K-12, and picking your kid up at 10 pm every night.

Simply, it sucks. This is why they all have low happiness scores, too.

19. November 2014 at 16:53

@Harun, I guess that in east Asia they really, really need Bryan Caplan to finish his book about education.

19. November 2014 at 18:46

Scott,

You need a growing economy (or expectations thereof) and relatively free immigration rules if you want immigration. In the 80s, Japan had the former but not the latter. Now they have the latter but not the former.

Net immigration numbers are hard to come by. (Japan has a large population of Chinese and Koreans nationals who are multi-generational.)

Look at what happened to the Korean fertility rates through the last recession. Maybe given the same growth rates, Korea will have a lower fertility rate, but in either country the rate will go up if economic growth rates go up. (As will immigration)

Yes, Japan has big cities, but given that, they will still have higher fertility rates if they have higher growth.

I don’t think you can conclude that birth rates will drop with more women working. Maybe working women will have more children. Or non-working women will have more children.

Definitely 7%…. at least if you get rid of taxes on capital (and a few other supply side reforms like employment at will).

1. January 2015 at 03:03

[…] years later, trend real GDP in Japan is around 0.0%, by Sumner’s (offhand) estimation and I don’t doubt it. Had the BOJ maintained the 9.5% NGDP target in this alternate timeline, […]

27. May 2015 at 15:12

[…] times, many recently following a taxation boost final year. Given a low trend enlargement rate, “Japan will have lots some-more ‘recessions’ during a 21st century,” predicts Scott Sumner, an economist during a Mercatus Center, a consider […]

27. May 2015 at 19:45

[…] times, many recently following a taxation boost final year. Given a low trend enlargement rate, “Japan will have lots some-more ‘recessions’ during a 21st century,” predicts Scott Sumner, an economist during a Mercatus Center, a consider […]

27. May 2015 at 22:01

[…] times, many recently following a taxation boost final year. Given a low trend enlargement rate, “Japan will have lots some-more ‘recessions’ during a 21st century,” predicts Scott Sumner, an economist during a Mercatus Center, a consider […]

29. May 2015 at 04:09

[…] times, most recently following a tax increase last year. Given its low trend growth rate, “Japan will have lots more ‘recessions’ during the 21st century,” predicts Scott Sumner, an economist at the Mercatus Center, a think […]

23. February 2017 at 05:07

[…] years later, trend real GDP in Japan is around 0.0%, by Sumner’s (offhand) estimation and I don’t doubt it. Had the BOJ maintained the 9.5% NGDP target in this alternate timeline, […]