Investment bleg

Here’s Paul Krugman:

The political payoff, of course, never arrived. And the economic results have been disappointing. True, we’ve had two quarters of fairly fast economic growth, but such growth spurts are fairly common — there was a substantially bigger spurt in 2014, and hardly anyone noticed. And this growth was driven largely by consumer spending and, surprise, government spending, which wasn’t what the tax cutters promised.

Meanwhile, there’s no sign of the vast investment boom the law’s backers promised. Corporations have used the tax cut’s proceeds largely to buy back their own stock rather than to add jobs and expand capacity.

He’s right about GDP growth in 2014, but I’m not seeing data to support his claims about investment. Am I misinterpreting the investment data?

[BTW, in early 2014 Krugman thought the elimination of extended unemployment benefits would hurt employment growth. I thought it would help. It helped a lot.]

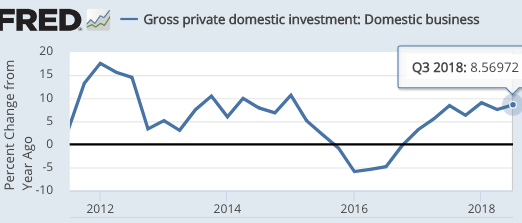

The Fred data site reports that both total investment and business investment are rising at a pace of about 8% per year, which is roughly 6% in real terms. Isn’t that consistent with the corporate tax cut helping? And job growth has been stronger than many (including me) expected, given the low rate of unemployment. Of course it’s nothing like the miracle Trump promised when he suggested the real unemployment rate was 20% to 40% (and I expect growth to slow next year), but that’s a separate question from the issue of whether the corporate tax cut helped the economy. The data suggest it has, unless I’m missing something. This graph shows growth rates for business investment:

PS. Why is Trump trying to drive down oil prices? In the second half of this post, I showed that high oil prices now tend to boost industrial production—mostly due to fracking. Doesn’t Trump want more industrial production? Look at investment growth in late 2015 and 2016, when oil prices were low.

PS. Why is Trump trying to drive down oil prices? In the second half of this post, I showed that high oil prices now tend to boost industrial production—mostly due to fracking. Doesn’t Trump want more industrial production? Look at investment growth in late 2015 and 2016, when oil prices were low.

PPS. The criticism of the Trump tax cuts that people should be making relates to the budget deficit. But many on the left have lost credibility on that issue, and hence they tend to keep quiet.

PPPS. Happy Thanksgiving everyone!

Tags:

22. November 2018 at 16:58

Krugman also pointed out that accounting conventions can influence where investment takes place, at least on paper. So if nation A lowers its tax rate, then multinational corporations will say that investment took place in nation A. Another complicating factor is that 35% of the US stock market capitalization is owned by offshore entities.

Wall Street economists seem to think the corporate tax cut primarily resulted in share buybacks.

Then again, much of the US stock market is owned by permanent investors, such as pension funds and mutual funds. So would corporate stock buybacks result in higher PEs?

We do know that the federal deficit has been ballooning. Perhaps the US Federal Reserve will buy back a few trillion more of US Treasuries in the next recession thus offsetting this latest increase in federal debt.

Which also raises a fascinating point. Like the American stock market, US Treasuries are owned globally. There is something like $270 trillion of investable assets on the planet ( this figure includes property).

So, the Federal Reserve buying back $4 trillion in Treasuries is but a small cup in the bucket, if we assume globalized capital markets.

It is a bit depraved to say so, but it appears the Federal Reserve could monetize the national debt for a long long time.

23. November 2018 at 05:04

Scott,

Lowering the tax rate on capital > increased investment > higher growth.

You have previously stated that lower taxes on capital result in a one time increase in growth but do not permanently increase the growth rate.

Could you elaborate?

23. November 2018 at 07:27

Witheld income & employment tax data looks pretty strong despite the lower rates for 2018. Krugman may be wrong on the GDP numbers being a blip.

23. November 2018 at 08:07

And why the hate for stock buybacks? I mean, I can sort of understand hate for stock buybacks from economically illiterate peoplw, but wouldn’t Paul Krugman know better?

(The stock buybacks are just listed companies giving back capital to shareholders. The shareholders can either consume that capital (and consumer spending was supposed to be a good thing?), or invest it elsewhere (which was also supposed to be a good thing?). Or am I missing something?

23. November 2018 at 08:23

Matthias – i agree. Further the cuts have helped fund corporate pension plans.

23. November 2018 at 08:28

Matthias,

Nothing wrong with them per se. However, it leads one to believe that at the minimum the companies who engaged in buy backs had no better investment opportunity for the cash.

If the best use of the cash is to engage in stock buy backs, what does that say about their view of long term revenue growth opportunities?

My rough take is that it assumes incorrectly the investment opportunities that the real growth firms face.

We’re seeing a world in which marginal cost for growth companies is historically low. They don’t need to buy land and build a factory.

Network effects and regulatory arbitrage/capture are king. In a rent seeking world, the best use of cash is a buyback. But maybe that’s too pessimistic….

23. November 2018 at 10:10

Happy Thanksgiving to you too! Krugman’s claim about the investment data seem to be “there’s no sign of the vast investment boom the law’s backers promised”. The chart you provide doesn’t show any kind of ‘vast investment boom’ happening yet so I’m not sure why you disagree with him.

23. November 2018 at 11:22

dtoh, That’s the standard Solow model, based on diminishing returns, etc. Think of a primitive farm. Adding a tractor helps. Another another helps more, as the farmer’s son can use it at the same time. Adding another 10 tractors helps very little. There are diminishing returns.

Matthias, I agree.

Jerry, But there is the sort of investment boom that sensible proponents of supply side economics would have expected. He’s not just criticizing Trump’s extreme claims, but also the entire supply side agenda.

23. November 2018 at 15:11

Scott, how much of the investment downturn in 2015 was the result of the Fed’s overly tight monetary policy versus the decline in oil prices? Also, because of Saudi Arabia’s attempt in the 2014 to 2016 time frame to drive US shale oil producers out of the market, many of them have made significant improvements in lowering their marginal costs since then.

23. November 2018 at 19:06

Speaking of investing in plant and equipment in the US, and will the corporate income tax cut change things, ponder this from IHSMarkit:

“The expansion of the FPD (flat panel display) equipment market that started in 2016 has been driven by the high equipment intensity of new flexible active-matrix organic light-emitting diode (AMOLED) display factories and the scale of Gen 10.5/11 LCD factories,” said Chase Li, senior analyst at IHS Markit. “This expansion has been further fueled by Chinese local governments, which have supported panel makers with various mechanisms such as financing, land grants, reduced taxes, infrastructure and direct subsidies.”

Okay. So, why would anybody risk capital to build a flat-panel display factory in the US? Even if you wanted to, could you get financing? Would it be prudent is risk capital on a factory in the US, given that China engages in “financing, land grants, reduced taxes, infrastructure and direct subsidies” of factories? What if China amps up its level of support for such factories in response to your new factory?

Would not this reality of China’s manufacturing scene tend to suppress capital investment in the US?

So…okay we see less new plant and equipment in the US,a and we turn manufacturing over to the Chinese.

Now, in free-trade theory, this should result in higher living standards for Americans. But a funny thing happens on the way to the Life of Riley. We have to pay for those imports.

Scott Sumner says Americans can trade houses for imports, and they are. But there is a problem in that. In many regions of the nation, housing supply is scarce, and kept tight by property zoning. So we see house prices soar—which feeds into the PCE core, and thus requires the Fed to tighten up. A tighter Fed must suffocate economic growth. Higher housing costs also means lower living standards.

So is this a win for the exalted American consumer? A tighter Fed and higher housing costs?

And what of the long-term effect of reduced investment in capital plant and equipment in the US? No worries?

Chronic US current account trade deficits are financed by borrowing money or selling assets. 35% of the US stock market capitalization is already owned offshore, and that fraction is rising. Some might regard this as economic colonization.

I have nothing against corporate income tax cuts and stock buybacks, in fact I do not support taxing productive behavior at all. But remember, the US operates in world of dirigiste economies and intensive property zoning in the US, and many other structural impediments.

Free market theories tend to be weak on how economies develop or re-develop in the modern world.

Given current ground rules, it makes sense for US-based multinationals to respond to corporate income tax cuts by share buybacks and increasing investment in plant and equipment…in China.

24. November 2018 at 05:10

The investment opportunities can be in different industries and companies. That’s why the buybacks may be best for all of us.

24. November 2018 at 12:20

Gordon, That’s hard to say. But industrial production in energy was especially weak.

25. November 2018 at 10:51

Scott, you are right that GPDI looks okay but if you look at the components of it, the promised investment boom is hard to find. Last quarter the largest contribution to GDP within GPDI was inventories and that seems likely to have been at least partially a function of existing and anticipated tariffs.

But that was only the most recent quarter. Looking back a little further one does find a pretty good run of investment in equipment. But it starts in Q1 2017 (+9.1%) and by the most recent quarter is only +0.4%; it mostly precedes the change in the tax law. The big contribution of non-residential structures is essentially fracking and has little to do with the tax change. There is a recent rise in intellectual property investment but I’m not familiar enough with the category to know what that might mean. It certainly sounds positive but it also seems hard to measure.

Overall, I don’t see any boom from the tax changes.

27. November 2018 at 15:08

If the GDP growth was coming from incentive (AS) effects, wouldn’t you expect to see downward pressure on prices? TIPS spreads rose as growth accelerated, which implies to me that this is caused by demand.