In China, the nominal wages are real

This is not fake news:

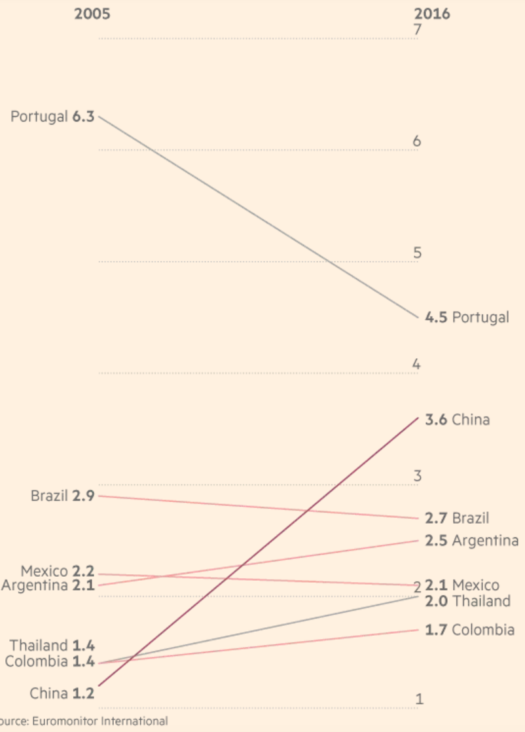

Average wages in China’s manufacturing sector have soared above those in countries such as Brazil and Mexico and are fast catching up with Greece and Portugal after a decade of breakneck growth that has seen Chinese pay packets treble.

Across China’s labour force as a whole, hourly incomes now exceed those in every major Latin American state apart from Chile, and are at around 70 per cent of the level in weaker eurozone countries, according to data from Euromonitor International, a research group.

And here’s a graph of real wage growth (not PPP adjusted):

Why is this important? Because year after year we see China pundits predicting a crash. When it doesn’t happen, some people claim the GDP numbers are “fake news”. The problem with these arguments is that the Chinese wage numbers (showing real wages growing at 10.5% annually over the past 11 years) are consistent with the reported gains in GDP. So the Chinese government would have to get its 1.4 billion people to participate in The Great GDP Cover-up, by getting them to also lie to reporters about their wage gains.

Why is this important? Because year after year we see China pundits predicting a crash. When it doesn’t happen, some people claim the GDP numbers are “fake news”. The problem with these arguments is that the Chinese wage numbers (showing real wages growing at 10.5% annually over the past 11 years) are consistent with the reported gains in GDP. So the Chinese government would have to get its 1.4 billion people to participate in The Great GDP Cover-up, by getting them to also lie to reporters about their wage gains.

My wife recently mentioned that her mother was now paying 35 yuan/hour (i.e. $5/hour) to her maid, a sum that her mother found completely mindboggling. So what’s the theory? Is my mother-in-law participating in the cover-up, lying to her daughter? Or maybe my wife is fabricating Chinese wage numbers, to make her homeland look good. Perhaps I married someone in the Chinese propaganda ministry.

Hmmm . . . that would explain . . .

Seriously, it’s time for people to face reality. China is not a bubble; it’s a very successful developing country. The GDP data is real, even if it’s nominal. China may well have a debt crisis at some point in the next decade or two, but like South Korea it will recover and move into the high income category.

PS. If anything, the wage data suggests that China may be understating its GDP growth, as China’s reported GDP (PPP adjusted) is still well below the levels of Mexico and Argentina.

PPS. When China’s crash does occur, you can be 100% sure I will have failed to predict it. Just as I promise you I will fail to predict the next US recession. And the next stock market crash.

Tags:

28. February 2017 at 18:10

Isn’t the returns on capital far lower in China versus Mexico or Argentina? That would explain for wages taking a higher percentage of GDP.

28. February 2017 at 20:11

My parents are from Mexico, and I shared this information with them. My father asked, “What could Mexico do to to increase wages like China?” He was also surprised since he believes Mexico is much more freer than China.

1. March 2017 at 03:38

This post is correct, but China will not have a “debt crisis.”

Every few years, the People’s Bank of China buys sour loans from the banking industry. I think the PBoC basically prints money and buys the bad debts, and thus the banks are subsequently unencumbered.

The PBoC is still below its inflation target, so this evidently can work without setting off inflation.

For that matter, the Bank of Japan has been essentially buying back huge amounts of debt, and they are still struggling right on the line with deflation in Japan.

Both China and Japan run trade surpluses. I am not sure how this plays into the ability to monetize debt without consequence, but maybe it does.

China and Japan do not have inflation pressures in the property sector caused by capital inflows.

China has some housing inflation, due to property zoning in major cities and rapid growth, but not due to running trade deficits.

Orthodox macroeconomists and doomsters for years have been predicting gloom in China’s banking sector. They seem blissfully unaware the PBoC went through a round of buying sour loans a few years ago, without consequence.

Call it QE and eliminating bad debt at the same time.

I suspect that China’s banking system is much sturdier than that of the United States, due to this PBoC release valve.

The US bank problem response was the 2008 Gong Show.

1. March 2017 at 04:41

https://www.bloomberg.com/news/articles/2016-06-02/china-toxic-debt-solution-has-one-big-problem-as-banks-buy-npls

The above is a great chart showing the PBoC periodically buying bad debt…and the China economy continues to flourish as Scott’s post indicates. Inflation has actually been going down.

There remains a professional macroeconomist taboo, a nostrum, a near ideological superstition that central banks cannot acquire bad debts, or conduct helicopter drops, or conduct QE, to positive effect.

Yet the historical record is abundant, from Japan’s helicopter drops in the Great Depression, to the Federal Reserve’s QE program, to China’s present-day buying of bad bank debts, that central banks can often obtain excellent results through such interventions.

The doomsters are lucky to have Zimbabwe…Germany was getting long in the tooth as a story. Well, there is always Argentina.

1. March 2017 at 05:13

Sometimes I think China works because it is unencumbered by ideology. Just get growth. Do whatever to get growth. Too bad Americans are burdened by ideology.

1. March 2017 at 06:10

James, That might be part of it.

Benny, “Ideology” is usually a code word for “ideas I disagree with”.

Keep in mind that America “works” far better than China, so your two country example doesn’t quite prove your point.

In addition, I see little evidence that America is burdened by ideology, we seem to elect people based on personality, not ideas.

I do agree with you in one sense. China became less ideological after Mao, and has obviously done much better.

1. March 2017 at 09:58

Fake news. Everybody knows China lies about ‘wage growth’. Witness the city in south China were everybody is a millionaire, provided they don’t leave the city (the ‘millions’ they ‘own’ are in fact owned by the city government).

OT- “India’s GDP figures were just released and lo and behold they are great! Quarterly growth for Oct-Dec (demonetization, the banning of 86% of India’s cash, hit on Nov. 8) was 7% on an annual year over year basis. Many analysts and critics had predicted a significant slowdown” – reported by Alex Tabarrok in Marginal Revolution. More proof that money is neutral (reducing the money supply via an implicit tax had no effect on NGDP or real GDP). When are you going to blog about this, Dr. Sumner, as you promised? See also Moldova.

1. March 2017 at 10:48

Dr. Sumner,

This is a very interest and useful piece. What I find important is that Chinese real wages are increasing despite the fact that China is leading the world in applying robotics to manufacturing [1][2]. Chinese workers are being replaced by robots [3], mostly by imported robots [4]. However, despite this, China’s economy continues to expand. Robotics, and automation generally have not had a negative impact on the Chinese economy in general.

On of the on-going arguments in the United States has been role of the export of capital, globalization, and free trade on the status of the US working class. Whilst some argue the export of capital (‘off-shoring” or “délocalisation) is the cause of decaying conditions in many parts of the formerly industrialized regions of the US (and elsewhere), working through the loss of manufacturing jobs, a common response is that most job loss in this area is caused by automation and the use of robots. This article however contradicts that argument, China is rapidly automating and “robotisizing” but the conditions of the working class are, at least in terms of wages, improving.

[1] https://www.technologyreview.com/s/601215/china-is-building-a-robot-army-of-model-workers/

[2] https://www.ft.com/content/1dbd8c60-0cc6-11e6-ad80-67655613c2d6

[3] http://www.bbc.com/news/technology-36376966

[4] https://www.bloomberg.com/view/articles/2016-06-09/china-has-a-robot-problem

1. March 2017 at 10:58

@ssumner: Maybe ideology isn’t exactly the right word, perhaps it’s partisanship. China has only one party so they are all working together to get growth (and of course stay in power doing exactly that). In the US the two parties now hate each other and prefer fighting to working together. Solving problems isn’t really high on their agenda.

1. March 2017 at 11:09

Rising wages in China also makes Trump’s obsession about trade with China idiotic, since China’s cost advantage is, as one would expect, diminishing. Indeed, trade with China is entering a new phase, from one where China produced goods for Western (American) forms (because of cost advantages in China) to one where China produces goods for China firms. In this new phase, goods produced in China for China firms will compete against goods produced by western firms including goods produced in China for western firms. Yes, China is rapidly becoming a creator and producer of technology. Sure, western firms will complain that China stole the technology from western firms, but that won’t make China’s goods any less appealing to buyers in western countries as well as in China.

1. March 2017 at 11:38

What portion of the three-fold rise in the average Chinese manufacturing wage is due to changes in composition? Less employment in low value-added manufacturing and a greater proportion in higher value-added.

Employment in manufacturing basic goods and apparel is almost certainly growing slower if at all in China; countries like Vietnam, Cambodia and Bangladesh are today capturing the global growth and relocation of these industries.

1. March 2017 at 12:01

Ray, India supports my monetary transmission mechanism, as I already pointed out. I’ll post on it when the data for Q1 is in.

Alex jumped the gun–but I hope he is right (in which case I will be right.)

David, Good point. Ultimately, real wages depend on productivity, and robots boost worker productivity.

msgkings, But then why is the US doing better than China?

I’d add that China has several factions, which often strongly disagree as to which direction the country should move. Hence reforms are occurring more slowly than you’d like.

Rayward, I’d add that low wages don’t give China a cost advantage, as they reflect low productivity.

Numeraire, That’s part of it.

1. March 2017 at 13:10

@ssumner: why is the US ‘doing better’ than China? We have been far ahead of them for centuries, but they are catching up. Will we still be ‘doing better’ in 20 years? 40? Hard to say.

1. March 2017 at 13:20

very random Q with no better place to ask it- what evidence is there for or against the existence recognizable business cycles before the industrial revolution?

1. March 2017 at 15:03

Scott,

Not a code word, really. You said “China became less ideological after Mao, and has obviously done much better.” On this I agree. China is “communist” in name rather than deed these days, so much the better for everyone.

1. March 2017 at 20:39

@Sumner – who says: “Ray, India supports my monetary transmission mechanism, as I already pointed out. I’ll post on it when the data for Q1 is in.” – professor, I have to hand it to you that seem to always say this. It’s like some skit from Monty Python I’ve never seen, where somebody says “have you ever done X?”, and the buffoon (that would be you) keeps saying “I’ve done that”, no matter how ludicrous X may be (maybe some variant of the empty cheese shop, which I have seen). If Bernanke writes a paper in 2002 (as he did, the FAVAR paper) saying the Fed has very little power, and money is largely neutral, you’ll simply say: ‘My NGDPLT supports that’. If 180 economists all sign a letter saying NGDPLT does not work, you’ll counter “My NGDPLT supports that”. Everything and the kitchen sink included, you’ve already said that, somewhere in the archives of this site. Amazing! I wonder then what’s left to say? Why am I even reading this site anymore? It’s all been said and done, I should just go home (probably a good idea). Good night!

2. March 2017 at 20:30

msgkings, Yes, we’ll be doing better in 20 years, and probably in 40. And by then China will be democratic, like us.

30. March 2017 at 10:58

Is it possible that Chinese wages look artificially high because the CNY is overvalued? China has currency controls, which is slowing capital flight.

What is insane is the fact that China still has an export surplus, despite an overvalued currency. If you look at property prices in Chinese cities, they are routinely the equal of property prices in Europe and Canada/US.

7. June 2017 at 13:35

Jeff, after the dollar has fallen over 8% since January, we can fell that the yuan is not “overvalued”. Furthermore, the yuan has naturally appreciated 35% since 2005, and only lost 8% over the last two years.

Undervalued and overvalued are buzzwords that imply that the markets are significantly wrong. Everyone (and I mean everyone) was claiming that the yuan would be 7.2-7.5 to the dollar by year end. Now it is 6.75.

Most big bank Fx predictions are bogus meant to influence the market in the direction of their trade. The exact same thing happens for credit raters.

The Yuan is strengthening because China is strengthening while the case for US rate hikes and US growth increases has diminished.