How low is the natural rate of interest?

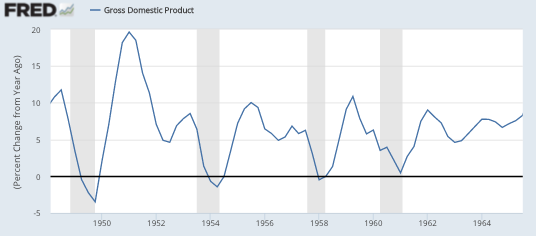

I have a new post at Econlog on the natural rate of interest. Here I’d like to suggest that it might be lower than many people assume. Here’s the rate of NGDP growth from 1947 to 1965:

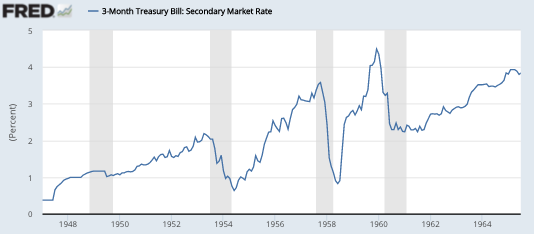

And here is the yield on T-bills during that period:

And here is the yield on T-bills during that period:

Notice that NGDP growth averaged around 6% during the first few postwar decades, and T-bill yields averaged around 2% or 3%.

Notice that NGDP growth averaged around 6% during the first few postwar decades, and T-bill yields averaged around 2% or 3%.

Today the Fed is implicitly targeting NGDP growth at 3%. (They still think it’s about 4%, but they’ll figure it out eventually.) If trend NGDP growth is now about 3% lower than during the postwar period, you might expect the natural interest rate to also be significantly lower, indeed close to zero.

Of course if you used more recent periods then the results would be a bit different. My point is that there isn’t really anything unprecedented about the current low level of rates. We’ve seen interest rates at a level 3 percentage points below trend NGDP growth before, so there’s no saying it can’t happen again. I still expect interest rates to rise next year, as does the market, but hopefully this exercise will give you a sense of why both the market and I are pessimistic about the Fed’s ability to drive rates much higher by 2018.

Tags:

2. November 2015 at 06:41

S.T.U.P.I.D. = “Notice that NGDP growth averaged around 6% during the first few postwar decades, and T-bill yields averaged around 2% or 3%.”

Hay-Zeus, does Sumner not know that during the postwar decades the USA and most countries practiced ‘financial repression’? Up until 1980 the rate at which paper could be sold to retail consumers was fixed for most common demand deposits, and this spilled over into the bond market. If you need more information, just read this paper found online: “The return of financial repression” by CARMEN M. REINHART, Banque de France – Financial Stability Review – No. 16 – April 2012

No Sumner devotees, S.T.U.P.I.D does not mean STUPID, it means something else. If I want to call Sumner stupid, I don’t have to resort to an acronym.

2. November 2015 at 06:51

Scott,

There doesn’t seem to be any clear bias with longer rates. Is it due to term premia, coincidence, or is there actually something here?

https://research.stlouisfed.org/fred2/graph/?g=2nOa

2. November 2015 at 07:45

More and more convinced there can no more be a natural rate of interest than a natural rate of inflation, especially since inflation expectations are themselves a component of the nominal interest rate.

2. November 2015 at 07:49

Mark Sadowski has been busy;

https://thefaintofheart.wordpress.com/2015/11/01/qe-and-business-investment-the-var-evidence-part-3/

‘Thus equipment is by far the most important component of business investment, and I find it remarkably difficult to believe, given QE’s demonstrably positive effect on investment in equipment (as well as its demonstrably positive effect on the output and price level), that it might have a negative effect on business investment overall.’

2. November 2015 at 10:38

@TallDave, Imagine a world without money. I believe the concept of an interest rate would still apply in such a world. To me, THAT is the natural rate of interest (unknowable of course.)

2. November 2015 at 11:46

how can there be a ‘natural’ interest rate/ inflation/deflation etc rate for some thing thats isn’t ‘natural’ at all since its man made?

and with out money (o any thing with similar characteristics), how would inflation, or interest, or GDP, deflation even register?

2. November 2015 at 11:56

@dw, I give you a goat today, you pay me back with two goats a year from now.

2. November 2015 at 12:05

If women were used as currency you would have a natural negative interest rate. I would lend you a 26 year old and you would pay me back, in 2 years, with a 21 year old. 🙂

2. November 2015 at 12:56

It’s a good point that there’s nothing special about zero when it comes to real interest rates. The difference between low and negative real rates is one of degree – not one of kind. And it’s not clear why short-term, risk-free rates should be positive, even if there exist risky, medium- to long-term investment opportunities with expected positive returns. Real short-term rates first dipped negative back in 2002-2003. That might have been the canary in the savings-glut coal mine. Banks came up with a witches brew/alphabet soup (pick your metaphor) of ABCP/SIV/CDOs to recycle risky subprime mortgages into AAA-rated paper, and that postponed the inevitable until Greenspan, perhaps mistaking the rusted-out, bald-tire jalopy of the US financial system for a Ferrari, attempted a sharp corner by tightening rapidly in 2005-2006 and ended up putting the whole economy into the ditch.

2. November 2015 at 13:38

The Fed is targeting 2% inflation but is getting 1.5% inflation. Their implied NGDP target is 3%, but they likely think it is 4%. They have not figured either out it seems. What policy actions could they perform to get their desired target? Betting markets, futures markets, etc. can at least tell them what an efficient market believes. The markets believe 1.5% and 3%, respectively, presumably—based on your comment. The Fed must believe inflation will rise to 2%, even though the market does not—–since they are signaling higher rates. Why do they believe this?

My favorite answer (third time I have said this) is they simply want to get rates higher because it “feels” better (or because they can lower them again when they “need” to). I really do think it is this crazy.

2. November 2015 at 13:49

Brian — I don’t think the existence of money matters one way or the other, people would just use some commodity. And then we’d be arguing over what is the “natural” amount of gold or wheat or goats one expects in future promises relative to the amount lent today. Which, again, would depend on expected inflation in terms of that commodity.

2. November 2015 at 15:45

Don´t try looking for Wally when there are many clones hanging about!

https://thefaintofheart.wordpress.com/2015/10/25/looking-for-wally-when-there-are-many-wallies/

2. November 2015 at 16:03

I am surprised Scott Sumner expects higher interest rates in the future, although he left unspecified whether he meant real or nominal.

Seems like there is plenty of capital available, and the world is experiencing slow growth. Inflation continues its 30-year trend lower and lower. Global central banks are loath to stimulate growth.

I expect even lower interest rates ahead.

2. November 2015 at 17:10

A fairly accurate estimate for the level of natural rates, which also misses the mark, is the average real rate of profit. This variable is the closest measure we have to the difference between productive expenditures and total expenditures. The higher people’s time preference is, the more present goods are valued relative to future goods, and the lower people’s time preference is, the less present goods are valued relative to future goods (all the while of course are present goods valued higher than future goods in absolute terms).

If I place more value on future goods, I will save and invest more relative to my consumption. By doing so I bring about higher productive expenditures relative to total expenditures. That in turn reduces the average rate of profit, which in turn forces interest rates downward.

The more I consume on the other hand, the less productive expenditures I will make relative to total expenditures. That increases the average rate of profit, which in turn forces interest rates upward.

We can estimate the average rate of profit in the economy by dividing total business costs by total business revenues, and to minimize accounting shenanigans, we should look at for example the total private investment and NGDP

This difference, by the way, has been on a perpetual INCREASE since as far back as our data goes:

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=2omo

The huge difference between private investment to total spending suggests that the natural rate today, after decades of relentless Fed intervention designed to stave off correction after correction, is extremely high today.

Market monetarism doesn’t have a valid theory of markets with which to work. It takes government for granted too often and in too many sets of data.

2. November 2015 at 17:30

“people would just use some commodity. And then we’d be arguing over what is the “natural” amount of gold or wheat or goats one expects in future promises relative to the amount lent today. Which, again, would depend on expected inflation in terms of that commodity.”

That’s a big part of the reason that futures markets are naturally in contango. Forward goats are more expensive because I am essentially giving you a goat today at todays $ and you will be giving me back 1.015 goats * todays $ at a future date.

2. November 2015 at 18:58

Benjamin Cole, an apt student of Sumner’s and presumably a good reader of his writings, is surprised that Sumner is calling for higher, not lower, rates. Goes to show that after years and years of reading this blog, people who fully support Sumner’s worldview and are sympathetic to him still can’t figure him out. Which goes to show what a clever economist Sumner is, speaking from both sides of his mouth, like the oracle at Delphi.

Wikipedia:

In 359 BC, Philip II of Macedon consulted the Oracle and was told:

With silver spears you may conquer the world

The king then sought to control the silver mines in the neighbouring Thracian and Illyrian kingdom, and using them to bribe his way to early victories, playing one Greek state off against the others, and isolating his enemies by bribes to potential allies.

An early example of monetarism in practice. But, since we know money is neutral, this form of money illusion was vastly overrated, not unlike the Spanish ‘resource curse’ of silver from the New World.

2. November 2015 at 22:04

Noah Smith has a new column on John Cochrane and economic growth:

http://www.bloombergview.com/articles/2015-11-02/conservatives-don-t-have-a-secret-formula-for-growth

http://noahpinionblog.blogspot.com/2015/11/growth-vs-static-efficiency.html

3. November 2015 at 04:38

@Brian Donohue,

Interesting thought experiment. If it could be carried out in reality, there would be a significant liquidity premium built in so you still couldn’t observe a natural interest rate. People willing to take 2% interest on their cash will actually want 2 goats for one.

Wait, we did have that experiment a long time ago and that’s why they invented money! : -)

3. November 2015 at 05:24

@TravisV

I stopped reading Noah Smith a long ago. But urged by you, I decided to read this time. And frankly, he does not seem to know what comppounding is. In addition, he is one of those people who believe that technology driven growth just “happens” in society, no need for entrepreneurs and tech companies turning technology into actual products. Seriously, other people may disagree, but I don’t understand why this guys receives so much attention …

3. November 2015 at 07:28

@Jose Romeu Robazzi – my Brazilian friend you are profoundly ignorant of economic theory, though you seem to understand finance. In fact, Noah Smith is simply espousing the well-known and uncontroversial Sobel model for economic growth, where only technology drives growth in the long run, and the other factors (taxes, savings, etc) merely help one reach the production possibilities frontier faster. The Solow model is logical and simple to derive, but technology is deemed “dropped from the heavens”, i.e. exogenous to the economy. Given the weak (IMO) incentives to invent, this is not necessarily a bad assumption, that is, most really worthy inventions do indeed drop out of the sky randomly, designed by Nobel Prize winning inventors, who, ex ante to winning the Nobel, were more or less inventing for the fun of it (e.g., a university researcher with tenure). However, I do believe innovation can be engineered, so I think other models like perhaps Romer’s are more accurate for growth, but, I can’t prove it. In this sense I’m like Sumner. Sumner thinks his NGDPLT is a superior monetary framework but since nobody in history has tried it, he can’t prove his framework works (never mind money neutrality). So he resorts to ‘pounding the table’ with faux-certainty and bulling his critics; a poor substitute for being courteous but that’s Scott being Scott.

3. November 2015 at 07:31

@myself – “Solow” growth model, not Sobel.

3. November 2015 at 07:46

i wrote it also to Murphy blog, but confusion is in what hapenes when

NAtural rate = MArket rate. i think you scott thinks price stability

and Bob thinks in growing economy it means deflation.

however i dont understand how you could said in one blog before that price level is going down in growing economy

and i think u added that because of CB price are stable. which is confusing for me…

3. November 2015 at 08:26

Scott. Care to explain why you think rates will rise next year? Growth is currently below historical trend, and slowing. Inflation is also falling. Where will higher rates spring from?

3. November 2015 at 09:28

Mike Rulle

Cen banks think inflation is going to 2% because their model tells them that the output gap determines inflation. All cen banks use the same standard macro model. It is a clash with the other big macro idea that AD determines inflation, and the cen bank determines AD.

https://thefaintofheart.wordpress.com/2015/11/02/central-bankers-on-target-with-their-targets/

3. November 2015 at 11:45

Ray, Maybe.

DF, Why choose Germany? What does the US look like?

Mike, Be patient, they’ll figure it out eventually.

Ben and David, I expect rates to be lower than the Fed does. My forecast is the market forecast, thus I expect rates will rise slightly next year..

3. November 2015 at 13:38

Scott: Perhaps rates will rise on the short end. But the long end will continue to reflect nominal growth and inflationary prospects, which continue to deteriorate.

3. November 2015 at 20:34

Sumner (after I said he was a Janus-two-faced son-of-a-gun): “Ray, Maybe.”

He did it again! He’s messing with my mind….ahhh! Enough to make me stop posting here…maybe that’s his intent. Your loss reader. 😉

4. November 2015 at 18:05

David, Yes, I expect long rates to stay low.

Ray, Please don’t go, not right after you said something that might actually be correct.

5. November 2015 at 15:34

[…] Scott Sumner added that there was “nothing natural about the natural rate of interest” and added some comments and charts on his own blog, declaring that the natural rate is surely […]