Greg Ip on trade imbalances and demand

Ramesh Ponnuru sent me a WSJ article by Greg Ip:

If workers lose their jobs to imports and central banks can’t bolster domestic spending enough to re-employ them, a country may be worse off, and keeping those imports out can make it better off.

Mr. Summers, a former Treasury secretary, is no protectionist and no fan of Mr. Trump, whose election, he warns, could lead to recession in the U.S. and financial crisis abroad. But he does worry that chronically weak demand could make protectionism both respectable and irresistible.

Others, such as New York Times columnist Paul Krugman and Michael Pettis at Peking University have already noted how in a world with too little demand, one country’s trade surplus inflicts unemployment on the country with a deficit.

Even if Summers, Krugman and Pettis are correct (and I think they are wrong) the argument does not apply to the world we live in today. Thus Greg Ip is mistaken when he says “but those conditions may now be present.” They are not.

Let’s start with the US. The US is not at the zero bound, and the Fed is expected to raise rates in a few days because they think that failing to do so would result in excessive AD. So if protectionism somehow miraculously boosted AD in the US, the Fed would simply raise rates even faster to prevent any stimulative effect on AD.

Now it’s true that the Eurozone and Japan are both at the zero bound. But both economies have very large current account surpluses, so obviously trade deficits are not depressing output in those two regions. Even very depressed areas such as Italy run surpluses.

In fact, unemployment has almost nothing to do with trade “imbalances” (a term I hate).

Update: Dilip sent me the following, from Jared Bernstein and Dean Baker:

In this context, the trade deficit was subtracting from demand in the domestic economy. Spending that could have employed people who needed jobs in the U.S. was instead employing people in Germany, China, and other countries from which America imports goods and services. In principle, the U.S. government could have looked to spur other channels of demand to offset the trade deficit, but as a practical matter this is often not easy to do: The most straightforward way to generate demand is through additional government spending, but there are major political obstacles to running large budget deficits even at times when it would be beneficial to the economy.

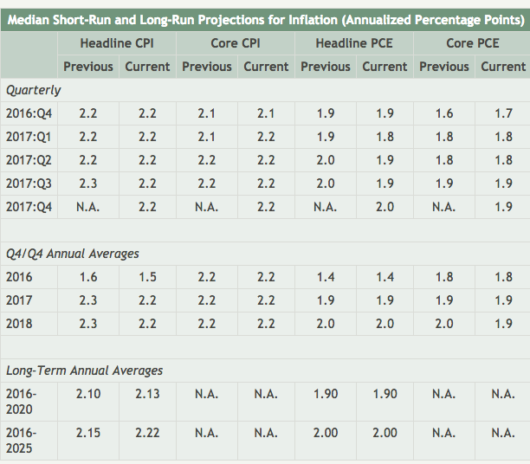

No, the most straightforward way to boost demand is to adopt a more stimulative monetary policy. But that won’t happen because the Fed currently thinks it’s better to slow the growth in demand by raising its target interest rate. (And they may well be correct. The consensus of private sector forecasters was that we were roughly on target for 2% inflation, even before the recent bump up in TIPS spreads):

Tags:

8. December 2016 at 12:47

Protectionism is not the answer. But when you reiterate factual trade issues while (inadvertently) giving the impression that domestic employment is mostly a non issue, some will mistakenly get the impression you believe nothing needs to be done in this regard. That matters, because a lot of people still listen to you, who in some instances have given up looking to others for economic problem solving.

8. December 2016 at 13:00

Isn’t Krugman usually making fun of “This Time is Different”-fear mongering and paranoia?

8. December 2016 at 13:07

Meanwhile, back at the ranch;

http://www.nytimes.com/2016/12/08/us/politics/andrew-puzder-labor-secretary-trump.html?_r=0

—————-quote—————

President-elect Donald J. Trump is expected to name Andrew F. Puzder, chief executive of the company that operates the fast food outlets Hardee’s and Carl’s Jr. and an outspoken critic of the worker protections enacted by the Obama administration, to be secretary of labor, people close to the transition said on Thursday.

Mr. Puzder has spent his career in the private sector and has opposed efforts to expand eligibility for overtime pay, while arguing that large minimum wage increases hurt small businesses and lead to job loss among low-skilled workers.

He strongly supports repealing the Affordable Care Act, which he maintains has helped create a “restaurant recession” because rising premiums have left middle- and working-class people with less money to spend dining out.

—————-endquote————–

And a bonus;

—————-quote—————–

The advertisements that Mr. Puzder’s companies runs to promote its restaurants frequently feature women wearing next to nothing while gesturing suggestively. “I like our ads,” he told the publication Entrepreneur. “I like beautiful women eating burgers in bikinis. I think it’s very American.

—————endquote————-

Make America babelicious again!

8. December 2016 at 13:18

What does it even mean when people say that manufacturing jobs are lost? Isn’t it part of the truth that most people from the First World just don’t want to do those jobs anymore? What so great about working at a steelmill? What’s so great about putting together an iPhone?

8. December 2016 at 14:14

Becky, I need to talk more about supply side reforms.

Patrick, That looks like a good pick.

8. December 2016 at 15:45

@scott

Not necessarily disagreeing with your argument, but

1. As I keep saying it’s not about jobs in the aggregate but about individual jobs (both number and quality).

2. Even it you look at employment in the aggregate, I don’t think you can argue that Fed incompetence rebuts the argument that a higher CA balance would boosts employment. Suppose the Fed was targeting 10% unemployment would you argue that monetary offset prevents trade from impacting employment.

3. I don’t think either the unemployment rate or the inflation rate are the best ways to determine if the economy is at full potential. Labor force participation and mix of full time and part time jobs are probably better measures. Also if you make too drastic a course correction on trend growth, short term you will get elevated levels of inflation. I think you need to look at inflation after the economy has been on path of higher growth for some time. If you go suddenly from 1% to 4% growth, supply can’t adjust fast enough and you will get higher short term inflation. If you’ve been on a steady 4% path, suppliers will have adjusted, and you’ll get a better supply/demand balance and less inflation.

8. December 2016 at 15:46

@christian list

Please tell me you’re being facetious.

8. December 2016 at 15:53

O/T: http://theresurgent.com/trump-calls-for-stimulus-to-prime-the-pump/

I’m going to guess that’s not going to be a problem for them.

8. December 2016 at 15:56

Oh, gadzooks.

Because the US might—might— be approaching 2% inflation, the Fed might be correct in raising rates.

We now have 5% unemployment, perhaps 10%, depending on how you measure it.

But the topic is the 2% inflation target, which is supposed to be an average? And the US has been below target for years.

Egads. And orthodox macroeconomists wonder why the public has turned their backs on the profession.

Gee, would a 2.5% inflation target be the end of the world?

And why do Thailand and Japan have essentially no unemployment and no inflation?

By the way between 1982 and and 2007, the average inflation rate (CPI) was just south of 3% and real GDP growth was just north of 3%.

Perhaps new policies in our negotiated trade deficits is not the right approach.

The jibber-jabber about 2% inflation is certainly not the right approach either.

8. December 2016 at 16:06

Please excuse my ignorance as a lay person. Would someone explain to me the rationale of those who claim the trade deficit is hurting aggregate demand when the trade deficit is offset by an investment surplus? Why doesn’t the investment surplus negate their claim? For example, China is investing a billion dollars in a paper making plant in Arkansas that is expected to provide a good number of well paying jobs to that state.

8. December 2016 at 16:10

What I don’t understand about summers argument is what does AD really have to do with it? Why do protectionist policies facilitate an increase in aggregate demand? When does raising the price of goods ever increase aggregate demand?

8. December 2016 at 16:51

1) So the solution to Trump was easier money making protectionism less appealing?

2) That graphic looks like more of the same ol’ same ol’ regarding inflation. “We’re at 1.4% now, but might be at 2% next year and 2.5% several years down the road. We can’t risk that 2.5% several years down the road, so we better tighten today!” Has anybody explained that if you tighten before you hit 2%, you aren’t going to hit 2%?

8. December 2016 at 17:13

Spot on.

8. December 2016 at 17:28

dtoh, You said:

“As I keep saying it’s not about jobs in the aggregate but about individual jobs (both number and quality).”

“It” may be about number and quality but THIS POST is about aggregate demand, and is responding to numerous other posts about aggregate demand. CA deficits do not reduce AD. Period, end of story.

As far as job quality, automation is one of the best ways to boost job quality, it’s why America’s jobs today are much higher quality than 50 years ago.

If the Fed targets inflation or NGDP (it can’t target unemployment) then trade will not impact AD. Trade may affect the labor market in some other way, but not via AD.

You said:

Also if you make too drastic a course correction on trend growth, short term you will get elevated levels of inflation.”

That entirely depends on what causes the change in growth. If it’s supply side factors you do not get higher inflation, you get lower inflation. And demand side factors are not capable of impacting trend growth.

Gordon, You said:

“Please excuse my ignorance as a lay person. Would someone explain to me the rationale of those who claim the trade deficit is hurting aggregate demand when the trade deficit is offset by an investment surplus? Why doesn’t the investment surplus negate their claim? For example, China is investing a billion dollars in a paper making plant in Arkansas that is expected to provide a good number of well paying jobs to that state.”

You are not ignorant, it’s the rest of the world (excluding me and a few others) who are ignorant. You are completely correct.

Thanks George.

8. December 2016 at 20:25

‘In this context, the trade deficit was subtracting from demand in the domestic economy. Spending that could have employed people who needed jobs in the U.S. was instead employing people in Germany, China, and other countries from which America imports goods and services.’

Jared Bernstein being one of those crackerjack economic advisers employed by Barack Obama.

8. December 2016 at 22:23

@scott

““It” may be about number and quality but THIS POST is about aggregate demand, and is responding to numerous other posts about aggregate demand.”

Then it’s an irrelevant post. Every agrees that trade improves aggregate demand. The only reason that trade is a topic of current political interest is its impact on individual jobs. That the ruling elite don’t get this is evidenced by the fact that people are still writing these irrelevant posts about trade and aggregate impacts and also one of the reasons why Trump was elected.

If monetary policy is effective, then monetary policy is the sole determinant of AD and it is a tautological, obvious and uninteresting argument that CA will not impact AD. The question is whether changes in CA can lead to a more optimal mix of real growth and inflation if monetary policy is adaptive. I don’t believe you have addressed this.

“As far as job quality, automation is one of the best ways to boost job quality, it’s why America’s jobs today are much higher quality than 50 years ago. “

Mostly agree but personally I’d much rather being punching out auto parts in a factory than drafting boilerplate documents in a Wall St. law firm. But yes and in this respect, automation is very different than trade. I’ll elaborate when you do a post on this subject.

9. December 2016 at 05:34

And so, once again, Keynesianism undermines the very foundation of economic understanding, reverting discourse back to the era of the mercantilists. How utterly depressing yet unsurprising. The defunct economists walk among us like zombies.

9. December 2016 at 06:10

OT – is the India currency replacement a natural experiment evidence that money is not short-term neutral? (Answer below): today’s Bloomberg – “Modi’s shock move to recall 86 percent of the currency in circulation in a bid to tackle corruption is taking a heavy toll on the economy, with Goldman Sachs Group Inc. slashing its fourth-quarter growth projection to 4 percent, compared with an expansion of 7.3 percent in the previous three months. The Reserve Bank of India held interest rates on Wednesday, surprising economists who had been expecting it to cut”.

Answer: no, it’s more like fiscal policy, since Modi’s withdrawal of high-denomination notes and replacement with low-denomination notes is not ‘de facto’ revenue neutral nor a form of crude “QE” (which, if money was exchanged one-for-one with no de facto losses, arguably would be evidence of money non-neutrality if the economy declined for a lack of high-denomination notes) but rather it’s akin to a de factor tax increase, hence the contraction. Score: Keynesianism 1: Monetarism O.

9. December 2016 at 07:22

@Gordon,

Excellent point. I’ve always said to others, “they have to spend it someday. otherwise they’re giving us cars, steel and other things for “paper dollars””. Your explanation is a key insight for me. Thanks.

9. December 2016 at 07:26

Monetary policy may indeed be the first best answer.

I would also like a billion dollars.

I see a change in monetary policy about as likely as winning the billion dollar Powerball. As we have seen since 2008, the FOMC members and economists are not going to come to grips with reality on their own. There is no mechanism to hold the FOMC accountable. People just generally do not admit they are wrong, especially when groupthink is involved. That is why Trump got elected, technocrats full of smugness who cannot admit they are wrong.

Change in monetary policy will only happen if Trump fires people and cleans house at the FOMC and replaces the members. If he does that, you will say he’s a disgrace injecting politics into monetary policy. Or, Trump and the Republican GOP take other actions you won’t like – for example switching to some version of Taylor’s proposed rules based policy regime. Firing people carries risks, we don’t know the newbies will be better. The rules for policy Congress adopts won’t be good ones.

So, yes, a change in monetary policy at the Fed would be nice but its unlikely and carries a high cost and risk.

We are going to get supply side reforms for sure. By the time you get over Trump as President and get around to blogging about supply side reforms, Trump and the GOP will already be well into passing laws and rolling back regulations. They have big plans on energy, banking, taxes, and labor.

The trade deficit is a problem and it is going to get fixed. The question is what is the cost.

Don’t get distracted by the 35% tariff proposed by Trump. This is Trump’s style of negotiation: Pick something we know will work, even if awful, and let other people come up with alternatives.

To people unfamiliar with this negotiation style, it appears to be flip-flopping when he subsequently accepts the alternatives. It really isn’t. It is more like persuasion: By going extreme he gets people to concede there is a problem.

Economists are now conceding we have a trade deficit problem, see how that works? People are now in “no we cannot do that! lets see what else we can do mode.”

He is giving people a choice: Come up with something acceptable, we will do X. This is how Trump drives the agenda.

You can call it rhetoric, or a bluff, but it’s really a conversation about what costs we are willing to bear to fix the trade deficit. Fixing Fed monetary policy has costs/risks, protectionism has costs/risks, and supply side reforms have costs/risks (environmental, health, and safety risks, among others). Not doing anything also has costs and risks, and voters rejected that.

So, which costs are people willing to bear to fix the problem. Are we willing to let Trump clean house at the Fed? Are we willing to let the GOP pass a “reform the Fed” bill?

9. December 2016 at 09:53

dtoh, You said;

“Then it’s an irrelevant post. Every agrees that trade improves aggregate demand.”

I don’t. Before you tell me one of my posts is irrelelant, you might want to figure out what I’m actually saying.

You said:

“But yes and in this respect, automation is very different than trade.”

No it’s not, they are exactly the same. You are entirely missing the point. I’ve recently done some posts on this over at Econlog.

Ray, You said:

“Score: Keynesianism 1: Monetarism O”

And so we learn that Ray doesn’t even know that Keyneisan is based on the presumption that money is NOT neutral. If money is neutral than Keynesianism collapses.

Ray, you are like a cute little kindergardener. You say the funniest things!

dwb, There are so many problems with your comment that I don’t know where to begin. Trump could be the greatest president in US histroy and it would not change my view of him. My view was not based on the presumption that he’d be a horrible president, it was based on the presumption that he’s a horrible human being, totally unfit to be president. If we avoid a nuclear war that’s great, but that won’t make me change my view that he lacks the character to be commander in chief.

I see no evidence that economists think trade deficits are bad. If so, they need to rewrite the textbooks. And as for your view that Trump will get rid of the trade deficit, I’m speechless. All the policies he’s announced so far would make it bigger. Have you seen what’s happened to the value of the dollar? Are you paying attention?

BTW, In saying Trump won’t eliminate the deficit I’m actually praising him—eliminating the defict would be insane. I doubt you could find more than a handful of economists who would favor that.

9. December 2016 at 14:44

Scott, you said,

“No it’s not, they are exactly the same. You are entirely missing the point. I’ve recently done some posts on this over at Econlog.”

I disagree and will comment when you do a post here. (I don’t read Econlog. I figure it costs me $3k a year in wasted time to have to switch between two different web sites in order to read all your posts.)

You said,

“I see no evidence that economists think trade deficits are bad.

You also said,

“Pick up any EC101 textbook in the past 50 years. They all acknowledge there are losers to trade. … This idea that the losers are ignored is just a figment of your imagination.”

So can we therefore conclude that your view (and the view of economists) is that it is not bad thing that people lose their jobs because of trade deficits.

See also my comment on your latest post on utilitarianism.

9. December 2016 at 19:29

Scott, since when is good character a qualification for Politician in Chief? I think you need a bit more cynicism in your view of politics and the people who work at it.

Good character may increase the odds that someone will be a good president, but the number of recent counter-examples is pretty high. Consider:

Gerald Ford good character, mediocre president

Jimmy Carter good character, awful president

Ronald Reagan OK character, pretty good president

Bush senior good character, mediocre president

Bill Clinton bad character, pretty good president

Bush junior good character, bad president

Barack Obama good character, mediocre president

Donald Trump ?, ?

I don’t really agree with you that Trump is an evil man. The people who know him best, his children and various wives all seem to think he’s a good guy. And his children all appear to be well-adjusted decent human beings. I think that says a lot about him.

Now, he is definitely an unconventional politician. He lies a lot, but then, isn’t that what we expect from politicians? The difference with Trump is that he’s so over the top with it. I get the impression that his real message is: “Look, everybody’s lying to you. The conventional politicians, the media, the various interest groups, they’re all lying through their teeth, almost all the time. And the voters like being lied to, else they wouldn’t keep reelecting all these liars. So I lie to you too, but at least my lies are entertaining.”

10. December 2016 at 07:30

how does having fewer jobs because jobs have been exported help domestic aggregate demand? and if trade does, wouldnt just exporting all jobs then increase demand even more? and if we export the jobs, the magic of new jobs to replace those that were lost seems to have failed to work any more. course that maybe because business wants to only hire those who have experience (at least a few years of it too) with the job the prospective employee applied for. not just education any more. and while Trump maybe evil (which i think is true) he told voters what they already believed to be true, they just hadnt heard that from any one else. and they believed that because their experience told them that to be true

10. December 2016 at 08:57

dtoh, You said:

“So can we therefore conclude that your view (and the view of economists) is that it is not bad thing that people lose their jobs because of trade deficits.”

No, that’s faulty logic on your part. Economists don’t believe that trade deficits cost jobs. If they did, then they might believe trade deficits are bad. BTW, if I’m wrong about trade deficits, then basically all of supply-side economics is wrong, including the view that tax cuts spur growth. It’s the same (classical) model. Do you really want to go there?

Jeff, If we don’t judge politicians based on what they say, then how can we judge them? Trump has no track record as a politician. His words are all we have. At least with Bill Clinton we could look at his record as governor of Arkansas.

Should we vote for Jeffrey Dahmer or Charles Manson, on the grounds that character doesn’t matter? Obviously not. So it’s really a question of how much character matters.

You also ignore the fact that I am looking at the whole package, not just character in the sense of sexual morality, but also intelligence, vindictiveness, judgment, and lots of other factors. Clinton had lots of good qualities, and sexual morality is one of the least important in a president. Clinton lied about policy issues far, far less than Trump does.

Having said all that, I agree that an excellent character can be unsuccessful–Herbert Hoover’s a good example. But that’s because Presidents have far less impact than we assume, as I pointed out in a previous post. That’s why I don’t have the Trump Derangement Syndrome that impacts people like Krugman. I don’t think that presidents are all that important, and never have thought that. Unlike Krugman, I’d never lose sleep over an idiot like Trump.

As I said before, I think Gore would have invaded Iraq. I’ve said the same about Fed chairs, we overestimate their influence. But you still want to pick a good one.

BTW, I’d guess that Trump’s kids were raised by his mom–he seems pretty busy.

dw, Your comment makes no sense. Please present some evidence for your claims. Europe has a huge trade surplus, Australia has a huge deficit, as does America. Who creates far more jobs? You have zero evidence that we have not created jobs to replace those lost via trade. We have.

And domestic AD is determined by the Fed, not trade, that’s EC101.

10. December 2016 at 09:58

Gerald Ford good character, mediocre president

Jimmy Carter good character, awful president

Ronald Reagan OK character, pretty good president

Bush senior good character, mediocre president

Bill Clinton bad character, pretty good president

Bush junior good character, bad president

Barack Obama good character, mediocre president

Ford was satisfactory for the most part, but he was a pioneer in the realm of post-presidential buckraking. Nixon accepted a fee of $600,000 for the Frost interviews (a contextually similar sum today would be about $4 million), but I do not believe he ever hit the speaking circuit (and he likely had overdue legal bills in 1976, so has an excuse); the Nixons also relinquished their security detail in 1986. I’m not sure Lady Bird Johnson or anyone else who came after ever did.

Jimmy Carter has good character – up to a point. He’s also vain and prideful in ways his peers are not. And, of course, has the Secret Service following him around carrying his luggage.

Reagan was given to confounding current history with the issue of the imagination (or old movie plots). I don’t think he had notable character defects aside from that. His children have been an embarrassment, but it’s difficult to discern how that relates to anything he did do or did not do. IIRC, his post-presidential buckraking was limited to a couple of one-offs, but I may have that wrong.

Again, both Bushes have hoovered up large sums from the speaking circuit. They just stick to topics and fora which do not attract much attention. If I’m not mistaken, Harry Truman, the issue of the Pendergast machine in Kansas City, refused offers like this, even though he was fairly impecunious in his 70s.

The notion that the spiteful, shallow, and self-indulgent Obama, who (in conjunction with his wife) has a history with legally-sanctioned graft, who lies as brazenly as Richard Nixon, who went to a fundraiser the morning after the Benghazi disaster, and who gave the world the IRS scandal, is a man of ‘good character’ beggars belief.

Bilge Clinton, good president? No one who has entered that office in the last 90 years has been dealt a more agreeable hand of cards (something you refuse to acknowledge when you call his predecessor a ‘mediocre president’). The most successful policy initiative of those years was the welfare reform inspired by Gov. Thompson of Wisconsin, which Clinton only signed into law because Dick Morris said he must. He put his signature on the law reviving universal banking and his minions sabotaged Brooksley Born’s attempts to flush out the dark market in derivatives.

George Bush the Younger was a ‘bad president’ only in the imagination of partisan Democrats and palaeo twerps. Compare the condition in which he left Iraq with the condition Obama will be leaving Iraq.

10. December 2016 at 11:50

Scott’s right. But AD = money times velocity. So all you have to do is force the commercial banks out of the savings business and AD rises (the 1966 S&L credit crunch is empirical evidence). And by channeling savings through non-bank conduits savings are matched with non-inflationary real outlets (not so with the CBs as CB lending/investing is inflationary).

All savings originate within the commercial banking system, unless currency is withdrawn. Commercial bank held savings deposits, rather than being a source of loan funds to the banks, are the indirect consequence of prior bank credit creation. I.e., the source of all time (savings) accounts are transaction based accounts, directly or indirectly via the currency route or thru the CB’s undivided profits accounts. And the growth of transaction based accounts can largely be traced to the expansion of Reserve Bank credit.

Thus, all CB held deposits are lost to both consumption and investment until their owners invest them directly or indirectly via non-bank conduits.

That is to say that secular strangulation, chronically deficient AD, is where savings are increasingly bottled up within the confines of the CB system. And unless savings are expeditiously activated and put back to work, completing the circuit income and transactions velocity of funds, the resultant deceleration in money velocity will reduce real-output.

I.e., money (savings) flowing through the non-banks never leaves the CB system. The NBs are the CB’s customers. From the standpoint of the CBs, the monetary savings practices of the public are reflected in the velocity of their deposits and not in their volume. Whether the public saves or dis-saves, chooses to hold their savings in the CBs or to transfer them to non-bank conduits will not, per se, alter the total assets or liabilities off the CBs, nor alter the forms of these assets and liabilities.

Thus, until the CBs are driven out of the savings business, the world will enter a prolonged economic deceleration in growth and incomes. This is the source of the pervasive error that characterizes the Keynesian economics, that there is no difference between money and liquid assets, the Gurley-Shaw thesis.

Just “google” financial intermediary and you will be deluged with the magnitude of this error. I.e. never are the CBs conduits between savers and borrowers. The CBs, from the standpoint of the economy and the system, always create new money when they lend/invest. Deposits are the result of lending, not the other way around.

10. December 2016 at 16:21

Scott,

Again you’re refusing to recognize the distinction between the loss of aggregate jobs and the loss of individual jobs. This is exactly why Trump was elected

10. December 2016 at 17:00

Ray Lopez

9. December 2016 at 06:10

OT – is the India currency replacement a natural experiment evidence that money is not short-term neutral?

—————

That’s the most ridiculous statement I’ve ever read. Do you know why?

11. December 2016 at 08:02

Dtoh, No, I am not at all missing that distinction, and that has nothing to do with why Trump was elected. It was not a vote against automation, believe me.

12. December 2016 at 11:42

The widespread introduction of ATS and Now deposit accounts in January 1980, in conjunction with the publication of the G.6 Debit and Demand Deposit Turnover release, initially distorted Yale Professor Irving Fisher’s transactions velocity of circulation, Vt, figures for M1a.

The transactions, Vt, of DDs (demand deposits) for a given month is equal to total bank debits to these deposits divided by the average volume of DDs for the same period. The exclusion of ATS and NOW accounts in the denominator was the principal explanation of the sharp upward statistical “bias” in these figures.

But the Fed never “cleaned up its act”, reporting errors notwithstanding, viz., Manufacturers Hanover Trust Co. of New York’s overestimated back-to-back figures of $3.7b on Oct. 3 and $800m on Oct. 10, 1979.

And the Fed never reclassified the DFI’s deposit categories when Congress laid the legal basis for turning 38,000 financial intermediaries into 38,000 commercial banks via the DIDMCA of March 31st 1980 (this Act was the direct cause of the S&L crisis, as well as the Great Recession, by as Dr. Leland Pritchard predicted: allowing money “to approximate M3”).

To the Keynesian economists on the Fed’s research staff, transactions velocity is a statistical stepchild”. It is income velocity, Vi, that matters. Vi is calculated by dividing N-gDp for a given period by the average volume of money for the same period. A decline in the income velocity of money is supposed to suggest that the Fed initiate an expansion or less contractive monetary policy. This signal could be right – by sheer accident.

N-gDp is determined by the volume of goods and services coming on the market relative to the actual “transactions” flow of money. Rates-of-change, roc’s, in money flows (money times velocity), can serve as a reasonably good proxy for the roc’s of those money flows, M*Vt, which finance R-gDp (when international and money center transactions are excluded).

Any increase in Vt, since it will tend to cause N-gDp to rise, will give the Vi economists false signals. This is true even though both the volume of money and Vt tend to move in the same direction. The effect on money flows and N-gDp of an increase in both money and Vt is obviously greater than an increase in either money or Vt. Consequently Vi declines and vice versa. Given these circumstances it is a tighter money policy that is probably needed, not the easier policy the Vi economists would probably recommend.

M2 is the money figure currently in vogue as a measure of the impact of money on the economy. But 95 percent of all demand drafts clear thru transaction based accounts, or M1 (and retail MMMF deposits are not “money” as Martin Wolf, chief economics commentator at the Financial Times, rightly says: “money is not subject to liquidity of solvency issues”).

And the upward bias as a consequence of classifying S&L and CU deposits at commercial banks (but not Mutual Savings Bank deposits, MSB deposit classifications had always been wrong up until then – ever since the Fed’s inception), rather than as interbank demand deposits, IBDDs (some bankers and stock holders are losing their income from the remuneration of reserves).

These issues, plus the weekly M1 figures, are often distorted by net shifts of funds from the public to U.S. Treasury, or vice versa. When you write a check to “Uncle Sam”, the money supply is diminished thereby (TT&L accounts swept to the General Fund Account). When you get a check from Uncle Sam, the money supply expands (General Fund Account to, e.g., social security recipients). In real economic terms the money supply does neither. But that is the way the irrational way the Fed counts money. See David Stockman:

“Since the eve of the financial crisis in 2007, a rapidly increasing share of DPI (disposable personal income) has been accounted for by the explosive growth of transfer payments.” And transfer payments aren’t included in gDp tabulations. So some economic models need adjusted.

Thus, the Fed’s monetary mis-management was compounded by Chairman Alan Greenspan:

“By the early 1990s, the relationship between M2 growth and the performance of the economy also had weakened. Interest rates were at the lowest levels in more than three decades, prompting some savers to move funds out of the savings and time deposits that are part of M2 into stock and bond mutual funds, which are not included in any of the money supply measures. Thus, in July 1993, when the economy had been growing for more than two years, Fed Chairman Alan Greenspan remarked in Congressional testimony that “if the historical relationships between M2 and nominal income had remained intact, the behavior of M2 in recent years would have been consistent with an economy in severe contraction.” Chairman Greenspan added, “The historical relationships between money and income, and between money and the price level have largely broken down, depriving the aggregates of much of their usefulness as guides to policy. At least for the time being, M2 has been downgraded as a reliable indicator of financial conditions in the economy, and no single variable has yet been identified to take its place.”

https://www.newyorkfed.org/aboutthefed/fedpoint/fed49.html

The Greenspan Fed then discontinued the survey, calculation, and publication for all bank debits in September 1996 (by mistake, driven by the “Paperwork Reduction Act ‘PRA’ of 1995”) when Ed Fry was its manager in D.C. Thus, stakeholders are left without an anchor or rudder to steer the genuine economy.

Lacking any means for making a valid estimate of money flows, or even a reliable mean-of-payment money figure, one must fall back on a surrogate, member bank legal reserves data:

See my SA instablog: “Surrogates”:

http://seekingalpha.com/instablog/7143701-salmo-trutta/3794476-surrogates

See:

https://fraser.stlouisfed.org/scribd/?item_id=491335&filepath=/files/docs/releases/g6comm/g6_19961023.pdf

Our economy now requires DD Vt to be maintained at these lofty hyper-transaction activity levels in order to just sustain economic growth. But the Vi economists (using national income and product accounts), chiefly endorse M2 Vi:

https://fred.stlouisfed.org/series/M2V

The impact of an injection (or draining) of money is not “neutral” as the distributed lag effect of money flows verifies.

“Neutrality of money is the idea that a change in the stock of money affects only nominal variables in the economy such as prices, wages, and exchange rates, with no effect on real variables, like employment, real GDP, and real consumption.[1]” – Wikipedia (not a Phillips’s curve confirmation).

Federal Register, G.6 release, debit and demand deposit turnover

https://www.gpo.gov/fdsys/pkg/FR-1996-09-30/pdf/96-24973.pdf

My “money flows” projection:

parse; dt; & roc’s in [real-output; and inflation]:

08/1/2016 ,,,,, 0.111 ,,,,, 0.20

09/1/2016 ,,,,, 0.112 ,,,,, 0.20

10/1/2016 ,,,,, 0.039 ,,,,, 0.17

11/1/2016 ,,,,, 0.105 ,,,,, 0.19

12/1/2016 ,,,,, 0.124 ,,,,, 0.12

01/1/2017 ,,,,, 0.093 ,,,,, 0.15

02/1/2016 ,,,,, 0.063 ,,,,, 0.15

03/1/2016 ,,,,, 0.068 ,,,,, 0.14

04/1/2016 ,,,,, 0.046 ,,,,, 0.14

Leland James Pritchard, Ph.D., Economics, Chicago 1933, MS, Statistics, Syracuse said 9/8/81:

“Considering the distortions in the definition of M1a and the rapid increase in the currency component the correlation of the time series is remarkable…You have hit on a predictive device nobody has hit on yet.”

As Janet Yellen and the FOMC meet to consider raising interest rates, this economic projection is important. It spells a deceleration in R-gDp and an acceleration in inflation, viz. stagflation (FOMC schizophrenia, the kind immediately before the 4th qtr. of 2008).

12. December 2016 at 13:54

The only people who have to edit comments are those whose views are wrong.