Do current account deficits costs jobs?

Over at Econlog I have a post that suggests the answer is no, CA deficits do not cost jobs.

But suppose I’m wrong, and suppose they do cost jobs. In that case, trade has been a major net contributor to American jobs during the 21st century, as our deficit was about 4% of GDP during the 2000 tech boom, and as large as 6% of GDP during the 2006 housing boom. Today it is only 2.6% of GDP. So if you really believe that rising trade deficits cost jobs, you’d be forced to believe that the shrinking deficits since 2000 have created jobs.

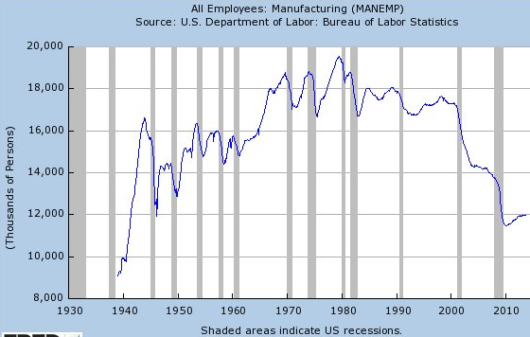

So why have manufacturing jobs plummeted since 2000? One answer is that the current account deficit is the wrong figure, since it also includes our surplus in trade in services. If you just look at goods, the deficit is closer to 4.2% of GDP.

So why have manufacturing jobs plummeted since 2000? One answer is that the current account deficit is the wrong figure, since it also includes our surplus in trade in services. If you just look at goods, the deficit is closer to 4.2% of GDP.

But even that doesn’t really explain very much, because it’s slightly lower than the 4.35% of GDP trade deficit in goods back in 2000. So again, the big loss of manufacturing jobs is something of a mystery. Yes, we import more goods than we used to, but exports of goods have risen at about the same rate since 2000. So why does it seem like trade has devastated our manufacturing sector?

Perhaps because trade interacts with automation. Not only do we lose jobs in manufacturing to automation, but trade leads us to re-orient our production toward goods that use relatively less labor (tech, aircraft, chemicals, farm produces, etc.), while we import goods like clothing, furniture and autos.

So trade and automation are both parts of a bigger trend, Schumpeterian creative destruction, which is transforming big areas of our economy. It’s especially painful as during the earlier period of automation (say 1950-2000) the physical output of goods was still rising fast. So the blow of automation was partly cushioned by a rise in output. (Although not in the coal and steel industries!) Since 2000, however, we’ve seen slower growth in physical output for a number of reasons, including slower workforce growth, a shift to a service economy, and a home building recession (which normally absorbs manufactured goods like home appliances, carpet, etc.) We are producing more goods than ever, but with dramatically fewer workers.

Update: Steve Cicala sent me a very interesting piece on coal that he had published in Forbes. Ironically, environmental regulations actually helped West Virginia miners, by forcing utilities to install scrubbers that cleaned up emissions from the dirtier West Virginia coal. (Wyoming coal has less sulfur.) He also discusses the issue of competition from natural gas.

Update: Steve Cicala sent me a very interesting piece on coal that he had published in Forbes. Ironically, environmental regulations actually helped West Virginia miners, by forcing utilities to install scrubbers that cleaned up emissions from the dirtier West Virginia coal. (Wyoming coal has less sulfur.) He also discusses the issue of competition from natural gas.

Tags:

22. December 2016 at 09:54

If they didn’t, surplus countries wouldn’t peg their currencies (money laundering)

22. December 2016 at 11:22

Environmental regulations were tweaked to help West Virginia by Senator Byrd. They help West Virginia by design. This is a story of intended consequences.

22. December 2016 at 13:53

“We are producing more goods than ever, but with dramatically fewer workers.”

-In manufacturing, peak productivity was in February 2012.

https://fred.stlouisfed.org/graph/?g=ccwe

Trade (or automation!) could cost jobs even without any trade deficits. Between 2000 and 2007, the export of low-productivity manufacturing jobs to China did coincide with a large trade deficit and did result in higher U.S. manufacturing productivity. For the half-decade since 2011, though, manufacturing productivity has not grown. The only precedent for this in American history is the 1977-1982 productivity stagnation.

BTW, the people who elected Trump might want manufacturing jobs back, but in most cases, they never had them in the first place. Education, not job losses, was the leading driver of Trump support in November. I have to keep repeating this, as rebutting Trump’s rhetoric about trade and manufacturing jobs is all well and good (nobody said Trump was especially knowledgeable about the economy, other than the voters), but it leaves room for a misdiagnosis of the determinants of his support and leads the conversation into a fairly futile one about solutions to the oft-nonexistent problem of lost manufacturing jobs (in the plains of Missouri? the southern Georgia highlands? rural and exurban Florida?), rather than looking at the issue of low-skilled labor in general. And assuming high incomes would stop Trump is totally unsubstantiated. Livingston County, MI and Suffolk County, NY, both of which went for Trump in both the primary and the general by over eight points and went harder for him in November 2016 than for Willard S**t in November 2012, aren’t suffering by any stretch of the imagination.

22. December 2016 at 14:25

Harding, Interesting, if you divide by NAICS manufacturing you get productivity looking much better.

22. December 2016 at 14:41

@ssumner

-Better, but not much.

https://fred.stlouisfed.org/graph/?g=ccxq

https://fred.stlouisfed.org/series/OPHMFG confirms the stagnation.

Multifactor productivity in manufacturing (MFGPROD) has actually fallen since 2007.

22. December 2016 at 14:48

Have you seen the latest #s?

22. December 2016 at 15:20

sell everything

22. December 2016 at 16:07

“Notice that Dr. Navarro’s estimate of a 2.44 trillion increase over 10 years from the elimination of our trade deficit is just his estimate of the gain in tax revenue. It is not possible to back out exactly what he expects the increase in nominal GDP would be as result of such a policy enactment, but it would be at least a few multiples of the revenue gain. Navarro provides absolutely no analysis of what the macroeconomic consequences of such a policy enactment would be, although one would think that raising the level of U.S. nominal GDP by more than 35% would be worth remarking upon…

Returning to the world of macroeconomics… While it is true that trade flows should balance in the very long run—in fact there are many sets of preferences for which they need not balance—no one has ever argued that in a world of capital mobility, trade flows need balance in the short or even intermediate run. But almost everyone does understand that dramatically raising the level of U.S. nominal GDP must have macro-economic consequences irrespective of the process by which that increase is brought about. It is remarkably odd therefore to spend 10 pages tracing out the supposed macroeconomic consequences of the U.S.’ persistent trade deficit, but no pages whatsoever tracing out what the macroeconomic consequences of a step-change increase in our nominal output might be.”

22. December 2016 at 17:18

A nonsense post, full of counterfactuals and ‘what ifs’. I’d like to see a post ‘what if money is neutral, how would you explain this ZYX phenomena?’ If the phenomena can be explained more simply by assuming money neutrality, it should be done so. Ockham’s Razor. In fact, you can pretty much explain the entire economy as a random number generator with a slight upward bias and assuming the Fed follows the market. But doing so would put a lot of economists out of business.

22. December 2016 at 19:13

If I understand the arguments of orthodox macroeconomists, the US should…ban exports.

The income we lose from exporting will be made up by capital inflows.

The capital and labor we devote to serving foreign markets could then be devoted to serving domestic markets.

We would be even richer and have higher standards of living!

22. December 2016 at 19:34

@Benjamin Cole – I assume your post is parody, but with the readers of Sumner one never knows… see here: http://www.nytimes.com/2016/12/02/upshot/want-to-rev-up-the-economy-dont-worry-about-the-trade-deficit.html?smid=pl-share&_r=0 for what orthodox economists like Mankiw think of trade deficits. It’s sound logic, but they are too glib IMO about deficits. At some point if people lose faith in the US dollar it seems the whole edifice of ‘deficits don’t harm the USA’ will come crashing down. And if it does, what exactly does the USA export? Beside Boeing jets, maybe wheat, corn, I can’t think of anything.

22. December 2016 at 20:12

OT Deep questions by Ray Lopez (TM)…

“Thus it is that modern countries place primary emphasis on fiscal policy, in whose service monetary policy is relegated to the subsidiary role of a useful but necessary handmaiden.” – Alvin Hansen, “A Guide to Keynes” (1952). OT question for the reader: why would monetary policy even be useful, assuming money is neutral?

Friedman & Schwartz’s 1963 book “A Monetary History of the United States, 1867–1960”: (from Sims’ Nobel lecture) “Their book (1963a) argued that from the detailed historical record one could see that in many instances money stock had moved first, and income had followed” – OT question for the reader: given Friedman et al’s propensity for polemics, and given that the data pre-WWII is, as our host Sumner admits, rather patchy, how much of of Friedman et al’s book is snake oil bunko? At lot. I bet a lot.

22. December 2016 at 20:45

The Mysterious Man Known As Ray Lopez:

My trenchant, witty synopsis of orthodox macroeconomics regarding trade deficits is accurate, as far as I can tell.

Your point—the dollar’s exchange rate may eventually fall—is probably true, but maybe not.

There are ferocious flows of global hot money (perhaps $10 trillion seeking highest interest rates, risk-adjusted) and another perhaps $30-$40 trillion, perhaps more, in offshore bank accounts, such a Cayman Islands, Panama etc.

It may be the U.S. can consume more than it produces for many more lifetimes. The U.S.dollar may go up or down, who knows, with such mountains of money in offshore banks making molehills of dollar-flows attached to trade?

(Capital inflows and migration to the US, in connection with yoke-like property zoning, may undercut the middle class, but there is little to be discussed on that score.)

Add on, there are large amounts of US paper cash in circulation, as in $4,600 for every US resident. Even more in in paper yen, per Japanese resident.

You might conclude orthodox macroeconomics has lost some explanatory power, given huge structural and institutional imperfections in the global financial system, uncounted cash in circulation, and property zoning.

Or, you might cling more tightly to ossified nostrums.

Ray Lopez, given the debacle in India, I think you need to migrate to Mumbai, and tell the residents there that taking cash out of circulation does not matter. It is only money, with no impact on real commerce. They do not seem to understand, and commerce is getting crimped.

22. December 2016 at 21:06

@Ben Cole, Thai turkey farmer – obviously the tax in India was confiscatory, since the government correctly concluded people would NOT trade in their notes at par, because they were tax cheats, and that’s exactly what happened (the rich tax cheats had to take a haircut). So it was not a simple money = neutral experiment.

Ponder this: OT- Christopher A. Sims, 2011 Nobelist’s lecture: “While my 1980a paper and subsequent work with VAR models made clear that monetary policy responded to the state of the economy and that the money stock was predictable in a model including interest rates, an explicit theoretical model that validated Fischer Black’s intuition arrived later in my 1989 paper, which showed that a monetary policy of making interest rates respond positively to the growth rate of the money stock would lead to an apparent causal ordering from money to income, even in a model with negligible effects of monetary policy on real variables.” –

translation: you can pretend that the Fed influences the economy, as foolish Ben Cole does, but in fact it’s an illusion, as monetary policy responds to the economy, not the other way around, and money is neutral (has no effect on real variables). So says Nobelist Sims. As I’ve said all along… In fact, for you ‘skolers’ out there, the 19th C ‘real bills doctrine’ of discounting any paper a bank customer brings to the bank, depending on the whims of the bank, is not a bad policy at all since money is largely neutral.

22. December 2016 at 22:52

The Mysterious Man Known As Ray Lopez:

I have added ducks now too. They are hearty. Peking ducks are great. Egg ducks too. Duck-eggs have more calories than chicken eggs.

On macroeconomics:

Okay, so you have Nation House-Land. Nation House-Land trades houses to Nation Working, and Nation Working produces goods and services for Nation House-Land’s houses.

So why should the Nation House-Land dollar ever decline?

Now, there might be a wrinkle.

Suppose Nation House-Land zones property, so there is a noose on the housing supply? Well, the price of housing will appreciate. This works well for those who own houses, or can acquire houses to sell later. They gets lots of money selling houses to buy goods and services from Nation Working.

Now some people in Nation House-Land might not be able to buy houses, as they cannot access credit markets. And the house prices are so high! But banks lend 80% of their capital on property. Property is considered collateral. So foreign capital is leveraged and poured into extant property, in large part.

So, in Nation House-Land, the people without property find the house-sellers are buying goods and services offshore. The non-property owners are losers, and that is too bad, but unimportant.

I do not see why the Nation House-Land dollar should fall in this picture. Moreover, it seems like a wonderful arrangement for the propertied class.

As for Nobelist Sims, I am not even sure what he said. If he said monetary policy does not affect real output, he never studied history.

Now, perhaps in one regard I agree with you.

I think the right policy is simple helicopter drops, or money financed fiscal programs. Maybe this way the Treasury Department just sidesteps the fetishists at the Fed, and prints money and spends it. Maybe you call that fiscal policy, and not monetary policy, since the Fed is outside the loop.

I think QE with federal deficits is roughly the same thing.

BTW, read this:

http://www.businessinsider.com/lord-adair-turner-on-central-banks-interest-rates-and-printing-money-2016-11

Ray Lopez, you have been reading too many monetary tracts by little boys in short pants, delivering sanctimonious sermonettes. Let me guess, the answer is tight money, as that is always the answer to a little cult-crowd of snivelers that infests monetary policy forums.

The real answer is to print money and lots of it. Answer tax needs with fresh cash. Let it rip, and don’t stop until there are labor shortages across the nation. Then ask me what to do next.

Unzone property next. All of it.

23. December 2016 at 05:53

@Ben Cole, Thai turkey farmer –

– Sims the Nobelist does believe in monetarism, but to make it work he had to include interest rates in his analysis, since simple base money expansion did not seem to work. Reminds me of CAPM and beta (had to be expanded from a one-factor to a three-factor model, and now to a five-factor model, and it still fails to completely explain risk/reward). Reminds me also of Friedman, who at first simply cited M1 creation, then had to retract. Reminds me of the initial success and then failure of the Philips Curve. Reminds me of Sumner’s NGDPLT panacea. And we all know about the (in)famous FAVAR paper I keep pounding the table about. ’nuff said

– Cole: “I do not see why the Nation House-Land dollar should fall in this picture.” – Land, Labor and Capital work fine in a closed system but when you need foreigners money to finance your debt–and at the moment I think 15% of US debt is interest payments, much of it to foreigners, then, if foreigners lose interest in the dollar (a tall order? we’ll see), you either have to default on the debt or hyperinflate it away. No other choice. I personally think the US govt will simply renounce all debt held by foreigners. The loss will be eaten by the Chinese, JP, German govts that hold US debt. But that’s 25 to 50 years down the road probably.

– printing money does not work. Neither does fiscal policy. None of these policies, flip sides of the same charlatan coin, work. But economists would go out of business if they told their clients and the public that. They have to maintain an illusion of control. Sorry to see you (and most reading this) bought into that illusion.

23. December 2016 at 06:13

Automation does indeed play SOME role in the decline in manufacturing jobs, but it is not the sole or even primary role, nor is it a 50-50 with trade deficits or surpluses.

It is a fallacy to attribute only laissez faire reasons to the changes in manufacturing. Central banks, regulations, domestic government budget deficits and yes, automation, are in totality responsible.

Sumner underestimates one rather obvious non-market factor which is China’s monetary policy. This anti-market activity has harmed local Chinese citizens by forcing them to redeem US dollars to the Chinese central bank at a fake rate which keeps the Yuan “cheap” relative to other currencies. Foreign investors have for many decades had access to artificially cheap Chinese labor, which has shifted a large portion of manufacturing to China. Austrians have been pointing this out for years. You cannot pretend automation is a main reason when many of the jobs that have arisen in China on the basis of foreign investment has been to a large extent manual labor as well. It is not like robots are doing everything there either. Robots are of course increasing in usage all around the world, but it is not the reason for the loss of manufacturing jobs in the US and gain of manufacturing jobs in China. There is a lot of manual labor based manufacturing jobs in China that to a significant extent would have arisen in the US had there been laissez faire money, or at least a totally freely floating Yuan.

23. December 2016 at 08:19

Ben, You said:

“If I understand the arguments of orthodox macroeconomists”

A big if . . .

23. December 2016 at 09:45

OT -John B. Taylor in yesterday’s WSJ, Asia editon: “Yet in a recent empirical study, Alex Nikolsko-Rzhevskyy of Lehigh University and David Papell and Ruxandra Prodan of the University of Houston divided U.S. history into periods, such as the 1980s and ’90s, where Fed policy basically adhered to the Taylor rule and periods, such as the past dozen years, where it did not. Unemployment was 1.4 percent- age points lower on average in the Taylor-rule periods, and it reached devastating highs of 10% or more in the non-Taylor-rule periods”

So where is the DSGE or otherwise computer simulation of our host’s NGDPLT rule? Why doesn’t Sumner order some grad student to do this sort of analysis? Taylor seems politically well connected, while our host languishes here in the bleacher bum seats. Sad.

@ssumner – yes, it’s hard to figure out when Ben Cole is kidding and when he’s serious, he’s so far out in left field (worse than you). I wonder what Marcus Nunes is paying him for his articles. At least I’m driving traffic to you for free (people come here to read me as much as they read you). Happy holidays…

23. December 2016 at 10:18

“the Mysterious Man Known As Ray Lopez…”

I think you are you confusing Ray Lopas with

Dos Equis’s “Most Interesting Man in the World”.

But then again I’ve heard that Philippine mosquitoes refuse to bite him purely out of respect….and he once ran a marathon in Greece because it was on his way…or was it the police were after him for money laundering…..well anyways…Stay Thirsty My Friends….

23. December 2016 at 15:29

“OT -John B. Taylor in yesterday’s WSJ, Asia editon: “Yet in a recent empirical study, Alex Nikolsko-Rzhevskyy of Lehigh University and David Papell and Ruxandra Prodan of the University of Houston divided U.S. history into periods, such as the 1980s and ’90s, where Fed policy basically adhered to the Taylor rule and periods, such as the past dozen years, where it did not. Unemployment was 1.4 percent- age points lower on average in the Taylor-rule periods, and it reached devastating highs of 10% or more in the non-Taylor-rule periods””

Here is the article.

http://www.wsj.com/articles/the-case-for-a-rules-based-fed-1482276881

As a non-economist, I may be talking out of line. But it looks like the Taylor Rule has a magic number for the “right” real interest rate. The natural rate has decreased significantly. The natural rate can’t be easily predicted or calculated. It’s like predicting or calculating the future price of corn. There are too many microfoundational factors.

This is also my first time really looking at this Taylor Rule thing. Again, I may be out of line, but why does it get so much traction in economic circles? Why not just say “raise interest rates to reduce inflation/NGDP and vice versa?”

A rough model of NGDP versus unemployment and inflation is not too difficult either. You don’t need a model of NGDPLT specifically, but the general idea that declining or slowly growing NGDP causes unemployment. There is VERY strong evidence for declining NGDP equals increasing unemployment, including anecdotal, empirical and model-based.

23. December 2016 at 19:29

94% of net job growth over the last decade was in the alternative work category

Alternative work means part time and contract work, not full Tim, 9-5 jobs.

https://www.cebglobal.com/talentdaily/part-time-temporary-employment-new-normal/

23. December 2016 at 23:12

Merry Christmas Scott! Enjoy these timeless Alt-Right classics!

https://www.youtube.com/watch?v=iIVo60Wm-fI

24. December 2016 at 06:38

@engineer

Ray Lopez is a good fit in the Dos Equis commercials, but I think The Man of La Mancha is closer.

BTW, the song “The impossible Dream” is from a stage version of the classic book.

Imagine Ray Lopez, face florid, singing that song as he bravely charges down against fiat money.

There are giants to be slayed.

24. December 2016 at 07:12

Money is not neutral:

The 1981 ‘TIME BOMB’

Federal Reserve Bank of St. Louis – FRASER, G.6 Debits and Deposit Turnover at Commercial Banks

https://fraser.stlouisfed.org/title/3954#!491139

As prophesied: 1980 time bomb (before 1980, “you couldn’t write a check against it” – 1961 quote)

https://fraser.stlouisfed.org/scribd/?item_id=491162&filepath=/files/docs/releases/g6comm/g6_19820216.pdf

dec 99.8 1979

jan 105.5

feb 107.3

mar 111.2

apr 109.2

may 112.2

jun 111.5

jul 114.3

aug 116

sep 116.9

oct 119.2

nov 115.4

dec 118.2

jan 125.8 1980

feb 129.3

mar 129.7

apr 126.8

may 132

jun 134.7

jul 135.3

aug 135.4

sep 135.3

oct 135.2

nov 141.8

dec 150.8

jan 161.3 1981 – intro of NOW & ATS accounts

feb 168.7

mar 176.9

apr 171.8

may 176.3

jun 185.8

jul 182.4

aug 189.9

sep 191.6

oct 193.6

nov 190.7

dec 206.6

24. December 2016 at 07:25

N-gNp exploded at a 19.1 percent annual rate of change in the 1st qtr. of 1981. This was due to the wide-spread introduction of ATS and NOW accounts.

The sharp increase in CB DD velocity since 1964 was the consequence of a variety of factors which include:

1) the daily compounding of interest on savings accounts in commercial banks and “thrift” institutions (S&Ls, CUs, and MSBs),

2) the increasing use of electronics to transfer funds,

3) the introduction of negotiable commercial bank certificates of deposits, and

4) the rapid growth of ATS (automatic transfers of savings to DDs) and NOW (negotiable orders of withdrawal) accounts

…all which enabled people to economize on demand deposits (exploit opportunity costs), and resulted in the sharp increase in DD Vt.

But the most important single factor contributing to the increased rate of money turnover probably were those structural (liquidity) changes which made virtually all time (savings) deposits the equivalent of low velocity demand deposits (viz., the elimination of gate-keeping restrictions, viz., the “monetization” of TDs).

These changes included the virtual elimination of Regulation Q ceilings (caps on rates paid to savers) and the introduction of interest bearing checking accounts. These institutional innovations allow all of us, from the treasurers of the largest corporations, to the smallest savers, to hold any temporary surplus cash in an interest bearing account which can be shifted at little or no cost, without notice, and no loss of accumulated income, into demand deposits or currency.

Plus, high interest rates and expectations of higher prices were both cause and effect of rising rates of Vt.

We can, if we want, minimize money velocity, and go back to the days when a savings account was just that – and not an adjunct to our checking accounts.

These developments involved essentially “one-time” events.

The plateau in DD Vt in 1981 started secular strangulation.

https://fred.stlouisfed.org/series/MZMV

24. December 2016 at 07:28

When monetary savings are activated (& put to work), by either investing directly or indirectly via non-bank conduits (constituting a transfer of title within the CB system by matching / pooling counter-parties outside the system), and provided that those investment outlets are in real-things, then the non-inflationary output creates a myriad of other investible and bankable opportunities (has a multiplier effect).

This creates higher and firmer real-rates of interest, with lower loss from bad debts.

An old lesson: …if the debt was acquired to finance the acquisition of a (1) (new-security), the proceeds of which are used to finance plant and equipment expansion, or the construction of a new house, rather than the purchase of an (2) (existing-security) to finance the purchase of an existing house (read bailout), or to finance (1) (inventory-expansion), rather than refinance (2) (existing-inventories).

The former types of investment (1) are designated as “real” (new), as contrasted to the latter (2), which constitute “financial” (existing) investment (like TARP & FASB regulation).

Financial investment (aka “wealth effect”) provides a relatively insignificant demand for labor and materials and in some instances the over-all effects may actually be economically retarding, even contractionary.

Compared to real investment, financial investment is inconsequential as a contributor to employment and production. Only debt growing out of real investment, or consumption, makes an actual direct demand for labor and materials.

24. December 2016 at 10:03

@Matthew Waters – you are indeed ignorant, as you say. Keep in mind the Taylor rule counterfactuals are judged by what would have happened according to the Taylor rule calibrated models, meaning, you’re just taking the word of the model builder for how bad things would have been without the Taylor rule. Google “potential GDP” for a starter.

@flow5 – while I find your factual posts interesting, just re-read them with the assumption that money is neutral and see how silly they appear. It’s like a social scientist saying: “I observed a rooster crowing, then, about the same time, I saw a dawning light that indicated the sun was rising…I repeated this experiment three days in a row, and each time the cock crowed at about the time the sun rose”. So what? In your case, so what that banks led more, velocity changes, when business improves? Old as mankind…

24. December 2016 at 12:53

@ray lopes

if you actually traded the money markets you might have a different opinion. I’ve NEVER lost trading interest rate futures contracts. I know. You don’t.

25. December 2016 at 08:04

When the U.S. sneezes (e.g., unconventional monetary policy), the rest of the world still catches a cold (reflecting mis-aligned currencies and maturity mis-matches and wider credit-spread responses), viz. a synchronized impact, correlated with cross-border movements and adjustments in market volatility, asset prices and capital – channeled / concentrated hot-money flows disrupting the exchange rates between dominant trading partners (the Fed’s reciprocal currency swap lines notwithstanding).

Money flows are not neutral, money flows do change the economic patterns of trade, production and consumption, employment and R-gDp (the denigration of the Phillips Curve notwithstanding). Money flows do not exclusively, as pontificated by Ben Bernanke, act only on nominal quantities in prices, wages, exchange rate, etc. (who blames our declining incomes and the redistribution of wealth to the upper quintiles on technology, robots, globalization, and aging). No, BuB doesn’t know money from mud pie. Money flows are not, as Milton Friedman and Anna Schwartz advocated, punctuated with “long and variable” results (helicopter drops notwithstanding).

The distributed lag effects of money flows (money times velocity), are mathematical impregnable constants (hence exactly as my “market zinger” forecast played out at the end of 2012 via the expiration of the FDIC’s unlimited transaction deposit insurance, or “putting savings back to work”, not QE3’s impact (which ended without a paradoxical “taper tantrum” outcome). Quantitative easing programs, as IBDDs were remunerated, induced non-bank disintermediation and a deceleration in money velocity. This was immediately reflected by the money market’s response after all QE programs ended.

It is not exactly a Cantillon effect on the allocation of long-term fixed capital goods, but more so impacts the consumption of short-term intermediate durable consumer goods.

In May 2013, a monetary policy expectations’ shock wave (changing perception of risk premia in the spot and forward/swap markets precipitating portfolio re-allocations) came on the signal, via jawboning, that the Fed would taper its QE3, LSAP purchases of treasury securities and MBS agency bonds, decried as a “taper tantrum” i.e., temporary “noise” (fiscal budget policy sequestration notwithstanding).

No, the “expectations” charge that there was a “taper tantrum” is false. Money flows, the proxy for real-output), had ex-ante, or previously cemented, the markets’ upcoming reaction.

– Michel de Nostredame

26. December 2016 at 08:03

Credit Suisse’s Global Money Notes #8 is wrong (and so is Ben Bernanke’s “savings glut” hypothesis):

“With that assumption in mind, this issue of Global Money Notes explains why an FOMC determined to normalize interest rates has no choice but to become a Dealer of Last Resort in the FX swap market and provide quantitative Eurodollar easing (“QEE”) for the rest of the world through its dollar swap lines. The U.S.’s exorbitant privilege –its ability to borrow in its own currency anywhere in the world thanks to a vast and deep Eurodollar market – is waning. The first throw of sand at the gears of the global Eurodollar market was the adoption of Basel III which imposed liquidity requirements on a system born out of banks’ desire to avoid reserve requirements in the first place.”

“The second was money fund reform ‘Prime funds’ loss of over $1 trillion in assets under management amounts to the clamping of a major global funding “artery” whose role was to bridge the Eurodollar market ’s marginal dollar needs. These needs are now bridged through a smaller and increasingly tight “vein” that’s the balance sheet of American banks under Basel III. The result is a Eurodollar market that’s structurally more expensive and less liquid and dominant than it used to be. Basel III and money fund reform are turning the exorbitant privilege into an existential trilemma that’s usually a problem for EM central banks with pegs to the dollar, rather than the Fed at the center of the dollar based financial order According to the Fed’s newfound trilemma, it is impossible to have constraints on bank balance sheets (restraining capital mobility in global money markets), a par exchange rate between onshore dollars and Eurodollars, and a domestically oriented monetary policy mandate. Something will have to give.”

E-$s do not represent “savings”.

E-$ banking originated in the City of London and London based banks still dominate the E-$ banking system. As the number of banks participating in the E-$ transactions increased, the E-$ bankers discovered that the E-$ deposits they created for borrowers often did not result in any diminution of their U.S. $ balances – the System was merely shifting balances within itself. That is, drafts drawn on E-$ banks increasingly were deposited in other E-$ banks. Thus was laid the economic basis of an international system of “prudential” reserve banking – the discovery that the amount of actual U.S. $ reserves required to support the E-$ loans made – and E-$ deposits (money) created.

The prudential reserves of the E-$ banks consist of various U.S. $-denominated liquid assets (U.S. Treasury bills, U.S. commercial bank CDs, Repurchase Agreements, etc.) and interbank demand deposits held in U.S. banks. These are liquid balances in the U.S., or any other major currency country. If a bank’s balance is inadequate to meet a specific payment in the E-$ system, it borrows in the London money market at or near the LIBOR rate (the London Inter-bank Offering Rate), a rate before Basel III, substantially below the prime rates of most banks.

All prior prudential reserve banking systems have heretofore “come a cropper”.

26. December 2016 at 10:28

“Ironically, environmental regulations actually helped West Virginia miners, by forcing utilities to install scrubbers that cleaned up emissions from the dirtier West Virginia coal. ”

Ironically, from what I have read, lots of pollution controls on coal plants are not currently being used because of the large pollution reduction from switching to gas. The total emissions are what is tracked and not emissions from individual plants.

http://www.baltimoresun.com/features/green/blog/bs-md-upwind-air-pollution-20161116-story.html

It is doubtful, with or without Trump, that any new coal plants and very few nuclear plants (with current technology) will every be built. The abundance of NG and the rapidly falling price of solar/wind makes coal much more costly even without additional pollution requirements. Add to that the uncertainty/risk premium of future restrictions and I have little doubt that coal use will continue it’s current trajectory down.

http://sites.utexas.edu/energyinstitute/files/2016/12/UT-Austin-Energy-Institute-Press-Release-Full-Cost-of-Electricity-study.pdf

The question is how fast. There I think Trump could make a small difference in some areas of the country. The electricity demand peaked about 10 years ago, so there is not a huge demand for new plants unless regulations are too costly to maintain them. Here the action is as much on the state level as on the Federal. Most of the coal plants taken off-line were old and in need of major refurbishment and that investment is not going to happen. Coal operators are hoping that NG prices will rebound driven by LNG and Mexican exports, but I am very doubtful. The NG producers have

continually improved their techniques are getting twice as much/well by using more fracking sand now. Ironically, the best thing for coal would probably be the anti-fracking referendums, but those have never happened in areas with major reserves and don’t think they will be happening in Texas anytime soon.

The real game changer in the energy sector in my mind is electric cars. If they become widespread, that is going to be hugely disruptive to just so many aspects of the economy. Even there, I don’t believe all of the additional electricity will result in any more coal use.

In terms of account deficits, there seems to an equilibrium point in our trade deficit such that gains in one area actually cause losses in others. Our account deficits in energy have greatly improved and that has also made some industries like petrochemicals more competitive. At they same time, that has made the dollar stronger than it otherwise would have been, and caused other industries to be less competitive and the deficit to become even more imbalanced in these. I don’t really understand how advanced economies like Japan and Germany can still run huge account surpluses especially when they import nearly all their energy needs.

Also, many economists (outside of MM circles) blame the great recession on the account imbalances via the housing bubble. I suspect that it was a contributing factor. One thing that Ray states above that is certainly true is that it is hard to separate cause and effect in complex systems.

On a separate note…I just read that nutritional scientists now say that eggs help to lower cholesterol (something in the yolk, just don’t eat more than 4 per day)….and 97% of experts would have disagreed only a couple of years ago.

26. December 2016 at 11:04

Since the NBER’s Business Cycle Dating Committee’s, start of the GR in Dec. 2007, R-gDp has grown by c. 12% and the deflator has grown by c. 14% (stagflation). So, overall, income has declined (secular strangulation). And the distribution of income has shifted to the upper quintiles. That’s exactly how the economy is set up to work (it’s modeled to decelerate and then shrink).

And: “the NBER does not define a recession in terms of two consecutive quarters of decline in real GDP. Rather, a recession is a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales”.

Keynesian economists are “dimensionally confused” (never having learned a credit from a debit, and thus do not understand the flow of funds, the U.S. savings-investment process). All savings originate within the DFIs, deposit taking, money creating, financial institutions. And from the standpoint of the entire economy and the member banking system, the DFIs always create new money when they lend/invest.

The DFIs do not loan out existing deposits, saved or otherwise. Contrary to the Fed’s bible: “Requiem for Regulation Q: What It Did and Why It Passed Away” – R. Alton Gilbert; deposits are the result of lending, not the other way around. Whether the public saves, or dis-saves, chooses to hold their savings in the DFIs, or transfers their savings to a non-bank conduit, will not, per se, alter the total assets, liabilities, or earning assets of the DFIs, nor alter the forms of these assets and liabilities (transaction or savings accounts).

Savings flowing through the non-banks never leave the payment’s system. And virtually all demand drafts clear thru transaction account classifications. When savings are matched with investments, there is a transfer of title inside DFI deposits. So unless DFI saver-holders invest directly or indirectly via non-bank conduits (outside the payment’s system), money velocity and thus AD, money times velocity, will slow.

I.e., contrary to public enemy #1, the ABA, the non-banks are not in competition with the DFIs. The complete deregulation of commercial bank deposit rate ceilings was patently conspiratorial: “well funded lobbyists that routinely spends more money influencing legislation, than all other industry and labor groupings”. God doesn’t like “ugly”.

http://cepr.net/documents/publications/dereg-timeline-2009-07.pdf

Inflation (which is ill-defined and understated, esp. considering lower per-unit pricing), relative to R-gDp, will widen substantially in 2017. That’s how it’s modeled, a priori & a posteriori. Money flows are not neutral. They demonstrably affect real variables, employment, consumption, and R-gdp. Rates-of-change my M*Vt time series are mathematically impregnated constants, ex-ante extrapolations.

26. December 2016 at 11:39

@engineer:

“that is certainly true is that it is hard to separate cause and effect in complex systems”

———-

Patently false:

POSTED: Dec 13 2007 06:55 PM |

The Commerce Department said retail sales in Oct 2007 increased by 1.2% over Oct 2006, & up a huge 6.3% from Nov 2006.

10/1/2007,,,,,,,-0.47,,,,,,, -0.22 * temporary bottom

11/1/2007,,,,,,, 0.14,,,,,,, -0.18

12/1/2007,,,,,,, 0.44,,,,,,,-0.23

1/1/2008,,,,,,, 0.59,,,,,,, 0.06

2/1/2008,,,,,,, 0.45,,,,,,, 0.10

3/1/2008,,,,,,, 0.06,,,,,,, 0.04

4/1/2008,,,,,,, 0.04,,,,,,, 0.02

5/1/2008,,,,,,, 0.09,,,,,,, 0.04

6/1/2008,,,,,,, 0.20,,,,,,, 0.05

7/1/2008,,,,,,, 0.32,,,,,,, 0.10

8/1/2008,,,,,,, 0.15,,,,,,, 0.05

9/1/2008,,,,,,, 0.00,,,,,,, 0.13

10/1/2008,,,,,,, -0.20,,,,,,, 0.10 * possible recession

11/1/2008,,,,,,, -0.10,,,,,,, 0.00 * possible recession

12/1/2008,,,,,,, 0.10,,,,,,, -0.06 * possible recession

Trajectory as predicted:

26. December 2016 at 13:38

Flow5:. It still seems to me that you are looking at an effect. Potentially a much better one the the Federal reserve uses, such that changing coarse could have been enacted much sooner. But it is still a leading indicator and not the ultimate cause, right?

26. December 2016 at 15:11

@Engineer:

No, it’s a cause. M*Vt = P*T (and it’s also a surrogate for bank debits).

The validity of the multiplier as a predictive device is predicted on the assumption that the commercial banks will immediately expand credit and the money supply (invest in some type of earning asset), if they are supplied with additional excess reserves, IBDDs. The inconsequential volume of excess reserves held by the member commercial banks during 1942 and Sept. 2008 provides documentary proof that they undoubtedly did.

Historically, coming out of a recession, the commercial banks, today’s DFIs, bought highly liquid, short-term assets, pending a more profitable disposition of their legal and economic lending capacity, i.e., between 1942 and Oct 1, 2008, the CBs remained fully “lent up”, the CBs minimized their non-earning assets, their excess reserves.

Indeed, in direct contrast to the GR, excess reserves balances actually fell during some economic recessions, 12/69 – 11/70; 11/73 – 3/75; 1/80 – 7/80; 7/81 – 11/82 (i.e., until the S&L crisis). Excess reserve balances never exceeded > $2b, and only for 1 month, in 1/91 (and not over $4b until 8/07, and then not exceeding that threshold until 9/08 (just before the payment of interest on excess reserve balances turned non-earning assets into commercial bank’s earning assets on 10/6/08). I.e., the BOG shot itself in the foot and emasculated its “open market power”.

The CBs always responded (by purchasing short-term securities), without delay – to any injection of excess reserve balances, i.e., to any excess lending capacity, by the Central bank. I.e., the CB’s response was always self-correcting, or counter-cyclically (without Gov’t intervention), by expanding the money stock (buying securities, not necessarily making loans). And today, in contrast to the Great Depression, there is a surfeit of eligible collateral (viz., considering our 19 trillion dollar federal debt).

Monetary policy objectives should be formulated in terms of desired rates-of-change, roc’s, in monetary flows, M*Vt (our means-of-payment money times its velocity of circulation), relative to roc’s in R-gDp.

Roc’s in N-gDp (though “raw materials, intermediate goods and labor costs, which comprise the bulk of business spending are not treated in N-gDp”), can serve as a proxy figure for roc’s in all economic transactions, P*T, in Yale Professor Irving Fisher’s truistic “equation of exchange” (where the proper index # provides clues to the overall economies’ “price-level”). Roc’s in R-gDp have to be used, of course, as a policy standard.

26. December 2016 at 15:29

@Engineer:

“changing coarse could have been enacted much sooner”

————

What caused the GR happened way before yield curve changes. AIG stopped writing CDS in 2006.

2006-01-01 4.29

2006-02-01 4.49

2006-03-01 4.59

2006-04-01 4.79

2006-05-01 4.94

2006-06-01 4.99

2006-07-01 5.24

2006-08-01 5.25

2006-09-01 5.25

2006-10-01 5.25

2006-11-01 5.25

2006-12-01 5.24

2007-01-01 5.25

2007-02-01 5.26

2007-03-01 5.26

2007-04-01 5.25

2007-05-01 5.25

2007-06-01 5.25

2007-07-01 5.26

2007-08-01 5.02 first drop in effective funds rate (monthly)

26. December 2016 at 15:34

At the height of the Doc.com stock market bubble, Federal Reserve Chairman Alan Greenspan initiated a “tight” monetary policy (for 31 out of 34 months).

Note: A “tight” money policy is defined as one where the rate-of-change in monetary flows (our means-of-payment money times its transactions rate of turnover) is no greater than 2-3% above the rate-of-change in the real output of goods & services.

Greenspan then wildly reversed his “tight” money policy (at that point Greenspan was well behind the employment curve), & reverted to a very “easy” monetary policy — for 20 consecutive months (i.e., despite 14 raises in the FFR (June 30, 2004 until January 31, 2006), -every single rate hike was “behind the inflationary curve”). I.e., Greenspan NEVER tightened monetary policy.

And as soon as Bernanke was appointed to the Chairman of the Federal Reserve, he immediately initiated, his first “contractionary” money policy for 29 consecutive months (coinciding both with the end of the housing bubble, & the peak in the Case-Shiller’s National Housing Index in the 2nd qtr of 2006 @ 189.93), or at first, sufficient to wring inflation out of the economy, but persisting until the economy plunged into a depression).

Note: A “contractionary” money policy is defined as one where the rate-of-change (roc’s) in monetary flows (our means-of-payment money times its transactions rate of turnover) is less than 2% above the rate-of-change in the real output of goods & services (for this entire 2 year period roc’s in MVt, proxy for inflation, were NEGATIVE (less than zero!).

Money market & bank liquidity continued to evaporate despite the FOMC’s 7 reductions in the target FFR (which began on 9/18/07 until 4/30/08). Bernanke didn’t initiate an “easy” money policy, and continued to drain liquidity despite Bear Sterns two hedge funds that collapsed on July 16, 2007, & immediately thereafter filed for bankruptcy protection on July 31, 2007 — as they had lost nearly all of their value.

BuB didn’t ease until Lehman Brothers later filed for bankruptcy protection (& it was one the Federal Reserve Bank of New York’s primary dealers in the Treasury Market), on September 15, 2008. The next day AIG’s stock dropped 60%. I.e., BuB maintained his “tight” money policy [i.e., credit easing or mix of assets, not quantitative easing –injecting new money & reserves].

The FOMC’s “tight” money policy was due to flawed Keynesian dogma (using interest rate manipulation as a monetary transmission mechanism), rather than by using open market operations of the buying type to expand legal reserves & the money stock — and thus AD.

On January 10, 2008 Federal Reserve Chairman Ben Bernanke pontificated: “The Federal Reserve is not forecasting a recession”.

Bernanke subsequently initiated the economy’s coup de grâce during July 2008 (his second ultra-contractionary money policy). The 3rd contractionary policy was the introduction of the payment of interest on excess reserves, which destroyed non-bank lending/investing (the 1966 S&L credit crunch is the economic paradigm).

Note aside: the 2 year rate-of-change (roc) in MVt (which the FED can control – i.e., the roc in N-gDp), peaked in the 2nd qtr of 2006 @ 12%. Bernanke let it fall to 8% by the 4th qtr of 2007 (or by 33%). N-gDp fell to 6% in the 3rd qtr of 2008 (another 25%). N-gDp then plummeted to a -2% in the 2nd qtr of 2009 (another – 133%).

By withdrawing liquidity from the financial markets, risk aversion was amplified, haircuts were increased, additional and/or a higher quality of collateral was required, liquidity mis-matches were multiplied, funding sources dried up, long-term illiquid assets went on fire-sale, non-bank deposit runs developed, withdrawal restrictions were imposed, forced liquidations lowered asset values, counter-parties’ credit default risks were magnified– all of which contributed a general crisis of confidence & frozen financial markets (regulatory malfeasance was a subordinate factor).

I.e., Alan Greenspan didn’t start “easing” on January 3, 2000, when the FFR was first lowered by 1/2, to 6%. Greenspan didn’t change from a “tight” monetary policy, to an “easier” monetary policy, until after 11 reductions in the FFR, ending just before the reduction on November 6, 2002 @ 1 & 1/4% (approximately coinciding with the bottom in equity prices).

I.e., Greenspan was responsible for both high employment (June 2003, @ 6.3%), & high inflation (rampant real-estate and commodity speculation).

And BuB NEVER eased. BuB then relentlessly drove the economy into the ground, creating a protracted un-employment, & under-employment rate, nightmare.

27. December 2016 at 10:09

Cause and effect:

https://www.youtube.com/watch?list=FLRhV1rWIpm_pU19bBm_2RXw&v=3AMCcYnAsdQ

27. December 2016 at 11:41

Tom Brown:

Right, the earth’s not warming. So the air force jets can stop spraying barium.

29. December 2016 at 06:36

The CAD is friction to growing NGDP. We buy goods in $, and the sellers park the proceeds in treasuries and in essence becomes dead money. It probably reduces the hot potato effect.

31. December 2016 at 08:19

Rising CA deficits should not ever cost jobs, what is the case for that system? The problem is if CA deficits are expected to ever fall in the future, that can only happen if today’s CA deficits are funding increasingly productive investments, or if future economic activity retreats with the deficits.

If you are a protectionist you see a country with rising CA deficits trading sustainable jobs (manufacturing or something) for jobs that will go away when debt-laden actors are forced to retrench.

If not, and you also don’t see any limit to the direction or duration of CA balances, then jobs are jobs are jobs. They don’t need funding.