Bernanke on Brexit

Scott Freelander recently asked me about a Bernanke post, which appears to be guilty of reasoning from a price change:

The U.K. economic slowdown to come will be exacerbated by falling asset values (houses, commercial real estate, stocks) and damaged confidence on the part of households and businesses. Ironically, the sharp decline in the value of the pound may be a bit of a buffer here as, all else equal, it will make British exports more competitive.

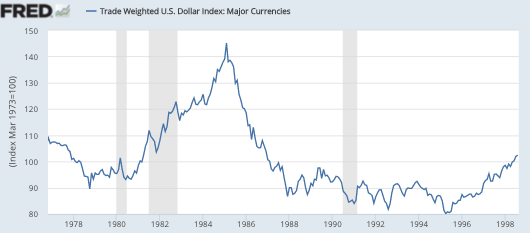

Here I’d probably cut Bernanke a bit more slack than Scott, as the phrase “all else equals” seems a nod in the direction of the dangers of reasoning from a price change. The pound fell sharply when the Brexit vote was announced, because of an anticipated decline in the demand for pounds. Brexit will reduce the foreign demand for British goods, services and assets. Since one needs pounds to buy British stuff, this reduces the value of the pound, as well as the quantity of exports. Think of it as a leftward shift in the demand for pounds, on an S&D diagram. Bernanke presumably meant that British exports fall by less than if the BoE had pegged the pound, while demand was shifting left. That is correct.

One other point. I recall one recent example where the pound fell a couple of cents on expansionary talk from Mark Carney. That can be viewed as a positive shift in the supply of pounds, which would indeed boost exports.

Here’s another example that Scott noticed, from the same post:

In the United States, the economic recovery is unlikely to be derailed by the market turmoil, so long as conditions in financial markets don’t get significantly worse: The strengthening of the dollar and the declines in U.S. equities are relatively moderate so far. Moreover, the decline in longer-term U.S. interest rates (including mortgage rates) partially offsets the tightening effects of the dollar and stocks on financial conditions. However, clearly the Fed and other U.S. policymakers will remain cautious until the effects of the British vote are better sorted out.

Long-term rates probably fell due to a decline in expected NGDP growth after Brexit (or maybe a greater preference for safe assets). Presumably Bernanke meant that the drop in long-term interest rates would be more expansionary than if the Fed had pegged those rates by selling T-bonds, right as expected NGDP growth in the US was declining. Again I’m cutting Bernanke some slack, as he’s obviously a brilliant economist and in his memoir I recall him saying that rising long-term interest rates during QE could actually be a sign that it was working. So I think his views are not far apart from mine.

Nonetheless, I’m pretty fanatic on the “never reason from a price change issue”, and I feel that even while Bernanke is aware of all the points I just made, talking about the effect of lower interest rates and lower exchange rates can tend to mislead the public. In another recent post I said:

I certainly agree with the 38 out of 40 economists who view anti-trade deficit arguments as reflecting ignorance of the most basic ideas in EC101. And yet, according to the Council on Foreign Relations, guess who else is ignorant of EC101?

Since April, Treasury has been applying a quantitative framework to determine if a country is managing its currency inappropriately for competitive advantage–that is, keeping it undervalued. Japan already meets two of the three criteria–a bilateral trade surplus with the U.S. over $20 billion, and a current account surplus greater than 3 percent of GDP–and will meet the third if intervention exceeds ¥10 trillion in a twelve-month period. This is not a high threshold historically–Japan sold ¥14 trillion in 2011 and ¥35 trillion in 2003-4.

So apparently those highly educated bureaucrats at the Treasury, with their 6 figure incomes and their posh DC lifestyles, are actually a part of the ignorant masses that are pushing Trump-style populism. And in fact they are pushing nonsense, the “quantitative framework” has no more support in economic theory than astrology has in high-level physics. So if the public has been reading articles for decades and decades about how our Treasury officials valiantly try to protect us from evil Asian exporters, is it any wonder that the now are susceptible to the arguments of right and left wing populists?

I worry when experts talk about the expansionary impact of a lower exchange rate, or a lower interest rate. This recent Forbes piece is an example of what may result:

After Friday’s market close, people remarked that both the bond market and the stock market were at all time highs.

It’s not supposed to work that way. Now, it is a common misconception that bonds always are negatively correlated with stocks. Actually, over the long term, they have a correlation of zero with stocks. But they spend most of their time in one of two regimes, either strongly positively correlated or strongly negatively correlated. Over time it works out to be zero. Yet here we are, with stocks and bonds on the highs.

David Zervos, market strategist at Jefferies, commented that “Central banks may finally be taking this too far.” I think central banks started taking things too far in 1913, but yes, with nearly every financial asset in the stratosphere, you could easily come to the conclusion that there has been too much monetary easing. I am not the first to say that central banks are addicted to higher asset prices. It’s hard to imagine a scenario where they willingly let the markets deflate.

We’ve been having a lot of bubbles in recent years (a feature of a world populated with central banks), from the dot-com bubble in 2000 to the housing bubble in 2007 to what people are calling the “central bank bubble” or “the everything bubble” now. Chances are, this could be the biggest bubble of all, and perhaps the most dangerous.

A few years ago, I predicted that in the future there would be almost non-stop complaints about bubbles. People would see them everywhere. That’s because low interest rates are the new normal, and thus P/E ratios, price to rent ratios, etc., will be higher than in the past. It will look like there are bubbles everywhere, but of course bubbles don’t actually exist.

Part of the problem is that the public thinks it’s been told that low rates are easy money, which should boost asset prices. So they see this as a central bank phenomenon, even though the lowest rates are in places (like Switzerland) where money has been tightest, and the higher rates are in easier money places like Australia. The public misreads posts like the Bernanke example I just cited, and learns the wrong lesson. That why I want economists to stop talking about the causal impact of a change in interest rates, inflation or exchange rates, and start talking in terms of the causal impact of changes in NGDP growth, where expected NGDP growth represents the stance of monetary policy.

Let me remind you of some earlier words of wisdom from Bernanke:

The imperfect reliability of money growth as an indicator of monetary policy is unfortunate, because we don’t really have anything satisfactory to replace it. As emphasized by Friedman (in his eleventh proposition) and by Allan Meltzer, nominal interest rates are not good indicators of the stance of policy, as a high nominal interest rate can indicate either monetary tightness or ease, depending on the state of inflation expectations. Indeed, confusing low nominal interest rates with monetary ease was the source of major problems in the 1930s, and it has perhaps been a problem in Japan in recent years as well. The real short-term interest rate, another candidate measure of policy stance, is also imperfect, because it mixes monetary and real influences, such as the rate of productivity growth. In addition, the value of specific policy indicators can be affected by the nature of the operating regime employed by the central bank, as shown for example in empirical work of mine with Ilian Mihov.

The absence of a clear and straightforward measure of monetary ease or tightness is a major problem in practice. How can we know, for example, whether policy is “neutral” or excessively “activist”? I will return to this issue shortly. . . .

Do contemporary monetary policymakers provide the nominal stability recommended by Friedman? The answer to this question is not entirely straightforward. As I discussed earlier, for reasons of financial innovation and institutional change, the rate of money growth does not seem to be an adequate measure of the stance of monetary policy, and hence a stable monetary background for the economy cannot necessarily be identified with stable money growth. Nor are there other instruments of monetary policy whose behavior can be used unambiguously to judge this issue, as I have already noted. In particular, the fact that the Federal Reserve and other central banks actively manipulate their instrument interest rates is not necessarily inconsistent with their providing a stable monetary background, as that manipulation might be necessary to offset shocks that would otherwise endanger nominal stability.

Ultimately, it appears, one can check to see if an economy has a stable monetary background only by looking at macroeconomic indicators such as nominal GDP growth and inflation. On this criterion it appears that modern central bankers have taken Milton Friedman’s advice to heart. [emphasis added]

That last sentence seemed true in 2003, but obviously not today. What happened?