Puerto Rico or Ireland? The choice facing Greece

The Financial Times has an article discussing the situation in Greece, which is described as being pretty bleak. Living standards have fallen significantly:

The new report was prepared by IMF staff ahead of a February 6 board meeting to discuss the fund’s participation in an EU-led €86bn bailout of Greece and signals the continuing hard line the IMF is taking on debt relief for Athens. It offers a bleaker view of Greece’s economic dilemmas than an analysis prepared last year, warning that the debt load is “highly unsustainable” and would not improve even if it implemented further reforms recommended by the fund. . . .

“Even with these ambitious polices in place, Greece cannot grow out of its debt problem,” IMF staff warned in the report, seen by the Financial Times and drafted as part of the fund’s annual review of member economies. “Greece requires substantial debt relief from its European partners to restore debt sustainability.”

The IMF declined to comment, citing a policy of not commenting on leaked material.

The fund calculated that Greece’s debt load would reach 170 per cent of gross domestic product by 2020 and 164 per cent by 2022, “but become explosive thereafter” and grow to 275 per cent of GDP by 2060.

In contrast, the Germans believe that the Greeks need to tighten their belts, and get on with economic reforms. Given that I’m a utilitarian, why do I favor Germany’s “tough love” approach over the soft love (or at least less tough love) approach of the IMF?

First let’s consider the “austerity” question. In the Keynesian model, austerity may be a foolish policy during a temporary recession, or even a fairly long depression. But in the very long run, countries face hard budget constraints. And by any stretch of the imagination the period from 2022 to 2060 must be viewed as “the very long run.” It’s impossible to justify large and growing budget deficits during that 38-year period on the basis of “fiscal stimulus”. That’s the road to bankruptcy.

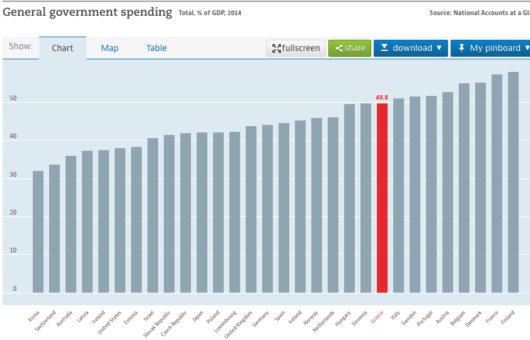

It’s not easy to find accurate data on government spending and taxes, but the OECD has a graph showing that Greece spends just under 50% of GDP. The IMF is simply wrong when it claims Greece’s debt situation is unsustainable. If Greece had a smaller government sector, say closer to the 36% of GDP in Australia, or the 23% of GDP in Taiwan, then it could easily handle the challenges out to 2060.

The counterargument is that those sorts of cuts are not politically realistic in Greece, and at the moment I’d have to agree. Some would claim the Greeks have already suffered from severe austerity. You might wonder how that can be, given that nearly 1/2 of Greek GDP goes into government spending. The problem here is that as G has fallen sharply, so has GDP, leaving the G/GDP ratio little changed, even as the Greek people have seen slashes in important programs. The deeper problem is that Greece does not produce like a developed country, but its citizens expect the level of services and pensions normally associated with a developed country. That’s why there is so much hostility to Greece in the middle-income countries of Eastern Europe, where benefit levels are lower. I can see both sides of the debate, but next I’d like to explain why I think the German approach is the best option.

Greece faces two options. One is to become a sort of ward of the EU, kept afloat by endless subsides, with a loss of sovereignty. Here a model might be Puerto Rico, or the US possessions of the South Pacific, or perhaps the Native American reservations within the US. These regions consume more than they produce, with the help of transfers from Washington.

But there is another model. When I was young, Ireland was quite poor. Articles were written explaining how the Irish poverty reflected some sort of flaw in the Irish culture, or even a lack of intelligence. But then Ireland adopted a neoliberal economic model, and it has now become one of the richest countries in the world (although that’s a bit overstated, as its GDP exceeds its GNP due to heavy multinational investment.) Still it’s a successful economy.

When I researched neoliberalism back in 2008, I was puzzled by Greece’s relatively high GDP per capita, given that it had the least neoliberal model in the entire developed world. Of course we all know what happened next, that flawed model finally caught up with the Greeks. Greece tried to maintain developed country living standards with a third world-type economic structure, riddled with corruption and statism, by borrowing lots of money.

I sympathize with the Greek people, but the hard truth is that they continually elected the flawed and corrupt governments that brought Greece to its current situation. The Germans are right; Greeks need to tighten their belts and adopt neoliberal economic reforms. This will allow them to boom like Ireland, and eventually get back to much higher living standards.

The Puerto Rican option might look tempting–have other countries pay for your consumption–but in the end the political winds in Europe will shift and Greece will be left to fend for itself. Thus the reforms should start right now. If they start running budget surpluses then the Greek debt is certainly serviceable in this new world of ultra-low interest rates.

Unfortunately, I don’t think they will follow my advice. I predict that Greece will choose the Puerto Rican option. The only question in my mind is whether the Northern Europeans will allow it. Perhaps that’s one tiny silver lining from the new nationalism sweeping the world.

PS. The more I find out about Trump, the less I like him. He doesn’t even know how to do populism right:

Republicans and Democrats in Congress and in state legislatures have recently pushed legislation to rein in the long-standing practice of police seizing the cash and property of suspects who haven’t been convicted. . . .

Likening such efforts to the Iran nuclear deal he has often lambasted, Trump said no one understands the phenomenon.

He said Congress would be “beat up” badly by the voters if it stood in the way of police efforts to conduct civil asset forfeiture.

A 2014 Washington Post investigation found that police had taken billions of dollars in cash from motorists without search warrants, and without charging them with a crime.

If you read libertarian media you frequently come across almost unbelievable abuses in this areas, things that you’d expect from law enforcement in Nigeria, not America. And Trump opposes any reforms. Sad!

He’s just an appalling human being, in every possible way. Fortunately he’s President of the US rather than the Philippines. The courts will at least somewhat limit the damage over here.