I view The Economist as the best magazine in the world, which is why I like to pick on them so much. I recently came across a couple examples of faith-based reasoning at the Economist. Here’s a piece on the recent recovery in Japan:

JAPAN’S economy has been so sickly for so long that many have stopped looking for signs of recovery. And yet, on close examination, they are there. Years of massive fiscal and monetary stimulus seem to be having some effect. Unemployment is below 3%—the lowest rate in 23 years—and wages are rising, at least for casual workers. Prices are creeping up, too, albeit by much less than the Bank of Japan’s 2% inflation target.

Yikes! Massive fiscal stimulus? In fact, Abenomics has involved a sharp contraction in fiscal policy, mostly due to a large increase in their national sales tax. Budget deficits are shrinking dramatically. Yes, fiscal policy was expansionary in the 1990s and early 2000s, but that corresponded to perhaps the worst 19 year performance in aggregate demand ever seen in a developed economy, with NGDP actually falling between 1993 and 2012. It’s only since the beginning of 2013 that Japanese NGDP has shown signs of life:

Then I came across this headline on Bitcoin:

Then I came across this headline on Bitcoin:

Manias, panics and Initial Coin Offerings

Crypto-coin mania illustrates the crazy and not-so-crazy sides of bubbles

In fact, it would be hard to find a more perfect refutation of the bubble hypothesis than Bitcoin. And yet somehow The Economist sees Bitcoin as a good example of a bubble.

Recall that back in 2012 when Bitcoin was trading at $12, the Economist was already calling it a bubble:

These curious capabilities make Bitcoins a combination of a commodity and a fiat currency (creating the coins is referred to as “mining” and they have value only because people accept them). But boosters inflated a Bitcoin bubble. Shortly after the currency launched, articles spread around the internet arguing that Bitcoins would protect wealth from hyperinflation and that early adopters would make a fortune. The dollar price of a Bitcoin currency unit climbed from a few cents in 2010 to a peak of nearly $30 in June 2011 (see chart), according to data compiled by Mt Gox, a popular online Bitcoin exchange. Inevitably, the currency then crashed back down, bottoming out at $2 in November 2011.

Inevitably? Do the writers at The Economist have no sense of shame? It’s bad enough that they prevented me from becoming filthy rich by purchasing bitcoin back in 2012, but after being spectacularly wrong about it being a bubble in 2012, they continue to make the same predictions over an over again, year after year. Bitcoin could fall 99% tomorrow and the Economist would still be completely wrong about it being a bubble. Please, I beg you, just stop trying to predict asset prices. I don’t buy the Economist for investment tips.

As each day goes by the four anti-EMH arguments from 2009 (when I started blogging) look weaker and weaker. NASDAQ 5000? It just soared past 6700. (Roughly 5000 in real terms) Housing prices? They’re soaring again. Hedge funds and college endowments outperform? Not any more. Bitcoin is a bubble at $30? Where can I buy some at that price.

But of course none of this will matter. People don’t believe in fiscal stimulus and bubbles because of the facts, as the evidence strongly refutes these theories. Rather it seems like soaring prices are a bubble, and it seems like big government spending programs should boost the economy. Thus people will continue to believe these myths no matter how much evidence piles up against.

PS. And it’s even worse. When Bitcoin prices finally plunge (and they will at some point, as all highly volatile asset prices do) then the bubbleheads will think they were right all along, even as they’ve been wrong all along.

It’s hopeless.

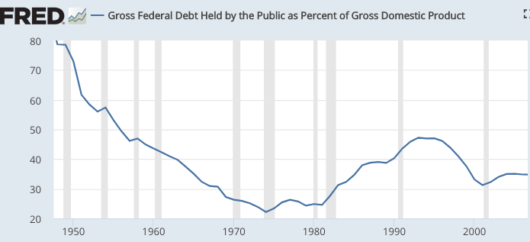

So no, fiscal policy has not been unsustainable for decades. The debt ratio fell from 80% of GDP in 1947 to 35% of GDP in 2007. That’s not to say that there were no long term fiscal challenges in 2007—the looming retirement of baby boomers was an issue that needed to be addressed.

So no, fiscal policy has not been unsustainable for decades. The debt ratio fell from 80% of GDP in 1947 to 35% of GDP in 2007. That’s not to say that there were no long term fiscal challenges in 2007—the looming retirement of baby boomers was an issue that needed to be addressed.