It was not “inability”

Over at Econlog, I have a post discussing Bernanke’s views on price level targeting. Here I’d like to nitpick a couple passages from Bernanke’s post:

As price-level targeting and “make-up” policies are closely related, they could be combined in various ways. For example, by promising to return the price level to trend after a period at the zero lower bound, the Fed could use the language of price-level targeting to make precise its commitment to make up for its inability to respond adequately during the period when rates are at zero.

It was not inability to cut rates that prevented the Fed from acting after Lehman failed in September 2008.

It was not inability that caused the Fed to raise the interest rate on reserves in October 2008.

It was not inability that caused the Fed to refuse to cut rates to zero in November 2008.

It was not inability that caused the Fed to refuse to do negative IOR, when Sweden adopted the policy in 2009.

It was not inability that caused the Fed to prematurely end QE1 in late 2009.

It was not inability that caused the Fed to prematurely end QE2 in mid-2011

It was not inability that caused the Fed to prematurely talk about tapering in 2013.

It was not inability that caused the Fed to prematurely raise rates in 2015.

Now Fed policy is roughly appropriate. But it was obviously too contractionary for many, many consecutive months and years, just as had been the case in Japan. Just to refresh your memories, Bernanke’s paper that criticized the BOJ on almost precisely the same grounds as I criticized the Fed was entitled:

And the answer he gave was a resounding yes. That’s not to say the Fed’s job is easy. I might have done no better than Bernanke, if I were in his shoes. There are all sorts of political pressures within the Fed and also from the outside. It’s a very hard job. But it’s never about inability; it’s about the Fed’s willingness to do whatever it takes. It’s willingness to show what Bernanke once called “Rooseveltian resolve”.

One other quibble:

Support for a higher inflation target seems to be increasing along with worries about the ZLB. In a recent post entitled “The case for a higher inflation target gets stronger,” Stephen Cecchetti and Kermit Schoenholtz cite four arguments in favor:

-

the persistent decline in normal interest rates;

-

findings (like those of KR) that the frequency and severity of future ZLB episodes may be worse than previously thought, even given the low level of normal interest rates;

-

-

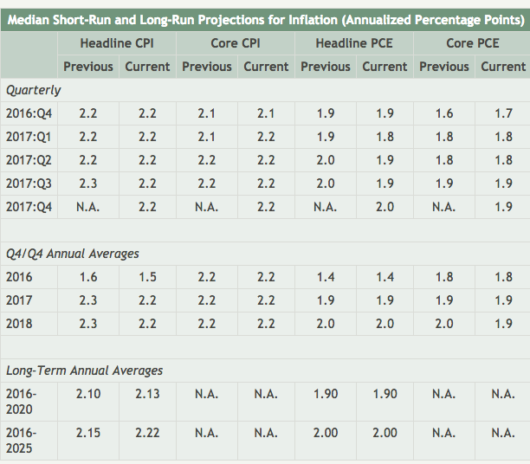

calculations that suggest that standard inflation measures may overstate actual increases in the cost of living by more than had been understood.

I don’t have a big problem with this, but I don’t really like point four. If higher inflation is a good idea, it has nothing to do with the fact that “standard inflation measures may overstate actual increases in the cost of living”. There are several theories about the welfare cost of inflation, but none of them hinge in any way on the question of whether the BLS properly accounts for quality changes, or the substitution effect, or the new product effect. The welfare costs of inflation have to do with things like menu costs for adjusting prices, or excess taxation of capital income when inflation is high. Point four creates the misleading impression that economists want to control inflation so that consumers will benefit from a dollar that loses 2% of its purchasing power each year in terms of . . . what? Utility?

I also disagree with this:

Second, although quantifying the economic costs of inflation has proved difficult and controversial, we know that inflation is very unpopular with the public. This may be due to reasons that economists find unpersuasive—e.g., people may believe that the wage increases they receive are fully earned (that is, not due in part to prevailing inflation), while simultaneously blaming inflation for eroding the purchasing power of those wages.

The thing that is unpopular with the public is called “inflation” by the man on the street, but it has nothing to do with inflation as defined by economists. I talk a lot about how the American public in 1990 thought inflation was higher than in 1980. But an even better example occurred in Europe, where polls showed that Europeans believed that inflation jumped dramatically after the euro was introduced. I had European students tell me this with a straight face, back when I taught at Bentley. I’m not sure what Europeans were annoyed about in 2002, but it was not “inflation” as the concept is understood by economists. We need to stop trying to please a deeply confused public that doesn’t understand our terminology, and instead produce a macroeconomic environment with stable NGDP growth, stable growth in incomes, and stable employment growth. They liked it in the 1990s, and they would like it now.

I vaguely recall reading that there were more complaints about inflation than deflation during the Great Depression. (Can someone confirm?)

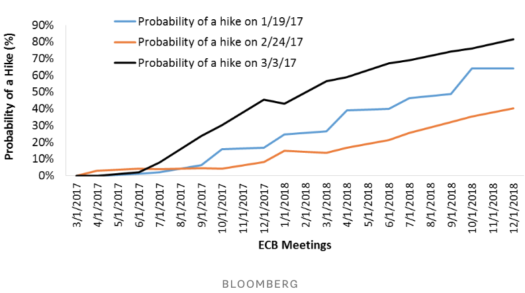

PS. Here’s today’s headline from the FT:

I’m still skeptical of the Trump reflation story. Monetary offset is still in place, and supply side gains are likely to be a couple tenths of a percent at best, assuming he can get anything through Congress.

HT: rtd