The RBA as firm and policymaker

Here is the Financial Times:

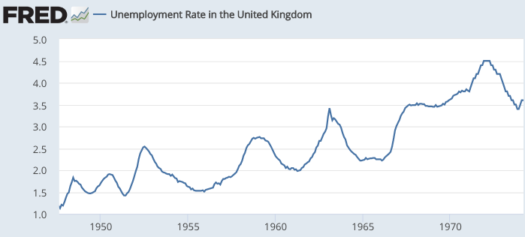

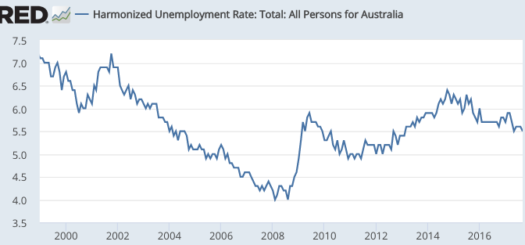

Australia has created 1m jobs over five years and its economy is growing at a healthy 3.1 per cent a year, but for workers the “lucky country” has lost some of its shine. Wages growth is stuck near record lows and household debt is among the highest in the developed world.

Average wages grew 2.1 per cent in the year to the end of March, below the 3.5 to 4 per cent levels that Australians enjoyed during a decade-long commodities boom that ended in 2013.

This is causing concern at the Reserve Bank of Australia, which has warned that weak household income growth and high debt posed a risk to the economy. “The crisis is really in wage growth,” Philip Lowe, the RBA governor, cautioned last year as he implored workers to demand higher wages to stimulate the economy.

A few comments:

1. Australia has now gone 27 years without a recession, despite wild swings in the markets for its key commodity exports (iron, coal, food, etc.) So much for the theory that good monetary policy cannot smooth out the business cycle. So much for the theory that housing bubbles cause economic instability. So much for the theory that decade after decade of massive current account deficits are a problem. The naysayers have been telling me “you just wait” since I began blogging in early 2009. I’m still waiting, and the Australian expansion keeps rolling along.

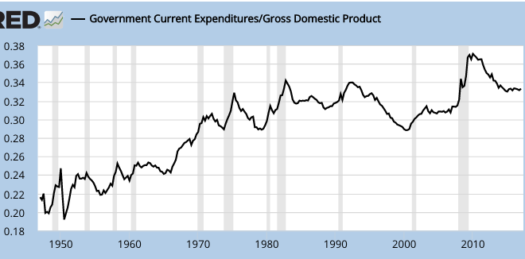

2. The RBA is confused. It is concerned about slow nominal wage growth, but it is the RBA itself that determines Aussie nominal wage growth. If it wants wages to grow faster, then it should raise the Australian NGDP growth rate.

The consequences of low wage growth are not restricted to workers. Mr Lowe, RBA governor, has warned of a cascade effect whereby it contributes to weak inflation, which keeps interest rates at record low levels — a trend that pushes up asset valuations and social inequality.

Weak wage growth also damps spending by households and restricts income tax collection by the government, which is betting on a rapid recovery of wages growth to 3.25 per cent by 2019-20 to meet its pledge to return the budget to surplus.

Nope, low wage growth, low inflation, low interest rates and slow spending are all caused by slow NGDP growth, aka tight money.

It also poses a risk to industrial peace. Last month, Australia stopped printing money for the first time in 107 years due to a strike at Note Printing Australia, a wholly owned subsidiary of the RBA. Workers are demanding a pay rise of at least 3.5 per cent and have rejected an offer of 2 per cent.

“The RBA is lecturing businesses on the need to lift wages but is refusing to offer its own workers a decent raise,” said Tony Piccolo, regional secretary of the Australian Manufacturing Workers’ Union. “Governor Lowe needs to practice what he preaches.”

The RBA is both a firm and a policymaker. The RBA as policymaker is confused as to why nominal wage growth is so slow. The business side of the RBA is fully aware of why this is occurring. It’s “the market”, i.e. slow NGDP growth, which is holding down wage growth.