Binder and Rodrigue on NGDP targeting

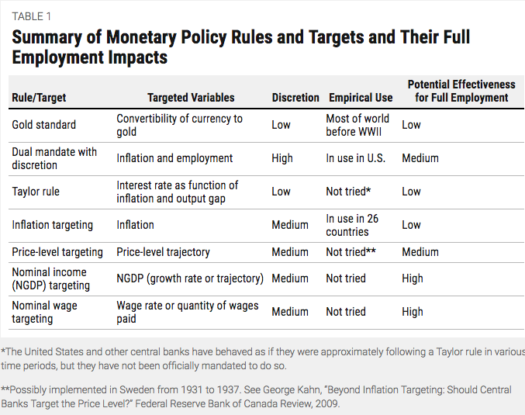

Carola Binder and Alex Rodrigue have a very nice new paper out on monetary policy rules, for the Center on Budget and Policy Priorities. Their paper suggests that either NGDP targeting or total wage targeting is likely to produce the best employment outcomes:

I’d quibble a bit with the rankings, for instance I view the Taylor Rule as much superior to the gold standard, at least at positive interest rates. But I do agree about the advantages of NGDP and wage targeting. They discuss two types of wage targeting:

I’d quibble a bit with the rankings, for instance I view the Taylor Rule as much superior to the gold standard, at least at positive interest rates. But I do agree about the advantages of NGDP and wage targeting. They discuss two types of wage targeting:

Nominal wage targeting can refer to targeting the wage rate (the price of labor) or targeting the quantity of wages paid (total nominal labor compensation, or the average hourly wage times the total number of hours worked). The former can be thought of as a special type of inflation targeting, since wages themselves are a price and wage growth is a type of inflation. Inflation-targeting central banks choose which specific price index to use for their inflation target; nominal wage targeting entails choosing a price index with 100 percent weight on wages. Mankiw and Reis (2003) find that “a central bank that wants to achieve maximum stability of economic activity should use a price index that gives substantial weight to the level of nominal wages.”

I tend to favor either targeting total wage payments, or the expected future level of average hourly wages, and they hold exactly the same view:

Nominal wage targeting has never been attempted, and its implementation could entail several challenges. First, there is no single wage rate. Policymakers would need to choose whether to target mean or median wages or some other measure. Second, nominal wages tend to respond to monetary policy with a lag. It may thus be preferable to target either expected future wages or total nominal labor compensation, which reacts more quickly.

In a slump, total wage payments fall faster than average wages per hour (due to wage stickiness). So if you are not using a futures market approach, then aggregate wages may give a clearer signal. However on theoretical grounds average hourly wages are slightly better, and hence to be preferred if the lag problem can be addressed with a futures market for average hourly wages.

Speaking of futures markets, they are skeptical:

Since NGDP responds slowly to monetary policy, Sumner proposes a futures contract approach that would allow monetary policy to respond to expected future NGDP instead of current NGDP.[80] The Fed would set up a futures market in which participants would bet as to whether the future NGDP growth rate would exceed or fall short of the Fed’s target. The Fed would then adjust the monetary base, just as it does today, according to the bets. So, if traders on this NGDP prediction market thought nominal growth would exceed the Fed’s target, the Fed would reduce the base, and vice versa.[81]

This approach is based on the notion that the market is an efficient forecaster, but it could be problematic for a number of reasons. For instance, the futures market could be subject to manipulation by large speculators,[82] or trading volume could be too low. More broadly, the futures-market approach would drastically limit the Fed’s discretion; the Fed would play a passive role. We think it would be more effective for the Fed to commit to pursuing the NGDP target in the medium run, taking into account the Fed’s own forecasts of future NGDP in its policy decisions.

Not surprisingly, this is one area where I do not agree. But before explaining why, let me point out that I would strongly support their (Svenssonian) suggestion of targeting the central bank’s own internal NGDP medium term forecast as a second best policy, as long as it was a part of the level targeting system.

Now for my response:

1. The lack of discretion could be viewed as a feature, not a bug. If you want to preserve some discretion, however, my “guardrails” approach can be employed. Indeed even Bill Woolsey’s index futures convertibility approach allows for discretion, if the central bank sees one big speculator trying to manipulate the market. (Keep in mind that all trades are with the central bank as the counter-party, so they’d know if someone were trying to manipulate the market.) And of course manipulation would be almost impossible under the guardrails approach, where the central bank would promise to go short on 5% NGDP contracts, and long on 3% NGDP contracts. And finally, the same manipulation possibilities apply to a gold standard and/or Bretton Woods regime. But if you search the literature on these regimes, you will discover almost nothing on “market manipulation”, at least when rates actually are fixed and stable. (Selling a currency before devaluation doesn’t count, as no one expects the central bank would default on NGDP futures.) I think it’s a needless worry.

2. Low trading volume is not a problem; indeed the system does not require any trading at all. Here’s an analogy. A gold standard would work fine as long as people were free to convert currency into gold at a fixed price, regardless of whether any such trading actually occurred. It would simply mean that monetary policy is on target. And if you still are concerned about trading, the central bank can always create trading by paying a high enough interest rate on margin accounts.

Even if NGDP futures markets are not to be used to set the policy instrument, there is NO EXCUSE for the failure of central banks to set up NGDP prediction markets, and subsidize trading. This would provide essential high frequency data on NGDP expectations after important monetary policy events, and hence would be invaluable to monetary researchers. Their failure to do so is gross dereliction of duty, which future generations will look back on in disbelief. I would have loved to have such a market in the second half of 2008, exposing all their foolish decisions.

HT: Dilip

Tags:

6. October 2016 at 09:40

NGDP Targeting was really “tried”

http://ngdp-advisers.com/monetary-policy-greenspan-years-aftermath/

6. October 2016 at 09:42

Dr. Sumner,

I doubt that central bankers will support giving up their discretion, however beneficial it might be. How many would even want to be central bankers if there’s no discretion, regulatory roles aside?

Hence, it seems if your preferred non-discretionary NGDPLT regime is to be adopted, Congress and the President would have to force it on the Fed. That doesn’t seem likely right now, but one never knows. Things sometimes change rapidly in politics.

The idea of a central bank choosing to set up an NGDP futures market also seems far-fetched, for similar reasons. I doubt central bankers want the accountability that, again, might limit their discretion.

The NGDP Advisors approach, or the one I’m developing seem more realistic. The idea is to have a high profile, credible market-based implicit NGDP forecast, which can use futures in existing liquid asset markets. It’s a second-best approach functionally, but far more feasible.

Perhaps one day soon there will be something like the JP Morgan Chase NGDP forecast, or Vanguard NGDP forecast. Accountability for central banks is much more likely to come from without.

6. October 2016 at 10:57

@ssumner – is this you? “Ray, You still don’t know? Really? I think the IS curve often slopes upward. ” Slopes upward he says. Was that a brain fart? And please refresh our memory, what happens if the Fed adopts NGDPLT and fails to hit its target? Is there a penalty, who wins? The traders betting against the Fed? And who settles the trade? The Fed deposits money into the traders betting against it? Please explain. Considering increased money supply did not get absorbed in Japan as predicted by theory for the last 5-10-20 years shows that your scheme could be like pushing on a string. Money is largely short term neutral, as well as long term.

@AntiSchiff – “CME said to have shelved inflation futures plan – 22 April 2014 – Contracts had been drafted, but did not attract enough support” – the financial graveyard is littered with bogus products nobody wants, as you may find out yourself.

The last column of the chart: Sumner blasts the Taylor Rule being classified same as the Gold Standard yet lauds his framework for scoring high. Unbelievable priors and confirmation bias at work. Sumner is the Donald Trump of monetarism.

6. October 2016 at 11:09

I think that average hourly earnings would make a terrible target variable. Simply looking at the data for the last recession (https://fred.stlouisfed.org/graph/fredgraph.png?g=7A2w), there’s no discernible signal from wages-per-hour until the recession was well underway. To borrow Nick Rowe’s terminology, it’s a dog that didn’t bark.

This makes sense with even the smallest amount of wage stickiness: workers would obviously prefer to remain at their current job than switch jobs to a pay-cut, and when forced to issue layoffs business would prefer to fire the most marginal (and probably lowest-paid) workers first.

In contrast, more “level” measurements like total payroll, quits, job openings, and hires (https://fred.stlouisfed.org/graph/fredgraph.png?g=7A3r) provided much better contemporaneous evidence of the 2008 recession.

6. October 2016 at 13:50

Marcus, Yes, in a sort of loose way.

Antischiff, I expect them to maintain some discretion under NGDP targeting, and don’t see that as a big problem.

Ray, You are getting desperate.

Majromax, Yes, it’s a lagging variable, which is why you’d want to target expected future average hourly wages, if you adopted any sort of wage target.

6. October 2016 at 15:51

Excellent blogging. And set those NGDPLT high!

6. October 2016 at 16:15

OT-class question: what are the implications of the below for Sumners NGDPLT? see the ‘real money stock’ stat. Answer: not good, not good at all, even if we have a NGDP futures market. While real GDP falls, this stat is only known “after the fact” (often after the recession is officially over) and during the recession, both inflation and real money stock often do not fall. Feel like traveling blind in a storm with no navigator? Then hop aboard the SS Scott Sumner Steamer! All aboard!

Macroeconomic variables and number of recessions from 1947-1992 where variable falls in USA, quoted in D. Romer, “Advanced Macroeconomics” (1996).

Note real money stock only falls in 5/6 recessions, inflation only falls in 4/8 recessions.

(Variable, avg change, number of recessions where variable falls)

(Real GDP, avg change in recession : -4.7%, 9/9)

(Employment, -2.2%, 9/9)

(output per hour, non-farm, -1.4%, 8/9)

(T-bill 3 mo interest rate, -1.9%, 9/9)

(inflation, -0.9%, 5/8)

(real money stock [M-2/GDP deflator, since 1959], -1.4%, 5/6)

6. October 2016 at 17:18

Time to lay a trap for Sumner….

Q: Dr. Sumner, do you believe monetary expansions lower people’s short term expected inflation beliefs?

I look forward to your reply…. (hehe does he see it coming?)

6. October 2016 at 19:48

@scott Briefly.

1. As I keep saying you need to think about selling the concept. In terms of easy understanding then

Combined inflation + growth target > NGDP target > wage target

(The first two are the same just with different names.)

2. I’ve said it before and I’ll say it again although you will ignore it because you have a blind spot on this issue, NGDP linked notes are better and easier to implement than a futures market. Especially if you are putting bells and whistles (like high margin interest) on a futures market. (I’ll not post the reason for my views again as they are well documented in my past comments.)

6. October 2016 at 19:50

@scott

Oh and as I have said, replace the FOMC with an iPhone app. It will do a much better job.

6. October 2016 at 20:06

dtoh, Are my replies also well documented in past comments? 🙂

6. October 2016 at 20:07

Ray, Germany’s real money stock fell 98% during the 1920-23 hyperinflation. Explain.

6. October 2016 at 21:53

I would like to discuss a relatively minor point. It’s very far from where we are today, but still here goes.

Targetting expected average wages vs. targetting expected median wages (or 40 perecentile or 30 percentile) (Both targets are LT, both target expected wages; execution mechanism – futures or not, should not matter)

Targetting average wages would slow down expansion in a scenario where some fraction are going great, but the rest of people are facing stagnant wages. Targetting median (or 30 percentile or lower) wages would continue maintaining expansion in this scenario until the benefits trickle down.

In a contraction scenario, it might be reversed. What are the various considerations here? Any thoughts?

7. October 2016 at 01:20

@ssumner – not on point. You first professor. Inflation expectations and money expansion is the issue. Why Germany’s real money stock fell during hyperinflation I would say is not on point since hyperinflation and ordinary inflation are two different things.

7. October 2016 at 04:24

This article from John Mauldin is one of the best I have ever read at Talkmarkets, not on NGDP, but on higher inflation targeting and the serious issues ignoring it will cause.

He went to Jackson Hole and this article was the result:

http://www.talkmarkets.com/content/economics–politics/monetary-mountain-madness?post=105833&uid=4798

7. October 2016 at 05:51

I find myself (gulp!) agreeing with Ray on the point concerning gold. If a paper’s arguments are deemed generally worthwhile, and that paper happens to put in a good word for gold, at least relative to some alternatives, one ought to allow that gold may have some virtues not noted in other studies.

Of course, the usual proviso that there were many different “gold standards” applies. If the paper’s results are based to any considerable extent on evidence from the (badly botched) post-WWI gold standard, the Binder-Rodrigue findings are especially surprising. Assuming that the techniques used to arrive at them have merit, they deserve to be taken seriously, if only for the sake of determining whether they are in fact mistaken.

7. October 2016 at 05:59

BTW: To venture guess (for I haven’t had a chance to read the paper), I suspect that B-R may be equating the Bretton-Woods era with “the gold standard.” If so, then their finding is indeed quite misleading, for gold played hardly any role in regulating money stocks during that era, which is more accurately described of one involving an international dollar standard. The dollar’;s convertibility into gold was nominal only; no sooner did it cease to be so than the pretense was dropped.

7. October 2016 at 06:20

Prakash, In practice the two would be very similar, but if I had to pick one, it might be median wages. This variable is probably closer to the situation of the typical worker.

Ray, I hope you are smart enough to know that it is on point, and that you lost the argument. But maybe not.

Let’s try again. Real money demand fell during the 1970s. Why?

George, Given that I tend to disagree with almost 100% of what I read these days, I tend to grade papers on a curve. I’m thrilled if I see something I like.

I think the gold standard comment was just a sort of throwaway observation, not based on any careful analysis on their part. Having said that, I believe their claim about the impact of a gold standard on employment is defensible, even if somewhat uncertain.

7. October 2016 at 07:06

Scott,

Are my replies also well documented in past comments?

As they say, if Two people don’t agree in five minutes, they aren’t ever going to agree. But just for the record, I’m right. 🙂

7. October 2016 at 07:16

The table needs a column for “historical effectiveness”. While things with high discretion have high potential we should judge those things by their track record. Honest people would rate “dual mandate” as a failure based on history.

There really is only one good (stable) system (NGDPLT) and any engineer will tell you so.

7. October 2016 at 07:57

YES! George Selgin agrees with Ray. Something for my notes file.

OT (somewhat) -I’d like Selgin or even our host opine on fixed exchange rates (like a gold standard, there’s less volatility than today’s floating exchange rates). See the paper cited in David Romer’s Macroeconomics textbook: “Baxter and Stockman (1989), for example, do not find any clear difference in the behavior of economic aggregates under floating and fixed exchange rates”. China does it, and less volatility cannot be a bad thing, agreed? Tyler Cowen by email informs me fixed exchange rates are more unstable than floating rates but that’s IMO somewhat a small point, just readjust the rates periodically like China does.

@ssumner – my reply is above. I trust you’re smart enough to see it. Why do Baxter et al find no real effects from nominal shocks in AD? The 1970s was a supply shock due to oil. Your turn professor. I’m beating you…and now I have George Selgin on my side, he’s like Elvis! Us trolls can be very clever…

7. October 2016 at 08:00

Scott, what is your opinion about the essay by your favorite President in your favorite magazine?

http://www.economist.com/news/briefing/21708216-americas-president-writes-us-about-four-crucial-areas-unfinished-business-economic

Rate it on a scala from 1 to 10 – or from “Drumpf” to “Oh mein Führer, oh mein Führer, I can walk again”. =)

7. October 2016 at 09:07

This is perhaps the most significant statement Mauldin made in his article:

“Because the Fed is banker-driven, it thinks cost of capital is everything and therefore that a lower interest rate will stimulate activity. They’re right up to a point, but that relationship is not linear. It flattens out as you get closer to zero.

Yellen is aware of this. Her point with Footnote 8 was that interest rates aren’t always an effective stimulant. But also, she isn’t the only vote. She has to convince the other governors and regional Fed bank presidents, and they are all influenced to varying degrees by the banking industry, which loves lower rates.

Come to think of it, this might also explain Footnote 8. Negative rates are death to commercial banks. A -9% NIRP would kill many banks. So maybe that footnote was a warning, the Yellen equivalent of a brushback pitch to overly eager bankers. “Look what can happen if we don’t do it my way.”

I truly don’t think Yellen will take us down to -9% or anywhere close to it. I do think she is mentally prepared to go below zero if she sees no better alternatives according to her personal economic religious beliefs. I also feel very confident that she and her colleagues won’t take rates much higher from here. I think we will see 0% again (and below) before we see +2%.

Look, sooner or later a recession is coming. This recovery, feeble as it has been, is already long in the tooth. I think there is the real possibility we will enter at least a mild recession no later than the end of 2017, brought about by a crisis and recession in Europe. Those of us in the US really should pay close attention to what is going on at the polls in Europe just as we pay attention to the polls in Florida. How will the Fed respond when that recession hits?

The Fed is making those plans right now. If you think 2008–2009 was a wild ride, I suggest you fasten your seatbelt and prepare to take an airbag in the face. The next ride will be even wilder.”

http://www.talkmarkets.com/content/economics–politics/monetary-mountain-madness?post=105833&uid=4798

7. October 2016 at 10:13

Lack of discretion seems like a feature simply because it would bind central banks to aggressive policy when the circumstances warrant it.

As it stands now, central bankers use their discretion to chicken out and follow conventional approaches in dire crises.

In other words, it is in precisely the worst situations where you want central banks to have the least ability to do anything but follow the NGDP target

7. October 2016 at 10:30

“In other words, it is in precisely the worst situations where you want central banks to have the least ability to do anything but follow the NGDP target.”

They obviously should at least pay attention to NGDP. But bonds are being hoarded as collateral. Maybe hoarded more than cash. They appear to be being hoarded by companies who actually have to pay negative interest, like in Europe.

So, protecting banks, being procyclical, forcing banks to stop lending when they need to lend the most, is all what central banks do to make the rich richer and the poor poorer. Banks have bet on low rates and slow growth, and their counterparties are hoarding bonds like crazy.

I think that bodes ill for the real economy and for any stimulus that forgets banks rule.

7. October 2016 at 13:20

On the large speculators point: it’s just occured to me that it would be much cheaper to just bribe central bankers, rather than fight a bidding war in a competitive market in order to manipulate it.

7. October 2016 at 15:59

Ray, You said:

“The 1970s was a supply shock due to oil.”

Reminds me of my D students. They didn’t understand the question, so they put any old thing down that came into their heads. Once again Ray, what happened to real money demand during the 1970s, and why?

Christian, You tell me, what does Coolidge have to say?

W. Peden. Yes, competition to “manipulate” the market would make a . . . competitive market!

7. October 2016 at 16:17

Coolidge says that we need a new hen. Since Hillary is just more of the same, I interpret this as you finally endorsing Trump now. We just need to break this to Mrs. Coolidge very gently…

7. October 2016 at 19:17

Great study, thanks for sharing.

Have to agree, not much is worse than the gold standard (you might even call it the “gold standard” of bad monetary policy). Those sections of your book where it gradually dawns on the reader that the headlines of the gold standard era are dominated by rumors of gold flows are absolutely terrifying.

7. October 2016 at 21:09

Real money demand:

“If inflation erodes the purchasing power of the unit of account, economic agents will want to hold higher nominal balances to compensate, to keep their real money balances constant.”

That makes sense to me. Those who think people will spend more when money is evaporating are nuts.

“When interest is high, more people want to supply money to the system because seigniorage is higher. So more people want to form banks or find other ways of issuing money, extant bankers want to issue more money (notes and/or deposits), and so forth.”

This makes sense to me too. We have low rates and quite literally no new banks are being formed.

In the 1970’s when inflation was big, people were buying stamps, old coins and everything they thought would be better than money.

http://2012books.lardbucket.org/books/finance-banking-and-money-v1.0/s23-money-demand.html

But, Keynes was wrong about holding bonds. He said more people hold them when interests are high. But really, people are hoarding bonds now, when interest rates are creepily low.

Keynes said, as paraphrased by the link:

“When interest rates are low, the opportunity cost of holding money is low, and the expectation is that rates will rise, decreasing the price of bonds. So people hold larger money balances when rates are low. Overall, then, money demand and interest rates are inversely related.”

But it isn’t true. They are not inversely related when they are being hoarded for collateral. He didn’t have that issue, apparently. But now it is simply not true.

But since it is true that rates rise during expansions, we can be assured that we will never have an expansion! Never, never, never, never.

7. October 2016 at 23:35

@ssumner – I’d hate to have you as my econ professor (which I aced), doctrinaire to the point of derangement. I answered you on the 1970s: the inflation was due to a non-monetary shock, namely, a supply shock due to lack of oil. Of course money supply changes in response to non-monetary supply shocks, but we’re discussing the inability of monetary shocks to change real variables like real GDP. That’s the issue here. And you got trapped. I win. Just to give you a pointer: the Baxter et al paper was cited by D. Romer in the section of his textbook on whether there’s evidence monetarism works, and it’s a counter-example, meaning, it shows it does not work. Here’s another reference to Baxter et al., which is still a good paper today (not refuted): “Baxter and Stockman (1989) found that the transition to a freely floating exchange rate regime only led to a substantial upward shift in both nominal and real exchange rate variability but virtually no change in the distributions of conventional macroeconomic fundamentals.”- Sarno, The Economics of Exchange Rates (2003) Got that? Big swings in nominal prices, but nothing happens in real variables. Defeats monetarism. Defeats you. World is saved from the blogger that (tried to) save the world.

PS–I’m glad that you give D grades rather than F grades. I had a few professors like you, and I could live with a D as it allows you to graduate, and move on to bigger and better things (like getting paid more than your professor, like most of your successful students do now).

8. October 2016 at 00:03

Monetarism used to work, Ray. That was before structured finance. Now that bonds are hoarded, it won’t work too well. Who would let it when the counterparties would all go broke? The system has defeated stimulus. The Fed could not stimulate itself with Donald Trump’s sexist comments about grabbing women in their private parts. Nothing will move the Fed.

Again, basic theory, that money demand and interest rates are inversely related is false. That means, of course, Ray, that no expansions will take place because rates cannot rise.

8. October 2016 at 05:36

‘ it’s just occured to me that it would be much cheaper to just bribe central bankers….’

Or, as Scott has proposed in my favorite paper of his, make their pay contingent on their hitting their targets.

8. October 2016 at 07:10

I asked:

“Once again Ray, what happened to real money demand during the 1970s, and why?”

You answered:

“I answered you on the 1970s: the inflation was due to a non-monetary shock, namely, a supply shock due to lack of oil.”

Oh come on Ray, if you are going to be this dumb, it won’t be any fun picking on you. Don’t become someone I tune out, like MF or Gary. Please at least try.

Thanks Talldave.

8. October 2016 at 09:33

I told you the truth about monetarism and the ineffectiveness of stimulus going forward, Scott. You should not tune that out.

8. October 2016 at 22:41

@ssumner – re your question to me, you should read this by Blinder, at the same place you blog: http://www.econlib.org/library/Enc/KeynesianEconomics.html. He claims the 1970s vindicates Keynesian economics, not neo-Classical. Velocity went up (it was not a constant as predicted by your hero Friedman) but this does not address our issue, which you avoid. Again, I repeat, how does Baxter & Stockman’s paper address how unimportant are nominal, non-monetary shocks? To simplify for you (necessary): big swings in exchange rates, but these big swings don’t affect real variables. Acceptable answers (pick one): (A) proof that monetarism does not work, or, (B) proof big Fx participants like Cargill hedge their bets with contracts such as derivatives, futures, forward exchanges and the like, and are not affected by big nominal swings in prices, or, (C) I don’t know, since I don’t read the literature, as I prefer not to read stuff that goes against my priors (that would be YOU, professor. Have you read Bernanke et al. 2002 FAVAR paper yet? No? Why not?)

9. October 2016 at 07:51

Ray, One more time, what happens to real money demand when inflation increases? It’s a simple 101 question. Just answer it.