Liars

This is a follow up to my previous post.

Part 1: Capitalism later

When I was young I believed the GOP was more supportive of small government than the Dems. I’m not sure why I believed this; when I came of age Nixon was president, and he was arguably the most anti-libertarian president of my lifetime (with the important exception of ending the draft.)

Supporters of the GOP always used to say that the president (Nixon, Ford, Reagan) wanted smaller government, but the Congress wouldn’t go along. When the GOP finally took Congress in 1994, the alleged roadblock was President Clinton. Finally, in 2001 nirvana arrived for us libertarians; the GOP took all branches of government, and we got . . . one of the biggest new entitlement programs in history, a massive increase in the National Security State, and a much greater Federal involvement in education. The fastest growth in Federal spending since LBJ was president (for several years.)

That should have ended any illusions about the GOP being the party of small government, except to the most hopelessly deluded. But with the rise of the Tea Party movement we are again hearing this meme—the GOP wants to trim the size of government. For instance, the GOP has spent the last two years bashing Obama for not reining in Fannie and Freddie. And now that they have taken Congress, the Wall Street Journal says they are ready to act:

Earlier this year, leading House Republicans proposed to privatize mortgage giants Fannie Mae and Freddie Mac or place them in receivership starting in two years.

Now, as Republicans prepare to assume control of the House next week, they aren’t in as big a rush, cautioning that withdrawing government support in the housing market should be gradual. . . .

Republicans were backing a bill by Rep. Jeb Hensarling (R., Texas) to start cutting the government’s ties to the mortgage giants or begin winding them down in two years; if they were deemed financially viable, they would become fully private within five years.

“Of all the dumb regulation that caused our economic crisis, none was dumber than that which created the (Fannie and Freddie) monopolies,” Mr. Hensarling said in March. . . .

Many Republicans now concede that a speedy exit may not be practical, because Fannie Mae and Freddie Mac have such a dominant position in the nation’s housing market. Mr. Garrett said he has “not established a specific timeframe for winding them down.”

[Insert obligatory Claude Rains exclamation here.]

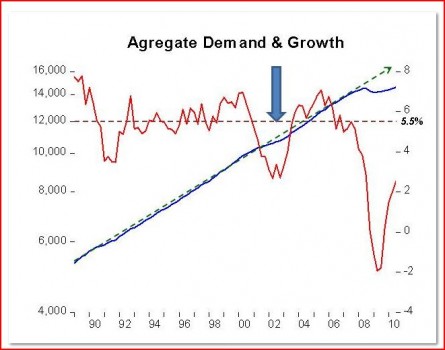

Some might argue that the GOP is simply facing reality, the economy is weak and a drop in the housing market might further depress aggregate demand. But since when is the GOP worried about AD? They have been insisting that the Fed is making a mistake in trying to boost AD with a more expansionary policy—that this would merely bail out the Obama administration’s failed big government policies. No, the GOP is not motivated by a desire to boost AD. And neither are they opposed to more intervention in the free market.

The mostly like explanation is that the GOP’s paymasters in real estate and banking quietly had a word with them after the election. I’d guess it went something like this:

“We greatly appreciate the help from the Tea Party in getting you guys back into a position of power. But now these neophytes need to step aside and let the big boys take over.”

So which is it? Is the GOP lying when they say we don’t need more AD, and that Fed policy is too easy?

Or are they lying when they say we need smaller government, and that the housing fiasco was caused by people like Barney Frank, who promoted the GSEs?

Part 2: Regulation later

And then there’s the Dems. They used the subprime fiasco to rail against unregulated free market capitalism, the so-called “market fundamentalism” of people like . . . well people like me. Of course the true market fundamentalists were always opposed to the housing/banking system, which was riddled with moral hazard. Unfortunately there were plenty of so-called market fundamentalists who cheer-leaded the “deregulation” of banking the the US, Ireland, Iceland, etc, thereby discrediting the entire movement.

In any case, the Dems did get around to “re-regulating” the housing mortgage system in the US. More than a kilo-page of re-regulation. There’s just one thing, they forgot to ban un-insured subprime mortgages. That’s right, the alleged cause of the entire mess, which is already banned in many countries the Dems seem to hold up as models, was given a free pass. There is no requirement that buyers put at least 20% down. Indeed there is no requirement that they put even 5% down. Nor are there any plans to phase in such a ban over a 5 or 10 year time frame.

So if regulation isn’t really the motivation of the Dems, what is? The same WSJ article provides one answer:

Democrats tend to favor a more active role for the government in housing to ensure that underserved communities have access to mortgages.

So there you are. The GOP doesn’t favor small government and the Dems don’t favor regulation. Instead the GOP favors a bloc of people who vote for the GOP and contribute money to their campaigns, and the Dems favor a bloc of people who vote for the Dems and contribute money to their campaigns.

I’m not so cynical (yet) that I would deny there are some idealists in politics. My hunch is that some politicians (even some I don’t like such as Barney Frank) are driven partly by idealistic motives. After all, Frank recently mentioned abolishing Fannie and Freddie. But whatever idealism exists is not strong enough to overcome the special interest groups.

Fortunately, good governance is not a zero-sum game, so once and a while the two parties come together and strike a deal that is win-win (such as the 1978 deregulation bill, or the 1986 tax reform, or the 1996 welfare reform.)

The most one can hope for is that some creative politician will be able to cobble together another such compromise sometime in the next 10 years. Of course it would be much easier to do if we were Switzerland, Denmark, or Singapore. Heck, if we were even Canada or Australia. But we are a nation of 310 million people with very diverse cultural values and perspectives on economics.

Happy New Year!