What monetary recessions don’t look like

This post is a sort of response to a Tyler Cowen post entitled “Japan slides into recession,” even though I don’t actually disagree with his comments:

“Japan’s economy contracted at a much-worse-than-expected 3.7% annualized rate in the January-March period, tipping the country into a recession as the March 11 earthquake and tsunami caused declines in consumer spending, business investment and private-sector inventories.”The article is here. . . . The simple lesson is that earthquakes and tsunamis are contractionary, not expansionary. This is a classic example of real business cycle theory and how it can also apply to economies which are, in some regards, still in Keynesian corridors.

It is certainly true that natural disasters don’t help an economy, by creating jobs rebuilding the damage. But it’s also true that recessions caused by real shocks like natural disasters look nothing like recessions caused by tight money. For one thing, they don’t necessarily reduce future expected NGDP, and hence the economy tends to recover quickly. The big drop in 1st quarter GDP was largely due to an unprecedented plunge in March industrial production–down 15.3%. When you consider the fact that the tsunami occurred on the 11th, it seems likely that IP fell over 20% in the last two thirds of March.

But since then it has risen sharply, rising 1.6% in April, and 5.7% in May—the biggest jump since 1953. Yes, it is still about 8% below February levels, but the point is that output only fell for one month. With a monetary recession, output usually falls for 6 to 18 months.

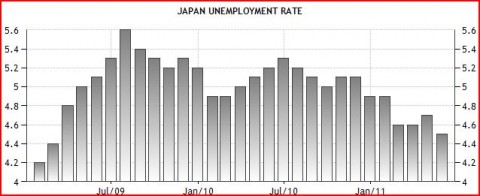

An even bigger difference shows up in the unemployment data. Because companies know that output will quickly recover, they tend to hold on to workers. Thus the unemployment rate has continued to fall during the “recession,” which is obviously quite unlike a monetary recession.

Tags: Real Business Cycle Theory

11. July 2011 at 11:17

Scott

I think many of us get your point about BOJ’s true nature and its effect on the Japanese economy. So, to move on, could you do a post on all the reforms (both supply and demand side) that you would enact as King of Japan?

11. July 2011 at 11:54

Prof. Sumner,

It’s not as immediate as a forecast, but I was interested on your thoughts about the utility of the expected change in family income data collected by the University of Michigan’s consumer survey. Here’s a link: http://www.clevelandfed.org/research/trends/2011/0611/01infpri.cf

11. July 2011 at 13:11

Contemplationist. I’d set a 2% NGDP growth target, level targeting.

I’d probably so some supply-side reforms, but I don’t know enough about Japan to comment. I might do some decentralization, let local governments have more power. Stop taxing capital.

Shocking, That link doesn’t work for me. In general I prefer market data to survey data.

12. July 2011 at 13:59

@Scott: SHocking left off the final ‘m’, the URL is http://www.clevelandfed.org/research/trends/2011/0611/01infpri.cfm

13. July 2011 at 11:51

Thanks Anthony.

13. July 2011 at 11:54

That family graph is stunning—worth a post.