Krugman’s lucky to be an American

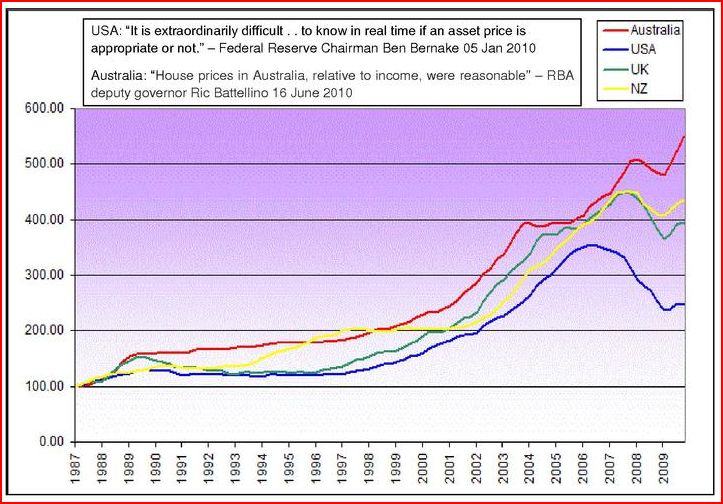

In 2005 Paul Krugman called the US housing bubble. A couple weeks ago he reminded us that he called the bubble, and implied only a fool (or a brainy right-wing ideologue?) could have failed to see it. He presented a graph showing that housing prices in the US had been rising rapidly. Interestingly, housing prices had been rising rapidly in lots of countries, but relatively few turned out to have housing bubbles. Here’s a graph Tyler Cowen linked to recently:

Let’s use the archive list of months as a vertical line to estimate prices in 2005 when Krugman made the call, and compare them to today’s price:

US 2005 = 300, 2010 = 250

UK 2005 = 375, 2010 = 395

NZ 2005 = 330, 2010 = 430

Aus 2005 = 390, 2010 = 550

I don’t know about you, but to me only the US looks like a clear-cut bubble. Yes there were some rises and falls in other countries, but it wasn’t obvious (ex ante) in 2005 whether prices in the other three countries were above or below their long run equilibrium. Indeed it still isn’t, as Australian housing prices could crash at any time.

I’ve consistently argued that the bubble theory is only useful if it leads to good predictions. Krugman did make a good prediction, that housing prices would be lower in the not too distant future. BTW, I’d say you at least need to provide some sort of time frame—say 5 years out. It’s not enough to say “I predict prices will keep rising, and then eventually fall.” That’s true of any market. Although Krugman did not provide a specific number in the post I linked to, I am pretty sure that the actual drop in the US occurred over the sort of time frame he envisioned, if he had been forced to name a date. So I give him complete credit for a correct prediction.

But here’s my question. Given that the other three markets did not decline over the same time period, is it really true that we could be confident, ex ante, that US houses were overpriced in 2005? It certainly seems so given everything that has happened since, but might that be a cognitive illusion? Confirmation bias? I doubt Krugman thought NGDP would suddenly fall 8% below trend in the 12 months after mid-2008. Where would housing prices be today if NGDP had kept growing at 5%. I don’t know.

I’m inclined to believe there was some irrationality in the 2005 housing market, but I am less confident than Krugman that price bubbles are easy to spot. In the next post I’ll provide one reason why, despite the undeniable excesses that swept the housing market, investors with rational expectations about NGDP growth and immigration might not have spotted the oncoming collapse in US housing prices.

BTW, look at housing prices in Australia; the one country on the list that did not experience a recession in 2008, and which has very rapid immigration.

PS. This interactive graph in The Economist shows that among 20 countries, only the US and Ireland showed a clear bubble-like pattern after 2005. In most countries prices are now higher than in 2005, and in the few other exceptions (Germany, Japan) there had been no run-up in prices prior to 2005. So my results don’t come from cherry-picking these four anglophone nations, bubbles really are hard to spot. (I’m puzzled by the Spanish price graph, but even if it is inaccurate and Spain was a bubble, that just makes three clear bubbles in The Economist group of 20.)

You can adjust the horizontal scale to get different starting dates. Many countries saw steep price run-ups prior to 2005. If you start at 2005:Q2, it’s easy to compare current prices to mid-2005 prices.

PPS: Compare Krugman’s mea culpa post, with these Japan predictions dredged up by David Henderson. The second paragraph shows Krugman at his best. What happened to that guy?

Tags: bubbles, housing bubble

4. September 2010 at 07:31

Krugman cheered for a housing bubble before he “called” it. He said we needed easy money for a housing boom to offset the 2000 tech crash.

4. September 2010 at 07:40

“What happened to that guy?”

Amongst other things, he went on to write The Return of Depression Economics, The Accidental Theorist, Pop Internationalism, some quite remarkable “wonkish” papers and (with two others) The Spatial Economy. He’s also a noted columnist and blogger. Really, someone should give the man a prize.

4. September 2010 at 07:49

Another excellent blog by Scott Sumner.

4. September 2010 at 07:55

Morgan, As did I.

Kevin, I am certainly impressed that a guy can change his mind about so many things, and yet find hardly anything he was wrong about.

Pop Internationalism is the only one of his books that I read–and it’s great. Seems nothing like his current China bashing.

Thanks Benjamin.

4. September 2010 at 09:50

Scott,

I can probably provide some useful info re. UK.

Unfortunately, unlike US, British house prices only started to decline at the end of 2007. By the middle of 2008 everyone had an “ouch, it can actually go down” moment, but then terrible thing happened: interest rates were slushed. Now, unlike the US, a substantial number of UK mortgages are trackers linked to BoE base rate. As a result a few people had a luxury of paying no interest at all on their mortgages for awhile (yes, they had base-1.5% rate with no floor) and now it is not uncommon to have 2.39% rate when there is 60% equity. That quickly stopped the decline – why sell and take the hit if you can afford to pay (peanuts). Prices started rising again and stopped only recently. Classic case of “market can stay irrational longer then you can stay solvent”, especially with some useful govt intervention. Current average house price is above £160K – in a country where the average income is about £25K! Not a bubble?

But you are right – I can not predict when the crush will happen here.

4. September 2010 at 10:40

I’m not saying it’s possible to consistently predict bubbles (and I think trying to do it for stocks is pretty much impossible). But there was good reason to be suspicious about the United States. With no obvious shifts in demographics nor some new spike in the typical household income it seemed odd that house prices would jump so rapidly. I didn’t necessarily think this meant “bubble,” but it made me highly suspicious. Especially because people always tend to suck at forecasting housing prices and usually have absurdly optimistic expectations.

So, I was curious about some of the “fundamentals” of the housing market of nations on those charts. Obviously, it’s a lot harder to pin down the “fundamentals” of housing valuation then something like a stock – but I would assume one of the key fundamentals would be household income. In which case, I think it would be instructive to look at GDP per capita growth over the relevant time period (2000-2006). I just used basic google public data and they don’t have inflation-adjusted data and I’m too lazy to look since I know inflation was fairly stable over 2000-2006 in all of these nations so it should be fairly representative to just look the raw exchange-rate adjusted data.

For the United States we saw fairly steady GDP per capita growth, nothing special:

2000: $34,605

2001: $35,343

2002: $36,196

2003: $37,571

2004: $39,679

2005: $41,832

2006: $43,961

Percent Change =~ 27%

However, let’s look at the other nations:

Australia saw a pretty sizable gdp per capita increase concurrent with their run-up in housing prices.

2000: $21,151

2001: $19,053

2002: $19,588

2003: $22,882

2004: $29,734

2005: $33,087

2006: $34,996

Percent Change =~ 65%

As did the United Kingdom:

2000: $25,089

2001: $24,884

2002: $27,172

2003: $31,238

2004: $36,708

2005: $37,870

2006: $40,189

Percent Change = ~ 60%

And New Zealand:

2000: $13,192

2001: $13,444

2002: $16,353

2003: $21,221

2004: $24,661

2005: $26,391

2006: $25,988

Percent Change =~ 97%

Furthermore, when you watch the biggest year on year rise in per capita income it seems to follow the respective nations housing price accelerations moderately well. I think it’s reasonable to expect that rising per capita income would led to a bid up in prices as people demand more land, bigger houses, better amenities when incomes rise. When I look at the run-up in housing prices in nations that are also seeing sizable increases in per capita income, I wouldn’t be as inclined to think a bubble is brewing. But, when you see small per capita increases and rapidly accelerating house prices this should lead to, at a minimum, some suspicion – as in the United States.

The case for a U.S. housing bubble, just by looking at the raw data, seems to be much better than a housing bubble in the other nations and the housing price drop data seems to confirm that. I think your analysis shows that the housing market just looks more efficient in the other nations as they are responding to “real” fundamentals like rising incomes.

Again, I’m not one that thinks it’s “easy” to spot bubbles (and nothing frightens me more than people calling on the Fed to counteract future bubbles, as though they are capable of picking out bubbles and fine-tuning monetary policy to that extent anyway). However, I think there was grounds to believe, or at least grounds for suspicion, that a housing bubble was underway in the 2000s. This is especially true since if you are going to spot a bubble, the housing market is the one you are most able to see. Housing arbitrage is incredibly difficult to do, especially due to the high volatility of housing prices, which means the market can easily deviate from efficiency since we rely on arbitrage to negate the noise traders in most markets. We also know that there is significant evidence that housing prices do not follow a random walk and are thus somewhat forecastable, unlike equity markets. That’s not to say you can easily pick out a housing bubble, but I think of all of the markets housing is the simplest to do.

4. September 2010 at 10:54

Joseph, Thanks for that very interesting info.

I disagree with you on three points.

1. The UK government did not intervene to prop up house prices, instead they drove them lower with a tight money policy that slowed NGDP growth. As I am sure you know, low interest rates don’t mean easy money.

2. The price/income ratio you describe could well be the long run equilibrium. It is in many places in America.

3. You can’t say there is a bubble, unless you can predict the direction of prices better than the EMH says you should be able to predict prices. That’s a common fallacy people have. They think they can assert the EMH is wrong (i.e there are bubbles), without having any ability to say whether prices are above or below the long run trend. If prices are above long run trend, that implies they are likely to fall over the long term (say 50 years), at least in real terms. Is that your prediction?

Ted, You are comparing apples and oranges. Those per capita income statistics are clearly not in local currency terms–presumably they are in US dollars. But the housing data is in local currency terms. So I’m afraid that can’t explain any differences.

4. September 2010 at 11:47

I am certainly impressed that a guy can change his mind about so many things, and yet find hardly anything he was wrong about.

The changes of mind and the wrongness may be in your image of Krugman, rather than his actual writings. For example, your link to David Henderson attributes to Krugman (1990) the view that America ”may well be the third-ranked economic power by the end of this decade.” Well, that certainly looks like it turned out wrong. But even if we take Henderson’s account of the book at face value (more on that in a moment), it’s clear that this alternative version of the 1990s was only going to happen if Europe and Japan played their cards properly. You know as well as I do that Krugman wasn’t betting heavily on that; his criticisms of EU and Japanese policy-makers have never been especially gentle. Or maybe you don’t know that, since you’ve only read one Krugman book. (What the hell’s wrong with you? You thought it was great. Go read the others. I assure you they are just as good.) Anyway, just in case you really didn’t know what Krugman thought about EU policy in the 1990s, take a look at Unmitigated Gauls. I think you’ll like it.

That aside, did David Henderson really give an accurate picture of Krugman’s 1990 views? Sadly I no longer have a copy of The Age of Diminished Expectations and it’s at least 15 years since I read it, so I can’t say for sure. But I have found David Henderson to be unreliable on a previous occasion. It’s only fair to note that he posted a correction in response to my comment but I told him I thought it was a bit grudging.

4. September 2010 at 11:49

Scott,

1) Yeah, I know you say so and I have no knowledge to argue. I have just my gut feeling. When house prices increase 3+ times over 10 years it is a bubble. When interest rates are slushed before prices really fall so that people who can not afford to pay 5% can now save hundreds per month by paying 2.5% – that’s BoE propping up house prices.

2) May be you are right but when the ratio like that exists in “many places” it is not the same as having this ratio as average across England.

3) I know nothing about EMH and I know “smart” govt policy can achieve anything over substantial periods of time (North Korea still exists after all), but in general, hoping for the best in terms of govt actions – yes, I think prices should return to average and much faster, even 10 years is too long. They fell in US (and they will fall more) and they should fall in UK (and Canada).

Please check the site I linked to in the other post – these guys not only called the bubble, they proved a great source of information. And I hope their info may prove some of your claims are wrong. 🙂

4. September 2010 at 12:33

I’m pretty sure Krugman just got his prediction from Dean Baker, who has been screaming bubble since 2002.

http://www.cepr.net/index.php/publications/reports/the-run-up-in-home-prices-is-it-real-or-is-it-another-bubble/

4. September 2010 at 13:27

I believe Dean Baker called the housing bubble much earlier than Krugman. See this paper:

http://www.cepr.net/index.php/publications/reports/the-run-up-in-home-prices-is-it-real-or-is-it-another-bubble

4. September 2010 at 13:30

Isn’t price to rent ratio a far better indicator of bubbles?

If both go up or down simultaneously, it’s normal supply and demand at work – if they diverge this is a good suggestion that something bubbly might be happening.

Raw prices as such don’t seem terribly relevant at all.

4. September 2010 at 14:06

Professor Sumner,

When you posted about Russ Roberts’s paper on the financial crisis, my chief argument against it was that it didn’t explain how the whole world experienced a housing bubble.

In fact, the savings glut argument proposed by so many, is used to explain why it was the world experienced a housing bubble and not just the USA.

So, to make sure I’ve understood you, you’re both denying the savings glut argument and the sheer existence of a global bubble in the world, against the arguments of neatly ALL economists?

Joe

4. September 2010 at 15:55

I agree with Tomsz. Looking at the at the rent and housing price divergence makes it very obvious a housing bubble exists. Here’s how it looks for Australia up to 2007. It was obvious in 2005 and it’s obvious now. That baby is going to pop soon.

http://4.bp.blogspot.com/_XwObQeSm5bc/SZKHOx64V7I/AAAAAAAAAGw/mm4zbUZSEMM/s1600-h/real_housing_prices_abs.JPG

Source: http://scottreeve.blogspot.com/2009/02/beware-australian-housing-debt-bubble.html

Among other factors, Dean Baker also used the rent and housing price divergence to identify the bubble in the US.

http://imgur.com/ziGgi

Source: http://www.cepr.net/documents/publications/housing_bubble_2005_11.pdf

4. September 2010 at 16:03

I have to call attention to Dilip’s comment. I remember reading alarm bells from Dean Baker well before I saw them anywhere else (especialy Krugman). But the central question remains, how do we define a bubble?

4. September 2010 at 17:38

I share Prof. Sumner’s skepticism about loosely throwing the term bubble at everything that goes up in price. If bubbles are so obvious and easy to spot how can bubbles exist? They would not exist if they were easy to spot.

Joseph, the UK did not have a housing crash probably because it did not have a housing bubble in the first place. Prices rose from 1997 at 7 1/2 per cent per annum, annual RPI 2 1/2. They started to decline from mid 2007 but at worst only fell to 2006 prices. When the BoE adopted a more aggressive monetary stance policy prices started to rise. Which suggests Prof. Sumner is correct in his argument that the real problem is tight money.

Even when prices were at their highest in 2007, average mortgage repayments as a percentage of income was not historically high. Sure there are some areas that have been too frothy. However, the real reason prices have risen is because there is a shortage of desirable housing caused by artificial land shortages. Moreover, increased immigration is another factor. Using multiple of earnings ratio as an average for where house prices should be is not a good guide. That ratio is not static anyway but has been rising for forty years. Rents are a much better guide and the national rental yield suggests property is only a few per cent overvalued. If the BoE slashing interest rates explains why there has been no housing slump. Why have they crashed in Ireland and Spain where they also have low interest rates?

4. September 2010 at 19:25

Scott it dawns on me that during the housing boom, I was SoCal and Miami, and because I’m constantly talking to guys looking for money, and getting business plans all the time, in my experience, I ran across a TON of guys who who flipping houses, doing all kinds of crazy shit. Guys who were not your normal entrepreneur. They had bought a house and sold it immediately early on for a profit, found the same crowd of fraudsters willing to lie on docs left and right, and suddenly were sitting on a couple houses. It was EVERYWHERE.

I’m saying this because I’m know I’m right about what caused all this, I was there seeing it, and I wonder:

Did you not see this day in and day out while you were being a professor at Bentley? Weren’t all your college students taking out fraudulent loans and buying two and three condos in high rises at the beach on their 35K a year they made DJ’ing at clubs?

4. September 2010 at 23:17

Why is 1987 the baseline?

And the housing bubble was most sizable in 4 or 5 states — using nation figures hides the massive scale of the bubble in specific regions (my house doubled in sale price then crashed back in half in a 5 year period).

The housing boom and bust thing had happened in SoCal before — in the late 1980s early 1990s period.

Lots of folks were anticipating something of a repeat (e.g. the lead business and real estate reporter at the OC Register).

5. September 2010 at 01:50

Richard W,

I agree that “artificial land shortages” are responsible for a significant part of price increase. Nevertheless, I disagree on most of the rest.

First of all, I used the following as a data source.

http://blogs.reuters.com/felix-salmon/2010/01/12/house-price-chart-of-the-day/

1) Ireland: prices started falling there earlier and the fall has gained more momentum (and the bubble was even bigger). They also have a much bigger bank problems because of the small size of the economy and now the country rating is down and they seem to have at least 1% higher rates then UK has.

2) How did you get 7.5%? My calc says 3.5 yroot 12 (96-2008) >11%; And I can’t see how 7.5 is relevant anyway – it is 3.5 times over ten years. Has income grown at least 2 fold? How can you afford to pay that much?

3) When you say average “mortgage repayments as a percentage of income was not historically high” it hides the fact that payments are (often) linked to BoE rate. Had it increased the rates (and high rates do not ness. mean tight money, do they? 😉 ), the average payment would have looked much worse. And as far as I remember, in 2007, when rates were at 5%+, all indicators showed prices (and payments) were way too high.

4) BTW, what tight money are we talking about back in 2007, when the prices started going down and NR fell? I have not seen Scott claiming money was tight in 06-07, when US prices started falling. Interbank lending became tight, yes, because the idiots suddenly woke up to face the music.

5) Not sure what “national rental yield” you mean. All figures are very flawed at least because the number of transaction on a property market is still low. When there are 7-8 sales in a village over a month, it is not easy to produce any reasonable stats. All I know is my rent is the same now as it was 3 years ago for guys living here before me.

You do not like multiplier, that is fine. I have a simple personal indicator: when my wife and I, earning more then average income for the area and having saved a substantial deposit, can not afford to buy proper house without committing to paying more then 40% of our income over 25 years, something is horribly wrong. It can not last forever.

5. September 2010 at 05:12

Joseph,

See this article written by John Kay at the FT to see what I am getting at.

http://www.johnkay.com/2010/03/31/bankers-can%E2%80%99t-blame-the-uk-housing-market/

I do not doubt for a moment that there were significant price increases. Moreover, there was an increase in the gap of affordability for first-time buyers compared to existing owners. In 2000 there was around half a percentage point difference between these two groups, with first-time buyers spending 19.4 per cent of their income on mortgage repayments compared with 18.9 per cent for existing owners. In 2008 the difference was 3.4 percentage points (22.7 per cent for first-time buyers and 19.4 per cent for existing owner-occupiers). However, as you acknowledge artificial land shortages causing shortages was the driver. Therefore, the run-up in prices was for fundamental reasons and not a speculative bubble. Although there was some speculation in the buy-to-let market most people bought houses to live in them. In places like Spain, Dubai and Ireland the driver was speculation.

The national rental yield is the sum of actual rental payments and imputed rents of owner-occupiers by the value of the housing stock The yield averaged 3.6% between 1965 and 2007. The low value partly reflects the inclusion of subsidised social housing and vacant properties.The current yield is 3.4% implying slight overvaluation but the deviation will be corrected by rising rents. People need somewhere to live so it is a better guide than disposable income ratios.

Obviously if the Bank tightened monetary policy they could manufacture a crash. The fact that there has been no slump in contrast to other places suggests to me that the increases were driven by fundamentals rather than a speculative bubble. As long as the NIMBY brigade and local government restrict supply high prices will be the norm.

5. September 2010 at 07:32

Kevin, Even all the Krugman fans I know agree with me entirely. When I talk to leftist faculty they say he held all those horrible right wing views in the 1990s, and has now come to his senses.

I suppose his fans are just as deluded as I am. We are just making it up.

By the way, I’ve read 100s of his columns over the years, so I know quite that well he has moved sharply to the left. To imply otherwise is just silly. I don’t need to read all his books. I actually wouldn’t mind reading more of his books, but there are 100s of other books I’d like to read even more, and I lack the time to do so.

Joseph, You said;

“Yeah, I know you say so and I have no knowledge to argue. I have just my gut feeling. When house prices increase 3+ times over 10 years it is a bubble”

Gut feelings are very unreliable in economics. Most people have a gut feeling that monetary policy is easy right now. Or than the low Chinese yuan is hurting the US economy. Or that immigrants steal jobs. Or that automation steals jobs. All those gut instincts happen to be false.

When prices rise and fall people cry “bubble”. When prices rise, are predicted to fall, but rise still further, people continue to say bubble (Australia). Thus even if the predictions of the model are false, people are so attached to the model that they can’t shake it.

You said;

“2) May be you are right but when the ratio like that exists in “many places” it is not the same as having this ratio as average across England.”

Keep in mind that population density in Britain is closer to the Northeast corridor, than to places like Texas. That’s not to say real housing prices can’t fall in Britain, I’d say there is a 50/50 chance of that happening.

Edwin and Dilip, This is another thing that people get confused about. Calling bubble early is worse than calling it late. Not better. The earlier one calls it, the less accurate and useful the prediction.

Here’s an example. Galbraith called the 1987 stock market crash 9 months before it occurred. The Dow promptly rose from 1700 to 2700, and then fell back to 1700. So the information was worthless. Now if he had made the call right before the crash . . .

Regarding those who accurately predicted the housing crash; in any market some will think the product underpriced and some overpriced. Ex ante one side will have been right. Dumb luck.

Tomasz, Rents are very sticky, but I can see why people might want to use it.

Joe, Just look at the data in the economist. Since 2005 housing prices have risen in all but four countries (out of 20 in the sample.) And two of the 4 where they fell (Germany and Japan, clearly were not bubbles in 2005, because prices hadn’t risen substantially. So the data clearly shows no housing bubble. Earlier I did a post criticizing The Economist. They had an add suggesting people buy their magazine, showing that they had predicted housing prices would fall in all sorts of countries. Then they acted like the prediction was correct, even though it was flat out wrong, housing prices had risen in most of those countries (I believe 5 out of 6)

I have no idea why economists thought there was a global housing bubble. I suppose I did at one time as well. I guess they never bothered to look at the data. Or maybe the data is wrong and I am wrong. If so, shame on The Economist for printing it.

Edwin, It’s pretty clear Australia didn’t have a housing bubble in 2005. So any theory that says they did must be highly flawed. Australian housing prices could drop sharply, and still be higher than 2005 levels.

And if Dean Baker called a US housing bubble in 2002, he’s the last person anyone should want to cite.

Mark, See by previous answers.

The only meaningful definition of bubble is divergence from the prediction of the EMH. (Usually on the upside.)

Richard, All very good points.

Morgan, Everyone knew that was going on. We all heard the same stories, as the newspapers were full of examples of people doing that. Anyone who could fog a mirror was given a huge mortgage. Don’t act like you are the only one who knew.

Greg, Regardless of the starting date all these countries saw steep price run-ups prior to 2005. And Krugman’s bubble prediction was for the national market, at least that’s how he portrayed it in his blog post. That’s what I was reacting to.

Joseph, Just to be clear, I never blamed the 2006-08 price drop on tight money, I blamed the 2008-09 price drop on tight money.

Richard, I like your last comment about NIMBY. What frustrates me is that so many people think it is normal for housing prices to stay at some constant share of income. Real housing prices change over time just like real oil prices or the real price of common stock or the real price of any asset. Clearly in the US prices overshot in 2006, but that’s hard to see in real time, as these other countries show.

5. September 2010 at 07:32

Richard,

Sorry, this article makes very little sense to me. Claims that the banks had no problems with their mortgage books and refers to the stats showing few reposessions but does not take into account banks only recovered when and because the rate was slashed (which increased the margins, let the banks refinance under better terms and let them decrease the rates to ridiculous levels for the customers). Plus as I mentioned the numbers do not look reliable. BTW, I may be wrong but I read somewhere that affordability numbers only include interest – no wonder they produce fantasy land “20% averages”. 200K mortgage with 5% is 1182 over 25y, that will buy a shoebox with little land in the SE even if you have 100K deposit. And you still need 6K take home family income to make it 20%. That average inclome does not exist here. Proper houses start at 400K – and they were below 150 just 15 years ago. And they only cost a 100K to build – now.

Have you seen prices in Scotland? Scotland is no Greater London but yet they had huge increases as well – that’s country that has hardly any chance of stable development.

5. September 2010 at 08:01

Scott,

>>Just to be clear, I never blamed the 2006-08 price drop on tight money, I blamed the 2008-09 price drop on tight money.

Yes, I thought so, that’s why I said I did not agree with Richard’s statement (see below) that prices fell due to tight money. Prices fell in US and started falling in UK before money was tight (according to your definition), the fact that they stopped falling here after rates were slushed just proves to me this was a temp stop and they will fall further at least in real terms as soon as rates are back to normal.

Richard said

>>>>When the BoE adopted a more aggressive monetary stance policy prices started to rise. Which suggests Prof. Sumner is correct in his argument that the real problem is tight money.

Scott, one more thing. Morgan already mentioned it but you do not seem to take notice. It is not that I think house prices should be constant. I just think price can not realistically change too much relative to income – simply because mortgage payment is currenly by far the biggest part of family expendatures. When petrol price rices 50% we hate it but then if we spent £70/month before £105 will not kill us. Whereas when house prices rise 3 times we have to pay £1200/m where before we would get away with probably £600. This money – as you said – levels out across the globe, but I could not care less 🙂 about the globe – we become slaves if we take on the debt that high and importantly we do not buy anything else. We do not buy new cars, latest TVs, iPhones – nothing. We just live to pay off the mortgage. Is that the economy you would like to see? And no, I do not want the govt to control prices, I actually want it out completely. But I also want reasonable people to acknowledge that the situation where so much money pays for something that really costs very little is not normal and has to be corrected – be it with 5% Fed rates, removal of building restrictions or some other, hopefully free market way. Too much to ask? I though so.

5. September 2010 at 09:17

I will tell you WHY the housing bubble was easy to spot.

1. Every foolish relative you have was talking about real estate flipping.

2. Carton Sheets commercials on every hour.

3. Shows like flip this house were booming.

Once they get the last suckers into the game to hold the bag, the smart money gets out.

I would like you to compare the above scenario with how gold is being promoted currently, you will see similar parallels. They even had a show on tv called Gold Rush.

5. September 2010 at 10:27

[…] comments often inspire new posts, and this is a good example. In my post on Krugman’s 2005 prediction of a housing bubble, a number of commenters pointed out that Dean Baker made the […]

5. September 2010 at 10:31

> Tomasz, Rents are very sticky

I don’t understand why you think so, it seems exactly the other way to me.

Looking at renting market in London, there is a lot of competition between very large number of sellers and buyers, with typical contract lasting a year at particular price per month. After that, neither party has any obligation to prolong this (typically with one month notice period etc.), and definitely no obligation to keep rent level the same.

There are no menu costs, as there are no menus. People move in and out all the time. It’s not possible to “wait out” bad market and store rent-years somehow, so to any landlord it’s better to rent it out cheaper now, and increase rents later than to keep it unoccupied.

In places with legal rent control it might be difficult to increase rents, but that’s rent control not rent stickiness. Is there anythings that would suggest upward stickiness of rents at all? Even wages aren’t really sticky upwards.

Some downward stickiness perhaps exists due to money illusion, but this isn’t relevant to bubbles.

5. September 2010 at 14:32

Spotting potential bubles is easy – identifying if or when they pop is the hard part.

I started following real estate analysis around 2001. In 2002 NBER published WP 8966 “Boom-Busts in Asset Prices” which showed real estate booms and busts were not really correlated – sometimes busts happened without a preceding boom, and sometimes a boom happened without a bust. Based on that I thought the US had about a 33-50% chance of a bust. The alternative to the bust is either slow decline or stability.

The published figures for Dean Baker’s real estate sale indicate he lost money by selling (and then renting) way too early.

5. September 2010 at 15:18

Joseph,

It was the inadequate monetary policy response by the BoE from around September 07 that led to the banking crisis a year later. Apart from not recognising what was going on they completely botched the Northern Rock issue. Google Prof Tim Congdon on the right and Prof Danny Blanchflower on the left and see what they were saying throughout 2008. Sure slashing interest rates after the a slowdown had developed into a crisis allowed more people to service their mortgage. However, it was the Bank that allowed the crisis to develop.

I don’t quite follow your Scotland point. After London, South East & East of England, Scotland has the 4th highest incomes in the UK.

I am not arguing in favour of high prices. It is just that I am skeptical that high prices prove a bubble. There are a lot of fundamental causes to the high prices. Moreover, I do not think it is the Banks’ job to maintain high prices beyond any other consideration. However, their monetary policy failed in 2008, and that led to problems in the banking sector becoming a severe recession. Policy was too tight throughout 2008, so money was too tight in the UK.

The problem is the Governor gets an easy time in the UK. No politician either government or opposition would dream of criticising the BoE. Apart from a mild grilling at the Treasury Select Committee the governor and the MPC get pretty much a free ride and that leads to complacency.

5. September 2010 at 23:42

Richard,

As you have definitely noticed I am quite an ignorant person. I know next to nothing about economic theory and frankly not much outside it. That probably explains why it is beyond me that you blaim BoE for failing to ease in 2007, but do not pay any attention to the levels of debt people and banks had by that time. This is a fresh blog post written by clever hedge fund guy: http://brontecapital.blogspot.com/2010/09/bank-capital-ratios-and-standing-on.html

Notice his point about bank levegage. Every time somebody mentions “easying” I mentally ask “who do you want to take all this new debt on”? Because of all the people I might (we have income, credit history and deposit) but I won’t – not that level of debt. And most people I know are either already in debt or will have to take it on to help their grown up kids. So apart from – as John mentions – older people (who have no kids) no one is really a winner. Well, banks are – until the music stops.

As for Scotland, look at population growth there. See it? That’s because it is not there. 2% in 20 years – that can hardly explain “fundumentally” any house price increase in a country where land is not really an issue.

I do remember that Blanchflower kept voting for lowering the rates. It changes little. I must admit it makes me laugh and cry seeing academics, Nobel laureats argueing about major things, not small details. They have no more clue then stupid I when I call something a bubble on the basis of gut feeling. Too many variables in their equiations.

The reason we had low inflation in 90-s is China. Now China cannot lower prices any more – what, t-shirts for 0.99 instead of £1? Oil is not getting cheaper, even computer parts like memory are not getting cheaper. Food – if you do your own shopping – is up 25-100% on different items from my list in 4 years (yes, I have records). Taxes rise and will rise more. Unless something gives(and it’s better be house prices) – I can see no reason to take any risk at all and take debt on.

6. September 2010 at 09:07

Joseph, We need to be clear about one thing, when we talk about house prices, we are actually talking about land prices. Where land is cheap (at least in the US), you don’t get high house prices. The cost of building a house can rise, but nowhere near as dramatically as “housing prices” rise. So the problem in places like New York and California is land prices. The question is whether high land prices are sustainable in those areas. In some cases (New York and SF and Coastal LA), the answer is yes. The mistake people made in 2006 was assuming that the coastal model was spreading to inland California and Florida and Nevada. It now looks like it did not, but at the time many thought it did.

But in cities like San Francisco I’d expect housing to remain “unaffordable” according to traditional metrics for the next 100 years. People want to live there, and will do what it takes. My wife and I plan to live in an “unaffordable” home in LA when we retire. I say unaffordable because our retirement income will be low relative to the value of the house. (Of course we won’t have to make mortgage payments.)

Regarding Scotland, time will tell.

Rob. Let me know when the gold bubble is about to pop, so I can sell gold short.

Tomasz, You said;

“In places with legal rent control it might be difficult to increase rents, but that’s rent control not rent stickiness. Is there anythings that would suggest upward stickiness of rents at all? Even wages aren’t really sticky upwards.”

I know landlords who almost never raise rents on a good tenant, but raise rents after they move out. But your point is somewhat valid, perhaps rents aren’t as sticky as I assumed.

Rich, You said;

“Spotting potential bubles is easy – identifying if or when they pop is the hard part.”

Spotting actual bubbles is hard, potential bubbles is easy.

6. September 2010 at 10:39

Scott,

I know quite well that it all comes down to land prices. Again it changes nothing. Your question “whether high land prices are sustainable in those areas” is a million dollar one. I do agree there are some areas where prices are and will be unreachable for an average Joe. It is just clear to me that when there are 5% (or 15%) of people with income (or wealth) way above average that at best (or rather in the worst case scenario) means there will be roughly 5% of houses that are out of reach. Chealsea, central London or NY and San Francisco – so be it. But when huge territory like the South East of England gets out of reach for families with above average income (or should I say a person in the top 10 percentile) and actually the whole of UK has prices that are completely unaffordable for an average person working in this area that will not last forever.

7. September 2010 at 06:45

Joseph, You may be right, but as for right now those supposedly unaffordable houses are actually being purchased by people who supposedly cannot afford them. I guess the response is that they can only afford them becuase of low rates, which aren’t expected to last. And that get’s into flaws in the banking system, where banks make too many unsound loans. I don’t know enough about the UK to comment, you might be right.

7. September 2010 at 13:22

Scott,

Yes, some people are buying – but some were buying in 2007 at peak prices. They may be alright – if they are in a chain and sell their properties at the same time. Anyway, the number of transactions is low.

Thank you for listening. I hope I should now be able to switch back to preffered read-only mode 🙂 Like most people here, I enjoy your posts – even when I completely disagree with something.

8. September 2010 at 16:11

Thanks Joseph