The man who revealed too little

Time for one more stab at QE, and then we’ll have a bit of (I hope) good natured fun with my favorite target in the blogosphere.

Paul Krugman has a new piece on the problems with QE, in both Japan and Britain. As usual, I agree with much of what he has to say, but have a slightly different take on things:

Actually, this has a moral beyond not to worry about inflation. It’s also a reminder that it’s hard to make monetary policy effective in a liquidity trap. There are some writers who suggest that all we need is more determination on the part of Bernanke et al; while I dearly wish the Fed would try harder, it’s not all that easy, because just pushing out money doesn’t do anything. You either have to buy lots of long-term assets “” we’re talking multiple trillions here “” or credibly commit not just the current FOMC, but future FOMCs, to pursuing higher inflation targets.

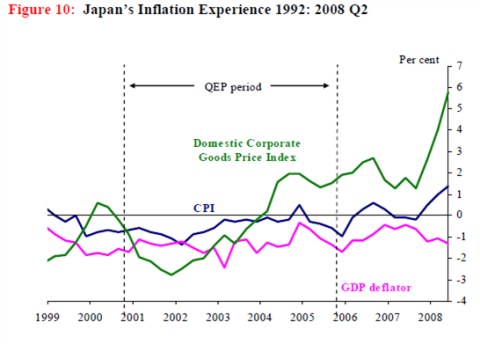

I agree that the key is expectations; if you don’t commit to higher inflation, you won’t get results from QE. But I’m not sure this makes monetary stimulus hard to do. Take a look at the graph he provides (and his comment after on the effects of QE):

Hmm. Deflation just kept on going.

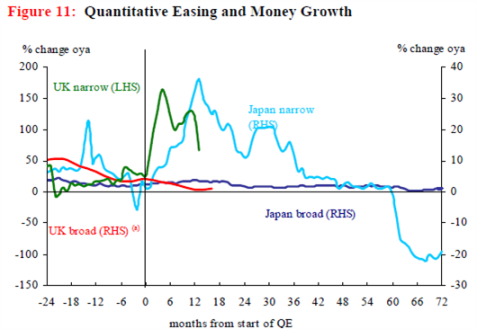

Yes and no. The policy does get CPI inflation up to near zero percent during 2003-08. The deflator keeps falling, but my hunch is that the BOJ cares more about the CPI. Also note that unlike the Fed, which has a 2% inflation target, the BOJ has a target of zero inflation. I think you can make an argument that the policy succeeded, in the sense that they got the inflation rate they wanted. (Of course recent Japanese inflation has again fallen short of target, just as in most other countries.) Why do I think that the BOJ succeeded in its own terms? Because they acted like they had succeeded. Note the big drop in the monetary base in 2006 (below). Things like that don’t just happen for no reason. Krugman doesn’t discuss the decline, but I think the reason for the fall is fairly clear, indeed it is easily explained by Krugman’s own model of the liquidity trap.

In the late 1990s Krugman modeled an “expectations trap,” where at zero interest rates conservative central banks had trouble committing to higher long term inflation targets, because the public didn’t believe they would carry through with the policy once the crisis was over. And because prices are sticky, it’s hard to raise inflation in the short term. It might be easier to explain this idea with a numerical example. Suppose the nominal rate falls to zero, and the Fed decides to double the monetary base, in order to boost AD. In Krugman’s model that extra money might be hoarded, if the increase was not expected to be permanent. So why not announce that the increase will be permanent? That would work, but perhaps too well. If the public expected the liquidity trap to be over in 5 years, then a doubled monetary base might result in a doubled price level. But the public doesn’t believe a conservative central banker would allow such high inflation. OK, then how about promise to leave the money supply 10% higher in 5 years, so that we’d get 2% expected inflation? Or 15% higher for 3% expected inflation? The problem is that they can’t really even credibly commit to that, because velocity is unstable and so the Fed must, in the real world, reserve the right to move the money supply as needed.

OK, so why not just promise to leave enough money in the economy in five years time so that prices rise by the target amount. Bingo. And unless I am mistaken (and I usually am when interpreting Krugman) I think he would say this is the key—you need to credibly promise to create inflation. QE is just something that allows you to meet the promise, but it won’t by itself cause monetary stimulus to be credible. Of course technically Krugman’s model doesn’t say that QE won’t work, it says temporary injections don’t work. But given his model of conservative central bankers, this pessimistic assumption might be warranted.

So far it sounds like I mostly agree with Krugman, and in a technical sense I do. But let’s return to the big drop in the Japanese base in 2006—how are we to interpret that? In one sense a Krugmanite could say; “See, the Japanese currency injection was temporary, just as Krugman predicted.” [Notice I say a “Krugmanite,” not Krugman–you’ll see why later.] And again, I’d have to agree. But what is revealing isn’t the fact that the money was withdrawn, but the implicit inflation target it revealed. By 2006 they again had gained control of policy and were tightening. Why? Apparently because their inflation target really is 0%. Even worse, they don’t believe in level targeting, or catching up for past under-shooting. If we are going to judge the Japanese on how closely the CPI adheres to their 0% inflation target, they haven’t done that bad. I happen to think the target is a bit too low, as it exposes them to frequent liquidity traps. But they are basically hitting their target, as they see it. If they weren’t they would have waited until a 2% trend rate developed before withdrawing the QE, not stable prices. Indeed they also tightened in the year 2000, again with during a period of slightly negative inflation. So we have two “revealed preference” examples clearly indicating that Japan has an ultra-low inflation target.

So what does the Japanese case show? It shows that QE may fail to boost prices. And I think it also shows that QE may fail to boost prices because the public correctly understands that the conservative central banks will immediately withdraw the QE when the crisis is over. But, unlike Krugman, I don’t think it shows that monetary stimulus is hard when rates are at zero. Rather it shows that the BOJ has a really, really low inflation target, zero or even slightly negative.

Krugman does propose one solution, a higher inflation target. Then he notes, correctly, that central banks are too conservative to implement such a policy. Just today, Bernanke reiterated his opposition to the very sort of policy he recommended that the Japanese adopt. Of course I find this very maddening. But in a sense it’s even worse, as the Fed doesn’t even need to adopt a higher inflation target. Their implicit 2% target might be enough, under two conditions:

1. They adopted level targeting.

2. They got serious about it.

In a previous post I explained all this, and pointed out that it’s not my idea, its Bernanke’s. He recommended that as soon as the Japanese fell into a deflationary liquidty trap, they adopt level targeting, making up for any over- or undershooting. We entered a (mildly) deflationary liquidity trap around September 2008. Is it too much to ask for a conservative central banker to stick to the 2% target they claim to have, and make it level targeting in a crisis? The core CPI has fallen well below the 2% target path from September 2008, and more importantly is now expected to fall even further behind. A policy of 2% inflation targeting, level targeting, retroactive to September 2008, would dramatically raise inflation expectations over the next few years. Hitting that sort of target with 9.9% unemployment (i.e. fairly flat SRAS) would require much higher AD, much higher NGDP. As you know, I favor NGDP targeting, but even price level targeting would be much better than the current passivity. It would also inoculate us from the deflationary effects of the Greek crisis.

What does Krugman think of level targeting? I’m tempted to speculate, but last time I tried to decipher his beliefs the brilliant but prickly pundit called me a “damn liar.” Or maybe he didn’t. Maybe that accusation is itself a damn lie. And that’s the problem. I find him very elusive. The term “damn lies” appeared in the title of his post. And it was about how I had mischaracterized his views. But who knows? Which brings me to my next point.

I get tired of being slapped down for misinterpreting him. So perhaps I should refer to him by a codename. Odds are he hasn’t gotten this far in this overlong post, so he won’t know who I am referring to. Something like ‘the zen master.’ No that’s taken. The ‘gnomic one? ‘ “He who shall not be named?” I notice he just left for Morocco, site of the opening scene in The Man Who Knew too Much. So how about The Man Who Revealed Too Little?

Think I’m exaggerating? OK, let’s have some fun with this golden oldie from 2005:

And the backlash [against neoliberalism] has reached our closest neighbor. Mexico’s current president, Vicente Fox, a former Coca-Cola executive, is a firm believer in free markets. But his administration is widely considered a failure.

So what is Krugman saying here? You might think; “Isn’t it obvious? He’s saying that Fox implemented free market reforms and they failed.” If so, you underestimate the subtlety of Mr. Krugman. He didn’t say that Fox implemented any free market reforms at all. He said he was a firm believer in free markets. And who could dispute the proposition that mere belief in free markets, if not actually implemented, does not produce economic miracles? How dare you assume he claimed Fox implemented such policies!

By now you probably think that I am ready for the lunatic asylum. But let’s see who gets the last laugh. The fact is that Mr. Fox did not implement free market reforms. Why not? Because the Mexican legislature was firmly controlled by the opposition PRI, who had no interest in helping him. Yes, Krugman’s right that Fox was unpopular, as you’d expect of any leader who failed to get things done. Think about it. If you wanted to say economic reforms failed, why not just come out and say it. Why refer to a leader who believed in market reforms, when it takes no more ink to say a leader who implemented market reforms. (OK, ‘implemented’ is a couple extra letters—‘enacted’ would do.)

Here’s another gem from the same article:

Latin Americans are the most disillusioned. Through much of the 1990’s, they bought into the “Washington consensus” – which we should note came from Clinton administration officials as well as from Wall Street economists and conservative think tanks – which said that privatization, deregulation and free trade would lead to economic takeoff. Instead, growth remained sluggish, inequality increased, and the region was struck by a series of economic crises.

At first glance you might think; “Aha Sumner, there’s your smoking gun. He does oppose the neoliberal agenda of privatization, deregulation and free trade, or at the very least thinks it failed. Just as you said. You’ve finally nailed him.” Not so fast. He didn’t say these policies were tried and failed, he said they were recommended by American officials, and he also said Latin America had not done well. But he never actually said the policies were tried and failed. Again, you might think I am being absurdly pedantic here. But I am quite serious. Indeed I think it is quite possible that Krugman actually favors neoliberalism–as many of his fans insist who write in the comment section of my blog.

As with the President Fox example, my interpretation also has the virtue of being true. In most of Latin American neoliberal policies are been tried only fitfully. Only one country in Latin America has enthusiastically embraced neoliberalism; Chile. And Chile also happens to be the only economic success story in South America. So the facts of the matter actually fit my interpretation, strange as it may seem. (BTW, Chile ranks 10 in the Heritage Index of Economic Freedom, the next highest South American country is Uruguay at 33, which I believe is the second most successful economy in South America.)

Now if you have an ounce of common sense you shouldn’t believe anything I just wrote. I understand that it is quite a reach to spin this sort of convoluted interpretation. But no matter how much it seems to defy common sense, I think it quite possible that my seemingly bizarre reading is the correct one. Here’s why.

Much as right-wingers like to pick on Krugman, and make fun of him, he has never moved so far left as to lose credibility. So think about this for a moment. A center left government takes over after Pinochet leaves office. Until the recent election, the leader of Chile was a respected moderate socialist. This government kept almost all the neoliberal reforms, and added some extra social spending. Suppose Krugman was called upon to advise Ms. Bachelet in 2006, soon after he wrote this article. Suppose she asked whether they should junk the entire neoliberal agenda and follow the Chavez strategy. My hunch is that Krugman would have told them to do exactly what they did–keep the neoliberal reforms and add a bit of social spending.

Now least you think I am incredibly naive, let me be clear about one thing. I understand that when Krugman’s chic fans on the upper west side of Manhattan read his columns, they don’t know about what really is going on in Chile. And I don’t doubt that they read his column as claiming that neoliberalism has brought misery to Latin America—which is of course exactly what they already knew from Hollywood films like the most recent James Bond pic. But does Krugman believe this? I’m not so sure. After all, it’s not true. And after all, Krugman’s a pretty smart guy. It’s a genuine mystery to me. Thus the title of this post.

Earlier I referred to him as a brilliant but prickly pundit. My right wing fans get angry when I say he is smart, and I suppose the left wing readers think I am mocking him. They would both be wrong. There is a nice anecdote in the recent New Yorker profile that illustrates why I think Krugman is so brilliant:

“What does it mean to do economics?” Krugman asked on the stage in Montreal. “Economics is really about two stories. One is the story of the old economist and younger economist walking down the street, and the younger economist says, ‘Look, there’s a hundred-dollar bill,’ and the older one says, ‘Nonsense, if it was there somebody would have picked it up already.’ So sometimes you do find hundred-dollar bills lying on the street, but not often””generally people respond to opportunities. The other is the Yogi Berra line ‘Nobody goes to Coney Island anymore; it’s too crowded.’ That’s the idea that things tend to settle into some kind of equilibrium where what people expect is in line with what they actually encounter.”

I know nothing about his work in economic geography, but he deserves a Nobel Prize just for boiling economics down to its essentials. He’s very good at using the revealing parable, like his babysitting co-op metaphor for a (nominal shock) recession. He is especially good at the folly of tight money policies, as revealed in this pointed but accurate critique of the right in the very same column that contained the nonsense about neoliberalism:

But the most dramatic example of the backlash is Argentina, once the darling of Wall Street and the think tanks. Today, after a devastating recession, the country is run by a populist who often blames foreigners for the country’s economic problems, and has forced Argentina’s foreign creditors to accept a settlement that gives them only 32 cents on the dollar.

Free market policies being blamed for recessions caused by tight money. Sound familiar?

So I am quite sincere about his brilliance. His economic intuition is off the charts. But then there is this, from the same New Yorker profile:

Krugman was bemused by the reactions. True, he had accused Chicago economists of espousing ridiculous ideas in part because of financial incentives””sabbaticals at the Hoover Institution, job opportunities on Wall Street. But when those economists responded with anger he was surprised. “There was no personal invective in what I wrote,” he says. “I never insulted anybody’s personality. It was always at the level of ideas.”

Ideas? Your opponents are in it for the money? I guess that’s the “idea” that they are intellectual prostitutes? Hmmm, why would they be annoyed by that?

So is he brilliant? Yes. But social intelligence? Let’s just say it’s “on the charts.”

If Krugman weren’t saying those awful things about neoliberalism he’d be one of my favorite economists, maybe my favorite living economist now that Friedman’s dead. But I just can’t overlook those quotations. I know full well how his readers interpret them, and I am pretty sure that he does as well.

But I always like to look on the bright side. The blogosphere would be a much impoverished place without him. There are lots of bloggers I enjoy more, but no one who seems so essential on the big issues.

Call me Ahab

In a recent research report on the euro area, economists at DeutscheBank, led by Thomas Mayer, said that euro area countries “can learn some valuable lessons from the Baltics’ experience over recent quarters.” Those countries survived drastic budget consolidation without devaluing their currencies.

Tags:

26. May 2010 at 19:26

Scott,

It’s a little scary how often it seems we agree. Krugman is one of my favourite economists — he is the man who got me interested in the field to begin with. Essays like the Accidental Theorist and the parable of the babysitting co-op were my first encounter with economics. Moreover, the Krugman I read then had no qualms about confronting the mistakes of the right or the left. If anything, when I first encountered him, I had the impression he leaned to the right.

I am confident that the Krugman of that era lives on today. The problem is he’s hidden himself behind a veil of left-wing adherents, who won’t stomach a word from him against their orthodoxies. So he’s trapped by his audience. He is wise enough to not deny what he actually believes, but while he is still free to criticise the failures of the right, he is no longer free to do the same for the left.

It is frustrating. The Krugman of the ’90s had no qualms about attacking well-meaning leftists who opposed trade under the mistaken belief that it is inhumane. The same Krugman today would probably point out some obvious failures in countries which pursued an open trade policy, while wriggling out of any literal wording that might imply he is not a believer in free trade.

26. May 2010 at 20:58

Krugman writes things he’s too smart to know are not true. He knows what happened in Chile versus what happened in Venezuela. When he writes stuff that is clearly wrong, it’s not because he doesn’t know better. He just cares more about scoring partisan points.

There is no excusing this. Why are you trying to?

26. May 2010 at 21:00

Uhh, I meant “too smart to think are true”.

26. May 2010 at 22:52

Ahab, with this post again you show that you are the greatest of bloggers.

Perhaps you should consider the idea that your white whale is symbolic of an indifferent universe.

26. May 2010 at 23:17

or, as ambrose bierce defined in his Devil’s Dictionary: “Liberal, noun : someone who won’t take his own side in an argument.”

27. May 2010 at 04:19

There is a clue to understanding why Krugman seeks out political points: because anyone who paid an ounce of attention during the leadup to the Iraq War realized that the people who determine policy don’t listen to the conscientiously-correct academics who hedge everything, they listen to the pundits who beat their chests and say I AM RIGHT. LISTEN TO ME.

27. May 2010 at 04:43

Your post has reminded me this piece by Krugman on Friedman:

http://www.nybooks.com/articles/archives/2007/feb/15/who-was-milton-friedman/?page=4

First, you will notice that Krugman concedes that deregulation can be good. Second, you will find a kind of similarity between Krugman’s objections and yours.

27. May 2010 at 05:19

johnleemk, Yes, he’s changed. Good comment.

Jeff, I think you misread this. Parts were intended to be humorous, but at the end I said that’s why I can’t consider him my favorite economist, despite his talent. So I agree with you.

rob, Thanks. The Bierce quote pretty much summarizes this post, doesn’t it?

David, But I am claiming the opposite. He hides his true beliefs. Everyone thinks he’s outspoken, but does anyone know what he thinks about the most important trend in the world economy since 1980? Does anyone know whether he thinks neoliberal reforms are on balance good or bad? If that’s too general, how about what he thinks of Latin America, or even more specifically, Chile.

Jean, That post left a bad taste in my mouth. He accused Friedman of being deceptive and dishonest. And right after Friedman had died and wasn’t there to defend himself. And his charges were wrong, as he doesn’t quite get the Monetary History. He is relying on a cartoonish simplification that is stuck in his memory.

27. May 2010 at 05:19

You should call Krugman Mr Disingenuous

27. May 2010 at 06:38

Scott,

If Krugman weren’t saying those things about neo-liberalism, he could be “your favorite liberal economist?” And he’s “essential on the big issues?” Care to explain why?

Best,

David

27. May 2010 at 06:43

Scott, you’re correct and his deliberate use of vague language is one of the more annoying things about Paul’s work in the NYT. And I agree that he is very, very smart. Like Jeff commented, too smart to believe what he is saying. Rather than be clear in his language, he phrases things so that his fans will agree with him while still giving himself an out. “I never *said* that!” Often this will include an appeal to “textbook economics” without making it clear that is an appeal to *his* textbook only (http://krugman.blogs.nytimes.com/2010/03/23/moderate-inflation-versus-hyperinflation/). Especially silly, since saying “according to textbook economics” is implicitly saying “according to widely accepted knowledge and assumptions in the field of economics, such as you would find in most or all introductory economics textbooks”, but what he’s really saying is “according to my books, that I wrote.” Two very different things.

It’s these little tricks that make Paul so frustrating to read, because you constantly have to try and figure out what he is really saying. He clearly can turn a phrase, as you point out, his genius lies in communicating economics concepts clearly. So the fact that he doesn’t do this in the NYT blog causes me to assume he does it on purpose, so that he can imply outrageous things and earn praise from his fan base, while protecting himself from counterargument. You’re not paranoid, you are absolutely correct.

What’s also so frustrating is how often he mocks a commenter or another blogger for disagreeing with him (as you know), but I’ve never seen him correct anyone on his team who misunderstands his point. Many commenters on the NYT blog “agree” with Paul and call for statist policies and vast anti-neoliberal reforms (price controls, near 100% MTR, eliminate H1-B visas) and NEVER have I seen Paul tell them “Wait, that’s not what I said.” (Don’t get me wrong, there are always a few dozen rightwing wackadoos that see the USSR in everything too.)

Ultimately, while I understand he is a huge force in the field, I find it difficult to read his articles and blog because I cannot get past these childish linguistic tricks and his blatant pandering to the left. I want to tell him, “Yes, you were right about the WMDs and people on the right said some mean things about you, but it is time to grow up and be a big boy now.”

27. May 2010 at 07:08

I am still quite skeptical that monetary policy can be effective in a liquidity trap for a number of reasons.

One is the tinker bell analogy, can the Fed really control expectations? Certainly not if most market participants believe monetary policy is essentially interest policy (It may not matter if this belief is inaccurate). With current tools I don’t see how they reliably move expectations, there’s no action analogous to Roosevelt leaving the gold standard, there would need to be a shock and awe factor to change expectations.

Second is reading Richard Koo’s work on Japan and ‘Balance Sheet Recessions,’ which lead me to question whether current models really apply our current predicament. I’ll quote Koo here via Kevin Drum.

“With their balance sheets in a shambles, people had no choice but to reorient their economic priorities from the usual profit maximization to debt minimization in order to put their financial houses in order. This shift, in turn, nullified the effectiveness of economic theories and

policies based on the assumption that the private sector always seeks to maximize profits.

….Those whose balance sheets are underwater will try to pay down debt as quickly as possible to restore their credit ratings, regardless of the level of interest rates. By 1995 Japanese interest rates were almost at zero, but instead of borrowing more, Japan’s corporate sector became a net repayer of debt until 2005 “” fully 10 years later ”

The only policy regime that strikes me as plausible is monetize a portion of the deficit, which, of course, blurs our traditional notions of monetary policy and fiscal policy. But it may provide both the shock and awe needed to change expectations and recalc those Ricardian equivalence calcs.

27. May 2010 at 07:15

DanC, That’s a good one.

David, Ouch, Was I too kind? I think he is an extremely talented blogger, and can understand why other liberal bloggers worship him. But I think he misuses his talent. The guy who wrote Pop Internationalism had an amazing ability to think logically, get to the heart of an issue, and communicate well. The same qualities Friedman had. I also think there are aspects to his personality that have diverted his career onto the wrong track in the last 10 years, and I think his talent is being wasted. He’s become a partisan figure, and that makes him pull his punches on free trade, etc.

Maybe I should have said my favorite mainstream economist. At this stage of my life I prefer unconventional people like Tyler Cowen and Deirdre McCloskey. I was also just considering popular economists, not academics like Bennett McCallum, who I respect more in terms of academic work.

He’s essential on big issues not because I agree with him, but he’s the go-to guy to find out what liberals are thinking. Whatever he says will be parroted by certain other unnamed liberal bloggers in short order.

27. May 2010 at 07:17

David, BTW, This is the key line in my post:

“But I just can’t overlook those quotations. I know full well how his readers interpret them, and I am pretty sure that he does as well.”

27. May 2010 at 07:22

Sumner- One question on the NGDP market you envision, is this a gov’t debt market like Shiller’s Mils based on GDP or just a derivitives type market?

Oh, and here’s the link to the Koo paper:

http://www.house.gov/apps/list/hearing/financialsvcs_dem/richardc.koo.pdf

27. May 2010 at 07:25

From the Friedman piece:

Friedman’s laissez-faire absolutism contributed to an intellectual climate in which faith in markets and disdain for government often trumps the evidence.

If Friedman can be responsible for anything anyone says, why can’t Krugman be responsible for at least a few of the things Krugman says?

27. May 2010 at 07:26

MikeMcK, Very good observations.

OGT, I have addressed those arguments many times. The Fed could target NGDP futures, and peg the price if necessary. Japan could have depreciated the yen. Even Paul Krugman doesn’t buy the liquidity trap argument, he criticizes the Fed for being too conservative. Markets don’t believe in liquidity traps, they jumped upward when QE was announced in March 2009.

The Fed could set an explicit price level target, level targeting. They could charge interest on excess reserves. They could buy $10 trillion in Treasury debt (which is not fiscal policy at all, it is 100% monetary policy.)

Bernanke doesn’t say they couldn’t generate higher inflation expectations, he says they don’t want to.

27. May 2010 at 07:36

Scott,

I think your codename should be Goldilocks…

Alex.

27. May 2010 at 07:39

On the subject of very bad coverage of the Baltic states check out this article on Lithuania by Steve Forbes:

http://www.forbes.com/forbes/2010/0607/opinions-steve-forbes-fact-comment-europes-unsung-heroes.html

The article celebrates Lithuania’s neoliberal economic policy without once mentioning the fact they are in a depression with 18% unemployment and have a sovereign debt crisis with 10 year bond rates at 14%. With articles like these how can people fail to be oblivious to the fact that tight money is the problem in the EU.

27. May 2010 at 08:25

One of the more obviously wrong things Krugman has said recently is “China … is actually tightening monetary policy to avoid an overheating economy “” when basic textbook economics says that it should be appreciating its currency instead.” (http://krugman.blogs.nytimes.com/2010/05/26/reasons-to-despair/) As far as I understand, those are the same thing.

I wonder if you see a hedge in there that makes him subtly right instead?

27. May 2010 at 08:29

Is Japan the basket case that many in the MSM imply it is?

From

http://super-economy.blogspot.com/2010/05/paul-krugman-wrote-in-nyt-that-we-are.html

The importance of the demographic transformation in Japan is even more clear if we include the entire 1990-2007 period.

In non-population adjusted figures, Japan’s real GDP grew by 26% in total these years, the lowest in the OECD. In comparison the figures are 63% for the U.S and 44% for the EU.15.

But during this period the U.S saw it’s potential labor force (the number of people between 15-65) increase by 23% and the EU.15 by 11%, while Japan had a decrease of 4%.

Between 1990-2007, GDP per working age adult increased by 31.8% in the United States, by 29.6% in EU.15 and by 31.0% in Japan. The figures are nearly identical!

Japan has simply not been growing slower than other advanced countries once we adjust for demographic change.

27. May 2010 at 08:52

“Suppose the nominal rate falls to zero, and the Fed decides to double the monetary base, in order to boost AD. In Krugman’s model that extra money might be hoarded, if the increase was not expected to be permanent. So why not announce that the increase will be permanent? That would work, but perhaps too well.”

I think Buiter adresses this point here:

http://www.nber.org/~wbuiter/helijpe.pdf

“Helicopter Money

Irredeemable fiat money and the liquidity trap

Or: is money net wealth after all?”

On a personal note: If someone is going to call me a liar, I prefer that they call me a damn liar.

27. May 2010 at 09:02

Krugman’s behaviour is sociopathic. He seems utterly devoid of principle and empathy. He writes to manipulate and intimidate. He is like a nihilist, with no particular respect truth; reason and facts are mere tools to influence the opinions of others. At best, he is mischievous; at worst, he is dangerous. I don’t waste my time, though he does inspire interesting reactions (as his remarks seem calculated to do).

27. May 2010 at 09:11

Krugman is brilliant – in the economics of trade (and I really do mean that. He deserves his Nobel Prize). Outside of that, though, he just brings a general “economist” perspective to a whole bunch of issues that he has little knowledge of beyond “well-informed layman”, and that’s where you see his weaknesses.* He can still make some good points, though.

*See a lot of the stuff he’s written on the Financial Crisis in America, which was then dissected by the excellent Economics of Contempt blog.

27. May 2010 at 09:57

This was a great post – but I think there’s an ingredient missing from the analysis.

Let’s say you asked Krugman whether he agrees with the neoliberal reforms, and he just answered “Only the ones that worked, and only because they worked in those particular situations. To the extent those effective policy reforms resembled neoliberal recommendations and produced positive results – that is almost definitely a coincidence and certainly not because fallacious neoliberalism has anything coherent to tell us about a general approach to economic policy-making.”

Krugman is something of a rationalist-constructivist anti-Hayek in these matters. He rejects most of the “justification” for laissez-faire ideology and the corollary suspicion of and disdain for government involvement. He doubts a “spontaneous-order equilibrium” is optimal in many situations, and he believes that policy determined by elite experts such as himself would produce a more reliable and more optimal economic environment. Sometimes that policy would mirror the “neoliberal” doctine, (again, coincidentally) but often it won’t.

He is not so much committed to any particular political-economic dogma or normative-judgments of market activity, but instead has a strong faith in the ability of mortal minds to discover when free-markets work best (and grudgingly let them work in those contexts, in a kind of lesser of two-evil analysis). In other contexts government experts could derive the maximizing social-economic policy. His normative judgment is that if the state can do better than what imperfect-markets would accomplish, then it should, and anyone who stands in the way is an evil fool fanatically devoted to a false-religion of free-marketism.

So, when you speak of someone “believing in a neoliberal reform” there’s two ways to think about what that means. I’ll use an economist’s advice to a county with public ownership of a price-controlled monopoly national-airline to illustrate:

1. You should remove price-controls, privatize the airline, break it up into competitive entities, and in due time permit international competition, because current policy is far away from the social optimum given current conditions. This advice, of course, is subject to changes to circumstances which may justify a constant modification of the level of government ownership, action, regulation, and intervention in this particular industry.

This particular advice may seem “liberal”, but is basically part of a larger scheme that emphasizes energetic government management of commerce for the sake of maximizing social welfare. In the current circumstance, the institutional advantages of privatized competition would increase welfare. In a different context though, such optimal management could conceivably require greater regulation and control, and even nationalization, of the industry – so you must constantly monitor the situation and be prepared to alter the balance in an inevitably ad-hoc and improvised manner. Is it just the fact that right now, given current conditions, a policy that looks like “liberalization” would be better for your country.

2. The same advice as above, but with this rationale: You should give up entirely the idea of trying to price-control, precisely-manage, tightly-regulate, intervene, own, etc… the airline sector (except perhaps in a dire emergency). This is not just because it would produce a better result for you in the particular conditions at the moment, but because it would produce a better result for your people almost all the time and for almost all the foreseeable future.

Release your desire for political control (which always invites the corrosive forces of corruption) and let the pricing and competitive market mechanisms work their magic – it will almost always work out for the best in the long-run in terms of the efficient allocation of societal resources. Light regulation for public safety and welfare is justified, but also all that should be required. In general, the optimal social result is for the government to try an minimize it’s commercial role while still protecting the public from harm.

And furthermore, there is good reason to believe that the proponent of advice version #1 above is wrong about the ability of elite government experts to do the right analysis and recalculation or “beat” the information-aggregation and welfare-production of the free marketplace. There is also something to be said about predictability and the rule-of-law and the capacity of individuals to plan about the management of their private-spheres without worrying about unknowable upsets of all known factors by whimsical and arbitrary government fiat.

—-

So, when you ask a manager-type Krugman about whether he “believes in neoliberal reforms”, the answer necessarily lacks any specific content. It’s actually (seemingly) pragmatic and non-ideological – “I believe it what works best given the particular circumstances of time and place, but not a flawed philosophy that gives an ‘always-right’ answer that is not, in fact, ‘always right’ in different contexts, but isn’t even close to correct in any specific single context!”

So you probably can’t get an answer to what you’re really asking about.

27. May 2010 at 09:59

All I have to say is that Krugman’s blog isn’t great, but I read it regularly. It doesn’t do enough to connect people like me with a deeper understanding of macroeconomics like this one does.

But, it is a lot better than De Long’s. His is so ugly and cluttered that I can’t stand to look at it. Also, I hate blogs with 10s of links to other posts, stories, etc. daily. Of course, then there’s the fact that he’s a huge immature jerk, who can’t even tolerate differences of opinion in his comments section.

I finally unsubscribed this week.

27. May 2010 at 11:29

Scott:

Thank you, Scott. Great posts.

With regards to the difference between growth rates before and after the 1970s, something else that has to be kept in mind is that the growth immediately after WWII did not fully take care of all the cots that were caused by the underlying economic activities. Environmental and other laws addressing externalities were not fully developed yet, so much of the growth of that time came at the expense of third parties. Let us just think about the smog in LA and the pollution in the great lakes.

I am not an economist and I do not know if there are studies about this, but it occurs to me that it may not be a coincidence that growth slowed down during the 1970s. This coincides with the time when western societies became wealthy enough to care about living in a clean environment and demanded their politicians to pass laws that made businesses assume a greater part of the cost of their activities. Maybe it was this extra burden (compounded by the high tax rates of that time) that had the system collapse before the neoliberal reforms. Of course growth after the 1970s will not match growth prior to that date because, although there are lower taxes, businesses have to internalize the full costs of their activities.

By the way, I write and read your blog from Chile. I agree with your assessment that our economy grew thanks to the neoliberal policies in place since the 1970s. This is not even a matter of debate here and no politician (even the fringe ones) wish to change things. In that regard, we are far to the right than the USA or Europe. The only economic policy debate here is how much spending should the government direct to improve the living conditions of the poor (and the debate is about spending on the poor, not passing laws to change the way markets operate with the hope that the poor would do better).

And with regards to the comment from a previous post by the blogger from Angry Bear about CODELCO, the Chilean state-owned copper company, it is true that the Chilean government has not privatized that company, but it certainly privatized the production of copper. Before the 1980s, 100% of the Chilean production of copper was in the hands of CODELCO. Now, it is less than 30% and a La Escondida, a private company, may surpass it soon (see this graph from 1985 to date: http://es.wikipedia.org/wiki/Archivo:ProduccionMineralCobre_Chile_1985_2004.png).

Keep up the excellent work.

Best regards,

Ignacio Concha

27. May 2010 at 19:00

Hi Scott,

You give Krugman too much credit when you mention the baby-sitting co-op. He did popularize the model, but it is not his own work. The original article is by Joan and Richard Sweeney:

http://en.wikipedia.org/wiki/Capitol_Hill_Babysitting_Co-op

This minor point should not be taken too seriously: I think your blog is great!

And take it from a “chic Upper-West-Side Manhattanite”: you are more convincing than Krugman by a very wide margin.

28. May 2010 at 04:05

[…] that the economic recovery continues. This is mostly a monetary policy issue. As Scott Sumner argues (persuasively, in my view), the Fed could be doing more to juice the […]

28. May 2010 at 05:38

[…] that the economic recovery continues. This is mostly a monetary policy issue. As Scott Sumner argues (persuasively, in my view), the Fed could be doing more to juice the […]

28. May 2010 at 05:46

OGT, I think it’s like Shiller’s trils, but am not sure. It’s just futures contracts where the maturity value is a fixed fraction of future NGDP.

The Koo paper lost me in the first paragraph, where he says low rates are extremely easy money.

Paul, Good point.

Alex, Yes, Goldilocks sounds good.

Mark, Yes, I’m not a big fan of Forbes anymore. Monetary policy is the Achilles heel of the right.

Lee, You like him even less than I do.

Brett, Thanks for the tip.

JeffreyY, In practice they are closely related, which is why I object to his argument. His out is that the Chinese government could buy less foreign bonds and more domestic debt.

Richard, Good points. I take a moderate position. The slow growth is partly population, but the fact that the level of GDP is far below US levels (despite the fact that Japanese people are better educated and harder working than we are) suggests they need to reform their domestic economy. Monetary policy doesn’t affect long run growth, but the near zero rates and mild deflation makes it harder for them to respond to crises with stimulus, and then they foolishly rely on fiscal stimulus. Their debt problems look severe to me, partly for the same demographic reasons you cite.

Indy, I understand what you say, and mostly agree. But what I want is very simple. On balance, does he think the neoliberal reforms in places like Chile and Britain did more harm than good? Yes or no. He obviously writes in such a way this his readers naturally infer he thinks they did more harm than good. I think he actually believes they did more good than harm. Inquiring minds want to know the truth.

Mike, I’ve also had problems with his comment section. On the other hand I would never deny DeLong is a very smart guy. But he’s definitely a warrior in the ideological battle, not a bemused observer like me.

Ignacio, That’s a great point about environmental costs, and if statsguy is reading this it relates to his point about measured GDP–but makes the recent past look relatively good by comparison to pre-1973. (Until the recent oil spill, I suppose.)

I did know there were some private copper companies, and should have mentioned that point.

As I outsider I think Chile’s biggest unmet need is its educational system. Is that a mistaken impression? What would be required for Chile to get closer to Australian/NZ GDP levels? I mention those countries because they are also far away from major markets.

Dikran, I knew that, and tried to word it so it didn’t seem he’d thought up the idea, but obviously should have been clearer. I meant he is good at explaining ideas.

29. May 2010 at 06:44

Scott:

You are correct that Chile’s biggest unmet need is its educational system. This is what is holding the country back from being a developed nation.

Although higher education was liberalized in the early 1980s (at the time, with a few exceptions, only the government and the Catholic Church had universities) so now most universities are less than 30 years old and most college students are the first in their families to go to university, there are still significant issues with schools. This is mostly caused by little funding and excessive regulation and is the reason why many students going to college cannot hold their own and drop out.

Today most families have voted with their feet and taken their kids out of public schools to enroll them in charter schools (where they sometimes have to pay a supplemental fee). However, government subsidies of these schools continue to be small. This makes results in overworked teachers and minimum infrastructure. In addition, regulations make the curriculum inflexible, which prevents schools from implementing novel approaches to teaching children. The new government is planning to change this so let us hope they are successful in their attempt.

In the shorter run, I think that what is required for Chile to go back to growing at 7% like it did during the late 1980s and 1990s is to modernize the bureacracy, which can no longer handle the requirements of the country. The government does not have the resources, and somtimes not even the disposition, to do its job to allow businesses to carry on their activities successfully.

Best,

Ignacio

29. May 2010 at 23:44

@ssumner:

I wasn’t attacking you, nor Friedman… But I was either saying that Krugman does reveal too little because he has political goals in mind and that not surprisingly, he thinks that everyone does the same as him.

30. May 2010 at 07:39

jean, I see your point. I try not to be political, but rather concede where the other side has good arguments. He used to do that in the 1990s, but something changed. I don’t doubt that he thinks the other side plays dirty, but I don’t, and I expect everyone to play fair regardless of what others do.

30. May 2010 at 07:40

Ignacio, Thanks for the info. That was helpful.

16. June 2010 at 06:50

[…] Tags: Paul Krugman, Scott Sumner, Thomas Sowell — vipulnaik @ 2:50 pm In the blog post The Man Who Revealed Too Little, Scott Sumner outs Paul Krugman’s deliberate caginess — suggesting that Krugman does […]

7. July 2010 at 06:14

[…] mõista, mida ta tegelikult väidab või mitte, on põhjust lugeda Scott Sumner’i postitust The man who revealed to little, eriti teist poolt. Tegelikult ei tahtnud ma kirjutada Krugman’ist, kes on Eestile […]

10. October 2013 at 13:50

[…] would give them. The tone of Tyler’s criticisms about the risks of open borders strikes me as slightly reminiscent of Paul Krugman’s tone on macroeconomic policy: worded just so, to avoid falling afoul of the economics, without really dissuading people from […]