Show us your target

John Taylor has been pressing the Fed to move toward a more rules-based approach. I think Taylor is right on the big issue, although I don’t share his preference for using interest rates as a policy instrument.

I’ve always believed that the first step toward a rules-based approach is to clearly spell out the goal of monetary policy. That should be an issue on which everyone on the FOMC agrees, once a decision has been made and voted on. Unfortunately, the Fed has not done this. The Fed’s policy goals are still shrouded in mystery.

The simplest solution would be for the Fed to set a univariate policy goal, say 2% PCE inflation or 4% NGDP growth. Then spell out whether they favor growth rate targeting or level targeting. Instead the Fed has chosen a dual target of 2% PCE inflation and unemployment close to the natural rate. But what does that actually mean? In order to make the goal clear, we need enough information to figure out whether previous policy was to expansionary or too contractionary. Right now we lack that information. Over the past 12 months, the unemployment rate has fallen to a level below the Fed estimate of the natural rate, while inflation has undershot their target. So was the policy instrument setting 12 months ago too expansionary or too contractionary? I don’t know, which is precisely the problem.

The Fed often objects that explicit policy rules are too simplistic, and that they need to take many data points into account, as the economy is quite complex. OK, but that doesn’t excuse the lack of an explicit target, it just makes the target a bit more complicated. So let’s discuss what a plausible Fed target might look like.

1. For inflation, the Fed might worry about the distorting effects of oil price shocks. In that case, they can use core PCE inflation, setting the target at two percent.

2. The labor market is even more complicated. The Fed might want to take account of both the standard U-3 unemployment rate, as well as the more comprehensive U-6. Some would even add in the prime age labor force participation rate (PALFPR). Here’s how a labor market indicator might look with those three variables:

Labor slack = U3 + 0.5*U6 + 0.1*(100% – PALFPR)

At the moment, U3 unemployment is 4.1% and U6 unemployment is 8.2%. U6 is also roughly twice as volatile as U3. The coefficient of 0.5 on the U6 rate is intended to give the two measures roughly equal weight. The labor force participation rate is 81.8%, so 100% minus that rate is 18.2%. I gave this variable a lower weight, because it’s partly cyclical and partly structural. Monetary policy can only address cyclical changes.

Using these weights, my current measure of labor market slack is 4.1% + 0.5*8.2% + 0.1*18.2% = 10.02%

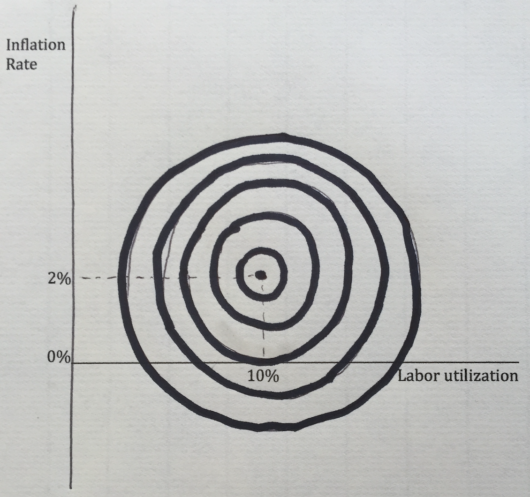

For simplicity, let’s suppose the Fed sets a target of 2% inflation and 10.0% labor market slack, using this formula. (They could adjust that figure over time, as research on labor markets gave the Fed a better feel for the “natural rate” of labor market slack.) Then the Fed would also want to create a set of “indifference curves”, each of which illustrates a set of outcomes that are equally suboptimal. Unless I’m mistaken, that map would look like a target:

While I lack Jasper Johns’ skill as an artist, I think you get the point. Interestingly, some conservatives get why inflation above 2% is bad, but are confused as to why below 2% inflation is a problem. Some liberals get why high labor market slack is a problem, but don’t see why a tight labor market is a problem. But if the Fed is serious about its targets, it should treat overshoots and undershoots of each variable as both being undesirable. I.e., 3% unemployment is bad because it leads to future instability in the economy. That doesn’t mean the indifference curves must be perfect circles, but they should at be least vaguely circular.

While I lack Jasper Johns’ skill as an artist, I think you get the point. Interestingly, some conservatives get why inflation above 2% is bad, but are confused as to why below 2% inflation is a problem. Some liberals get why high labor market slack is a problem, but don’t see why a tight labor market is a problem. But if the Fed is serious about its targets, it should treat overshoots and undershoots of each variable as both being undesirable. I.e., 3% unemployment is bad because it leads to future instability in the economy. That doesn’t mean the indifference curves must be perfect circles, but they should at be least vaguely circular.

Of course I do not favor this dual variable policy goal; I favor something like 4% NGDP growth targeting, level targeting. That looks like a point on a line, and is far easier to explain. But even a complex target like inflation and labor market slack can be turned into a mathematical formula, which makes it possible to evaluate the effectiveness of Fed policy.

This is all the first step towards a Taylor-like policy rule. The next step is to spell out an instrument rule. You need to explain how and why you adjust the policy instrument. If the instrument is the fed funds rate, Taylor would recommend something like the “Taylor Rule”, although he’s indicated that under his proposal the Fed would be free to choose its own rule, and even deviate on occasion if they spelled out why to Congress. (Presumably he is thinking of extreme events, like the 2008 financial crisis.) I’d use the monetary base as my instrument (it has no zero bound problem) and my rule would adjust the base according to trading in the NGDP futures market. Whatever it takes.

PS. Contrary to what you often read, Congress’s dual mandate does not require the Fed to adopt a complex dual variable policy goal. NGDP targeting is 100% consistent with the Fed’s dual mandate, as it implicitly address both employment and inflation. NGDP growth is inflation plus RGDP growth, and the latter variable is highly correlated with employment at cyclical frequencies.

PPS. After I drew up the graph, I realized that the horizontal axis should be called labor slack, not labor utilization.

Tags:

22. February 2018 at 10:18

I say that the Fed has multiple targets over multiple time-frames. Whether this is official or not is irrelevant. Look at the behavior. In the short term the target is interest rates. In the medium term it is inflation, and in the long-term it is stability of growth. This is how they will be judged.

The Fed is after stable NGDP growth, even if it isn’t their official target. My take on it, is that our Professor would like them to be up-front about it. If their ultimate goal is stable GDP growth make that the official target in every time-frame. Without the NGDPLT futures market, I am not clear on what Sumner would target in the short-term. But, If such a market were to exist that would be more desirable to peg than interest rates.

And of course Friedman argued that the Fed should ditch interest rates as a target in the short term and target money supply growth in all time frames. If velocity is constant, then steady money growth would be steady NGDP growth. The jury is still out on the stability of V.

22. February 2018 at 10:51

Dr. Sumner,

I believe you got it right with Labor Utilization rather than Labor Slack. If you use Labor Utilization, you can then measure monetary stance relative to a target curve rather than a target point. If forecasts are coming in below the curve, policy is too tight; if they’re coming in above the curve, policy is too loose. Check it out:

https://drive.google.com/file/d/1MNEv1MiPzti0KmLb3Sy2eP8CsX3Edjcr/view?usp=sharing

It’s a essentially a Philips curve?

22. February 2018 at 12:48

Doug, You asked:

“Without the NGDPLT futures market, I am not clear on what Sumner would target in the short-term.”

The Fed’s internal forecast of NGDP growth.

22. February 2018 at 12:49

Randomize, Nice, but mine looks like a target. 🙂

22. February 2018 at 13:32

Your PS is especially good, important and accurate.

22. February 2018 at 14:06

Don’t like the comment policy in econlog so I am going to leave a reaction to your post titled, “you get what you pay for” here for your consideration.

First, I get what you are saying but… I don’t think you would see people truly living homeless for 100k a year because being homeless sucks balls and isn’t worth 100k.

Walk out your door when you get home and do not return for 48 hours. Put on something unwashed and grubby and take nothing with you except perhaps a blanket. Either don’t eat for 48 hours, beg passers by for money to get something to eat or walk or beg for bus money for a ride to a soup kitchen. Find somewhere to sleep (including a homeless shelter) and see if you find that experience to be worth 458 bucks. Imagine doing that tonight in Detroit Michigan as well.

Suppose we could make it even more realistic and we could somehow grant you the ability to take on the mental or physical state of a random homeless person for those 48 hours (perhaps you could swap in having been sexually abused as a child, or were suffering a heroin addiction and the withdrawal you would experience, or had schizophrenia for the duration or were disabled or any of the real world reasons people really end up homeless… no one opts for homelessness).

Would you do it? I don’t think even one February night alone out on the streets with a physical or mental health issue is worth 274 bucks… imagine a year of that.

Would giving these individuals 100k end homelessness? nope. Would there be scammers crawling out of the woodwork? Yep.

Point is being a real homeless individual with their issues would be a horrific experience, requiring much more compensation than 100k to endure.

22. February 2018 at 14:13

*548 bucks.

22. February 2018 at 15:21

Student, You said:

“I don’t think you would see people truly living homeless for 100k a year because being homeless sucks balls and isn’t worth 100k.”

For the vast majority of American’s it is not worth it, as you say. But for millions and millions of Americans it most certainly would be.

Think about the 2,000,000 Americans currently in prison, and then think about how they got there. What were they trying to achieve when they got caught? Then think about how many millions more Americans have served at least some time in prison over the past decade. What sort of reward were they chasing? Is that something you’d find appealing?

It’s a mistake for you or I to assume that our preferences are representative of the entire population.

(Just to be clear, I’m not comparing the homeless to prisoners in a moral sense, just as an example of the fact that lots of people are willing to undergo hardship for rewards that would be unappealing to you and I)

Here’s another way of thinking about it. Why do places like Cambridge, Mass. have 10 times more homeless people than a neighboring town? Hint, where is it more profitable to be homeless?

22. February 2018 at 15:58

Fair points but committing crimes is a little different. Most people commit crimes thinking they won’t get caught and almost all at least initially claim to be innocent.

Your point about assuming personal preferences being representative is a good one too. However, I talk to a lot of homeless people asking for money. Several times have even taken them to lunch or dinner with me. I have also done a bit of volunteering at kitchens or shelters. I have never once found a person to say or appear to just choose to not work. Call it at least 100 interactions and never has anyone said or even appeared to be doing that. I suppose they could be lying but I doubt it.

Try it. The next time you come across a homeless person or someone begging. Take them to lunch or talk to them for a few minutes in exchange for 10 bucks or so. Pretty sure all of them will be mentally ill, have serious health problems, or be substance abusers.

22. February 2018 at 16:50

The Reserve Bank of Australia seems to do well not with a target but a inflation band range.

China and Australia seem to do better with higher inflation targets than Japan and the US, which are at 2% but do not hit their targets.

What if a 2% inflation target is actually too low?

Are any economies prospering with a 2% inflation target?

The 2% inflation target appears to be one chosen for aesthetic purposes. I have never seen an empirical reason for 2%.

I suspect the question of instruments rather than targets will soon come to the fore. That is, in the next recession we will hit zero bound quickly.

The claptrap mechanism of stuffing banks with reserves and hoping they lend it out could be ineffective for years.

The practice of macro economics appears hopelessly ossified.

22. February 2018 at 17:13

Ben Cole: The RBA broad band target (2-3%pa inflation in average over business cycle) in practice, is how an NGDP target looks in interest rate language.

22. February 2018 at 20:09

Professor Sumner,

I think the idea of such a rule, which is essentially a loss function, might run into some issues. I’ll try to abstract from your example somewhat, as I think you were just giving an example of what such an employment target might look like.

(a) I agree with looking at prime-age participation, but that trend line has been declining for decades. We would need to ‘grandfather in,’ in a sense, secular trends and/or hysteresis effects from the recession, to the extent they exist. I think this would be difficult unless we were to take, for example, not prime-age participation, but its deviation from a smoothed trend, say from a Hodrick-Prescott filter. Then there are issues as to what exactly that trend is, what smoothing parameter to use, etc. I’m not exactly for giving the Fed more discretion, but I think this allows them to set these parameters to whatever they’d like and adds quite a bit of complexity. For example, if you wanted countercyclical inflation, would the degree of overshoot you’d be willing to accept depend on stabilizing the value of the associated measure? (I suppose this resembles a level target, but provided you could appropriately adjust for non-monetary factors, this is a good idea.)

(b) Say we agreed on a trend. Then there’s the issue of weighing things. If, for example, we’re wrong on the trend line in either direction, we’re essentially saying we’re indifferent between a systemic miss on the unemployment rate to compensate for such a miss. I think the indifference curves adjust somewhat for this, but I can’t say I quite know what the weights out to be–and, even then, I think they would need to vary over time as we learn more about trend prime-age. We may even weigh things differently depending on the state of the business cycle if some variables are slow-moving.

(c) I think I’d much prefer some sort of diffusion index of labor market conditions, not much unlike the LMCI. Currently, we only have the rate of change of the index. I’d want to focus on the level, and could definitely foresee this being a critical focus of monetary policy.

With that said, I think your quite right that the Fed should be more direct about its goals and should have an observable target. The alternates to NGDP in this respect are lacking rather signficiantly.

22. February 2018 at 20:47

Lorenzo:

Indeed—I have pontificated as much, calling an inflation band “the poor man’s NGDP target.”

I think that bit of flex in an inflation band is a good idea, as well as a modestly high average target than 2%. Bravo for Sydney.

In the US, we will still get back to an argument about instruments in next recession, whether with inflation band or NGGPLT or simple 2% target.

We will hit zero lower bound quickly. True, there can be negative interest on reserves, but banks cannot be forced to lend out.

So that means QE, or money-financed fiscal programs (or QE plus deficit-spending which sure seems like money-financed fiscal programs).

Entirely forgotten today is that the Fed used to buy bonds directly from the Treasury, from 1942 to 1981, whenever the Treasury could not sell all of its bonds. This is prevented by modern-day statute but is not a law of nature nor Constitutional law. So that is another option and bypasses the whole problem with large reserves and then IOER and all that claptrap.

Let us hope it is many years until we meet such circumstances.

23. February 2018 at 03:54

Assume more demand is required. To assume that is best rectified via an interest rate cut is to assume the problem is inadequate investment spending rather than inadequate consumer demand: an assumption which has no foundation.

23. February 2018 at 08:49

The Fed will never agree to an explicit target. To do so, it would have to admit that it really does have control over monetary policy and that policy can be effective enough to hit the target. But that implies that all of the bad outcomes we’ve seen in the past as well as any future ones are actually the Fed’s fault. Don’t hold your breath.

23. February 2018 at 08:55

Dr. Sumner,

You’ve got me there; the target is way more of a target than the curve is! 😀

In all seriousness, the curve lends itself well to a rules-based approach and solves the balancing act of the Fed trying to meet two different goals that may, at times, send them conflicting messages about their current stance.

23. February 2018 at 10:22

Student, You said:

“Most people commit crimes thinking they won’t get caught”

Really? Aren’t most crimes committed by people who are arrested many, many times during their lives? After 11 arrests, do they still think there is no risk of going to prison?

I do agree that a large number of homeless have mental health issues, drug problems, etc. But that has no bearing on my claim. Nobody is paying our current homeless $100,000.

Indeed my post had absolutely no implications for the nature of people who are currently homeless. I wasn’t commenting on them.

Fred, Keep in mind that all those things that you rightly point out are hard to determine, are things the Fed MUST determine under its current regime. (That’s why I like NGDPLT)

Ralph, A cut in interest rates is not a policy, it’s an effect of policy that might be expansionary or contractionary. Talk about the policies, not the (ambiguous) effects. When AD is too low then money is too tight. Whether interest rates are too high or low is a completely separate issue.

Jeff, You said:

“The Fed will never agree to an explicit target.”

The ECB has an inflation target. Never say never.

Randomize, Yes, that’s a good argument. Again the line is best—NGDPLT.

23. February 2018 at 13:13

I’ve been reading this blog for 9 years and this is the first time I’ve noticed that Mr. Sumner is one of those weirdos who use two spaces after a period. But then I noticed something weird. In the comments, this ssumner commenter only uses one space after a period like a normal person. Could it be that ssumner is actually an imposter? I can’t see any other explanation.

23. February 2018 at 15:13

As usual, good points. But a criminal thinking they won’t get caught is not the same thing as thinking their is no chance of getting caught. And even if they did think that, many people are irrational. Just look at how many people play slots in a casino and buy scratch tickets.

I realize you weren’t talking about the current homeless. I am just saying very few people would live the homeless life even for 100k. A lot of people would try to fake it for 100k but that’s something different.

One last point… Jasper John has nothing on you. That’s some high quality stuff you drew.

24. February 2018 at 03:04

Is the Bank of Israel reading your blog?

http://macromarketmusings.blogspot.com.es/2018/02/assorted-macro-musings.html

24. February 2018 at 08:00

The type of post I love! IMHO, at the very least, the Fed or the Department of labor should track Labor Slack as you’ve described it here.

24. February 2018 at 09:36

JUNE 2017 FORECAST:

These #s are not extrapolated, they simply reflect any impulse or abatement (change in momentum), based on the history of lags.

01/1/2017 ,,,,, 0.13 ,,,,, 0.19

02/1/2017 ,,,,, 0.08 ,,,,, 0.16

03/1/2017 ,,,,, 0.06 ,,,,, 0.13

04/1/2017 ,,,,, 0.08 ,,,,, 0.18

05/1/2017 ,,,,, 0.09 ,,,,, 0.23

06/1/2017 ,,,,, 0.07 ,,,,, 0.19

07/1/2017 ,,,,, 0.07 ,,,,, 0.16 commodities & rates bottom

08/1/2017 ,,,,, 0.06 ,,,,, 0.20

09/1/2017 ,,,,, 0.06 ,,,,, 0.21

10/1/2017 ,,,,, 0.01 ,,,,, 0.21

11/1/2017 ,,,,, 0.03 ,,,,, 0.19

12/1/2017 ,,,,, 0.05 ,,,,, 0.11

01/1/2018 ,,,,, 0.01 ,,,,, 0.17

02/1/2018 ,,,,, 0.00 ,,,,, 0.18 (short commodities/buy bonds)

03/1/2018 ,,,,, 0.00 ,,,,, 0.14

04/1/2018 ,,,,, 0.00 ,,,,, 0.11

05/1/2018 ,,,,, 0.00 ,,,,, 0.12

06/1/2018 ,,,,, 0.00 ,,,,, 0.09

07/1/2018 ,,,,, 0.00 ,,,,, 0.09

08/1/2018 ,,,,, 0.00 ,,,,, 0.07

09/1/2018 ,,,,, 0.00 ,,,,, 0.07

10/1/2018 ,,,,, 0.00 ,,,,, 0.06

11/1/2018 ,,,,, 0.00 ,,,,, 0.06

Jun 25, 2017. 02:54 PMLink

This is the most recent trajectory, and it’s one that’s matching:

Parse: date; real-output; inflation

1/1/2018 ,,,,, 0.09 ,,,,, 0.27

2/1/2018 ,,,,, 0.14 ,,,,, 0.34 sell commodities

3/1/2018 ,,,,, 0.12 ,,,,, 0.30

4/1/2018 ,,,,, 0.11 ,,,,, 0.27

5/1/2018 ,,,,, 0.11 ,,,,, 0.27

6/1/2018 ,,,,, 0.11 ,,,,, 0.25

“It is double pleasure to deceive the deceiver.” – Niccolo Machiavelli

– Michel de Nostredame

24. February 2018 at 10:24

“Why Inflation Is a Bigger Risk to Stocks Than Rising Rates”

http://awealthofcommonsense.com/2018/02/talking-inflation-interest-rates-on-whatd-you-miss/

24. February 2018 at 19:00

TravisV:

In the last several years, the CPI core sans housing is under 1%. And now it looks like housing costs are flattening out in the cities where is has been rising fastest, along the West Coast, Boston and NYC (where due to property zoning there are chronic and manipulated housing shortages, roughly orchestrated by developers, lenders, existing property owners and compliant city officials).

Conspiracy theory?

Why is people will recite this sentiment, but then dismiss conspiracy theories?:

“People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.” ― Adam Smith.

Anyway, with Amazon moving out, we are seeing businesses and people leave the high-cost cities, and that should cool things off.

So we may see another year of low inflation. Oil prices are under pressure too.

Unit labor costs have been falling.

Interesting outlook.

24. February 2018 at 22:07

Student, There is nothing irrational about gambling–I’ve played the slots.

Inklet, Thanks, I did a post at Econlog.

Thanks Cory.

25. February 2018 at 02:27

Dr. Sumner,

How can playing slots be rational when the house stays ahead, on average?

This is a very interesting post though. I like when you make your thoughts so explicit.

25. February 2018 at 11:50

https://www1.folha.uol.com.br/poder/2018/02/para-surpresa-de-japoneses-bolsonaro-e-recebido-aos-gritos-no-pais.shtml

Famous Brazilian Representative (and presidential candidate) Bolsonaro was granted a hero’s welcome in Japan. Could you people please share that information with your friends, if you have any, and acquaintances? Write your Representatives and Senators?

Representative Bolsonaro is the most pro-American candidate, he favors protecting foreign investments in Brazil, he favors close military cooperation with America and he wants to stand up to Red China’s imperialism and make it harder for the Chinese buying Brazilian agricultural lands and mineral resources. Representative Bolsonaro opposes communism. Representative Bolsonaro believes, as famous American president John Kennedy did, that “this Hemisphere intends to remain the master of its own house”.

Remember what Mr. Kissinger said: as Brazil goes, so goes South America.

https://www.poetryfoundation.org/poems/51642/invictus

26. February 2018 at 07:38

Antischiff, Gambling is fun. The whole point of life is to have fun.

26. February 2018 at 09:23

Dr. Sumner,

I’m very surprised an economist would consider casino gambling fun. I find no appeal in it.

2. March 2018 at 06:55

Long-time reader, 1st time commenter.

Not to nitpick, but since U6 includes U3, shouldn’t your variable be .5*(U6 – U3) rather than directly on U6?

You want to have isolated underemployed, not double counting U3, right?