Was the zero bound holding back the Fed during 2009-15?

Most people thought the answers was yes. I thought it was no. Here’s a question for the zero bound worriers. If the zero bound was holding back the Fed during 2009-15, then what’s been holding back the Fed over the past 20 months? Inflation is still below target.

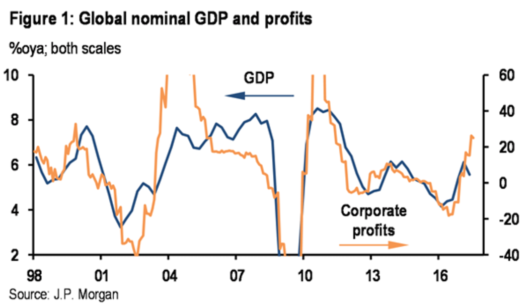

Ignacio Morales set me an interesting graph from JP Morgan, which shows the correlation between global NGDP growth and growth in global profits:

Notice that the correlation seems particularly strong since 2009.

Notice that the correlation seems particularly strong since 2009.

Ben Southwood sent me a ECB study by Luca Gambetti and Alberto Musso, which shows that the ECB’s asset purchase program worked via many different channels. Here’s the abstract:

This paper provides empirical evidence on the macroeconomic impact of the expanded asset purchase programme (APP) announced by the European Central Bank (ECB) in January 2015. The shock associated to the APP is identified with a combination of sign, timing and magnitude restrictions in the context of an estimated time-varying parameter VAR model with stochastic volatility. The evidence suggests that the APP had a significant upward effect on both real GDP and HICP inflation in the euro area during the first two years. The effect on real GDP appears to be stronger in the short term, while that on HICP inflation seems more marked in the medium term. Moreover, several channels of transmission appear to have been activated, including the portfolio rebalancing channel, the exchange rate channel, the inflation re-anchoring channel and the credit channel.

Ben Klutsey pointed me to a Larry Summers piece in the FT:

Historically, the Fed has responded to recession by cutting rates substantially, with the benchmark funds rate falling by 400 basis points or more in the context of downturns over the past two generations. However, it is very unlikely that there will be room for this kind of rate cutting when the next recession comes given market forecasts. So the central bank will have to improvise with a combination of rhetoric and direct market intervention to influence longer-term rates. That will be tricky given that 10-year Treasuries currently yield below 2.20 per cent and this would decline precipitously with a recession and any move to cut Fed funds.

As a result, the economy is probably quite brittle within the current inflation targeting framework. This is under-appreciated. Responsible new leadership at the Fed will have to give serious thought to shifting the monetary policy framework, perhaps by putting more emphasis on nominal gross domestic product growth, focusing on the price level rather than inflation (so periods of low inflation are followed by periods of high inflation) or raising the inflation target. None of these steps would be easy in current circumstances, but once recession has come effectiveness will diminish.

Tags:

16. August 2017 at 00:32

Why tweety-bird around?

Why not money-financed fiscal programs, aka “helicopter drops” for the next recession?

The little-discussed history is that money-financed fiscal programs were effective in the Great Depression in Japan. In fact, there was no Great Depression in Japan. It lasted two years, before Finance Minister Takahashi Korekiyo ended it with money-financed fiscal programs.

Western central bankers never implemented the policies to end the Great Depression. It took WWII to do it.

Some argue that the Great Recession, or at least its aftermath, has never ended either. The US remains far below pre-2008 projections of real GDP.

As conventional macroeconomists seem to accept the sluggish and below-trend GDP output as new normal, is seems the Great Recession left the US economy crippled, perhaps permanently.

Is money neutral? Ask Ray Lopez, he assures us that it is so!

Michael Woodford and Adair Turner (who have weightier views than Ray Lopez) have endorsed helicopter drops, although I think Woodford regards QE plus federal deficits to be the same thing, provided the Fed’s balance sheet is never reduced.

David Beckworth says something along the same lines, that QE needs to be regarded as permanent (same discussion here about IOER might be worthy).

Have orthodox macroeconomists (and legislators and conventional Fed implementation) erected a monetary structure and set of laws and accepted procedures that prevent effective monetary policy? Seems likely, and we will find out in the next recession.

In conventional circles, totems and procedures are genuflected to, regardless of efficacy. So we say the Fed must act through primary dealers and must create reserves at commercial banks, etc.

What can the Fed do in the next recession?

Not much. Our best conventional economic and legislative minds have arranged matters just so.

16. August 2017 at 01:33

Abandon inflation targeting!

https://www.youtube.com/watch?v=RsHv4qLAQzs

16. August 2017 at 06:57

Prof. Sumner,

What do you think of the “central-bank-losing-money” channel that Ricardo Reis mentioned in his interview with David Beckworth a few weeks ago? Chris Sims (http://sims.princeton.edu/yftp/JacksonHole16/JHpaper.pdf) and others have also alluded to that fact that a large central bank balance sheet may make forward guidance more credible by ensuring a path of low interest rates.

16. August 2017 at 09:02

William, I’m not really a fan of that approach. I don’t view it as credible in a rich developed country, where central banks would be bailed out if necessary to prevent inflation.

16. August 2017 at 16:41

“…where central banks would be bailed out if necessary to prevent inflation.”

It is comments like this that prove to me how confused Sumner really is about the monetary system.

First, central banks are the cause of inflation. To say that governments need to keep central banks around to *prevent* inflation is laughably misguided.

Second, to even entertain the notion, let alone agree or disagree with it, that central banks being “bailed out”, shows a misunderstanding of the fact that central banks are legalized counterfeiters. Central banks do not go bankrupt because they can effectively “print” (that is a euphemism) whatever quantity of currency will clear the debt. Central banks were ostensibly created to be the “lender of last resort” for shaky fractional reserve banks that kept going bankrupt because of lending more than they can cover through withdrawal requests. Now of course this was the publicized excuse for it, but Congress at the time went along with it in part because of a promise of the central bank to monetize government debts should that super rare and totally not every day event occur (is anyone else laughing at that dupe?).

Here we are 100 years later with central banks not only causing perpetual inflation, not only monetizing government debt everyday, not only replacing member bank reserves everyday, but now, in the case of the Fed, the regulator/authority of banks, a black ops financier to keep the spending out of the day to day public eye (NY Fed for example secretly (at the time, since leaked) shipped $40 billion to Iraq to finance the post invasion colonization, and who knows what other corrupt and shady activities, since a full audit is not and never has taken place.

Any idiot can press CTRL-P to add more currency, temporarily goose nominal statistics, then blame capitalism and not enough central bank inflation when the deflation causing real errors are revealed. All those VAR garbage models are predicated on false economic beliefs that for some extremely surprising and totally unexpected reason are not being addressed by those whose incomes depend on not asking those questions.

16. August 2017 at 17:10

Sumner, this is the first day of the NAFTA renegotiation talks. Your review?

https://theconservativetreehouse.com/2017/08/16/nafta-day-1-u-s-trade-rep-robert-lighthizer-opening-statement/

16. August 2017 at 18:27

Why are we ignoring the four rounds of QE?

That, and the experience of negative rates in Japan, shows that we are not constrained by the zero bound. No such bound actually exists, especially in a world where far more transactions are made electronically than physically.

The initial failures of Japan’s ZIRP and QE in 1999-2001 led the rest of the Central Banks to conclude that those methods are risky and flawed at best. Thank God that Bernanke had studied the actual data that showed the eventual successes of Japan’s ZIRP and QE policies in the 2002-2006 period. His policy response of QE and ZIRP was at first only supported by Janet Yellen in early 2009.

Just imagine a world where he chose to “let the free market handle it” (as the whole Fed had for most of 2008), the economy continued to tank, he gets the boot from Obama, and the Fed loses far more credibility.

What would have saved us then? NGDP targeting? It would have been a new Great Depression and probably would have only ended through a new world war.

Anyway, I sincerely dislike these so-called “laws of economics”. We have to be aware of the rules, laws, and trends that we consider to represent the actual resulting phenomenon in the economy. That is obvious. But in reality, there is always an asterisk next to each of those categories. Call it the “Try in Exceptional Circumstances” asterisk.

We live in exceptional times after all. And rules are meant to be broken.

17. August 2017 at 04:59

AlecFahrin:

Great comments.

Indeed, Japan has been showing promise of late, Q2 corporate profits up 33% YOY, and economy growing.

The Bank of Japan is operating an aggressive QE program, negative interest on reserves, and holding interest rates on 10-year JGB at zero.

There are two job openings for every job hunter in Japan. Tokyo is regarded as the most livable big city on the planet.

The BoJ is having difficulty meeting inflation targets—from the low side that is.

Japan is not the US, but events there suggest the Fed is far too timid.

Add on: The japan is leading the US to having huge amounts of cash in circulation. BTW, Ben Bernanke recently cited Fed forecast for $7,353 in cash in circulation for every US resident, by 2025. Yes, the family of four has $29,000 under the mattress.

The good news is that both the US and Japan may have more economic activity than is being recorded. Cash business, off the books.

Or, U.S. cash is being used to open bank accounts in the Cayman Islands. Opening an account in the Caymans, and then transferring money digitally triggers reporting. So how did $32 trillion end up in offshore accounts?

The bad news is that underground economies will grow rapidly in low-inflation environments, and not bear fair share of taxes.

17. August 2017 at 07:39

It seems as if the Fed doesn’t do all that it can so that it can leave some room in the future if it needs it.

What do you think of giving the Fed the power to buy bonds directly from the Treasury (alongside your favorite targeting regime)? It would take a long time to run out of debt. There’s plenty of monetary room in the national debt.

17. August 2017 at 07:50

Harding, Moronic.

Beamish, Not doing all you can actually leads to less ammunition for future actions, not more.

I see no need for the Fed to buy bonds directly from the Treasury

17. August 2017 at 08:58

What about just granting the authority to the Fed to buy bonds from the Treasury? Even if the actual buying weren’t necessary, it would be a sign of commitment to do whatever it takes. And if the Fed had that power, it wouldn’t have to implicitly insure the shadow banking system. When the next crash comes it could just walk away and start writing checks to the government.

18. August 2017 at 10:01

Sorry for being off-topic. I have just published an interview with Jeremy Stein and I can’t wait to share it with you. It is about his proposal to keep Fed’s Balance Sheet sizeable for financial stability reason. But this is a very interesting bit:

“S: Absolutely. I don’t think you need to target a certain quantity size of the Fed’s balance sheet.

In an ideal world, the Fed and the Treasury together would be looking at various market indicators and trying to get a sense if there is a scarcity of safe assets. For example, one indicator that we pointed to is the slope of the very front-end of the yield curve. If there is a very big difference between the rate of one-week T-bills and six-month T-bill, that is telling you there is a shortage of the very short maturity securities.

In some sense, what you are doing is you would like to target that spread and make sure it is not getting too big. That doesn’t necessarily correspondent to a fixed size of the balance sheet, but it might correspond either to the Fed’s willingness to expand the balance sheet when needed, or the Treasury’s willingness to pay attention to the spread and issue more T-bills.”

18. August 2017 at 10:01

Sorry…. The link is here…

http://en.econreporter.com/en/2017/08/fed-keep-sizeable-balance-sheet-according-former-fed-governor-jeremy-stein/

19. August 2017 at 09:15

beamish, I don’t see the point of that–what difference does it make who they buy the bonds from?

Cloud, i don’t have strong views on that. It seems like a minor issue to me (and I’m not a bond market expert.)

19. August 2017 at 11:40

I guess I was thinking that buying bonds from the Treasury would encourage economic activity by reducing the debt and reducing future taxes. Buying from banks isn’t working well anymore because interest rates are so low. I’m probably confused, though.