Let’s improve the way we report exchange rate movements

This post is motivated by recent headlines suggesting that the Chinese yuan has depreciated in recent days. Here’s an example:

China’s yuan weakens to 5-1/2 low as c.bank tolerates depreciation

This headline is completely inaccurate; the Chinese yuan has been appreciating in recent days. So that’s one problem I’d like to fix. I’d like to see the media start reporting accurate data on exchange rates, so that we know what is actually happening to them. Not inaccurate information, which leads to bad public policy decisions.

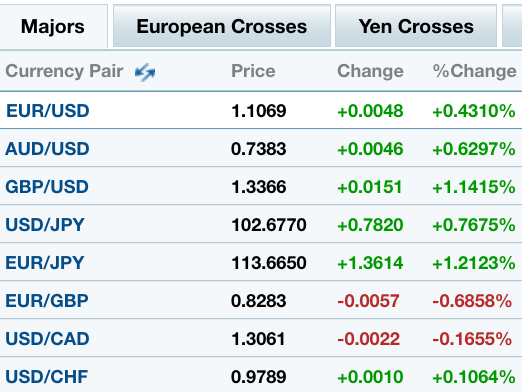

Another problem with the reporting of exchange rates is that it’s often done in a very confusing table, where sometimes a bigger number means the exchange rate has appreciated, and sometimes a bigger number means depreciation. Most of us now know that a bigger number means a weaker yen and a stronger euro, but who can keep straight the Canadian and Australian dollar, which are also not reported in a consistent fashion? I also get confused by exchange rates that are very close to one, like the Swiss franc:

My proposal would solve both of these problems in one fell swoop. I propose that Bloomberg, or some similar company, create a table of currency indices. Thus instead of reporting exchange rates against the dollar, they would be reported against a weighted index of the 10 or 20 most important currencies. The numbers would all start at 100 on January 1st, 2017, and then proceed from there. For all currencies a bigger number would mean currency appreciation, and vice versa.

My proposal would solve both of these problems in one fell swoop. I propose that Bloomberg, or some similar company, create a table of currency indices. Thus instead of reporting exchange rates against the dollar, they would be reported against a weighted index of the 10 or 20 most important currencies. The numbers would all start at 100 on January 1st, 2017, and then proceed from there. For all currencies a bigger number would mean currency appreciation, and vice versa.

Let’s take the recent example of the Chinese yuan. Why did Reuters wrongly report a depreciation appreciation in the yuan? Because the number of yuan required to buy one US dollar rose by about 1% in the days after Brexit, from 6.58 to 6.65. Notice how confusing that is—a bigger number means depreciation, not appreciation. But it gets worse. The dollar appreciated strongly against almost all currencies, up around 2% against the euro, Canadian dollar and Australian dollar. It fell slightly against the yen, but soared against the pound. So 2% is a ballpark figure for dollar appreciation. But that means the Chinese yuan actually appreciated by about 1% after Brexit, as it fell against the dollar by less than the dollar rose against other currencies.

Initially I’d like to see a separate table reported, similar to the one above, along side the old method. Each trade-weighted exchange rate would be reported as “US$ index” or “yuan index” or “euro index” or “yen index”, and in every case a bigger number would mean currency appreciation. You’d never have the problem of the media reporting that a currency had depreciated, when it actually appreciated.

After a few years people would start to migrate to the new and better way of reporting exchange rates, just as they gradually migrated from the Dow to the S&P500, as a benchmark for the stock market. I’d like to see them continue to report the old table with exchange rate vis-a-vis the home currency, as a benefit to tourists, but without the daily change. Changes in the exchange rate would only be reported on the index table.

PS. I suggest that a committee of interested parties, perhaps including the top business media outlets, sit down and agree on a set of countries to be used to construct the various exchange rate index numbers, so that there is consistency from one media outlet to another.

PPS. Why doesn’t the market solve this problem? Perhaps the combination of inertia and network externalities requires a “nudge” to move us to a better system.

Tags:

28. June 2016 at 08:07

I’m curious – what’s the math on this? I mean, how would you go about figuring out the index – And, as an economics student, where would I look to figuring out the math?

28. June 2016 at 08:22

Trade Weighted U.S. Dollar Index: Major Currencies (DTWEXM)

https://en.wikipedia.org/wiki/Trade-weighted_US_dollar_index

https://fred.stlouisfed.org/series/DTWEXM

Not sure from your post if you are disappointed that headlines (and even entire articles) typically only report the pairwise exchange rates, just as they often will only refer to the Dow and not the SP500.

28. June 2016 at 08:40

There are currency indices, you just need to access the data on them. The reason why people use currency crosses (for all their faults) is because that’s what people actually in the market use.

I also find the way they teach the basics of currencies very confusing. Doing currency conversions tends to look a lot like conversions in physics. However, 1.2 USD/EUR is not 1.2 US dollar over 1 euro, it’s 1 USD buys 1.2 euros. Once you get that straight in your head, it’s much easier.

28. June 2016 at 08:45

It is vexing. I often report on the yen “rising” against the U.S dollar, soaring from 102 to 99 (recent example). It always take a bit of mental gymnastics to dicipher.

There are trade-weighted baskets etc out there.

It will take Bloomberg or World Bank to craft a reportable and deferred to currency metric.

28. June 2016 at 09:18

Michael, See Dennis’s comment, which provides an example of a dollar index. I want that sort of thing for all currencies. They are often trade weighted indices.

Thanks Dennis.

John, You said:

“Once you get that straight in your head, it’s much easier.”

As I indicated in the post, I do have that straight in my head, but only because the euro is famous. For less famous currencies it’s hard to keep them all in your head unless you do this sort of work every day.

But the bigger problem is the cross rates (which are only of interest to specialists) vs. the index rate, which is what the news media should be reporting. It’s insane for there to be newspaper headlines that say the yuan depreciated when it actually appreciated.

Here’s an analogy that might help. Wall Street specialists care about individual stock prices, whereas most average people want the news to report the big indices, like the S&P500. Suppose the S&P500 fell by 4% in a day, but the news media reported the stock market rose because one company (say Telsa) increased in value. That would clearly be misleading, and for the same reason the current reporting of exchange rates is highly misleading.

If they want to also report the cross rates for the specialists, that’s fine.

28. June 2016 at 09:23

Scott says….”Thus instead of reporting exchange rates against the dollar, they would be reported against a weighted index of the 10 or 20 most important currencies. The numbers would all start at 100 on January 1st, 2017, and then proceed from there. For all currencies a bigger number would mean currency appreciation, and vice versa.”

I think this would be a great stat… Just unpacking it would show all kinds of interesting relationships.. I think as a policy tool it’d be better..but like any stat you’d have to be careful to watch all the inputs.. Outliers would need to be accounted for..like If one of the 20 countries is affected by a massive shock it would skew the results and policy makers would need to take that into account.

28. June 2016 at 09:24

On a somewhat related note, can anyone explain to me why the Yen is the ultimate “safe haven” asset?

I can understand why dollar would appreciate against everything, as the US economy is one of the only bright spots in the world and capital would flow to dollar denominated assets. But why the hell did yen appreciate against even the dollar?

Found this IMF working paper (https://www.imf.org/external/pubs/ft/wp/2013/wp13228.pdf), but their conclusion is essentially the Yen appreciates because people think it will appreciate. That isn’t very helpful. They hint somewhat at future expected inflows leading to repricing, but don’t really show if it’s actually true or why that would be the case.

Anyone read any good papers on this?

28. June 2016 at 10:54

Scott wrote:

Because the number of yuan required to buy one US dollar rose by about 1% in the days after Brexit, from 6.58 to 6.65. Notice how confusing that is—a bigger number means depreciation, not appreciation. But it gets worse. The dollar appreciated strongly against almost all currencies, up around 2% against the euro, Canadian dollar and Australian dollar. It fell slightly against the yen, but soared against the pound. So 2% is a ballpark figure for dollar appreciation. But that means the Chinese yuan actually appreciated by about 1% after Brexit, as it fell against the dollar by less than the dollar rose against other currencies.

I understand full well what you’re saying, Scott, but in fairness to the financial press, couldn’t they plausibly respond:

‘Hey, when we say the Chinese currency weakens against the dollar, we mean, the number of yuan you need to buy a dollar goes up. Period. It’s the Chinese central bank’s job to maintain a desired exchange rate (if that’s what they want to do), and if a shock hits, they can choose to roll with it or offset it. I mean, if a car drives off the winding road of a cliff, would you say it was the driver’s fault or the road’s?’

28. June 2016 at 11:33

Bob, That misses the point. My post has nothing to do with the issue of whether the PBOC could or could not have prevented the move in the yuan. I’m saying something more basic. The press is simply wrong when they said the yuan depreciated; it appreciated. Chinese government policy has no bearing on this at all—I’m simply claiming the press articles contain typos, they should say the yuan appreciated, because it did. Instead they say it depreciated. That’s wrong.

If all stocks go down, except Tesla goes up, would you say “the New York stock market went up”?

28. June 2016 at 12:05

The yuan depreciated relative to the $ and appreciated relative to most currencies.

The yuan is pegged to the $. What’s there to talk about?

28. June 2016 at 13:52

CHY appreciated in recent days?

No it hasn’t, if by “appreciation” we mean “fewer Yuan are needed to purchase USD today as compared to a few days ago.”

http://imgur.com/tl12lc9

Which is, you know, the definition meant in the article.

Leave it to Sumner to pretend that his own esoteric definition that nobody uses, is somehow the definition accepted by everyone else such that if they argue, correctly, that the Yuan has depreciated, then they are making an objective mistake.

A more reasonable response to the article would be something akin to “While it is true that the Yuan has depreciated in recent days, the definition being assumed here is the CHYUSD exchange rate, so I propose a better definition, X, because of such and such reasons, and according to that definition, the CHY appreciated.”

28. June 2016 at 15:12

I have seen some newspapers quote the trade weighed dollar, which would solve some of the problem.

Another solution would be to quote all currencies as units FX / $ or $ / unit of FX. I preffer the FX / USD, and this is what my tables show.

JPY/ USD = 0.0101 USD

EUR / USD= 1.31 USD

CAD / USD = 0.98 USD

IDR / USD = 0.000103$

of course, you have to be comfortable with small numbers.

At one time this rule worked. “The dollar block” — The largest English speaking countries, (GBP, NZD, AUD, CAD) quoted $ / FX, and everyone else quoted FX / $.

Then the Euro came along and was backward. And then for reasons I don’t fully understand CAD flipped its quote.

28. June 2016 at 20:24

Seems the only person confused about currency movements in this piece was…Sumner himself.

29. June 2016 at 05:29

Harding, You said:

“The yuan is pegged to the $.”

Yes, but only in a very approximate way, and they also look at other currencies, not just the dollar. If it were rigidly pegged, then how could it have depreciated almost continually against the dollar over the past two years? And even if it were pegged, that would have no bearing on my post.

In fact, the Chinese government now looks at a variety of other currencies when making adjustments, although the dollar remains the most important.

Doug, Yes, that’s what I want, but for other currencies as well, not just the dollar.

The changes you mention would help a bit, but would not address the mistake the media made in claiming the yuan depreciated. Also, I’d start the index numbers at 100, as tiny fractions are harder to visualize.

Ray, You said:

“Seems the only person confused about currency movements in this piece was…Sumner himself.”

And so Ray can’t read comments.

29. June 2016 at 09:20

The WSJ does a mostly good job on currency reporting, they use a proprietary index to describe all movement in the US dollar.

“The Wall Street Journal Dollar Index, which measures the dollar against a basket of 16 currencies”

http://www.wsj.com/articles/dollar-falls-as-brexit-uncertainty-eases-1467212145

I agree they should use a similar index for all other currencies as well.

29. June 2016 at 10:13

the ‘market’ doesnt change it cause it has incentive to do so