The global shift to services and high tech

One of the popular theories of low interest rates is that demographics are reducing the need for physical investment, and that investment which does occur is skewed more and more toward high tech. Because prices of high tech investment goods are falling fast, growth in dollar spending on investment is reduced below what people want to save at “normal” interest rates, which puts downward pressure on interest rates. The Economist has a recent article on a major industrial power in East Asia, which seems to be rapidly shedding its heavy industry. See if you can guess the country:

FOR an export juggernaut, XXXXX’s losing streak is alarming: for 14 straight months its exports have fallen in value terms compared with a year earlier. In January they plummeted by 18.8% to just under $37 billion—the steepest drop since 2009. Petrochemical products are a key XXXXXXX export, so low global oil prices partly explain the numbers. Still, the country’s longtime engines of growth, including steel mills, shipyards and car plants, appear to be running out of puff.

Now suppose I told you that this country was expected to grow in 2016 at roughly the same pace (2.6%) as it has over the past decade. Might you be skeptical of the official figures?

The country is South Korea, and I’ve never heard anyone question the accuracy of their GDP numbers. Here’s why they keep growing, despite the depressed conditions in heavy industry:

Other businesses are thriving despite the downturn. Seven of the ten best-performing stocks last year in the MSCI Asia Pacific Index, a benchmark followed by big investment funds, were South Korean, among them pharmaceutical, cosmetics and aerospace firms.

Media stocks have been buoyed recently by the success of CJ E&M, a subsidiary of CJ Corp, another chaebol.

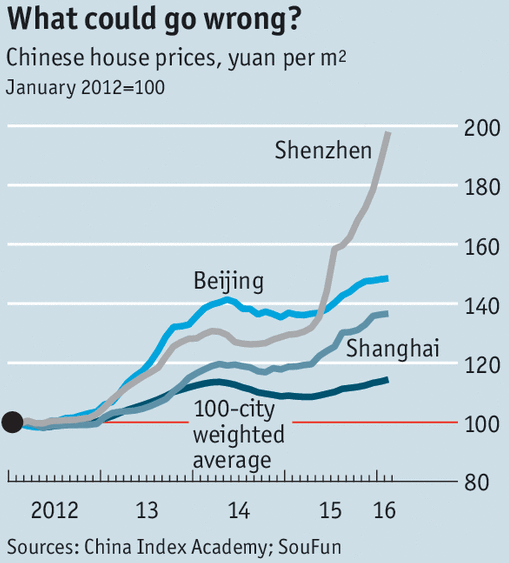

Do we have any evidence that this is also occurring in China? If high tech were booming, it ought to show up in housing prices in the centers of high tech, especially Shenzhen—which is the Silicon Valley of China. Here are recent trends in housing prices:

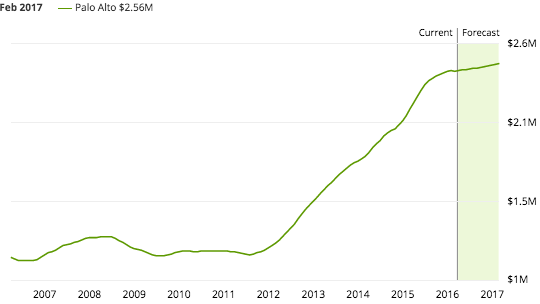

Hmmm, Shenzhen looks kind of like Palo Alto. I suspect that much of what we see in global trade figures is part of a general worldwide trend from producing things to producing experiences. That China recession people have been predicting? Maybe 2017.

PS. The Economist article on house prices is entitled “For Whom the Bubble Blows”. Let me know when the Palo Alto bubble bursts, I’d like to buy a house there. I’m willing to pay prices from the peak of the 2006 housing “bubble”. Here’s Zillow:

Tags:

29. March 2016 at 07:30

Scott,

Uhm, how many posts and emails have I made in past 6 years arguing that Digital Deflation – the once in humanity switch from atomic to digital means a new reality on inflation and thus the correct NGDP LT?

You have all the trends stuff there now, BUT! what if I told you that even though digital deflation makes it hard to correctly measure GDP, it ill soon overwhelm law and tax system and LVT will become more necessary, bc it’s the only way to truly handle economic inequality?

Last Question. has the inaccuracy of GDP measurement (constant large revisions) increased during Digital Deflation?

29. March 2016 at 07:31

One more thing…

Ready to admit even the US will have #Uber4Weflare – the ultimate high tech solution for low skill welfare / job training.

29. March 2016 at 07:34

Palo Alto, and the surrounding towns, have absolutely brutal housing supply restrictions for residential housing. (There’s quite a lot of varied causes, including Prop 13 and the CA tax and spending regime making residential, especially high density residential, a net negative on the city balance sheet, unlike industrial.) Demand is certainly high, but supply is restricted so prices go up very fast. In less supply constrained markets, real home prices don’t go up like that.

As a result, I am reluctant to tout Palo Alto and the Bay Area’s high housing prices as a success by itself, considering that if my (and your) favored housing policies were adopted, the housing prices would moderate or even fall, possible even “bursting the bubble.”

In other words– never reason from a price change!

29. March 2016 at 08:27

Morgan, I don’t know if the inaccuracy has increased.

John, I certainly agree that high prices are not a sign of a healthy housing policy, and favor less restrictive zoning rules.

29. March 2016 at 09:37

Location, location, location.

You would not want to buy a house in Victorville at the 2006 bubble peak. You’d still be 30% or more underwater.

29. March 2016 at 09:39

Mr. Sumner

“Now suppose I told you that this country was expected to grow in 2016 at roughly the same pace (2.6%) as it has over the past decade. Might you be skeptical of the official figures?”

No I would prob just think of this country as an outlier.

Its clear that the developed world is suffering from some kind of phenomenon keeping the neutral real interest rate super low. For example real forward rates in the U.S, Japan, Europe are barely positive if not negative. No G-7 country is expected to hit 2% inflation over the next 10 yrs.

Perhaps not in an exhaustive manner, an aging population and an increase of investment spending coming from tech companies are common denominators.

How much cash does apple and google have laying around? What are Snapchat’s capital expenditures vs Sony? These less cap intensive firms push down real interest rates and will continue to do so. Of large amounts of spending in public infrastructure can help.

“we wanted flying cars, instead we got 140 characters”

29. March 2016 at 09:59

If you look at the official aggregate numbers since 2001, isn’t housing inflation still around 10% total? CIA seems to be a private outfit like WIND, which has similar numbers.

Like the currency inflection point and the skyrocketing ratio of FX reserves to M2, seems like like another suggestion China is doing too much fiscal+monetary stimulus, understating NGDP and overstating RGDP growth. No question they’ve had tremendous growth, but perhaps a percent or three less tremendous than the official RGDP numbers.

29. March 2016 at 10:00

sorry s/b understating inflation above

29. March 2016 at 10:48

Scott– Indeed, and if the zoning and other policies were changed, Palo Alto might well have a housing price crash. Does that make it a “bubble?” Like you, I don’t know if the word makes sense, but there’s some decent evidence (such as from Ed Glaeser) that housing restrictions increase the volatility of house prices (instead of increasing the volatility of supply).

29. March 2016 at 10:55

I don’t know about this popular theory that you mention. Are global demographics actually reducing the ‘need’ for physical investment? It seems that population is still growing and that there are still many tens (hundreds?) of millions of people throughout the world that need physical products maybe even a lot more than high-tech ones. Is it that they can’t provide the effective demand for them even though the need for them is obviously there? Or is it more of a supply problem, like we just aren’t able to make enough pipe for sewer and water systems for instance?

I know this question makes me seem like some unrealistic bleeding heart, but if it is primarily a demand problem, shouldn’t it be easier to figure out some solutions?

29. March 2016 at 11:03

Scratch what I said.

29. March 2016 at 11:10

James, Low real interest rates are not a problem, they are simply a market outcome.

Talldave, You asked:

“If you look at the official aggregate numbers since 2001, isn’t housing inflation still around 10% total?”

No, not according to US government data (CPI, etc.)

John, You asked:

“Scott– Indeed, and if the zoning and other policies were changed, Palo Alto might well have a housing price crash. Does that make it a “bubble?””

Clearly not, as zoning is part of the “fundamentals” that go into asset prices.

Jerry, My econ teacher once forbad us from using the term ‘need’. What people need and what they can buy are two different things. I’m trying to explain the world as it is.

29. March 2016 at 11:14

“Now suppose I told you that this country was expected to grow in 2016 at roughly the same pace (2.6%) as it has over the past decade. Might you be skeptical of the official figures?”

-Nah. That’s ’cause 2.6% is not 6%.

@james

-Maybe central banks can almost always control real interest rates, too.

29. March 2016 at 11:27

“James, Low real interest rates are not a problem, they are simply a market outcome.”

I agree with that. Low rates reflect low growth. But what if we can’t reach to real interest rate required for full employment? Or at least that it’s so low (negative) that’s its difficult to reach. Isn’t that problem of itself? Not trying argue its a question.

E. Harding

“-Maybe central banks can almost always control real interest rates, too.”

What point are you trying to make? Of course you wouldn’t agree that the fed controls long term interest rates? Influence sure but not control. You’re sentence lacks so much substance it’s almost impossible to respond

29. March 2016 at 12:25

“What people need and what people can buy are two different things. I’m trying to explain the world as it is.” Well that’s not the worst way to be called an unrealistic bleeding heart. 🙂 Appreciate the reply, as always, thank you.

29. March 2016 at 12:42

Harding. Let me get this straight. Are you saying a major industrial power can have a huge drop in its heavy industry sector, showing up as dramatically reduced exports, without any significant drop in its overall GDP growth rate? Seriously?

(If so, then I agree.)

James, You said:

“I agree with that. Low rates reflect low growth. But what if we can’t reach to real interest rate required for full employment? Or at least that it’s so low (negative) that’s its difficult to reach. Isn’t that problem of itself? Not trying argue its a question.”

It’s not a problem with sound monetary policy. If you target NGDP, then the interest rate will always settle at a level consistent with macro stability.

29. March 2016 at 12:43

“Are you saying a major industrial power can have a huge drop in its heavy industry sector, showing up as dramatically reduced exports, without any significant drop in its overall GDP growth rate?”

-If that growth rate is low enough, it’s plausible.

29. March 2016 at 13:04

Believers in bubbles always think the future will prove them right. Pessimism is depressing.

29. March 2016 at 13:48

@Jerry Brown

“I don’t know about this popular theory that you mention. Are global demographics actually reducing the ‘need’ for physical investment?

I think he was describing secular stagnation (although I believe he uses South Korea to refute it). Its a theory made popular again by Larry Summers. Long story short it says that the interest rate needed to reach full employment is super low maybe prob negative. An aging population and less capital intensive companies help keep the rate low among other things. More importantly secular stagnation concludes that large investments in public infrastructure and other forms of fiscal stimulus may help economic growth. It overall advocates for monetary stimulus but argues tools at central banks disposal may not be optimal thus fiscal policy should be considered. Check it out!

29. March 2016 at 13:55

Scott, you might want to have some fun at Desmond Lachman’s expense;

http://www.aei.org/publication/quantitative-easings-chickens-coming-home-to-roost/comment-page-1/#comment-150431

‘Since 2008, the Federal Reserve has engaged in three rounds of quantitative easing that has enormously expanded the size of the Federal Reserve’s balance sheet from $800 billion to around $4.5 trillion at present. It has done so with the intention of stimulating the U.S. economy through increasing asset prices and through encouraging more risk taking by lenders.’

By paying banks to hold the QE as excess reserves at the Fed?

‘In the process, the Federal Reserve has helped to produce a strong bull market in equity prices…’

In 2007 the Dow was above 14,000 (iirc), today, nine years later, it’s about 17,500; only 21% higher.

‘While the Federal Reserve might claim that its policy of aggressive quantitative easing helped to shorten the U.S. economic recession and to promote the gradual economic recovery of the past several years, it also contributed to a sense of economic unfairness among a broad segment of the electorate. Equally troubling, it seems to have set up the stage for large corrections in both domestic and global financial markets that could entail substantial long run costs to the American and global economies.’

My bold in the above.

29. March 2016 at 13:56

If we always have low, low interest rates in the forseeable future, then can Monetary Policy ever work? Or are we all just following the the road Japan started 25 years ago? It makes sense that investment capital has greatly diminished because of slow population growth and tech companies don’t need to borrow a lot. Also, with more tech goods and falling population, doesn’t that mean inflation can always be contained? (Of course, I believe the slowdown of wars and military spending the last 25 years is making an impact on investment as well.)

I know the Japanese government is looking to financial stimulus but I am guessing it is guaranteed not to work. Except maybe if they start giving huge child tax credits is their solution. I know social conservative would love the idea!

29. March 2016 at 14:07

@James Elizondo

Yes James, thank you. I think you are correct about that. I was talking about the “needs” in the world being such that strong investment in basic physical output was still desirable when their are still so many potential customers. But, as Scott points out, they don’t have any money to buy things, and even if we might be happier if we supplied them, that is just not how things work in this world.

29. March 2016 at 14:17

Oops didn’t mean to imply Professor Sumner says we might be happier to supply them. That was what I was trying to say. Under certain circumstances that is.

29. March 2016 at 14:53

In other news: Sumner believes there was no bubble in Dutch tulip prices since, 300 years later, you can buy these tulips at a greater nominal price than back then (or similar nonsense).

As for Palo Alto, last I checked, there’s plenty of cheap housing there. East Palo Alto. You got a problem with dat? That’s the data problem then.

@Morgan Warstler – hedonic adjustments and the Cambridge Capital Controversy are your reading assignments for this thread. Once you understand why Google is worth more than General Motors, despite owning fewer assets and employing fewer people, you’re on your way to understanding today’s economy (and why it’s a house of cards).

29. March 2016 at 15:45

‘If we always have low, low interest rates in the forseeable future, then can Monetary Policy ever work?’

Sure, and we’d be better off if monetary policy was conducted if interest rates were completely ignored while doing it.

29. March 2016 at 16:17

Financial Times

Chinese tourism spending leaps 53%

Financial Times-Mar 21, 2559 BE (2016)

While outbound Chinese tourism has been growing strongly in recent years, the figures represent a….

Somehow I do not associate a 53% annual leap in tourism outlays with an economic collapse.

The risk to China probably stems from a Westernizing central bank and too-tight money. Like the Fed, the PBOC is below inflation target….

29. March 2016 at 16:18

The housing situation is dire enough that companies in the bay are being less restrictive about remote work, as it’s very difficult to convince experienced talent, who often have families, to move into that real state market.

You’ll also be interested to hear that some of those companies are having quite the interest in economics. A few weeks ago, we hosted Larry Summers for a company-wide chat.

29. March 2016 at 18:04

Sumner why is it that for bubbles you keep believing that a subsequent bubble somehow disproves he existence of the previous bubble?

Bubbles are not a one time in all of history event. They recur. Just because previous bubbles and busts are followed by subsequent bubbles and busts, where future peaks are higher than previous peaks, that for snot entitle you to pretend that bubbles don’t exist. You are ignoring people’s investment time horizons. You do not have an infinite investment time horizon. Yet an infinite horizon is what you would have to have to deny the bubbles and busts through history, as if investors are immortal beings not subject to any relatively short term losses.

To call the housing market during 2000-2007 a bubble, is not falsified or refuted or even challenged by subsequent bubbles the peaks of which supercede the previous peaks. It is not as if every investor bought at the bottom and held the entire time. The fact that the prices changed over time implies there were transactions taking place every day the whole period. That means many losses were actually incurred, by those investors who have less than infinite investment time horizons.

In your crude macro worldview that totally ignores and abstracts from individual investors, the reality of bubbles and busts looks to you as nothing but a long term gradual rise, and one organic blob of “the market” not incurring any losses because heck, we’re at a new peak today!

29. March 2016 at 18:05

“…that for snot entitle…”

Autocorrect is the bane of my existence.

29. March 2016 at 18:34

Here is the problem. Yes, there are hard to access cities where prices are exploding. But rents are even going up in cities that have not experienced that, simply because the bankers bought the houses and are all jacking up the prices.

It is insane that prices are going up when wages should go down to compete with the world. It makes no sense and is really a form of robbery.

I almost don’t want a boom now, because prices will just be out of control in housing.

29. March 2016 at 18:37

“You’ll also be interested to hear that some of those companies are having quite the interest in economics. A few weeks ago, we hosted Larry Summers for a company-wide chat.”

So, what did you learn? Hold on to your $100 bills because Sumner wants to end them. And the mainstream press even reported it. That is highly unusual for local press because monetary stuff is rarely reported. And Sumner lied when he said it was because of crime that we should get rid of the $100 when it is because he wants to break the zero lower bound, wherever that happens to be. I wrote about Sumner, a dreadful representative of international banking, destroying the peace of Westfalia, or Westphalia: http://www.talkmarkets.com/content/global-markets/larry-summers-100-dollar-bill-ban-and-westfalia-lost?post=86090

29. March 2016 at 18:44

Sorry, Summers, not Sumner!!!!!!!!

29. March 2016 at 21:24

Ray Lopez: I believe you have struck upon something.

I contend there are a few investment categories that can be considered to be occasionally in bubbles. This is where the value of the “investment” is purely a subjective and contemporary estimate.

This category includes a lot of collectibles, such as Andy Warhol art, or gold, or tulip bulbs.

No projectable income now and forever.

30. March 2016 at 00:56

“I wrote about Sumner, a dreadful representative of international banking, destroying the peace of Westfalia, or Westphalia:”

Awesome stuff. And he’s not even Jewish. Or on second thought, maybe he is??? Gary, you should follow him into the bathroom and look at his pee-pee.

30. March 2016 at 03:32

I could not find Shenzhen like city in broad Tokyo area.

30. March 2016 at 04:37

Interesting post, I did guess South Korea but you could have put Japan or China in there. Not sure if I totally agree about housing. All real estate is local.

30. March 2016 at 05:43

“I wrote about Sumner, a dreadful representative of international banking, destroying the peace of Westfalia, or Westphalia:”

Awesome stuff. And he’s not even Jewish. Or on second thought, maybe he is??? Gary, you should follow him into the bathroom and look at his pee-pee.”

Lots of gentiles are circumcised. However, I corrected the post, because I was writing about Larry Summers and you know it. I will count your response as a gotcha and a funny. 🙂

30. March 2016 at 08:20

David Henderson writes:

“It would have been much more straightforward simply to expand the number of people subsidized rather than to make the majority of people under age 65 go through hoops and lose insurance they liked, and have a paternalistic (and not a nice parent, either) government design health insurance plans, screw younger medium- and high-income people, and take the insurance component out of health insurance.”

http://econlog.econlib.org/archives/2016/03/obamacare_spent.html

But was it ever feasible that a “straightforward” subsidy could have gotten 60 votes in the Senate?

30. March 2016 at 17:53

Harding, Why would the growth rate matter? Growth slows, or it doesn’t.

Thanks Patrick, I’ll take a “sense of economic unfairness” over being the eurozone, any day of the week.

Collin, No problem if they follow MM advice.

Bob, I read that some firefighters in Menlo Park live 100 miles away.

Travis, Probably not, but I wish they’d tried.

31. March 2016 at 07:27

Prof. Sumner,

Also RE: Henderson’s post: would Obamacare have been better or worse if it had only required 50 votes in the Senate rather than 60 (due to the filibuster)?

31. March 2016 at 20:11

Sumner wrote: “I read that some firefighters in Menlo Park live 100 miles away.”

That’s true in many cities on the SF peninsula. But it’s because firefighting is not a 9-to-5 job. They aren’t doing a daily 100mi commute. Firefighters typically work 4-days-on and 3 (?) days off, so it’s a weekly commute, not a daily commute. During the work cycle they live in the fire station. A couple hour weekly commute is very doable, and many of them live in mountain forests of the Sierras. Not a bad life.

(The problem actually comes later in their careers. Fire Chief is more like a 9-to-5, M-F job. But you can’t promote an experienced firefighter to fire chief, if they don’t live locally. So there are problems staffing the administrative ranks.)

1. April 2016 at 17:51

Travis, I’m not sure.

Don, Thanks for that info.