Bernanke on NGDP targeting

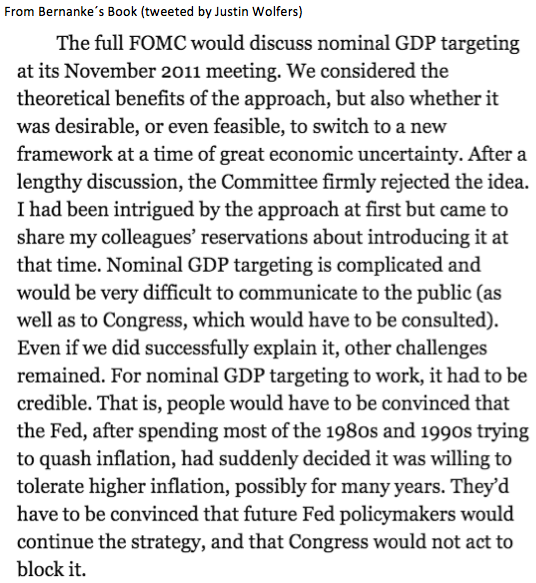

We’ll have to wait for the 2011 minutes to know exactly what happened, but this paragraph sent to me by Marcus Nunes and also Stephen Kirchner (apparently from Justin Wolfers tweet), confirms what I thought after I heard Bernanke’s response to a reporter on NGDP targeting, back in 2011:

[Update: Marcus indicated it was Neil Irwin, Not Justin Wolfers who tweeted.]

At the time, I thought Bernanke probably had at least some sympathy for NGDP targeting. That’s partly based on the comments he made at the 2011 press conference, which was sort of along the lines of “very interesting idea, but in the end we stayed with IT” (but not those exact words!) and also based on the fact that he is one of the few academics who used to discuss NGDP in the context of monetary policy, which shows the basic idea has been on his mind for many years. It’s also an idea that tends to appeal to people outside the Fed who have Bernanke’s general views on monetary policy. Like me!

At the time, I thought Bernanke probably had at least some sympathy for NGDP targeting. That’s partly based on the comments he made at the 2011 press conference, which was sort of along the lines of “very interesting idea, but in the end we stayed with IT” (but not those exact words!) and also based on the fact that he is one of the few academics who used to discuss NGDP in the context of monetary policy, which shows the basic idea has been on his mind for many years. It’s also an idea that tends to appeal to people outside the Fed who have Bernanke’s general views on monetary policy. Like me!

I still think that if Bernanke had been an academic during the Great Recession he would have supported NGDP, or at least been very sympathetic.

Of course once you join the Fed your freedom to maneuver is far less. Even I understand that the Fed would have looked crazy to suddenly adopt NGDPLT, just as they were finally settling on an explicit 2% inflation target. I’ve always thought of this as a 10 or 20 year struggle, and still believe that.

Still it’s good to know that the objections are not too serious. Over time the shift from IT to NGDPLT will look less opportunistic. Perhaps the shift could occur at a moment when NGDPLT would not lead to higher expected inflation. And it’s actually much easier to explain NGDPLT to the public than IT, which Fed officials would realize if they ever bothered to read my papers on NGDP targeting. (Try explaining to the public that you are trying to “raise their cost of living” for their own good, and be sure to use “Phillips Curves” in your explanation. Lots of luck!)

NGDP targeting is something that academic economists need to mull over for a while. Once a majority of academic economists favor NGDPLT, it will be much easier for the world’s central banks to switch over to the new policy.

PS. If you don’t agree with my take on Bernanke, read this post.

Tags:

5. October 2015 at 18:24

From what I understand Bernanke likes the idea of NGDP targeting from a scientific perspective but he thinks it can not be implemented for political reasons. The best thing that could happen to market monetarism right now would be a Nobel Prize for some of the creators. This would change the political environment from one day to another. I know it’s extremely unlikely but one can always dream.

5. October 2015 at 18:45

Scott, regarding the politics of NGDP, perhaps the titles of these two recent Noah Smith posts (the first asking a question, and the second [inadvertently] providing a possible answer) provide a clue to the answer to why Bernanke thought it was politically impossible to implement:

“Why Does Wall Street Want Higher Rates?”

answer(?)…

“The Rich Get Hit Harder by Inflation Than the Poor”

5. October 2015 at 18:58

… In fact I seem to recall Bernanke being threatened with “ugly treatment” down in Texas by one particular presidential hopeful back in 2012 for the traitorous crime of too much “money printing” while the WH was occupied by the ‘wrong’ person. How dare that traitorous Bernanke! The only good, moral, godly and righteous thing to do would have been to strangle the economy even more to demonstrate to all decent Americans that they had made a frightful mistake in 2008. How else are they going to learn???

5. October 2015 at 20:35

[…] 16. He argues that the idea of ngdp targeting is too complicated and could not easily be made credible, given that the Fed has built up its reputation as an inflation fighter. It also raises the risk that a non-credible ngdp target wouldn’t boost output, but would deliver price inflation, thereby resurrecting stagflation as a potential problem. (By the way, here is Scott’s response.) […]

5. October 2015 at 20:50

[…] 16. He argues that the idea of ngdp targeting is too complicated and could not easily be made credible, given that the Fed has built up its reputation as an inflation fighter. It also raises the risk that a non-credible ngdp target wouldn’t boost output, but would deliver price inflation, thereby resurrecting stagflation as a potential problem. (By the way, here is Scott’s response.) […]

5. October 2015 at 21:22

LOL, shows how out of touch Sumner is with literature, as Bernanke’s book has been out now for quite some time. If Sumner ever bothered to read Bernanke’s 2003 FAVAR paper, he might have second thoughts about the efficacy of monetarism.

“if they ever bothered to read my papers on NGDP targeting.” – LOL, what papers? The links on the right hand side of your page? That thems jokes.

5. October 2015 at 23:21

Ray, you said “Bernanke’s book has been out now for quite some time.”

How can you be so repeatedly, actively stupid? I don’t understand. No one can be this dumb purely by chance.

For the record, Bernanke’s book was released on October 5, 2015, literally the same day as you posted your comment.

Amazing.

6. October 2015 at 03:05

The reminds me of the arguments in baseball about batting average versus on-base percentage back in the 1980s. OBP is much easier to explain, because it’s a straight probability. BA is a conditional probability, and the condition, an at bat, can only be described by what it is not. It took a long time for OBP to sink in.

6. October 2015 at 03:31

NGPD targetting seems to be getting lots of limelight at the moment.

Ryan Avent “An NGDP target would have worked out better”

http://www.economist.com/blogs/freeexchange/2015/10/ben-bernankes-big-blunder?fsrc=rss

& Martin Wolf “One possibility would be to replace the inflation target with one for nominal GDP”

http://www.ft.com/cms/s/0/d0f0e212-6773-11e5-a57f-21b88f7d973f.html?ftcamp=published_links%2Frss%2Fcomment_columnists_martin-wolf%2Ffeed%2F%2Fproduct#axzz3nmkxZoNA

6. October 2015 at 04:47

We also debated whether the “zero lower bound”””the fact that interest rates cannot be reduced below zero””meant we were “running out of ammunition.” Cutting the federal funds rate wasn’t the only conceivable tool for spurring growth, as staff research papers had been exploring for several years and as I had argued at Princeton. But Greenspan downplayed the zero-bound concern. He suggested that, if the federal funds rate did hit zero, the Committee would be able to find other ways to further ease monetary policy, though he did not at that point say exactly how.Read more at location 983 – Delete this highlight

I like this quote from that book.

6. October 2015 at 04:48

Excellent blogging.

I think NGDPLT is easy to explain to the public. After all, it is the “real” GDP is that is adjusted by a guess at inflation rates.

Just say, “We are shooting for higher economic growth, or gross domestic product. We want GDP to grow at 6% a year. After a bad year we will shoot even higher, to catch up.”

Bernanke flubbed one aspect of this: “Never let a crisis go to waste.”

That means, when there is a crisis, there is often an opportunity to change a regime, when before crisis, the status quo was good enough, or accepted, or cemented in.

I suppose Bernanke is an quiet academic, and not a world-beater. Too bad a NGDPLT Volckerian type was not around in 2008.

And Yellen is the opposite picture of a Volcker.

6. October 2015 at 04:50

David Pinto: Think Eddie Yost.

6. October 2015 at 04:56

@Benjamin Cole

I admire your enthusiasm, but since I first grasped NGDPLT, I thought if you continue to associate it with higher inflation you are actually working against the idea. Instead, all of you NGDPLT defenders should focus on the symetrical aspect of the model, which is: yes, under a negative supply shock we have more inflation and less growth, but on the other hand, under a positive supply shock we have less inflation and more real growth.

6. October 2015 at 05:03

Christian, Right now NGDP targeting is clearly on a path to success. More and more economists are endorsing the idea, and hence unless something goes wrong I’d expect it to be adopted within a few decades.

Tom, I don’t agree that “Wall Street” favors tighter money. Some loudmouths on Wall Street do, but not stock investors overall.

Ray, You said:

LOL, shows how out of touch Sumner is with literature, as Bernanke’s book has been out now for quite some time.”

So someone who doesn’t know when his book came out is “out of touch”? Seriously. Oh wait, the book came out yesterday. So yes, I guess you are really out of touch Ray. Finally you are right about something—it does show one is out of touch.

Ben, Touche!

David, Good analogy.

Adam, Thanks for the link.

Denis, Good quote.

Ben Cole, Yes, they missed an opportunity.

6. October 2015 at 05:45

“As the FOMC was pushing for a stronger recovery, we got some help from fiscal policy. In May 2003, the Bush administration won new tax cuts from Congress, on top of tax cuts approved in 2001. The bill put cash into people’s pockets by cutting taxes on wages and on personal interest and dividends. To the extent they spent their tax cuts, demand for goods and services would increase, thus encouraging more production and hiring.”

Monetary offset anyone?

6. October 2015 at 06:29

I think the whole problem with the Fed (and the ECB BTW) since 2007 has been timidity. They were afraid to do what needed to be done, this one example.

6. October 2015 at 06:31

BTW I think Greenspan was more willing to take chances and he might have helped make it less severe. BTW seems to be an argument for free banking of at least breaking the USA in multiple currency zones.

6. October 2015 at 06:33

Mr. Robazzi: I have changed my mind in the last five minutes.

Now I believe the Federal Reserve should target a 4% ceiling on unemployment. They then could disavow any responsibility for inflation. They could say inflation is caused by structural problems. That the Congress should reduce taxes, regulations and disability programs and open up doors for immigrants. Outlaw property zoning by cities. The Federal Reserve could say that creating more competition will limit inflation.

The crazy thing is, right now a 4% unemployment ceiling would work better than a 2% IT.

6. October 2015 at 06:37

NGDPT discussions at the FOMC have been recurrent!

https://thefaintofheart.wordpress.com/2015/10/06/ngdp-targeting-and-fomc-discussions/

6. October 2015 at 06:37

Ugh, and Yellen seems to be a Keynesian. Maybe we can send the Fed governors a copy of The Structure of Scientific Revolutions.

6. October 2015 at 09:00

Didn’t “they” also reject more QE in 2011? So in reality the consequence of the bloated base you speak of was a choice between some degree of lesser-best choices and they chose the worst one.

Amazing.

6. October 2015 at 09:28

You guys are being way too hard on Ray. Bernanke’s book was out for, like, several hours before he posted that comment.

6. October 2015 at 09:33

Benjamin Cole, or Eddie Joost. 🙂

6. October 2015 at 11:02

Dear Commenters,

Is this reasoning from a price change?

http://thereformedbroker.com/2015/10/06/what-oil-does-to-profit-margins

“What Oil Does to Profit Margins”

6. October 2015 at 13:29

Lay people already understand NGDP growth and they support it at large. They will never understand inflation and they do not support it.

6. October 2015 at 14:20

Scott,

Have you considered doing a post on the “We need to raise rates now, so that we can cut rates when the next crisis comes around” argument? I’ve noticed it in the Shadow Monetary Policy of the Insitute for Economic Affairs in the UK, including their latest minutes. It seems like a good example of the weirdness to which interest-rate orientated thinking can lead a macroeconomist.

6. October 2015 at 14:24

I have Bernanke’s book. I look in the index under ‘Sumner’…nothing, but plenty of entries for ‘Summers.’

Okay, too much to hope for, so ‘Nominal GDP targeting’ is supposed to be on pp 317-19. Nothing even close to that on those pages.

Anyone know where it’s buried?

6. October 2015 at 17:56

Browsing through Bernanke’s book, I find a really silly misstatement of fact on page 439; he claims that Glass-Steagall was repealed in 1999, which opened the door for ‘”financial supermarkets” large and complex firms that offered both commercial and investment banking services.’

Problem is, the two provisions of GS that define and separate commercial and investment banking (#16 and #21) have never been repealed. Nor did they have anything to say about lending for real estate or MBS, in the first place.

He also seems to disbelieve in the Quantity Theory of Money.

7. October 2015 at 02:32

“[The Fed] has a 2 percent inflation target. It needs to get inflation up to that target,” said Bernanke. “Easy money is justified by the need to get inflation up to the target.”

http://www.cnbc.com/2015/10/05/ben-bernanke-slow-productivity-growth-is-weighing-on-us-economy.html

7. October 2015 at 05:13

Denis, Yikes, who said that?

Floccina, Yes, timidity.

Ben, Don’t go there.

Marcus, I did a post on that way back when. It does show that the Fed’s been aware of NGDP for a long time.

W. Peden, I have already, but send me a link and I’ll do another one.

Patrick, I admit that I’m not well informed on that. What actual changes occurred with the 1999 law? Why was there this perception? Were investment banks given some other powers?

Morgan. I agree with Bernanke. Good interview.

7. October 2015 at 06:53

Bernanke’s memoir was named “Courage to Act” back in April of this year, as several news stories reported at the time, so I assumed it was published back then. My bad. But, if Sumner was really “in the loop” he would have received a pre-publication copy to review. I guess: (a) Sumner is out of the circle of trust that book publishers have, and/or (b) Sumner cannot be trusted to keep confidential any book entrusted to him for pre-publication review. Shame on Sumner if so.

7. October 2015 at 07:03

From the Senate Banking Committee’s Gramm, Leach, Bliley site;

http://www.banking.senate.gov/conf/grmleach.htm

‘Repeals the restrictions on banks affiliating with securities firms contained in sections 20 and 32 of the Glass-Steagall Act.’

One of those provisions prohibited a ‘bank holding company’ from owning both an investment bank and a commercial (depository/checking) bank. The latter two firms are defined by provisions 16 and 21 of Glass-Steagall. Which have never been repealed.

The other provision of GS that was repealed by GLB was one that prohibited one individual from sitting on the boards of both types of banks.

Also, if a BHC owns/buys both types of banks they have to keep their balance sheets separate. A commercial bank cannot hold as an asset an investment bank (or part of one).

That you, an academic macro guy, didn’t know that is understandable. But the head of The Fed?

As to the popular perception of Glass-Steagall having been repealed…journalism is a lousy way of distributing accurate information to the public.

7. October 2015 at 10:22

W. Peden — You just want me to tear all my hair out, don’t you?

7. October 2015 at 10:54

So is NGDP targeting based on nominal Gross Domestic Product growth or nominal Gross Domestic Income growth? I assume Gross Domestic Product but I see a lot of discussion about the role of income growth (wages, profits, etc.) It’s not like these two series grow in lock step quarterly. Many economists actually believe that GDI growth is more reliable during business cycle turning points. What say NGDP targeters?

Several here have mentioned that real GDP equals nominal GDP adjusted by an inflation guess. I assume that most here, though, understand that deflation is performed at very detailed product/expenditure levels using hundreds (if not more) of detailed product price indexes. The result is an aggregate (Fisher) quantity index. Aggregate price indexes (such as GDP deflator) are implicit by definition.

7. October 2015 at 21:55

Scott is another quote by Ben from Ben memoir…

8. October 2015 at 03:24

Ray, Or maybe I was in the loop, but kept quiet?

Patrick, My problem is that when I read legislation, I tend to forget it because it’s not very intuitive (at least to me). Often it’s even hard to understand for a non-lawyer. I trust the press to explain the implications, which can be a big mistake.

Ben, Yes I recall the deflator is measured that way. On the NGDP/NGDI question, I’m an agnostic. I believe the federal government has a new measure, which averages the two. That’s probably the most accurate.

13. October 2015 at 10:46

As PK has observed, you could have a good debate between Prof. Bernanke and Chairman Bernanke about M pol at the zero bound. Prof Bernanke was much more radical and recommended NPLT (Tokyo, 2003). The Chairman seems to have forgotten all about NPLT. He would squirm under interrogation by the professor, as did the BoJ in 2003.

14. October 2015 at 09:00

Chris, Yes, I made the same point back in 2009.