Gavyn Davies on 4 types of shocks

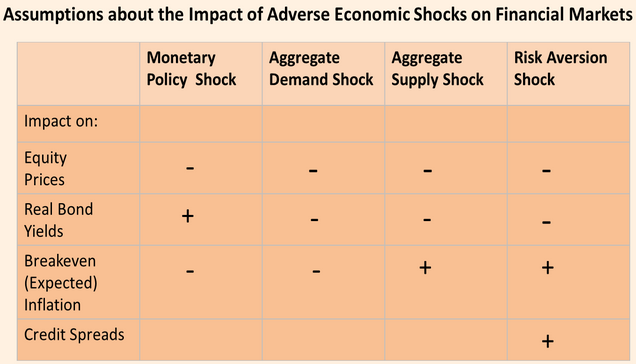

James Alexander pointed me to a fascinating piece by Gavyn Davies in the FT. In this table, he summarizes the impact of 4 types of shocks on the various markets:

I don’t think those results always hold up (tight money can sometimes reduce real rates) but it’s pretty reliable in most cases. Davies then argues that in recent months the behavior of markets is most consistent with monetary tightening by the Fed:

I don’t think those results always hold up (tight money can sometimes reduce real rates) but it’s pretty reliable in most cases. Davies then argues that in recent months the behavior of markets is most consistent with monetary tightening by the Fed:

There are important conclusions from these charts:

-

The behaviour of US equities since mid 2014 has been impacted on by two supportive shocks, and two depressing shocks.

-

The supporting shocks have been a decline in risk aversion (presumably driven by a drop in the risk of a major crisis in the euro area after quantitative easing by the European Central Bank became likely), and a positive aggregate supply shock from lower oil prices.

-

The depressing shocks have been a significant monetary tightening shock as the Fed has approached lift-off, and more recently a minor negative demand shock that could have stemmed from China or the domestic US economy.

-

These shocks roughly cancelled each other out until May 2015, since when the negative shocks have started to outweigh the positive ones.

-

The sharp decline in equity prices since June 2015 has been mainly driven by a monetary tightening shock, rather than by a negative demand shock from China or elsewhere. This was initially partially offset by a beneficial supply shock from lower oil prices, but in the last couple of weeks this has reversed as oil prices have rebounded.

-

In September, the monetary shock has dampened slightly as Fed speeches have reduced expectations of a September lift off for US interest rates.

This methodology is not infallible so a sanity check is important: does it seem plausible that the model attributes much of the weakness in risk assets to a “monetary shock”? Some people will be sceptical about this, because there has been no increase in US interest rates, and no change in the Fed’s balance sheet in recent months. However, the rise in real bond yields and the decline in break-even inflation rates is clearly indicative of perceived monetary tightening. And indicators of overall financial conditions have clearly tightened. No other shocks can plausibly explain this combination [2].

Furthermore, over the past couple of weeks the timing of the ups and downs in the markets has been exactly what would be expected from the varying signals thatWilliam Dudley, Stanley Fischer and John Williams have given the markets. So this result seems fairly robust.

The most likely inference is that the markets have observed the adverse developments emerging from China, especially the possibility of further devaluations in the renminbi, and have concluded that the Fed would normally ease policy in response to these deflationary risks. Yet the Fed has seemed to be on a pre-determined path to announce lift-off before the end of the year, and has been very reluctant to deviate from that tightening path. This has been interpreted by the markets as a hawkish shift in the Fed’s policy framework.

The case for postponement of lift-off was argued strongly by both Martin Wolf andLarry Summers in the FT yesterday. The Fed will probably heed these arguments. If they do not, financial turbulence could swiftly return.

Great stuff. Let me just add one point. Between July and November 2008 there was a shock to the stock market, real bond yields, and TIPS spreads that was almost an order of magnitude bigger than the recent shock. A huge shock, and according to the model presented by Davies it must have been a contractionary monetary shock.

Funny that everyone thought I was crazy when I first made that claim.

We are making progress if the FT is now publishing claims of a contractionary monetary shock during a period of very low interest rates and a bloated monetary base. Next time another 2008 happens, we MMs won’t be laughed at. (Even better, this recognition makes another 2008 less likely.)

Tags:

10. September 2015 at 14:45

I think supply shocks would increase yield, no? I can’t think of a good story to explain a supply shock leading to lower bond yields.

10. September 2015 at 15:16

Right on!

Britonomist, he did say real yields. I’m guessing that if the market expected a left shift in AS to slow real growth, nominal yields might rise while real yields fell.

10. September 2015 at 15:19

Rajat, That’s how I’d also respond to Britonomist, but to be honest I’m not sure that’s right. The ceteris paribus problem here is formidable, for instance, what does it mean to hold “monetary policy” constant during an adverse supply shock?

10. September 2015 at 15:43

O/T: Peter Schiff says he measures macro statistics by asking people about their “feelings.” Is he a grifter or just retarded?

10. September 2015 at 15:43

Based on recent (2008, 2011) experience, central banks seem to have allowed monetary conditions to tighten in response to negative supply shocks. Isn’t that consistent with inflation-targeting?

10. September 2015 at 16:23

Sumner: “I don’t think those results always hold up (tight money can sometimes reduce real rates) but it’s pretty reliable in most cases.” – wise words of qualification.

The “+” and “-” symbols are a bit confusing to me; I think the FT author is using them for ‘positive impact’ and ‘negative’ impact’ but to me it seems like ‘correlation’ and ‘no correlation’. For instance, here is an excellent Hussman article http://www.hussmanfunds.com/wmc/wmc150622.htm (Fed does not guarantee the stock market; don’t fight the fed is not true) that shows the Fed does not give a ‘put’ to the market, contrary to popular belief. Yet does the FT chart seem to refute this? Not clear to me.

10. September 2015 at 16:38

The link below provides a visual of “monetary shocks”. I would say they come in 3 “flavors”: 1) An inflationary monetary shock (think “Great Inflation”); 2) A stabilizing monetary shock (think “Great Moderation” and 3) A depressive monetary shock (think “Great Recession/Lesser Depression”). This last is dangerous insofar as inflation is not a problem and NGDP growth is too low but positive and also relatively stable. So, if the Central Bank is afraid to take the nominal economy to a higher level path, it will be tempted (for “mystic”) reasons to “tighten”, and this will likely worsen the depressive state (not so “lesser depression”). It is sufficient that there are expectations of that outcome for the economy to be “wobbly”…

https://thefaintofheart.wordpress.com/2014/01/10/visible-benefits-of-level-targeting-ngdp/

PS I don´t think oil was just, or even mostly, a positive supply shock. To a significant extent, the fall in oil prices since mid-2014, was a reflection of a negative demand (monetary) shock.

10. September 2015 at 16:39

This post is reasoning from a price change.

10. September 2015 at 16:46

Scott, I think GD could collapse the 4 types of shocks into 2: A monetary/demand shocks and supply shocks. The “Risk Aversion” shock (positive or negative) is a consequence of the type of AD or AS shock that prevailed. For example, the stabilizing monetary/demand shock with Volcker/Greenspan induced a strong fall in risk aversion, with the Dow going from 800 in 1982 to 12000 in 1999.

10. September 2015 at 16:55

@Major Friedman

Not quite. This is a much clearer “reasoning from a price change” example:

https://thefaintofheart.wordpress.com/2014/10/16/oh-my-when-you-reason-from-a-price-change/

10. September 2015 at 17:26

Excellent words of wisdom from marcus nunes. I cannot add to what the Great Man says, except to say perhaps the drop in oil prices since 2014 is not only due to monetary reasons relating to lack of demand in the USA (if that’s what the GM is saying), but also due to the slow down in China (perhaps unofficially started in 2014?) and the increase in supply from US frackers.

NOTE: Nune’s link to “Visible benefits of level targeting NGDP” is excellent, but you have to take his word for it that the four regimes act they way they do, since it’s not clear how the red circles move from t to t+1. For example, the “Great Inflation” is deemed unstable, but I can easily construct a stable Great Inflation graph if you assume data point t+1 is simply shifted up from t (rather than randomly placed up, down or sideways). Put another way: if money is neutral, people will adjust to inflation and it’s no different than the Great Moderation with zero inflation. Also real US GDP in the 1970s was on some metrics slightly higher than in the low-inflation 1980s, which also underscores money neutrality.

10. September 2015 at 18:16

Ray, if your “intuition” is fogged up, this one has arrows to guide you!

https://thefaintofheart.wordpress.com/2013/10/04/the-great-moderationthe-great-stagnation-not-according-to-phase-diagrams/

10. September 2015 at 20:28

If July to November 2008 has to be a monetary shock this would say you are suggesting that real bond yields increased during that time frame according to this model. What you are looking at for this time frame to validate rising real bond yields?

10. September 2015 at 20:37

Monetary tighening since mid 2014? No, as the graph on the following page shows, the monetary contraction began around January 2014. The only manifestation at the time was the fall in commodity prices.

http://www.philipji.com/item/2015-09-06/a-fed-rate-hike-wont-have-adverse-results-for-now

But there’s probably nothing to fear until the second half of 2016. In 2017 if the contraction continues, we will almost certainly see a crash in financial markets, probably spectacular.

11. September 2015 at 06:15

Rajat, yes.

Ray, It is confusing. Plus means positive impact from negative money shock.

Marcus, I agree that it’s more useful to focus on two shocks.

Chase. Yields on 5 year TIPS soared much higher after July 2008. Some of that may be data flaws, but some is very real.

11. September 2015 at 07:43

@marcus nunes – thanks that link is awesome. Indeed, if your data is correct, it seems the economy is obeying a sort of 40 to 60 year Kondratiev wave with NGDP. https://en.wikipedia.org/wiki/Kondratiev_wave

You should do a paper on this, and perhaps leave out the monetary ‘explanation’, which would undercut the implicit thesis that this is endogenous to an economy and not the result of central bank planning. It’s an interesting pattern.

11. September 2015 at 10:14

Scott, thanks for the reply. It seems to me that the 5 year TIPS speaks to the declining inflation expectations and possibly not necessarily real bond yields. If this is your proxy for real bond yields, I am curious how then the 5 year TIPS is expected to react in the Aggregate Demand Shock scenario?

According to the above chart the inflation expectations are also declining in that scenario which on the face would make you believe TIPS yields would increase as investors pull out of those. However, you are saying that in the demand shock scenario TIPS would not increase. Does this mean you are suggesting that in a demand shock situation people would stay in or buy into TIPS in expectation of the Fed lowering rates as fast or faster than the decline in inflation expectations thereby anchoring or increasing future expected inflation? If that is the case, given EMH doesn’t that mean the expected inflation would have to be positive or at least not negative?

That seems to make the model a non-sequitor or at the very least difficult to explain. What is the scenario that leads to both declining inflation expectations and declining TIPS yields? The only way I can bridge the two is to suggest that TIPS are only a measure of inflation expectations and not real bond yields.

I am certainly not an economist or bond guru so forgive me if this is basic.

11. September 2015 at 14:46

Doesn’t this imply then that a devaluation in the renminbi should matter more to the Fed policy calculus than a 0.2ppt drop in the unemployment rate? That seems a bit off, at least to me.

11. September 2015 at 18:08

Marcus Nunes:

That is also an example.

More obvious than this post, but not unlike this post.

12. September 2015 at 05:09

Chase, I wouldn’t call 5 year TIPS a “proxy” for real bond yields, it is the actual, risk-free ex ante and ex post real yield on 5 year bonds. That’s what it is.

Real interest rates respond unpredictably to both monetary and AD shocks (which I regard as basically the same thing.)

Both inflation and real interest rates often fall when there’s an adverse demand shock, such as the 1930s or post 2007. Falling AD directly reduces inflation, and reduces real rates by dramatically reducing the demand for credit to finance new investment projects.

Neil, They only matter to the extent that they affect the future expected path of NGDP, which will depend on all sorts of other factors.

13. September 2015 at 15:27

Disentangling supply and demand factors behind the oil price drop:

http://econbrowser.com/archives/2015/09/common-factors-in-commodity-and-asset-markets

14. September 2015 at 05:56

Marcus, That’s excellent.