Endogenous money and the QTM (#4)

In the first three posts of the series I sketched out a simple model of inflation and NGDP growth. For large persistent changes in the money supply, M dominates everything else. But inflation reflects both money growth and changes in the real demand for money. So real GDP growth raises real money demand, and hence is deflationary, while higher nominal interest rates reduce real money demand, and hence are inflationary. The later point is not just NeoFisherism; higher interest rates actually cause inflation to be higher than what you’d get from money growth alone. All my claims so far are supported by literally hundreds of money demand studies done in the 1970s and 1980s. This stuff is not controversial for monetary economists who recall the 1970s.

Here in the final post I’ll consider the money/inflation correlation you’d expect when the money growth rate is endogenous. I’ll start with the case of Bretton Woods, which covers the first part of the period in Barro’s table. Speaking of which, I erred in saying Barro used the monetary base; he actually used the currency stock. But I’m quite confident that this distinction was unimportant for the period covered. (Today it would be very important.) I also discovered that he got the data from the IMF. Still not sure if he used differences of logs.

Under Bretton Woods, exchange rates were fixed and this tended to equalize inflation, due to Purchasing Power Parity. But inflation rates were not completely equalized, as the real exchange rates would change over time, due to factors such as the Balassa-Samuelson effect. There would also be gaps between money and inflation, due to differing patterns of real GDP growth and velocity growth. And here’s the key point—there’s no logical reason to expect changes in real exchange rates to be strongly correlated with variations in money growth caused by all sorts of other factors. This means that under Bretton Woods, the variation in inflation rates (which is identical to the variation in real exchange rates) will not be closely correlated with variations in money growth rates.

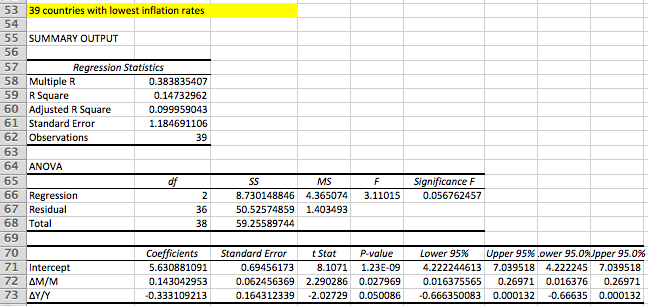

I had Patrick Horan do separate regressions for the top and bottom half of the data set, the 40 countries with the highest inflation rates and the 39 with the lowest. The top half regression had an R2 of over 98%. But here’s what he found in the bottom half:

A very low adjusted R2, below 10%. About the best you can say is that the coefficients have the correct sign.

A very low adjusted R2, below 10%. About the best you can say is that the coefficients have the correct sign.

And the problem isn’t just Bretton Woods, the same thing happens under inflation targeting. If everyone is targeting inflation at 2%, then any variation in inflation will simply represent central bank errors, and will likely not be strongly correlated with variation in money growth rates.

But don’t be fooled by the endogenous money correlations, or lack thereof. Money growth is still driving inflation and NGDP; it’s just that the need to hit certain inflation/exchange rate targets is driving money growth. If a country had decided to have 5% faster money growth, on average, then they would have had to leave Bretton Woods, and they would have had roughly 5% higher inflation and NGDP growth, on average.

Thus the entire “endogenous money” issue is often misunderstood. It doesn’t mean that money growth is unimportant; it just means that if you are targeting something other than money, then money growth is determined by your target. In other words, don’t say, “money growth didn’t cause X, as it’s endogenous”. Your interest rate, or exchange rate, or inflation target caused money growth to cause X. Money growth is still the “real thing”, even if you don’t see it in sophisticated models by Michael Woodford.

Conclusion: A monetarist model that tries to explain NGDP growth and inflation by looking at money growth, real GDP growth and the opportunity cost of holding money does an excellent job of explaining the stylized facts of the Great Inflation, when there was enormous variation in inflation and NGDP growth. And it does so in a way consistent with basic economic theory about how people behave, how they react to changes in the costs and benefits of holding real cash balances. As far as I know, no other model can explain all of these stylized facts. Indeed no other model comes close. I’ll gladly convert to New Keynesianism or Austrianism, or Old Keynesianism, or MMTism, or Marxism, or New Classical economics, or RBC, or any other school of thought, if you can provide a coherent theoretical explanation for these stylized facts. And if not, then please tell my why I shouldn’t keep on being a market monetarist. I’ve got a model that works; why give it up for one that doesn’t?

Tags:

13. August 2015 at 18:08

“And if not, then please tell my why I shouldn’t keep on being a market monetarist. I’ve got a model that works; why give it up for one that doesn’t?”

You already have tenure!

13. August 2015 at 18:15

First three posts? You had two posts label #3, this is the fifth post!

With that being said:

The other part of quote from Prices and Production was “I do not propose to quarrel with the positive content of this theory: I am even ready to concede that so far as it goes it is true”

In other words, Austrians don’t really dispute the fundamental truths of the quantity theory of money. An Austrian would find nothing surprising or unsettling about the data you’ve presented here, so there’s no real conversion to be done on this issue.

To really understand where Monetarism and Austrianism diverge, a good place to start is the dispute with Frank Knight over Capital as a “Crusonia Plant.” Or as Armen Alchian called it “The Knightian Theory of Bombs.”

13. August 2015 at 18:18

You totally should have included this chart with this post, for illustrative purposes:

http://againstjebelallawz.wordpress.com/2015/07/17/bretton-woods-chaos-price-stability/

13. August 2015 at 18:24

Marcus, I just gave it up.

Andrew, Didn’t a lot of Austrians predict high inflation back around 2008-09?

E. Harding, Nice graph.

13. August 2015 at 18:27

“Andrew, Didn’t a lot of Austrians predict high inflation back around 2008-09?”

-Yes, they did, due to the spike in base money.

13. August 2015 at 18:37

Yes, the ones who didn’t anticipate a sharp increase in money demand did. If anything that’s from taking the QTM too literally, not from failing to appreciate it.

13. August 2015 at 18:44

the FT on the rise of cash in bank accounts…

http://www.ft.com/intl/cms/s/0/00f5849e-41b4-11e5-b98b-87c7270955cf.html#axzz3iilHm1B5

13. August 2015 at 19:18

To put it another way, I think many Austrians implicitly adopted a sort of “crude Monetarist” model of money demand, rather than an Austrian one, back in 2008 to make their predictions of high inflation. I believe this was a mistake, and a theoretical mistake at that, but not an error of Austrian theory. Austrians =/= Austrian theory.

13. August 2015 at 19:25

austrians don’t know what austrian theory is, bless them.

13. August 2015 at 19:32

Philippe, totally unhelpful comment.

13. August 2015 at 19:40

sorry, do you need help?

13. August 2015 at 19:41

Yes Phillipe, some Austrians aren’t very good at understanding Austrian economics. That’d be because they’re individuals and not a massive homogenous blob. You know, like Frank Knight thought capital was (Bazinga?).

Evidently it would greatly discomfort you, and tell you that your ideas must be wrong, if anyone who called themselves a member of your school of thought ever failed to consistently apply the lessons that school teaches. Woe unto the methodological collectivists, how frightening it must be to ever belong to a group-what if some of them screw up, thereby discrediting you by association!

Well bless your poor little heart.

13. August 2015 at 19:42

methodological collectivists

lol

13. August 2015 at 19:44

Phillipe, if you’re quite done playing the role of child on the playground, I think your bell rang and you should get back to class. You know, so you can learn how adults discuss things other than team sports and politics.

13. August 2015 at 19:45

lol

13. August 2015 at 20:10

“Here in the final post …” praise the Lord! Sumner will not do a Erdmann fifty-post series trying to square the circle.

“Speaking of which, I erred in saying Barro used the monetary base” – don’t worry, nobody here is checking the data, which, as you imply (“But I’m quite confident that this distinction was unimportant for the period covered. (Today it would be very important.) ” is nothing but Mark Sadowski type ‘data mining’ of the bad kind, trying to find a universal pattern that holds under any time, where in fact none exist (“Today it would be very important”), and finding some sort of pattern that’s temporary (like Friedman’s rule that velocity is constant, which was only true for a few decades post-WWII). They do this all the time with stock market “charting” and finding patterns in random data where none in fact exist. Fooled by Randomness.

“This means that under Bretton Woods, the variation in inflation rates (which is identical to the variation in real exchange rates) will not be closely correlated with variations in money growth rates.”- logically, this also shows that money growth is not correlated with inflation much in the short term–sorry MF–and monetarism is a dead letter, as it relies on “sticky prices” and “money illusion” to work, neither premise being correct in the short term nor long term (sticky wages are slightly different, but not by much).

“I had Patrick Horan” — again? Poor guy, he’s Sumner’s intern vassal.

“But don’t be fooled by the endogenous money correlations, or lack thereof. Money growth is still driving inflation and NGDP; it’s just that the need to hit certain inflation / exchange rate targets is driving money growth. ” – ok if you say so, sorcier-docteur, we believe you, like the Pope believed Ptolemy.

“Thus the entire “endogenous money” issue is often misunderstood. It doesn’t mean that money growth is unimportant; it just means that if you are targeting something other than money, then money growth is determined by your target. In other words, don’t say, “money growth didn’t cause X, as it’s endogenous”. Your interest rate, or exchange rate, or inflation target caused money growth to cause X. Money growth is still the “real thing”, even if you don’t see it in sophisticated models by Michael Woodford.” – priceless. In this entire series not once was ‘endogenous money’ clearly defined, as I said before, now Sumner is conceding it’s the Achilles Heel of his theory, and that Woodford’s models don’t account for it (Woodford apparently does not even cite Sumner for anything in his public pronoucements, showing how little he thinks of this Great Man).

“I’ll gladly convert to … Marxism… if you can provide a coherent theoretical explanation for these stylized facts.” – Money neutrality. It explains everything; please tell me what it does not explain? You’re officially a Marxist now.

13. August 2015 at 20:30

Philippe — Agree, Ray is no longer the most entertaining commenter.

Scott — thanks for this series. I hope these are going in the education section here, I’ll have to read them again.

13. August 2015 at 20:37

TallDave, you should really grow up, too.

The quality of commenters here is so bad they can’t even tell the difference anymore.

13. August 2015 at 20:53

If I grew up I’d have to leave the playground. There are laws about that now.

13. August 2015 at 20:57

Yeah and engaging in point scoring and mocking people by team affiliation is something you can only do there, right?

I suppose if all you have is your immaturity it would be rude to take it away from you.

13. August 2015 at 21:20

Christ, Ray. Come up with a theory of the determinants of NGDP, the price level, and interest even half as coherent as Sumner’s. Maybe we’ll listen.

14. August 2015 at 04:04

Philippe, I miss seeing you on Bob Murphy’s blog. Shining a light in the deepest caves of ancapistan is what you’re best at. Is there anywhere else you normally comment these days?

Ray, if you keep posting diatribes that don’t make any sense I’m going to start assuming that you developed a secret crush on Scott because the Philippino love girls aren’t satisfying you anymore. It would explain a your weirdly personal obsession with Sumner.

14. August 2015 at 05:27

Andrew, I’d say that’s from using the simplistic version of the QTM that ignores changes in money demand. I’m NOT defending that model.

ptk, The media often defines “cash” to include bonds.

Ray, That’s right, 79 countries over 30 to 40 years is data mining.

14. August 2015 at 05:45

Right Scott, you’re not defending it, and neither would I.

14. August 2015 at 05:56

Scott,

Monetarism and Austrianism are both relevant. Classic Keynesianism has been supplanted by Monetarism. New Keynesianism is garbage.

Monetarism is best for identifying what has happened and what SHOULD happen. Want to know if an economy is struggling? Look at the monetary signals. But if one wants to understand WHY an economy has struggled or how to make an economy work better one needs to be an Austrian. One has to look under the surface and understand what is broken and then provide the market incentives to have the problem fixed.

I equate Monetarism and Austrianism to the problem of airplane crashes – the Smithsonian channel has a fantastic program called “Air Disasters” where each episode explores the causes of flight failure, I strongly recommend viewing it.

Monetarism equates to the fundamentals of flight, such as the air speed, the angle of attack, the engine power, the rate of climb or descent and the direction of flight. This instrumentation reveals whether or not the airplane is flying efficiently and, if not, where one might look to better understand the problem. But the question of flight failure can only be answered by in depth analysis and understanding of specific airplane functions. This is Austrianism.

Austrianism says that certain things need to happen in an economy for economic growth to occur. Without people and institutions functioning with good economic incentives there will be no lift off.

Monetarism says that an economy must be given the money (ie the power) to lift off. This is true. A well maintained plane will not soar if it lacks fuel. However, a plane with failed control surfaces will crash, no matter how much power is supplied by the engines. Both form and function are required for successful flight. So it is with an economy.

14. August 2015 at 06:23

Scott — it’s an important distinction, I had a brief scary moment early in the series where I momentarily thought you were endorsing backing theory 🙂

Good points Dan. I have a lot of sympathy for the Austrians because they’re far less wrong than the Keynesians or (God help us) MMT or ITE. The non-appearance of inflation led a problem similar to what’s happened to Democrats since 2010 — as moderate members fall out of a movement, those left tend to be the most inflexible ideologues, leading to Bernie Sanders on the one hand and the scourge of Internet Austrianism on the other.

BTW Sam Bowman’s piece on NGDP targeting is one I hadn’t seen before and a great primer. Covers all the basics and even works in an appeal to free banking.

14. August 2015 at 07:15

Sumner: “Ray, That’s right, 79 countries over 30 to 40 years is data mining.” – a large sample size is needed for convincing data mining. You’ve shown nothing in this series except the well known truism that as an economy grows, the base money supply also grows, which you confuse cause and effect by reversing the causation.

The most telling example of why monetarism fails is the increase of the Fed Reserve reserves from under $1T before 2008 to over $4.5T today, in seven years, yet the economy has stagnated. Explain that. Yet if you assume money is neutral, it’s easily explained: no amount of base money increase will change anythihg in the real economy (short or long term). Demand by the public (banks’ customers) determines what the banks get from the Fed, not the Fed dictating to the banks as you seem to think.

14. August 2015 at 07:27

@ Ray Lopez

-4 trillion is tiny in the grand scheme of things. You seriously think if the Fed printed 400 trillion, that wouldn’t affect anything?

14. August 2015 at 07:43

Oh now I see why TallDave is so abusive, he’s mistaken me for an “internet Austrian” because I happen to be an Austrian and on the internet.

Hey, TallDave, let’s make up, okay? I have a good idea how, too: we can both agree that Lopez is a crackpot who really doesn’t know what he’s talking about.

14. August 2015 at 08:28

TallDave, Thanks for bringing up NGDP targeting. Dr. Sumners series on QTM is really great and educational BUT, is QTM really THE reason he is a MM as he says? I always thought it was the healing power of NGDPLT that made one a MM.

Sam Bowman’s piece is OK but he uses some rather poor (or poorly described) examples to make his point IMHO. For example if there is a negative shock in oil supply he says we need inflation to drive prices up. Really? Market pricing doesn’t work for oil? Ok, he probably meant that that if oil prices take a sudden step upward other prices need to fall and absent some inflation, getting those prices to fall is hard and the actual short run result might be unemployment, but, I hope you see what I mean about poor examples.

In any event I’m hoping in the future that Dr. Sumner will treat us to a similar series on NGDP targeting. I’d really like to hear about the recession of 1973 and NGDP. I’m not trolling – honest – I’d just like to learn more about the full theory of NGDPT.

14. August 2015 at 08:54

@Capt. J Parker: “‘m hoping … that Dr. Sumner will treat us to a similar series on NGDP targeting.”

Have you read his National Affairs article, Re-Targeting the Fed?

14. August 2015 at 08:56

Parker — I think it’s fair to say there are versions of MM that don’t endorse NGDP targeting by a CB, e.g. the free banking example, but they generally approximate it.

Scott has actually used the oil shock example too, and it’s a good one to think through. I agree market pricing works fine, but as you say, if oil prices rise dramatically, one of two other things has to happen: overall prices have to rise or the Fed has to force them down with some flavor of monetary contraction. Almost no one thinks monetary contraction is a good idea in that circumstance. And that leads to an interesting conclusion: almost no one really believes in inflation targeting. Inflation targeting is just a less complete solution than NGDPLT.

NGDPLT is an interesting animal, Scott’s FAQs are helpful too.

14. August 2015 at 09:02

@Dan W.: “Both form and function are required for successful flight. So it is with an economy.”

I think your intuition serves you well, that there is more to the economy than just NGDPLT. But I think you’ve come to the wrong conclusion.

The distinction you should be making, is between supply-side factors, and demand-side factors. Market Monetarists are concerned with stabilizing the demand-side, with having the central bank chart a steady path of aggregate demand NGDP growth.

You’re absolutely right, that economies are also affected by supply-side factors. Regulation, minimum wage laws, occupational licensing, copyright and patents, construction zoning, etc. etc. etc.

Your mistake, though, is thinking that “Austrianism” is the only feasible analysis of the supply-side of the economy. Just because MMs don’t talk much about the supply-side, and Austrians do, doesn’t mean that the best economics is somehow a merger of the two. It’s fine to have a separate conversation about supply-side economics, but there are far better choices there than Austrianism.

14. August 2015 at 09:04

@TallDave-Free banking is not a form of Market Monetarism. The fact that freedom of note issue and removal of other regulations on banks would lead to nominal stability is a positive prediction of the theory of laissez faire in banking, it is not a normative recommendation.

Moreover, the “Market” in Market Monetarism specifically refers to the use of Futures Markets for NGDP to guide monetary policy. Freedom in banking obviates any need to create such a thing.

The only relation freedom in banking has to Market Monetarism is that Market Monetarists believe a Central Bank can be trained to imitate free banking. In calling free banking an approximation to Market Monetarism, you got this exactly backwards!

14. August 2015 at 09:52

The MM wiki is also pretty good. https://en.wikipedia.org/wiki/Market_monetarism

Andrew_FL — See Bowman’s link above. Haven’t expressed an opinion as to whether free banking actually would or could approximate NGDPLT but Sam’s not the only one to suggest that MM would support free banking on that basis.

14. August 2015 at 09:59

“Moreover, the “Market” in Market Monetarism specifically refers to the use of Futures Markets for NGDP to guide monetary policy. Freedom in banking obviates any need to create such a thing.”

That’s not quite true. Even under free banking, even in an anarcho-capitalist society, there would be some sort of base money regime. I’ve read/heard George Selgin make that point. An NGDP Futures Market is one sort of regime, a k% rule is another, having a frozen base is another etc. Obviously, in an an-cap society, the regime wouldn’t exist because of state enforcement.

14. August 2015 at 10:12

@TallDave-Bowman says “nominal GDP targeting is probably the closest we can get to ‘stateless’ money while having a central bank.” In otherwords Bowman said exactly what I said: Market Monetarists believe Central Banks can be trained to imitate free banking.

But don’t listen to me, listen to the man who coined the name “Market Monetarism”:

“I have often argued that NGDP targeting is a way to emulate the outcome in a truly competitive Free Banking system”

Emphasis added, from here:

http://marketmonetarist.com/2012/04/11/is-market-monetarism-just-market-socialism/

As for whether it would or could, lead to nominal stability, even though you’re still thinking about it the wrong way ’round, a good place to start is Selgin’s The Theory of Free Banking, or, if you prefer equations to economics, Free Banking and Monetary Control.

Important point: nominal stability is a positive prediction of Free Banking Theory given stable behavior of base money. Free Banking cannot create nominal stability if you have a discretionary central bank. But you can dispense with a central bank altogether and have a computer program determine the quantity of base money. Or you could use gold, and it might be that computer programs don’t improve on gold much. But I suspect they could.

14. August 2015 at 10:14

Yeesh, I didn’t close my italics tags right there. Only the word “emulate” should be emphasized in that sentence, sorry.

14. August 2015 at 10:18

@W. Peden-You’re right that Free Banking is not a base money regime. But you don’t need an NGDP futures market to have a stable base regime. You need an NGDP futures market to know whether your base money policy is too tight or loose, given instability of the money multiplier and velocity. Under free banking, the behavior of the effective money stream is roughly the same as the behavior of base money, meaning there’d be no difference between following an NGDP rule and a % change rule.

Also, while I have some An-Cap friends, I’m not an Anarchocapitalist. Swing and a miss there.

14. August 2015 at 10:24

I might also add that assuming an Austrian must be an anarcho-capitalist would have seemed especially odd to…well, pretty much everyone who called themselves an “Austrian” before Rothbard. Menger was not an Anarcho-capitalist, Bohm-Bawerk was not an Anarcho-capitalist, Weiser was a socialist, Mises was not an Anarcho-capitalist, and Hayek was not an Anarcho-capitalist.

Whether Rothbard’s libertarian ethics are correct or not, however, they have nothing to do with economics per se.

14. August 2015 at 10:52

Ray, You said:

“You’ve shown nothing in this series except the well known truism that as an economy grows, the base money supply also grows, which you confuse cause and effect by reversing the causation.”

Nope, I made just the opposite claim, that growth in the money supply has no long run impact on the economy’s growth.

That’s sort of a new low, even for you.

You said:

“Explain that.”

I think I did explain that, in the #3 post in the series.

Captain Parker, I have many papers on NGDP targeting that you can google. The National Affairs piece, the Mercatus piece, the Cato piece.

14. August 2015 at 10:54

Andrew FL,

I didn’t want to suggest that you’re an anarcho-capitalist. It’s just a useful way of illustrating the relation (or lack thereof) between NGDP futures markets and a state-owned central bank.

You don’t NEED an NGDP futures market for any policy particular monetary policy goal. That’s not to say that it doesn’t have stabilising properties in a given monetary base regime.

14. August 2015 at 10:59

Don Geddis and TallDave, Thanks, I need to study that Nat. Affairs article. At first pass though it didn’t seem give me any more than what I thought I already knew from reading this blog namely: 1)Sticky prices are bad during negative shocks and inflation un-sticks them and 2) NGDP and RGDP “tend to move together in the short run.” I want to believe in NGDPLT. I do. But, the little red guy with the horns on my shoulder keeps saying: Isn’t #2 just correlation? don’t you need a more rigorous basis for designing policy? and #1 might seem right, all the New Keynesians agree with it but, what about 1973, What caused that recession? Were not prices and wages very non-sticky then with 8% inflation? Why wouldn’t prices quickly adjust after an oil price shock when you had 8% inflation, sparing you from a contraction in RGDP? Would NGDPT have made any difference in 1973?

14. August 2015 at 11:01

Scott,

Am I correct in understanding that, in principle, your market monetarist model could be written down mathematically, but you just haven’t done it?

14. August 2015 at 11:10

@W. Peden-NGDP futures markets as a guide to base money policy is a base money regime. You can’t have it with “different” base money regimes!

NGDP targeting is stabilizing given a particular banking regime, relative to other base regimes. Given a free banking regime, there’s no difference, or very little difference between NGDP targeting and a % rule regime.

People in an Anarcho-capitalist state wouldn’t set up an NGDP futures market. Scott knows this, that’s why he wants one to be subsidized by the state. An anarchocapitalist society wouldn’t measure NGDP at all, so they could hardly have an NGDP futures market!

The base money regime of an anarcho-capitalist society is ambiguous, and contingent on the historical environment. As Menger observed, a commodity would emerge as base money out of barter. But transitioning to Anarcho-capitalism from a modern, fiat money state is not emerging from barter. More likely I think people would continue to use dollars as they’re base money. Why do I think that? Apart from the fact that it seems to follow from the regression theorem, that’s exactly what happened with the Somali Shilling when there was no longer a Central Bank to “support” it. A new base money might be adopted by people later if it served their needs better than the base money of the now non-existent central bank. In our modern society I’d say it’s very likely that if they did switch to something else as base money, it’d be something like a synthetic commodity “money”-a “cryptocurrency” like Bitcoin (but not Bitcoin, Bitcoin’s a bad example of a good idea). I actually think it’s very unlikely people would voluntarily readopt gold, which is either a shame or for the best depending upon your point of view.

14. August 2015 at 11:10

Captain, The economy was under wage/price controls in 1973, so no, they were not very “non-sticky”. BTW, most of 1973 was a boom year, until the end.

However I do agree that NGDP targeting would have made less difference in 1974 than in other recessions. i think it always would have been a bit better, but 1974 is where the improvement would have been least pronounced.

Ilya, A general equilibrium model would be tough to write down, as there is a sort of “indeterminacy problem” with fiat money. But certainly you can do partial equilibrium, which is the approach preferred by Milton Friedman. I agree with Friedman, and disagree with much of modern macro, which focuses on the general equilibrium approach.

14. August 2015 at 11:13

Andrew, I agree with you on base money, an anarcho capitalist society in Canada would almost certainly use US dollars if the Canadian government was abolished.

14. August 2015 at 11:49

Scott-If the Canadian Government was abolished, why wouldn’t they use-at least initially-Canadian dollars? Abolishing the government doesn’t require burning all the government money!

14. August 2015 at 12:00

Sumner is playing games, twisting words. You decide, see below.

Sumner in #3 post: “Nominal GDP growth depends on two factors, money base growth plus the change in velocity. And velocity is a function of the nominal interest rate.” –

Sumner in response to Lopez: ” (Lopez): “You’ve shown nothing in this series except the well known truism that as an economy grows, the base money supply also grows, which you confuse cause and effect by reversing the causation.” (Sumner)”Nope, I made just the opposite claim, that growth in the money supply has no long run impact on the economy’s growth”

1) so Sumner claims his views jive with mine? That as an economy grows, so does the base money supply? Ok, fine, we are in violent agreement. But in #3 post Sumner implies that Nominal GDP growth “depends on” base growth plus velocity. That’s fine, if Sumner makes clear these are dependent variables, that depend on the state of the economy, the state of the economy being the independent variable.

Concede that, and I go away. Just say it and I’ll claim victory: ‘the state of the economy –and the people who comprise it–determines both base money growth plus velocity, and these two parameters determine NGDP’.

Say it and I go away. And I do a victory dance.

@ E. Harding: as Nick Rowe pointed out, Fed printing $100T dollars of course would change nominal or real GDP–hyperinflation is the exception to money neutrality/super-neutrality, if there’s some significant money illusion and menu costs, as is likely with hyperinflation. I can see however that overnight saying “every dollar bill is now revalued at $1M and so on, with $10 =$10M” would change nothing except the prices and create some small menu cost adjustments and money illusion amongst the most ignorant (IQ 80 and below) population. It’s all a matter of how the price changes are done.

@sumner – what exactly is the ‘indeterminacy’ problem that prevents general equilibrium? And why are you so confident of partial equilibrium instead? Isn’t this just fancy talk to cover up your ignorance of rigorous math models? M. Woodford might agree? Anyway, do please make the admission above and I go away. I’m not here to belittle you. I’m just here to expose you as a fraud. Thanks btw for not kicking me off your blog–yet.

14. August 2015 at 12:20

Andrew FL,

An NGDP futures market is not, in itself, a base money regime, anymore than any other futures market is a base money regime, and its use for information is consistent with a wide range of base money regimes.

The rest of your post is inconsistent-

“People in an Anarcho-capitalist state wouldn’t set up an NGDP futures market…”

– but then-

“The base money regime of an anarcho-capitalist society is ambiguous, and contingent on the historical environment.”

I agree with the second quote, but the first is unsubstantiated conjecture.

14. August 2015 at 12:25

@W. Peden-Given that NGDP is a statistic collected by Government bureaucrats I don’t see how you could dispute the first quote.

With regard to your first statement, I wasn’t precise in my language: base money policy set by an NGDP futures market, is a base money regime. Thanks for making it clear my phrasing was confusing.

14. August 2015 at 12:35

“higher interest rates actually cause inflation to be higher than what you’d get from money growth alone”

I’m not trying to be a quibbler, but I’d like to confirm for my understanding. That would be “higher market interest rates”, right? Higher rates for IOR are contractionary, so they’d reduce inflation?

Thanks.

14. August 2015 at 13:40

Andrew_FL — Yes, and Nick Rowe actually endorsed free banking for Argentina at one point. So MM doesn’t insist on CBs, and thus FB can be one form of MM, or at least a policy MMs find consistent with MM.

14. August 2015 at 13:48

Dr. Sumner, Thanks Much. Wage and Price controls! Shame on me for forgetting that.

14. August 2015 at 13:54

@Ray Lopez: You are confused, because you have been very sloppy about distinguishing between nominal growth and real growth. They’re very different things, and any time you see (or write!) a statement about growth or GDP, you need to be extremely clear about whether you mean nominal, or real. Instead, you regularly confuse the two, and hence everything you say is confused.

“Concede that, and I go away. … Say it and I go away. … and I go away.”

Do you promise? But of course, you’ve lied about this same vow of silence in the past, and your promise was only as meaningful as taking a hunger strike between lunch and dinner.

14. August 2015 at 14:21

@ TallDave-It would be more accurate to say that there is overlap between advocates of free banking and advocates of Market Monetarist policy recommendations. Your attempt to imply that free banking is just a “kind of market monetarism,” however, is mistaken. It is not any kind of market monetarism. It happens to be an institutional framework the predictions of the theory of which overlap with the normative recommendations of market monetarists.

The idea that nominal stability created by a central bank targeting NGDP is the same thing as nominal stability that arises as an emergent property of market phenomena and individual action, as under freedom in banking, is a kind of reverse fallacy of composition.

14. August 2015 at 15:55

TallDave: “Andrew_FL “” Yes, and Nick Rowe actually endorsed free banking for Argentina at one point.”

Good Lord! Did I? (I’m not denying it, but I really can’t remember, which is what worries me.)

Maybe I thought there is no way it could be worse than actual Argentinian monetary policy, which sounds a fairly sensible position.

George Selgin and his buddies seem to me to be quite credible on the subject, but I’m not fully convinced yet.

NGDP targeting seems to me to be a reasonable approximation of what the supporters of free banking say free banking would do.

14. August 2015 at 16:46

Rowe wrote:

“NGDP targeting seems to me to be a reasonable approximation of what the supporters of free banking say free banking would do.”

That’s like saying a eugenics program of forced conceptions, sterilizations and abortions that leads to a 1% annual population growth is a reasonable approximation of what would take place in a free society.

Yeah, maybe the growth rates are roughly equal, but not all equal NGDP growth rates are truly equal.

The goal of free banking is not to achieve a fixed growth rate in total spending, so comparing NGDP targeting to free banking on the basis of the growth rate, is incredibly misleading.

14. August 2015 at 17:12

@Nick Rowe, I think he’s confused you for Nicolas Cachanosky for…some reason.

Personally, I’d take that as a compliment.

MF phrased what I was going to say a little um…more colorfully than I would probably say it, but basically, I’d say if you want to better understand the difference, between approximating the macro outcome, and the macro outcome emerging out of micro processes, a good place to start on the argument is Alex Salter’s Not All NGDP is Created Equal. I would also point to an interesting discussion that occurred on Bob’s blog a while back. This was my final summing up:

http://consultingbyrpm.com/blog/2014/11/yes-scott-sumner-is-the-ngdp-guy.html#comment-1335152

“Bingo. If *some* people have an increased demand to accumulate cash balances, you don’t solve the problem by supplying cash to completely different people. And that’s why a Central Bank doesn’t really solve the problem.”

14. August 2015 at 17:13

“Given that NGDP is a statistic collected by Government bureaucrats I don’t see how you could dispute the first quote.”

Hmmm, that’s a bit like saying “Law is administered by government bureaucrats, so there would be no law in an anarcho-capitalist society”.

14. August 2015 at 17:44

@W. Peden-It’s a bit like it as in, those sentences seem similar, cause you constructed them to have similar structure (or, rather, you constructed the second to sound similar to the first). But the two aren’t really the same thing. You really think that if the government had commissioned econometricians to invent the concept of NGDP that it would have been invented and monitored by private individuals Really? Why?

14. August 2015 at 17:49

W. Peden:

“Hmmm, that’s a bit like saying “Law is administered by government bureaucrats, so there would be no law in an anarcho-capitalist society”.”

Not really, it would be like saying we can’t trust the law when it is administered by government bureaucrats.

NGDP would still exist in an anarcho-capitalist society. It would be market driven, as it should.

14. August 2015 at 17:51

Andrew FL,

So now the claim is “If government officials hadn’t (?) invented the concept of NGDP, then there’s no reason to be certain that it would have been invented and monitored by private individuals?”

THAT claim seems very plausible to me.

14. August 2015 at 17:53

@MF-It would still exist, as an abstract concept one could estimate in theory. In practice there would not be much attention paid to actually measuring it, which is the point under dispute. For some reason W. Peden seems to think people in an Anarcho-capitalist society would have any interest whatsoever in collecting macro-economic statistics.

14. August 2015 at 17:55

MF,

If that was the argument, then it would just an argument for a different conclusion.

My claim has been that an NGDP futures market is compatible with free banking and it is necessary for some base money regimes under free banking. I’m not interested in debating any other related issues, or defending some stronger claim that I don’t believe e.g. that an NGDP futures market would certainly have developed in an anarcho-capitalist society.

14. August 2015 at 17:56

@Andrew_FL: “NGDP … would have been invented and monitored by private individuals Really? Why?”

Because demand shocks explain the elevated involuntary unemployment that results from recessions. So it’s a useful concept to track, whether or not there is any organization with both the power and responsibility to target aggregate demand.

14. August 2015 at 17:59

“For some reason W. Peden seems to think people in an Anarcho-capitalist society would have any interest whatsoever in collecting macro-economic statistics.”

To borrow a phrase, swing and a miss.

14. August 2015 at 17:59

W. Peden,

Oh don’t get me wrong, I don’t think what I said was the argument, just that I believe it is more similar than what you said, that’s all.

I mean, you didn’t intend for your analogy statement to be the actual argument Andrew made, I hope.

I fully agree with your second paragraph there about what your claim is.

14. August 2015 at 18:03

@W. Peden-“My claim has been that an NGDP futures market is compatible with free banking and it is necessary for some base money regimes under free banking.”

This statement makes no sense. Either the NGDP futures market determines the base money regime or it doesn’t. If it does, it is the base money regime. If it doesn’t, then how the heck can it be “necessary” for the base money regime?

Again: you don’t need an NGDP futures market to guide base money policy if the money multiplier tends to offset shifts in money velocity (that is, with BmV=PT, changes in m tend to offset changes in V under free banking, meaning that PT is determined by the path of B), because an NGDP target is, under such a system, the same thing as a % rule for the monetary base. Do you understand?

14. August 2015 at 18:06

@W. Peden-do you have any knowledge whatsoever about the history of GDP and now it was developed, and by who and for what reason? You should perhaps read up on it.

14. August 2015 at 18:06

Geddis:

“Because demand shocks explain the elevated involuntary unemployment that results from recessions.”

When will you accept that this is not an explanation at all, since it strips demand away from its causes and puts it into some abstract floating realm of thought where changes to it are decidedly unexplained “shocks”?

And if an employer does not want to hire workers at prevailing prices, and demand, such that unemployment temporarily falls, this is not involuntary. It is very much voluntary. If I decide not to pay you, that is voluntary.

Involuntary unemployment occurs when people are forced to not enter into wage contracts at the threat of aggression, who otherwise would have agreed to enter such contracts.

There is aggression in minimum wage laws, and the existence of central banking. Not demand changes. Saying the Fed did not inflate enough to reverse the effects of rising cash preference, is not an explanation of what caused the rising cash preference.

You seem to value “power”, as all socialist minded people do. That some people using aggression to erase and eliminate the values others would have successfully sought, so as to achieve their own values, which is totally unlike a market where values are mutually achievable.

14. August 2015 at 18:09

Andrew,

W Peden is just saying that an NGDP futures market is possible in a market setting.

He didn’t say it was “necessary”.

It is possible for you and I to exchange a futures contract based on expected future outcomes of NGDP.

There are futures markets in all kinds of things.

14. August 2015 at 18:26

@MF-The word necessary appear in the sentence “”My claim has been that an NGDP futures market is compatible with free banking and it is necessary for some base money regimes under free banking.”

I would appreciate if he could explain what base money regimes he has in mind. As in, more than one, other than one in which the price of NGDP futures is an explicit term in a rule that determines base money behavior. And I want him to explain what his theory of how free banking would work under such a base money regime that would be any different from a % growth rule for the monetary base.

But yes, I suppose some academics would go through the trouble of trying to collect NGDP so they could make bets on it’s future behavior. I might be a matter of niche interest. But it is only a matter of interest for academics because it was invented as a statistic (and not a theoretical concept which exists “out there”) first. And that was done, essentially, by governments, for governments.

14. August 2015 at 18:46

Agreed.

One of the unintended consequences, or perhaps I should say a necessary evil, within the choice of governmental encroachment and bureaucratization, is the increasing reliance on statistics and correlations, and the decreasing study of cause and effect.

14. August 2015 at 19:25

Excellent series, well done.

14. August 2015 at 19:42

@Don Geddis – as we have discussed, and I repeat it here: NGDP = RGDP + inflation. But the problem is, there’s no nexus between RGDP and NGDP in the short run (nor long run as Sumner concedes). “A little bit of inflation will help real growth” was a post WWII rule-of-thumb that the Keynesians tried to make something out of, as did Phillips curve fans, but it broke down.

The simplistic mandra that loose money is good for growth that you and Sumner expound is found here: Cato Policy Report, November/December 1999, Vol. 21, No. 6, Does Growth Cause Inflation?, by David R. Henderson [growth lowers inflation says DRH… cough, cough]

The more sophisticated reality is found here (see literature review):

Testing the Link between Inflation and Economic Growth: Evidence from Asia Vol.4 No.2, February 2013, Pradana M. Bandula Jayathileke, Rathnayaka M. Kapila Tharanga Rathnayake: “Reference [9] shows that inflation has no impact on eco- nomic growth except the situation where the inflation rate is over 40% that has negative impact on economic growth. Similarly, Reference [10] found no evidence to establish any meaningful relationship between inflation and economic growth by studying 70 countries for a pe- riod of 1960-1989. [9] M. Bruno and W. Easrerly, “Inflation Crisis and Long Run Growth,” Journal of Monetary Economics, Vol. 41,No. 1, 1998, pp. 3-26. [10] S. Paul, C. Kearney and K. Chowdhury, “Inflation and Economic Growth: A Multi-Country Empirical Analy-sis,” Applied Economics, Vol. 29, No. 10, 1997, pp. 1387-1401

Repeat after me: economics is random, money is neutral, and the ‘rules of thumb’ that you use work (if at all) only for a handful of countries over a short period of time, then they disappear. These rules of thumb are not iron-clad laws.

BTW I find in amusing that our host ‘pounds the table’ with certainty over NGDPLT when it’s never been applied in practice. I guess in his mind’s eye it must work, or, he’s just a Pied Piper pandering for publicity.

14. August 2015 at 19:53

@myself – just in case you’re wondering what the Indian authors found in their grammatical mistake prone econometrics “Granger causation” paper (which our own Mark A. Sadowski would enjoy): “The results reveal that there is a long run negative and significant relationship between the economic growth and inflation in Sri Lanka. Whereas no statistically significant relationships were found between the variables in China and in India, a negative and significant short run relationship was found for China. The causality results reveal that there is a unidirectional causality that runs from the economic growth to the inflation in China”

And btw the paper that found no link between growth and inflation of course has co-author the famous economist Easterly…if you don’t believe me, take it up with him.

PS–I am fully aware of Sumner’s metaphysics that “inflation is not necessarily a consequence of NGDPLT”. But this is to a large degree chicanery. Since NGDPLT has never been applied ever, it’s metaphysics to make this argument. It’s like me saying: “Communism works, but it’s never been applied correctly”. “True” if you accept my premise ‘never been applied correctly’. But bunkum otherwise, like NGDPLT.

14. August 2015 at 20:48

Thought experiment: if 100 anarcho-capitalists undertook a one way mission to Mars to establish an anarcho-capitalist utopia on the red planet, how many would survive the trip, would the survivors still be anarcho-capitalists upon arrival, and what would their utopia be like in 1 year, 10 years and 100 years out? Last question: volunteers?

@Nick Rowe,

“Good Lord! Did I? (I’m not denying it, but I really can’t remember, which is what worries me.)”

Yes, and then there was our bet… don’t you recall? I wasn’t going to mention it again, but you do owe me $10,000 ($US). Plus interest. Oh, what the hell, I’ll waive the interest.

14. August 2015 at 21:21

Nick — yep, that was about the gist of it. Although I probably confused you with Lars. Sorry! I think this was what I remembered.

http://marketmonetarist.com/category/free-banking/

Andrew_FL — Actually someone had just asked whether MM necessarily required a CB to carry out NGDPLT. The sine qua non of MM seems to be a stable NGDI trend, however that happens.

14. August 2015 at 21:34

@myself – re my “PS” – I’m not saying Sumner is correct, I’m saying Sumner is likely to say, for those countries where inflation and high growth occurred, that the central bank “got it right with money creation” (whether high or low inflation, it does not matter) and in those countries showing the opposite that the central bank “got it wrong”. But this is chicanery, for two primary reasons: (1) Sumner must propose a model where we can test money expansion (be it M1, M2, M3, and they will have different results, as Friedman woefully found out, as did Volcker) and RGDP; (2) since money is neutral, any such model from (1) is likely simply the central bank responding to an expanding economy, there’s nothing novel about that, but to understand this point you must believe in money neutrality.

14. August 2015 at 22:27

I don’t get it, Scott. Here’s my simple-minded approach:

Totally differentiating the quantity equation and manipulating terms yields

dP/P = dM/M – dY/Y + dV/V

So if changes in velocity are small, money growth will have a coefficient close to plus one and real output growth will have a coefficient close to minus one. This seems to hold for the high-inflation subsample of countries. Plausibly, when inflation is extremely high, money is already a hot potato, V is maxed out, so dV/V = 0.

For the low-inflation subsample, there’s more wiggle room for V to change. For both coefficients to be so much closer to zero, it must be that money growth and real output growth are associated with sharply countervailing changes in V: increased money growth and increased growth in real output are both associated with increases in velocity. I think there’s a straightforward causal story here. A hike in inflation from more rapid money growth increases velocity by making money costlier to hold. A spurt in output growth increases velocity because there’s more stuff to buy at unexpectedly low prices.

But I don’t get what any of this has to do with “endogenous money,” other than possibly a hypothesis that it’s the central bank’s mucking around that is generating these shocks. That may be true for some or many of the shocks, or all, or none. It seems to me to be a logically separate hypothesis that has nothing much to do with the QTM.

15. August 2015 at 00:55

“Either the NGDP futures market determines the base money regime or it doesn’t. If it does, it is the base money regime. If it doesn’t, then how the heck can it be “necessary” for the base money regime?”

That X is not identical to Y doesn’t mean that X isn’t necessary for Y. There could be a base regime in which NGDP futures play a partial but not total role in determining the quantity of base money.

I don’t disagree with anything else you say in that comment, and it’s not inconsistent with anything I’ve said.

Major Freedom,

“W Peden is just saying that an NGDP futures market is possible in a market setting.”

Spot on. For all I know, there would or wouldn’t be such a market. I don’t have any tools with which to predict, at that level of detail, what things would be like in a radically different society, but there’s no incompatibility between free banking and NGDP futures markets, even in a pure free market society.

15. August 2015 at 02:35

Well…the Fed should go to $50 billion a month QE as conventional policy and stop IOER. I wonder in QE monetization of FICA taxes would fly (holiday on FICA taxes).

That’s my summation of these Sumner posts, which I found difficult to understand. So I agree, pass the liquor, go to the mattresses, and gun the money presses until they get us.

15. August 2015 at 05:38

Andrew, I think counterfeiting (which would presumably be legal with no government) would become a problem. If counterfeiting remained illegal then the Canadian money might circulate until it wore out. In the long run I strongly believe they’d use US dollars.

Ray, Don’t tell me that you don’t even know that the phrase “the economy grows” refers to RGDP? Surely you know at least that? NGDP is not “the economy”, it’s a way of measuring the value of money.

Bill, That’s right, higher market rates.

Thanks tkojejohngalt

Alex, I would argue exactly the opposite–velocity is more variable at high inflation rates.

Obviously there are many interpretations possible, but given what we know about Bretton Woods and (more recently) inflation targeting, the endogenous money story seems to be the most natural way of explaining the weaker correlations. I doubt that changes in M would have much long run effect on V or Y at low inflation rates.

15. August 2015 at 06:32

@sumner – the phrase “the economy grows” did not appear anywhere, so I’m not sure what your point is.

Please comment on the below. Given no nexus between economic growth and inflation, what does that say about NGDPLT?

Thanks. – RL

“Reference [9] shows that inflation has no impact on eco- nomic growth except the situation where the inflation rate is over 40% that has negative impact on economic growth. Similarly, Reference [10] found no evidence to establish any meaningful relationship between inflation and economic growth by studying 70 countries for a pe- riod of 1960-1989. [9] M. Bruno and W. Easterly, “Inflation Crisis and Long Run Growth,” Journal of Monetary Economics, Vol. 41,No. 1, 1998, pp. 3-26. [10] S. Paul, C. Kearney and K. Chowdhury, “Inflation and Economic Growth: A Multi-Country Empirical Analy-sis,” Applied Economics, Vol. 29, No. 10, 1997, pp. 1387-1401

15. August 2015 at 08:38

You can spend USD in Canada right now. As Canadians find their dollars acceptable in northern tier states like Washington.

15. August 2015 at 09:13

@Ray Lopez: “the phrase “the economy grows” did not appear anywhere”

Sumner was referring to your own previous silly comment, where you quote Sumner referring to “the economy’s growth”, and then proceed to clearly confuse nominal vs. real GDP, as I already told you once.

It’s hard having a conversation with someone who can’t even remember what he himself wrote.

15. August 2015 at 09:31

@Major.Freedom: “If I decide not to pay you, that is voluntary.”

Sure, but of course that’s not what the phrase “involuntary unemployment” means, so your comment is irrelevant. The phrase refers to skilled workers who are willing to work, but can’t find jobs to employ them. It doesn’t refer to employers who choose not to hire additional workers.

“Saying the Fed did not inflate enough to reverse the effects of rising cash preference, is not an explanation of what caused the rising cash preference.”

Once again, true, but, once again, irrelevant.

Yes, Fed actions on the money supply are no explanation of changing public cash preference. But nobody ever said they were. What they are, is an explanation of involuntary unemployment and recession. And what we have found is that, if the Fed cleverly offsets changes in cash preference, in order to maintain stable NGDI, then the public gets to hold the cash they want, and also the skilled workers get to remain employed, and also the nation winds up with more real wealth.

“totally unlike a market where values are mutually achievable.”

The values of a worker who wants a job but can’t find one, are not achievable in your market.

You are advocating an unmanaged market which exhibits regular business-cycle recessions, and the great economic pain of significant involuntary unemployment. You don’t mind, because you have a bizarre moral framework that “whatever the result of the free market, it must be, by definition, ‘good’.”

But some of us are more evolved than that, and can see the suffering from unemployment, and the reduction in real wealth from unnecessary recessions, and realize that — with just a light touch of government intervention — a mostly-free market can be improved with a central bank fiat currency and NGDPLT, in order to avoid the economic damage from unnecessary recessions.

You don’t care how much pain your ideal society causes the public, because for you “freedom” is an absolute, worth any cost, no matter how large. The rest of us are making cost/benefit tradeoffs, and social benefit from NGDPLT is huge, while the cost is negligible.

More freedom is better than less, all else equal. But it is not the only “good” in society, merely one of many. There exist other important values as well, and sometimes one must consider tradeoffs between them.

15. August 2015 at 09:34

@Ray Lopez: “Given no nexus between economic growth and inflation, what does that say about NGDPLT?”

Nothing at all, since NGDPLT (hint: what do those letters stand for?) is about (level) targeting nominal GDP, not inflation.

15. August 2015 at 10:04

@TallDave-I think Market Monetarists believe that should be the goal of monetary policy. But there’s a reason for the term market in Market Monetarism, as distinguishing it from old monetarism or slightly-less-old monetarism (which was new monetarism or just monetarism when it was distinguish from the early monetarists before Friedman’s “restatement” of the quantity theory.) I think it is called “Market Monetarism” to distinguish it’s greatest theoretical innovation compared to it’s predecessors. If you read Lars’ paper where he explains the rationale behind the name (“Market Monetarism: The Second Monetarist Counter-revolution”) he places a great deal of emphasis on the idea of markets guiding policy-hence market monetarism. The idea of nominal stability as a desirable goal is much older and not unique to Market Monetarists.

Some advocates of free banking are “fellow travelers” of market monetarists, mainly in seeing nominal stability as the main goal of policy. But I think it’s a mistake to claim that everyone who favors something that would achieve nominal stability is automatically a Market Monetarist. It does some serious violence to the history of thought, honestly, both for the people being assimilated into the Borg er MM collective, and the MM school itself.

15. August 2015 at 10:16

@W. Peden-Alright, it’s fair to say I haven’t understood your subtle point. Sorry.

Scott, my test case on this has been the Somali Shilling. Counterfeiting did occur in that case, but evidently the people using Somali Shillings didn’t care terribly much about this. In fact, catching a counterfeit was pretty easy because the counterfeits for various reasons and they still didn’t care: counterfeits circulated at par. As for wearing out, this is why I said what Canadians would do initially is continue to use their old money. Of course I could see people gradually transitioning to a different base money but the existing Canadian dollar has a lot of “inertia” behind it’s use. If I used it yesterday, I’ll use it today, and I’ll probably use it tomorrow.

15. August 2015 at 12:15

Has anyone seen this?

http://www.bloomberg.com/news/articles/2015-08-13/the-fed-is-on-thinner-ice-than-it-realizes-and-it-may-be-setting-us-up-for-recession

Tim Duy – a very moderate and careful guy – and not a commentor on MMF so far as I know – is very much on board with the idea that the Fed must NOT raise rates, but they probably will do so anyway. Views very similar to those on this blog.

15. August 2015 at 13:58

Also, Scott, it just occurred to me to point out to you that, for the record, Marx was a quantity theorist. Milton Friedman actually said this when he debated Walter Heller, to which Heller’s response was that that was why he was not a Marxist.

So the difference between Old Keynesians and Marxists is that Marxists take the quantity theory of money seriously!

15. August 2015 at 14:58

Ray, You said:

“Sumner in response to Lopez: “ (Lopez): “You’ve shown nothing in this series except the well known truism that as an economy grows, the base money supply also grows, which you confuse cause and effect by reversing the causation.” (Sumner)”Nope, I made just the opposite claim, that growth in the money supply has no long run impact on the economy’s growth”

And then you said:

“@sumner – the phrase “the economy grows” did not appear anywhere, so I’m not sure what your point is.”

OK, it was an economy grows, not the economy grows.

I agree that there is no connection between inflation and economic growth 1960-89.

Andrew. If counterfeits circulated at par then you obviously get hyperinflation. I doubt Somali has much implications for Canada. What was the value of the Somali money?

JimP, Yes, an excellent post by Tim Duy.

Andrew, Again, that’s probably a very crude version of the QTM, I assure you that Marx did not understand the modern QT

15. August 2015 at 15:22

Scott-J P Koning has a good post on the subject:

http://jpkoning.blogspot.com/2013/03/orphaned-currency-odd-case-of-somali.html

I personally suspect that counterfeiting was just not massive enough in scale to generate hyperinflation. Unfortunately I’m not aware of specific data on Somali inflation rates, though there had already been high inflation before the government collapsed which Koning also mentions.

Whether counterfeiting presents a problem for an orphaned currency, I suspect, depends upon its scale. So it may, or may not, be a sufficient problem to make it worth abandoning the currency entirely. If counterfeiters produce new fakes at the same rate as the defunct central bank produced new legitimate notes, what would be the problem? It could only be a problem if the counterfeiters produced new fakes at an elevated rate.

With regard to Marx, reading what he said I think you’re right, in fact if anything his understanding of the quantity theory is backwards. I just remembered Milton Friedman telling Heller than “Marx was a strict quantity theorist.”

15. August 2015 at 17:02

MMT!!!!!!

https://twitter.com/stephaniekelton/status/632715983099174913

🙂

15. August 2015 at 17:29

@Sumner, @Don Geddis – I was right then, and both Sumner and Geddis missed the point. I said: “(Lopez): “You’ve shown nothing in this series except the well known truism that as an economy grows, the base money supply also grows, which you confuse cause and effect by reversing the causation.” (Sumner)”Nope, I made just the opposite claim, that growth in the money supply has no long run impact on the economy’s growth””

1) I said: as RGDP increases, so does the base money supply. Do you doubt this? It’s been that way historically in the modern century (under a fixed gold standard it was not quite so obvious, though de facto it was also largely true then as more gold was dug out of the ground). I also floated a trial balloon about base money and real GDP growth, which Sumner clearly believes the first influences the second (short term), yet Sumner cleverly moved the goal posts and said long term there’s no influence. But let’s move on.

2) Sumner’s reply does not address my point. Sumner is merely saying that long-term, money is neutral. I agree. It’s got nothing to do with my point however, which was about both the long and short terms.

Scott (we’re on first name basis by now?), I’d like to see a model simulating how your NGDPLT works using historical data (since, as I predicted, you refuse to concede that your scheme has anything to do with inflation, since the data shows inflation does NOT increase growth, so you wisely side-step this issue). I do understand you feel that money illusion and sticky prices/wages will cause demand not to drop off and/or supply to increase if there’s a shock to the economy, but only if the Fed targets NGDP rather than inflation, since inflation is not a precise proxy for NGDP. (I think I covered all basis there).

Reader request: 1) come up with a model using data from all countries in the world where 2) the central bank ‘got it right’ and 3) during a shock to the economy (AD or AS) 4) the central bank printed enough money so that effectively NGDP was targeted and kept level, and 5) a crisis was averted or minimized. Sample episodes might be from all crises post-WWII as outlined by Rogoff et al or Niall Ferguson.

You have help now at Mercatus Center, so this is not a tall order? David Landis also had help when he wrote his magnus opus tome. Others prominent use help. Why not you? Why do you wish to not know the truth about whether your proposal really works? Are you afraid of the truth? Do you want the truth? Can you handle the truth? (image of J. Nicholson’s Few Good Men here).

@Don Gheddis – you were wrong…again! LOL you remind me of Robin to Sumner’s Batman. You try hard but you’re just a boy! 🙂

16. August 2015 at 05:08

Andrew, If counterfeiting became legal in Canada I assure you that there would be massive counterfeiting, and the value of money would fall to the cost of production—that’s hyperinflation.

Ray, You argue for short run money neutrality using a long run study (1960-89) OK.

And the countries that had the closest to NGDPLT during the Global Recession (Australia, Israel, etc.) did best.

16. August 2015 at 06:46

@Sumner – aha. Good, I’m trapping you, bit by bit. So your final answer is that Australia, Israel are exemplars of NGDPLT? Who else? Who is ‘etc’?

If we can identify which countries you feel practiced NGDPLT, we can build a model instead of doing (internet) Austrian type ‘thought experiments’.

Please do a blog post on all countries that you feel have ‘gotten it right’ and done NGDPLT, going back to as many years as you wish (up to the start of the modern era of central banking and fiat money of course).

16. August 2015 at 07:16

Prof. Sumner,

I don’t know what you call “austrianism” but if taking it narrowly as the ABCT, nothing in your theory contradicts ABCT. For example, if David Beckworth is correct and money was indeed a little too loose in 2003-2005, most of the subsequent events fit ABCT. And before someone argues that hyperinflation never happened, ABCT does not predict hyperinflation, it predicts malinvestments going bust, and consumer prices outpacing upstream prices, like capital goods or commodities prices. The events that happened in the last few years, in IMHO, do not contradict ABCT.

16. August 2015 at 08:46

I have been calling myself a market monetarist for some time–since the day the term was coined.

I have always been a bit skeptical regarding the “market” modifier.

My understanding for the reason for adding this modification was two-fold.

One is Sumner’s view that changes in monetary conditions can be deciphered by looking at what happens immediately in auction-type asset markets. Stocks, bonds, and commodities.

The second is support for institutional reforms that harness market forces to adjust the quantity of money and demand for it such that nominal stability is generated. Index futures targeting would be an example.

I have never had Scott’s trust in the wisdom of stock traders. I realize that his view developed by seeing how stock prices responded rapidly to news about changes relevant to the gold standard during the Great Depression.

I have always been interested in harnessing market forces so that the monetary regime generates macroeconomic stability.

The reason for “monetarism” is the view that slow steady growth in spending on output, or the nominal value of output, is the least bad approach to macroeconomic stability.

It is related to traditional monetarism in that slow steady growth of the M2 quantity of money was supposed to generate slow steady growth in spending on output. And that was considered the lest bad approach to macroeconomic stability.

Why market monetarists are not monetarists is the rejection of a target for the growth path of the quantity of money. We favor a monetary regime where the quantity of money adjusts according to changes in the demand to hold money.

Now, I was not an “orthodox monetarist” for long, if at all. I favored a monetary regime where the quantity of money adjusts to the demand to hold it from about the time I started graduate school at Virginia Tech. But I switched from favoring a stable price level to a stable growth path for spending a good bit ago too.

I think another element of “monetarism” is the skepticism regarding treating “the” interest rate as key for monetary theory. Skepticism about using an interest rate as an instrument, skepticism about using the level of interest rates as a to gauge of monetary conditions. These were all characteristics of traditional monetarists that we have carried forward to some degree.

By the way, I have also favored free banking for a long time. I think there is some truth in the stabilizing money multiplier process Selgin developed, but not enough “truth. I have never favored a fixed growth path for the monetary base.

For the most part, I have been especially interested in free banking systems that have no monetary base, but are still tied together by a rule based clearing system–one that harnesses market forces to stabilize a growth path for spending on output.

I have had no interest in a few decades in what sort of monetary order would or could have developed in an anarchist world or whether a monetary regime introduced by some political process of reform could survive the abolition of government.

I don’t understand that point of figuring out what would have happened in an anarchist world (well, I think I know but I am not interested in “proving” that everything the government has ever done is bad.) And the chances of government disappearing are so slim, that I don’t think worrying about how a monetary regime would survive really matters much.

16. August 2015 at 10:55

Ray, No country has been practicing NGDPLT, as you would understand if you knew how to read.

Jose, And I’m told it also doesn’t contradict Marxism. Perhaps nothing contradicts Austrianism, but lots of actual Austrians make incorrect claims about monetary economics. You certainly can’t claim that these posts represent Austrian economics.

Bill, I agree with most of what you say, except this:

“I have never had Scott’s trust in the wisdom of stock traders.”

I have almost no faith in thew wisdom of stock traders, just as I have little faith in people who guess the number of jellybeans in a jar. I have faith in markets, in the sense that markets are the least bad forecasters.

16. August 2015 at 12:06

@Bill Woolsey-My interest was in answering the question, what Lars intended “Market” in Market Monetarism to mean, since he’s credited with coining the name. In my view, in a just world, he’d be able to control the way a phrase he invented was used, if he so wished, as his property. I don’t think he’d object to your use, however.

I don’t deny there are Market Monetarists who like free banking! But they don’t have an intellectual monopoly (ha!) on it either.

With regard to anarchism, I got dragged into the weeds there. Sorry if you didn’t enjoy that discussion, I wasn’t trying to “prove” anything by it. Someone mentioned what they thought anarcho-capitalism would look like in terms of monetary systems and I followed them into the weeds.

@Scott-I doesn’t contradict Marxism for completely different reasons from not contradicting Austrian theory. It doesn’t contradict Marxism for the same reason it doesn’t contradict, say, the Alvarez hypothesis: the ideas have nothing to do with one another. Marxism is not a theory of output and inflation. The quantity theory doesn’t contradict Austrian theory, however, because Austrian theory accepts the fundamental truth of the quantity theory of money. You can’t be contradicted by something your theory holds to be true. You also can’t be contradicted by something your theory is silent on the question of. You shouldn’t be a Marxist because you’re a marginalist, not because you’re a monetarist, market or otherwise.

16. August 2015 at 20:18

Sumner: “And the countries that had the closest to NGDPLT during the Global Recession (Australia, Israel, etc.) did best.” and later: “Ray, No country has been practicing NGDPLT, as you would understand if you knew how to read.”

Wow, that’s metaphysics. Double wow. Tyler Cowen is right about macroeconomics in his podcast at “Maker Stories”, it’s more art than science. You’re an artist.

But Sumner you’re a dishonest artist. Like I said about a ‘true Communist’, you will never concede that NGDPLT has ever been practiced correctly. That’s dishonest. You’re a fraud. If I stop posting here, you’ll know why. You’ve reached the end of the road for me, nothing you say excites me. You’re about as honest as Eric Hobsbawm, CH, FBA, FRSL (9 June 1917 – 1 October 2012), a British Marxist historian of the rise of industrial capitalism. He was a Stalin apologist, that’s how strongly he viewed the world through his ideological lens. Sound familiar?

16. August 2015 at 20:54

Like any troll, Ray becomes the most sulky and petulant when he begins to realise his trolling is having no effect on its intended target…

17. August 2015 at 04:51

Andrew, Didn’t Marx also accept the QTM? Didn’t the Soviets target the money supply?

Ray, Your reading comprehension is even worse than I imagined.

17. August 2015 at 10:55

Prof. Sumner

Far from me to put a new tag on your model. Actually, what I was trying to say was that smart austrians, if they could, they should try to take portions of ABCT and blend it with your model, because I think it is possible, and more importantly, correct.

17. August 2015 at 15:30

Scott-This, as it turns out, was Marx’s interpretation of the quantity theory of money:

“The law, that the quantity of the circulating medium is determined by the sum of the prices of the commodities circulating, and the average velocity of currency may also be stated as follows: given the sum of the values of commodities, and the average rapidity of their metamorphoses, the quantity of precious metal current as money depends on the value of that precious metal. The erroneous opinion that it is, on the contrary, prices that are determined by the quantity of the circulating medium, and that the latter depends on the quantity of the precious metals in a country;this opinion was based by those who first held it, on the absurd hypothesis that commodities are without a price, and money without a value, when they first enter into circulation, and that, once in the circulation, an aliquot part of the medley of commodities is exchanged for an aliquot part of the heap of precious metals.”

About as backwards as it gets. But why did he get it wrong, in this particular fashion? Because the elementary error of Marxism is one of value theory. Again, the reason not to be a Marxist is that one should be a marginalist.

I’m not aware of Soviet money supply targeting, I thought they had planned to eliminate money eventually, however.

20. August 2015 at 04:26

Jose, That sounds like a good idea.

Andrew, Thanks, but I can’t understand that paragraph, so I won’t comment.