Draghi doesn’t understand what caused the eurozone double-dip

The ECB tightened monetary policy sharply in 2011. This caused NGDP growth to plunge, and the eurozone fell into a double-dip recession.

Whenever you have a demand-side recession, some people will look at specific industries, and/or specific regions, to see what caused it. This is mistake. The US housing industry was hit hard in the recent recession, but didn’t cause it. The PIIGs were hit especially hard after 2011, but did not cause the eurozone recession. In any recession, there will be regional and industry variation in intensity, due to supply-side factors. But those specific factors cannot explain a generalized decline in NGDP growth for an entire currency zone. Only monetary policy can explain that.

Here’s something from a Mario Draghi speech that Vaidas Urba sent me:

From 2011 onwards, however, developments in the two regions diverge. Unemployment in the US continues to fall at more or less the same rate. In the euro area, on the other hand, it begins a second rise that does not peak until April 2013. This divergence reflects a second, euro area-specific shock emanating from the sovereign debt crisis, which resulted in a six quarter recession for the euro area economy. Unlike the post-Lehman shock, however, which affected all euro area economies, virtually all of the job losses observed in this second period were concentrated in countries that were adversely affected by government bond market tensions (Figure 2).

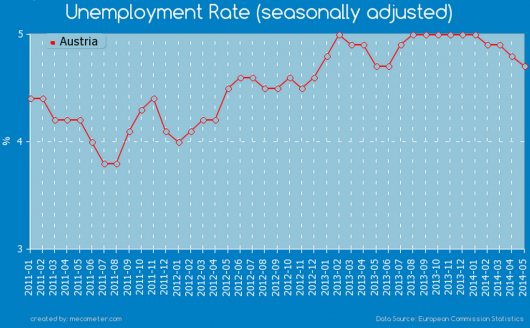

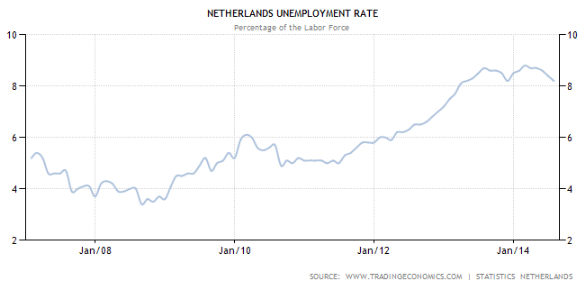

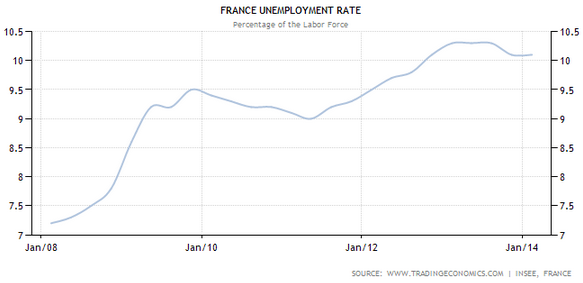

Is this true? Consider these graphs, showing that it wasn’t just the PIIGS that experienced a double dip:

So the Netherlands, France, Belgium and Austria also had double-dips. The Dutch double-dip was worse than the first dip. The ECB caused the double-dip recession—even new Keynesian models will tell you that. (After all, the ECB raised rates twice in 2011, so this wasn’t one of those zero bound issues.) Odd that Draghi doesn’t understand that the ECB caused the NGDP growth collapse, and that debt crises are the result of NGDP growth crashes. That doesn’t make me very hopeful that the eurozone’s long nightmare will end anytime soon.

So the Netherlands, France, Belgium and Austria also had double-dips. The Dutch double-dip was worse than the first dip. The ECB caused the double-dip recession—even new Keynesian models will tell you that. (After all, the ECB raised rates twice in 2011, so this wasn’t one of those zero bound issues.) Odd that Draghi doesn’t understand that the ECB caused the NGDP growth collapse, and that debt crises are the result of NGDP growth crashes. That doesn’t make me very hopeful that the eurozone’s long nightmare will end anytime soon.

Tags:

25. August 2014 at 06:28

Draghi is the Obama of central banking.

He sucks at his job and if things were normal would be seen as an awful holder of the office. However, the previous guy was so unbelievably bad and he got into office with such an aura of hope and promise that, even if he never delivered on either, he never gets the opprobrium that a man with a decent predecessor would receive.

25. August 2014 at 06:28

It gets even worse. Check this piece from Lars Christensen: http://marketmonetarist.com/2014/07/28/european-central-bankers-are-obsessing-about-everything-else-than-monetary-policy/

Obviously ECB Chief Economist Peter Praet thinks that the best solution to low inflation is if german unions negotiate for higher wages. There are people saying that main concern of this generation of Central Bankers is never to repeat mistakes of Central Banks in seventies.

It is happening again – only this time instead of saying that CB is powerless in face of high inflation they claim the same in face of low inflation. But the real culprit it is about wages and price controls are supposed solution.

25. August 2014 at 06:36

Luis, I agree.

JV, Very good point.

25. August 2014 at 06:50

Mark Sadowski, PLEASE COME BACK!!!

25. August 2014 at 07:09

What is it about central bankers? We used to scratch our heads at the Bank of Japan. Now they call Janet Yellen a dove, and she worships the 2 percent inflation ceiling.

25. August 2014 at 07:37

Scott, you, via Ryan Avent, have clearly had a big influence on the Economist editors by now: http://www.economist.com/news/leaders/21613259-european-central-bank-should-learn-success-unconventional-policies-america-and

25. August 2014 at 07:40

How is Draghi the Obama of central banking? The only thing Obama could do to affect CB policy is to appoint a fed chairman sympathetic to easing. Wasn’t the yellen appointment a good one in that regard?

25. August 2014 at 07:52

Scott: “Odd that Draghi doesn’t understand that … debt crises are the result of NGDP growth crashes.”

No central bank understands that. There were lots of good moments in the speech and market reaction was very favorable.

25. August 2014 at 07:57

It’s frustrating how you can have all the research, debate, and truth seeking you want, but it might all be outweighed in the public consciousness by something like the repeated use of a phrase like “post – Lehman shock”. I’m not saying there is deliberate deception, just that easy rhetorical choices, formed by our unreflected subconscious, have a much more powerful effect on our conclusions than we give them credit for.

25. August 2014 at 08:10

Thanks Saturos, although I doubt I had any effect on The Economist.

Student, There are many problems with your comment.

1. Even several years ago 6 out of the 7 Board members were Obama appointees, and policy was far too tight. It was an Obama Fed that did it.

2. When he took office he left several seats empty for more than a year despite having a filibuster proof majority in the Senate.

3. He tried to appoint Summers, who is considerably more hawkish than Yellen on the issue of monetary policy and asset market bubbles. He had to be forced to pick Yellen.

Vaidas, Markets have very low expectations for the ECB; my job is to hold their feet to the fire. I agree that Draghi is better than Trichet, much better.

Kevin, I agree.

25. August 2014 at 09:28

well argued, although 1 is a bit shaky. Sometimes people dont behave the way you would expect and being at the fed seems to render people much more conservative (not talking politically here), ala Bernanke. 2 is an enigma, wtf. 3, i forgot about already, spot on.

25. August 2014 at 11:27

Hi Scott,

Maybe the EU just returned to a (stagnating) trend in 2011 (graph at link)?

http://informationtransfereconomics.blogspot.com/2014/08/will-i-be-labeled-ecb-apologist-too.html

This makes me think of 1937 in the US (on which you have far more expertise than I). Sure, maybe in both cases raising rates killed the recovery. But maybe in both cases the recovery returned to trend and ended on its own, independent of monetary (or fiscal) policy?

25. August 2014 at 13:01

Krugman gets his way (in France, at least);

http://www.bbc.com/news/blogs-echochambers-28928713

‘Here’s Mr Montebourg’s response after being asked whether Europe has tilted too far toward austerity:

‘”That’s not my observation, that’s the diagnosis of financial institutions across the world, starting with the IMF which, whose director, Christine Lagarde, warned European leaders about an excess of budget consolidation. Paul Krugman, a Nobel laureate, also wrote on Aug. 13, “The nightmare scenario in Europe is not a hypothetical. The news that industrial production has ground to a halt raises the prospect of a new recession in Europe – its primary cause, austerity.” These warnings have also been sounded by other leaders of world powers including Barack Obama.”

Montebourg is also the guy who claimed that he was a socialist like Obama, who believed in nationalizing the steel industry.

He also got into a shouting match with Goodyear’s CEO, who claimed he’d have to be stupid to buy a French tire company when their employees only worked three hours a day.

25. August 2014 at 14:10

Scott,

An update to my previous comment: US in 1937 looks exactly like EU in 2011 (graph at link):

http://informationtransfereconomics.blogspot.com/2014/08/is-policy-relevant.html

Maybe policy was the same in the US in 1937 and the EU in 2011 — or maybe policy (fiscal or monetary) was irrelevant?

25. August 2014 at 15:24

Luis wins the internet for that day 🙂

25. August 2014 at 17:22

“In any recession, there will be regional and industry variation in intensity, due to supply-side factors. But those specific factors cannot explain a generalized decline in NGDP growth for an entire currency zone.”

With that sleight of hand, recessions are defined as declines in NGDP.

Real side causes of what appear to be demand side recessions need not be “industry specific” in the sense of “the housing industry”, or “the dotcom industry”. Real side causes for NGDP declines can be and for the last 100 years have been “aggregate” in nature. Too many resources and labor allocated “here”, and not enough resources and labor allocated “there”. This is an aggregate problem, and a real problem.

I suspect that the main reason NGDP declines are viewed as “causes of demand side recessions” is because of the illusion that prior inflation is not itself a positive cause for future problems, and in MM’s case that means as long as NGDP changes are within a certain range of arbitrary NGDP values.

Central banks have thus far not positively caused any NGDP declines. They have “sat back” and observed it falling for sure, but the absence of action is never a cause for actual events taking place. Actual events taking place have actual positive causes. Thus far in history, the causes of NGDP declines have always been real side factors. The central banks have during these times observed, but did not counteract the effects of, the real side causes.

NGDP fell drastically post 2008 because of positive causes in the economy. It is no refutation or challenge to this to point out that in principle the Fed could have reversed it by increased monetary inflation. This is no more a refutation that the NGDP decline was caused by real factors as is the claim that absence of drinking causes hangovers, or absence of medicine causes cancer.

The idea that no Fed action is itself an action is a contradiction. It is the illusion that the Fed controls even when it doesn’t control. It is a belief in omnipotent central banking. It is akin to the old belief that black market activity in socialist economies is controlled by the socialist government. There is no regard for individual human causation for black market activity because in the socialist view, the state is viewed as the primary cause of all, i.e. it is omnipotent.

This same illusion plagues MM thinking. There is no respect or appreciation for individual market actors affecting NGDP because in the MM view, the state is omnipotent in money. The fact that in principle the Fed could if it wanted influence or control or determine NGDP does not prove that the Fed is the only cause of NGDP changes. It is a non sequitur. The Fed relies on individual market actors to spend money. If market actors decide to spend less, there are (real) reasons for it.

NGDP fell post 2008 because of positive causes, not absences of causes. The Fed wasn’t burning people’s money. The Fed did not destroy anyone’s money. The market destroyed money by credit contraction. The market chose to reduce spending because something was seriously wrong on the real side. This real problem was capital and labor malinvestment.

26. August 2014 at 02:58

Two points on self-deception from the speech:

“[Those central banks back-stopping government debt] has in turn allowed fiscal consolidation in the US and Japan to be more backloaded.” It must have been! What else could it be?

And: Figure 7 shows the relative tightness of ECB vs US policy. Quite the spike in what seems to be 2011 (can anybody extend this graph backwards?). Also, the ECB is expected to be the tighter one until mid 2017.

26. August 2014 at 03:02

I meant to refer to the apparent backloading of fiscal consolidation in the US.

26. August 2014 at 03:39

Something that central banks persistently (if not consistently) do is evade responsibility. There is a fair bit of “wasn’t us, didn’t do it” in what is an otherwise informative speech by Draghi. But he joins a long line of central bankers in that refusal to take responsibility.

As the Romers pointed out, Fed annual reports tend exult the value of monetary policy in good times, and stress its impotence in bad times.

As I said in a guest post over at Marcus’s blog, that is why a (market) monetarist victory is necessary–to hold central banks responsible. That, after all, was Friedman’s actual macro-victory–to get the bulk of the profession, and so central bankers, to agree that inflation was a monetary phenomenon. Even the effective way to operationalise that responsibility turned out to be something other than his specific policy recommendation.

http://thefaintofheart.wordpress.com/2014/06/14/why-monetarist-victory-is-necessary-so-central-banks-cannot-hide/

26. August 2014 at 04:39

Interesting analysis: http://blogs.ft.com/gavyndavies/2014/08/25/draghi-steals-the-show-at-jackson-hole/

26. August 2014 at 15:40

That should be “even though the effective way …”

27. August 2014 at 05:48

Lorenzo, Yes, and Milton Friedman said it before the Romers.

Vaidas, I have a post at Econlog.