The amazing decline in American poverty

I get criticism from liberals when I claim that the poor are doing much better than in 1973, despite figures showing flat medium incomes and rising inequality. Floccina directed me to a Timothy Taylor post that discusses a study by the Brookings Institute. Yes, the liberal Brookings Institute, I presume there is only one:

However, in a paper published in the Fall 2012 issue of the Brookings Papers on Economic Activity, Bruce D. Meyer and James X. Sullivan present some alternative interpretations and more cheerful conclusions in “Winning the War: Poverty from the Great Society to the Great Recession.” They conclude: “Despite repeated claims of a failed war on poverty, our results show that the combination of targeted economic policies and policies that support growth has had a significant impact on poverty. … Noticeable improvements have been made in the last decade; although not as big as the improvements in some earlier decades, they are comparable to or better than the progress made in the 1980s. We may not yet have won the war on poverty, but we are certainly winning.”

. . .

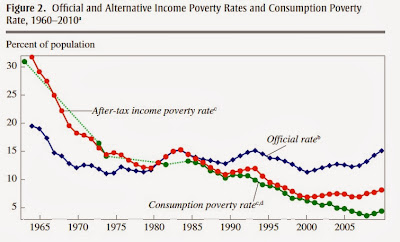

Here’s one of their illustrative calculations. The official poverty line is in blue. They then calculated income in a way that included taxes and the value of noncash benefits. They set up the calculation so that the two measures would have the same poverty rate in 1980, and then adjusted the poverty rate over time using the inflation rate. But when after-tax income is used in the calculation, the poverty rate falls more sharply over time, including during the last 30 years.

But perhaps their most striking result uses data on consumption, rather than data on income, to calculate the change in poverty rates over time. Consumption data comes from a different national survey than does income data (the Current Expenditure Survey rather than the Current Population Survey). Meyer and Sullivan point out that at the bottom of the income distribution, the answers about income on the Current Population Survey clearly understate the amount of income received. For example, only about half of welfare payments seem to be reported in the Current Population Survey. The proportion of economic activity that goes unreported to the tax authorities–and to the government survey–is probably higher at the bottom of the income distribution, too. In addition, when we talk about poverty what we are really worried about is more accurately captured by consumption rather than by income.

Meyer and Sullivan used consumption data, and again they set up the calculation so that the poverty rate for consumption data is the same as the poverty rate for income data as of 1980. Again, the blue line shows trhe official poverty rate. The red line shows the poverty rate with a broader definition of income, adjusted for after-tax income. The green line shows the change in the poverty rate if consumption is used to measure poverty. By this measure, the poverty rate almost reaches zero percent in 2007, before the Great Recession.

Thus, they write: “The results in this paper contradict the claim that poverty has shown little improvement over time and that antipoverty efforts have been ineffective. We show that moving from traditional income-based measures of poverty to a consumption-based measure, which is arguably superior on both theoretical and practical grounds””and, crucially, accounting for bias in the cost-of-living adjustment””leads to the conclusion that the poverty rate declined by 26.4 percentage points between 1960 and 2010, with 8.5 percentage points of that decline occurring since 1980.”

Just to be clear, the notion that the consumption-based poverty rate nearly reached zero percent does not mean that the war on poverty is won. After all, the poverty rate was originally set back in the early 1960s, and although the poverty line has been adjusted upward by the rate of inflation over time, it has not been adjusted for the amount of economic growth that has occurred. All poverty lines are set in the context of the society’s overall level of income: thus, a very low-income country the poverty rate per person might be set at $1.25/day or $2/day, while in the United States, the poverty rate for a family of 3 is around $16-$17 per person per day. One can argue that because the U.S. economy has grown dramatically in the half-century since the poverty level was set, the poverty line should be higher. But still, it’s worth knowing that the U.S. has made progress in terms of the existing poverty line–when using more appropriate standards of well-being like consumption or broader definitions of income

After-tax and transfer data is better than income, and consumption data is still better. Liberals are focusing on “inequality” when they should be focusing on poverty level consumption (as they were in 1973.) That’s the real problem.

PS. One of my earliest memories of college was when I took intermediate micro as a sophomore at Wisconsin. My professor once showed some data on what the US distribution of income would look like without transfer programs. He derived the estimates by looking at market income. I raised my hand and pointed out that if there were no transfer programs then surely the market income figures would be different. For instance, those on welfare might be forced to work in order to stay alive.

This Brookings study reminds me of another problem, the underground economy. Transfers to the poor don’t just discourage people from working, they also encourage people to work in the underground economy. Thus transfer programs have two effects. First, they make market income less equal than it would otherwise be. And second, they make reported market income less equal than actual market income. Both factors contribute to the much better performance of consumption than reported market income at the lower end of the spectrum. Which is obvious to anyone who travels around America and observes how the poor actually live.

PPS. I will be traveling the next few days–not much time for blogging.

Tags:

12. October 2013 at 10:56

How bout we make a deal:

– Abolish all public schools.

– Make the EITC way way way way more generous.

Deal? No deal?

P.S.: Here is a post from Yglesias on the subject from last year:

http://slate.me/R02g8q

12. October 2013 at 10:59

Removing/reducing transfer programs would then seem to hurt people who “play by the rules” more than those that don’t (e.g. those who participate in the underground economy or who just “kick back” on UI).

12. October 2013 at 11:04

Prof. Sumner also made this insightful comment last year:

“Philosophers tell us that the most ineffective way to become “happy” is to focus directly on becoming happy. And for similar reasons the worst way to reduce inequality is to focus on the “distribution of household income.” Focus on the root causes of the real problems. Change zoning laws to construct more low cost urban and suburban housing. Increase AD when NGDP is depressed. Provide wage subsidies to low wage single moms raising kids (financed by consumption taxes on the high consumers.) Weaken patent and copyright protections for minor innovations. Eliminate occupational licensing laws.”

http://www.themoneyillusion.com/?p=16306

12. October 2013 at 11:07

Excellent post.

I’m not sure if there is a formal definition for “underground economy”, but there are all sorts of ways to cut expenses, ranging from DIY plumbing and auto repairs, to dinner parties (rather than restaurants), to babysitting clubs, making friends with hairdressers, lawn/garden tool sharing, etc.

These things with all increase in the ObamaCare economy. People will need to earn enough (~$15K/adult) to qualify for almost free care, then it’s quittin’ time.

12. October 2013 at 11:33

BPEA is a journal that publishes papers from across the political spectrum. Neither Sullivan nor Meyer has a Brookings affiliation and it is not a “Brookings” paper any more than JPE articles are U of Chicago papers.

12. October 2013 at 11:45

“They then calculated income in a way that included taxes and the value of noncash benefits.”

Aaaaand poof goes any credibility of the study.

12. October 2013 at 12:42

It is definitely an interesting article. The one aspect that I somewhat disagree with is that welfare will discourage work and such. Countries with much more robust welfare programs than we do seem to have more social mobility from the bottom to the top. That seems to kind of contradict the idea that welfare programs will increase the laziness of those who obtain it. Additionally, Prof. Sumner’s argument to his professor concerning that if there are no welfare payments the poor may be encouraged to work more therefore changing the distribution of income charts also seems to be a somewhat tough argument to make. During a time of strong economic growth I could certainly see that being the case, but in a time like this I am not so sure.

12. October 2013 at 13:03

We created a whole bunch of programs that were based directly on a specific officially-reported level of (inflation-adjusted) income in the mid-1960s. And back-analysis shows that poverty as defined as that official level of income had been declining at an average of 1 percentage point a year from the start of the 20th century until the mid-1960s, when suddenly it held even at that level (with minor undulations) for the next five decades.

Which, well, duh. If you give people money and other valuable considerations for hitting a specific number, they’ll find all sorts of ways to hit that number. Any performance metric will be gamed.

So, if you define victory or failure in the War on Poverty on how many people have that pre-transfers level of income, then yes, the transfer programs failed utterly. So admit defeat and shut all the programs down in an effort to resume the historical -1 percentage point a year decline that would have ended poverty, as defined in the mid-1960s, early in the Reagan Administration. If you define it otherwise, well, you should stop quoting the pre-transfers level of income as a measure of poverty.

12. October 2013 at 14:47

Excellent blogging…but the War on Poverty, and the War on Terror will go on…and on…and on..

12. October 2013 at 14:56

…and thanks to you and your ilk, so will the War on Money.

12. October 2013 at 15:22

Prof. Sumner,

Looking forward to your thoughts on this Krugman post:

http://krugman.blogs.nytimes.com/2013/10/12/sticky-wages-and-the-macro-wars/?_r=0

“Back in the 70s, there was hardly any discussion of the determinants of nominal demand; what Lucas and his followers were arguing was that Keynesianism must be rejected because it was unable to derive wage stickiness from maximizing behavior.

………

I see that some of Caplan’s commenters are willing to accept that nominal demand matters, but draw the line at “nonsense” like the liquidity trap. Well, the zero lower bound is also a fact, and once you start admitting that demand matters, you’ll find yourself inexorably arriving at liquidity-trap analysis.”

12. October 2013 at 15:50

Travis, Deal.

Andy, My mistake.

Natt, You said;

“It is definitely an interesting article. The one aspect that I somewhat disagree with is that welfare will discourage work and such. Countries with much more robust welfare programs than we do seem to have more social mobility from the bottom to the top.”

There’s an obvious contradiction here. People in those countries tend to work much less than Americans. As far as mobility, you also have to account for ethnic diversity.

Steven, Good point.

Travis, I guess Krugman’s never heard of monetarism.

12. October 2013 at 16:30

off topic…but I think this P.K. post will interest…

“You see, the question of wage (and price) stickiness, and hence of real effects of changes in nominal demand, was what the great rejection of Keynesianism was all about. And I mean all about. Back in the 70s, there was hardly any discussion of the determinants of nominal demand; what Lucas and his followers were arguing was that Keynesianism must be rejected because it was unable to derive wage stickiness from maximizing behavior.”

http://krugman.blogs.nytimes.com/2013/10/12/sticky-wages-and-the-macro-wars/

12. October 2013 at 17:05

Great post, but you will never convince the liberals. Their whole world view is based on patronizing the poor. Their heads would explode if they had to accept the real facts about poverty.

13. October 2013 at 06:55

Two years ago, one of the authors of the paper did a podcast with Russ Roberts;

http://www.econtalk.org/archives/2011/10/bruce_meyer_on.html

13. October 2013 at 07:10

So the fact the poor from 40 years ago were worse off than the poor of today is the main reason why inequality statistics and studies don’t really matter?

This claim doesn’t make much sense. Considering most conservatives want to dismantle a lot of those “after tax transfers” for the poor. It also dismisses the fact a “poor” person from 40 years ago had a higher mobility rate, thus a higher likelihood to move up the income ladder than the poor of today. So in that regard, the poor of today are worse off, since they currently live in an America with one of the lowest mobility rates in the developed world. The poor of today have a higher likelihood of staying poor, than the poor of 40 years ago.

13. October 2013 at 08:44

Scott,

Fantastic article. Your work on inequality is great. You are superb at using logic instead of simply digging up data to support your points. Without the logic behind the data, any story becomes meaningless because the data can be picked to make it say whatever someone wants.

13. October 2013 at 09:54

Scott,

Off Topic.

Recent conversation in Fiscalist Lalaland:

Monetarist:

“Good news! Thanks to QE Japan’s real GDP rose 4.1% and 3.8% at an annual rate in 2013Q1 and 2013Q2 respectively.”

Fiscalist:

“Japan’s personal consumption is still down.”

Monetarist:

“Actually real household sector consumption rose 3.3% and 2.9% at an annual rate in 2013Q1 and 2013Q2 respectively.”

Fiscalist:

“The cost of living is going up in Japan because the yen is weaker. Real wages are going down.”

Monetarist:

“Actually real private sector monthly earnings are up sharply since December. They rose 3.0% from December through June, or at an average annual rate of 6.0%. They rose 5.5% and 1.8% at annual rate in 2013Q1 and 2013Q2 respectively.”

http://research.stlouisfed.org/fred2/graph/?graph_id=141389&category_id=0

Fiscalist:

“Japan’s economy has rebounded due to the infusion of fiscal stimulus.”

Monetarist:

“The fiscal stimulus under Abenomics is much smaller than popularly perceived. It is only 10.3 trillion yen or about 2% of GDP. To get a good idea of its actual impact I suggest consulting the IMF Fiscal Monitor.

In October 2012 Japan’s cyclically adjusted general government primary balance was projected to be (-7.5%), (-5.5%) and

(-4.5%) of potential GDP in calendar years 2013-15 respectively. In April this was revised to (-8.7%), (-6.1%) and (-4.8%) of potential GDP in calendar years 2013-15 respectively. A sum of the differences yields 2.1% of potential GDP.

The change in cyclically adjusted primary balance, which is of course a measure of the fiscal stimulus, has gone from (+0.9%), (+2.0%) and (+1.0%) of potential GDP in calendar years 2013-15 respectively before Abe to (-0.3%), (+2.6%) and (1.3%) in calendar years 2013-15 respectively after Abe.

In other words fiscal policy has gone from being contractionary to mildly stimulative in 2013 and becomes even more contractionary in 2014 and 2015.

Many people are enthused with the fiscal side of Abenomics not realizing that Japan has already had a wildly expansionary policy stance since 2008 with little to no impact on NGDP.”

Fiscalist:

“This conversation just confirms which side of the intensifying class war you’re on. You are cynically lambasting fiscal stimulus, while championing the anti-worker, pro-banker, globalist QE. This removes any doubt about whose interests you are serving.”

Monetarist:

“Derp.”

13. October 2013 at 10:37

Greg Ip fighting the good fight at the Economist: http://www.economist.com/blogs/freeexchange/2013/10/response-response-our-post-janet-yellen

13. October 2013 at 12:26

Scott,

To follow up what I said, I think that the best point you ever made about inequality is that income inequality is most strongly correlated with ethnic diversity with homogenous countries like Denmark have a high level of equality whereas ethnically diverse nations (U.S., Australia) tend to have greater inequality. Ethnic groups like the Aboriginies, American Indians, Arabs in Europe, or African-Americans tend to make less income as a group than the dominant ethnicity in a given nation. On the other hand, the Jewish population in America or the Igbos in Nigeria tend to have unusually high incomes as a group.

I believe that Milton Friedman made this point before. When someone who was debating him pointed out how successful Swedish socialism was at creating an equal society and reducing poverty, Friedman cleverly pointed there was very little poverty or income inequality among Scandinavians in America either. It is a brilliant but very politically incorrect point.

There is not much that the government can or should do about income inequality other than not fostering it by writing lots of regulations that make it hard for people to start businesses and move themselves up. Socialism does not reduce inequality. If anything, it can only make it worse by creating a political elite that contrasts with the unwashed masses. They said that in the USSR, outside of Moscow, the country was as poor as Bangladesh. If you want to create the highest degree of inequality possible, create a system where a core elite in the government controls all business. Unfortunately, this seems to be the default settings for all governments for all history. Only when this hold is broken does wealth really grow and it usually only last for a brief moment throughout history.

13. October 2013 at 12:52

John,

One could add that few societies (especially in modern times) could match Stalin’s USSR for inequality of power, which is the essential inequality that people tend to find objectionable.

13. October 2013 at 13:39

It wasn’t just inequality of power, but of consumption too. I was just reading ‘A Woman in Berlin’, the diary of an anonymous German woman from April through June 1945. Almost immediately after taking the city the Russians started handing out ration cards for food to the residents. There were several different classifications of ration cards, all depending on your assigned status; e.g. engineer, artist, etc.

13. October 2013 at 13:47

Not good: RBI chair Rajan is pressing Fed to tighten policy!

http://online.wsj.com/article/SB10001424052702304330904579133530766149484.html

14. October 2013 at 03:30

Schiller and Fama share Nobel. TROLOLOLOLOL-LOLOL-LOL-LOL.

14. October 2013 at 04:01

A market monetarist Nobel? Schiller endorsed GDP futures. And I tweeted this link to Scott’s market-efficency analysis of the 2008 meltdown: https://twitter.com/_Srijit/status/389717011359469568

14. October 2013 at 04:12

Tyler links to this Fama interview, which sounds quite Sumnerian (or is Sumner Famaian?): http://www.newyorker.com/online/blogs/johncassidy/2010/01/interview-with-eugene-fama.html

14. October 2013 at 04:33

Niall Ferguson may be wrong about a number of things,but he’s not wrong on Krugman’s manners.

http://blogs.spectator.co.uk/coffeehouse/2013/10/niall-ferguson-paul-krugman-gets-it-wrong-again-and-again-and-again-why-does-anyone-still-listen-to-him/

14. October 2013 at 05:49

…on Robert Shiller. When it comes to monetary economics, Shiller advocates an outright separation of the medium-of-exchange and unit-of-account, or what he calls indexed units of account [link]. Shiller’s scheme attempts to solve the same sorts of problems Scott is interested in solving, as was Irving Fisher for that matter with his compensated dollar scheme.

14. October 2013 at 05:50

Dear Conservative Movement,

Please pay less attention to clowns like Niall Ferguson and Peter Schiff and more attention to Jim Pethokoukis, Morgan Warstler and Bonnie Carr.

Thank you.

14. October 2013 at 08:03

Excellent piece in FT on Fama’s nobel and EMH in general. Titled “Why the efficient markets hypothesis merited a Nobel”. I’m worried they’ll kick my door down and make me bathe in my own blood if I send the link.

14. October 2013 at 08:06

This is a great post. Thanks for linking to the underlying study. You are framing this as a way of criticizing liberals, but I find that odd. It turns out that the income transfer programs are working quite well. Perhaps there would be less market inequality without transfer programs, but would consumption inequality be reduced? That seems unlikely. I’m all for investigating our income transfer programs to see how they could be improved in efficiency terms. If that means phasing out benefits slower to reduce marginal tax rates, fine. If that means more spending on weeding out fraud, fine. Just don’t expect me to support spending $2 on fraud detection to prevent $1 of fraud or to support killing transfers for marijuana use. Of course, I have not heard any rhetoric or noticed any policy proposals from the Republican party that seem to attempt much more than blanket reductions in income transfer without consideration for their efficiency. So I don’t sense an opportunity here for better policy through bipartisan action.

14. October 2013 at 08:34

The Nobel Prize committee honored Lars Peter Hansen for his work in developing a statistical method for testing rational theories of asset price movements. The statistical method Hansen developed is Generalized Method of Moments (GMM). The fact that Hansen won the Nobel Prize for his “empirical analysis of asset prices” caught me off guard as I did not realize this was the original application of GMM.

GMM is used in the estimation of the New Keynesian Phillips Curve. The New Keynesian Phillips Curve includes expectations of future inflation as an idependent variable. Since inflation expectations cannot really be observed, GMM offers a way around this difficulty.

The New Keynesian Phillips Curve, which was developed in 1995, is integral to most DSGE models that central banks across the globe are increasingly dependent. Thus it’s hard to imagine modern central banking without Hansen’s contributions to econometrics. So for Hansen to have won the prize for his empirical analysis of asset prices strikes me as somewhat ironic.

14. October 2013 at 08:49

Mark A. Sadowski,

I think that asset prices are in fashion right now.

14. October 2013 at 13:29

Sadowski,

It will always be this way, one side, the Fiscalists will NEVER bite.

Meanwhile the side that actually has the sex parts to mate with MM, well “we” deem them nasty, brutish and short, even though they have jobs, own their homes, and vote all the time.

Last night I offered (not bet) AEI’s @stanveuger $100 to debate me on “NGDPLT shrinks govt. and AEI should support it” if @jimpethokoukis would judge.

He spent a half hour calling me an idiot, and wouldn’t step up and debate it.

If MM isn’t going to pitch itself to the political interests whose END DESIRE it benefits, we might as well be selling it on Home Shopping Network.

15. October 2013 at 03:42

Bill, Obviously Krugman has never heard of rational expectations and the Lucas Critique.

Joe, Your first sentence is wrong. Inequality statistics are useless because they don’t accurately measure economic inequality.

I don’t understand how your comment about conservatives relates to this post. Yes, some conservatives oppose redistribution, but I favor it. So how does that relate to anything I said?

Thanks John.

Saturos, Thanks, I’ll take a look when I return.

JP, If you looked closely you’d find my views are much closer to Fisher than Shiller, but I do love the NGDP future proposal.

Mpowell, I was merely criticizing liberals on the question of whether poverty is declining, and also inequality. Not redistribution, which I support.

15. October 2013 at 11:02

Did you really have a good enough college experience that your early memories are from sophomore year? Well done, Scott.

16. October 2013 at 10:01

Saturos, Good interview of Fama.

James, I always enjoy seeing Krugman put in his place.

16. February 2017 at 04:36

[…] the general population.” Or “Nixon did that.” Nor has he read my post entitled “The Amazing Decline in American Poverty.” I presume he didn’t understand the sarcasm in the last sentence of my first paragraph, which […]