A pragmatic approach to monetary policy

In his recent post, Eli Dourado raises a number of interesting points:

The empirical point is summed up in the graph below. NGDP grew around 5 percent per year until around 2008, and then it fell, and then it grew at around 5 percent””or slightly less””per year again beginning in mid 2009. These facts are well known, but I bring them up here because they do constrain the kind of stories we can tell about the economy. Any story you tell has to contain a one-time shock that ended years ago, and it has to be consistent with NGDP that has grown at about the same rate over the last 3 years as it did before the shock arrived.

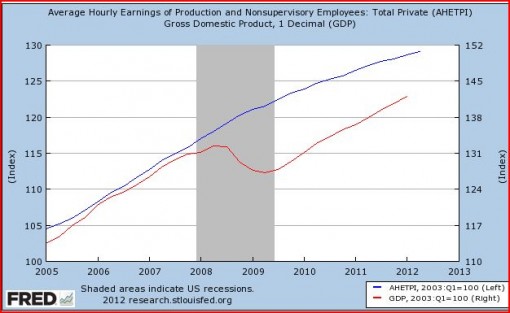

To be precise, NGDP has grown at a 4.1% rate over the last three years. Normally NGDP would grow faster than trend during a recovery, which means the Fed added insult to injury. If NGDP had grown at 5%, then RGDP would have also grown faster, and unemployment would be lower than 8.1%. But I accept Dourado’s broader point—you’d have expected wages to have mostly adjusted by now, and thus you’d have expected more progress on unemployment, even with a 4.1% NGDP growth rate. But the fact of the matter is that nominal wage growth has not slowed in tandem with NGDP growth. The facts are incontrovertible:

Take a close look at that graph (courtesy of George Selgin.) That’s not just roughly what the sticky wage theory would have predicted, it’s EXACTLY what the sticky wage theory would have predicted. The ratio of NGDP to nominal wages ratio of nominal wages to NGDP soared in 2008-09, and unemployment soared from 5% to 10%. Then nominal wage growth slowed modestly, and this slightly reduced the ratio of wages to NGDP. And of course unemployment fell slightly, from 10% to 8.1%. The theory fits the data perfectly.

[The post initially got the W/NGDP ratio backwards.]

That’s leaves Dourado with just one valid complaint; market monetarists haven’t explained why nominal wage growth fell only modestly, despite high unemployment. But here’s the problem, the brightest minds in macro have been unable to find plausible microfoundations for the standard macro model. I’ve offered several suggestions:

1. The zero lower bound produced by money illusion, combined with the fact that wages are still rising in healthy sectors, or sectors shielded from market forces.

2. The 40% boost in the minimum wage at the beginning of the recession.

3. The unusually long extension of UI benefits, which made our labor market more “European.”

4. A long term trend toward a growing share of national income going to capital, which makes the need for wage reduction even greater. This also helps explain why corporate profits are doing well in the recession.

But even I don’t think these are completely persuasive. So I try to take a pragmatic view of all this. If the best minds in the profession can’t come up with plausible microfoundations, then how am I supposed to do so? Why should I even try? I can’t even figure out why the NFL says that wasn’t an interception last night!

Given our limited knowledge, what sort of advice should we give our monetary policymakers? Let’s break the problem down into pieces:

A policy of NGDPLT is a nice safe choice when there’s lots of uncertainty about which macro model is correct. I gather that Dourado agrees on this point.

That means the entire debate is on where to start the new trend line, if the Fed adopts that sort of plan. Some favor going all the way back to the pre-2008 trend line, which would call for a period of rapid NGDP growth. Critics say that would risk another destabilizing boom.

Others say start the new trend line right here, and aim for 5% NGDP growth going forward. To that group I say that under current policy we are likely to fall a bit short of 5% NGDP growth. So if that’s your position then you should not only favor QE3, you should be calling for QE4.

I believe the balance of factors suggests that the safest choice is to go about 1/3 of the way back to the old trend line, and then level off at 5%. That’s based on the following pragmatic judgments:

1. I fully accept that the natural rate of unemployment might have risen to 8.1%, as it has in France, Spain, and Italy. But it’s by no means clear this has occurred. In the US the natural rate has probably been in the 4.5% to 6.5% for over 70 years. It’s never been close to 8.1%. So I regard 8.1% as very unlikely.

2. If it did rise to 8.1%, the most likely explanation is that the policies I mentioned above (minimum wage increase, extended UI, etc) caused the increase. But monetary stimulus would help on both fronts; reducing the real minimum wage (which never would have been passed had Congress know how little NGDP growth we were going to get) and also causing Congress to reduce the maximum UI benefit more quickly, as they do after every previous recovery from a recession.

3. David Glasner showed that equity markets are clearly rooting for higher inflation. That was true in the 1930s, but generally is not true during periods when the economy is close to the natural rate.

4. Ten year bonds yield 1.7%, suggesting we are much more likely to err on the side of excessively slow NGDP growth, a la Japan, than excessively rapid growth.

5. We know that nominal wages are very sticky, and that unemployment closely tracks the ratio of wages to NGDP. It is POSSIBLE that faster NGDP growth would merely lead to higher wages, and no gain in jobs, but how likely does that seem in this sort of labor market?

6. Level targeting calls for a catch-up period, and NGDP growth over the last 4 years has been the slowest since Herbert Hoover was President, about 2% per year. Admittedly the case for “catch-up” gets weaker as time goes by (a point on which I agree with Dourado) but I don’t think that the catch up argument has completely gone away.

That’s why I end up favoring going 1/3 of the way back to the old trend line. I balance Dourado’s very good arguments for caution, with what I see as very powerful arguments that the economy is still depressed by a lack of demand.

Ultimately it’s a judgment call, and I’d like to reiterate that in the long run the issues we agree on, (NGDP targeting) are far more important than the issues where we disagree (where to start the trend line.)

Regarding the Berger paper mentioned by Dourado, I don’t have time tonight to take a close look, but here are a few initial reactions:

The previous two recessions saw small drops in NGDP growth, and slower than normal recoveries. So there’s really no big mystery to explain, except to the extent that productivity behaved abnormally. I’ll accept Berger’s claim that it did, but it really doesn’t explain much, at least in this recession. The unemployment rate is not surprisingly high, it’s surprisingly low given the sub-3% RGDP growth since unemployment peaked at 10%. Indeed it’s not clear why unemployment fell at all. (I’ve had posts called “our job-filled non-recovery.”) And in the 2001 recession unemployment peaked at 6.3%, which probably isn’t much above the natural rate. I wasn’t complaining about tight money in 2001, it’s the recent recession that is the outlier.

So yes, things change over time and cycles today are different from the 1950s, just as they were different from the 1920s. But I fail to see how sudden drop in NGDP and RGDP could not be quickly reversed. It’s a mistake to think in terms of firms rehiring the workers they laid off. My understanding is that this doesn’t occur all that often. In a normal year where there is a net job creation of 1 million, you might have 29 million jobs lost and 30 million jobs gained. Most laid off workers go on to different firms. With that massive churn, it’s not at all difficult to create a couple million more net jobs if the economy starts from a depressed condition and the Fed makes sure we have rapid NGDP growth, as in 1983-84.

P.S. Eli also had this to say:

I assume that when he says “cutting-edge” he is not referring to the papers cited in Ryan’s post, since those are both from the 1980s.

Well at least he’s more polite than other bloggers. For a dinosaur like me who went to grad school in the 1970s, anything after 1980 is “cutting-edge research.” Remember that Steven Wright joke; “About 20 years ago . . . no wait, it was just last week.” That’s me—in reverse.

PPS. Ramesh Ponnuru has one of the best pieces on NGDP targeting that I’ve ever seen by a journalist.

Tags:

25. September 2012 at 16:55

“Others say start the new trend line right here, and aim for 5% NGDP growth going forward. To that group I say that under current policy we are likely to fall a bit short of 5% NGDP growth. So if that’s your position then you should not only favor QE3, you should be calling for QE4.”

And at 4.5% – the level mention by Goldman etc?

At the other end of the spectrum – to those saying “start the trend line right here”

there would be TWO POSSIBILITIES

and we notice AGAIN Scott only delves into one of them, and then runs back to paragraph after paragraph of his preferred position.

Why would anyone even suggest STARTING NOW if the goal wasn’t to establish an LT that we very quickly meet and have to raise rates?

Why not answer what is really being said?

Where is the hypothetical of MM where we are raising rates right away?

What happens after we raise rates because the rule says so:

1. does it increase or decrease credibility?

2. does it win conservatives over to NGDPLT?

3. doesn’t the impact of following the rule GREATLY OUTWEIGH the value of the make-up?

——

Read the above post from Scott.

Mostly it is him saying why we need make-up.

It is not him saying that NGDPLT will work without make-up.

Added to this, Scott already admits the there are structural problems.

If we can’t solve the situation with:

1. a rule based system and no make-up

2. structural changes

Why are we acting like NGDPLT is all that?

If NGDPLT to have the make-up to work, why is it so great?

25. September 2012 at 17:32

“The ratio of NGDP to nominal wages soared in 2008-09” Don’t you mean the opposite?

25. September 2012 at 18:08

[…] but now consider this gem. Today, Scott is trying to be open-minded and say that he acknowledges there are all sorts of real supply shocks to the system; he’s […]

25. September 2012 at 18:17

Thanks Rajat, I just corrected it.

25. September 2012 at 18:18

Scott,

What would happen if the Fed tried to stabilize the expected ratio of NGDP to nominal wages?

It seems intuitive that if sticky wages drive NGDP’s real effects, then the extent the ratio of nominal wages to NGDP remains elevated is exactly the extent to which it’s safe to push NGDP up faster than long-term trend. Is that a reasonable belief?

(If so, then maybe instead of “push NGDP 1/3 of the way back to pre-crisis trend” should you maybe advocate “push NGDP up until its ratio with nominal wages has returned to trend”?)

25. September 2012 at 18:19

For a huge number of Americans the minimum wage is set at the state or local level — and state and local government have proven willing and able to raise the minimum wage faster than the Fed can inflate it away.

Ditto with union government worker compensation — local and state governments are willing and able to increase that compensation faster than he Fed can inflate it away — and much or most of it is inflation protected in any case.

You can’t cure these problems with inflation in America any more than you can in Europe.

You need another fantasy.

25. September 2012 at 18:21

DKS, It’s a big mistake to target a real variable like W/NGDP. It leaves the price level unanchored.

Greg, In the long run yes, I’m focused on the business cycle here.

25. September 2012 at 19:02

Nominal wage stickiness is about contracts being written in nominal terms. But, given heterogeneous consumption/investment bundles/preferences, how else could contracts plausibly be written? Money is not only a (largely “the”) transaction good, it is, in effect, the common language of transaction and so of contract — hence a sort of “network” effect of being the unit, indeed medium, of account where your income contract is tied into your expenditure contracts.

Given utilities and debt contracts are also in the same “language”, and given we are social beings very concerned with status and standing (our notions of fairness are often about status while a strong element in bargaining is not losing “standing” for future interactions), there are powerful reasons for wage stickiness. Even when one hires new workers.

Possibly, in earlier times, when many industrial workers were ex-agrarian workers and used to rising and lowering prices for products across seasons, wage flexibility was more acceptable. But once we got plugged into debt, utilities, etc; not nearly so much.

25. September 2012 at 19:31

Scott,

You may want to re-check your data for wage growth, since George had revised the graph you’re now attributing to him such that it appears NGDP has caught up with wage growth.

From Mr. Selgin:

http://www.freebanking.org/2012/07/08/and-my-own-attempt-at-an-answer/

Remind me again what’s to like about a trend growth rate during which the USA suffered two serious booms and busts (dot com, housing) in much the same dreadful cycle as Japan? Doesn’t that suggest that George may be correct in Less Than Zero? Perhaps the ideal NGDP growth rate is equal to some productivity norm such that per-capita productivity growth produces gentle deflation on average. Why isn’t this the right time to change to slower NGDP growth (never mind deeper reform like freezing the monetary base and allowing competitive note issue)? If not now, when? Isn’t any change in the rate of growth going to be met with “but wages are sticky and contracts assume X” types of arguments?

25. September 2012 at 20:15

John Papola,

Scott has a bunch of sayings, along the lines of “Never reason from a price change”. To that Marcus Nunes and I would add, “Never reason from a chart change”.

http://thefaintofheart.wordpress.com/2012/07/10/don%c2%b4t-reason-from-a-chart-change-george-selgin%c2%b4s-question-to-market-monetarists/

Btw your rap videos are truly awesome. If you eventually become more supportive of the ideas on this blog, or just like the blog, would you think about teaching Scott to rap and getting him to make a cameo in Keynes-Hayek 3? Pleeease?

25. September 2012 at 20:18

“Indeed it’s not clear why unemployment fell at all.”

Scott, earlier you were explaining the drop in unemployment by saying that wages had adjusted somewhat. I pointed out a couple of times that this probably all reflected people leaving the labor force. Are you changing your mind then?

25. September 2012 at 22:00

I’d like to have your take on this Scott:

Part of what I see going on here is that labor participation had its own boom and bust cycle. Before the crisis, it was at an unsustainable level, but this was not obvious because it was hidden by the long term secular decline in the “normal” level. When the crisis hit, in addition to the normal pattern of labor participation, there was an additional effect of the popping of that “bubble”. One narrative going on here is that there were a lot of baby boomers with some flexibility in their employment options, and instead of retiring or slowing down gradually over the decade, many of them remained in the labor force to benefit from the boom, and then many of them left the labor force all at once. Now, labor force participation is basically where it should be. The shrinking labor force can explain the slower GDP growth coming out of the recession, which would be exascerbated by this “LFP bust” effect. And, now, the labor force is still overstated because of the excessive unemployment insurance.

My understanding is that no new extended UEI applicants have been accepted since June, and that existing ones will be eliminated by the end of the year. Out of those 2 million + people, if roughly 1/3 leave the labor force, 1/3 remain unemployed, and 1/3 lower their reservation wage and become employed, the end of that policy will single-handedly lower the unemployment rate by 1%. If we are early into next year and have unemployment under 7%, it looks like basically a recovered economy.

In fact, I think it’s basically a recovered economy now, considering the demographic issues at play, and it’s simply these inflated unemployment numbers, due to the extended insurance (and somewhat due to minimum wage), that has everyone so perplexed about what’s going on. If we didn’t have these big unemployment numbers, we wouldn’t greet every piece of mitigating economic data as further proof of something awry, and we’d all be acting as if the economy was normal. We could be there by mid-2013, but I think there will still be a lot of hand wringing about the labor force participation rate.

25. September 2012 at 22:25

Time to talk about the fiscal cliff. My instinct is to yell “yeehaw” and jump. My question: can monetary policy be the net that keeps income from going splat?

25. September 2012 at 23:22

“To be precise, NGDP has grown at a 4.1% rate over the last three years.”

Is this fake precision of the sort “the multiplier is 1.73”, or can you make the case that we have such a good handle on these measures to the point that one decimal point precision is relevant in policy discussions? In fact, you went further and linked the 0.9% difference to a corresponding effect on unemployment. Is such a relation still believable at such “micro”-scales?

26. September 2012 at 00:24

Everyone, Evan Soltas has a new theory of the Great Depression:

http://www.bloomberg.com/news/2012-09-25/housing-was-at-the-root-of-the-great-depression-too.html

26. September 2012 at 00:26

Pietro, yes, NGDP is pretty easy to measure. Just add up the prices of all the final goods and services produced by the economy, without making any corrections. And there’s a pretty big connection to unemployment – NGDP is precisely what is used to pay wages. Total wage payments cannot exceed total money income, which is NGDP.

26. September 2012 at 00:27

Scott, did you see this? (I posted it earlier)

http://marginalrevolution.com/marginalrevolution/2012/09/questions-about-tips.html

26. September 2012 at 03:40

Do you think Nate Silver might be onto MM?

http://delong.typepad.com/sdj/2012/09/there-is-a-huge-amount-of-mean-reversion-in-nate-silvers-model-right-now.html

26. September 2012 at 04:23

Scott,

Did you see in the FT “Portugal drops plans for cuts to pay” and “Portugal swaps pay cuts for tax rises?” Long story short, the Portuguese government tried to solve the sticky nominal wage problem by mandating across the board cuts to nominal pay. It was politically difficult, to put it lightly.

26. September 2012 at 05:16

Nate Silver on Sept 4th, 2010 said the chances of a GOP 60 seat gain was 1:4.

You don’t need to know anything else about Nate Silver’s “model”

You can go back to this time 2010 and READ the language of how he casts the election in the NYT.

Sumner often wants to talk about inflation hawks who got it so wrong.

Note Unanswered:

If NGDPLT has to have make-up to work, WHY is it so great?

26. September 2012 at 05:35

[…] they have no leg to stand on. So let’s go through it more slowly. Here’s the relevant quote from Scott, to refresh our memories: If [the natural rate of unemployment in the US] did rise to 8.1%, the […]

26. September 2012 at 06:07

I’m still struggling to understand why and how the “trend” we’re supposed to be on is chosen. It seems like there was a rate of spending growth from 1980 through 1995 that was pretty stable. Then, around 1995, growth accelerated, which happens to correlate with the dot-com bubble. Then, in 2002/3, growth accelerated again, correlating with the greatest global bubble in history.

Why should we want to get back to the bubble path? And isn’t it possible that we’re actually already back to a medium run path now? Here’s a somewhat crude graph aimed at making my point.

http://emergentorder.com/econ/Trend-Spending-Growth.jpg

The way Sumner talks about the long run growth trend, you’d think that the red link should have mostly carried straight from the 80s and 90s to 2008. It doesn’t. So are we really talking about an ACCELERATION rate of spending, not a growth rate? Whose model calls for ever increasing rates of spending growth?

26. September 2012 at 07:00

If the natural rate of unemployment has been pushed up because of too generous minimum wage and unemployment insurance then the time to address the problem is AFTER the economy get back to normal, not during a down turn.

Also the minimum wage has not changed significantly If it is the the problem, how come it it is only now effecting the natural rate ?

26. September 2012 at 07:13

Eli:

Any story you tell has to contain a one-time shock that ended years ago, and it has to be consistent with NGDP that has grown at about the same rate over the last 3 years as it did before the shock arrived.

Let me give it a shot. First, suppose a family depends on 2 apple trees for food, if 1 apple tree dies, even if the other apple tree is producing apples at the same (trend) rate as before, it won’t be enough to feed the whole family unless, a. the family’s stomach shrink by half or b. another apple tree has to be planted. Since it’s hard to shrink one’s stomach (sticky wages) then you gotta plant another apple tree (fill up “the hole” as Nunes put it).

Another factor which the apple tree analogy didn’t mention but we need to take into account is population growth, suppose we assume the US population grows at more or less the same pace as before the crisis, then the growth rate returning to the long term trend simply means it’s keeping up with the population growth, but those jobs that’d been destroyed are not coming back unless either a. “the hole” is filled b. civilian noninstitutional population growth slows while NGDP continue to grow at 5% c. wages drop by around 10% (roughly the size of “the hole”). It will probably take a lot longer if you go for option b. or c.

If you look at US civilian noninsitutional population (table 1) and total employment (table 2) data:

Table 1

31/12/1980 168883

31/12/81 171166 1.35%

31/12/82 173199 1.19%

30/12/83 175121 1.11%

31/12/84 177306 1.25%

31/12/85 179112 1.02%

31/12/86 181547 1.36%

31/12/87 183620 1.14%

30/12/88 185402 0.97%

29/12/89 187165 0.95%

31/12/90 190017 1.52%

31/12/91 191798 0.94%

31/12/92 193784 1.04%

31/12/93 195794 1.04%

30/12/94 197765 1.01%

29/12/95 199508 0.88%

31/12/96 201636 1.07%

31/12/97 204098 1.22%

31/12/98 206270 1.06%

31/12/99 208832 1.24%

29/12/00 213736 2.35%

31/12/01 216315 1.21%

31/12/02 218741 1.12%

31/12/03 222509 1.72%

31/12/04 224640 0.96%

30/12/05 227425 1.24%

29/12/06 230108 1.18%

31/12/07 233156 1.32%

31/12/08 235035 0.81%

31/12/09 236924 0.80%

31/12/10 238889 0.83%

30/12/11 240584 0.71%

Table 2

31/12/1980 99634

31/12/81 99645 0.01%

31/12/82 99032 -0.62%

30/12/83 102996 4.00%

31/12/84 106223 3.13%

31/12/85 108216 1.88%

31/12/86 110728 2.32%

31/12/87 113793 2.77%

30/12/88 116104 2.03%

29/12/89 117830 1.49%

31/12/90 118241 0.35%

31/12/91 117466 -0.66%

31/12/92 118997 1.30%

31/12/93 121464 2.07%

30/12/94 124721 2.68%

29/12/95 125088 0.29%

31/12/96 127860 2.22%

31/12/97 130679 2.20%

31/12/98 132602 1.47%

31/12/99 134523 1.45%

29/12/00 137614 2.30%

31/12/01 136047 -1.14%

31/12/02 136426 0.28%

31/12/03 138411 1.46%

31/12/04 140125 1.24%

30/12/05 142752 1.87%

29/12/06 145970 2.25%

31/12/07 146273 0.21%

31/12/08 143328 -2.01%

31/12/09 137968 -3.74%

31/12/10 139220 0.91%

30/12/11 140790 1.13%

One thing to notice is that the long term average growth of both data are amazingly similar at around 1.1%, I think that underpins the so called “natural rate of unemployment”.

This leads me to wonder if any temporary discrepancy between the growth rate of one versus the other should coincide with the business cycle, and here’s what I found:

Table 3:

Date NGDP A-B

31/12/81 9.6 -1.35%

31/12/82 3.7 -1.19%

30/12/83 11.3 -1.11%

31/12/84 9.4 -1.25%

31/12/85 7.1 -1.02%

31/12/86 5.2 -1.36%

31/12/87 7.5 -1.14%

30/12/88 7.5 -0.97%

29/12/89 6.3 -0.95%

31/12/90 4.7 -1.52%

31/12/91 4.2 -0.94%

31/12/92 6.6 -1.04%

31/12/93 4.9 -1.04%

30/12/94 6.4 -1.01%

29/12/95 4.1 -0.88%

31/12/96 6.4 -1.07%

31/12/97 6 -1.22%

31/12/98 6.1 -1.06%

31/12/99 6.4 -1.24%

29/12/00 5.4 -2.35%

31/12/01 2.4 -1.21%

31/12/02 3.8 -1.12%

31/12/03 6 -1.72%

31/12/04 6.2 -0.96%

30/12/05 6.4 -1.24%

29/12/06 5.3 -1.18%

31/12/07 4.9 -1.32%

31/12/08 -1.2 -0.81%

31/12/09 0.4 -0.80%

31/12/10 4.3 -0.83%

30/12/11 4 -0.71%

Where A-B is third column of table 1 – third column of table 2.

Can’t really post a chart here but if you plot it in excel, you can see that both sequences are highly correlated. Hence, I think NGDP plays a more dominant role in employment than anything else, at least up until now.

26. September 2012 at 07:34

John, your graph uses a linear scale for NGDP. This is completely wrong, as the NGDP stability which we had during the Great Moderation entailed steady year-on-year percentage growth. This can be represented with a logarithmic scale (you know, like the Richter scale), or an exponential curve on a linear scale, of the form y = a(1 + b)^x. This would give you a curved trendline, as you can see in this post: http://thefaintofheart.wordpress.com/2012/09/18/50-years-of-us-growth-and-inflation-history-from-a-market-monetarist-perspective/

What you’ve done is fitted two linear approximations to an exponential curve, intersecting at the inflexion point, then claimed to have found two separate trend paths. This mistake becomes more plausible since Volcker was actually disinflating the NGDP growth rate from 1983-86, as you can see here: http://thefaintofheart.wordpress.com/2012/09/13/ngdp-targeting-is-no-temporary-catch-up-trick/

For comparison, this is what NGDP looks like when it’s really unstable: http://thefaintofheart.wordpress.com/2012/08/25/the-origins-of-the-great-inflation/

Took me a moment to realize your mistake – I knew it had to be wrong, as I remembered the stylized fact that NGDP growth had followed a pretty stable path throughout the Great Moderation. The 90’s boom was in the stock market, not NGDP.

To demonstrate instability, you would have to find a shift in the percentage growth rate of spending. So recheck your math, is what I’m saying. When you see your mistake, I’m sure you’ll get a laugh out of it too.

Incidentally, in kinematics terms, an “acceleration rate” is a growth rate. If a body (call it “NGDP”)’s position over time is described by an exponential curve y = ae^(ln(b)x), then its derivative function, giving the velocity at each point, is given by a(ln(b))e^(ln(b)x), which is a number that changes as a function of x. So the velocity will also be constantly rising, and the body will be accelerating. So a constant 5% rate of NGDP growth implies that NGDP will accelerate, with a rate of growth that constantly rises as a number instead of a percentage.

Hope that helps 😀

26. September 2012 at 07:35

John, your graph uses a linear scale for NGDP. This is completely wrong, as the NGDP stability which we had during the Great Moderation entailed steady year-on-year percentage growth. This can be represented with a logarithmic scale (you know, like the Richter scale), or an exponential curve on a linear scale, of the form y = a(1 + b)^x. This would give you a curved trendline, as you can see in this post: http://thefaintofheart.wordpress.com/2012/09/18/50-years-of-us-growth-and-inflation-history-from-a-market-monetarist-perspective/

What you’ve done is fitted two linear approximations to an exponential curve, intersecting at the inflexion point, then claimed to have found two separate trend paths. This mistake becomes more plausible since Volcker was actually disinflating the NGDP growth rate from 1983-86, as you can see here: http://thefaintofheart.wordpress.com/2012/09/13/ngdp-targeting-is-no-temporary-catch-up-trick/

[third link omitted for quick submission]

Took me a moment to realize your mistake – I knew it had to be wrong, as I remembered the stylized fact that NGDP growth had followed a pretty stable path throughout the Great Moderation. The 90’s boom was in the stock market, not NGDP.

To demonstrate instability, you would have to find a shift in the percentage growth rate of spending. So recheck your math, is what I’m saying. When you see your mistake, I’m sure you’ll get a laugh out of it too.

Incidentally, in kinematics terms, an “acceleration rate” is a growth rate. If a body (call it “NGDP”)’s position over time is described by an exponential curve y = ae^(ln(b)x), then its derivative function, giving the velocity at each point, is given by a(ln(b))e^(ln(b)x), which is a number that changes as a function of x. So the velocity will also be constantly rising, and the body will be accelerating. So a constant 5% rate of NGDP growth implies that NGDP will accelerate, with a rate of growth that constantly rises as a number instead of a percentage.

Hope that helps 😀

26. September 2012 at 07:35

John Papola:

Wouldn’t that chart need to use a log scale?

26. September 2012 at 08:28

Ah yes, log vs. lin. Got it. That helps a great deal.

26. September 2012 at 08:53

Now I see it…

http://emergentorder.com/econ/NGDP-log.jpg

Hmmm. So when can we downshift to a productivity norm?

26. September 2012 at 08:57

Saturos:

Everyone, Evan Soltas has a new theory of the Great Depression:

That theory isn’t new. In fact, it looks Austrian.

26. September 2012 at 10:26

There are two sticky wage problems, not one.

The first is why wages are sticky within any given company. I think this quote from Truman Bewley answers the question pretty well:

“Resistance to reduction in pay comes primarily from employers,not from workers or their representatives, though it is anticipation of negative employee reactions that makes employers oppose pay cutting. The claim that wage rigidity gives rise to unexploited gains from trade is invalid, because a firm would lose more money from the adverse effects of cutting pay than it would gain from lower wages and benefits.”

From Why Wages Don’t Fall, Harvard University press 1999

and :

“I learned…that the advantage of layoffs over pay reductions was that they ‘get misery out the door'”.

What is a bit harder to explain is why average wages increase in the face of a massive cutback of $14-$23 per hour jobs combined with a full recovery to trend of $7.50-$14 per hour jobs. Considering that there hasn’t been a full recovery in the $23-$50 sector, the only explanation is substantial wage increases for the remaining employees, and this is what we see.

Against this, the change in job mix should only amount to around a 1% pay cut averaged across the entire working population.

The statistics are rather interesting.

relative to 2007, the numbers for 2011 are

average earnings 108.77%

total employment 93.41%

calculated payroll 101.6%

actual payroll figures will probably be different since they are calculated differently. If you know how to find these and also can explain how they are calculated so they can be compared, I’d be interested in seeing the results.

FRED has some payroll indices, but I have no idea how they’re calculated, and the BLS gave me no joy in finding out.

26. September 2012 at 11:08

Employers with more sophisticated, professional workers often use variable pay structures, typically called “bonuses” or “profit sharing.” The latter is even becoming reasonably common in manufacturing (e.g. at Ford). For bonuses the extra pay usually relates in part to performance goals of the individual and in part to performance goals of the company. In high end law and finance, these bonuses can be a substantial portion of total compensation, but even at the 5% to 10% level you would often see in other businesses, that seems like at least moderate wage flexibility.

Why don’t we see broader adoption of bonuses/profit-sharing as a means to decrease wage stickiness for their employees? Even on a micro level, it would seem likely to be advantageous to the employer over a fixed wage, at least above the minimum wage lower bound. Are owners overly interested in capturing short to medium term gains with higher risk over the long term? Or is it a preference among workers for wage certainty and traditional pay structures of hourly or salary wages plus benefits only? Or something else?

26. September 2012 at 11:38

That was a superb article by Ramesh Ponnuru, and it’s especially nice to see it coming from a senior editor at the National Review.

26. September 2012 at 11:50

Guys, Ryan Avent’s second reply to Eli Dourado is magnificent (HT Marcus Nunes): econ.st/P66zcm

26. September 2012 at 11:51

Damn, won’t accept a shortened link?

http://www.economist.com/blogs/freeexchange/2012/09/short-runs

26. September 2012 at 12:47

“…if the economy starts from a depressed condition and the Fed makes sure we have rapid NGDP growth, as in 1983-84.”

I’m having problems with this statement Prof Sumner. I think the 1984 recovery had much more to do with Reagan administration’s reforms, than it had with the Fed’s targeting of nominal GDP growth.

If you look at the graph here… http://im-an-economist.blogspot.com/2012/09/an-overview-of-market-monetarism.html

…the inflation rate was decreasing rapidly during the 1980s recovery, so it couldn’t have caused nominal GDP to increase so substantially. Or am I missing something?

That’s what I feel about the current recession as well. It’s more a structural problem than an aggregate demand shock. And it should be resolved not via short-run monetary or fiscal stimuli, but via structural reforms focused on the labour market, deregulation of businesses and creating a new institutional paradigm of economic growth.

For example, back in the US, a lot of business got outsourced to Asia which made a lot of workers in the West redundant, but no one fired them until it became too costly to keep them on. However this was a natural transition due to a technological change of the new decade. Now there must be a process or rediscovering new skills and new ways to create and sustain value in the West. This is what we should be focused on; creating new jobs, not restoring old ones. Creating a new long-run growth path for the economy, not pegging a target for the old growth path.

27. September 2012 at 03:27

I wouldn’t call what Evan S. has a theory, more a suggested line for further enquiry.

27. September 2012 at 05:32

Vuk, Yes, the supply-side policies were better, but that has only a modest impact on the cycle. The huge difference in NGDP growth is the big factor.

27. September 2012 at 22:30

Scott, and what is going on with your NFL anyways???

28. September 2012 at 05:30

Scott, we’ll agree to disagree then 🙂

Even though I still don’t see the resemblance between today’s calls for higher short-run inflation and higher inflationary expectations and the 1980s recovery in which Volcker brought it down in 1983/84, and influenced lower inflationary expectations (http://1.bp.blogspot.com/-iGoDPEou7eE/UGCKlO4u0MI/AAAAAAAAAyw/JFeNmV10FSM/s1600/Inflation_US.png).

I just tend to think that NGDP growth was increased by something else back then, rather than inflation.

28. September 2012 at 05:42

Vuk, NGDP was increased by easy money back then. I’m not calling for more inflation, I’m calling for NGDP to be increased by easy money today. Exactly the same argument. Don’t even talk about inflation, it’s meaningless and only confuses things.

Saturos, And it was my team that got screwed.

28. September 2012 at 08:54

Fair enough, thanks for clarifying. However, I still think structural reforms will do the trick as they did in Estonia, Latvia, Sweden in 92, Germany in 2003, etc.

28. September 2012 at 08:59

Don’t get me wrong, I think NGDP targeting could be a good new monetary policy, particularly if it could impose more macroeconomic stability, eliminate (or at least relax) the vast threat of asset bubbles, and impose more restraints on the economy during high-output growth, as you claim in your great texts for National Affairs and ASI (I particularly like your ideas for an NGDP futures market). But I don’t see it helpful in restarting the current recovery. Other smaller aggregate demand shocks (like in 2001) – yes, but this time I think the problem is more structural, or dare I say more institutional.

Perhaps this is due to my persistent focus on structural and institutional reforms that makes me reject any attempt to quick-fix the system by restoring it to the former unsustainable growth path.

29. September 2012 at 09:04

[…] Tim Duy: Is Low Inflation Always Good?, by Tim Duy: I was intrigued by something Scott Sumner wrote last week: I’d also point out that the US has experienced 3 major equity or residential real estate bubbles […]

26. December 2013 at 23:03

Lorenzo (and John Papola–you may also be interested in this),

Couldn’t wage contracts be written using Quasi Real Indexing?

“We can achieve recession protection through indexing wages, mortgages, bonds, etc., to changes in nominal GDP but not to aggregate-supply-caused inflation. This type of indexing we call, “quasi-real indexing.” (David Eagle, quoted by Lars Christensen).

http://marketmonetarist.com/2011/12/03/quasi-real-indexing-indexing-for-market-monetarists/